Understanding Escape the Fax Machine: A Quick Overview

What are faxless payday loans?

Faxless payday loans are short-term, small-dollar loans that don’t require you to fax any documents. This eliminates a significant hurdle for many borrowers. Traditional payday loans often demand verification of income and identity via faxed paperwork, a process that can be inconvenient and time-consuming, especially for those without easy access to fax machines or reliable internet. Faxless options streamline the application process considerably.

These loans leverage technology to verify information electronically. Lenders typically use online systems to access your bank statements and other financial data. This allows for faster processing times and quicker access to funds. Remember that while convenient, faxless payday loans still carry high interest rates and potential risks. “Always carefully review the terms and conditions before borrowing, and explore all available options to avoid falling into a cycle of debt.” Consider alternatives like credit unions or small-loan programs before resorting to a payday loan.

Benefits of choosing faxless options

Choosing a faxless payday loan offers several key advantages in today’s digital age. Firstly, it dramatically increases convenience. You save valuable time by eliminating the need to locate, scan, and transmit documents. This streamlined process allows for faster loan approvals and quicker access to needed funds. Many lenders offer completely online applications, further enhancing efficiency. Instead of waiting for fax confirmation, you can receive updates and track your application progress in real-time through secure online portals.

Secondly, faxless options enhance privacy and security. Faxing personal documents carries inherent risks, including the potential for interception or loss of sensitive information. Online applications, using secure encryption, provide a more secure method for transmitting your data. “By opting for a faxless process, you minimize the risk of identity theft or fraud associated with traditional fax methods,” ultimately protecting your financial well-being. Reputable lenders prioritize data security, employing advanced encryption technologies to safeguard your information throughout the loan process.

Are faxless loans truly convenient?

The convenience of faxless payday loans is largely dependent on the lender. While many online lenders advertise a streamlined, paperless application process, the reality can vary. Some lenders might still request additional documentation, slowing down the process. This could negate the time-saving benefits touted by faxless options. Always check the specific requirements of each lender before applying.

Ultimately, the true convenience hinges on your individual circumstances. If you have readily available digital copies of your documents and a stable internet connection, a faxless payday loan can be significantly faster than traditional methods. However, if you lack digital access or experience technical difficulties, the process might prove equally or more cumbersome. “The speed and ease of faxless applications should be weighed against the potential for delays caused by additional verification requests or technological issues.” Therefore, carefully consider your personal technological capabilities before committing to a faxless online loan.

How Faxless Payday Loans Work: The Application Process

Step-by-step guide to applying for a faxless loan

First, locate a reputable online lender specializing in faxless payday loans. Many legitimate lenders advertise their services online. Carefully review their terms and conditions, paying close attention to interest rates and fees. Compare several lenders to find the best option for your financial situation. Remember to check online reviews and ratings from independent sources like the Better Business Bureau to gauge the lender’s reliability.

Next, complete the online application. This usually involves providing personal information, employment details, and bank account information. Be accurate and truthful in your responses. Incomplete or inaccurate information will delay your application and may result in rejection. “Submitting your application is typically quick and easy, often taking just a few minutes.” After submission, you’ll usually receive a near-instant decision. If approved, the funds will generally be deposited directly into your bank account within one to two business days. Always remember to read the fine print before accepting any loan offer to fully understand the repayment terms.

Required documents and information

Applying for a faxless payday loan typically requires less paperwork than traditional loans. Expect to provide basic personal information, including your full name, address, date of birth, and Social Security number. You’ll also need your bank account details for direct deposit of funds and, importantly, proof of income. This might be a recent paystub or bank statement showing regular deposits. Some lenders may also request contact information for verification purposes. Remember, providing accurate information is crucial for a smooth and successful application.

“Failing to provide complete and accurate information can lead to application delays or rejection.” Be prepared to electronically upload the necessary documents. Many lenders now accept digital copies of pay stubs and bank statements. This streamlined process eliminates the need for fax machines and often speeds up the approval time. Payday loans are designed to be short-term solutions, so quick and easy applications are essential. Always check the specific requirements of your chosen lender before submitting your application. Avoid lenders who ask for excessive personal information.

Verification and approval timelines

Verification of your information is typically quick. Most faxless payday loan providers use electronic verification systems. This speeds up the process considerably. Expect a decision within minutes to a few hours, depending on the lender and the complexity of your application. Some lenders may request additional information, which could slightly extend the timeframe. Always check the lender’s website for estimated processing times.

