Understanding Payday Loans Tupelo

Defining Payday Loans and Their Purpose

Payday loans in Tupelo, MS, are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They’re typically due on your next payday, hence the name. These loans are intended for emergency expenses, such as unexpected car repairs or medical bills. However, it’s crucial to understand the high interest rates associated with these loans. Borrowers should only consider them as a last resort, after exploring all other financial options. Mississippi has specific regulations governing payday lending, so knowing those rules is essential before you apply.

Before taking out a payday loan in Tupelo, carefully consider the total cost. The fees and interest can quickly add up, making repayment difficult. Failure to repay on time can lead to further fees and damage your credit score. Therefore, ensure you have a solid repayment plan in place *before* signing any agreement. “Thorough research and comparison shopping among different lenders are vital to finding the best terms and avoiding predatory lending practices.” Remember, responsible borrowing is key to avoiding a debt cycle.

How Payday Loans Work: A Step-by-Step Process

Securing a payday loan in Tupelo, MS involves a straightforward process. First, you’ll need to locate a reputable lender, either online or in person. Many lenders operate within the city limits, offering varying terms and interest rates. Carefully compare offers before committing. You’ll then need to complete an application, providing personal and financial information such as proof of income and a valid ID. Lenders verify this information to assess your creditworthiness and repayment ability. Approval typically occurs quickly, sometimes within the same day.

Once approved, the lender disburses the funds, usually directly into your bank account. The loan amount will be determined based on your income and the lender’s policies, usually capped at a state-mandated limit. Remember, payday loans in Mississippi are regulated, meaning there are legal restrictions on the interest rates and fees charged. “Failing to repay the loan on time can result in significant additional fees and potentially impact your credit score.” It’s crucial to understand the repayment terms and plan accordingly to avoid further financial hardship. Always read the loan agreement thoroughly before signing.

The Legal Landscape of Payday Lending in Mississippi

Mississippi’s payday lending laws are complex. They regulate the maximum loan amount, finance charges, and the length of the loan term. Borrowers should understand these limits to avoid unexpected fees or illegal practices. The Mississippi Department of Banking and Consumer Finance oversees payday lenders and handles consumer complaints. Their website is a valuable resource for information on current regulations.

Interest rates in Mississippi can be quite high. This is a key factor to consider when researching payday loan options in Tupelo. Always compare rates from different lenders before committing. “Choosing a lender based solely on convenience or aggressive advertising could prove costly.” Remember to carefully read all the fine print before signing any loan agreement, paying particular attention to the Annual Percentage Rate (APR) and all associated fees. Understanding these aspects will help you make an informed decision that best suits your financial situation.

Finding Reputable Lenders in Tupelo

Identifying Licensed and Reliable Lenders

Before borrowing money from any payday loan lender in Tupelo, MS, always verify their licensing. The Mississippi Department of Banking and Consumer Finance regulates payday lenders. Check their website to confirm a lender’s license is current and valid. Don’t hesitate to contact the department directly if you have any doubts. Ignoring this crucial step could lead to dealing with an unlicensed, potentially predatory lender. “Choosing a licensed lender is your first line of defense against scams and unfair practices.”

Look beyond just the license. Examine online reviews and testimonials. Websites like the Better Business Bureau (BBB) offer valuable insights into a lender’s reputation. Pay close attention to complaints regarding fees, interest rates, or collection practices. Consider lenders with a history of positive customer experiences and transparent fee structures. Remember, a low interest rate isn’t everything. Transparency and ethical business practices are equally important when selecting a payday loan provider in Tupelo. “A reputable lender will readily provide all the necessary information upfront.”

Checking Reviews and Testimonials

Before applying for a payday loan in Tupelo, MS, thoroughly research potential lenders. Don’t rely solely on advertising. Actively seek out reviews and testimonials from past borrowers. Websites like the Better Business Bureau (BBB) offer valuable insights into a lender’s reputation and history. Look for patterns in feedback; consistent complaints about high fees or aggressive collection practices should raise red flags.

