Real Estate Line of Credit Explained offers investors and property owners flexible access to funds by leveraging the equity in their properties. It functions like a revolving credit account, allowing borrowers to draw and repay funds multiple times without the need for repeated approvals. This makes it a useful tool for financing purchases, renovations, or other real estate expenses.

Unlike traditional loans that require complete approval for each transaction, a line of credit simplifies cash flow management by providing ongoing access to capital. It can be secured through various means, including home equity or securities, depending on the lender’s terms and the borrower’s financial situation. This flexibility can be especially valuable in fast-paced real estate markets or during property rehab projects.

Understanding Real Estate Lines of Credit

A real estate line of credit provides flexible financing tailored to the needs of investors and property owners. It offers quick access to funds and operates differently from traditional loans, affecting repayment and usage.

Definition and Key Features

A real estate line of credit (RELOC) is a revolving credit facility secured by real estate, allowing borrowers to draw funds up to a preset limit. It is commonly used by investors for property acquisition, renovation, or short-term capital needs.

Key features include:

- Flexibility: Borrowers can draw and repay funds repeatedly without reapplying.

- Interest on used funds only: Interest accrues only on the amount drawn, not the full credit limit.

- Lower interest rates: Typically lower than unsecured credit due to collateral backing.

- Variable limits: Limits depend on property value and borrower creditworthiness.

Guidance lines of credit and construction lines of credit are examples often based on this model, adapted to specific project needs.

How Real Estate Lines of Credit Work

A lender pre-approves a credit limit based on the borrower’s equity, financials, and credit history. Borrowers can then draw funds as needed, using the line for multiple investments or expenses like repairs, renovation, or flipping properties.

Repayments reduce the outstanding balance, restoring available credit. This revolving structure supports ongoing projects without new loan approvals each time.

Unsecured business lines of credit, such as those offered by Coast Hill or TN Bank, may be used for real estate investments but typically require strong financials and usually attract higher interest rates due to increased risk.

Differences from Traditional Loans

Unlike traditional term loans, which provide a lump sum upfront, a real estate line of credit offers ongoing access to a credit pool. This means:

| Aspect | Real Estate Line of Credit | Traditional Loan |

|---|---|---|

| Disbursement | Flexible, as needed | Full amount disbursed at once |

| Interest Charged On | Amount borrowed | Total loan principal |

| Repayment Structure | Revolving credit, ongoing draws | Fixed payments over term |

| Usage | Multiple projects or expenses | One specific purpose |

| Collateral Requirement | Usually secured by property | Secured or unsecured |

This structure makes RELOCs ideal for investors managing multiple projects or irregular expenses. However, responsible management is required to avoid overuse and high debt levels.

Types of Real Estate Lines of Credit

Real estate lines of credit come in various forms based on how they are secured, who uses them, and their underlying structure. Each type offers specific advantages depending on the borrower’s needs and financial situation.

Secured vs. Unsecured Credit Lines

Secured lines of credit are backed by collateral, usually real estate equity. This lowers the risk for lenders and often results in lower interest rates. For example, a home equity line of credit (HELOC) typically acts as a second mortgage, such as a home equity loan in second position in Daly City. These secured lines may offer competitive rates like HELOC rates in Wichita, KS.

Unsecured lines of credit do not require collateral but carry higher interest rates and lower borrowing limits. They are less common for real estate investments because lenders prefer the security of physical assets. Borrowers should carefully weigh the risks, especially if they seek cash value line of credit products without tied property.

Personal and Business Real Estate Credit Lines

Personal real estate credit lines are based on an individual’s creditworthiness and property equity. They are typically used for home renovations or single investment properties. These lines are often easier to obtain but may have lower limits.

Business real estate credit lines are designed for investors and companies managing multiple properties. These lines support ongoing purchases, repairs, and renovations with higher borrowing limits. Businesses benefit from revolving credit similar to a business credit card, providing quick access to capital without repeated applications.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) uses the borrower’s home equity as collateral. It functions as a revolving line, allowing borrowing up to a specific limit based on home value minus any existing mortgages. Interest rates are often variable and influenced by market conditions.

HELOCs are popular for residential investors looking for flexible funding options with competitive rates, such as those available in Connecticut. They contrast with closed-end home equity loans, which provide a lump sum upfront rather than ongoing access to funds. HELOCs are suitable for projects with unpredictable costs due to their draw-as-needed feature.

