How to Get a Personal Loan Approved in the USA? This is always seem daunting, but with the right knowledge and preparation, it doesn’t have to be. Whether you need funds for an emergency, a large purchase, or to consolidate debt, understanding the process can help you secure the best personal loan for your needs.

This comprehensive guide walks you through everything you need to know to improve your chances of approval—from checking your credit report to submitting a strong application. With the right strategies, you can increase your odds and secure funding on favorable terms.

What Is a Personal Loan?

A personal loan is a type of installment loan that allows you to borrow a fixed amount of money and pay it back over a set period, usually in monthly payments, along with interest. These loans are typically unsecured, meaning you don’t need to put up collateral like a house or car to get approved.

Benefits of Unsecured Loans

- No risk of asset forfeiture

- Faster application process

- Can be used for multiple financial needs

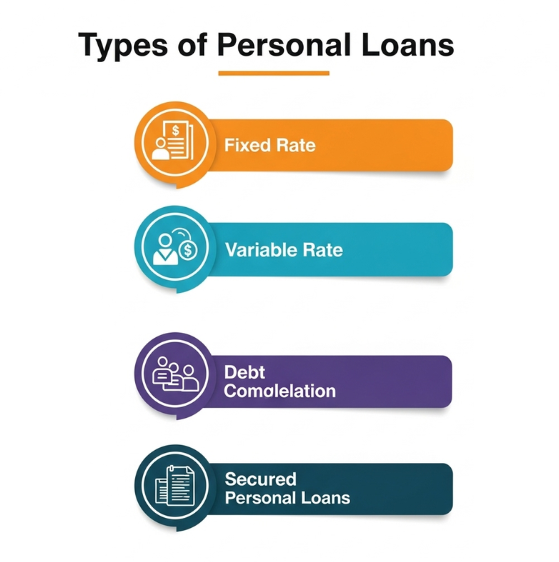

Types of Personal Loans

Understanding your options helps you pick the best type of loan for your situation. Here are the most common types:

| Type of Loan | Interest Rate | Ideal For |

|---|---|---|

| Fixed-Rate Loan | Constant | Predictable monthly payments |

| Variable-Rate Loan | Fluctuates | Shorter-term loans, potential lower rates |

| Debt Consolidation | Often lower | Combining high-interest debts |

| Secured Personal Loan | Lower (but riskier) | Backed by collateral like a vehicle or savings |

Each loan type serves a different financial purpose. Fixed-rate loans provide stability, while debt consolidation loans help streamline payments and reduce interest costs.

Common Uses of Personal Loans

Personal loans are versatile and can be used for many legitimate purposes:

- Debt consolidation

- Home renovation or repair

- Medical expenses

- Wedding or vacation

- Education-related expenses

- Emergency fund gaps

It’s important to match the loan purpose to the terms you’re offered. For example, using a high-interest personal loan for a luxury trip may not be financially wise, whereas using it for a medical emergency or consolidating 25%+ APR credit cards could save you thousands.

Pros and Cons of Personal Loans

Like any financial product, personal loans come with benefits and drawbacks.

Advantages

- No collateral required

- Fixed monthly payments

- Lower interest rates than credit cards (in many cases)

- Fast approval process

Disadvantages

- Higher rates for borrowers with low credit

- May come with origination or late fees

- Can damage credit if payments are missed

Key Factors That Affect Loan Approval

Credit Score

Your credit score is one of the most significant elements lenders consider when evaluating your loan application.

Credit Score Ranges:

- Excellent (750–850): Best rates and easy approvals

- Good (700–749): Approved by most lenders

- Fair (650–699): Approved with moderate terms

- Poor (below 650): May need a co-signer or face higher rates

Example: A person with a score of 780 may get a $10,000 loan at 7% interest, while someone with a 620 score might pay 18% or more for the same loan.

How to Improve Your Score

- Pay bills on time

- Keep credit card balances low

- Avoid new hard inquiries before applying

- Dispute errors on your credit report

Income and Employment

Lenders need to know that you have a stable and sufficient income source to repay the loan.

