Understanding Delaware Payday Loan Regulations

Key aspects of Delaware’s payday lending laws

Delaware’s payday lending landscape is governed by a complex interplay of state and federal regulations. Key limitations exist on the amount a lender can charge in fees and interest. These restrictions aim to protect borrowers from exploitative practices common in the payday loan industry. The Delaware Department of Banking oversees these regulations, providing resources and handling complaints. Understanding these rules is crucial before considering a Delaware payday loan. Always check the latest updates on their official website.

Critically, Delaware law does not explicitly cap the annual percentage rate (APR) for payday loans. This absence of a direct APR cap, however, doesn’t imply unchecked lending practices. Instead, the state’s regulations indirectly control costs through limitations on fees. “Borrowers must carefully compare loan offers and fully understand all associated fees and repayment terms to avoid unexpected costs and potential debt traps.” This careful comparison, along with understanding the total repayment amount, is key to responsible short-term borrowing in Delaware. Remember, a lack of regulation in one area doesn’t mean a complete absence of consumer protection.

License requirements for lenders in Delaware

Delaware has strict regulations governing payday lenders. To operate legally, lenders must obtain a license from the Delaware State Bank Commissioner. This process involves a thorough application, background checks, and meeting specific financial requirements. Failure to obtain the necessary license results in significant penalties, including hefty fines and potential legal action. The licensing process is designed to protect consumers from predatory lending practices. The Delaware Department of Justice website provides detailed information on the application process and requirements.

Securing a license is not a simple task. Lenders must demonstrate financial stability and a commitment to complying with all relevant state and federal laws. This includes adhering to strict rules regarding interest rates, loan terms, and collection practices. Transparency is key. Lenders must clearly disclose all fees and terms to borrowers before loan disbursement. “Borrowers should always carefully review loan agreements and understand the total cost of borrowing before signing.” By understanding Delaware’s licensing requirements for payday lenders, consumers can better protect themselves and identify legitimate, responsible lending institutions.

Maximum loan amounts and interest rates allowed

Delaware law strictly regulates payday loans to protect borrowers from exploitative practices. There’s no set maximum loan amount specified by state law, but lenders often impose their own limits based on factors like the borrower’s income and credit history. This means the amount you can borrow will vary greatly between lenders. It’s crucial to compare offers before committing to any loan. Always check the lender’s website or contact them directly to confirm their current lending limits.

Regarding interest rates, Delaware’s regulations are equally important to understand. While there isn’t a specific Annual Percentage Rate (APR) cap for payday loans, the effective interest rates can be extremely high. These high costs quickly accumulate, making it difficult for borrowers to repay. “Failing to understand these fees can lead to a debt cycle that’s hard to escape,” so always carefully review all loan terms and conditions before signing. Consider the total cost of borrowing, including all fees and interest, to make an informed decision. Explore alternative financial solutions if the cost of a payday loan seems excessive.

The role of the Delaware Department of Justice in overseeing payday loans

The Delaware Department of Justice (DOJ) plays a crucial role in regulating the payday lending industry within the state. They are responsible for enforcing existing laws concerning Delaware payday loans, ensuring lenders comply with interest rate caps, licensing requirements, and other relevant statutes. This oversight aims to protect consumers from predatory lending practices and exorbitant fees. The DOJ investigates complaints, conducts audits, and takes legal action against lenders who violate state regulations. Their website offers resources and guidance for both borrowers and lenders seeking to understand their obligations under Delaware law.

Effective enforcement by the DOJ is vital for maintaining a fair and transparent payday loan market in Delaware. Consumers can report suspected violations directly to the DOJ, contributing to proactive regulatory efforts. “The department’s actions help to prevent unscrupulous lenders from exploiting vulnerable individuals seeking short-term financial assistance.” This active role ensures accountability and fosters a more responsible lending environment. Therefore, understanding the DOJ’s involvement is crucial for both borrowers seeking short-term loans in Delaware and lenders operating within the state’s legal framework.