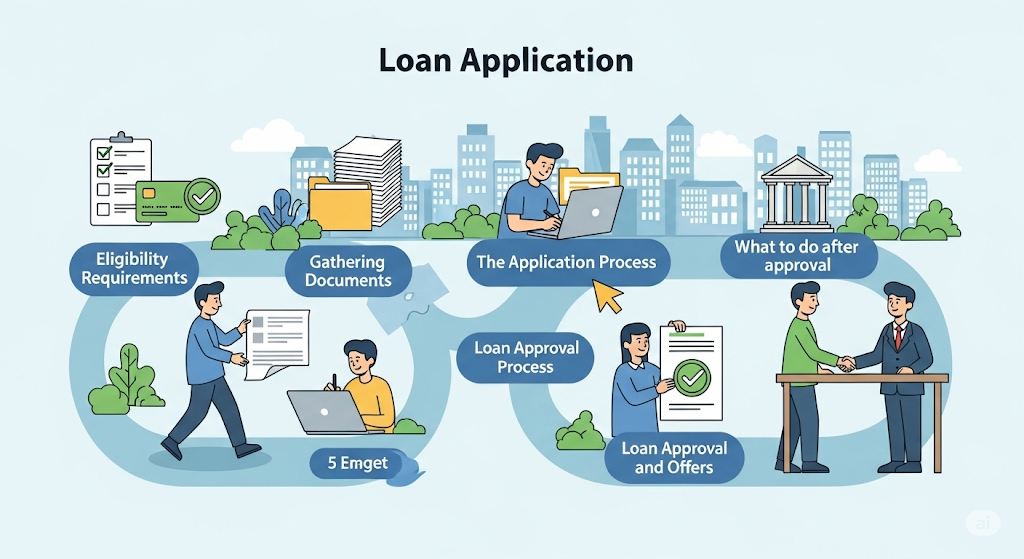

Eligibility Requirements and Application Process

Qualifying for a real estate line of credit involves meeting specific financial criteria, submitting detailed documentation, and undergoing a thorough property appraisal. These elements ensure the lender can evaluate the borrower’s creditworthiness and the collateral value.

Credit Score and Financial Criteria

Lenders primarily assess credit scores, income, and existing debts to determine eligibility. A credit score of at least 620 is often required, though higher scores improve approval chances and interest rates.

Income verification is essential, demonstrating the ability to repay the loan. Lenders also consider debt-to-income (DTI) ratios, typically favoring a DTI below 43%.

For real estate investors or those seeking a line of credit for home auctions, having substantial equity in the property is critical. Equity often needs to be at least 20-25% of the home’s value.

Required Documentation

Applicants must provide multiple documents to support their application. Key items include:

- Proof of income (pay stubs, tax returns, or business financials)

- Credit history reports

- Property deed or mortgage statement

- Identification (driver’s license or passport)

Additional documents might be requested depending on the lender and the property type. For auctions, proof of funds or pre-approval boosts credibility and may speed approval.

Property Appraisal Considerations

The property’s value directly impacts the credit limit available. Lenders require a formal appraisal to assess current market value and determine loan-to-value (LTV) ratios.

For lines of credit against investment properties or homes bought for auction, appraisers check condition, location, and comparable sales. Higher appraisals mean larger credit limits.

Some lenders allow flexible collateral options but typically require accurate appraisals before approving funding. The appraisal process can take 2 to 4 weeks, depending on complexity.

Interest Rates and Fees

Real estate lines of credit (LOCs) have variable interest rates influenced by multiple factors. Borrowers should expect rates to vary by location, creditworthiness, and loan type. Additionally, fees can add to the overall cost and differ among lenders.

Factors Affecting Real Estate LOC Rates

Interest rates on real estate lines of credit typically depend on the prime rate, credit score, loan-to-value ratio, and location. For example, HELOC rates in Connecticut may differ from those in Wichita, KS or Virginia due to regional lending standards and market conditions.

A credit score above 700 often qualifies borrowers for lower rates. The borrowing amount relative to the property’s value (loan-to-value ratio) also impacts rates—higher equity usually yields better terms.

