10 Alternatives to Payday Loans

When financial emergencies strike—unexpected car repairs, medical bills, or a rent deadline—it’s easy to feel backed into a corner. For many Americans, payday loans seem like the fastest solution. But with sky-high interest rates (often exceeding 400% APR) and a cycle of debt that can be hard to escape, they’re rarely the best choice.

Thankfully, there are safer, more affordable alternatives to payday loans. This guide explores ten options that provide fast cash without the crushing costs. Whether you’re rebuilding your credit, managing a tight budget, or simply exploring your options, this blog will walk you through smarter paths—and how DollarDay.AI can help you access them.

1. Personal Loans from Credit Unions

Why it’s better: Lower interest rates and flexible terms.

Credit unions are nonprofit financial institutions that often provide small personal loans at far better rates than payday lenders.

- APRs typically between 6% and 18%

- No prepayment penalties

- Focus on helping members, not profits

Pro Tip: Look for credit unions with credit-builder programs if your score is low.

2. Installment Loans from Online Lenders

Why it’s better: Transparent terms and structured repayment.

Installment loans spread repayment over several months or years, unlike payday loans that require full repayment within weeks.

Top online lenders: Upstart, Avant, LendingClub

- Rates based on credit profile

- Predictable monthly payments

- Can improve your credit when repaid on time

DollarDay.AI Advantage: We partner with trusted online lenders and help you navigate their approval criteria.

3. Employer-Based Loans or Advances

Why it’s better: Low or zero interest and payroll-based deductions.

Some employers offer paycheck advances or employer-sponsored small loans.

- Repaid via payroll deduction

- No credit check

- Often fee-free

Ask HR: You may be eligible and not even know it.

4. Earned Wage Access (EWA) Apps

Why it’s better: Access money you’ve already earned without high fees.

Apps like Earnin, Brigit, and DailyPay allow users to withdraw a portion of their earned wages ahead of payday.

- No interest (tips may apply)

- Fast transfers

- Ideal for hourly or gig workers

Caution: Frequent use can still disrupt budgeting.

5. Peer-to-Peer Lending Platforms

Why it’s better: More flexible underwriting and competitive rates.

Sites like Prosper and LendingClub connect borrowers with individual investors.

- Rates based on risk profile

- Can borrow from $1,000–$40,000

- Transparent terms

Bonus: Some platforms report to credit bureaus—on-time payments help build credit.

6. 0% APR Credit Card Offers

Why it’s better: Pay no interest during the promo period.

If you have good credit, a credit card with a 0% introductory APR can be a smart short-term borrowing tool.

- Promo periods of 12–18 months

- Great for planned, short-term expenses

- Requires discipline to avoid post-promo rates

Tip: Use only if you’re confident in repayment within the zero-interest window.

7. Payment Plans with Service Providers

Why it’s better: Avoid borrowing entirely.

Many hospitals, utility companies, and even landlords will allow payment plans if you’re upfront about your situation.

- Interest-free in many cases

- Protects your credit from missed payments

- Builds trust and goodwill with providers

DollarDAY.AI Suggests: Use this option before considering any form of loan.

8. Borrowing from Friends or Family

Why it’s better: Flexible terms and potentially zero interest.

While not always easy, a loan from someone you trust can be a lifeline.

- No credit check

- Custom repayment plans

- Often interest-free

Important: Put everything in writing to avoid misunderstandings.

9. Community Assistance Programs & Nonprofits

Why it’s better: Grants or no-interest loans for those in need.

Nonprofits, religious organizations, and local government programs often offer emergency assistance.

- No repayment needed in some cases

- Available for rent, food, medical bills, and utilities

- Requires paperwork, but worth the effort

Example: The Salvation Army, Catholic Charities, or Modest Needs Foundation

10. Pawn Shop Loans or Selling Personal Items

Why it’s better: Short-term cash without credit impact.

While not ideal, pawn shop loans don’t affect your credit score and offer fast funding.

