Understanding Payday Loans in Mobile Alabama (AL)

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They are typically due on your next payday, hence the name. These loans often carry high interest rates and fees, making them a costly option if not repaid promptly. In Mobile, Alabama, as in other states, regulations govern payday lending, including limits on loan amounts and interest rates, although these regulations can still lead to substantial borrowing costs. Always carefully consider the total cost before borrowing.

Borrowers in Mobile should be aware of the potential risks associated with payday loans. Missed payments can trigger a cycle of debt, leading to further fees and charges. Before applying for a payday loan in Mobile, Alabama, it’s crucial to explore all available alternatives, such as borrowing from friends or family, negotiating with creditors for extended payment plans, or seeking financial counseling. “Choosing a payday loan should be a last resort, only after exhausting all other possibilities.” Responsible borrowing is key to avoiding a financial hardship.

How Payday Loans Work in Alabama

In Alabama, payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. You borrow a relatively small amount of money, typically due on your next payday. The lender will require access to your bank account to automatically debit the repayment amount. Interest rates are high, reflecting the inherent risk for lenders. Always carefully review the loan agreement before signing. Failing to repay on time can lead to hefty fees and further debt.

Remember, Alabama law regulates payday loans. These regulations include caps on loan amounts and restrictions on the number of outstanding loans. Before considering a payday loan in Mobile, AL, thoroughly research all costs and fees associated with the loan. Explore all available options first, including borrowing from friends or family, negotiating with creditors, or seeking financial counseling. “Choosing a payday loan should be a last resort, carefully considered in light of its potential financial consequences.” Consider the potential impact on your budget and ability to meet other financial obligations before proceeding.

Key Differences Between Payday and Installment Loans

Payday loans and installment loans share the common ground of offering short-term financing, but crucial differences exist. Payday loans are typically small, short-term loans due on your next payday. They’re designed for immediate needs, often repaid in a single lump sum. Interest rates on payday loans can be significantly higher than other loan types. Alabama, like many states, regulates payday lending, but borrowers should always carefully review the terms and conditions.

Installment loans, conversely, offer borrowers more flexibility. They’re repaid in smaller, regular installments over a longer period, typically months. This structured repayment plan makes budgeting easier for many. While interest rates might be lower than payday loans, the total cost might still be substantial depending on the loan amount and repayment schedule. Choosing between a payday loan and an installment loan in Mobile, AL, depends heavily on your financial situation and repayment capacity. “Understanding these differences is key to making an informed borrowing decision.”

Eligibility Requirements for Payday Loans in Mobile

Credit Score and History

Payday lenders in Mobile, Alabama, generally don’t perform extensive credit checks like traditional banks. They often focus more on your ability to repay the loan on your next payday. This means a poor credit score won’t automatically disqualify you. However, extremely poor credit history, marked by frequent defaults or bankruptcies, might raise concerns for lenders. They may require higher interest rates or refuse your application altogether. Always compare offers from several lenders to find the best terms.

Remember, while a pristine credit score isn’t mandatory for payday loan approval in Mobile, demonstrating responsible financial behavior is crucial. “Lenders prioritize your current income and employment stability over your past credit performance.” Factors like regular income verification and a stable employment history significantly impact your chances of approval. Providing proof of income, such as pay stubs or bank statements, greatly strengthens your application. Be aware of the potential high interest rates associated with payday loans and carefully consider the repayment terms before borrowing.

Income and Employment Verification

Lenders in Mobile, Alabama, typically require proof of regular income to approve a payday loan application. This isn’t just about showing you have a job; it’s about demonstrating a consistent ability to repay the loan. They need to see evidence that you receive a reliable income stream, sufficient to cover your existing expenses *and* the payday loan repayment. Acceptable forms of proof can include pay stubs, bank statements showing regular deposits, or tax returns. The specific requirements vary between lenders, so it’s crucial to check each lender’s specific criteria before applying.