Most HELOCs adjust rates based on the prime rate plus a margin. This means if the Federal Reserve changes rates, the borrowing cost adjusts accordingly. Introductory rates may be offered for several months before reverting to standard variable rates.

Common Fees and Costs

Real estate lines of credit often include several fees beyond the interest rate. Common charges include:

- Application or origination fees: One-time fees for processing the loan.

- Annual fees: Charged yearly to maintain the line of credit.

- Draw fees: Fees applied each time funds are withdrawn.

- Closing costs: These can include appraisal, title search, and legal fees.

Some lenders waive certain fees as incentives. Borrowers should also watch for prepayment penalties or inactivity fees. Comparing details from lenders offering HELOCs in different states, like Virginia or Kansas, can reveal notable fee differences.

Understanding these elements helps borrowers estimate total costs accurately before committing.

Using a Real Estate Line of Credit

A real estate line of credit provides access to funds using property equity, offering flexibility for various financial needs. It works well for home upgrades, investment purchases, and other uses requiring quick, ongoing funding.

Common Usage Scenarios

A real estate line of credit allows borrowers to tap into their property’s equity as needed. This revolving credit can cover expenses like emergency repairs, debt consolidation, or even an automobile down payment.

Users benefit from interest charged only on the amount drawn, not the full credit limit. Automatic payment pools can help manage repayments smoothly by scheduling monthly withdrawals. This can help avoid missed payments and maintain credit health.

The flexibility to reuse the credit line after repayment makes it a practical tool for fluctuating financial needs.

Financing Home Improvements

Many homeowners use a real estate line of credit to fund renovations and repairs. This financing option avoids high-interest personal loans or credit cards.

Accessing money through the line of credit can speed up projects like kitchen remodeling, roofing, or adding energy-efficient features. Since the loan is secured by the home, interest rates are usually lower than unsecured loans.

It also allows borrowers to budget incrementally—drawing funds for each phase of improvement rather than seeking a lump sum.

Purchasing Investment Properties

Investors use real estate lines of credit to finance acquisition and renovation of investment properties. This is particularly useful for fix-and-flip projects where quick access to cash is critical.

The line of credit can cover down payments or renovation costs, although some lenders restrict using it for initial property purchases. After buying the property, investors can refinance with traditional mortgages to repay the line of credit.

Using this credit type can offer faster purchasing power and flexibility compared to traditional loans, supporting portfolio growth efficiently.

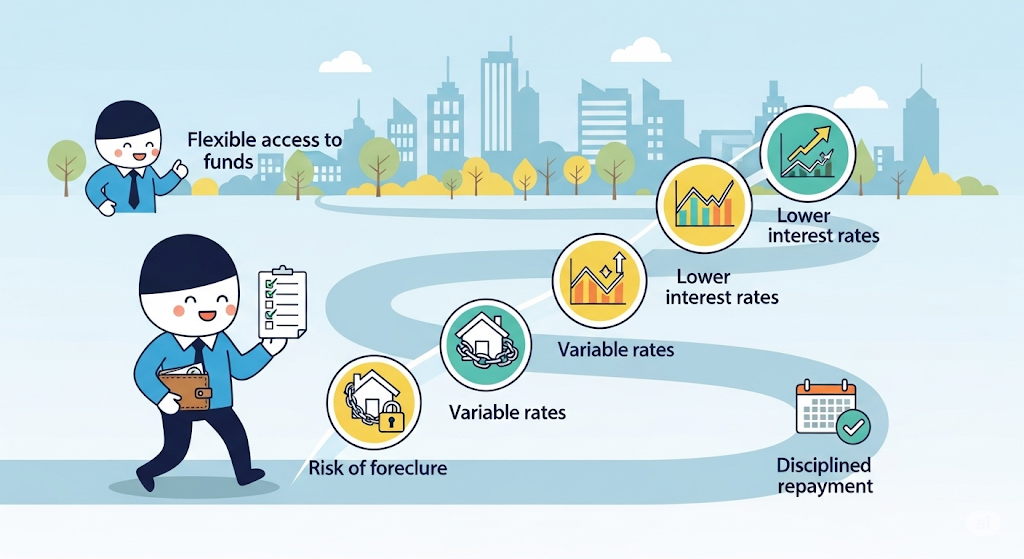

Pros and Cons of Real Estate Lines of Credit

Real estate lines of credit offer flexible borrowing options by allowing access to funds up to a set limit. They are useful for financing multiple properties or renovations without needing to sell investments. However, users should weigh benefits like flexible cash access against potential cost increases and risks.

