Payday loans in Jackson, Mississippi are short-term, small-dollar cash advances designed to help residents cover urgent expenses until their next paycheck. They’re known for speed, accessibility, and simple application processes — often delivering funds the same day.

In Jackson, payday loans operate under Mississippi’s regulated lending laws, which limit loan amounts, set maximum fees, and establish repayment terms. While these loans can be a lifeline in emergencies, understanding how they work — along with the benefits, risks, and alternatives — is essential for making smart financial choices.

This detailed guide will explain what payday loans are, how they function, their legal framework in Mississippi, costs, eligibility, advantages, potential downsides, and practical tips for borrowing responsibly. You’ll also learn about local lender options, online payday loans, repayment strategies, and the future of short-term lending in Jackson.

Understanding Payday Loans in Jackson, Mississippi

A payday loan is a short-term borrowing option designed for quick access to funds when facing unexpected expenses. Unlike traditional loans, payday loans:

- Focus on income and repayment ability rather than credit scores

- Require minimal documentation

- Provide fast approvals and same-day funding in many cases

Mississippi Payday Loan Highlights:

- Loan Amount Limit: $500 maximum

- Term: Minimum 7 days, maximum 30 days

- Fee Cap: $20 per $100 borrowed for loans ≤ $250; slightly higher for larger amounts

- Rollovers: Not allowed

How Payday Loans Work in Jackson

The process for obtaining a payday loan in Jackson is straightforward.

Step-by-Step Process

- Choose a Licensed Lender

- Verify licensing through the Mississippi Department of Banking and Consumer Finance.

- Avoid unlicensed or out-of-state lenders operating without compliance.

- Submit an Application

- In-store or online.

- Provide proof of income, valid ID, and active checking account details.

- Approval

- Many lenders offer instant decisions.

- Approval is based on income and repayment ability, not credit history.

- Receive Funds

- Cash or direct deposit.

- Funding often occurs within hours of approval.

- Repay the Loan

- Due in full (principal + fees) on your next payday.

- Payment is often collected via automatic bank withdrawal.

Legal Framework in Mississippi

Mississippi regulates payday loans to protect consumers and ensure transparent lending practices.

| Regulation | Details |

|---|---|

| Max Loan Amount | $500 |

| Loan Term | 7–30 days |

| Max Fee for ≤ $250 Loan | $20 per $100 borrowed |

| Max Fee for > $250 Loan | $21.95 per $100 borrowed |

| Rollovers | Not permitted |

| Licensing | Required for all lenders |

Consumer Protection Tip: If your lender is not licensed in Mississippi, you may lose access to state-backed borrower protections.

Eligibility Requirements

To qualify for a payday loan in Jackson, you must:

- Be 18 years or older

- Provide proof of Mississippi residency

- Show steady income from employment or benefits

- Have an active checking account

- Present a valid government-issued ID

No credit score requirement makes payday loans accessible to many who may not qualify for traditional financing.

The True Cost of Payday Loans

Payday loans are designed for convenience, but they come at a higher cost compared to traditional loans.

Example Cost Calculation:

Borrowing $300 for 14 days with the maximum legal fee ($20 per $100):

- Principal: $300

- Fee: $60

- Total Repayment: $360

Annual Percentage Rate (APR):

Short-term loans like this can carry APRs exceeding 500%, though the fee in dollars may be lower than overdraft charges or late payment penalties.

Benefits of Payday Loans in Jackson

- Speed: Fast application, approval, and funding.

- Accessibility: No credit check required.

- Simplicity: Straightforward process with minimal paperwork.

- Emergency Use: Can prevent utility shut-offs, repossessions, or late fees.

- Privacy: No need to ask family or friends for help.

Risks and Downsides

- High Costs: Significantly more expensive than personal loans.

- Short Repayment Period: Typically due in 2–4 weeks.

- Debt Cycle Risk: Reborrowing can lead to ongoing financial strain.

Smart Borrowing Rule: Only borrow what you can comfortably repay with your next paycheck.

Common Use Cases in Jackson

Car Repairs

Example: A commuter in Jackson uses a $450 payday loan to fix their car’s transmission, avoiding missed workdays.

Medical Bills

Cover urgent co-pays or prescriptions without delaying treatment.

Utility Payments

Prevent power shut-offs from Entergy Mississippi, avoiding reconnection fees.