Eligibility Criteria for Delaware Payday Loans

Credit score requirements and impact on interest rates

Unlike many traditional loans, Delaware payday loans generally don’t have stringent credit score requirements. Lenders often prioritize your ability to repay the loan, focusing more on your income and employment history than your credit rating. This means individuals with poor or even non-existent credit histories may still qualify. However, this doesn’t mean creditworthiness is irrelevant. A strong credit score could potentially influence the interest rate offered, potentially leading to a lower APR. While lenders may not explicitly state a minimum credit score, a higher score might give you a negotiating advantage for more favorable terms.

Keep in mind that the interest rates on payday loans in Delaware are already high. “Even with a good credit score, you’ll likely face a significantly higher interest rate than you would with a traditional loan,” so careful consideration of the total cost is crucial. Exploring alternative financing options, like credit unions or small-loan programs, should always be considered before resorting to a high-interest payday loan. Remember to always compare offers from multiple lenders to secure the best possible rate, and carefully read the loan agreement before signing.

Employment verification and income stability

Lenders in Delaware carefully scrutinize employment verification when considering payday loan applications. They need assurance you possess a stable income stream capable of repaying the loan. This typically involves providing pay stubs, bank statements showing regular deposits, or a letter from your employer confirming your employment status and income. The frequency and consistency of your income are key factors. Inconsistent income, frequent job changes, or reliance on irregular sources of income may hinder your approval chances.

“Insufficient proof of income is a common reason for payday loan applications being denied in Delaware.” Lenders assess your income against the loan amount to determine your ability to repay. They calculate your debt-to-income ratio, comparing your monthly income to your existing debt obligations. A high debt-to-income ratio, showing you already have significant financial commitments, may raise concerns about your capacity to manage an additional payday loan. Therefore, providing comprehensive and accurate documentation is crucial for a successful application. Consider gathering all necessary documents before applying for a Delaware payday loan to streamline the process.

Proof of residency and Delaware identification

Securing a Delaware payday loan requires verifiable proof of your residency within the state. Lenders typically request documents such as a current utility bill, bank statement, or rental agreement displaying your Delaware address. These documents must show your name and address, matching the information you provide on your loan application. Discrepancies can lead to application delays or rejection. Remember, the address must be a physical Delaware address; a PO Box is insufficient.

Furthermore, you’ll need a valid form of Delaware identification. This is crucial for verifying your identity and age. A Delaware driver’s license is ideal, but a state-issued ID card will also suffice. “Ensure the information on your identification perfectly matches your loan application.” Expired or damaged identification will likely not be accepted. Always double-check the validity of your identification before applying for a payday loan to streamline the process and increase your chances of approval. Failing to provide proper identification will result in immediate loan application denial.

Required documents for application submission

Applying for a Delaware payday loan requires providing specific documentation to verify your identity and financial situation. Lenders typically request a government-issued photo ID, such as a driver’s license or passport, to confirm your identity and residency within the state. Proof of income is also crucial, often demonstrated through pay stubs showing consistent employment and income for the past several months, or bank statements reflecting regular deposits. Failure to provide these essential documents will likely result in application rejection.

Beyond the basics, lenders may request additional documentation depending on individual circumstances. This could include proof of address, such as a utility bill or bank statement, to verify your Delaware residency. Some lenders might also ask for details about your existing debts to assess your overall financial health. “It is vital to gather all necessary documents beforehand to streamline the application process and improve your chances of approval.” Remember, honesty and accuracy are paramount. Providing false information can lead to legal repercussions and further complicate your financial situation. Always check the specific requirements listed by the individual lender before submitting your application.

The Application and Loan Process

Steps involved in applying for a payday loan in Delaware

Securing a payday loan in Delaware typically begins with online applications. Many lenders have user-friendly websites. You’ll need to provide personal information, including your Social Security number, proof of income, and bank account details. Be prepared to answer questions about your employment history and current financial situation. Remember to carefully review all terms and conditions before proceeding. Incorrect or incomplete information can delay your application or lead to rejection.