Approval timelines vary significantly. Factors such as your credit score, income, and the amount borrowed influence how long it takes. While some lenders boast instant approval, this isn’t always the reality. “Expect a reasonable timeframe for a thorough review, especially for larger loan amounts.” Be wary of lenders promising unrealistically fast approvals, as this could be a sign of a less reputable provider. A quick turnaround is possible, but responsible lending practices require careful review.

Eligibility Requirements for Faxless Payday Loans

Income and employment verification

Most faxless payday loan providers require proof of income to assess your ability to repay the loan. This usually involves providing pay stubs from your employer for the past few months. Some lenders might accept bank statements showing regular deposits, especially if you’re self-employed or receive regular government benefits. Always check the lender’s specific requirements, as these can vary. Don’t assume all faxless lenders have the same criteria; confirming this upfront saves time and potential disappointment.

The verification process itself is generally straightforward. Many online lenders use secure systems to verify employment information instantly. This eliminates the need for faxes entirely. However, be prepared to provide your employer’s contact information. This allows the lender to confirm your employment details directly. “Providing accurate information is crucial for a successful application and ensures you receive fair consideration.” Failure to do so could lead to delays or rejection of your application. Remember to review the lender’s privacy policy to understand how your data is handled.

Credit score considerations

Many lenders offering faxless payday loans understand that a poor credit history doesn’t always reflect current financial stability. They often use alternative scoring methods or focus more on your current income and employment status. While a good credit score can certainly improve your chances of approval and potentially secure a lower interest rate, it’s not always a strict requirement. Some lenders specialize in working with borrowers who have less-than-perfect credit, making faxless payday loans accessible even with a lower score.

However, a very low or severely damaged credit score may still limit your options. Lenders assess risk, and a history of missed payments suggests a higher likelihood of default. “While a perfect credit history isn’t necessary, demonstrating responsible financial behavior through consistent income and on-time bill payments can significantly improve your eligibility.” Expect more rigorous scrutiny if your credit report shows numerous delinquencies or bankruptcies. This is why responsible financial management is crucial, even when considering short-term loan options like faxless payday loans.

Bank account requirements

Most faxless payday loan providers require a valid and active checking or savings account. This account must be in your name and have been open for a reasonable period, typically at least a few months. This allows the lender to directly deposit your loan proceeds and subsequently debit repayments. They will verify your account details to ensure legitimacy, often through automated systems. Providing inaccurate information could delay or prevent approval.

“Lenders prioritize accounts with a consistent history of activity and sufficient funds to cover any potential overdraft fees.” Insufficient funds could be a flag for lenders concerned about your ability to repay. Some lenders may have minimum balance requirements or restrictions on the type of account accepted, so check individual lender terms carefully. Always review the fine print before agreeing to a loan to avoid unexpected fees or complications. Keeping your bank account details up-to-date and accurate is critical for a smooth application and loan disbursement process for your faxless payday loan.

Exploring Alternatives to Traditional Payday Loans

Personal loans with shorter repayment terms

Many lenders offer personal loans with shorter repayment terms than traditional installment loans. These loans can provide a viable alternative to payday loans, especially for borrowers needing a smaller amount of money for a short period. While interest rates might be higher than longer-term loans, they are often lower than those charged by payday lenders. Consider exploring options from credit unions or online lenders specializing in short-term personal loans. Remember to always compare interest rates and fees before committing.

“It’s crucial to carefully review the terms and conditions of any personal loan before signing the agreement.” Look for lenders with transparent fee structures and a clear explanation of repayment schedules. Factors like your credit score and the loan amount significantly impact the interest rate you’ll receive. Checking your credit report beforehand can help you understand your borrowing power and find the most suitable loan offer. Faxless applications are commonly available, simplifying the process further.

Lines of credit for emergency funds

A line of credit offers a flexible alternative to payday loans, providing access to funds as needed. Unlike a payday loan’s single, lump-sum disbursement, a line of credit allows you to borrow and repay funds repeatedly, up to a pre-approved limit. This flexibility is particularly helpful for managing unexpected expenses or covering a series of smaller emergencies over time, rather than needing one large sum. Many banks and credit unions offer these options, often with lower interest rates than payday loans. Be sure to compare APRs and terms carefully.