“It’s vital to remember that the amount of income needed isn’t just a minimum wage requirement; it’s a function of your existing debt, expenses, and the loan amount requested.” Lenders assess your debt-to-income ratio (DTI) to gauge your repayment capacity. A high DTI can lead to rejection, even if you meet the minimum income threshold. Therefore, be prepared to provide comprehensive financial documentation. This proactive approach will help you understand your eligibility and avoid application rejection due to insufficient income verification. Being transparent and organized with your financial information will greatly improve your chances of approval.

Residence Requirements in Mobile, AL

To qualify for a payday loan in Mobile, Alabama, you must meet specific residency requirements. Lenders typically require proof of residency, such as a utility bill or rental agreement, showing your current address within Mobile city limits or the surrounding county. This verification process ensures you are a legal resident and helps the lender assess your creditworthiness and ability to repay the loan within your local context. Failure to provide accurate and verifiable proof of residency will likely result in your application being denied.

The exact timeframe you must have lived in Mobile might vary between lenders. Some may require a minimum residency period, perhaps several months, while others might be more flexible. “Always check the specific requirements directly with the lending institution before applying, as these stipulations can change.” Consider factors like length of employment and consistent income history, which also play a crucial role in loan approval, along with your Mobile residency status. Don’t hesitate to contact multiple lenders to compare their policies and find the best fit for your specific situation in Mobile, AL.

