How Do You Become Mortgage Loan Underwriter

How Do you become mortgage loan underwriter is a professional who evaluates and assesses the risk of lending money to potential homebuyers. They serve as the gatekeepers of the mortgage lending process, ensuring that loans are granted to individuals capable of repaying them. This involves a meticulous review of financial documents and the ability to make informed decisions based on data analysis.

Detailed Responsibilities

- Reviewing Loan Applications: An underwriter meticulously examines loan applications to ensure all necessary information is provided and accurate. This step is crucial as it forms the foundation for the entire underwriting process. Missing or incorrect information can delay loan approval and potentially result in a poor lending decision.

- Analyzing Financial Documents: Underwriters evaluate financial documents such as tax returns, pay stubs, and bank statements to assess the borrower’s financial health. This analysis helps determine the borrower’s ability to repay the loan. A deep understanding of financial statements is essential to identify any red flags or inconsistencies.

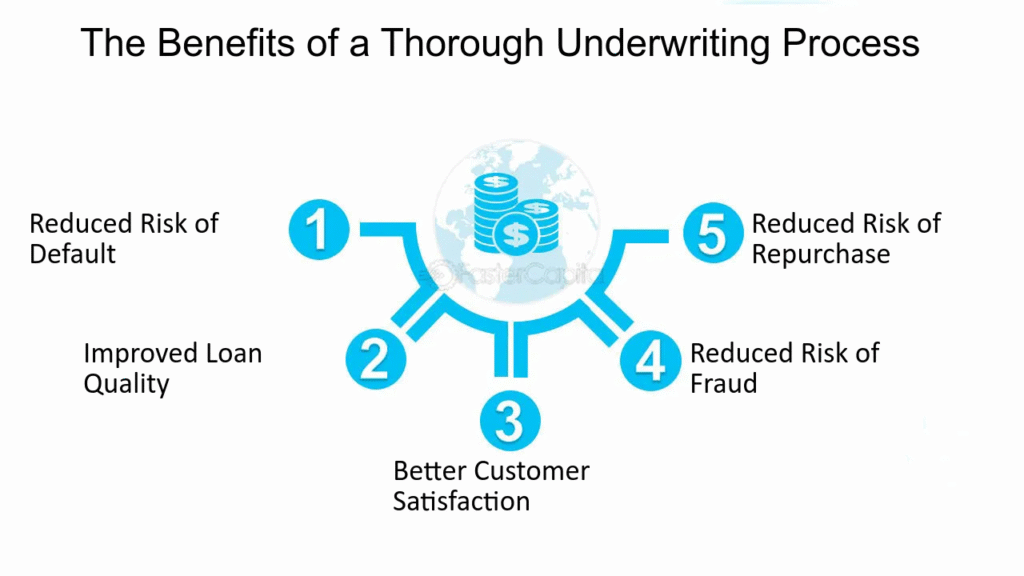

- Assessing Risk: Determining the level of risk associated with lending to a particular borrower is a core duty. Underwriters use their expertise to decide on loan approval or denial. This involves calculating debt-to-income ratios, reviewing credit scores, and other risk assessment tools to ensure that the borrower can meet the loan terms.

- Collaboration with Stakeholders: Working closely with loan officers, processors, and other financial professionals is key to gathering additional information when needed. Effective communication ensures a smooth underwriting process and helps resolve any discrepancies in the application.

- Compliance Assurance: Ensuring all underwriting decisions comply with federal and state regulations is a critical responsibility. An underwriter must stay informed about industry changes and legal requirements to avoid legal issues and maintain the institution’s credibility.

Skills Required for a Mortgage Underwriter

To excel as a mortgage loan underwriter, you’ll need a combination of technical and soft skills. Mastering these skills will not only make you effective in your role but also enhance your career prospects.

Technical Skills

- Financial Analysis: The ability to interpret complex financial data and assess the creditworthiness of applicants is fundamental. This includes understanding financial ratios, cash flow analysis, and economic trends that might impact loan repayment.

- Attention to Detail: Precision in evaluating documents and identifying discrepancies or potential issues is crucial. An underwriter must be meticulous, as even minor errors can have significant consequences in the lending process.

- Regulatory Knowledge: Understanding of industry regulations and guidelines to ensure compliance is non-negotiable. Staying updated with the latest changes in mortgage laws and financial regulations is part of the job.