Advantages for Property Owners

Real estate lines of credit provide quick access to capital for property purchases, renovations, or other investments. Borrowers often benefit from lower interest rates compared to unsecured loans.

They enable repeated borrowing up to the credit limit, supporting multiple deals without reapplying. This flexibility can help investors take advantage of opportunities faster.

Using a line of credit backed by home equity or securities may allow owners to avoid selling assets, preserving long-term investment positions. Additionally, debit cards linked to these accounts offer easy, on-demand access to funds without delays.

Potential Risks and Drawbacks

Interest rates on real estate lines of credit can increase, raising monthly payments unexpectedly. This variable cost can impact long-term affordability.

Lines of credit require disciplined repayment strategies. Over-borrowing or failing to maintain payments risks foreclosure or other financial consequences.

Some credit lines charge fees for setup or inactivity, which add to the overall cost. Borrowers must understand all terms to avoid surprises.

Relying heavily on borrowed funds may strain personal finances if property values decline or rental income fluctuates. Risks increase without strong cash flow or financial planning.

Repayment Strategies and Management

A real estate line of credit offers flexibility in managing payments, but borrowers must balance this with disciplined financial planning. Effective repayment reduces interest costs and protects credit health, especially when state obligations like Oregon estimated tax payments factor into cash flow.

Flexible Repayment Options

A real estate line of credit allows borrowers to repay based on their available funds rather than fixed monthly amounts. Payments can fluctuate as borrowers choose to pay off principal and interest or only interest during low cash flow periods.

This flexibility requires clear tracking of balances and payment schedules to avoid overspending. Borrowers should establish a repayment plan that includes:

- Minimum interest payments during slow periods

- Lump-sum principal repayments when cash is abundant

- Periodic reviews of credit limits and terms

Using flexible payments strategically helps maintain liquidity while steadily reducing debt.

Impact on Credit Score

Timely repayments on a real estate line of credit influence credit scores positively by showing responsible credit use. Conversely, missed or late payments can reduce creditworthiness and raise borrowing costs.

Credit utilization—the ratio of borrowed to available credit—should ideally remain below 30%. High utilization signals risk to lenders and may lower scores.

Borrowers should also be mindful that Oregon estimated tax payments and other financial obligations can strain cash flow. Maintaining a buffer and prioritizing debt repayments keeps credit profiles strong and borrowing power intact.

Legal and Financial Considerations

Understanding the implications of securing a real estate line of credit involves careful attention to both legal rights over the property and timelines for debt enforcement. These factors affect how lenders recover funds and how borrowers manage risk.

Lien and Collateral Implications

A real estate line of credit typically requires the property to serve as collateral. This means a lien is placed on the property to secure the loan. If the borrower defaults, the lender can enforce this lien, potentially leading to foreclosure.

It is important to note that credit card companies generally cannot place a lien on a house without a separate judgment. However, if a credit card debt results in a court judgment, a creditor may then file a lien against real estate owned by the debtor.

For contractors, lien rights vary by state. Without a written contract, a contractor’s ability to file a lien or sue may be limited. Some jurisdictions permit a mechanic’s lien even without a formal contract if work was performed and not paid.

Statute of Limitations and Debt Collection

The statute of limitations determines how long a creditor has to legally pursue repayment. In Georgia, the statute of limitations for credit card debt is typically four years from the last payment or activity.

After this period, debt collectors generally cannot sue to enforce payment, but the debt still exists and may affect credit reports. Borrowers should be cautious about making payments that could reset this timeline.

Contractors suing for nonpayment without a contract may face similar timing rules for bringing claims. Legal action without a written agreement can be more challenging, but some claims, such as quantum meruit, allow recovery for work done if timely filed.

Comparing Real Estate Lines of Credit to Other Financial Products

Real estate lines of credit offer flexibility in borrowing but differ significantly from other financial products like home equity loans, business lines of credit, and credit cards. Understanding these differences helps borrowers make better funding choices based on cost, access to funds, and repayment terms.

