What Happens When You Bypass PIN on a Debit Card, Risks and Legal Implications Explained, the purchase is often processed as a credit transaction rather than a direct debit from the bank account. This means the transaction does not require immediate PIN verification, and the payment authorization does not happen in real time. The merchant signals the bank that the cardholder chose not to enter their PIN, which can affect how the transaction is processed and monitored.

This process is common for smaller purchases or in situations where the card is used “as credit” by swiping without entering a PIN. While it offers convenience, it may also carry different security and processing implications, such as delayed authorization or increased responsibility for fraud detection by the card issuer. Understanding these differences helps consumers make safer and more informed decisions when using their debit cards.

What Is PIN Bypass on a Debit Card

PIN bypass on a debit card allows users to complete transactions without entering a personal identification number. This process involves specific methods that affect how payments are authorized and happen in everyday situations like card swipes or online purchases.

Definition and Explanation

PIN bypass means completing a debit card transaction without inputting the PIN. Instead of the typical real-time authorization using a PIN, the transaction proceeds as a signature or credit-style payment. This method is sometimes called a PIN-less transaction or processing as credit.

A debit card usually requires a PIN for cash withdrawals and certain purchases, but PIN bypass allows flexibility. The payment still deducts money from the holder’s account, just without immediate PIN verification. This is common with cards classified as electronic debit cards or those with limited PIN enforcement.

Techniques Used to Bypass PIN

There are several techniques for bypassing the PIN on a debit card:

- Swiping “as credit”: The card is swiped without entering a PIN; the merchant processes it like a credit transaction, often requiring a signature instead.

- Terminal PIN cancel or signature option: Payment terminals may offer a button to skip PIN entry and accept a signature.

- Online, phone, or mail payments: These transactions never require a PIN since the card number and expiration are used for authorization.

- Contactless or tap payments: Some cards allow low-value contactless payments without a PIN.

Common Scenarios Where PIN Is Bypassed

PIN bypass often occurs in these situations:

- When paying at retail stores by swiping a debit card as credit.

- Using contactless payments for small amounts where PIN entry is not mandated.

- Online shopping, phone orders, or mail-in payments where only card details are provided.

- When a cardholder forgets the PIN or the terminal prompts an option to bypass PIN entry for convenience.

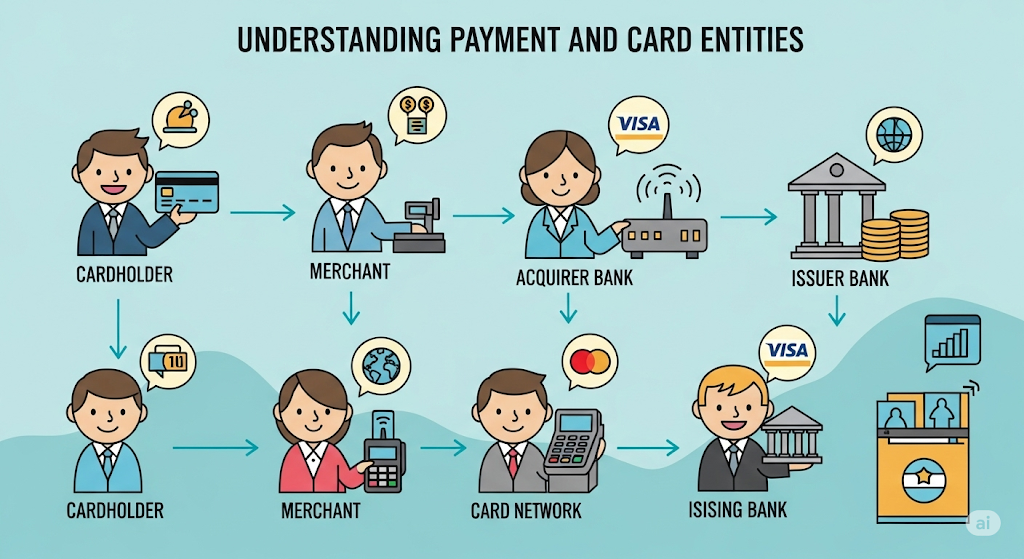

How Debit Card Transactions Work

Debit card transactions involve the transfer of funds directly from a cardholder’s bank account to a merchant. They can be authorized in multiple ways, impacting the speed, security, and processing method of the payment. Key distinctions exist in how PIN and signature authorizations affect transaction flow, supported by card networks ensuring correct routing and settlement.

