Understanding Payday Loans Greeley

What are payday loans and how do they work?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They are typically due on your next pay date, usually within two to four weeks. Interest rates on payday loans are typically very high, significantly higher than those of traditional loans. Borrowers provide a post-dated check or authorize an electronic debit from their bank account for repayment. Before you apply, carefully compare interest rates and fees among various lenders in Greeley. It is crucial to understand the total cost of borrowing.

Understanding the mechanics is key to responsible borrowing. You’ll typically need to provide proof of income, identification, and a checking account. The lender will assess your creditworthiness, but approval is often easier to obtain than with traditional loans. However, the high interest rates mean that even a small loan can quickly become expensive if not repaid promptly. “Always borrow only what you absolutely need and have a solid repayment plan in place before applying for a payday loan in Greeley.” Failure to repay on time can lead to additional fees and impact your credit score.

Eligibility requirements for payday loans in Greeley

Securing a payday loan in Greeley requires meeting specific criteria. Lenders typically verify your employment status, demanding proof of consistent income to ensure repayment ability. They’ll also check your bank account details to confirm direct deposit capabilities for both loan disbursement and repayment. Your credit history is often considered, although payday loans are known for being more accessible to borrowers with less-than-perfect credit scores than traditional loans. However, a history of missed payments on other loans might hinder your application. Finally, you must be of legal age—18 years or older—and a resident of Colorado.

Meeting these requirements is crucial. “Failing to provide accurate information or falsifying documents could have serious legal consequences.” Lenders will assess your ability to repay the loan within the agreed timeframe, often two to four weeks. Factors like your current income, existing debts, and living expenses play a significant role in this assessment. Understanding these eligibility requirements before applying will save you time and potential frustration. Always carefully review the lender’s terms and conditions before signing any agreement to ensure complete clarity regarding the loan’s repayment schedule and associated fees. Remember, responsible borrowing is key when utilizing payday loans in Greeley.

Interest rates and fees associated with payday loans in Greeley

Payday loans in Greeley, like elsewhere, come with significant costs. These are usually expressed as Annual Percentage Rates (APRs), which can be deceptively high. While the advertised loan amount might seem manageable, the total repayment often surpasses expectations due to accumulated interest and fees. Always carefully review the loan agreement to understand the full cost before signing. Ignoring the fine print can lead to a debt cycle difficult to escape. Remember to compare APRs across different lenders to find the most favorable terms.

Fees can include origination fees, late payment penalties, and potentially even rollover fees if you’re unable to repay on time. These additional charges quickly inflate the overall cost of the loan. In Greeley, as in most places, it is crucial to budget carefully before considering a payday loan and ensure you can comfortably repay the entire amount, including all fees, by the due date. “Failing to do so can lead to a snowball effect of accumulating debt and negatively impact your credit score.” Consider exploring alternative financial solutions before resorting to a payday loan, such as negotiating with creditors or seeking help from credit counseling services.

Finding Reputable Lenders in Greeley

How to identify legitimate and trustworthy lenders

Identifying legitimate payday loan lenders in Greeley requires careful scrutiny. Avoid lenders with vague or hidden fees. Check for clear descriptions of interest rates and repayment terms upfront. Legitimate lenders will readily provide this information. Always confirm their licensing and registration with the Colorado Division of Banking. A quick online search can verify this crucial detail. Don’t hesitate to ask questions; a reputable lender will be transparent and helpful. “Transparency and clear communication are hallmarks of trustworthy payday loan providers.”

Look for lenders with positive customer reviews and a strong online presence. Websites with outdated information or unprofessional design might indicate a less reputable company. Consider checking the Better Business Bureau (BBB) website for complaints or ratings. This can provide valuable insight into a lender’s history and customer satisfaction. Remember to compare interest rates and fees across multiple lenders before making a decision. “Choosing the right lender can significantly impact your overall borrowing experience and financial well-being.” Take your time, do your research, and choose wisely.

Tips for comparing lenders and their offerings

Before choosing a payday loan lender in Greeley, compare several options. Look beyond just the advertised interest rate. Annual Percentage Rate (APR), which includes fees, gives a truer picture of the loan’s cost. Check for hidden fees. Some lenders charge extra for things like late payments or early repayment. Always clarify these fees upfront. “Transparency is key when dealing with financial products, so choose lenders that are open about their practices.”