What Lenders Check:

- Your monthly gross income

- Employment history and stability

- Additional sources of income (freelance, rental, etc.)

Tip: Self-employed individuals should keep profit and loss statements, 1099s, or tax returns ready.

Debt-to-Income Ratio

This is the percentage of your income that goes toward existing debt payments.

Formula:

plaintextCopyEditDTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Ideal DTI Ranges:

- Below 36%: Excellent

- 37%–49%: Acceptable with strong credit

- Above 50%: Risky in most cases

Example: If your monthly debt is $1,200 and your income is $4,000, your DTI is 30%—considered good.

Loan Amount and Purpose

Lenders evaluate whether the loan amount is justified by your financial profile.

Tips:

- Only borrow what you truly need

- Clearly explain the purpose (home improvement, debt consolidation, etc.)

- Avoid vague or luxury-only purposes, especially if your credit score is borderline

Specificity helps: “I’m borrowing $12,000 to consolidate three credit cards at 22–27% APR” is stronger than “I just need money.”

Steps to Get a Personal Loan Approved

1. Research and Compare Lenders

Look at banks, credit unions, fintech lenders, and even peer-to-peer platforms. Compare:

- Interest rates

- Origination fees

- Repayment terms

- Early repayment penalties

Tip: Use loan marketplaces like LendingTree or NerdWallet to pre-qualify with multiple lenders.

2. Check Your Credit Report

Get your free report at AnnualCreditReport.com. Review for:

- Errors in account balances

- Inaccurate late payments

- Fraudulent accounts

Correcting these can increase your score before applying.

3. Gather Financial Documents

Prepare the following:

- Government-issued ID

- Recent pay stubs or 2 years of tax returns (for self-employed)

- Bank statements

- Employer verification or offer letter (if recently hired)

Having these ready can cut approval time by days.

4. Pre-Qualify with Multiple Lenders

Pre-qualification lets you check if you’re likely to be approved without a hard inquiry.

Benefits:

- No impact on credit score

- Compare interest rates and loan amounts

- Avoid wasting time on lenders who won’t approve you

5. Submit Your Loan Application

Once you’ve chosen a lender:

- Fill out the application accurately

- Double-check all details

- Upload required documents

- Be transparent about your income and debts

6. Prepare for a Hard Credit Inquiry

Once you formally apply, a hard pull is done on your credit, which may drop your score slightly (usually 5–10 points).

Avoid:

- Applying to multiple lenders at once

- Applying for other credit (like cards) in the same month

Tips to Improve Your Approval Odds

- Keep your credit utilization below 30%

- Avoid job hopping before applying

- Reduce your DTI by paying off smaller debts first

- Get a co-signer with excellent credit if needed

- Open a credit-builder loan 6–12 months before applying

Borrowers who prepare 3–6 months in advance often get 25–40% better loan terms.

FAQs

What is the minimum credit score for a personal loan?

Many lenders require a minimum score of 600–640, but some approve loans for scores as low as 580 with high interest rates.

Can I get a loan with no credit history?

Yes, some lenders offer loans to those with no credit if you have income, a co-signer, or banking history. Look into credit unions or fintech apps.

How fast can I get a personal loan?

Some online lenders offer same-day or next-day funding. Banks may take 2–7 business days.

Do personal loans hurt your credit?

A hard inquiry may lower your score slightly, but making on-time payments can help improve your score over time.

Can I use a personal loan to pay off credit card debt?

Yes, and it’s one of the most common and smart uses—especially if the loan’s interest rate is lower.

Conclusion

Securing a personal loan in the USA in 2025 is achievable with planning, preparation, and a proactive approach. Understand what lenders look for—credit score, income, DTI, and loan purpose—and take steps to strengthen your financial profile before applying.

By checking your credit report, pre-qualifying with lenders, gathering accurate documents, and submitting a thorough application, you can dramatically increase your chances of approval. Remember to borrow responsibly and make sure the loan aligns with your financial goals.

With the right steps, your personal loan can be more than just funds—it can be a tool to build a stronger financial future.