PIN vs Signature Transactions

When a debit card transaction uses a PIN, it is completed as an online transaction. The cardholder enters a personal identification number, which authenticates the payment instantly. This method debits the account immediately, reducing credit risk for merchants.

Signature transactions allow the card to be processed as a credit transaction. The customer signs instead of entering a PIN, and the payment may take longer to process because it often goes through a credit card network like Visa. This method generally offers more consumer protections but can delay fund transfer.

Small purchases, often under $25, may allow debit cards to bypass PIN entry altogether. This speeds up checkout but relies more heavily on the card network’s fraud detection rather than direct bank authorization.

Role of Card Networks

Card networks such as Visa Debit act as intermediaries between banks, merchants, and payment processors. They route transactions either as debit or credit depending on how the card is used—swiped as “debit” with PIN or “credit” with signature.

The network ensures funds move correctly from the cardholder’s bank account to the merchant, handling settlement and authorization requests. Networks also dictate rules for PIN bypass or signature options, influencing the speed and liability of transactions.

These networks enable PIN-less, signature-based transactions, sometimes referred to as “bypass PIN” transactions, by marking them to alert the issuing bank that no PIN was entered. This mechanism balances convenience with risk management.

PIN Security Features

The PIN functions as a primary security measure in debit transactions, preventing unauthorized use by requiring a secret code. PIN entry must be done securely at the point of sale to protect against skimming or shoulder-surfing.

Proper security measures include setting a strong, unique PIN and never sharing it. Merchants and banks also implement encryption and secure PIN entry devices to protect this information during transactions.

Bypassing the PIN shifts reliance to other security layers such as merchant ID verification and processing safeguards implemented by card networks. Despite this, using a PIN remains the strongest protection against fraud and unauthorized access to debit accounts.