Consider the lender’s reputation. Online reviews can offer valuable insights. Look for mentions of customer service and the ease of the loan process. Check the Better Business Bureau (BBB) website for complaints and ratings. Also, see if the lender is licensed and compliant with Colorado’s regulations for payday loans. Prioritize lenders with clear terms and conditions, easily accessible contact information, and a proven track record of fair lending practices. This will help avoid potential problems later.

Avoidance of predatory lending practices

Predatory lenders often target those facing financial emergencies. They may advertise extremely low initial interest rates, concealing exorbitant fees and high APRs. Be wary of lenders who pressure you into a loan immediately or don’t clearly explain the terms. Always read the fine print carefully. Compare offers from multiple lenders before committing to any payday loan in Greeley. Understand the total cost of the loan, including all fees and interest, before signing any agreement.

Look for lenders licensed and regulated by the state of Colorado. Check the Colorado Division of Banking’s website for a list of licensed lenders. Avoid lenders operating without proper authorization. Transparency is key. A reputable lender will openly provide all loan details, including repayment terms, penalties for late payments, and any additional charges. “If a lender is unwilling to provide this information upfront, it’s a significant red flag, and you should seek a loan elsewhere.” Remember, responsible borrowing starts with finding a trustworthy lender. Always compare loan options, and never feel pressured into a decision.

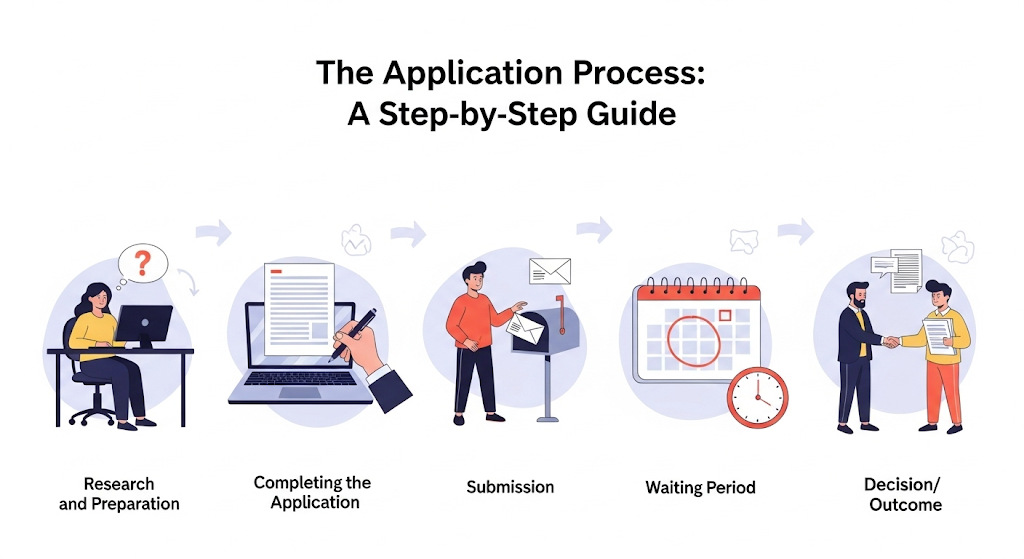

The Application Process: Step-by-Step

Online applications: ease and convenience

Applying for a payday loan in Greeley online offers unparalleled ease and convenience. Many lenders in the area provide user-friendly websites and mobile apps. This eliminates the need for travel to a physical location, saving you valuable time, especially during an emergency. You can complete the application from anywhere with an internet connection, at any time of day or night. This flexibility is particularly beneficial for individuals with busy schedules or limited mobility.

Look for lenders with secure online portals. Check for features like encryption and data protection to ensure your sensitive information remains safe. Reputable lenders will clearly outline their fees and terms online, allowing for easy comparison shopping. “Remember to carefully review all documents before submitting your application to avoid misunderstandings later.” Before submitting your application, confirm the lender’s licensing and reputation with the Colorado Division of Banking. Choosing a reliable online platform significantly simplifies the payday loan application process in Greeley, offering a straightforward and efficient solution to urgent financial needs.