Interest Rates and Fees: What to Expect

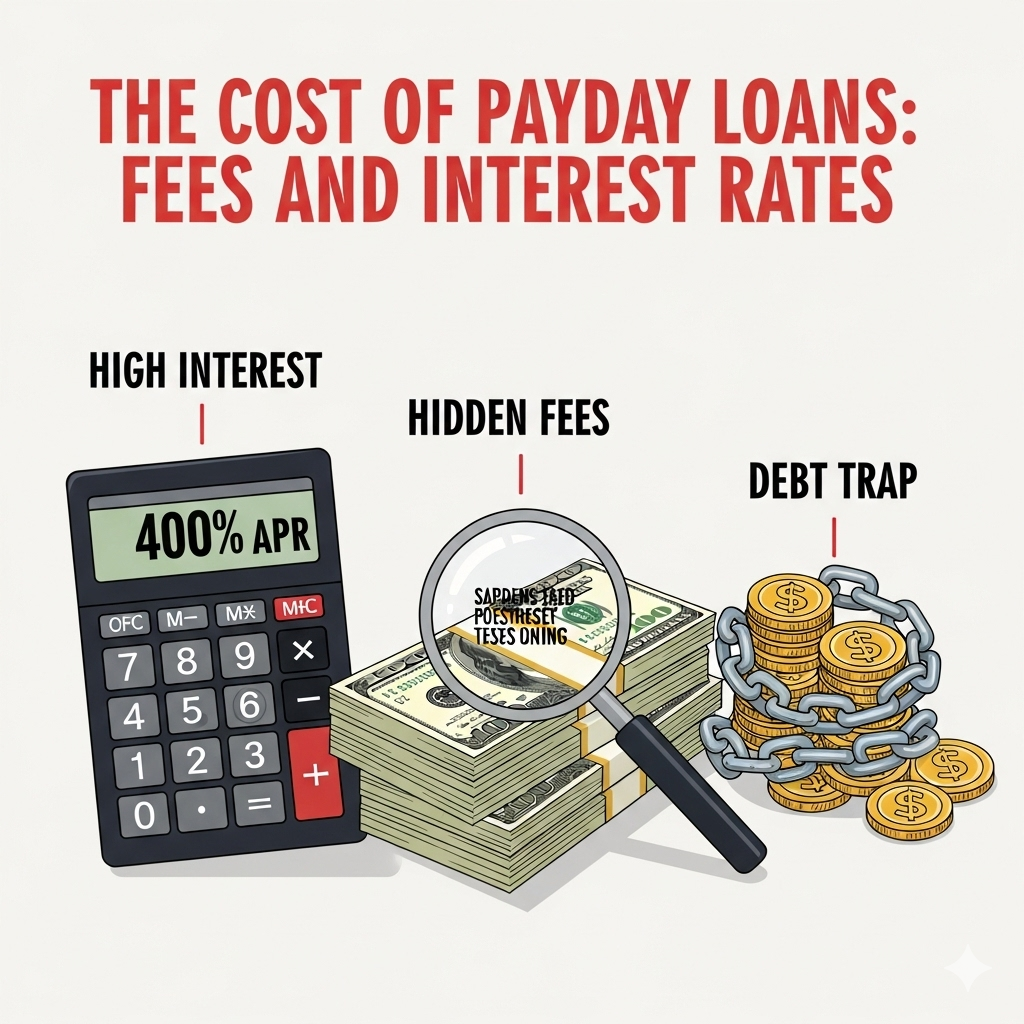

Typical APRs for Payday Loans in Alabama

Alabama’s payday loan market is characterized by high interest rates. Expect Annual Percentage Rates (APRs) significantly exceeding those of traditional loans. These rates can easily reach 400% or more, making them extremely expensive. Remember, the advertised fee might seem small, but when annualized, the true cost becomes shockingly high. Always calculate the total repayment amount before borrowing.

This high cost reflects the inherent risk for lenders. Payday loans are short-term, high-risk loans with a substantial default rate. “Borrowers should carefully weigh the cost against their financial situation and only consider a payday loan as a last resort,” to avoid a debt trap. Compare APRs from different lenders in Mobile, Alabama, but be aware that rates are typically standardized across the state due to regulations. Always read the fine print thoroughly before signing any agreement.

Understanding Fees and Charges

Payday loans in Mobile, Alabama, often involve various fees beyond the interest rate. These can significantly impact the total cost. Expect to see fees for things like application processing, origination, and potential late payment charges. Always obtain a clear breakdown of all charges *before* signing any agreement. Alabama state law regulates these fees, but lenders may still have varying policies. “Carefully review the loan contract to fully understand the total cost of borrowing.”

Common additional fees might include NSF (non-sufficient funds) charges if your bank account lacks sufficient funds for repayment. Some lenders also charge for early repayment, though this is less common. Be aware that these added costs can quickly escalate the loan’s overall expense. Comparison shopping across multiple lenders is crucial to find the most affordable option. “Ignoring the fine print can lead to unexpected and substantial fees, significantly increasing your debt.”

Calculating the Total Cost of a Payday Loan

Understanding the true cost of a payday loan in Mobile, Alabama, goes beyond the advertised interest rate. Lenders often charge significant fees, such as origination fees or late payment penalties, which substantially increase the total amount you repay. These added fees can quickly transform a seemingly small loan into a considerable financial burden. Always request a complete breakdown of all charges before signing any agreement. This allows for a clear comparison of offers from different lenders.

To accurately calculate the total cost, start by identifying the loan’s Annual Percentage Rate (APR). The APR represents the total cost of borrowing, including interest and fees, expressed as a yearly percentage. You can use online APR calculators readily available to determine the final repayment amount, factoring in the loan term and all associated charges. “Remember to factor in potential rollover fees, as these can dramatically inflate your total repayment significantly if you cannot repay the loan on time.” Carefully review all loan documents to avoid unexpected costs and make an informed borrowing decision.

Finding Reputable Lenders in Mobile, AL

How to Identify Reputable Payday Loan Providers

Before choosing a payday loan provider in Mobile, Alabama, carefully examine their licensing and registration. Ensure they hold the necessary permits to operate legally within the state. The Alabama State Banking Department is a valuable resource for verifying licenses. Avoid lenders who lack transparency about their fees and interest rates. Legitimate lenders will openly display this crucial information. Hidden fees are a major red flag, often signaling predatory lending practices.

