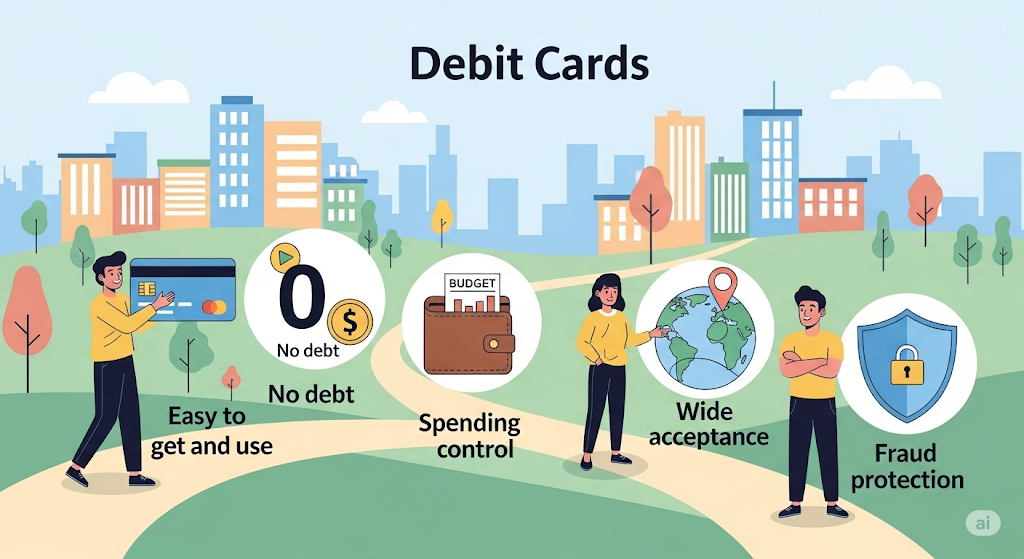

Pros of Debit Cards offer a straightforward way to access money directly from a checking account without the need to carry cash or borrow credit. They provide quick and convenient payment options for everyday purchases, both in person and online.

One key benefit of debit cards is the ability to avoid debt by using only the funds available in the account, which helps control spending. Additionally, debit cards often come with fewer fees than credit cards and allow easy access to cash through ATMs.

Beyond convenience, debit cards can simplify budgeting by showing real-time transaction records. This transparency helps users stay aware of their finances without accumulating interest or credit balances.

Understanding Debit Cards

Debit cards provide direct access to funds in a bank account and come with various features that affect their use and security. They operate electronically, allowing users to make payments or withdraw cash without carrying physical money.

Definition and Key Features

A debit card is an electronic payment card linked directly to the user’s checking or savings account. It allows funds to be deducted immediately when the cardholder makes a purchase or ATM withdrawal.

Key features include ATM access, PIN verification, and the ability to be used for in-store or online purchases. Some debit cards, such as Shazam debit cards, use specific payment networks designed for secure and widespread acceptance. Cards may carry brand logos like Visa or Mastercard, which enables global use and additional protections.

Not all debit cards are the same; for example, the Bank of Bhutan International Debit Card offers features tailored for cross-border use, such as foreign currency transactions and international ATM access.

How Debit Cards Work

When a debit card is used, the system verifies if the account has sufficient funds. If approved, the transaction amount is withdrawn directly from the linked bank account. Payment networks like Visa or Shazam facilitate this transfer electronically and securely.

The card’s chip and magnetic stripe store essential data for transaction processing. PIN entry helps prevent unauthorized use, especially for cash withdrawals. Some cards allow contactless payments, speeding up small in-person transactions.

Debits remove money in real-time, reducing the risk of accruing debt unlike credit cards, but could expose users to overdraft fees if spending exceeds the available balance.

Types of Debit Cards

Debit cards come in several types based on their network and issuing bank. The most common are Visa Debit and U.S. Debit cards, often differing by region or financial institution.

- Visa Debit: Accepted worldwide, offers fraud protection, and supports online and contactless payments.

- U.S. Debit: Used mostly domestically and may operate on different networks like Shazam or NYCE.

- Electronic Debit Cards: Cards with built-in chips and magnetic stripes for secure electronic transactions.

- Specialized cards: Some, like the Bank of Bhutan International Debit Card, add specific benefits like multi-currency support and wider ATM networks.

