Understanding Payday Loans Lubbock

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. Borrowers often use them for emergency situations like car repairs, medical bills, or utility payments. It’s crucial to understand that these loans often come with high interest rates. This makes them a costly option if not repaid promptly. Always carefully consider the total repayment amount before borrowing.

In Lubbock, Texas, as in other states, payday lenders are regulated. These regulations aim to protect borrowers from predatory lending practices. However, always thoroughly research any lender before applying. Compare interest rates and fees to find the best option for your financial situation. Remember to read the loan agreement completely before signing. “Failing to understand the terms can lead to unforeseen financial difficulties.” Consider exploring alternative financing options if a payday loan‘s high costs outweigh the benefits. Alternatives include credit unions, which may offer smaller loans at more affordable rates.

How Payday Loans Work in Texas

In Texas, payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. You borrow a specific amount, typically due on your next payday. The lender will typically require access to your bank account for automatic repayment. Interest rates are high, reflecting the short repayment period and inherent risk for the lender. Always carefully review the loan agreement before signing. Remember, failing to repay on time can lead to significant fees and further financial difficulties.

Texas law regulates payday loans, setting limits on loan amounts and fees. These regulations aim to protect borrowers from predatory lending practices. However, “it’s crucial to shop around and compare offers from different lenders” to find the best terms. Understanding the total cost, including all fees and interest, is essential before committing to a payday loan. Consider this loan option only as a last resort for urgent financial needs, and always explore alternatives like credit counseling or borrowing from friends and family first.

Lubbock-Specific Regulations and Laws

Before considering a payday loan in Lubbock, TX, it’s crucial to understand the local regulations. Texas, unlike some states, doesn’t cap interest rates on payday loans. This means lenders can charge significant fees. However, Texas law dictates strict loan limits. Borrowers cannot receive more than $500 in a single loan. Furthermore, lenders are prohibited from rolling over loans indefinitely. These regulations aim to protect consumers from a cycle of debt. Always carefully review the loan agreement before signing. Understanding the total cost, including fees, is paramount.

Remember, finding a reputable lender is key. Research lenders thoroughly, checking online reviews and the Texas Office of Consumer Credit Commissioner’s website for complaints or violations. Ignoring these legal aspects can lead to financial hardship. “Failing to understand Lubbock’s specific payday loan laws can result in unexpected fees and difficult-to-manage debt.” Consider the potential consequences carefully. Compare offers from multiple lenders before making a decision. Explore alternative borrowing options, such as credit unions or small-loan programs, if possible, to find a better solution.

Finding Reputable Payday Loan Lenders in Lubbock

Factors to Consider When Choosing a Lender

Choosing the right payday loan lender in Lubbock is crucial. Don’t rush the process. Carefully consider factors like APR (Annual Percentage Rate). A lower APR means lower overall costs. Compare offers from multiple lenders to find the best deal. Check online reviews and ratings from reputable sources like the Better Business Bureau. This helps you gauge the lender’s reputation and customer service quality.

Beyond the APR, investigate the lender’s fees and terms. Look for hidden charges or penalties. Transparency is key. A reputable lender will clearly outline all costs upfront. Avoid lenders with excessively high fees or unclear terms. “Choosing a lender with a strong online presence and readily available contact information is also a good indicator of reliability.” Finally, ensure the lender is licensed and complies with all Texas state regulations governing payday loans. This protects you from fraudulent operations.

How to Spot a Predatory Lender

Beware of lenders advertising unrealistically low interest rates or easy approvals with little to no credit check. These are often red flags indicating a predatory lender. Legitimate payday loan providers in Lubbock, Texas, will clearly outline all fees and interest rates upfront. They will also verify your income and employment to ensure you can repay the loan. Don’t fall for pressure tactics or high-pressure sales pitches.

Predatory lenders often target vulnerable individuals. They may use confusing jargon or deliberately obscure vital information within lengthy contracts. Always read the fine print carefully. Before signing anything, compare offers from multiple lenders to find the best terms. Remember, a reputable lender will be transparent and upfront about their fees and lending practices. “If something seems too good to be true, it probably is.” Consider consulting a financial advisor before committing to a payday loan to understand all the implications. Researching the lender’s licensing and reputation with the Texas Office of Consumer Credit Commissioner is a crucial step.

Online vs. In-Person Lenders in Lubbock

Choosing between online and in-person payday loan lenders in Lubbock depends on your priorities. Online lenders offer convenience. You can apply from anywhere with an internet connection. This saves time and travel. However, thorough research is crucial. Verify licensing and legitimacy before submitting any personal information. Some online lenders may operate outside Texas regulations, leading to higher fees or predatory practices. Always check reviews and compare interest rates across multiple platforms.