Once your application is submitted, the lender will review it. This process can take a few minutes to a few hours. Approval depends on factors like your creditworthiness and debt-to-income ratio. If approved, the funds are usually deposited directly into your bank account. This often occurs within one business day, though this timeframe varies by lender. “Always compare interest rates and fees from multiple lenders to find the most suitable option for your financial needs.” Remember to understand the repayment terms completely to avoid unforeseen issues.

Online vs. in-person application methods

Applying for a Delaware payday loan can be done either online or in person. Online applications are often faster and more convenient. Many lenders have user-friendly websites, allowing you to complete the process from anywhere with an internet connection. You’ll need to provide personal information, employment details, and bank account information. Expect to receive a quicker response, sometimes within minutes, depending on the lender. However, remember to carefully review the terms and conditions before acceptance. Security is paramount, so choose reputable lenders with established online security protocols.

In contrast, applying in person involves visiting a physical payday loan store. This method can offer more immediate feedback and allows for direct interaction with a loan officer. You can clarify any questions or concerns face-to-face. This personal approach might be beneficial for those less comfortable with online transactions or who prefer a more hands-on experience. However, be aware that in-person applications might involve longer processing times. “Remember to always compare interest rates and fees before choosing a lender, regardless of your application method.” This ensures you’re getting the best possible deal on your Delaware payday loan.

Time required for loan approval and disbursement

The speed of payday loan approval in Delaware varies significantly depending on the lender and your individual circumstances. Many online lenders advertise same-day funding, but this isn’t always guaranteed. Expect the application process, including verification of your employment and bank information, to take several hours at minimum. Some lenders may require additional documentation, potentially lengthening the timeframe. “Always check the lender’s stated processing times before applying.”

Following approval, the disbursement of funds typically occurs through direct deposit into your bank account. This process usually takes between one and two business days. However, factors like your bank’s processing times and the lender’s internal procedures can influence this timeline. For example, applying late in the day might delay the deposit until the next business day. “Be aware that weekend applications will likely result in disbursement on the following Monday.” Always confirm the expected disbursement date with your lender to manage your expectations effectively.

Factors that influence approval speed

Several factors significantly impact how quickly your Delaware payday loan application is processed. Your credit history plays a crucial role. Lenders often perform a credit check, though not always a hard inquiry impacting your credit score. A strong credit history generally leads to faster approvals. The completeness and accuracy of your application also matter. Missing information or inconsistencies will cause delays. Providing all required documents upfront streamlines the process. Finally, the lender’s individual policies and current workload influence processing times. Some lenders offer same-day funding, while others may take a few business days.

“The speed of your payday loan approval depends heavily on your preparation.” Review the lender’s specific requirements beforehand. Ensure you have readily available proof of income, employment verification, and bank account details. Applying during peak business hours might result in longer wait times. Submitting your application early in the day often improves chances for faster processing. Remember to carefully read all terms and conditions before accepting any loan. Understanding these details beforehand helps avoid unexpected delays or complications later.

Interest Rates, Fees, and Repayment Terms

Average interest rates on Delaware payday loans

Finding the average interest rate for a Delaware payday loan isn’t straightforward. Unlike some states with publicly available rate caps, Delaware’s payday lending industry operates with less regulatory oversight regarding interest. This means rates can vary significantly between lenders, potentially ranging from a seemingly low 15% to a significantly higher 400% or more, annually. The final cost depends heavily on the lender’s specific policies and the loan amount. Always confirm the Annual Percentage Rate (APR) before signing any agreement.

“Understanding the true cost of borrowing is crucial.” Factors such as loan fees, often presented as separate charges, further inflate the overall interest. These fees can include origination fees, application fees, and late payment penalties. These add to the already high interest rates, substantially increasing the borrower’s total repayment burden. Therefore, meticulously comparing offers from multiple lenders is essential to secure the most favorable terms and minimize the long-term financial impact of a payday loan in Delaware. Remember to fully understand all associated charges before committing to a loan.

