When someone sees JPMCB Card Services on their credit report, it can raise questions about what it means and why it’s there. JPMCB stands for JPMorgan Chase Bank, and this entry typically appears due to credit card activity linked to Chase, such as applying for a card, having an existing Chase credit card, or being an authorized user on someone else’s account. It reflects Chase’s role as the creditor and is associated with inquiries or accounts managed by the bank.

This designation on a credit report is not unusual for anyone interacting with Chase’s financial products. It may show as a hard inquiry if a person recently applied for a Chase credit card, or as an account if they have a card issued by JPMCB. Understanding this can help individuals interpret their credit reports with more clarity and avoid unnecessary concern when they spot JPMCB Card Services listed.

What Is JPMCB Card Services on My Credit Report?

JPMCB Card Services is commonly seen on credit reports when an individual has a connection with JPMorgan Chase credit products. This listing relates to how Chase manages credit inquiries, accounts, and sometimes authorized use linked to their credit cards. Understanding the details clarifies its presence and implications.

Definition of JPMCB Card Services

JPMCB stands for JPMorgan Chase Bank Card Services. It is the designation used in credit reports to represent Chase’s credit card operations. When someone applies for a Chase credit card, this entity performs a hard credit inquiry to assess creditworthiness.

This name may appear on credit reports due to applications, existing cards, or authorized user status. It reflects Chase’s role in managing credit accounts but does not indicate any specific issue by itself.

JPMCB’s Role as a Credit Card Issuer

JPMorgan Chase issues a broad range of credit cards, including rewards cards for travel, dining, cash back, and more. As one of the largest credit card issuers, they manage millions of accounts that often appear on consumer credit profiles.

Their Card Services department processes applications, approvals, and ongoing account management. This includes conducting credit checks and reporting activity to credit bureaus regularly to maintain updated records.

How JPMCB Card Services Appears on Credit Reports

The appearance typically takes two forms: hard inquiries and active credit accounts. A hard inquiry from JPMCB signals a recent credit card application. This inquiry may slightly decrease the credit score temporarily.

Active accounts listed under JPMCB show current Chase credit cards held by the individual or authorized users. If the entry is unfamiliar, it can point to unauthorized activity, which should be addressed quickly.

Some credit card reconciliation software tools also track such entries to ensure reports remain accurate and to catch discrepancies early. Users monitoring their credit reports can identify JPMCB entries to verify legitimate credit activity from Chase.

Common Reasons JPMCB Card Services Appears on a Credit Report

JPMCB Card Services entries on credit reports usually point to specific credit card activities linked to JPMorgan Chase Bank. These include account openings, membership status like authorized users, and changes stemming from account or portfolio transfers.

Account Origination Through JPMCB

An account listed under JPMCB typically means the individual applied for or opened a credit card with JPMorgan Chase. This includes cards issued under brands like Christell White Paterson Credit Card or AAMCO Credit Card, when associated with Chase.

When someone applies, a hard inquiry shows up as JPMCB, which affects the credit report. The account will remain until it is closed or written off. It documents payment history, balance, and account status directly tied to the credit card issuer.

Authorized User and Joint Account Scenarios

If someone is added as an authorized user on a Chase credit card, that card’s account shows on their report listed as JPMCB. This applies to those linked to Christell White Paterson or AAMCO credit card accounts managed by Chase.

Being an authorized user means the primary cardholder controls the account, but activity affects both parties’ credit reports. Joint accounts function similarly, with each account holder’s report reflecting the same Chase-issued card account data.

Account Transfers or Portfolio Acquisitions

Sometimes, JPMCB appears because accounts were transferred from other banks or companies to Chase. JPMorgan Chase acquires portfolios, taking over management of certain credit cards, including those like the AAMCO credit card if Chase assumes the account.

Transfer impacts may include changes in account numbers or reporting details, but the accounts continue to show as JPMCB on credit reports. This ensures continuity of credit history under Chase’s management after the acquisition.

Understanding JPMCB-Related Credit Cards

JPMCB, short for JPMorgan Chase Bank, issues a wide range of credit cards that appear on credit reports under this name. These cards include different types tailored for various users, often carrying well-known brand names or partnerships. JPMCB cards work with major payment networks, impacting how they’re processed and used globally.