Secured lines of credit, often backed by collateral like a savings account or vehicle, are generally easier to obtain and offer more favorable interest rates. However, understand the risks involved with pledging assets as collateral. Unsecured lines of credit, which don’t require collateral, might have stricter qualification criteria and higher interest rates. “Carefully consider your financial situation and repayment capacity before applying for any line of credit, regardless of whether it’s secured or unsecured.” Always read the terms and conditions thoroughly before committing to any financial product. Responsible borrowing is key to avoiding future financial hardship.

Community resources and financial assistance programs

Many communities offer financial assistance programs designed to help individuals facing short-term financial hardship. These programs often provide emergency funds, budget counseling, and assistance with utility bills or rent. Local charities, churches, and non-profit organizations frequently operate these programs. Contact your local United Way or search online for “emergency financial assistance [your city/state]” to find available resources. Eligibility requirements vary, so it’s crucial to check each program’s specific criteria.

Exploring these options can offer a lifeline, preventing reliance on high-interest payday loans. “Utilizing community resources provides a more sustainable and responsible path to managing unexpected expenses, avoiding the debt trap often associated with faxless or traditional payday loans.” Remember to thoroughly investigate each program to determine if it meets your immediate needs and aligns with your long-term financial goals. Often, these free or low-cost services can help you navigate a difficult financial situation more effectively than a short-term loan.

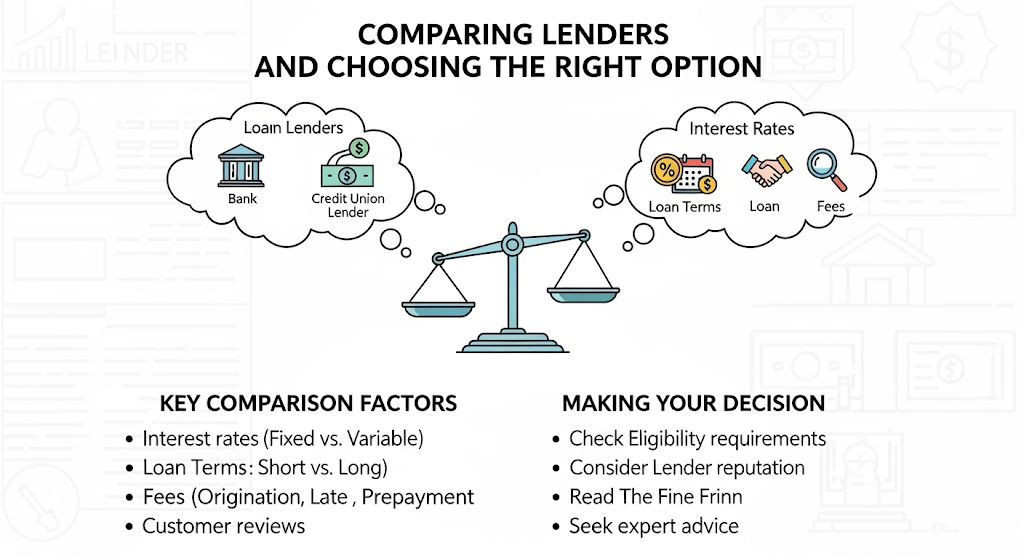

Comparing Lenders and Choosing the Right Option

Interest rates and fees: A detailed comparison

Understanding the true cost of a loan is crucial. Payday loans, even faxless ones, often carry high interest rates and substantial fees. These can quickly spiral out of control if not carefully managed. For example, a $500 loan might accrue $100 in fees, significantly increasing the total repayment amount. Always compare the Annual Percentage Rate (APR), which reflects the total cost of borrowing, across different lenders. Avoid lenders advertising deceptively low rates that hide exorbitant fees.

Shop around! Carefully review the terms and conditions of each offer. Look beyond advertised rates. Note any hidden charges or prepayment penalties. Consider the repayment schedule. Does it fit your budget? “Choosing the lender with the lowest APR, transparent fees, and a manageable repayment plan is paramount to avoiding a debt trap,” especially when dealing with short-term, high-interest loans like payday loans, even if they offer convenient faxless application processes. Remember, responsible borrowing is key, regardless of the application method.