Alternatives to Payday Loans

Before applying, consider:

- Credit Union Small-Dollar Loans

- Installment Loans with longer terms and lower APRs

- Utility Bill Extensions

- Local Nonprofit Assistance (e.g., United Way, Catholic Charities)

- Gig Economy Work for quick earnings

Online Payday Loans in Jackson

Advantages

- Apply 24/7 from anywhere

- Funds deposited directly to your account

- No travel needed

Important Considerations

- Confirm Mississippi licensing

- Avoid lenders charging upfront fees

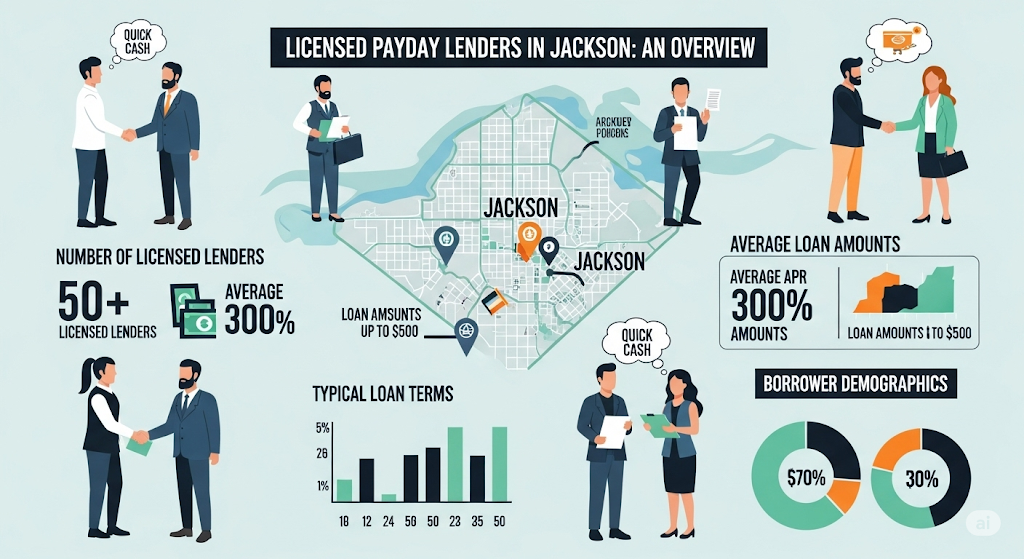

Licensed Payday Lenders in Jackson

While DollarDay connects borrowers to lenders, examples of licensed payday loan providers include:

- Advance America – Multiple Jackson locations

- Check Into Cash – Known for flexible repayment options

- TitleMax – Offers payday and title loan products

Repayment Strategies for Success

- Plan Ahead: Allocate repayment funds immediately after borrowing.

- Avoid Overlapping Loans: Multiple loans can cause unmanageable debt.

- Communicate Early: Contact your lender if repayment issues arise.

Security and Compliance

Mississippi’s lending regulations require:

- Clear fee and term disclosures

- Written contracts

- Consumer rights information

Borrowers should:

- Verify lender licensing

- Keep all documentation

- Avoid unlicensed operators

Local Lending Statistics & Insights

- According to the Consumer Financial Protection Bureau (CFPB), payday loan usage in Mississippi is among the highest in the U.S.

- A significant percentage of borrowers use loans for recurring expenses rather than one-time emergencies.

- In Jackson specifically, the most common loan amounts fall between $200 and $400.

Case Studies from Jackson

Case Study 1 – Avoiding Utility Shut-Off

Maria from West Jackson faced a $280 overdue power bill. A payday loan allowed her to pay it on time, avoiding a $50 reconnection fee.

Case Study 2 – Car Repair for Job Security

James, a delivery driver, used a $350 payday loan to repair his vehicle, ensuring he could keep his delivery schedule and maintain income.

Future Trends in Jackson Payday Lending

- Digital Growth: Online applications continue to rise.

- Regulatory Evolution: Potential federal and state changes to fee structures.

- Alternative Lending Expansion: Growth in small installment loan options.