Types of Credit Cards Issued by JPMCB

JPMCB offers several types of credit cards, including personal, business, and co-branded options. Personal cards range from cashback to travel rewards, designed to fit multiple customer needs. Business credit cards target small to medium enterprises and may include credit union business credit cards through partnerships.

Debit cards issued by JPMCB come in US debit and Visa debit varieties. The latter provides broader acceptance internationally compared to a typical US debit card, although both debit types function differently from credit cards. Importantly, JPMCB credit cards often come with features like fraud protection, reward points, and concierge services.

Branded and Co-Branded Credit Cards

Many JPMCB credit cards carry either Chase’s own brand or are co-branded with major retailers and service providers. Examples include the Chase Sapphire cards for travel enthusiasts and Amazon Prime Rewards cards for frequent Amazon shoppers. Co-branded cards allow cardholders to earn rewards accelerated by purchases in specific categories, like travel, dining, or retail.

These branded cards help enhance customer loyalty by offering exclusive perks aligned with the partner’s business. Co-branded credit cards issued by JPMCB are fully backed by JPMorgan Chase Bank and their policies. The use of a co-brand does not change how the card appears on a credit report—it still lists JPMCB Card Services.

How JPMCB Relates to Major Card Networks

JPMCB credit cards are typically linked with major card networks such as Visa or Mastercard. This affiliation allows cardholders to use their JPMCB cards wherever these networks are accepted. The card network processes payments while JPMCB handles the account management and issuing functions.

Visa debit cards from JPMCB, distinct from credit cards, provide direct access to funds without running a line of credit, unlike credit cards under the same network. Credit union business credit cards issued by or in partnership with JPMCB may also utilize these networks to offer wider acceptance and benefit from established fraud protections and transaction protocols.

Implications for Your Credit Score

JPMCB Card Services entries on a credit report reflect active or past credit activities with JPMorgan Chase. These entries influence the credit score based on account status, inquiries, utilization, and history. Understanding these factors helps in managing credit health effectively.

New Accounts and Credit Inquiries

When a person applies for a Chase credit card, JPMCB performs a hard inquiry on their credit report. This inquiry remains on the credit report for up to two years but usually impacts the score primarily for about one year.

Opening a new card can temporarily lower the credit score due to the credit pull and the creation of a new account. However, responsible use like timely payments can improve the score over time.

Fraudulent accounts or theft related to JPMCB cards may also appear, and individuals should investigate any suspicious activity immediately. In cases of first-time credit card theft, prompt reporting can prevent extended damage to the credit score.

Impact of Credit Utilization

Credit utilization refers to the percentage of available credit a person uses. For JPMCB cards, high utilization on Chase credit cards can negatively affect the credit score. Maintaining a utilization ratio below 30% is generally advised to avoid adverse effects.

If the account is shared, as an authorized user, the primary cardholder’s credit habits directly influence the score. Proper monitoring helps prevent unexpected drops caused by changes in the account’s balance or misuse.

Closed Accounts and Credit History

Closed JPMCB accounts influence the credit report differently depending on the reason for closure and account age. Closed accounts in good standing can remain on the report for up to 10 years, contributing positively to the length of credit history.

Negative closures, including unpaid debts, could impact the credit score until they are removed after the statute of limitations. In Georgia, this is typically six years for credit card debt, but this may vary by case.

Individuals should regularly review their credit reports to ensure closed JPMCB accounts are accurately reported and to check for unresolved discrepancies resulting from theft or errors.

Dealing With Unrecognized JPMCB Entries

When an unfamiliar JPMCB entry appears on a credit report, it requires careful attention. The cardholder must determine if the activity is authorized or possibly fraudulent. Taking prompt and clear steps can help protect credit integrity and resolve discrepancies efficiently.

Identifying Legitimate vs Fraudulent Activity

JPMCB entries often relate to credit card accounts or applications with Chase. Legitimate activity includes recent card applications, purchases, or account status updates. A hard inquiry after a credit application is normal and could temporarily lower a credit score.

Fraudulent activity might involve unauthorized credit card abuse charges or accounts opened without permission. If the entry seems unfamiliar, reviewing recent financial actions and contacting JPMorgan Chase for transaction details helps clarify legitimacy. Also, distinctions between soft declines and hard declines during sales applications can cause confusion but usually don’t appear as credit inquiries.

Steps to Take for Disputed Accounts

If an entry is suspected to be inaccurate or fraudulent, the cardholder should first contact JPMorgan Chase directly. They can offer specific information about the account or inquiry in question. Disputing the inquiry or account through Chase can prevent further damage.