In-person lenders provide a face-to-face interaction. This can be beneficial for clarifying loan terms or addressing concerns. You can build a relationship with a local lender. This might lead to more favorable treatment in the future. However, in-person applications require travel time and may have more limited hours. “Before choosing a lender, regardless of their location, always compare APRs, fees, and repayment options to find the best deal.” Remember to carefully read all loan agreements. Understanding the terms completely protects you from unexpected charges and ensures a smooth borrowing process.

The Application and Approval Process

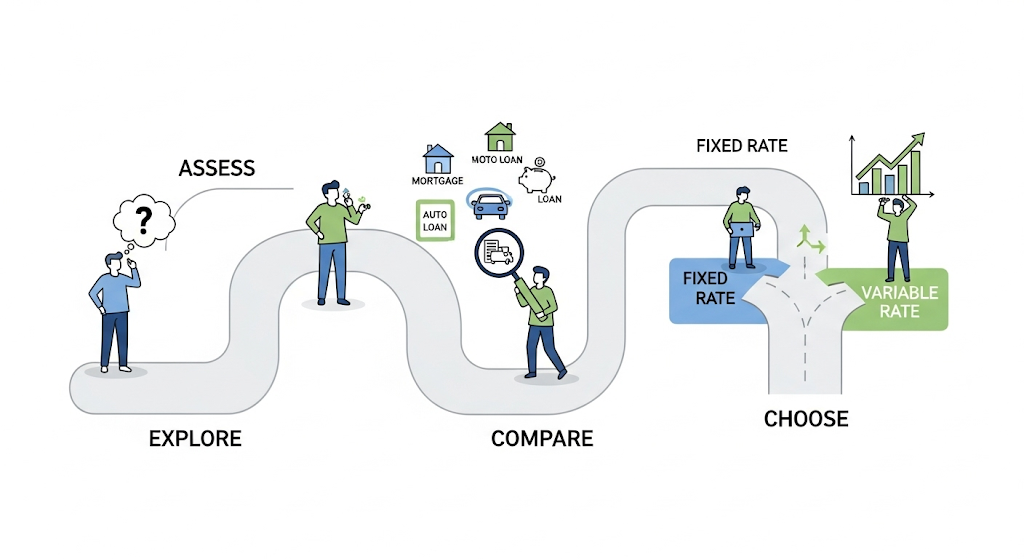

Step-by-Step Guide to Applying for a Payday Loan

Applying for a payday loan in Lubbock is generally a straightforward process. Most lenders offer online applications, requiring basic personal information such as your name, address, employment details, and bank account information. You’ll also need to provide proof of income, typically a recent pay stub. Be prepared to answer questions about your financial situation honestly and accurately. Lenders use this information to assess your ability to repay the loan. Incomplete applications will delay the process. Double-check all details before submitting.

Once you submit your application, the lender will review it. This typically takes only a few minutes to a few hours for online applications. Approval depends on factors like your credit score, income, and debt-to-income ratio. If approved, the funds are usually deposited directly into your bank account within one business day. However, some lenders may offer same-day cash options. Remember, always compare interest rates and fees from multiple lenders before choosing a payday loan in Lubbock. “Choosing the right lender can save you significant costs in the long run.” Read the terms and conditions carefully before signing any agreement.

Required Documents and Information

Securing a payday loan in Lubbock typically requires providing some basic personal and financial information. Expect to present a valid government-issued photo ID, such as a driver’s license or state ID card. You’ll also need proof of income, which might be your most recent pay stubs or bank statements showing consistent deposits. Lenders verify this information to assess your ability to repay the loan. Providing inaccurate information can delay the process or even result in application denial.

Many lenders will also request your bank account information for direct deposit of the loan funds and automatic repayment on your due date. This streamlined process is common among payday loan providers in Lubbock. Remember to carefully review all terms and conditions before signing any agreement. “Always compare interest rates and fees across multiple lenders to find the best deal, as these can vary significantly.” Be aware of potential hidden fees and understand the repayment schedule to avoid falling into a cycle of debt.

Understanding Loan Terms and Interest Rates

Before you sign anything, carefully review the loan terms. Payday loans in Lubbock, like elsewhere, often involve high interest rates. Understanding these rates is crucial to avoiding a debt trap. “Always calculate the total repayment amount, including all fees and interest, before accepting the loan.” This will give you a clear picture of the actual cost. Consider the Annual Percentage Rate (APR), not just the stated interest. The APR reflects the total cost of borrowing, including fees.

