Table of Contents

- What Is a Land Equity Loan?

- How Does a Land Equity Loan Work?

- Qualifying for a Land Equity Loan

- Land Equity Loan vs. Home Equity Loan

- What Can You Use a Land Equity Loan For?

- Benefits of a Land Equity Loan

- Drawbacks & Risks

- Statistics and Market Trends (2024–2025)

- Alternatives to Land Equity Loans

- How to Apply for a Land Equity Loan

- FAQs

- Final Thoughts

1. What Is a Land Equity Loan?

A land equity loan allows a landowner to borrow money using the equity in a piece of land (owned outright or with substantial value) as collateral. This loan works similarly to a home equity loan, except the secured asset is undeveloped or developed land instead of a house.

Equity = Land Value – Existing Debt on Land

If you own land worth $150,000 and owe nothing on it, you have $150,000 in equity. Most lenders allow you to borrow a percentage of this value (typically 50–70%).

2. How Does a Land Equity Loan Work?

Here’s how the process generally works:

- Appraisal: The lender evaluates the current market value of your land.

- Loan-to-Value (LTV) Ratio: Typically around 50–70% of the land’s appraised value.

- Loan Term: Can range from 5 to 20 years.

- Interest Rate: Slightly higher than home equity loans due to increased lender risk.

- Collateral: The land itself secures the loan.

If you default, the lender has the right to foreclose and take ownership of the land.

3. Qualifying for a Land Equity Loan

While the approval process varies by lender, most will consider:

Requirements:

- Clear land title

- Land deed and recent appraisal

- Good to excellent credit (660+ preferred)

- Proof of income

- Debt-to-income (DTI) ratio under 43%

- Purpose of loan (e.g., construction, investment, debt consolidation)

Some lenders prefer land that:

- Has road access

- Is zoned for residential or commercial use

- Is not in environmentally protected zones

4. Land Equity Loan vs. Home Equity Loan

| Feature | Land Equity Loan | Home Equity Loan |

|---|---|---|

| Collateral | Raw/Vacant/Developed Land | House |

| Interest Rate | Higher | Lower |

| Loan Amount | Lower LTV (50–70%) | Higher LTV (up to 85%) |

| Risk to Lender | Higher | Lower |

| Loan Purpose | Broad (construction, etc.) | Similar |

If you already have a home, a home equity loan might offer better rates. But if you only own land, a land equity loan is the way to go.

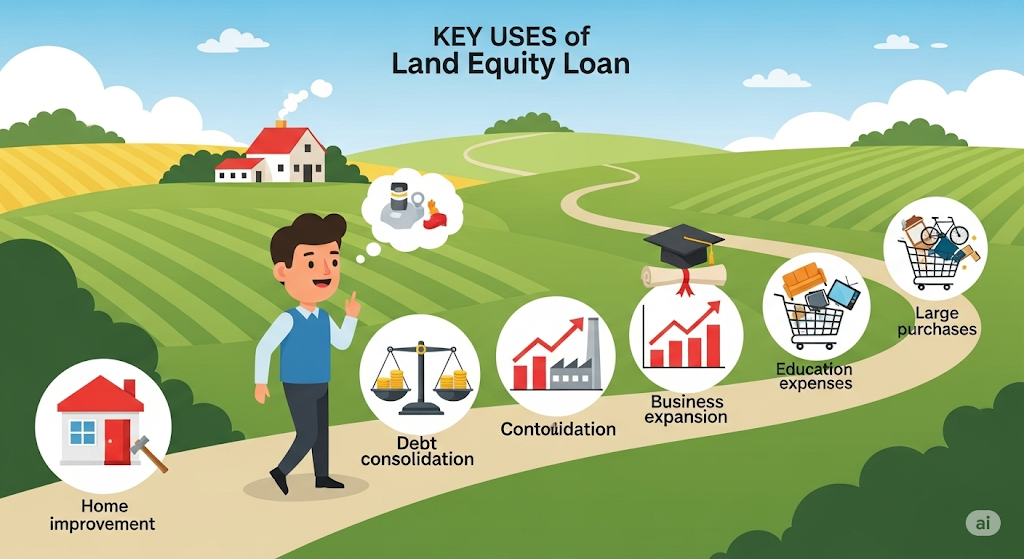

5. What Can You Use a Land Equity Loan For?

The funds from a land equity loan can be used for:

- Building a home

- Starting a business

- Paying for college

- Buying equipment or vehicles

- Consolidating debt

- Making home improvements

- Financing another property

Note: Some lenders might restrict usage for speculative investments.

6. Benefits of a Land Equity Loan

Advantages:

- Access capital without selling land

- Retain full land ownership

- Flexible usage of funds

- Can be used as a down payment for construction

- Long repayment terms

If you plan to develop the land, this loan can be the foundation of your future home or business.

7. Drawbacks & Risks

Disadvantages:

- Higher interest rates than home loans

- Limited lender options

- Stricter credit and income requirements

- May require land to be developed or zoned

- Foreclosure risk if you default

“Land is harder to liquidate than a home, so lenders view land equity loans as riskier,” says Jeff Kueker, a financial advisor in Missouri.

8. Land Equity Loan Statistics & Market Trends

Let’s look at data related to land ownership and land financing in the U.S. (as of 2024–2025):

Key Statistics:

- 91 million acres of privately owned land were purchased in the U.S. between 2010 and 2023 (USDA).

- Average land price per acre (rural) in 2024: $4,670 (National Agricultural Statistics Service).

- Average LTV ratio for land loans: 55–65% (Bankrate).

- 45% of borrowers use land equity loans to build homes (National Association of Home Builders).

- Delinquency rate for land loans: 1.8% vs. 0.95% for home loans (Federal Reserve, Q4 2024).

- Only 35% of U.S. banks currently offer land equity loans (FDIC 2024 Survey).

9. Alternatives to Land Equity Loans

If you don’t qualify for a land equity loan or want better terms, consider these alternatives:

1. Personal Loan

- Unsecured, quick approval

- Higher interest rates

2. Home Equity Line of Credit (HELOC)

- If you have a home with equity

3. Cash-Out Refinance

- If you own property with a mortgage

4. Land Contract or Seller Financing

- When buying land from a private seller

5. Construction-to-Permanent Loan

- Good if you’re building on land you already own

10. How to Apply for a Land Equity Loan

Step-by-Step Process:

- Get Land Appraised

- Check Your Credit Score

- Compare Lenders – Use credit unions, rural banks, or online lenders

- Gather Documents:

- Land deed/title

- Proof of income

- Credit report

- Tax returns

- Appraisal report

- Submit Application

- Get Approved and Sign Terms

- Receive Funding

Pro Tip: Choose lenders familiar with agricultural, rural, or recreational land. They’re more likely to approve land-based financing.

11. Frequently Asked Questions

Can I get a land equity loan with bad credit?

It’s difficult. Most lenders require minimum 620–660 credit score, but some credit unions or private lenders might consider lower scores with higher rates.

Is raw land eligible?

Not always. Some lenders require developed or at least partially improved land. Zoning, access to roads, and utilities help your case.

How long does it take to get approved?

Expect 2 to 6 weeks from application to funding, depending on lender and paperwork readiness.

What happens if I default?

The lender can seize and sell the land to recover their funds.

12. Final Thoughts

A land equity loan is a powerful financing option if you own valuable land and need access to capital. Whether you plan to build, invest, or consolidate debt, this type of loan allows you to leverage an otherwise dormant asset.

Key Takeaways:

- Works similarly to home equity loans but is harder to obtain.

- Ideal for landowners looking to build or invest.

- Requires clear title, good credit, and proof of income.

- Compare multiple lenders for the best terms.