These differences affect global usability, fees, and acceptance standards.

Debit Card vs. Credit Card

Debit cards withdraw money directly from existing funds, avoiding debt, while credit cards borrow money up to a credit limit, creating balances to repay later.

Debit cards typically require a PIN for transactions, whereas credit cards often use signatures or PINs depending on the region. Debit transactions generally post immediately, while credit card billing is monthly.

In terms of protection, credit cards often offer stronger fraud liability rules and rewards programs. Debit cards, while convenient and budget-friendly, may expose users to greater risk if lost or stolen, due to faster fund depletion.

Both cards can be Visa-branded, but their use, cost, and security features vary based on these fundamental differences.

Advantages of Debit Cards

Debit cards offer practical benefits that make managing everyday finances easier. They provide quick access to funds and support a seamless payment experience in various settings.

Convenience and Accessibility

Debit cards allow users to make purchases without carrying cash. They are linked directly to checking accounts, enabling spending within available balances. This helps avoid overspending and keeps track of expenses in real time.

Many banks also issue HSA debit cards, which permit authorized withdrawals for qualified medical expenses. Users can conveniently pay for healthcare costs without extra steps or fees.

Transactions can be completed online or in stores, and ATMs worldwide accept debit cards for cash withdrawals. This accessibility supports both planned purchases and emergencies.

Instant Access to Funds

Unlike credit cards, debit cards draw funds immediately from a user’s bank account. This means purchases reflect the actual account balance, reducing the risk of debt accumulation.

For those managing tight budgets, this instant access prevents overspending beyond available resources. It also eliminates the need for monthly bill payments, since money is spent directly from the account.

Additionally, cash withdrawals using debit cards provide immediate liquidity. Customers can get cash from ATMs anytime, including for uses like HSA withdrawals if the card is linked to a health savings account.

Widespread Acceptance

Debit cards are accepted at millions of locations worldwide, from retail stores and gas stations to restaurants and online merchants.

This broad acceptance makes debit cards a reliable payment method for almost any purchase, supporting everyday expenses and travel needs without requiring multiple payment forms.

Many debit cards carry major network logos such as Visa or Mastercard, enabling access to international merchants and ATMs. This global compatibility increases their value as a flexible spending tool.

Financial Control and Budgeting

Using a debit card helps individuals maintain clear limits on spending and offers immediate insights into available funds. This direct connection to the checking account prevents borrowing beyond means. Practical tools for budgeting and managing daily expenses become easier through this method of payment.

Limiting Overspending

A debit card restricts spending to the current balance in the linked bank account. There is no option to borrow beyond what is available, unlike credit cards, which can encourage overspending due to borrowing limits.

This restriction can be particularly helpful for those working to avoid debt or manage their finances without credit. It reduces the risk of accumulating fees or interest charges.

People with bad credit often prefer debit cards for this reason—they allow them to transact without relying on credit approval. For budgeting purposes, the inability to spend more than the account holds acts as a natural safeguard.

Real-Time Transaction Tracking

Debit card transactions immediately reflect on the linked bank account. This real-time updating allows users to see each purchase and withdrawal without delay.

Many banks offer apps or notifications that provide instant alerts when a debit card is used. This transparency in spending helps monitor balances and avoid overdraft fees.

Since debit card transactions are deducted from the account rather than recorded as accounts receivable like credit cards, users deal with actual cash flow rather than future payments. This clarity supports more disciplined financial management in everyday life.

Safety and Security of Debit Card Usage

Debit cards incorporate several security features to protect users’ funds and personal information. These include technology safeguards, fraud detection systems, and recommended user practices to reduce the risk of unauthorized access or theft.

PIN and Chip Technology

Most debit cards require a Personal Identification Number (PIN) to authorize transactions, adding an important layer of security. When using a chip-enabled card, the chip generates a unique transaction code that makes it harder for fraudsters to clone the card.

If the chip malfunctions, transactions can often revert to the magnetic stripe or require manual entry of the PIN. Bypassing the PIN removes a critical safety step and increases vulnerability to fraud. Some debit cards offer PINless transactions for small purchases, but these are limited in value and closely monitored.

For security, many banks recommend monitoring account activity regularly to spot and report suspicious transactions promptly.