Frequently Asked Questions

1. What are payday loans and how do they work in Jackson, Mississippi?

A payday loan in Jackson, Mississippi is a short-term cash advance designed to cover expenses until your next paycheck. You borrow a small amount, usually between $100–$500, and repay it on your next payday, plus fees. Many lenders in Jackson offer both in-person and online applications, making it possible to receive same-day funding. These loans are popular for emergencies but should be used responsibly due to higher interest rates compared to traditional loans.

2. Can I get a payday loan in Jackson, Mississippi with bad credit?

Yes. Most payday loan lenders in Jackson, MS do not require a high credit score for approval. Instead, they focus on your income and ability to repay. If you have steady employment or a regular source of income, you may qualify even with bad credit. Many lenders skip hard credit checks, making the process faster and easier for borrowers who may not meet traditional bank requirements. This makes payday loans an option for urgent financial needs.

4. What documents are required for payday loans in Jackson, Mississippi?

Most payday loan providers in Jackson, MS require proof of identity, proof of income, and an active bank account. You’ll typically need a government-issued photo ID (such as a driver’s license), recent pay stubs or bank statements, and a personal check or bank account information for repayment. Requirements may vary by lender, but the process is usually quick and straightforward. Having these documents ready before applying can speed up approval and help you get your funds faster.

5. Are payday loans legal in Jackson, Mississippi?

Yes, payday loans are legal in Jackson, Mississippi and regulated under state law. Lenders must follow specific rules regarding maximum loan amounts, fees, and repayment terms. In Mississippi, the maximum payday loan amount is generally $500, and repayment terms usually range from 14 to 30 days. Licensed lenders must clearly disclose all fees and interest rates before you sign an agreement. Borrowers should only work with licensed, reputable lenders to avoid predatory practices or illegal loan terms.

6. What is the maximum amount I can borrow with a payday loan in Jackson, MS?

In Jackson, Mississippi, payday loan amounts typically range from $100 to $500, depending on your income and the lender’s policies. State law limits the total amount you can borrow to prevent excessive debt. Some lenders may offer slightly higher amounts if you have strong repayment ability, but most stay within the legal maximum. Always borrow only what you need, since payday loans carry higher fees and interest rates than traditional credit options, and repayment terms are short.

7. How do I apply for a payday loan online in Jackson, Mississippi?

Applying online for a payday loan in Jackson, MS is quick and simple. Visit the lender’s website, fill out an application form with your personal details, employment information, and bank account number, then upload required documents. Once approved, funds are deposited directly into your account—often within one business day. This option is convenient for those unable to visit a store location. Make sure to choose a licensed Mississippi lender to ensure fair practices and transparent terms.

8. Can I get same-day approval for payday loans in Jackson, MS?

Yes. Many payday lenders in Jackson, Mississippi offer same-day approval if you apply during regular business hours and meet the requirements. In-store applications often result in instant decisions and immediate cash payout. Online applications can also be approved quickly, though the funds may not appear in your account until the next business day. For fastest results, apply early, have your documents ready, and ensure your bank account information is accurate for smooth fund transfer.

9. Do payday loan lenders in Jackson check my credit score?

Most payday lenders in Jackson, Mississippi do not perform hard credit checks, making them accessible to borrowers with poor or no credit history. Instead, they focus on verifying your income and employment status to determine if you can repay the loan. This means your credit score is unlikely to be affected by applying. However, if you fail to repay, your debt may be sent to collections, which could negatively impact your credit over time.

10. What are the interest rates for payday loans in Jackson, Mississippi?

Interest rates for payday loans in Jackson, MS are typically expressed as a flat fee rather than a traditional APR. In Mississippi, lenders can charge up to $20 per $100 borrowed for loans under $250, and slightly lower fees for larger amounts. While these rates are higher than traditional loans, they reflect the short-term nature of payday lending. Always read the loan agreement carefully to understand the total repayment amount before accepting the loan.

11. Can I repay my Jackson, MS payday loan early without penalties?

Yes. Most licensed payday lenders in Jackson, Mississippi allow you to repay your loan early without additional fees or penalties. Early repayment can save you money on interest or finance charges, making it a smart financial move if you have extra funds before your due date. Check your loan agreement for any specific terms, but reputable lenders encourage early payoff as it benefits both parties. Always confirm policies before signing the loan contract.