In-person applications: what to expect

Applying for a payday loan in person in Greeley typically involves visiting a lender’s physical location. Bring your government-issued photo ID, proof of income (like pay stubs or bank statements), and proof of your Greeley address. Expect to fill out an application form, providing details about your employment, bank account, and the loan amount you need. Be prepared to answer questions about your financial situation honestly and transparently. Lenders will verify the information you provide, and this process can take some time.

“The lender will assess your creditworthiness based on the information you submit,” and a quick decision is usually possible. However, some lenders might require additional documentation. Before you visit, check the lender’s website or call ahead to confirm their required documents and hours of operation. This will streamline the process and reduce potential delays. Remember to carefully review the loan agreement before signing, ensuring you fully understand the terms and conditions, including interest rates and repayment schedules, to avoid unexpected fees or charges. Payday loans in Greeley should be considered a short-term solution, and responsible borrowing practices are crucial.

Required documentation and information

Securing a payday loan in Greeley, Colorado, typically requires providing specific documentation to verify your identity and financial stability. Lenders will need your government-issued photo ID, such as a driver’s license or state ID card. Proof of income is also crucial, often demonstrated through pay stubs from your employer showing consistent earnings for the past few months. Bank statements are another key requirement, demonstrating your active account and transaction history. This helps the lender assess your ability to repay the loan on time. Failure to provide complete and accurate documentation will likely delay or prevent approval.

“Payday loan applications in Greeley often involve more than just basic information; lenders need comprehensive data to assess risk.” Beyond the essentials, be prepared to provide your Social Security number and contact information. Some lenders may also request proof of address, such as a utility bill or rental agreement. This helps ensure you are a resident of Greeley and can be easily reached if needed. Always check the specific requirements of the lender before applying, as individual stipulations may vary. Remember, providing accurate and complete information is crucial for a smooth and successful application process for your payday loan.

Responsible Borrowing and Repayment

Creating a repayment plan to avoid default

Before taking out a payday loan in Greeley, create a detailed repayment plan. This isn’t just about knowing the due date; it’s about ensuring you have the funds readily available. Identify your regular income sources and meticulously track your expenses. Subtract essential living costs (rent, utilities, groceries) from your income. The remaining amount should comfortably cover the loan’s repayment. If it doesn’t, explore alternative options before proceeding. Consider consolidating debts or discussing a payment extension with your lender. “Failing to plan is planning to fail,” and a thorough budget is crucial for responsible borrowing.

A realistic repayment plan involves more than simply hoping for enough money. Build in a buffer. Unexpected expenses happen. Setting aside a small emergency fund specifically for loan repayment can prevent default. Automatically transferring a portion of your paycheck to a savings account dedicated to this purpose can make repayment effortless. Remember, defaulting on a payday loan in Greeley impacts your credit score, making future borrowing more challenging and potentially more expensive. Prioritize timely repayment to protect your financial well-being. “Proactive planning minimizes stress and safeguards your financial future.”

Understanding the potential consequences of late payments

Late payments on payday loans in Greeley, Colorado, can trigger a chain reaction of serious financial consequences. Your credit score will suffer, making it harder to secure loans, rent an apartment, or even get a job in the future. Many lenders report late payments to credit bureaus, impacting your financial standing for years. Further, you’ll face additional fees and charges, potentially snowballing your debt and making repayment even more challenging. These extra costs can quickly exceed the original loan amount.

Consider the implications beyond your credit report. Repeated late payments can lead to collection agency involvement. These agencies employ aggressive tactics to recover the debt, including repeated phone calls, letters, and potentially legal action. “Failing to meet your payment obligations can result in significant stress and financial hardship, far exceeding the initial loan amount.” Therefore, meticulous planning and budgeting before applying for a payday loan in Greeley are crucial to avoid these damaging repercussions. Always prioritize responsible borrowing and prompt repayment to protect your financial well-being.