Fraud Protection Measures

Banks deploy multiple fraud protection tools, such as real-time transaction monitoring, alerts for suspicious activity, and the ability to quickly freeze or cancel a card. These measures help detect unauthorized use, even if the physical card is not present.

If someone uses a debit card without physically having it, it usually means card details have been stolen digitally. Immediate reporting and account freezing are essential to limit losses since debit card fraud impacts the user’s actual funds.

Proper Security Practices

Users must follow specific security practices to keep their debit cards safe. These include regularly changing PINs, avoiding sharing card details, monitoring account statements, and using secure networks for online transactions.

Using ATMs in secure locations and covering the keypad when entering the PIN can prevent skimming and shoulder surfing. Enabling transaction alerts also allows quick response to unfamiliar charges, minimizing financial damage.

Global and Online Usability

Debit cards are widely accepted across different countries and online platforms, offering convenience for everyday transactions. Their usability extends beyond local purchases, enabling users to access funds internationally and shop from various online merchants securely.

International Transactions

Debit cards issued by banks like the Bank of Bhutan often come with international capabilities, allowing holders to make purchases and withdraw cash abroad. These cards typically support foreign currency conversions and use security features such as PIN protection and fraud monitoring to safeguard users during international transactions.

Users benefit from access to global ATM networks, reducing the need to carry large amounts of cash while traveling. Additionally, many cards offer competitive foreign exchange rates and seamless processing of money transfers, which can include transfers through authorized money order and foreign exchange providers.

Online Purchases with Debit Cards

Debit cards provide a straightforward way to shop online by linking directly to a checking account. This setup ensures that purchases are funded immediately, helping users control their spending without accruing debt.

Security measures like CVV codes, two-factor authentication, and transaction alerts enhance the safety of online transactions. Many debit cards, including international versions, are accepted by major online merchants and payment platforms, making it easy to buy a wide range of goods and services worldwide.

Key features for online purchases include:

- Immediate payment from available account funds

- Enhanced security with PINs and verification codes

- Compatibility with global e-commerce sites

- Fraud detection systems to minimize risks

Debit Cards and Credit Building

Debit cards generally do not affect credit scores because they draw money directly from a checking account. However, certain debit cards linked to credit-building tools or secured accounts can support credit improvement efforts.

Impact on Credit Score

Regular debit card use does not report to credit bureaus, so it has no direct impact on credit scores. Unlike credit cards or loans, debit transactions are withdrawals, not credit extensions.

Some specialized debit cards, often linked to secured credit accounts or prepaid cards with credit-building features, can help users build credit. These products report activity to credit agencies, allowing responsible use to improve scores.

Traditional debit spending alone won’t improve credit history. Users must seek cards explicitly designed to provide credit reporting or consider combining debit card use with other credit-building strategies.

Debit Cards for Bad Credit

Individuals with poor credit or no credit history may find limited credit-building benefits from standard debit cards. However, certain debit cards marketed as solutions for “bad credit” situations exist.

These cards typically link to secured credit accounts or services that report timely payments to credit bureaus. They offer a controlled spending environment and can serve those who struggle to qualify for regular credit cards.

A useful approach is to use such debit cards alongside other credit-repair tools. This approach helps avoid debt accumulation while slowly establishing a positive credit record, essential for improving financial opportunities.

| Feature | Standard Debit Card | Debit Card for Bad Credit |

|---|---|---|

| Requires credit check | No | Sometimes |

| Reports to credit bureaus | No | Yes, if linked to secured account |

| Helps build or repair credit | No | Yes |

Business and Specialized Debit Card Uses

Business and specialized debit cards offer distinct functions tailored to specific financial needs. These cards simplify expense management, support automated transactions, and provide controlled access to funds, making them practical tools for managing cash flow and operational costs.

Business Debit Card Features

Business debit cards allow companies to access their funds directly, enabling immediate payments without incurring credit. They typically include features such as spending limits, transaction tracking, and multiple card issuance for employees, which help maintain oversight and control over business expenses.

Companies can use these cards for routine payments, including automatic payment pools for utilities or service subscriptions, reducing the administrative burden of manual payments. However, it is usually not advisable to use business debit cards for personal expenses, as this can complicate financial records and tax reporting.