Many lenders in Lubbock provide detailed information about their payday loan interest rates and fees upfront. However, it’s your responsibility to understand them completely. Don’t hesitate to ask questions if anything is unclear. Shop around and compare offers from multiple lenders. This comparison shopping can help you secure the best possible terms for your short-term loan. Remember, responsibly managing a payday loan requires careful attention to detail and financial planning. “Failing to understand the terms can lead to unforeseen financial difficulties.”

Responsible Borrowing and Avoiding Debt Traps

Budgeting and Financial Planning Tips

Before considering a payday loan in Lubbock, prioritize creating a realistic budget. List all your monthly income and expenses. Identify areas where you can cut back. Even small savings add up. Consider using budgeting apps or spreadsheets to track your spending. This increased awareness helps you understand your financial situation. Many free resources, like the Consumer Financial Protection Bureau website, offer budgeting tools and advice. “Failing to plan is planning to fail,” so taking the time to budget is crucial.

Once you have a clear budget, develop a short-term and long-term financial plan. This plan should identify your financial goals. Are you saving for a down payment? Paying off debt? Prioritizing these goals helps you make informed decisions. Consider using the 50/30/20 budgeting rule (50% needs, 30% wants, 20% savings and debt repayment). A well-defined plan minimizes the likelihood of needing high-interest loans like payday loans. Remember, responsible financial planning is key to long-term financial health. It provides a solid foundation, reducing your reliance on quick cash solutions.

Alternatives to Payday Loans in Lubbock

Before rushing into a payday loan in Lubbock, explore alternatives. Consider credit unions, which often offer smaller, more affordable loans with better terms than payday lenders. They frequently prioritize member well-being, providing financial education and counseling resources. Many credit unions have specific programs designed to assist members facing financial hardship.

Exploring other options is crucial. Look into Community Action Programs in Lubbock that offer emergency financial assistance. These programs might provide grants or low-interest loans for essential needs. You can also negotiate with your creditors for extended payment plans. This avoids accumulating additional fees and interest. “Remember, proactive communication with creditors is often more effective than seeking high-interest, short-term loans.” Finally, budget carefully and identify areas where you can cut expenses to free up cash. This often provides a more sustainable solution than payday loans.

Managing Debt and Avoiding Late Payments

Successfully managing a payday loan in Lubbock requires careful planning and proactive steps. Create a realistic budget that accounts for all your expenses, including the loan repayment. Identify any areas where you can cut back to free up funds for the loan. Prioritize your loan payment above all other non-essential expenses. Set calendar reminders for the due date to avoid late fees. “Failing to do so can significantly increase the overall cost of the loan and push you deeper into debt.”

Consider setting up automatic payments from your checking account. This ensures on-time repayment, preventing late payment penalties and avoiding negative impacts on your credit score. Explore options for debt consolidation or financial counseling if you’re struggling to manage multiple debts. Local non-profit organizations often offer free or low-cost financial literacy programs and debt management assistance. Remember, responsible borrowing practices are key to avoiding the pitfalls of payday loans. “Proactive planning and adherence to a strict repayment schedule are essential for navigating this financial tool safely.”

Frequently Asked Questions (FAQs) About Payday Loans in Lubbock

What are the common fees associated with payday loans?

Payday loans in Lubbock, like elsewhere, typically involve several fees. The most significant is the finance charge, often expressed as an Annual Percentage Rate (APR), but this can be misleading as payday loans are short-term. The APR can appear incredibly high due to the loan’s short repayment period. Other common fees might include origination fees, charged for processing the loan application, and late fees if you fail to repay on time. “Always carefully review the loan agreement before signing to understand all associated costs.” Some lenders might also add additional fees for insufficient funds or returned checks.

It’s crucial to compare fees across multiple lenders in Lubbock before choosing a payday loan. Interest rates and fees can vary significantly. Remember that even small differences in fees can accumulate quickly, especially considering the short repayment period. Don’t hesitate to ask questions. Understanding the complete cost picture will help you make an informed decision and avoid unexpected charges. “Always prioritize lenders that are transparent about their fees and provide clear terms and conditions.” Consider the total cost, not just the initial loan amount, before committing to a payday loan.

What happens if I can’t repay my loan?