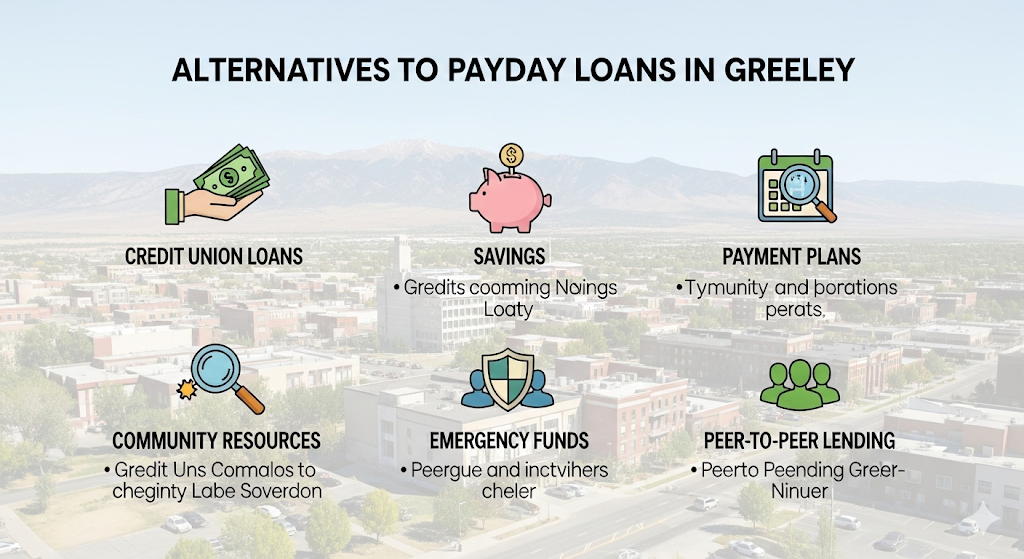

Exploring alternatives to payday loans

Before you consider a payday loan in Greeley, explore other options. Many resources offer short-term financial assistance, potentially avoiding the high interest rates associated with payday loans. Check with local charities or non-profit organizations. They often provide emergency financial aid or connect you with relevant resources. Consider reaching out to your church or community center. They may have programs designed to help people facing unexpected expenses. Exploring these avenues first can save you significant money in the long run.

Credit unions frequently offer small-dollar loans with more manageable interest rates than payday lenders. These loans are often designed for short-term needs. They are a better alternative for those needing to bridge a gap until their next paycheck. You might also consider borrowing from family or friends. This option, while requiring open communication, can be a compassionate and interest-free way to address immediate needs. “Always prioritize exploring these alternatives before resorting to high-interest payday loans in Greeley.” Remember, responsible borrowing involves careful consideration of all available options.

Alternatives to Payday Loans in Greeley

Community resources for financial assistance

Facing a financial emergency? Before considering a payday loan in Greeley, explore the wealth of community resources available to help. Many local non-profit organizations offer financial assistance programs. These programs may provide emergency grants, budget counseling, or help with paying essential bills. Contact the United Way of Weld County or the local Salvation Army for a starting point. They can often direct you to programs best suited to your specific needs. Remember to inquire about eligibility requirements and application processes.

Local churches and food banks frequently offer supplemental support beyond food. Some may provide small, short-term loans or connect individuals with credit counseling services. Research local options online, or reach out to your community leaders for referrals. “Don’t hesitate to ask for help; many resources are available, and seeking assistance is a sign of strength, not weakness.” Remember to thoroughly research any organization before sharing sensitive financial information. By exploring these alternatives, you can potentially avoid the high costs and potential debt trap associated with payday loans in Greeley.

Credit unions and their loan options

Credit unions often offer a more affordable and accessible alternative to payday loans in Greeley. Unlike payday lenders, credit unions are not-for-profit organizations focused on serving their members. This means they typically offer lower interest rates and more flexible repayment terms. Many credit unions provide small-dollar loans specifically designed to meet short-term financial needs. These loans can help you avoid the high costs and potential debt traps associated with payday loans. Before applying, explore the specific loan products offered by local credit unions in Greeley.

Consider researching credit unions like the MountainView Credit Union or others serving Greeley. They may offer personal loans, secured loans (using an asset as collateral), or even emergency loans. These options may have less stringent requirements than payday loans. “Always compare interest rates, fees, and repayment terms across different lenders before making a decision.” Credit unions often prioritize financial education for their members, providing resources to improve your overall financial health and reduce your reliance on high-cost borrowing in the future. This empowers you to make better-informed decisions about managing your money.

