Table of Contents

- Introduction

- What Are Holiday Loans?

- Why People Need Holiday Loans

- What Are No Credit Check Loans?

- Types of Holiday Loans with No Credit Check

- Pros and Cons of No Credit Check Holiday Loans

- Where to Find Holiday Loans Without a Credit Check

- How to Apply for a No Credit Check Holiday Loan

- Eligibility Requirements

- Tips for Getting Approved

- Alternatives to No Credit Check Holiday Loans

- Risks to Be Aware Of

- Responsible Borrowing During the Holidays

- FAQs

- Conclusion

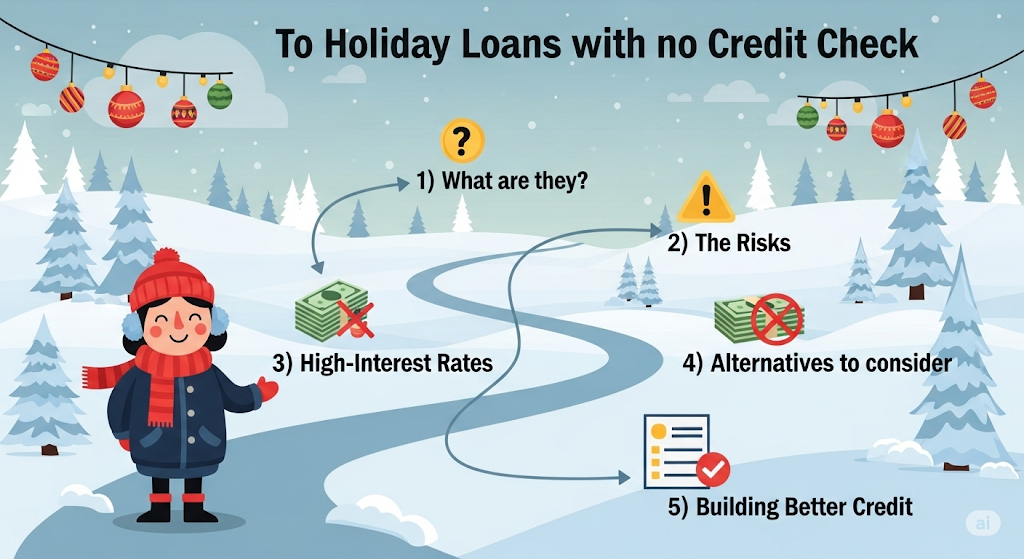

1. Introduction

The holiday season is often filled with joy, celebration, and spending. Whether it’s gifts, travel, or festive feasts, expenses can quickly add up. For many Americans, especially those with poor credit scores, funding holiday celebrations can be challenging. That’s where holiday loans with no credit check come into play. This guide will explain what these loans are, how they work, their pros and cons, and alternatives to consider.

2. What Are Holiday Loans?

Holiday loans are personal loans used specifically to cover seasonal expenses such as:

- Buying gifts

- Holiday travel

- Hosting parties

- Decorations and food

They’re typically short-term loans ranging from $200 to $5,000, depending on the lender and your financial situation.

3. Why People Need Holiday Loans

The average American spends over $1,000 during the holiday season, according to the National Retail Federation. Reasons for needing a loan may include:

- Unexpected expenses during holidays

- Insufficient savings

- Low monthly income

- Desire to create a memorable celebration

4. What Are No Credit Check Loans?

No credit check loans are loans where the lender does not pull your credit report from the major bureaus (Equifax, Experian, TransUnion). Instead, they base your approval on:

- Income verification

- Employment status

- Banking history

- Ability to repay

This is ideal for borrowers with bad credit or no credit history.

5. Types of Holiday Loans with No Credit Check

Several types of loans fall under the no-credit-check category, including:

A. Payday Loans

- Short-term (usually 2–4 weeks)

- High interest (up to 400% APR)

- Borrow $100–$1,000

- Due by your next payday

B. Title Loans

- Requires vehicle title as collateral

- Borrow up to 50% of your car’s value

- High risk of repossession

C. Installment Loans

- Fixed repayment terms (3 to 12 months)

- More predictable payments

- Higher borrowing limits

D. Buy Now, Pay Later (BNPL)

- Used for specific purchases (like electronics or gifts)