Reputation and customer reviews: Finding trustworthy lenders

Before applying for any faxless payday loan or alternative, thoroughly research potential lenders. Check independent review sites like the Better Business Bureau (BBB) and Trustpilot. Look for lenders with a history of positive customer feedback and a strong track record of ethical lending practices. Avoid companies with numerous complaints about high fees, aggressive collection tactics, or misleading advertising. “A lender’s reputation is crucial; it reflects their commitment to fair and transparent financial services.”

Pay close attention to the specifics of customer reviews. Do they mention quick and easy applications? Were the loan terms clearly explained upfront? Was the customer service helpful and responsive? These details reveal more than just a simple star rating. Consider the volume of reviews as well. A small number of positive reviews might be less reliable than a large number, even with some negative feedback sprinkled in. “Prioritize lenders with consistently positive feedback and a demonstrably transparent application process, especially if you are seeking a faxless solution to expedite your application.”

Security and data privacy: Protecting your personal information

Protecting your financial data is paramount when seeking a faxless payday loan or alternative. Reputable online lenders utilize robust encryption and security protocols, such as SSL certificates, to safeguard your sensitive information during transmission. Look for lenders who clearly outline their data privacy policies on their websites, specifying how they collect, use, and protect your personal data. Transparency is key; avoid lenders that are vague or lack detailed information on security measures.

Choosing a lender with a strong track record and positive customer reviews regarding data security is crucial. Check independent review sites and look for mentions of secure platforms and data protection practices. Consider lenders who comply with regulations like the Fair Credit Reporting Act (FCRA) and other relevant data privacy laws. “Remember, your personal information is valuable; never share it with lenders who lack transparent security protocols or positive customer feedback regarding data privacy.” Prioritize lenders who prioritize your security, ensuring a safe and secure borrowing experience.

Responsible Borrowing and Repayment Strategies

Creating a realistic budget and repayment plan

Before applying for any faxless payday loan or alternative, meticulously track your income and expenses for at least a month. This provides a clear picture of your financial situation. Use budgeting apps or spreadsheets to categorize spending. Identify areas where you can cut back to free up funds for loan repayment. Remember, accurately assessing your finances is crucial for responsible borrowing. “Failing to budget effectively can lead to a cycle of debt and missed payments.”

Once you have a realistic budget, create a detailed repayment plan. Break down the loan amount into manageable installments that fit comfortably within your budget. Consider your payday schedule and factor in other regular bills to prevent unexpected shortfalls. Explore options like automatic payments to ensure timely repayments. “Prioritize loan repayment to avoid late fees and damage to your credit score. This also minimizes the long-term cost of the loan”. Remember, responsible borrowing involves planning for repayment from the outset.

Understanding the risks of payday loans

Payday loans, even faxless ones, carry significant risks. High interest rates are a major concern. These rates can quickly spiral out of control, leading to a debt trap. Many borrowers find themselves in a cycle of needing further loans to repay existing ones. This can severely impact credit scores and financial stability. The Consumer Financial Protection Bureau (CFPB) has documented numerous instances of borrowers facing extreme financial hardship due to payday loan debt.

Consider the potential consequences before applying. Missed payments can result in additional fees and damage your credit. Some lenders may use aggressive collection tactics. Explore alternatives like credit counseling or small loans from credit unions before resorting to a payday loan. “Always prioritize responsible borrowing and carefully consider the long-term implications of taking on short-term debt.” Remember, faxless options don’t eliminate these inherent risks. Thoroughly research lenders and understand the terms before signing any agreement.

Seeking professional financial advice when needed

Financial difficulties can be overwhelming. Seeking help is a sign of strength, not weakness. A certified financial advisor can provide personalized guidance tailored to your unique situation. They can help you create a realistic budget, explore debt management strategies, and identify potential alternatives to payday loans. Consider it an investment in your financial future. The National Foundation for Credit Counseling (NFCC) is a great resource to find reputable advisors in your area.

Remember, responsible borrowing isn’t just about choosing the right loan; it’s about managing your finances proactively. A financial advisor can help you understand your credit score, improve your financial literacy, and develop long-term strategies for avoiding debt traps. “Don’t hesitate to reach out for professional help; it could be the difference between managing your debt and spiraling further into financial hardship.” Utilizing available resources, such as free credit counseling sessions, is a crucial step in achieving lasting financial stability and escaping the cycle of high-interest loans.