Understanding APR and additional fees

Delaware payday loans often come with high Annual Percentage Rates (APR). These rates can significantly exceed 100%, making them very expensive compared to other borrowing options. Always confirm the APR before agreeing to a loan, as it represents the total cost of borrowing, including interest and fees. Remember that the advertised interest rate is only one part of the picture; understanding the full APR is crucial for responsible borrowing. It’s vital to compare offers from multiple lenders to find the lowest APR possible.

In addition to the APR, expect various fees. These can include origination fees, late payment penalties, and rollover fees. “These additional charges can quickly inflate the total cost of your loan, making it even more difficult to repay.” Carefully read the loan agreement to understand all associated costs. Late fees, in particular, can be substantial, potentially leading to a debt cycle. Budgeting for the full repayment amount, including all fees, is vital to avoid unexpected financial burdens. Consider exploring alternative financial solutions before resorting to payday loans due to the potentially high cost.

Common repayment structures and schedules

Delaware payday loans typically operate on a short-term repayment structure. Borrowers usually receive the funds directly deposited into their account, and repayment is often due on the borrower’s next payday. This timeframe, generally two to four weeks, is crucial to understand before obtaining a loan. Failure to repay on time can lead to significant consequences, including hefty late fees and potential damage to your credit score. Always confirm the exact repayment date with the lender to avoid costly mistakes. Be aware of the total cost, including fees and interest, to ensure you can afford repayment.

Understanding the repayment schedule is vital for responsible borrowing. Many lenders offer a single lump-sum repayment option. However, some may offer alternative structures, although these are less common for payday loans in Delaware. Carefully review your loan agreement to understand the specifics of your repayment plan. “Before signing any paperwork, ensure you fully comprehend the terms and conditions, including all associated fees and the total amount due at repayment.” Contacting a financial advisor or credit counselor can provide valuable support in managing your finances and navigating the complexities of payday loans.

Potential penalties for late or missed payments

Late payments on Delaware payday loans can lead to significant financial repercussions. Late fees are common, often adding a substantial percentage to the original loan amount. These fees can quickly accumulate, making the loan increasingly difficult to repay. Furthermore, continued delinquency may result in your loan being sent to a collections agency. This seriously impacts your credit score, making it harder to obtain credit in the future—including mortgages, auto loans, and even credit cards.

Repeated missed payments can also result in legal action from the lender. Legal fees and court costs will further increase your debt burden. In Delaware, specific regulations govern debt collection practices, but it’s crucial to understand that non-payment is a serious breach of contract. “Ignoring the problem will only worsen your financial situation.” Always contact your lender immediately if you anticipate difficulty making a payment; they may offer options such as extensions or payment plans to help you avoid these penalties. Proactive communication is key to managing your payday loan responsibly and minimizing potential negative consequences.

