Understanding Payday Loans in Modesto, CA

What are Payday Loans?

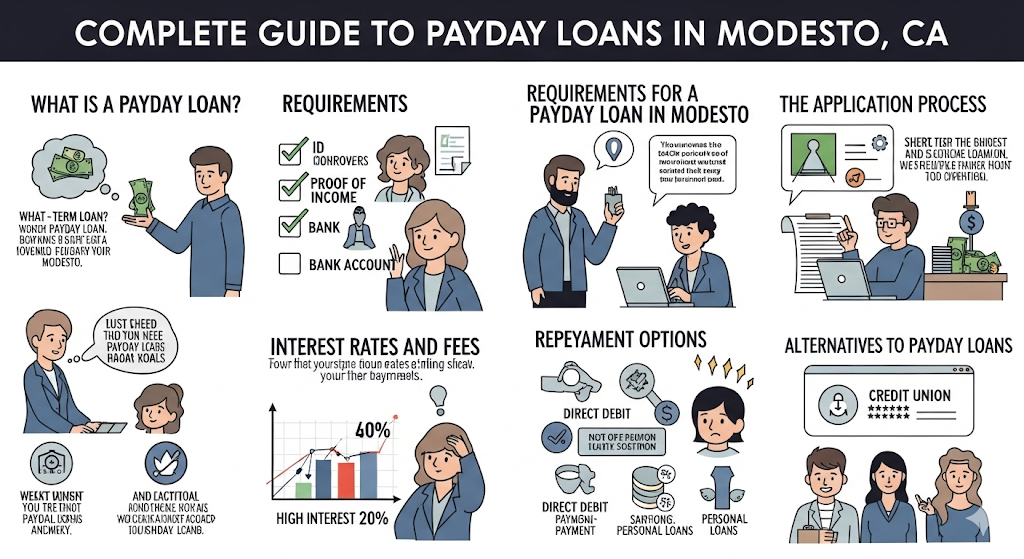

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They’re typically due on your next payday, hence the name. These loans are usually for smaller amounts, ranging from a few hundred to a thousand dollars, depending on state regulations and lender policies. Think of them as a temporary financial bridge to tide you over a difficult period. Finding a reputable lender is crucial when considering this type of financing. Always check reviews and compare interest rates before making a decision.

In Modesto, CA, as in other states, payday loans come with specific regulations. Interest rates and fees are governed by California law, designed to protect consumers from predatory lending practices. It’s essential to understand the total cost of borrowing before agreeing to a payday loan in Modesto. Failing to repay on time can lead to significant fees and impact your credit score. “Before applying for a payday loan, carefully weigh the pros and cons, explore alternative financing options like small credit union loans, and ensure you can comfortably repay the loan on time.” Responsible borrowing is key to avoiding a cycle of debt.

How Payday Loans Work in Modesto

Payday loans in Modesto, CA, are short-term, small-dollar loans designed to bridge financial gaps until your next payday. You borrow a specific amount, typically due on your next payday, along with fees. The application process is often quick and straightforward, frequently involving an online application or a visit to a storefront lender. Lenders assess your ability to repay based on your income and employment verification. Remember that these loans are meant for emergency situations and not long-term financial solutions. Late payments can lead to significant additional fees and negatively impact your credit score.

Before borrowing, carefully compare interest rates and fees among different lenders in Modesto. Don’t hesitate to shop around for the best terms. Understanding the total cost of borrowing, including all fees and interest, is crucial. “Failing to do so can lead to unforeseen debt burdens.” Reputable lenders in Modesto will clearly outline all loan terms upfront. Always review the loan agreement carefully before signing. Consider exploring alternative financial options, like credit counseling or borrowing from friends and family, before resorting to a payday loan if possible.

Eligibility Requirements for Modesto Residents

Securing a payday loan in Modesto, CA requires meeting specific criteria. Lenders typically verify your employment status, requiring proof of consistent income for at least a few months. This ensures you have the means to repay the loan. They will also check your bank account, confirming sufficient funds for direct deposit of the loan and subsequent repayment. Your age must also meet the legal lending requirements, generally 18 years or older. Finally, lenders will assess your credit history, though payday loans often cater to individuals with less-than-perfect credit scores. However, a responsible borrowing history is always looked upon favorably.

Beyond the basic requirements, some lenders in Modesto may have additional stipulations. For example, they might require a valid California driver’s license or state-issued ID as proof of residency. It’s crucial to contact individual lenders directly to understand their specific eligibility requirements. “Failure to meet these conditions will likely result in your application being denied.” Always read the terms and conditions carefully before accepting any loan. Remember, responsible borrowing practices are key to avoiding a cycle of debt. Compare various lenders and choose the option that best aligns with your financial situation and repayment capabilities.