Next, the individual should monitor their credit report closely for additional unauthorized activity. Free credit monitoring services can send alerts about new inquiries or changes. It is important to act immediately when a credit card abuse charge or suspicious activity is detected, as early response limits potential credit harm.

Reporting Errors to Credit Bureaus

When JPMCB entries are incorrect, reporting errors to credit bureaus is essential. The three major agencies—Equifax, Experian, and TransUnion—allow consumers to file disputes online or by mail.

Include evidence such as account statements, correspondence with Chase, or identity theft reports. The bureaus must investigate within 30 days. If errors are validated, they will remove or correct the JPMCB entry on the credit report.

Consumers should keep written records of all communications and remain persistent to ensure resolution. Correct reporting prevents prolonged score damage from inaccurate or fraudulent JPMCB card services listings.

Resolving Errors Related to JPMCB Card Services

Errors linked to JPMCB Card Services, such as unauthorized charges or incorrect account information, can impact credit reports and scores. Addressing these mistakes swiftly requires a clear process involving dispute filing, gathering evidence, and communicating with the involved parties.

How to File a Credit Report Dispute

To correct an error related to JPMCB Card Services, the first step is to file a dispute with the credit bureaus reporting the issue. This can typically be done online, by mail, or phone. The dispute should clearly identify the specific JPMCB entry, explain the error, and request removal or correction.

Including details like the type of error—whether an unrecognized inquiry or a charge such as “blossom up charge” or “acqra charge on credit card“—helps clarify the problem. Filing directly through the Equifax, Experian, and TransUnion websites ensures the dispute reaches the correct bureau swiftly.

Gathering Documentation and Evidence

Solid documentation supports a successful dispute. Collect statements showing the inaccurate charge or account information, communication with JPMCB, and any proof that the charge wasn’t authorized.

For instance, if a “blossom up charge” or “acqra charge” appears without recognition, gathering credit card statements and vendor receipts is critical. This evidence verifies the legitimacy or error of the transaction, letting the bureau and JPMCB investigate effectively.

Following Up With JPMCB and Credit Bureaus

After filing the dispute and submitting evidence, follow up regularly with both JPMCB and the credit bureaus. Credit bureaus usually investigate within 30 days, during which time JPMCB reviews the account or inquiry details.

If JPMCB confirms the error, it instructs bureaus to update the credit report. Continued communication ensures timely resolution. In cases of fraud or unauthorized charges, contacting JPMCB directly can prompt account freezes or further protective actions while the investigation proceeds.

Preventing Future Issues With Credit Report Listings

Maintaining accurate credit report information requires active effort. This involves regularly checking for errors, securing card use, and tracking all account actions closely.

Monitoring Your Credit Reports Regularly

Regular credit report reviews help detect inaccuracies or unauthorized activity early. Consumers should obtain reports from all three major bureaus—Equifax, Experian, and TransUnion—at least annually. Using free services or credit monitoring tools can simplify this process.

Spotting unfamiliar listings like JPMCB Card Services can signal unauthorized credit inquiries or account misuse. Early identification allows for prompt dispute filings and limits damage to credit scores.

If someone uses a debit card without having physical access, it often results from data breaches or phishing. Monitoring credit reports for unexpected entries related to your accounts can alert you to such situations.

Promoting Secure Use of Credit Cards

Proper security practices reduce the risk of fraudulent charges and negative credit report entries. Cardholders should never share PINs, passwords, or card details, and avoid using public Wi-Fi for financial transactions.

Using strong, unique passwords for online banking and regularly updating them adds defense layers. Enabling two-factor authentication helps prevent unauthorized access.

Physical care of cards is also essential. Reporting lost or stolen cards immediately can prevent misuse. Being cautious of phishing schemes or suspicious messages is critical to avoid revealing sensitive information.

Staying Informed About Account Activity

Keeping up with account activity limits surprises on credit reports. Consumers should set up alerts for transactions and payments through their card issuer’s app or website.

Reviewing monthly statements helps verify purchases and detect fraudulent activity early. Promptly addressing discrepancies with the card issuer can prevent lasting impacts on credit.

Understanding the terms of credit card accounts, including how and when inquiries occur, helps anticipate what will show on credit reports. Being proactive avoids confusion or concern about legitimate entries such as JPMCB Card Services.