Risks and Alternatives to Payday Loans

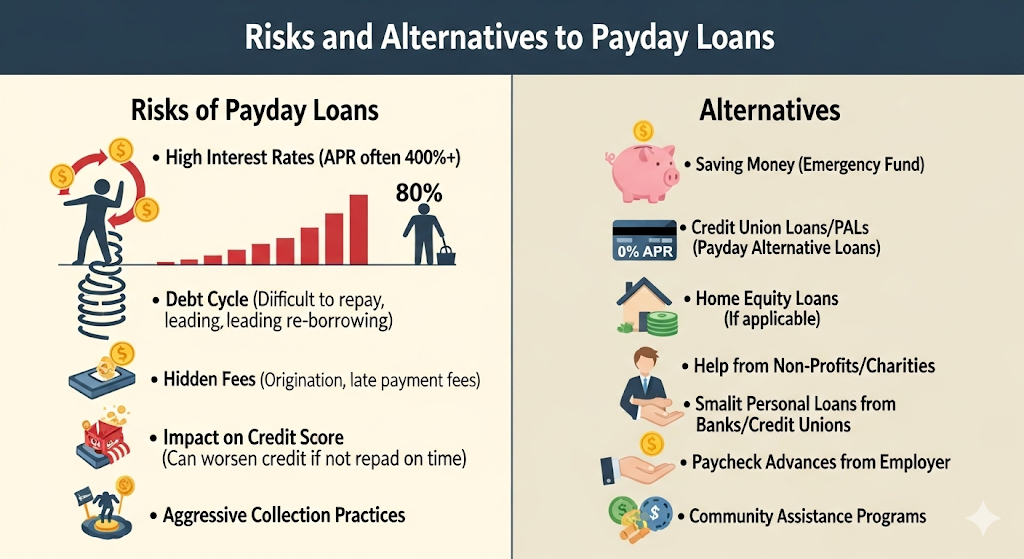

The dangers of debt cycles and high-interest rates

Payday loans in Delaware, like elsewhere, are notorious for their cripplingly high interest rates. These rates can easily exceed 400% APR, making it incredibly difficult to repay the loan on time. Missing even one payment can trigger a cascade of fees and penalties, pushing you deeper into debt. This quickly creates a dangerous debt cycle, where you’re constantly borrowing to cover previous loans, accumulating more and more interest along the way. This vicious cycle can trap borrowers for months, even years.

The consequences of this high-interest debt can be devastating. It can lead to financial instability, impacting your credit score significantly and hindering your ability to secure future loans or even rent an apartment. “Many borrowers find themselves sacrificing essential needs like food or medicine to meet their loan obligations,” a grim reality highlighting the severe impact of these predatory lending practices. Consider exploring alternatives like credit counseling, budgeting apps, or negotiating payment plans with creditors before turning to payday loans. These options offer a more sustainable path to financial stability than the short-term, high-cost relief a payday loan provides.

Exploring alternative borrowing options in Delaware

Before rushing into a Delaware payday loan, explore safer alternatives. Credit unions often offer small-dollar loans with more manageable interest rates than payday lenders. The National Credit Union Administration (NCUA) insures these loans, providing an extra layer of security. Check with your local credit union to see what options are available to you. They may also offer financial counseling to help you manage your finances effectively.

Consider also exploring secured loans. These loans use an asset, like a car or savings account, as collateral. This often secures a lower interest rate compared to unsecured payday loans. However, remember that defaulting on a secured loan can lead to the loss of your collateral. Finally, explore budgeting tools and debt management resources. Websites like the Consumer Financial Protection Bureau (CFPB) offer free resources and advice to help you create a budget and manage debt effectively. “Careful financial planning is often the best way to avoid needing a payday loan altogether.”

Credit counseling and financial literacy resources

Facing a financial emergency? Before considering a Delaware payday loan, explore free or low-cost credit counseling services. These services offer personalized financial guidance, helping you create a budget, manage debt, and develop a plan for long-term financial stability. The National Foundation for Credit Counseling (NFCC) is a reputable organization that can connect you with certified credit counselors in your area. They provide debt management plans and financial education workshops, equipping you with the skills to avoid predatory lending practices like high-interest payday loans.

Remember, financial literacy is key to breaking the cycle of debt. Many non-profit organizations and government agencies offer free resources. These include online courses, webinars, and workshops covering topics such as budgeting, saving, and investing. The Consumer Financial Protection Bureau (CFPB) website is an excellent starting point for finding reputable and trustworthy information. “Taking advantage of these free resources can empower you to make informed financial decisions and avoid the costly pitfalls of payday loans.” Seek help; it’s a crucial step towards building a secure financial future.

Seeking help from non-profit organizations and government programs

Facing financial hardship? Don’t automatically assume a Delaware payday loan is your only option. Numerous non-profit organizations and government programs offer crucial support. These resources can provide budgeting assistance, credit counseling, and even emergency financial aid. Organizations like the United Way and the Salvation Army often have local chapters offering such services. They can help you create a manageable budget and explore solutions beyond high-interest loans.