Security features such as PIN protection and fraud monitoring help safeguard business accounts. Additionally, many cards provide expense categorization tools, aiding in bookkeeping and budgeting.

Specialty Debit Card Applications

Specialty debit cards are designed for particular uses beyond standard business transactions. These include prepaid cards for payroll distribution, cards linked to specific projects or departments, and cards intended for controlled spending scenarios.

These cards improve financial discipline by limiting available funds to set amounts, reducing the risk of overspending. They also facilitate easier auditing since expenses are tied directly to predetermined budgets.

Specialized debit cards often support integration with financial software, streamlining expense reporting. Their use can extend to industries requiring tight expense control, such as construction or event management, where direct spending oversight is critical.

Common Issues and Considerations

Using debit cards involves some practical challenges that users should be aware of. These issues primarily involve the card’s functionality, security risks, and situations when transactions may be contested.

Card Declines and Malfunctions

Debit cards can be declined for various reasons, including insufficient funds or technical problems such as a chip malfunction. For example, a damaged chip on a debit card can prevent the card from being read properly, leading to declined transactions at payment terminals.

Network outages or system errors at banks or merchants can also cause declines. Users should always carry a backup payment method to avoid inconvenience, especially in critical situations.

In cases like the 100 Deerfield Lane charge on a debit card dispute, it is essential to verify the transaction and check for any potential errors or fraud. Regularly monitoring account activity helps identify issues quickly.

Lost or Stolen Debit Cards

Losing a debit card or having it stolen poses significant risks, including unauthorized access to the linked bank account. Cardholders must report the loss to their bank immediately to freeze the card and prevent further transactions.

Many banks provide zero liability policies for fraudulent charges if notified promptly. However, users may still be responsible for transactions made before the report, depending on the timing.

Replacing a lost or stolen card usually takes a few business days. Meanwhile, using mobile payment options linked to the bank account can offer temporary convenience without the physical card.

Transaction Disputes

Disputes can arise when a debit card transaction is incorrect, unauthorized, or involves a merchant error. Common examples include being charged twice or disputes related to unfamiliar charges, such as the 100 Deerfield Lane charge on debit card incident.

Consumers must notify their bank immediately and provide supporting documentation. Banks typically investigate disputes within a specific timeframe and may provisionally credit the account during the review.

It is important to understand the bank’s dispute policy and deadlines, as delays in reporting can limit the ability to reverse charges. Keeping thorough records of receipts and notifications can support the dispute process.

Comparisons with Other Payment Methods

Debit cards offer unique advantages depending on how they are compared to cash or digital wallets. These differences impact convenience, security, and accessibility, which are important considerations when choosing a payment method.

Cash vs. Debit Card

Cash is universally accepted and requires no technology, making it reliable during power outages or system failures. However, carrying cash can be risky due to theft or loss, with no recovery options.

A debit card links directly to a bank account, providing easy access to funds without carrying physical money. It offers convenience for online and in-person purchases and tracks spending automatically.

Security is a key point: debit cards often include PIN protection and monitoring for fraudulent activity. Unlike cash, lost or stolen cards can be blocked quickly.

| Feature | Cash | Debit Card |

|---|---|---|

| Acceptance | Widely accepted | Accepted almost everywhere |

| Security | None | PIN and fraud protection |

| Convenience | Limited | High (online and offline) |

| Risk of Loss | High, no recovery | Low, card can be canceled |

Debit Card vs. Digital Wallets

Digital wallets store debit card information electronically, enabling contactless, fast payments through smartphones or wearables. This adds a layer of convenience over physical cards, especially for frequent small transactions.

Debit cards do not rely on internet connectivity for in-store payments, while digital wallets often require device compatibility and battery power. Digital wallets can also integrate loyalty programs and offer enhanced fraud detection.

However, debit cards provide direct control without relying on an extra service, appealing to users wary of technology or data privacy concerns.

Both options enable cashless payments, but digital wallets combine multiple payment methods, whereas debit cards are tied to one account, offering simplicity.

Key differences include:

- Digital wallets: Seamless, multi-account management, reliant on technology

- Debit cards: Direct account access, widely accepted, no dependency on devices

This comparison can aid individuals, even those searching for terms like “debit card for bad credit crossword clue,” by highlighting how debit cards serve as straightforward financial tools compared to evolving digital payment systems.