Finding Reputable Payday Lenders in Modesto

Identifying Licensed and Reliable Lenders

In Modesto, California, finding a trustworthy payday loan provider requires diligence. Always verify a lender’s licensing with the California Department of Financial Protection and Innovation (DFPI). Their website provides a searchable database of licensed lenders. This simple check is your first line of defense against scams. Avoid lenders who pressure you into a loan or request upfront fees. Legitimate lenders will clearly outline all fees and terms.

Check online reviews and ratings from reputable sources like the Better Business Bureau (BBB). Look for consistent positive feedback and a history of resolving customer complaints fairly. Pay close attention to any recurring negative comments about high interest rates, aggressive collection practices, or hidden fees. Transparency is key. “A reputable lender will openly share all loan details, including APR, repayment terms, and potential penalties for late payments.” Remember, a quick payday loan should be a short-term solution; responsible borrowing is crucial.

Checking for Online Reviews and Testimonials

Before applying for a payday loan in Modesto, CA, thoroughly research potential lenders online. Don’t rely solely on a company’s website; check independent review platforms like the Better Business Bureau (BBB) and Google Reviews. Look for consistent patterns in customer feedback. Positive reviews highlighting quick processing times and helpful customer service are excellent indicators. Conversely, numerous complaints about high fees, aggressive collection practices, or difficulty contacting the lender should raise significant red flags. “Negative reviews often reveal crucial information about a lender’s true practices, which might not be readily apparent on their marketing materials.”

Pay close attention to the specifics within reviews. Do customers mention transparent fee structures? Were their loan applications processed efficiently? Did the lender communicate effectively throughout the borrowing process? Consider the volume of reviews as well; a few isolated negative comments are less concerning than a consistently negative trend across many reviews. By carefully analyzing online reviews and testimonials, you can significantly reduce the risk of encountering predatory lending practices and ensure a smoother, more trustworthy experience when securing a Modesto payday loan. “Remember, your due diligence is key to protecting yourself from unscrupulous lenders.”

Comparing Interest Rates and Fees

Interest rates and fees significantly impact the overall cost of a payday loan. Don’t just focus on the advertised rate. Carefully examine the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including interest and fees. This allows for a true comparison between lenders. Remember that fees can vary widely; some lenders might charge origination fees, late payment penalties, or other charges that can quickly add up. Always get the full breakdown of all costs before signing any agreement.

Comparing APRs is crucial for finding the best deal. Use online comparison tools or visit the California Department of Financial Protection and Innovation website for resources. “Checking multiple lenders before committing is essential to securing the most affordable payday loan in Modesto, CA.” Pay close attention to the total repayment amount and ensure it aligns with your budget. Avoid lenders with excessively high APRs or hidden fees, as these can lead to a debt trap. Choosing wisely can save you money and potential financial stress.

The Application Process: A Step-by-Step Guide

Gathering Required Documents

Before applying for a payday loan in Modesto, CA, gather all necessary documents. This will streamline the application process and increase your chances of approval. You’ll typically need a valid government-issued photo ID, proof of income (such as pay stubs or bank statements showing consistent deposits), and proof of your current residential address (like a utility bill or lease agreement). Failure to provide complete documentation can lead to delays or rejection.

“Ensuring you have these documents readily available is crucial for a smooth and efficient application.” Consider organizing them into a folder beforehand. Some lenders may also require additional information, such as your bank account details for direct deposit of the loan and perhaps your social security number. It’s always best to check the specific requirements of the lender you choose beforehand. Contacting the lender directly to confirm their needs will avoid any last-minute surprises and prevent application delays.

Completing the Online Application

Most payday loan providers in Modesto, CA, offer streamlined online applications. You’ll typically begin by providing basic personal information like your name, address, and contact details. Next, you’ll need to share your employment and income details, including your employer’s name and how long you’ve been employed. Accuracy is crucial here; providing false information can lead to application rejection. Be prepared to provide bank account details for direct deposit of the loan proceeds and for repayment. The entire process is designed to be quick and easy, often taking just a few minutes to complete.

After submitting your application, you’ll usually receive an almost immediate decision. Many lenders use automated systems to assess your eligibility based on the information provided. Factors considered include your credit score (although payday loans often don’t have stringent credit requirements), income level, and employment history. “If approved, you’ll be presented with the loan terms, including the interest rates and repayment schedule.” Review these carefully before accepting. Remember to read the fine print! Understand all fees and charges associated with the loan. Don’t hesitate to contact the lender if you have any questions before proceeding. “Choosing a reputable lender with transparent practices is key to a positive experience with a payday loan in Modesto.”