Consider exploring government programs designed to assist low-income individuals and families. The federal government and the state of Delaware both provide various aid programs, such as Temporary Assistance for Needy Families (TANF) and Supplemental Nutrition Assistance Program (SNAP) benefits. These aren’t quick fixes, but they can offer vital support while you work towards long-term financial stability. “Remember to research available resources thoroughly and contact these organizations directly to determine your eligibility and learn about their specific services.” Taking this proactive step can significantly improve your financial situation without resorting to predatory lending practices like those often associated with short-term payday loans in Delaware.

Finding Reputable Lenders in Delaware

Tips for identifying trustworthy and licensed lenders

Before applying for a Delaware payday loan, verifying a lender’s legitimacy is crucial. Check the Delaware Department of Banking’s website for a list of licensed lenders. This simple step helps avoid unlicensed operators who often charge exorbitant fees and engage in predatory lending practices. Always independently verify any license numbers provided. Don’t rely solely on online reviews; conduct thorough research.

Look for transparency in the lender’s fees and terms. Reputable lenders will clearly outline all charges upfront, including APR (Annual Percentage Rate) and any additional fees. Avoid lenders who pressure you into making a quick decision or who are vague about their lending practices. “Choosing a licensed and transparent lender is paramount to a safe and fair payday loan experience in Delaware.” Compare multiple offers to secure the best terms possible before committing to any loan. Remember, a responsible borrower always understands their financial obligations before proceeding.

Checking online reviews and reputation

Before applying for a Delaware payday loan, thoroughly investigate potential lenders online. Check multiple review sites, such as the Better Business Bureau (BBB) and Trustpilot, to gauge their reputation. Look for patterns in customer feedback. Pay close attention to complaints about hidden fees, aggressive collection practices, or difficulty in contacting customer service. A lender with consistently negative reviews should be avoided. Remember, a few isolated negative comments are normal, but a preponderance of complaints signals a potential problem.

“Choosing a reputable lender is crucial to protect yourself from predatory lending practices.” Payday loans already carry high interest rates. Selecting a lender with a strong online presence and positive reviews significantly reduces your risk of encountering hidden fees or unfair treatment. Focus on lenders with transparent fee structures and clear terms and conditions. Consider reading reviews specifically mentioning experiences with loan applications, repayment processes, and customer service interactions in Delaware. This detailed research will help you make an informed decision and find a suitable payday loan provider.

Understanding licensing and compliance information

Before considering any Delaware payday loan, diligently verify the lender’s licensing status. The Delaware Department of Justice regulates payday lenders. Their website is the primary resource for confirming a lender’s license and compliance history. Check for any reported violations or complaints. Ignoring this step significantly increases your risk of encountering fraudulent or predatory practices. “Always prioritize lenders with verifiable licenses and a clean regulatory record.”

Look beyond simple license verification. Examine the lender’s transparency. Do they clearly disclose all fees and interest rates upfront? Are their terms and conditions easily accessible and understandable? Reputable lenders readily provide this information. Avoid lenders who are vague or secretive about their fees or operating procedures. “Transparency is key to avoiding hidden charges and unexpected costs associated with Delaware payday loans.” Remember, a thorough investigation protects you from potential scams.

Safe borrowing practices to avoid scams and predatory lenders

Before applying for a Delaware payday loan, prioritize your safety. Scrutinize lenders thoroughly. Check their licensing with the Delaware Department of Banking. Verify their physical address and contact information. Avoid lenders who pressure you into quick decisions or charge excessive fees. Legitimate lenders will provide clear terms and conditions. “Always read the fine print before signing any loan agreement.”

Beware of extremely low interest rate offers or promises of guaranteed approvals. These are often red flags for predatory lending practices. Consider using comparison websites to evaluate multiple lenders and their APRs. Remember, you are legally entitled to a copy of the loan agreement before signing. Compare multiple offers to find the best interest rates and repayment terms. “Protecting your financial well-being requires diligence and careful consideration.” Report any suspicious activity to the appropriate authorities.