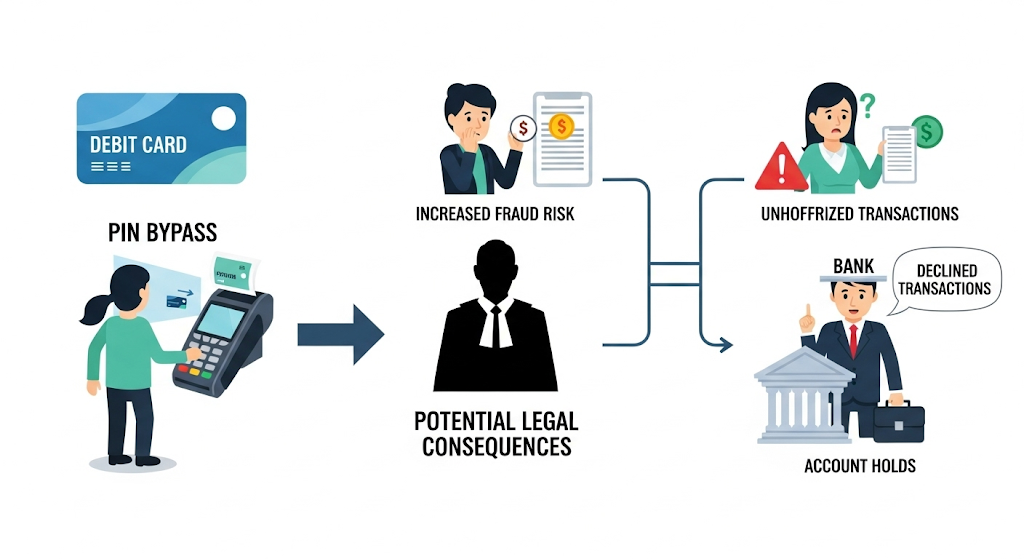

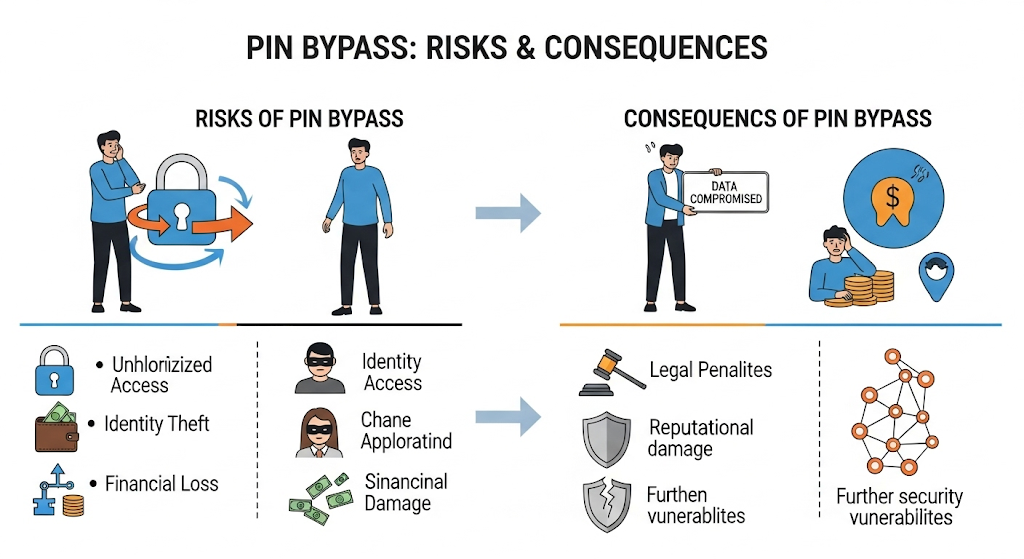

Risks and Consequences of PIN Bypass

Bypassing the PIN on a debit card introduces several risks affecting both cardholders and merchants. These risks include increased potential for fraud, complications around liability for unauthorized transactions, and financial penalties for merchants who allow or enable PIN bypass.

Fraud and Unauthorized Transactions

When the PIN is bypassed, transactions rely on weaker verification methods, such as signature or just card details. This creates an opportunity for fraudsters to make unauthorized purchases if they have access to the card number, expiration date, and security code.

Unlike credit card fraud, unauthorized debit transactions withdraw funds directly from the cardholder’s bank account, which can cause immediate financial loss. Recovery can be difficult and time-consuming, especially in cases of first-time offenses or felony-level credit card abuse.

Because a bypassed transaction often appears as a credit purchase, some fraud detection methods related to PIN entries don’t apply, increasing risk. Criminals can exploit this to commit credit card theft or credit card abuse charges by making multiple small purchases without triggering alarms.

Impact on Cardholder Liability

Cardholders face higher risks when PIN bypass is used, as their liability for unauthorized transactions can increase. Although many banks offer protection against credit card fraud, debit card fraud without a PIN is harder to reverse.

If the cardholder’s account is drained due to PIN bypass fraud, it might take days or weeks to dispute the charges. In such cases involving felony credit card theft, law enforcement involvement is sometimes necessary.

Liability depends on the cardholder’s promptness in reporting fraud, but bypassed PIN transactions weaken the case. This creates potential personal financial exposure and impacts trust in the security of the payment system.

Merchant Risks and Penalties

Merchants who allow PIN bypass may face higher transaction fees because these purchases are processed as credit, not debit. Fees can be as high as 4%, increasing costs for the business.

Allowing PIN bypass shifts some liability risks to merchants, especially if the bypass option is enabled on terminals without adequate safeguards. In cases involving credit card abuse charges, merchants might bear responsibility for losses if fraud occurs.

Merchants may also face penalties if terminals are programmed to allow PIN bypass against the regulations or card network rules. Some payment processors enable disabling PIN bypass to reduce this risk and improve fraud prevention.

Methods Criminals Use to Bypass PIN

Criminals use several specific techniques to bypass debit card PINs, exploiting both physical and digital vulnerabilities. These methods often involve duplicating cards, manipulating hardware, or interfering with payment systems to complete unauthorized transactions without the correct PIN

Card Cloning

Card cloning involves creating a duplicate debit card using stolen card data. Criminals obtain this data through skimming devices installed on ATMs or payment terminals. Once captured, the card information is often sold on credit card dump sites.

A cloned card can be programmed with a fake PIN or use a bypass technique that tricks terminals into approving transactions without PIN verification. One known method is the creation of a “Yescard,” which overlays a new PIN on the cloned card to bypass the original.

These cloned cards can be used at stores or ATMs, allowing thieves to withdraw funds or make purchases without knowing the legitimate PIN. The original chip on the card may malfunction, enabling attackers to exploit weaknesses in magnetic stripe fallback systems.