Pay close attention to the specifics of reviews. Do borrowers describe clear and straightforward loan agreements? Were the terms and conditions explained thoroughly? Did the lender provide excellent customer service, or were interactions frustrating and unhelpful? “Reading multiple reviews from various sources helps paint a complete picture of a lender’s reliability and trustworthiness.” Remember, a few positive reviews among many negative ones may be a sign of manipulation, so consider the overall trend in feedback before making a decision.

Comparing Interest Rates and Fees

Interest rates on payday loans in Tupelo, MS, vary significantly. Always compare offers from multiple lenders before committing. Don’t just focus on the advertised rate; examine the Annual Percentage Rate (APR), which reflects all fees and charges. A lower APR indicates a better deal, even if the initial interest rate seems lower. Remember, seemingly small differences in APR can translate into substantial cost differences over the loan’s term.

Look closely at all associated fees. Some lenders charge origination fees, late payment penalties, or even roll-over fees. These added costs can quickly increase your overall borrowing expense. “Carefully review the loan agreement to understand all charges before signing,” as unexpected fees can severely impact your budget. Use online comparison tools or consult with a financial advisor to help you navigate the complexities of payday loan terms in Tupelo and make an informed decision. Transparency from the lender is key; if fees are unclear, proceed with caution.

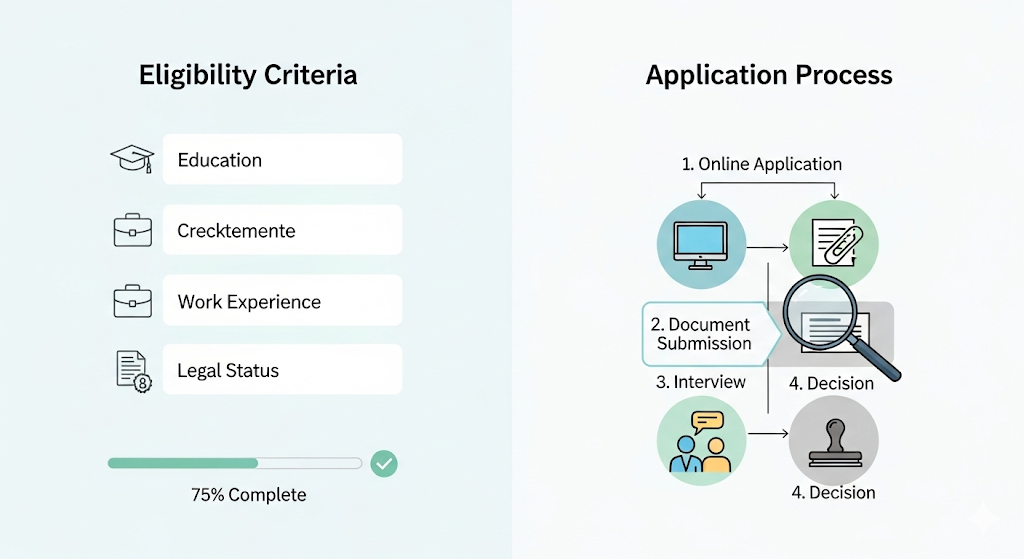

Eligibility Requirements and Application Process

Credit Score Impact: What Lenders Look For

Payday lenders in Tupelo, MS, typically don’t perform extensive credit checks like traditional banks. They prioritize your ability to repay the loan within the short timeframe. This means your credit score might not be the sole determinant of approval. However, a very poor credit history, indicating a pattern of missed payments or defaults, could negatively impact your chances of securing a loan. Some lenders might use alternative credit scoring methods or review your banking history to assess your risk.

“While a stellar credit score isn’t always required, a responsible financial history is highly beneficial.” Lenders look for consistent income and a stable banking relationship to gauge your capacity to repay. Providing accurate information on your income and employment history is crucial. Remember, misleading information can lead to immediate rejection. Transparency throughout the application process will greatly improve your chances of approval. Remember to carefully compare interest rates and fees among different lenders in Tupelo to ensure you’re getting the best possible terms for your short-term financial needs.