- Interest-free in many cases if paid on time

- No hard credit inquiry

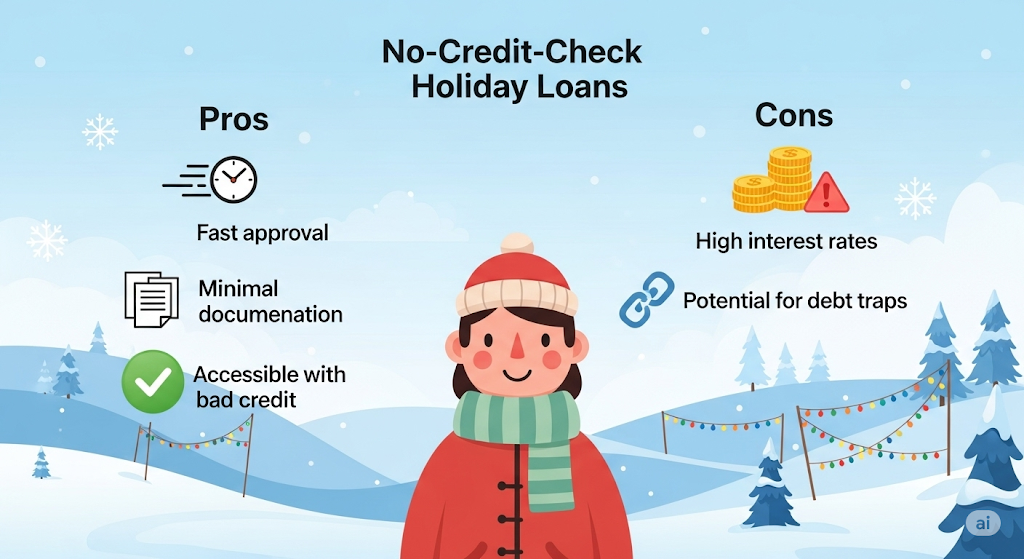

6. Pros and Cons of No Credit Check Holiday Loans

Pros:

- No impact on your credit score

- Fast approval (often same-day funding)

- Easy online application

- Ideal for people with bad credit

Cons:

- High interest rates

- Short repayment periods

- Risk of falling into a debt trap

- Limited regulation in some states

7. Where to Find Holiday Loans Without a Credit Check

Here are common sources to explore:

A. Online Lenders

Websites like OppLoans, Check Into Cash, CashNetUSA, and Rise Credit offer installment loans with flexible requirements.

B. Local Payday Loan Stores

Quick in-person cash loans, often requiring only a valid ID and proof of income.

C. Peer-to-Peer Lenders

Platforms like LendingClub and Upstart occasionally consider borrowers with poor credit (though many still run soft checks).

D. Credit Unions

Some offer special holiday loan programs during November and December with relaxed terms.

8. How to Apply for a No Credit Check Holiday Loan

Here are the steps:

- Choose a reputable lender.

- Gather required documents (ID, proof of income, bank statements).

- Fill out the online or in-store application.

- Wait for approval (many lenders provide decisions in minutes).

- Receive your funds (direct deposit or cash pickup).

9. Eligibility Requirements

Even with no credit checks, lenders still have criteria:

- U.S. resident, 18+ years old

- Valid government-issued ID

- Active checking account

- Minimum monthly income (often $1,000+)

- Proof of employment or benefits

10. Tips for Getting Approved

- Avoid applying to multiple lenders at once

- Be honest about your income

- Double-check your application

- Choose a lender that accepts alternative data (like bill payments)

11. Alternatives to No Credit Check Holiday Loans

Before diving into high-interest debt, consider:

A. Credit Builder Loans

Help improve credit while accessing small loan amounts.

B. Paycheck Advances

Some employers offer early access to earned wages.

C. Buy Now, Pay Later Apps

Apps like Klarna, Afterpay, and Affirm offer flexible payment terms.

D. Holiday Savings Plans

Some credit unions and banks offer year-round saving plans for holidays.

E. Side Hustles

Gig work during the holiday season can supplement your income and reduce the need for a loan.

12. Risks to Be Aware Of

Borrowing without understanding the terms can be dangerous:

- Rollovers and Renewals: Some payday lenders encourage extending the loan, leading to cycles of debt.

- Hidden Fees: Read the fine print. Some loans come with origination or processing fees.

- Repossession: Title loans put your vehicle at risk if you default.

- Scams: Avoid any lender who asks for upfront payment, gift cards, or personal info via social media.

13. Responsible Borrowing During the Holidays

Here’s how to stay safe and smart:

- Only borrow what you need.

- Have a repayment plan.

- Compare multiple offers.

- Understand APR, not just monthly payments.

- Pay on time to avoid extra fees.

14. FAQs

Q1: Can I get a holiday loan without a job?

You may qualify if you receive consistent income from benefits like Social Security, disability, or unemployment.

Q2: Will my credit score improve if I repay the loan?

No credit check lenders don’t always report to bureaus. Choose one that does if credit building is a goal.

Q3: How quickly can I receive funds?

Some online lenders offer same-day or next-day funding.

Q4: Is a holiday loan better than using a credit card?

If you qualify for a 0% APR credit card, that might be a cheaper option. Loans can be better if you need predictable payments.

Q5: Are no credit check loans legal in all states?

No. Some states ban or heavily regulate payday loans. Check your local laws before applying.

Q6: What documents do I need?

Usually: ID, proof of income, bank account info, and sometimes a utility bill.

Q7: Do these loans have prepayment penalties?

Most installment loans don’t—but check your lender’s terms to be sure.

Q8: Can I get a no credit check loan online?

Yes. Many lenders operate 100% online with quick application and approval processes.

Q9: Will the lender check my bank account?

Yes, most will verify bank activity and income via your account.

Q10: Can I apply during the weekend?

Yes, online applications are open 24/7, though funds might not be deposited until the next business day.

15. Conclusion

Holiday loans with no credit check can be a helpful solution for families who want to celebrate the season without the stress of limited funds. However, these loans come with high costs and risks, so it’s essential to research and borrow responsibly. Consider all your options, understand the terms, and only borrow what you can afford to repay.

If used wisely, a no-credit-check holiday loan can help you enjoy a festive and memorable season—without long-term financial consequences.