Table of Contents

- Introduction

- What Is a Loaner Vehicle?

- When Are Loaner Cars Offered?

- Types of Loaner Vehicles

- How Dealerships Use Loaner Cars

- Rules and Conditions of Loaner Car Use

- Benefits of Using a Loaner Vehicle

- Drawbacks and Risks of Loaner Vehicles

- Insurance and Liability Explained

- Buying a Loaner Vehicle: Pros and Cons

- Loaner Car vs. Rental Car vs. Courtesy Car

- Tips for Getting a Loaner Car

- FAQs About Loaner Vehicles

- Conclusion

1. Introduction

Have you ever taken your car to the dealership for repairs and walked out with another car to drive for free? That’s likely a loaner vehicle. Whether your car is in the shop for a few hours or several days, having a temporary replacement can keep your life moving. In this blog, we’ll break down everything you need to know about loaner vehicles—how they work, when to use them, and whether buying one might be a smart decision.

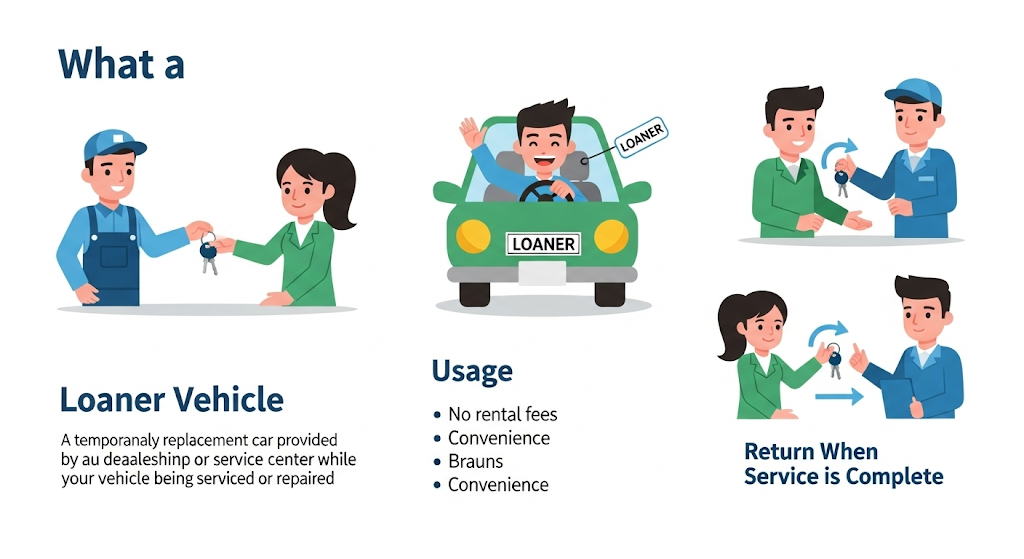

2. What Is a Loaner Vehicle?

A loaner vehicle is a temporary car provided by a dealership, manufacturer, or repair shop to customers whose cars are undergoing maintenance or warranty service. It’s a convenience offering that helps maintain customer satisfaction during the time their vehicle is unavailable.

These cars are typically newer models from the dealership’s inventory and are used exclusively for this purpose. They are sometimes also called:

- Courtesy vehicles

- Service loaners

- Replacement vehicles

3. When Are Loaner Cars Offered?

Loaner vehicles aren’t offered in every service situation. They are usually provided under the following conditions:

- Warranty or recall repairs: Provided free under warranty policies.

- Extended repairs: For repairs taking more than a few hours.

- VIP or luxury brand customers: Brands like Lexus, BMW, and Audi often offer complimentary loaners.

- Insurance claim situations: If you were not at fault in an accident, the other party’s insurance might cover a loaner.

4. Types of Loaner Vehicles

Loaner vehicles come in many forms depending on the dealership and the availability:

| Type | Description |

|---|---|

| Sedans | Common for everyday use |

| SUVs | Often offered by luxury dealerships |

| Electric Vehicles | Some brands may loan out EVs to showcase them |

| Luxury Cars | High-end brands give premium options for loyal customers |

| Economy Vehicles | Budget-friendly, compact cars for basic needs |

5. How Dealerships Use Loaner Cars

From a business standpoint, dealerships benefit in several ways:

- Customer Retention: Keeps customers happy during long wait times.

- Upselling Opportunity: Customers might test-drive their next car without realizing it.

- Increased Brand Trust: Providing a loaner shows a commitment to service.

- Fleet Rotation: After a few months, loaner cars are sold as certified pre-owned vehicles.

6. Rules and Conditions of Loaner Car Use

Loaner vehicles come with strict terms and conditions. Before taking one, read the paperwork carefully. Typical conditions include:

- Mileage limits (e.g., 100 miles/day)

- No smoking or pets

- Must return with same fuel level

- Valid driver’s license and insurance required

- Age restrictions (often 21 or 25+)

Violation of these terms can result in penalties or additional charges.

7. Benefits of Using a Loaner Vehicle

Using a loaner car is convenient, but the benefits go beyond just mobility.

✅ Key Benefits:

- No cost or low cost: Usually free for warranty work.

- Save on rental fees: Renting a car can be $40–$100/day.

- Try before you buy: You get to test a model you may want to purchase later.

- No disruption to routine: Keep commuting or doing errands as normal.

- Short-term coverage: Perfect when repairs are longer than expected.

8. Drawbacks and Risks of Loaner Vehicles

While beneficial, loaner cars do come with a few potential issues.