Required Documentation and Information

Securing a payday loan in Tupelo, MS, typically requires providing specific documentation to verify your identity and financial standing. Lenders will need a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is crucial, often demonstrated through recent pay stubs, bank statements, or other verifiable income sources. Expect lenders to thoroughly examine this information to assess your repayment ability. Failure to provide complete and accurate documentation will likely delay or prevent loan approval.

Beyond income verification, you’ll need to provide your current address and contact information. This may involve providing utility bills or bank statements showing your address. Accurate contact details, including a working phone number and email address, are vital for communication throughout the loan process. “Remember to double-check all information for accuracy before submitting your application, as inaccuracies can significantly impact the approval process.” Many lenders in Tupelo utilize online applications, streamlining the process, but you must still provide all necessary documentation digitally. Be prepared to answer questions about your credit history. While payday loans often don’t require perfect credit, your financial history informs the lender’s risk assessment.

Steps to Complete Your Application Successfully

Applying for a payday loan in Tupelo, MS, requires careful attention to detail. First, gather all necessary documents. This typically includes a valid government-issued photo ID, proof of income (pay stubs or bank statements), and proof of residency (utility bill or lease agreement). Incomplete applications are often rejected, so double-check everything before submission. Many lenders in Tupelo utilize online application portals, streamlining the process. However, some may still require in-person visits.

Next, accurately complete the application form. Pay close attention to all fields, ensuring accuracy in your personal and financial information. Providing false information is illegal and can have serious consequences. “Be honest and thorough; this is crucial for a successful application.” After submission, expect a response within a short timeframe, usually within a few business hours. Always follow up if you haven’t heard back within the expected time. Remember to compare offers from multiple lenders to secure the most favorable terms before accepting any payday loan.

Responsible Borrowing Practices and Financial Planning

Creating a Realistic Budget and Financial Plan

Before considering a payday loan in Tupelo, MS, meticulously track your income and expenses. Use budgeting apps or spreadsheets to gain a clear picture of your financial situation. Identify areas where you can cut back on spending. Prioritize essential expenses like housing, food, and transportation. This will help you understand your current financial health and whether a payday loan is truly necessary. Remember, even small changes can significantly impact your budget.

A realistic financial plan involves more than just budgeting. It requires setting short-term and long-term financial goals. For example, you might aim to pay off existing debts within six months or save for a down payment on a car within a year. By creating a detailed plan that considers both immediate needs and future aspirations, you’ll be better equipped to manage your finances and reduce your reliance on high-cost loans like payday loans in Tupelo, MS. “Failing to plan is planning to fail,” so take the time to create a strategy that works for you. This proactive approach will enhance your financial well-being and decrease the likelihood of needing emergency loans.

Understanding the Risks of Payday Loans

Payday loans in Tupelo, MS, like elsewhere, carry significant financial risks. The high interest rates can quickly spiral out of control, trapping borrowers in a cycle of debt. Missing even one payment can lead to steep penalties and further fees, exacerbating the initial debt. Consider the potential impact on your credit score; late payments or defaults are reported to credit bureaus, potentially hindering future borrowing opportunities, including mortgages or auto loans.

“Before considering a payday loan, thoroughly explore all alternative options.” These might include negotiating with creditors for extended payment plans, seeking financial counseling from a reputable organization like the National Foundation for Credit Counseling, or utilizing budgeting apps to manage expenses effectively. Remember, the short-term relief offered by a payday loan often comes at a long-term cost. Carefully weigh the potential benefits against the substantial risks involved before making a decision that could significantly impact your financial health. “Failing to do so could have severe consequences for your budget and creditworthiness.”

Exploring Alternative Financial Solutions

Before considering a payday loan in Tupelo, MS, explore alternatives. Credit unions often offer small-dollar loans with more manageable interest rates than payday lenders. The National Credit Union Administration (NCUA) insures credit union accounts, offering a level of safety not always present with payday lenders. Check with local credit unions like those affiliated with the Mississippi Credit Union League for options.