Understanding Loan Approval and Disbursement

After submitting your application, the lender will review your information. This typically involves a credit check and verification of your employment and income. The speed of this process varies depending on the lender and the complexity of your application. Some lenders offer same-day approvals; others may take a few business days. Be sure to check the specific lender’s policies before applying. Quick approval is a significant benefit of payday loans, but remember, speed doesn’t mean a lack of thoroughness.

Once your application is approved, the disbursement of funds usually happens quickly. Many lenders offer electronic transfers directly to your bank account, making the process seamless. You might receive your funds within minutes or a few hours of approval. However, some lenders may offer other disbursement methods, such as a check or a prepaid debit card. Always confirm the disbursement method before accepting a loan. “Understanding the lender’s process for loan approval and disbursement is key to managing your expectations and ensuring a smooth experience when accessing emergency cash.” Remember to carefully review all loan terms and conditions before accepting any payday loan in Modesto, CA.

Responsible Borrowing and Repayment

Creating a Repayment Plan

Before you apply for a payday loan in Modesto, CA, create a detailed repayment plan. This crucial step prevents default and its negative consequences. Carefully review your monthly budget. Identify all sources of income and necessary expenses. Subtract expenses from income to determine your disposable income. This will show how much you can realistically afford to repay each month.

Next, consider the payday loan’s terms. Note the loan amount, interest rate, and repayment due date. Factor these details into your repayment plan. Prioritize the loan repayment within your budget. “Failing to plan is planning to fail,” and a realistic budget prevents financial hardship. Consider setting up automatic payments to ensure timely repayments. Explore options like setting aside a portion of your paycheck each week to avoid last-minute scrambling for funds. This proactive approach significantly reduces the risk of late payments and associated fees.

Understanding the Implications of Late Payments

Late payments on payday loans in Modesto, CA, have serious consequences. Your interest rates will likely increase significantly, adding substantial costs to your already expensive loan. Many lenders also charge late fees, which can quickly accumulate and drastically increase the total amount you owe. These additional charges can create a cycle of debt, making repayment even more difficult. It’s crucial to prioritize on-time payments to avoid these penalties.

Furthermore, consistent late payments severely damage your credit score. This negative impact can affect your ability to secure loans, rent an apartment, or even get a job in the future. Lenders report late payments to credit bureaus, creating a lasting record. “Missing even one payment can have a significant and long-lasting effect on your financial health,” so meticulous planning and budgeting are vital. Consider setting up automatic payments to minimize the risk of late fees and ensure timely repayment of your payday loan. Failing to repay on time can lead to collection efforts and even legal action.

Exploring Alternatives to Payday Loans

Before committing to a payday loan in Modesto, CA, explore alternatives that may offer better terms and avoid a cycle of debt. Consider reaching out to local credit unions; they often provide smaller, more manageable loans with lower interest rates than payday lenders. You might also qualify for a small personal loan from your bank or an online lender. These options usually involve a credit check, but the long-term cost is typically far less than a payday loan’s high fees. Always compare APRs carefully.

Exploring options like budgeting apps or seeking financial counseling from non-profit organizations can also be incredibly helpful. These resources offer free or low-cost guidance on managing your finances, creating a realistic budget, and finding solutions for unexpected expenses. “Prioritizing responsible financial planning can prevent the need for high-interest loans altogether.” Remember, there are many resources available to help you manage your money effectively, reducing your reliance on expensive short-term borrowing solutions like payday loans.

Potential Risks and Alternatives to Payday Loans in Modesto

High-Interest Rates and Debt Cycles

Payday loans in Modesto, CA, often come with extremely high-interest rates. These rates can easily reach 400% or more annually. This means a small loan can quickly balloon into a significant debt. Borrowers might find themselves trapped in a cycle of repeatedly taking out new loans to pay off old ones. This is a dangerous situation that can lead to severe financial hardship. Careful budgeting and planning are essential before considering any payday loan.

Consider the potential long-term consequences before borrowing. High-interest rates dramatically increase the total cost of the loan. This often outweighs the perceived convenience. “Failing to repay on time can lead to further fees and penalties, exacerbating the debt problem.” Explore alternative solutions such as credit counseling or negotiating with creditors before turning to high-cost payday loans. These alternatives offer more sustainable solutions to short-term financial challenges. Remember, responsible borrowing is key to avoiding a dangerous debt cycle.