Device Tampering

Device tampering refers to the physical alteration of card readers or terminals to intercept PINs or bypass their entry. Criminals install skimming equipment and tiny cameras or overlays on keypads to capture the PIN as it is entered.

In some cases, terminals are modified to accept bypassed PINs, especially in chip-and-PIN systems. One notable attack involves soldering a programmable chip—often referred to as a “FUNcard”—onto the card’s chip. This chip intercepts the authentication query and falsely confirms the PIN without the user entering it.

Bank cards sometimes experience chip malfunctions, which attackers exploit by forcing transactions to revert to less secure magnetic stripe methods, making device tampering more effective.

Software and System Exploits

Software and system exploits target vulnerabilities in payment networks or terminal software to bypass PIN requirements. Criminals may manipulate transaction settings via malware or emulator devices that communicate with the issuer’s system, signaling that a PIN was entered even when it wasn’t.

Certain EMV protocols allow PIN entry bypass under specific conditions, which attackers can abuse by sending false transaction indicators. This makes the issuer believe the PIN was entered and authenticated.

Such exploits can also originate from compromised merchant systems or insider threats, enabling attackers to process unauthorized transactions without a PIN. These methods are less visible but pose significant risks due to their ability to circumvent traditional security checks.

Impacts on Consumers

Bypassing the PIN on a debit card changes how transactions are processed and can affect liability, fees, and fraud protection. Consumers face specific risks and responsibilities when using this method for purchases or withdrawals.

Financial Losses and Chargebacks

When a consumer bypasses the PIN, the transaction is processed as a credit sale rather than a debit one. This means the merchant pays higher fees, but the consumer may lose some protections linked to PIN-based transactions. Unauthorized or fraudulent charges often become harder to dispute because transactions lack immediate verification.

Chargebacks on PIN-bypassed transactions can take longer and may not always resolve in the cardholder’s favor. Consumers should closely monitor statements for unfamiliar entries to catch fraud early. Additionally, some merchants charge fees for certain credit card transactions, but fees linked to debit card use generally fall on the merchant, not the consumer.

Steps to Take After Unauthorized Use

If unauthorized transactions occur after bypassing the PIN, the cardholder must notify the bank immediately. Reporting quickly can limit financial liability under federal regulations when fraud is detected early.

He or she should:

- Contact the issuing bank’s fraud department.

- File a dispute for unauthorized charges.

- Request a replacement card if theft or loss is suspected.

- Review transaction history regularly to spot suspicious activity.

Consumers should also check if their debit card is linked to other accounts, such as an HSA, which might have additional withdrawal protections. Immediate action is critical to minimize losses.

Card Protection Best Practices

Consumers should safeguard their card and personal identification number to prevent misuse. Avoid writing the PIN on or near the debit card and be cautious about sharing card information online or with merchants.

Using a PIN adds a layer of security, so bypassing it should be done only when the environment feels secure. For those with low credit or special financial needs, choosing the right type of debit card and understanding its features is essential.

Good practices include:

- Regularly updating passwords and monitoring accounts.

- Using cards with fraud alert capabilities.

- Staying alert for unusual charges that might indicate misuse.

- Consumers unsure about transaction fees or card features—such as whether an attorney can charge for transaction fees or specifics on cash withdrawals on an HSA debit card—should consult their card issuer for precise details.

Merchant and Banking Industry Responses

Merchants and banks have adapted their systems and policies to address the implications of bypassing a PIN on debit card transactions. These changes focus on security enhancement, technological upgrades, and adjusting liability frameworks to reduce risks associated with PIN bypass.

Improved Security Measures

Merchants and banks have increased security protocols to counteract potential risks from PIN bypass. One key method is network tokenization, which replaces the actual card number with a one-time, stand-in number during processing. This reduces exposure to fraud and data theft.

Additionally, merchants using modern leasing MI charge systems and credit card reconciliation software can detect irregularities in bypassed PIN transactions. These tools help flag patterns that might indicate fraud or unauthorized use, allowing faster responses.

The use of exception processing through terminals capable of PIN bypass sends alerts to issuers, enabling them to monitor these transactions closely. Banks also rely more on real-time risk analytics to approve or decline transactions without a PIN.

