Understanding Los Angeles Payday Loans

What are Payday Loans and How Do They Work?

Payday loans in Los Angeles, like elsewhere, are short-term, small-dollar loans. They’re designed to help borrowers cover unexpected expenses until their next paycheck. You typically borrow a relatively small amount, often a few hundred dollars. Repayment is due on your next payday, usually within two to four weeks. The process often involves providing proof of income and a checking account. “Be aware, however, that these loans come with high fees and interest rates, making them a potentially expensive option if not repaid promptly.”

These high costs stem from the short repayment period and the ease of access. Lenders prioritize speed and convenience, often foregoing rigorous credit checks. This makes them appealing to individuals with poor credit or immediate financial needs. However, the convenience can be deceptive. Missing a payment can trigger additional fees and penalties, quickly escalating the debt. “It’s crucial to carefully consider the total cost of a payday loan before borrowing, and to only take out what you are absolutely certain you can repay on time.” Explore all alternatives before resorting to a payday loan in Los Angeles.

Eligibility Requirements for Payday Loans in Los Angeles

Securing a payday loan in Los Angeles requires meeting specific criteria. Lenders typically demand proof of regular income, showing a consistent ability to repay the loan. This often involves pay stubs or bank statements demonstrating sufficient income to cover the loan amount and your existing expenses. You’ll also need a valid government-issued photo ID and a verifiable active bank account for direct deposit of the loan proceeds and automated payments. Failing to meet these basic requirements will likely result in immediate loan application denial.

Beyond basic requirements, some lenders may consider your credit score, although it’s not always a decisive factor for short-term, small-dollar loans like payday loans. However, a poor credit history might lead to higher interest rates or stricter lending terms. “It’s crucial to carefully review the loan agreement and understand all associated fees and repayment schedules before signing anything.” Remember, responsibly managing your finances and exploring alternative solutions to payday loans, like credit counseling, can prevent long-term debt cycles. Always compare offers from multiple lenders to find the best terms.

The Application Process: A Step-by-Step Guide

Securing a payday loan in Los Angeles typically involves a straightforward application process. Most lenders require basic personal information, including your name, address, Social Security number, and employment details. You’ll also need to provide proof of income, such as pay stubs or bank statements. This verifies your ability to repay the loan. Many lenders now offer online applications, streamlining the process and providing quicker approvals. Be sure to carefully review the loan terms and conditions before signing any agreements.

Once your application is submitted, the lender will assess your creditworthiness, though a credit check isn’t always mandatory for payday loans in Los Angeles. The approval process can range from a few minutes to a few hours, depending on the lender and the volume of applications they are processing. Upon approval, you’ll receive the funds directly into your bank account, usually within one business day. Remember to understand the repayment terms thoroughly, including fees and interest rates. “Failing to repay on time can lead to significant financial penalties and impact your credit score, so careful budgeting is essential before applying for a Los Angeles payday loan.”

Interest Rates and Fees: The Cost of Borrowing

Calculating the Total Cost of a Payday Loan

Understanding the true cost of a payday loan in Los Angeles requires careful calculation beyond the advertised interest rate. Lenders often present a seemingly low APR, but this can be misleading. The Annual Percentage Rate (APR) doesn’t fully reflect the short loan term. Crucially, fees are often substantial and significantly impact the total repayment amount. For example, a $300 loan with a $45 fee and a two-week repayment period translates to a much higher effective interest rate than the stated APR suggests. Always obtain a clear breakdown of all charges before signing any agreement.

To calculate the total cost, start by adding all fees to the principal loan amount. This gives you the total repayment amount. Then, consider the repayment period. Divide the total repayment amount by the principal loan amount. This reveals the true cost of borrowing. Online calculators can simplify this process, but it’s crucial to double-check the figures against your loan agreement. “Remember, seemingly small fees can quickly escalate the overall cost, making payday loans a very expensive option for borrowers.” Always explore alternatives before resorting to a payday loan, especially in a city like Los Angeles with diverse financial resources.

Comparing Interest Rates Across Lenders in Los Angeles

Finding the best payday loan interest rates in Los Angeles requires diligent comparison. Don’t rely solely on advertised rates. Many lenders tack on various fees, significantly increasing the actual cost. Always calculate the Annual Percentage Rate (APR) to get a true picture of the overall borrowing expense. This includes all charges, not just the stated interest. Several online comparison tools can help simplify this process, providing a transparent view of different lenders’ offerings. Remember, APRs can vary drastically.