Soft Skills

- Communication: Clear communication with clients and team members to explain decisions and gather necessary information is vital. An underwriter must convey complex information in a straightforward manner to ensure all parties understand the decision-making process.

- Decision-Making: Confidence in making informed decisions based on data analysis is crucial. An underwriter must weigh various factors and potential outcomes to make the best decision for both the borrower and the lender.

- Problem-Solving: The ability to address issues or challenges that arise during the underwriting process is essential. This involves innovative thinking and adaptability to navigate unexpected situations effectively.

Steps to Become a Mortgage Loan Underwriter

Now that you understand the role and skills required, let’s outline the steps to become a mortgage loan underwriter. Following these steps will equip you with the knowledge and experience needed to succeed in this field.

Step 1: Obtain a Relevant Education

While a specific degree isn’t always required, having a bachelor’s degree in finance, business, economics, or a related field can be beneficial. These programs provide a solid foundation in financial principles, accounting, and economics, which are all relevant to underwriting. Some employers may prefer candidates with a formal education in these areas, as it demonstrates a commitment to the field.

Step 2: Gain Experience in the Financial Sector

Entry-level positions in banks, credit unions, or mortgage companies can provide valuable experience. Working as a loan processor or loan officer can offer insights into the mortgage lending process and help you build a foundation for a career in underwriting. This experience is invaluable as it provides practical knowledge and a deeper understanding of the financial industry’s workings.

Step 3: Complete Underwriting Training

Many financial institutions offer training programs for aspiring underwriters. These programs often cover topics like loan processing, risk assessment, and regulatory compliance. Enrolling in such courses can enhance your skills and knowledge, making you a more competitive candidate. Training provides practical insights and real-world scenarios that prepare you for the complexities of the job.

Step 4: Obtain Certification

While not always mandatory, obtaining a certification can boost your credibility and job prospects. Organizations like the Mortgage Bankers Association (MBA) and the National Association of Mortgage Underwriters (NAMU) offer certification programs for mortgage underwriters. Certification demonstrates your commitment to the profession and assures employers of your proficiency and dedication.

Step 5: Apply for Underwriter Positions

With education, experience, and training under your belt, you’re ready to apply for mortgage loan underwriter positions. Tailor your resume to highlight your relevant skills and experience. Networking with professionals in the industry can also open doors to job opportunities. Joining industry associations and attending conferences can expand your network and increase your visibility in the field.

Benefits of a Career as a Mortgage Loan Underwriter

Becoming a mortgage loan underwriter comes with several advantages. This career path offers not only financial rewards but also personal fulfillment and professional growth opportunities.

Job Stability

The demand for mortgage underwriters remains steady as long as people are buying homes and seeking loans. This career offers job stability and security, even during economic fluctuations. The housing market’s resilience contributes to a consistent need for skilled underwriters, ensuring job availability.

Competitive Salary

Mortgage loan underwriters often enjoy competitive salaries, with the potential for bonuses based on performance. As you gain experience and expertise, your earning potential can increase. The financial rewards in this field reflect the critical role underwriters play in the lending process.

Career Growth

There are opportunities for advancement within the field of loan underwriting. With experience, you can move into senior underwriting roles, management positions, or specialize in certain types of loans. Specialization in areas such as commercial loans or government-backed mortgages can further enhance your career prospects.

Helping People Achieve Homeownership

One of the most rewarding aspects of being a mortgage loan underwriter is helping individuals and families secure financing for their homes. Your work directly contributes to making dreams of homeownership come true. Knowing that your efforts help people achieve significant life milestones adds a fulfilling dimension to the job.

Conclusion

Embarking on a career as a mortgage loan underwriter offers a blend of financial analysis, decision-making, and the satisfaction of helping others achieve their homeownership goals. By acquiring the necessary education, skills, and experience, you can position yourself for success in this dynamic field. Whether you’re just starting your career or looking to make a change, becoming a mortgage loan underwriter can be a fulfilling and lucrative path.

Now that you know what it takes to become a mortgage loan underwriter, it’s time to take the first step toward this exciting career. With dedication and the right preparation, you can build a successful career that not only offers financial rewards but also the personal satisfaction of contributing to the dream of homeownership. Good luck!