PIN and Chip Technology Upgrades

Payment terminals and cards have been upgraded to incorporate more advanced chip technology, requiring stronger authentication methods beyond just the PIN. Some terminals now allow a chip plus signature approach instead of chip plus PIN during bypass, maintaining security while offering flexibility.

The introduction of the Common Application Identifier (AID) permits merchants to route transactions through different networks. This avoids limiting merchants to a single debit network and can influence the transaction flow when a PIN is bypassed.

Upgraded systems are designed to support smooth integration with modern payment processing software, improving reconciliation and reducing errors. These upgrades help merchants handle both PIN-required and PIN-bypass transactions seamlessly, optimizing their debit and credit transaction management.

Liability Shifts in PIN Bypass Cases

When a cardholder bypasses the PIN, liability rules differ from standard PIN transactions. By opting for PIN bypass, merchants can sometimes shift fraud liability to the issuer, especially if the transaction uses Chip+Signature or PINless routing.

Merchants who embrace terminals supporting PIN bypass receive an exception from the issuing bank, reducing their exposure to chargebacks on fraudulent transactions. However, this depends on compliance with network requirements and transaction limits.

Issuers, in turn, often monitor PIN-bypass transactions more rigorously to prevent losses. Liability shifts can influence merchant decisions on whether to encourage PIN bypass, balancing convenience with financial risk. This impacts how modern leasing MI charge and credit card reconciliation software accounts for disputed transactions in reporting.

Legal and Regulatory Considerations

Bypassing a PIN on a debit card involves specific legal and regulatory frameworks designed to protect consumers and financial institutions. Understanding these elements clarifies responsibilities and rights in such transactions.

Relevant State and Federal Laws

The Electronic Fund Transfer Act (EFTA) governs debit card transactions, including those without PIN entry. It mandates transparency in fee disclosure and limits consumer liability for unauthorized transactions, provided the cardholder reports fraud promptly.

States may have additional rules. For example, Georgia enforces a statute of limitations of six years for credit card debt, influencing when disputes related to PIN-bypass transactions can be legally pursued.

Merchants and banks must also comply with Payment Card Industry Data Security Standards (PCI DSS), which impact how PIN bypass transactions are authorized and recorded to reduce fraud.

Consumer Protection Rights

Consumers maintain protections under federal laws even when bypassing a PIN during debit transactions. If fraud or unauthorized use occurs, timely reporting limits their liability typically to $50 or less.

Issuers must clearly indicate when a transaction has been processed without a PIN, allowing cardholders to dispute charges if necessary. However, bypassed PIN transactions may reduce some safeguards since the transaction can resemble credit card processing, which often entails different dispute policies.

Consumers should always monitor statements closely and notify their bank immediately about suspicious activity to leverage these protections effectively.

Statute of Limitations for Legal Claims

The statute of limitations dictates the timeframe within which legal claims related to debit transactions can be filed. In Georgia, for credit card debt and related disputes, this period is six years.

This timeframe is critical if a merchant or bank seeks to recover funds lost through a PIN-bypass transaction or if a consumer pursues a claim against wrongful charges.

In cases involving contractors or merchants, whether a contract exists can impact the ability to sue for nonpayment, but the statute of limitations still applies to claims involving disputed payments through debit transactions.

Understanding these timelines helps all parties know when legal action is feasible following a disputed or unauthorized bypassed PIN transaction.

Special Cases and Payment Scenarios

Some payment methods allow debit card use without entering a PIN, depending on transaction type and industry requirements. This affects how funds are transferred, what protections apply, and which financial products clients might consider alongside these transactions.

Business Debit and Credit Card Uses

Businesses often use debit and credit cards differently than individuals. Business debit cards can be used without a PIN when run as credit transactions, which may help with cash flow management or streamline expenses. However, using a business debit card for personal expenses can complicate accounting and is generally discouraged.

Lines of credit such as the TN bank business line of credit or unsecured business lines of credit from providers like Coast Hill offer additional funding options beyond traditional debit card access. These credit lines often support large transactions without needing a PIN because they function more like credit products.

For daily operational expenses, some companies use automatic payment pools that consolidate payments, sometimes bypassing PIN requirements for ease and speed. This setup can reduce friction but requires strong controls to avoid errors or fraud.