Vs. Home Equity Loans

A home equity loan provides a lump sum with fixed interest rates and set repayment schedules. In contrast, a real estate line of credit is revolving, allowing borrowers to draw and repay repeatedly up to a credit limit.

Home equity loans often have higher closing costs and less flexibility. Lines of credit typically have variable rates but lower upfront fees. Borrowers who need ongoing access to funds for multiple projects benefit more from a line of credit.

For those managing renovation costs or investment property repairs, a line of credit adjusts to cash flow demands without refinancing each time they need money.

Vs. Business Lines of Credit

Business lines of credit, offered especially by credit unions or banks, provide working capital for general business needs. Real estate lines of credit are usually secured by the property itself and tailored for real estate investments.

Business credit lines rarely offer interest rates as low as real estate lines because they may be unsecured or based on different collateral. They are also more suited for operating expenses than property acquisition or renovation.

When using a credit union business credit card or tools like credit card reconciliation software, the ease of tracking expenses is higher. However, those tools generally support business credit lines, not real estate-specific loans.

Vs. Credit Cards

Credit cards provide quick liquidity but at much higher interest rates compared to real estate lines of credit. They lack the borrowing limits and terms tied to property equity.

Real estate lines offer much larger credit limits based on property value. Using credit cards heavily can lead to issues like credit card abuse charge flags or high interest accumulating, which real estate lines avoid.

While credit cards are convenient for small, immediate expenses, real estate lines support larger transactions such as purchasing materials or funding renovations. Financial tools like AAMCO credit card solutions focus on business credit but are not designed for real estate financing.

Security, Risks, and Best Practices

Proper security controls and awareness of common pitfalls are crucial to protect lines of credit used for real estate. Understanding how unauthorized access occurs and avoiding common errors helps maintain financial stability and creditworthiness.

Fraud Prevention and Account Security

Users should implement multi-factor authentication and regularly monitor account activity to detect unauthorized transactions quickly. Debit and credit card security measures such as chip technology help reduce fraud but can sometimes malfunction, requiring immediate reporting to the issuing bank.

Fraud can occur without physical possession of a card, often through data breaches or skimming devices. Regularly updating passwords and avoiding public Wi-Fi when managing accounts minimizes risks.

Keeping contact details current with the lender ensures timely communication if suspicious activities are detected. Setting transaction alerts can provide real-time notifications for unusual spending.

Common Mistakes to Avoid

One frequent error is overleveraging credit lines without a clear repayment strategy, which can lead to financial strain. Another is neglecting detailed record-keeping of expenses drawn from the line of credit, complicating tax reporting and budgeting.

Falling behind on payments or missing due dates can result in penalty fees and damage to credit scores. Borrowers should clearly understand the terms, especially how interest rates may vary and the consequences of reduced credit limits or suspended accounts.

Assuming all real estate lines of credit function like traditional loans is a mistake. Some are secured by property value, while others use securities or investment accounts as collateral, each with distinct risk profiles and obligations.

Special Use Cases and Related Solutions

Real estate lines of credit serve specific needs beyond typical property acquisitions and renovations. They can also support business financing and specialized payment structures, offering strategic flexibility for different financial scenarios.

Real Estate Credit for Businesses

Businesses often use real estate lines of credit to leverage property equity while managing cash flow. These credit lines provide quick access to funds, which can cover operational costs or finance property-related projects without liquidating assets.

Credit union business credit cards are a related financial tool for managing expenses alongside lines of credit. They offer businesses lower fees and competitive rates, enhancing financial control. Combining a real estate line of credit with such cards can streamline property investment and operational funding.

Using credit in this way helps businesses avoid traditional loan delays. Interest is usually charged only on the borrowed amount, making it a cost-efficient option for managing real estate-related expenses.

Alternative Payment and Financing Options

In addition to lines of credit, specialized payment solutions address unique financing needs. Automatic payment pools, for example, consolidate payments from multiple tenants or investors, simplifying collections and improving cash flow management.

Orthodontist payment plans illustrate alternative financing in practice. These tailored plans help patients spread costs over time, reflecting how customized credit terms can accommodate specific borrower needs. Though not directly related to real estate, such systems highlight the growing trend of flexible repayment solutions.

Real estate investors and developers can consider blending these alternative options with lines of credit for better liquidity management and diversified financing strategies. This approach helps mitigate refinancing challenges in fluctuating markets.