Look for lenders with a strong online presence and positive customer reviews. Websites that are poorly designed or lack contact information should raise concerns. Check independent review sites like the Better Business Bureau (BBB) for complaints and ratings. “Reading reviews helps you gauge the lender’s reliability and customer service.” Consider opting for lenders who are members of reputable industry associations, demonstrating a commitment to ethical lending practices. Remember, choosing a responsible lender is crucial for managing your payday loan responsibly and avoiding potential financial pitfalls.

Online vs. In-Person Lenders: Pros and Cons

Choosing between online and in-person payday loan lenders in Mobile, Alabama, requires careful consideration. Online lenders often offer convenience and a wider range of options, potentially saving you travel time. However, verifying their legitimacy is crucial. Thoroughly research any online lender before applying, checking for licensing and customer reviews. Be wary of extremely high interest rates or hidden fees which are common pitfalls.

In contrast, in-person lenders in Mobile provide a face-to-face interaction, allowing you to ask questions and clarify terms directly. This transparency can be beneficial, especially for those less comfortable with online transactions. However, the selection might be limited compared to online options. “Always check the lender’s license with the Alabama State Banking Department before committing to any loan, regardless of whether it’s online or in-person.” Remember to compare interest rates and fees between different lenders, both online and in-person, to secure the best possible terms for your specific financial situation.

Resources to Check Lender Reputation

Before you borrow from any payday loan lender in Mobile, Alabama, thoroughly investigate their reputation. The Better Business Bureau (BBB) website is an excellent starting point. Check for any complaints filed against the lender and review their overall rating. A low rating or numerous unresolved complaints should raise serious red flags. Consider this a crucial step in protecting yourself from potentially predatory lending practices.

Beyond the BBB, online reviews provide valuable insights. Websites like Google Reviews and Yelp often feature customer experiences with local Mobile payday loan providers. Look for consistent patterns in feedback. Positive reviews are great, but focus on negative ones. Do they highlight issues with fees, repayment terms, or overall customer service? “Ignoring negative reviews could cost you significantly, both financially and emotionally.” Remember, a lender’s online presence speaks volumes about their commitment to ethical business practices.

Responsible Borrowing Practices: Avoiding Financial Pitfalls

Creating a Budget and Financial Plan

Before considering a payday loan in Mobile, Alabama, carefully assess your financial situation. Creating a realistic budget is crucial. Track your income and expenses for a month to identify areas where you can cut back. Prioritize essential expenses like housing, food, and transportation. Then, allocate funds for debt repayment. This clear picture of your finances will reveal whether a payday loan is truly necessary or if other solutions exist. Consider exploring free budgeting apps or seeking guidance from a financial counselor. Many non-profit organizations offer free financial literacy programs in Mobile.

Developing a financial plan goes beyond budgeting. It’s about setting short-term and long-term goals. Ask yourself: What is the reason behind needing this loan? Is this a recurring problem? “Understanding the root cause of your financial difficulties is key to avoiding future reliance on high-interest payday loans.” If you consistently fall short, explore alternatives like negotiating payment plans with creditors or seeking professional financial advice. Remember, a payday loan should be a last resort, not a long-term solution for managing finances. Building a solid financial foundation through responsible budgeting and planning is the best way to avoid the payday loan trap.

Understanding the Risks of Payday Loans

Payday loans in Mobile, Alabama, offer quick cash but come with significant risks. High interest rates are a major concern. These rates can quickly escalate the cost of borrowing, leading to a debt trap for borrowers who struggle to repay on time. Late fees and additional charges further compound the problem. The Alabama State Banking Department provides resources for understanding these costs, emphasizing the importance of careful comparison shopping before committing to a loan.

“Failing to fully understand the terms and conditions of a payday loan can have severe consequences.” Many borrowers find themselves repeatedly taking out new loans to cover previous ones, creating a cycle of debt that’s difficult to break free from. Before applying for a payday loan, carefully evaluate your financial situation and explore all alternative options, such as credit counseling services or borrowing from friends and family. Budgeting tools and responsible financial planning are crucial in mitigating the inherent risks associated with payday lending.