Healthcare and Specialty Transactions

In healthcare, many providers accept payments without PIN entry, especially for treatment plans like orthodontics or root canal procedures. Payment plans and installment options, including those for LASIK surgery or dental care, often leverage card-on-file setups or credit lines.

Providers also partner with credit products that offer flexibility. For example, reality-based line-of-credit solutions like home equity loans or construction lines of credit may be used for medical expenses, allowing consumers to bypass PIN input while securing larger payments.

Specialty transactions in this sector prioritize security and compliance. Providers may avoid requiring PINs for phone or mail orders, instead relying on card verification processes, which balance convenience with fraud prevention.

Real Estate and Large Purchase Payment Methods

Real estate and large purchases often involve payment methods without immediate PIN entry. Home equity loans, home equity lines of credit (HELOC), and closed-end home equity loans offer funds for down payments or renovations, with payments processed as credit-style transactions not requiring a PIN.

For auctions or automobile down payment assistance, buyers might use credit lines designed for real estate or vehicles. These products, such as guidance line of credit or cash value line of credit, allow large payments without entering a PIN, as transactions are pre-approved and vetted by lenders.

Consumers should note that real estate-related loans vary by region, with rates differing across areas like Wichita, KS, or Virginia. These loans often provide alternatives to debit card payments, facilitating large transfers securely without real-time PIN authorization.

Detection and Prevention Strategies

Effective detection and prevention of PIN bypass on debit cards rely on a combination of advanced monitoring tools, thorough investigation protocols, and informed consumer behavior. These elements work together to reduce fraud risk and secure customer accounts.

Monitoring and Alerts

Banks implement real-time transaction monitoring systems to detect unusual activities, such as multiple small purchases designed to avoid PIN prompts. These systems trigger immediate alerts for suspicious patterns, enabling quicker response.

Institutions like the Bank of Bhutan incorporate features into their international debit cards that include automated fraud detection algorithms. Alerts can be sent via SMS, email, or app notifications to promptly inform users of unfamiliar transactions.

Account holders benefit from setting personalized alerts for transactions exceeding set amounts or occurring in new locations. This helps in early identification of PIN bypass attempts and restricts unauthorized account access.

Fraud Investigation Procedures

When a PIN bypass is suspected, banks initiate structured investigation processes. These typically involve verifying transaction details, cross-checking merchant data, and contacting customers for confirmation.

Investigators analyze transaction timestamps and locations to distinguish between legitimate bypasses and potential fraud. They also review terminal data to confirm if the PIN was indeed skipped or if a signature was used.

Proper security measures include maintaining detailed logs and enforcing strict authentication methods to provide evidence during disputes. This helps minimize client losses and supports regulatory compliance.

Consumer Education Initiatives

Financial institutions proactively educate users about the risks of bypassing their debit card PIN. Campaigns emphasize the importance of PIN confidentiality and caution against using unfamiliar or unsecured payment terminals.

Educational materials cover safe practices, such as monitoring account statements regularly and reporting unauthorized activities promptly. Banks like the Bank of Bhutan promote online resources and workshops to increase consumer awareness on debit card security.

Consumers are encouraged to use features like two-factor authentication and opt-in alerts to strengthen account protection. Understanding these measures reduces vulnerability to PIN bypass fraud.

Understanding Related Payment and Card Entities

When a debit card PIN is bypassed, the transaction may be processed differently depending on the payment types and entities involved. This affects how charges appear, the entities managing the transaction, and how related credit card charges are handled and reported.

Common Charges and Transaction Codes

Transactions without a PIN are often classified as credit rather than debit. This distinction impacts the timing of fund withdrawal and how charges are coded in statements.

Common transaction descriptions include:

- Acqra charge: Usually relates to acquiring bank fees or merchant processing.

- Blossom Up charge: Likely a merchant or service provider’s descriptor.

- 100 Deerfield Lane charge: Often a merchant location reference or corporate billing address.

Transactions may carry specific codes indicating whether a PIN was bypassed, affecting merchant fees, chargeback protocols, and dispute handling.

Third-Party and Corporate Card Details

Third-party entities or corporate accounts often involve additional layers in transaction processing. For example, Corporate Filings LLC charges on a credit card may indicate a business-related purchase or service.

Corporate cards differ from personal ones in reporting and authorization practices. They might not require PINs for transactions due to their usage policies.

