How Do Credit Cards Work

In a world where financial convenience is key, credit cards are both powerful tools and dangerous traps. Used wisely, they can help you build credit, earn rewards, and manage cash flow. But misused, they can lead to high-interest debt and long-term financial stress.

As of 2025, over 190 million Americans own at least one credit card. But surprisingly, many still don’t fully understand how credit cards actually work—how interest is charged, what a billing cycle means, or how your credit score is affected.

This comprehensive guide will help you understand:

- What a credit card is and how it differs from a debit card

- How billing cycles and payments work

- What interest, APR, and fees really mean

- How to build or ruin your credit with a card

- The pros and cons of rewards programs

- Smart habits to avoid debt and boost financial health

Let’s break it all down—so you can use your card like a pro, not a victim of plastic.

Chapter 1: What Is a Credit Card?

1.1 Basic Definition

A credit card is a payment tool that lets you borrow money from a lender (usually a bank) up to a set limit called a credit limit. You use the card to make purchases, and then either:

- Pay it off in full by the due date (no interest charged)

- Or carry a balance and pay interest on the remaining amount

1.2 How It Differs from a Debit Card

| Feature | Credit Card | Debit Card |

|---|---|---|

| Source of Funds | Borrowed from bank | Your own bank account |

| Interest Charged | If not paid in full | None |

| Credit Score Impact | Affects your credit score | No direct effect |

| Fraud Protection | Stronger | Limited depending on issuer |

1.3 Key Players in the Credit Card Ecosystem

- Issuer: The bank (e.g., Chase, Citi, Capital One) that gives you the card and manages your account

- Network: Visa, Mastercard, AmEx, Discover—handles processing and merchant relationships

- Cardholder: You, the user

- Merchant: Store or seller that accepts your card

Chapter 2: How Credit Cards Work — Step by Step

2.1 Getting a Card

Apply online, at a bank, or via mail. Approval depends on your credit score, income, and history.

2.2 Using the Card

Once approved:

- You’re assigned a credit limit (e.g., $2,000)

- You can make purchases up to that limit

- You receive monthly statements summarizing your charges

2.3 Billing Cycle & Statement

- Most billing cycles last 28–31 days

- At the end of each cycle, you’ll receive a statement with:

- Total amount due

- Minimum payment required

- Due date

- Interest charges (if applicable)

2.4 Making Payments

- Pay in full by the due date → No interest

- Pay less than full amount → Interest applies to unpaid balance

- Pay only minimum → Interest compounds and debt grows

Chapter 3: Understanding Interest, APR, and Fees

3.1 What Is APR?

APR = Annual Percentage Rate

This is your interest rate expressed yearly. If your APR is 20%, and you carry a $1,000 balance, you’ll pay about $200/year in interest.

3.2 Daily Interest (Compounding)

Most cards calculate interest daily, not monthly.

Example: Daily Rate=20%365=0.0548%\text{Daily Rate} = \frac{20\%}{365} = 0.0548\%Daily Rate=36520%=0.0548%

If you carry a balance, you’re charged interest every day until it’s paid off.

3.3 Types of APR

- Purchase APR: Charges on regular purchases

- Cash Advance APR: Higher (often 25–29%)

- Balance Transfer APR: May have 0% intro offers

- Penalty APR: Can jump to 29.99% if you miss payments

3.4 Common Fees

- Annual Fee: Some cards charge $95–$695/year

- Late Payment Fee: Up to $40

- Over-limit Fee: Rare now, but still exists

- Cash Advance Fee: 3%–5% + high APR

- Foreign Transaction Fee: 1%–3% if used abroad

Chapter 4: Credit Limits and Utilization

4.1 What Is a Credit Limit?

Your credit limit is the maximum amount you can charge on your card. It depends on:

- Your income

- Credit history

- Existing debts

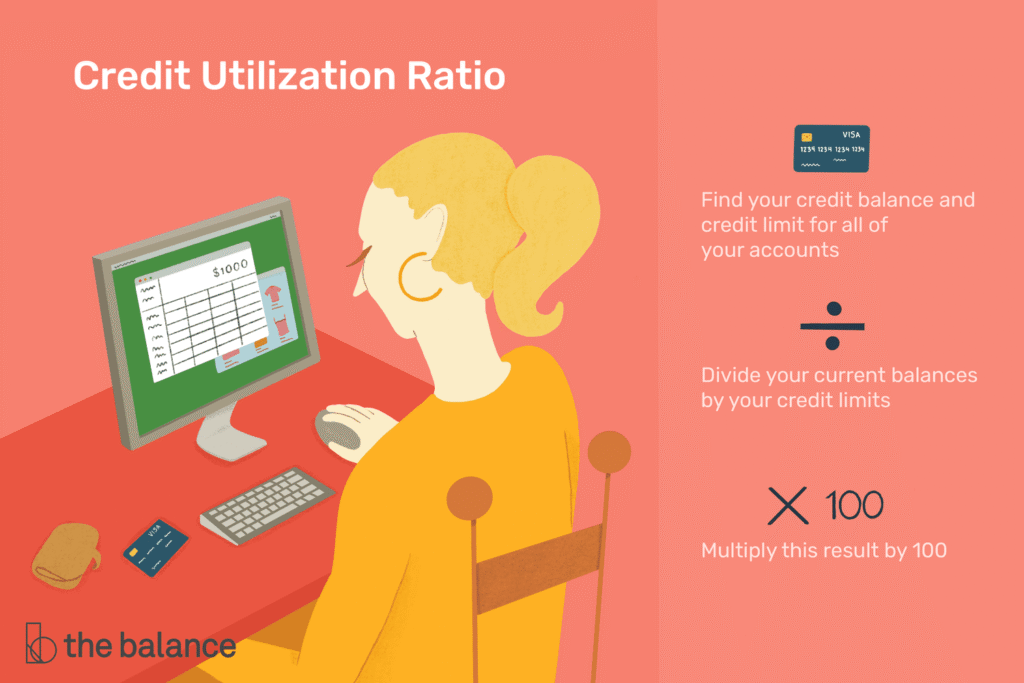

4.2 What Is Credit Utilization?

It’s the percentage of your limit you’re using. Utilization=BalanceCredit Limit×100\text{Utilization} = \frac{\text{Balance}}{\text{Credit Limit}} \times 100Utilization=Credit LimitBalance×100

Example:

- Limit: $5,000

- Balance: $2,000

- Utilization = 40%

Keeping your utilization under 30% is ideal for your credit score. Under 10% is even better.

Chapter 5: Credit Cards and Your Credit Score

Credit cards play a big role in your FICO and VantageScore credit scores. Here’s how:

🔢 5.1 How Credit Cards Affect Your Score:

- Payment History (35%): Pay on time, every time

- Credit Utilization (30%): Keep it low

- Length of Credit History (15%): The longer, the better

- New Credit (10%): Each new card = hard inquiry

- Credit Mix (10%): A healthy mix of credit types helps

📉 5.2 Things That Hurt Your Score:

- Late or missed payments

- Maxing out cards

- Opening many new cards in a short time

- Closing old accounts (can shorten credit age)

📈 5.3 Things That Help Your Score:

- Always pay at least the minimum

- Use less than 30% of your available credit

- Keep old accounts open (if no fees)

- Set up autopay or reminders

Chapter 6: Credit Card Rewards and Benefits

Credit cards aren’t just borrowing tools—they can offer real value.

✅ 6.1 Types of Rewards

- Cash Back: 1%–5% back on purchases

- Points: Redeemable for travel, merchandise, or gift cards

- Miles: Airline miles or hotel points

💳 6.2 Popular Reward Card Categories

- Dining & groceries

- Gas stations

- Online shopping

- Travel and airfare

🎁 6.3 Welcome Bonuses

Many cards offer $200–$1,000 bonuses if you spend a certain amount in the first 3 months.

🛡️ 6.4 Other Perks

- Purchase protection

- Extended warranties

- Trip cancellation insurance

- Airport lounge access (premium cards)

- Cell phone insurance

Note: Rewards are meaningless if you’re carrying a balance and paying interest.

Chapter 7: How to Use Credit Cards Responsibly

Using a credit card wisely can build your credit and save money. Here’s how to stay on the right track:

✅ 7.1 Always Pay On Time

- Use autopay or calendar reminders

- Even one late payment can hurt your credit and trigger fees

✅ 7.2 Pay in Full Whenever Possible

- This avoids interest entirely

- Partial payments lead to compounding debt

✅ 7.3 Don’t Max Out Your Cards

- Stay under 30% of your limit

- Higher balances = lower credit scores

✅ 7.4 Choose the Right Card

Pick a card based on your goals:

- Rewards

- Balance transfer

- Credit building

- Travel perks

✅ 7.5 Monitor Your Statements

- Review charges for fraud or mistakes

- Check due dates, interest charges, and fees

Chapter 8: Common Credit Card Mistakes to Avoid

Even smart people make mistakes with credit cards. Here are some to avoid:

❌ 8.1 Paying Only the Minimum

- Leads to long-term debt

- Increases total interest paid

❌ 8.2 Ignoring Your APR

- High-interest cards can cost hundreds in interest annually

- Always check for better offers or negotiate lower APRs

❌ 8.3 Using for Emergencies Only

- Using it occasionally is fine, but keeping it idle for too long can hurt your score

❌ 8.4 Opening Too Many Cards at Once

- Each application is a hard inquiry

- Lowers your average credit age

❌ 8.5 Falling for Intro Offers Without Reading Terms

- 0% APR doesn’t last forever

- Missing one payment can void the promo

Conclusion: Credit Cards Can Be a Friend or Foe—You Choose

So, how do credit cards work? They give you access to short-term borrowing—but whether they help or hurt you depends on how you use them.

When used responsibly:

- They build your credit

- Offer rewards and perks

- Improve your financial flexibility

When misused:

- They lead to high-interest debt

- Damage your credit score

- Create long-term financial stress

The bottom line: Credit cards are powerful tools. Educate yourself, use them wisely, and they’ll work in your favor—not against you.

✅ Final Takeaways:

- Always pay on time and in full to avoid interest

- Understand your billing cycle and APR

- Choose cards that align with your lifestyle and goals

- Use rewards responsibly—don’t overspend chasing points

- Keep your utilization low and track your credit score