Consider also tapping into community resources. Many non-profit organizations and churches provide financial assistance programs or budget counseling. The United Way of Northeast Mississippi, for example, connects individuals with local resources that could offer short-term financial help. “Exploring these options can often prevent the need for a high-interest payday loan and potentially save you significant money in the long run.” Remember to carefully research any organization before sharing sensitive financial information. Building a strong financial foundation through budgeting and saving is crucial for long-term financial health.

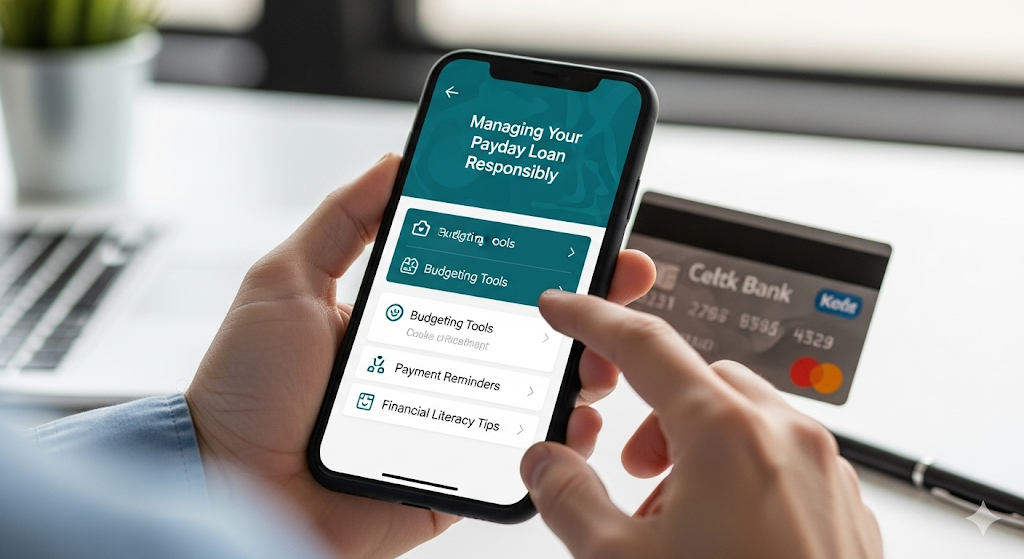

Managing Your Payday Loan Effectively

Making Timely Repayments and Avoiding Late Fees

Punctuality is paramount when dealing with payday loans in Tupelo, MS. Missing a payment triggers late fees, which can quickly snowball, making your debt significantly harder to manage. Always prioritize making your repayment on or before the due date. Many lenders offer online payment options for convenience, allowing you to schedule payments ahead of time and avoid last-minute rushes. Consider setting reminders on your phone or calendar to ensure you don’t miss a crucial payment date. Remember, consistent, timely repayments are key to maintaining a positive credit history, even with a short-term loan like a payday loan.

Failing to meet your repayment obligations can have severe consequences. Late fees in Mississippi can be substantial, adding considerable stress to your already tight budget. In addition to the financial burden, repeated late payments can negatively affect your credit score, impacting your ability to secure loans or credit in the future. “Understanding the implications of late payments is crucial for successfully navigating the payday loan process in Tupelo, MS,” and planning accordingly is essential to avoid unnecessary financial strain. Explore all available payment methods offered by your lender to find the most convenient and reliable option for you.

Communicating with Your Lender

Open communication is crucial when dealing with payday loans in Tupelo, MS, or anywhere else. Don’t hesitate to contact your lender if you anticipate trouble making a payment. Many lenders are willing to work with borrowers facing hardship, perhaps offering payment extensions or alternative repayment plans. Early communication shows responsibility and increases your chances of a positive outcome. Remember, ignoring the problem only makes it worse. Proactive communication can save you from further fees and potential damage to your credit score.

Always keep detailed records of all communication, whether it’s via phone, email, or in person. This documentation will prove invaluable should any disputes arise. Note the date, time, and the specific person you spoke with. If possible, get confirmation of any agreements in writing. “Understanding your rights and responsibilities as a borrower is essential for successfully navigating the payday loan process in Tupelo, MS.” Familiarize yourself with Mississippi’s regulations concerning payday lending practices. These regulations protect consumers and provide avenues for dispute resolution if necessary.