Exploring Alternatives: Budgeting, Credit Unions, Personal Loans

Before rushing into a payday loan in Modesto, explore alternatives that offer better long-term financial health. Creating a realistic budget is crucial. Track your income and expenses to identify areas for savings. Even small cuts can add up. Consider using budgeting apps or seeking free financial counseling services offered by many non-profit organizations in Modesto. These resources can provide personalized guidance and help you develop sustainable financial habits.

Credit unions and personal loans present viable alternatives to high-interest payday loans. Credit unions often offer lower interest rates and more flexible repayment terms than payday lenders. They also frequently provide financial education resources. Personal loans from banks or online lenders can provide larger sums of money with longer repayment periods. However, they usually require a credit check and good credit history. “Carefully compare interest rates, fees, and repayment terms before committing to any loan.” Research thoroughly to ensure you choose the most suitable option for your specific financial situation.

Seeking Financial Counseling

Facing a financial emergency can be overwhelming, making it tempting to rush into a payday loan. However, before considering such a high-interest loan, explore free resources like financial counseling. Non-profit credit counseling agencies offer expert guidance on budgeting, debt management, and creating a personalized plan to address your immediate needs and long-term financial stability. Many offer free initial consultations. These agencies can help you navigate challenging situations and avoid the pitfalls of predatory lending practices.

Consider the long-term implications of high-interest loans. “A financial counselor can help you develop a realistic budget and explore alternative solutions, such as negotiating with creditors or creating a debt management plan, ultimately preventing the cycle of debt associated with payday loans.” They can provide unbiased advice and connect you with community resources offering assistance with housing, food, and other essential needs. Remember, seeking professional help is a sign of strength, not weakness, and it can significantly improve your financial well-being. The National Foundation for Credit Counseling (NFCC) is a reputable organization that can help you find a certified counselor in your area.

Legal Protections and Consumer Rights

California Laws Governing Payday Loans

California has strong consumer protection laws regarding payday loans. These laws aim to prevent predatory lending practices and ensure borrowers understand the terms before agreeing to a loan. For instance, the maximum loan amount is capped, limiting the potential for overwhelming debt. The state also mandates clear disclosure of all fees and interest rates, preventing hidden charges that can trap borrowers in a cycle of debt. Understanding these regulations is crucial for Modesto residents considering a payday loan.

The California Department of Financial Protection and Innovation (DFPI) oversees payday lenders and enforces these regulations. They provide resources and information to help consumers understand their rights. Borrowers should always check the lender’s license with the DFPI to ensure they are operating legally and complying with California’s strict lending laws. If you believe a lender has violated these laws, reporting them to the DFPI is a vital step in protecting yourself and other consumers. “Remember, knowledge is your best defense against unfair lending practices.”

Protecting Yourself from Predatory Lending Practices

In Modesto, California, as elsewhere, borrowers need to be vigilant against predatory payday loan practices. High interest rates and aggressive collection tactics are hallmarks of such lenders. Always compare interest rates and fees across multiple lenders before committing to a loan. Read the fine print carefully, understanding all terms and conditions before signing any agreement. Don’t hesitate to ask questions if anything is unclear. The California Department of Financial Protection and Innovation (DFPI) is a valuable resource for information and assistance regarding payday loans and other consumer financial products. Their website offers valuable guides and tools to help consumers make informed decisions.

Avoid lenders who pressure you into borrowing more than you need or can comfortably repay. Legitimate lenders will never pressure you. If a lender uses threatening or harassing language, report them immediately to the DFPI. Remember that you have rights as a consumer. Explore alternative options like credit counseling or borrowing from friends and family before resorting to a payday loan if possible. “Failing to understand the terms could lead to a debt spiral, so thorough research and responsible borrowing are crucial.” Consider the potential consequences before taking out a payday loan, and always prioritize responsible financial management.

Where to Find Additional Help and Resources

Facing a financial emergency can be overwhelming, but knowing where to turn for help is crucial. In Modesto, CA, several organizations offer support to individuals struggling with debt or needing assistance with payday loans. The California Department of Financial Protection and Innovation (DFPI) is an excellent starting point. Their website provides valuable information on consumer rights, loan regulations, and resources for filing complaints against lenders who engage in unfair practices. You can also contact them directly via phone or mail for personalized guidance.

For broader financial counseling and education, consider reaching out to non-profit credit counseling agencies. These agencies often provide free or low-cost services, including budgeting assistance, debt management plans, and referrals to other relevant resources. Look for agencies accredited by the National Foundation for Credit Counseling (NFCC) to ensure quality and ethical practices. Remember, seeking help early is key. Don’t hesitate to contact these organizations even if you’re just exploring your options. “Proactive steps can significantly improve your financial well-being and prevent further complications with payday loans in Modesto, CA.”