Alternatives to Payday Loans: Exploring Options

Before considering a payday loan in Mobile, Alabama, explore alternatives. Credit unions often offer small-dollar loans with more manageable interest rates and repayment terms than payday lenders. The National Credit Union Administration (NCUA) insures these loans, offering an added layer of security. Check with local credit unions like the Alabama Credit Union League for options. Also, consider exploring community assistance programs. Many non-profit organizations provide financial assistance to individuals facing short-term hardship. United Way 211, for instance, can connect you with local resources.

Investigate budgeting apps and financial counseling services. These tools can help you identify areas to cut expenses and develop a sustainable budget to avoid future reliance on high-cost loans. Many free resources are available online. Remember, “carefully evaluating your financial situation before borrowing is crucial to making responsible decisions.” Failing to do so can lead to a cycle of debt that is difficult to escape. Prioritize exploring these alternatives before resorting to a payday loan. This proactive approach will help ensure your financial stability.

Legal Protections and Consumer Rights

Alabama’s Laws on Payday Lending

Alabama regulates payday lending, but the regulations are not as stringent as in some other states. The state sets a maximum loan amount, currently $500, and limits the finance charges lenders can assess. These limits are intended to protect borrowers from exploitative interest rates and excessive fees. However, rollover loans are permitted, allowing borrowers to extend the repayment period, which can lead to a cycle of debt for those who struggle to repay on time. Understanding these limitations is crucial before taking out a payday loan in Mobile.

Remember to carefully review the loan agreement before signing. Compare offers from multiple lenders to find the best terms. Alabama law requires lenders to provide clear and concise information about all fees and interest rates. If you feel a lender is violating Alabama law, contact the Alabama Attorney General’s office or the Consumer Financial Protection Bureau (CFPB) for assistance. “Failing to understand the full implications of a payday loan in Alabama can lead to serious financial difficulties.” Always explore alternative financial solutions before resorting to payday loans, such as credit counseling or negotiating with creditors.

Protecting Yourself From Predatory Lending Practices

In Mobile, Alabama, as elsewhere, payday loans can be a financial trap if you’re not careful. Predatory lenders often target vulnerable individuals with high-interest rates and hidden fees. Thoroughly research any lender before signing an agreement. Check online reviews and the Alabama State Banking Department’s website for complaints or violations. Understand the total cost of borrowing, including all fees and interest, before committing. Don’t be pressured into a loan you can’t afford to repay on time. “Failing to fully understand the terms can lead to a cycle of debt that’s difficult to escape.”

Consider exploring alternative solutions before resorting to a payday loan. Credit unions often offer small-dollar loans with more favorable terms. Budgeting apps and financial counseling services can provide valuable tools for managing your finances. The Consumer Financial Protection Bureau (CFPB) provides resources and guidance on avoiding predatory lending practices. Remember, you have rights. If you believe a lender has engaged in illegal or deceptive practices, report them to the CFPB and the Alabama Attorney General’s office. Knowing your rights and actively protecting yourself is crucial when dealing with payday loans in Mobile.

Where to Seek Help and File Complaints

Facing issues with a payday loan in Mobile, Alabama? Several resources can help. The Alabama Attorney General’s Office is your first stop for resolving disputes with lenders. Their website offers resources and a complaint filing system. You can also contact the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that regulates payday lenders. They investigate complaints and take action against lenders who violate federal laws. Remember to document everything—loan agreements, payment records, and communication with lenders. This will strengthen your case.

For local assistance, consider contacting non-profit credit counseling agencies in Mobile. These organizations often provide free or low-cost financial guidance and can help you navigate debt management strategies, including negotiating with payday lenders. “They can offer support and resources beyond simply filing complaints, potentially helping you create a long-term financial plan to avoid future reliance on high-interest loans.” Always research organizations thoroughly before sharing personal information. Checking their legitimacy with the Better Business Bureau is a prudent step. Knowing where to turn for help is crucial when dealing with the complexities of payday loans in Mobile, Alabama.