12. What happens if I can’t repay my payday loan on time in Jackson?

If you cannot repay your payday loan in Jackson, Mississippi on the due date, you may face additional fees, interest charges, and possible collection actions. Some lenders offer extensions or rollover options, but these can increase the total cost of the loan. If you know you’ll have trouble repaying, contact your lender immediately to discuss options. Avoid ignoring repayment, as unpaid loans may affect your bank account and credit profile. Responsible borrowing is essential to avoid financial strain.

13. Are there alternatives to payday loans in Jackson, Mississippi?

Yes, alternatives include personal installment loans, credit union small-dollar loans, credit card cash advances, or borrowing from friends and family. Some nonprofit organizations in Jackson also offer emergency financial assistance. While payday loans can be useful in urgent situations, exploring these alternatives may offer lower interest rates and longer repayment terms. If you have steady income, some lenders may offer flexible installment plans that are more affordable than traditional payday loan structures.

14. Do I need a bank account to get a payday loan in Jackson, MS?

In most cases, yes. Lenders in Jackson, Mississippi require an active checking account to deposit your loan funds and process repayments. A bank account also serves as proof of financial stability. However, some in-store lenders may offer cash payouts without requiring a bank account, though this is less common. Having a bank account makes the process smoother, especially if you apply online. Check with the specific lender about their payment and deposit options.

15. How many payday loans can I have at the same time in Jackson, Mississippi?

Mississippi law limits borrowers to one outstanding payday loan at a time from a single lender. However, you could potentially have loans from different lenders, though this is not recommended due to the risk of unmanageable debt. Multiple payday loans can quickly become difficult to repay because of high fees and short repayment terms. It’s best to borrow only what you need and ensure you can repay the loan on time to avoid financial strain.

16. Are there any licensed payday loan stores in downtown Jackson, MS?

Yes. Downtown Jackson, Mississippi has several licensed payday loan stores offering in-person applications and same-day cash payouts. Many are located near major intersections or shopping areas for convenience. Visiting a store allows you to ask questions directly and verify the lender’s credentials. Always check that the business is licensed by the Mississippi Department of Banking and Consumer Finance to ensure you’re working with a legitimate provider that follows state regulations.

17. Can I renew or roll over a payday loan in Jackson, Mississippi?

Some lenders in Jackson, MS may allow you to renew or roll over a payday loan by paying additional fees and extending your due date. However, Mississippi regulations limit the number of rollovers to prevent excessive debt accumulation. While rollovers can give you more time, they also increase the total cost of the loan. Before considering this option, ask your lender about repayment plans or other alternatives to avoid paying significantly more in interest and fees.

18. What are the pros and cons of payday loans in Jackson, MS?

Pros of payday loans in Jackson include fast approval, minimal credit checks, and same-day funding for emergencies. They’re accessible to people with bad credit and require simple documentation. Cons include high fees, short repayment terms, and the potential for debt cycles if not repaid on time. Borrowers should weigh these factors carefully before applying. Used responsibly, payday loans can bridge a temporary financial gap, but they are not intended for long-term borrowing needs.

19. How do I find trusted payday loan lenders in Jackson, Mississippi?

To find a trusted lender in Jackson, Mississippi, look for businesses licensed by the Mississippi Department of Banking and Consumer Finance. Check online reviews, ask for recommendations, and verify the lender’s physical address. Reputable lenders clearly disclose terms, avoid hidden fees, and offer customer support. Avoid companies that pressure you to borrow more than you need or skip providing written agreements. Transparency, licensing, and positive customer feedback are strong signs of a trustworthy lender.

20. Is it better to get a payday loan online or in-person in Jackson, MS?

Both options have advantages. Online payday loans in Jackson offer convenience, allowing you to apply from home and receive funds directly in your bank account. In-person loans provide face-to-face assistance, immediate cash, and the chance to verify the lender’s credentials on the spot. The better choice depends on your needs—if you want speed and comfort, go online; if you prefer personal interaction and same-day cash, visit a local licensed store.

Conclusion – Making Payday Loans Work for You

Payday loans in Jackson, Mississippi, are fast, flexible financial tools for emergencies. They can prevent bigger problems like utility shut-offs, repossessions, or lost workdays. However, they are costly and should be used sparingly.

By working with licensed lenders and borrowing only what you can repay, you can use payday loans to solve immediate financial needs without creating long-term challenges.

DollarDay connects you to trusted, licensed payday lenders in Jackson so you can get cash quickly and confidently. If you need funds today, take action before the problem grows.