Building a Strong Financial Future

Escaping the cycle of payday loans in Tupelo, MS, requires proactive financial planning. This means creating a realistic budget that tracks income and expenses meticulously. Identify areas where you can reduce spending and prioritize essential bills. Consider using budgeting apps or spreadsheets to gain a clear picture of your finances. Small changes, like packing lunch instead of eating out, can make a significant difference over time. “Building a strong financial foundation is crucial to avoid future reliance on high-interest loans.”

Once you have a solid budget in place, focus on saving. Even small, consistent savings contribute to an emergency fund. This fund acts as a buffer against unexpected expenses, preventing the need for a payday loan in the future. Explore options like high-yield savings accounts or credit unions in Tupelo for better interest rates. Remember that consistent effort is key. “Gradually building your savings will provide financial security and reduce your vulnerability to predatory lending practices associated with short-term loans like payday loans.”

Frequently Asked Questions (FAQ)

What are the common fees associated with payday loans?

Payday loans in Tupelo, MS, like elsewhere, often involve various fees. These can significantly impact the total cost. Expect to see finance charges, expressed as an Annual Percentage Rate (APR), which can be quite high. Additionally, many lenders charge origination fees, a one-time fee for processing the loan. Late payment fees are another common expense, adding to the already substantial cost if you’re unable to repay on time. Always carefully review the loan agreement to fully understand all associated fees before signing. “Failing to do so could lead to unexpected and substantial debt.”

Remember, the seemingly small fees quickly accumulate. For example, a $300 payday loan with a $30 finance charge and a $15 origination fee will cost you $45 in addition to the principal. This represents a significant percentage increase on a short-term loan. Furthermore, if you roll over the loan, these fees will compound, leading to a debt trap. Therefore, it is crucial to meticulously compare offers from different lenders, focusing not only on the interest rate but also on all other charges to find the most affordable option. “Borrowing responsibly and only when absolutely necessary is vital to avoiding a cycle of debt.”

What happens if I cannot repay my loan?

Falling behind on a payday loan in Tupelo, MS, can have serious consequences. Late fees accumulate quickly, significantly increasing your debt. Your lender may contact you repeatedly, potentially impacting your credit score. Repeated defaults can severely damage your creditworthiness, making it harder to secure loans, credit cards, or even rent an apartment in the future. Consider exploring options like debt counseling or negotiating a repayment plan with your lender *before* you default. Remember, proactive communication is key.

Ignoring the problem won’t make it go away. The lender may pursue legal action, such as wage garnishment or lawsuits, to recover the funds. In Mississippi, specific laws govern debt collection, offering some consumer protections. However, these protections do not eliminate the potential for significant financial hardship. “Failing to address a delinquent payday loan can lead to a cycle of debt and legal challenges that are difficult to overcome.” It is crucial to understand your rights and responsibilities regarding payday loan repayment. Seeking help from a reputable credit counselor or financial advisor is strongly advised if you are struggling.

What alternatives exist to payday loans in Tupelo?

Facing financial hardship and considering a payday loan in Tupelo, MS? Before you borrow, explore better options. Credit unions often offer small-dollar loans with more manageable interest rates than payday lenders. The National Credit Union Administration (NCUA) insures these loans, providing a safety net. Check with local credit unions like the Northeast Mississippi Credit Union or similar institutions for available programs. They may provide financial counseling as well.

Consider exploring budgeting apps and tools. These can help track spending and identify areas for savings. You might also seek assistance from local non-profit organizations offering financial literacy classes and guidance. Many churches and community centers offer similar resources. Remember, “responsible budgeting and financial planning are crucial for long-term financial health, avoiding the high-cost cycle of payday loans”. Explore all available resources before resorting to high-interest borrowing. Contact the Consumer Financial Protection Bureau (CFPB) for additional information and guidance on responsible financial management.