- Leave collateral (jewelry, electronics, tools)

- Get a small cash loan

- Repay to reclaim item

Alternative: Sell unused items online (Facebook Marketplace, eBay, OfferUp) for quick cash without the risk of loss.

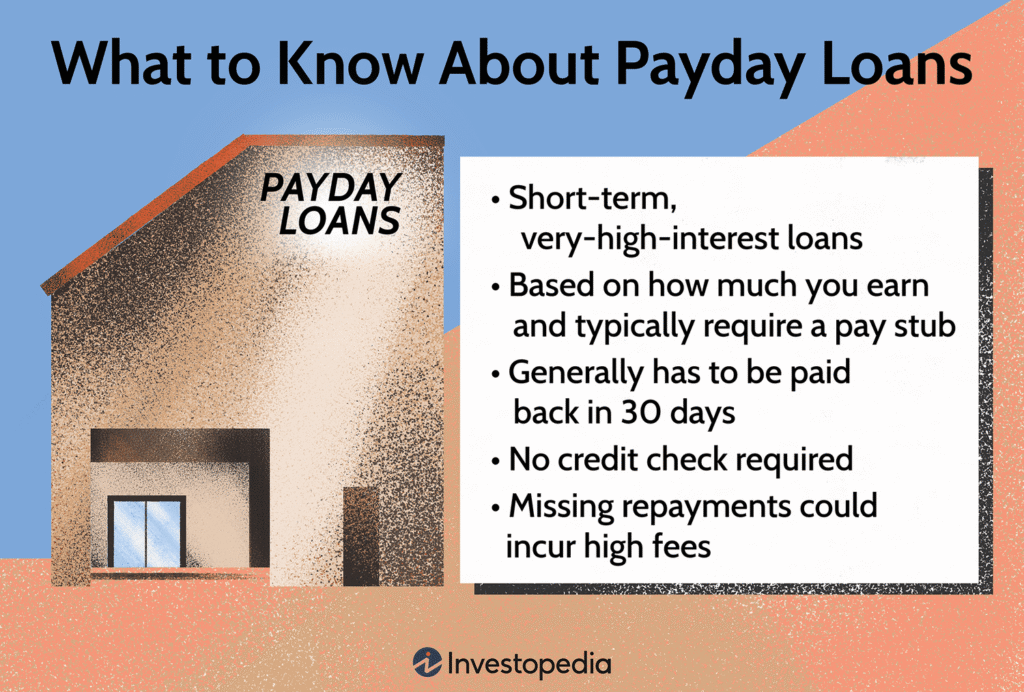

The True Cost of Payday Loans: Why to Avoid Them

Payday loans are:

- Extremely expensive: $15–$30 per $100 borrowed = 300–600% APR

- Short-term traps: Due on your next paycheck

- Hard to escape: Most borrowers reborrow multiple times

Result? A $300 loan can turn into $800 in fees over time.

DollarDay.AI Insight: Many of our clients came to us after being caught in payday cycles—we helped them refinance or restructure their debt.

DollarDay.AI: Your Financial Design Partner

At DollarDay.AI, we believe financial health is as essential as interior style. That’s why we:

- Guide clients to safe, responsible lending options

- Help improve credit scores for better borrowing terms

- Offer personalized debt reduction plans

- Connect you to community resources and grant programs

Whether you’re facing a sudden bill or planning for a long-term goal, we’re more than designers—we’re strategists for your life.

Final Thoughts

There’s no shame in needing quick cash—but there are smart ways to get it. Payday loans may be fast, but the long-term costs can derail your finances. With alternatives ranging from credit unions to wage access apps and nonprofit support, you have options that are safer, cheaper, and more empowering.

And with DollarDay.AI as your guide, you’re never navigating the money maze alone. We combine financial expertise with lifestyle design, helping you create not just a beautiful space—but a balanced, resilient life.

Need cash, but want to stay debt-smart? Talk to DollarDay.AI first.