Frequently Confused Terms and Transactions

Many consumers encounter unfamiliar terms and transactions on their credit reports and statements. Clarifying these entries is essential to avoid confusion and ensure accurate financial tracking.

Distinguishing Between JPMCB and Other Creditors

JPMCB refers specifically to JPMorgan Chase Bank’s credit card division. It appears on credit reports mainly for Chase-issued credit cards or related hard inquiries. This differs from other creditors like Corporate Filings LLC or Modern Leasing MI, which might be vendors or service providers unrelated to Chase.

For example, Corporate Filings LLC charges typically come from business-related expenses and may appear as vendor transactions rather than credit card inquiries. Similarly, Modern Leasing MI is usually connected to leasing or rental services, not credit issuers.

Recognizing JPMCB as a financial institution carrier, rather than a third-party vendor, helps consumers distinguish credit inquiries and account activity from unrelated charges by companies such as Towson CMF, which is sometimes mistaken for a creditor but often represents a municipal fee or local service.

Differences Between Credit Card and Debit Card Charges

Credit card charges, including those from JPMCB Card Services, reflect purchases or inquiries that impact credit scores differently than debit card transactions. Credit cards may trigger hard inquiries, which appear on credit reports and can influence credit scores.

Debit card transactions do not produce hard inquiries and typically don’t show up on credit reports since they draw directly from bank accounts. However, transactions labeled with vendor names like Towson CMF can appear on either card type as merchants process payments.

Understanding this distinction helps in interpreting entries labeled by service providers. For instance, a Towson CMF charge on a credit card likely signals a payment to a municipality or utility, whereas the same name on a bank statement may indicate a direct debit rather than a credit inquiry.

Commonly Misattributed Credit Report Notations

Some entries on credit reports, such as those from JPMCB Card Services, are often confused with fraud or unrecognized accounts. It is crucial to verify if the inquiry is authorized, especially since unauthorized hard inquiries can arise from misuse.

Charges from companies like Corporate Filings LLC or Modern Leasing MI may appear on credit statements but do not represent credit report inquiries. Instead, they are merchant transactions that could cause confusion if the consumer is unaware of the related service or purchase.

Consumers should regularly verify their credit reports for both authorized inquiries and transaction details to differentiate between legitimate credit activity and unknown or potentially fraudulent notations. This helps isolate what JPMCB means in contrast to unrelated entries.

Legal Protections and Consumer Rights

Consumers have specific rights and protections when it comes to credit reporting and unauthorized credit card activity. These rights ensure accuracy, give recourse for disputes, and provide ways to guard against fraud or misuse.

Fair Credit Reporting Act Overview

The Fair Credit Reporting Act (FCRA) regulates how credit reporting agencies collect, use, and share consumer credit information. It requires that credit reports be accurate, complete, and updated regularly.

Consumers can request a free credit report annually from each major credit bureau. If inaccuracies occur, such as unauthorized accounts from JPMCB Card Services appearing, the FCRA mandates that disputes be investigated within 30 days. During this period, the bureau must notify the creditor involved and correct any errors found.

The FCRA also limits who can access credit reports and for what purposes, helping prevent unauthorized use of credit information.

How to Protect Yourself From Credit Card Fraud

Consumers should monitor credit reports regularly for unexpected entries like JPMCB hard inquiries or accounts they didn’t authorize. Fraudulent use of credit information, including felony credit card abuse, can lead to unauthorized charges or new accounts.

To reduce risk, individuals can place fraud alerts or credit freezes on their reports. Using secure methods to apply for credit and carefully reviewing monthly statements helps detect suspicious activity.

If a consumer suspects fraud related to JPMCB Card Services or any other lender, they should report it immediately to the card issuer, credit bureaus, and potentially law enforcement to prevent further damage.

Understanding Credit Report Dispute Outcomes

When a consumer disputes an item on their credit report, such as a JPMCB inquiry or account, the credit bureau contacts the creditor for verification. If the creditor confirms the accuracy, the item stays on the report.

If the creditor cannot verify the information or if errors are found, the item must be removed or corrected promptly. The consumer receives a written report explaining the results of the investigation.

Disputes that involve potential contract or billing issues, such as nonpayment disputes where no contract exists, may require additional documentation or legal advice. Consumers may also question fees, like whether an attorney can charge credit card transaction fees, during these processes.