❌ Cons to Consider:

- Availability issues: Not all service centers offer them.

- Limited choice: You don’t get to choose the car type or model.

- High responsibility: Any damage may be your financial responsibility.

- Liability confusion: Insurance complications can arise during accidents.

9. Insurance and Liability Explained

Who pays if there’s an accident?

Loaner car insurance can be confusing. Here’s how it typically breaks down:

| Scenario | Who Covers It? |

|---|---|

| You cause an accident | Your personal auto insurance |

| Someone else causes an accident | Their insurance (if they’re at fault) |

| Car is damaged or stolen | You or dealership’s insurance (depends on terms) |

Tips:

- Always call your insurance company to confirm coverage.

- Some dealerships offer additional insurance or collision waivers.

10. Buying a Loaner Vehicle: Pros and Cons

After a few months or a few thousand miles, dealerships sell their loaner vehicles—often at a discount.

✅ Pros:

- Lower price than new cars

- Dealer-maintained, lightly used

- Low mileage

- Still under manufacturer’s warranty

❌ Cons:

- More wear and tear than a showroom car

- Limited negotiation room

- Could have been used by many drivers

- May lack new car financing options

11. Loaner Car vs. Rental Car vs. Courtesy Car

Here’s how a loaner car compares:

| Feature | Loaner Car | Rental Car | Courtesy Car |

|---|---|---|---|

| Who provides it | Dealership/service shop | Rental agency (Hertz, etc.) | Often from repair shops |

| Cost | Often free | Paid by day/hour | Usually free |

| Vehicle options | Limited | Wide variety | Basic models only |

| Insurance required | Yes | Yes | Sometimes covered by shop |

12. Tips for Getting a Loaner Car

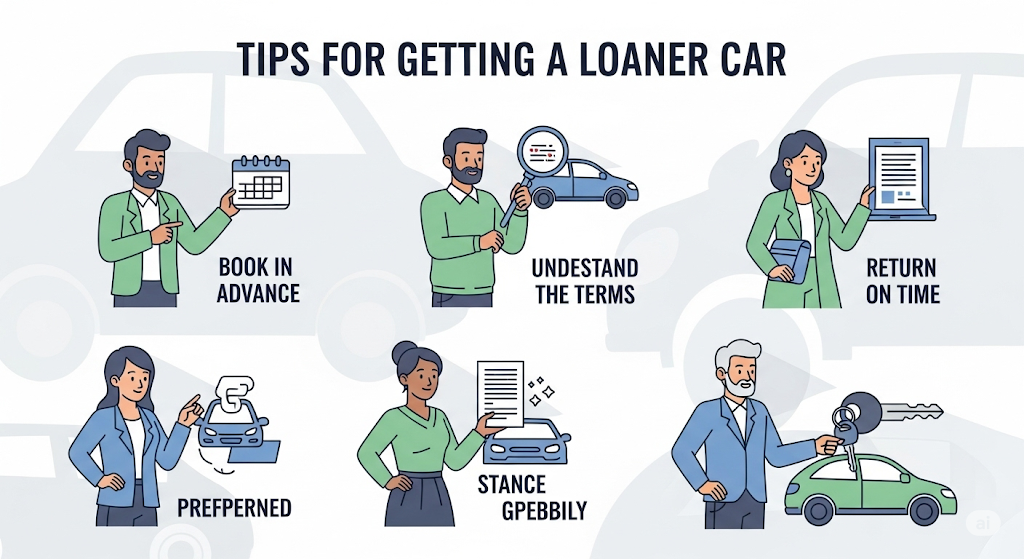

Want to make sure you’re eligible and prepared?

🔧 Tips Before Requesting:

- Schedule in advance (especially for luxury brands)

- Ask about fees, mileage, and fuel policies

- Confirm insurance coverage with your provider

- Return the car in the same condition

- Keep a copy of the agreement with you

13. FAQs About Loaner Vehicles

Q1. Is a loaner vehicle free?

Yes, most dealerships offer them free for warranty repairs or extended service. Non-warranty issues may incur a fee.

Q2. Do I need insurance for a loaner vehicle?

Yes. You must show proof of valid insurance. Your policy usually extends to the loaner.

Q3. Can I choose the type of loaner car I get?

Usually no. Dealerships assign based on availability.

Q4. Can I take the loaner out of state?

It depends on dealership policy. Always ask first.

Q5. What if I damage the loaner?

You’re liable for any damage not covered by your insurance.

Q6. Can I buy the loaner vehicle I drove?

Sometimes! Dealerships rotate loaners into certified pre-owned inventory.

Q7. Is a loaner car better than a rental?

It’s often cheaper or free, though with limited selection.

Q8. Can I use a loaner if I’m not the registered owner of the serviced car?

Usually not. Dealerships require ID and ownership match.

Q9. How long can I keep a loaner car?

Only as long as your car is in service—typically a day to a week.

Q10. Is a loaner vehicle covered under my warranty?

Only certain warranties include free loaner coverage. Read the fine print.

14. Conclusion

A loaner vehicle is more than just a convenience—it’s a smart way to keep your life moving while your car is in the shop. Whether you’re driving a luxury loaner from a premium dealership or a basic sedan for everyday errands, the experience can make vehicle service less stressful and even enjoyable. Just be sure to understand your responsibilities, confirm insurance coverage, and return the vehicle on time.

If you’re in the market for a used car, don’t forget to check out dealership loaners—they’re often a hidden gem with low mileage and great value.