Some credit unions offer business credit cards that blend personal and corporate controls, impacting fraud monitoring and billing descriptors.

Handling Credit Card Charges and Reporting

Charges like JPMCB Card Services reflect bank-level processing and may show on credit reports or statements to help identify authorized activity.

Disputed or unknown charges, such as those listed under Towson CMF or merchant aliases, require proper documentation to resolve.

Credit card companies rely on transaction data from acquirers and merchants to report accurately. Transactions without PINs may appear as signature-based or offline transactions, potentially delaying funds transfer.

Maintaining clarity in these charge descriptions helps cardholders identify legitimate activity and manage disputes effectively.

Consequences for Offenders and Legal Proceedings

Bypassing a debit card PIN typically triggers investigations focused on the method of fraud and extent of financial loss. Legal proceedings vary depending on the offense’s severity and prior criminal history. Penalties can range from fines to lengthy prison terms, particularly for repeated or significant offenses.

Investigation and Prosecution

Law enforcement begins by tracing unauthorized transactions through banking records and merchant surveillance. If a debit card PIN is bypassed, investigators focus on digital footprints and possible collusion with insiders. First-time offenses may lead to lighter charges, such as misdemeanor credit card abuse, but larger schemes can elevate charges to felony credit card theft.

Prosecutors gather evidence to prove intent and method, often distinguishing between credit card abuse and more serious felony-level theft. The complexity of PIN bypass means prosecutorial strategies may include examining technological tools and the offender’s access to the victim’s information.

Court Outcomes and Penalties

Penalties depend on transaction value and offender history. For first-time offenders, courts may impose probation, restitution, or fines under a credit card abuse charge. Felony credit card theft or felony credit card abuse typically results in harsher penalties: multiple years in prison and substantial financial penalties.

Sentencing reflects the damage caused. Courts consider victim impact, repeat offenses, and whether the offender used sophisticated methods to bypass security measures. In severe cases, prison terms can range from six months to over a decade, depending on jurisdiction and specific statutes.

Record Implications for Offenders

A conviction for bypassing a debit card PIN remains on the offender’s criminal record and affects future opportunities. Felony credit card theft leads to permanent records that impede employment, housing, and financial services.

Even first-time offenders face challenges, as misdemeanor charges might require disclosure during background checks. The long-term impact includes difficulty securing loans or jobs, especially in finance-related fields. Legal records often require formal processes for expungement, which may not always be granted depending on offense severity.

Financial Assistance and Alternative Payment Plans

Financial assistance often involves specific programs designed to support individuals through government benefits, unique payment certificates, and specialized tax arrangements. These tools provide targeted solutions for various needs, whether from social security distributions or managing tax obligations.

Government and Social Security Payments

Government assistance payments like the $1800 Social Security payment offer direct funds to eligible recipients. These payments typically arrive via direct deposit or mailed cards, requiring users to access funds securely.

Bypassing a PIN on debit transactions linked to such payments may limit immediate access but can sometimes be authorized based on the payment issuer’s rules.

Programs such as the Supernova payment provide emergency financial relief and work under controlled debit card systems. Users must follow specific transaction protocols to protect funds, especially when bypassing a PIN.

Understanding the security and authorization requirements helps prevent accidental blockages or fraud during these transactions.

Special Payment Certificates and Programs

Historical and specialized certificates like the 5 Cent Military Payment Certificate were designed to provide secure, controlled spending options for military personnel. Though outdated, they illustrate how payment systems have evolved to balance ease of use and security.

Modern equivalents focus on limiting fraud and unauthorized access. Such schemes often require PIN verification but may allow bypass in specific cases, depending on merchant capabilities or emergency access protocols. Knowing when and how a PIN bypass might apply is critical to avoid fees or declined transactions.

Tax and Estimated Payment Options

States like Oregon allow taxpayers to manage estimated tax payments through electronic methods, sometimes linked to debit cards with or without PIN requirements. Bypassing a PIN during such payments could affect processing speed or transaction approval, depending on the payment gateway and state regulations.

Taxpayers should verify whether their payment method supports bypassing a PIN safely. This ensures timely payment and avoids penalties. Alternative payment plans may also allow scheduling multiple transactions or using third-party apps, where PIN bypass options differ from standard debit card use.