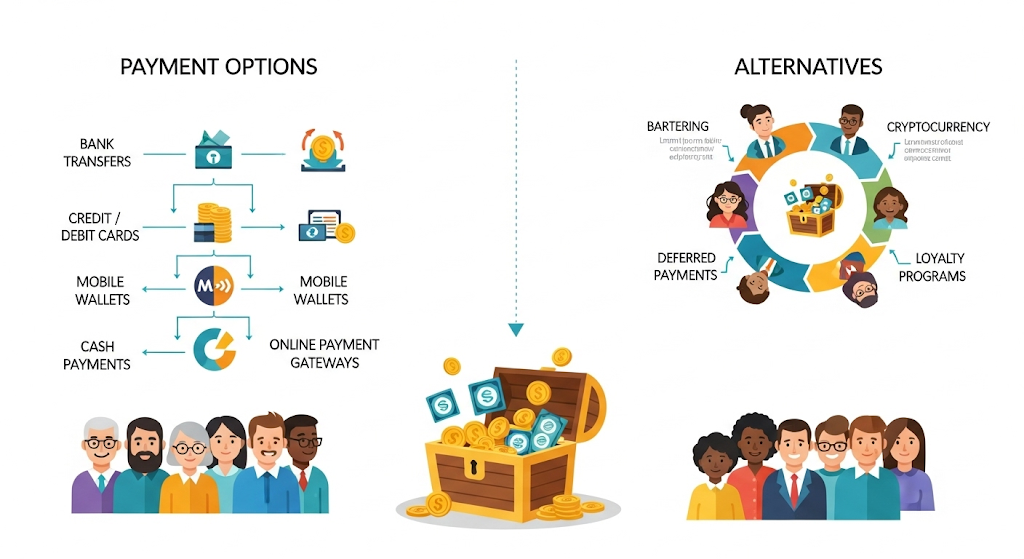

Exploring Payment Management Options and Alternatives

Different payment management methods serve various financial needs, from regular bill handling to managing business expenses or healthcare payments. Each option offers distinct advantages depending on the user’s financial situation and goals.

Automatic Payment Pools and How They Work

Automatic payment pools allow users to consolidate multiple recurring payments into a single, scheduled deduction. This setup reduces the risk of missed payments by grouping bills such as credit cards, utilities, and loans into one convenient process.

Funds are usually drawn from a linked checking or savings account on a preset date. Users can set limits and preferences to control which payments are included and when. These pools often help maintain credit score stability by ensuring payments process on time.

This method suits those who want simplified management and fewer manual transactions. It can also minimize late fees and improve budgeting accuracy by automating the cash flow.

Business and Personal Line of Credit Options

Unsecured business lines of credit, like those offered by Coast Hill, provide flexible borrowing for companies without requiring collateral. They allow businesses to draw funds up to a limit, repay, and reuse credit as needed, supporting cash flow gaps or unexpected expenses.

Personal lines of credit operate similarly but focus on individual borrowers. Both types typically have variable interest rates and no fixed repayment schedule, giving users freedom to plan repayments based on income flow.

These credit lines are useful alternatives to traditional loans, allowing access to working capital or emergency funds without frequent application processes. Approval depends on creditworthiness, income stability, and business performance.

Orthodontist and Healthcare Payment Plans

Orthodontist payment plans help patients manage the often high costs of dental treatments by breaking payments into smaller, fixed installments over time. These plans may be interest-free or include low fees, making costly procedures more accessible.

Healthcare providers sometimes partner with third-party companies to offer financing solutions tailored to medical needs. Patients can set monthly payments aligning with their budgets, avoiding lump sum payments.

Such plans differ from credit options by focusing solely on healthcare expenses, often without affecting credit scores if payments are timely. They provide a practical way to afford essential care without major financial strain.

Conclusion

JPMCB Card Services on a credit report refers to JPMorgan Chase Bank’s credit card division. It appears due to credit card applications, existing accounts, or authorized user statuses linked to Chase credit cards.

This entry often indicates a hard inquiry or account management activity. A hard inquiry may slightly lower the credit score temporarily but is normal when applying for credit.

If the listing is unfamiliar or unauthorized, the individual should promptly review and dispute it to avoid potential fraud. Monitoring credit regularly helps detect such issues early.

In summary, JPMCB Card Services is a routine part of credit reporting for Chase customers. Recognizing what it represents can help maintain accurate credit information and protect financial health.