Budgeting and financial planning tips

Before considering a payday loan in Greeley, explore budgeting strategies to prevent future financial emergencies. Creating a realistic monthly budget is crucial. Track your income and expenses meticulously. Identify areas where you can cut back on spending. Even small savings add up over time. Consider using budgeting apps or spreadsheets to simplify the process. Many free resources are available online to help you create a personalized budget that works for your unique financial situation. Remember to prioritize essential expenses like rent, utilities, and food before allocating funds to non-essential items. This proactive approach can significantly reduce your reliance on short-term loans.

Effective financial planning extends beyond simple budgeting. Consider building an emergency fund. Aim for three to six months’ worth of living expenses. This safety net provides a buffer against unexpected costs. Explore ways to increase your income. A side hustle or negotiating a raise can improve your financial stability. Regularly review your budget and financial goals. Adjust your spending habits as needed. Seek professional financial advice if you need help creating a long-term financial plan. “Building a strong financial foundation is the best way to avoid the high-interest rates and potential debt traps associated with payday loans.”

Legal Protections and Consumer Rights

Colorado’s regulations regarding payday loans

Colorado has specific regulations designed to protect consumers from predatory lending practices associated with payday loans in Greeley and across the state. These laws aim to limit the amount borrowers can be charged in fees and interest. The state caps the total finance charge a lender can collect on a payday loan. This helps prevent borrowers from falling into a cycle of debt. Knowing these limits is crucial before agreeing to a loan. Always compare offers from multiple lenders to find the most favorable terms.

Crucially, Colorado law mandates that lenders disclose all fees and interest rates upfront. This transparency is vital. You have a right to understand the total cost of the loan before you sign any agreement. Failure to comply with these disclosure requirements can result in penalties for the lender. Remember to carefully read all loan documents before proceeding. “If something seems unclear or too good to be true, seek clarification from the lender or a trusted financial advisor before signing.” Understanding your rights under Colorado’s payday loan regulations is your first line of defense against unfair lending practices.

Understanding your rights as a borrower

In Greeley, Colorado, and across the nation, borrowers have crucial legal protections when dealing with payday loans. The Colorado Division of Banking regulates these loans, setting limits on fees and interest rates. Understanding these regulations is critical before signing any agreement. Familiarize yourself with the state’s maximum allowable finance charges to avoid predatory lending practices. Researching reputable lenders is also vital. Check online reviews and compare offerings to find the best option for your specific financial circumstances. Don’t hesitate to ask questions; a responsible lender will clearly explain all terms and conditions.

Before committing to a payday loan in Greeley, carefully review the loan contract. Understand the repayment schedule and any potential penalties for late payments. Know your APR (Annual Percentage Rate) and the total cost of borrowing. If something seems unclear or unfair, seek clarification from the lender or a consumer protection agency. “Remember, you have the right to a clear and understandable agreement, and you are not obligated to sign anything you don’t fully comprehend.” Colorado law provides avenues for dispute resolution if issues arise, so understanding your rights as a borrower empowers you to make informed financial decisions.

Where to report predatory lending practices

In Greeley, Colorado, encountering predatory lending practices related to payday loans necessitates swift action. You have several avenues to report such issues. The Colorado Attorney General’s Office is your primary resource. Their website provides detailed information on filing complaints and navigating the process. They actively investigate and prosecute lenders engaging in illegal activities. Contacting them is crucial for initiating investigations and potentially recovering lost funds.

Beyond the Attorney General’s office, the Consumer Financial Protection Bureau (CFPB) is a federal agency with jurisdiction over payday lenders nationwide. The CFPB’s website offers tools and resources for consumers to file complaints about unfair, deceptive, or abusive practices. Filing a complaint with both the state and federal agencies maximizes your chances of a successful outcome. Remember to meticulously document all interactions with the lender, including loan agreements, payment records, and communications. “This documentation is vital for building a strong case against predatory lenders.” Don’t hesitate to seek legal counsel if you are struggling to navigate this process.