Falling behind on a payday loan in Lubbock can have serious consequences. Late fees accrue quickly, significantly increasing your debt. Repeated late payments can damage your credit score, making it harder to secure loans or even rent an apartment in the future. Contacting your lender immediately is crucial. They may offer options like extending the repayment period or setting up a payment plan to avoid further penalties. Ignoring the problem will only worsen the situation.

Remember, payday loans are meant to be short-term solutions, not long-term financial fixes. If you anticipate trouble repaying, explore alternative options beforehand. Consider seeking help from a credit counselor or exploring resources like local charities offering financial assistance. “Failing to address repayment issues promptly can lead to debt collection agencies contacting you, potentially impacting your personal relationships and employment.” Explore all available options before reaching a point of no return. Always prioritize responsible borrowing and repayment.

Are there any legal protections for borrowers in Lubbock?

Yes, borrowers in Lubbock, Texas, are afforded certain legal protections under Texas state law. These regulations aim to prevent predatory lending practices and ensure fair treatment. Key protections include limitations on the amount a lender can charge in fees and interest, as well as restrictions on the number of rollovers permitted on a loan. The Texas Office of Consumer Credit Commissioner (OCCC) actively enforces these rules, providing a recourse for borrowers who believe they have been mistreated. It’s crucial to understand your rights before agreeing to a payday loan.

Familiarize yourself with the specific regulations surrounding payday loans in Lubbock and Texas by visiting the OCCC website or consulting with a legal professional. Ignoring these protections could lead to serious financial difficulties. “Remember, understanding your rights as a borrower is your first line of defense against unfair lending practices.” Always thoroughly read the loan agreement before signing, clarifying any unclear terms with the lender. Don’t hesitate to seek independent advice if needed. Your financial well-being depends on it.

Resources and Further Assistance

Local credit counseling services

Facing financial hardship in Lubbock and considering a payday loan? Remember that while payday loans offer quick cash, they often come with high fees and interest rates that can trap you in a cycle of debt. Before making a decision, exploring alternative solutions is crucial. Local credit counseling agencies can provide invaluable support. They offer free or low-cost financial guidance, helping you create a budget, manage debt, and explore more sustainable options than short-term loans. Many agencies are affiliated with national organizations like the National Foundation for Credit Counseling (NFCC), ensuring a level of established expertise and credibility.

The benefits of credit counseling extend beyond immediate financial relief. These services provide education on responsible money management, empowering you to make informed choices about your finances. They can help you negotiate with creditors to lower payments or consolidate debts. For residents of Lubbock, searching online for “credit counseling near me” or contacting the NFCC directly will yield a list of reputable local agencies. Remember, seeking help is a sign of strength, not weakness. “Taking control of your finances through informed decision-making and utilizing available resources is key to long-term financial well-being.” Don’t hesitate to explore these valuable community resources before resorting to high-cost payday loans in Lubbock.

State and federal financial resources

Facing a financial emergency? Before considering a payday loan in Lubbock, explore free resources available through state and federal programs. The Texas Department of Housing and Community Affairs offers various assistance programs, including rental assistance and utility bill payment help. These programs can provide crucial support during unexpected hardship, potentially eliminating the need for high-interest short-term loans. Eligibility criteria vary depending on income and household size; check their website for details and application processes.

The federal government also provides financial aid through programs like the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF). These programs offer food assistance and cash aid to families meeting specific income requirements. Remember, payday loans often trap people in cycles of debt. “Exploring these free government programs is a critical first step in managing financial challenges.” Contact your local social services agency or visit the relevant government websites to learn more about eligibility and application procedures. These free resources offer a much more sustainable solution than incurring high fees and interest associated with Lubbock payday loans.

Community support organizations offering financial help

Facing financial hardship can be overwhelming, but you’re not alone. Lubbock boasts several dedicated community organizations offering vital financial assistance to residents struggling to make ends meet. These resources often provide more sustainable solutions than payday loans, focusing on budgeting guidance, credit counseling, and job search assistance. They may offer emergency financial aid or connect you with local charities offering food banks or housing assistance. Finding the right fit depends on your specific needs, so exploring options carefully is key.

Before considering a high-interest payday loan, investigate these community support programs thoroughly. Organizations like the United Way of Lubbock and the Salvation Army often provide crucial support, linking individuals with appropriate services. “Remember that these options often prioritize long-term financial stability over short-term fixes, equipping individuals with the tools to manage their finances effectively.” Check their websites or contact them directly to learn about eligibility requirements and application processes. Exploring these free or low-cost resources could save you significant money in the long run compared to the often-exorbitant fees associated with short-term payday loans in Lubbock.