Beware of lenders who obscure their fee structures. Transparency is key. Look for lenders that clearly display all charges upfront, including origination fees, late payment penalties, and any other potential costs. “Compare at least three to five lenders before making a decision to ensure you’re getting the best possible terms for your payday loan in Los Angeles.” Checking reviews from previous borrowers can also give valuable insights into a lender’s reputation and practices. This thorough approach helps you avoid unexpectedly high costs and protects you from predatory lending practices.

Avoiding Predatory Lending Practices

Los Angeles residents seeking payday loans must be vigilant against predatory lenders. These lenders often charge exorbitant interest rates and fees far exceeding California’s legal limits. Look for lenders transparently displaying all costs upfront, including APR (Annual Percentage Rate) and any additional charges. Avoid lenders who pressure you into borrowing more than you need or who make unrealistic promises about repayment. “Researching and comparing multiple lenders is crucial to finding the best terms.”

Always read the fine print carefully before signing any agreement. Be wary of lenders who require access to your bank account without clear explanation. Consider the potential impact on your finances. A missed payment can trigger a cascade of fees and negatively impact your credit score. Seek alternative financial solutions if possible, such as credit counseling or negotiating with creditors. Remember, understanding your rights as a borrower under California’s lending laws is your strongest defense against predatory practices. The California Department of Financial Protection and Innovation (DFPI) is a valuable resource for information and assistance.

Finding Reputable Payday Loan Lenders in Los Angeles

Identifying Licensed and Regulated Lenders

In Los Angeles, finding a legitimate payday loan provider requires diligence. Before considering any lender, verify their licensing status with the California Department of Financial Protection and Innovation (DFPI). Their website provides a searchable database of licensed lenders, allowing you to confirm a lender’s legitimacy before applying for a Los Angeles payday loan. Don’t rely solely on online reviews; always check official sources. Ignoring this step could expose you to predatory lending practices.

Look for clear and transparent fee schedules. Reputable lenders will openly disclose all charges and interest rates upfront. Avoid lenders who are vague about their fees or pressure you into quick decisions. Hidden fees are a major red flag indicating a potentially unreliable lender. “Choosing a licensed and regulated lender significantly reduces the risk of scams and unfair lending practices,” ensuring a safer borrowing experience. Remember to compare offers from several licensed lenders to find the best terms for your specific needs. Consider the total cost of the loan, not just the initial amount.

Checking Reviews and Ratings from Reputable Sources

Before you apply for a Los Angeles payday loan, thoroughly research potential lenders. Don’t rely solely on company websites. Instead, check independent review sites like the Better Business Bureau (BBB) and Yelp. Look for patterns in customer feedback. Positive reviews often highlight quick processing and helpful customer service. Negative reviews may reveal hidden fees or aggressive collection practices. Pay close attention to the lender’s response to negative reviews. This shows how they handle customer issues.

Consider the volume of reviews, too. A lender with only a few reviews might lack sufficient data for a fair assessment. Aim for lenders with many reviews, both positive and negative. A mix suggests a more established business. “Using multiple review platforms provides a more holistic view of the lender’s reputation and practices.” Remember, a perfect score isn’t realistic. Focus on identifying consistent themes and overall trends. This diligent research can help you avoid predatory lenders offering high-interest payday loans in Los Angeles and find a responsible option.

Tips for Safe Online Lending Practices

Before applying for a payday loan online in Los Angeles, prioritize your safety. Always verify the lender’s license with the California Department of Financial Protection and Innovation (DFPI). Check for secure connections (HTTPS) and look for reviews from other borrowers on reputable sites like the Better Business Bureau. Avoid lenders who pressure you into quick decisions or those with unclear fees and interest rates. Transparency is key.

Remember to read the terms and conditions carefully before agreeing to anything. Understand all fees, interest rates, and repayment schedules. Never share sensitive personal information unless you are absolutely certain the website is secure and legitimate. Compare multiple lenders to find the best terms. Consider alternatives like credit counseling or negotiating with creditors before resorting to a payday loan. “Always prioritize your financial well-being and avoid predatory lending practices.”

Alternatives to Payday Loans in Los Angeles

Exploring Low-Interest Loans and Credit Unions

Credit unions often offer lower interest rates than payday lenders. They are not-for-profit organizations. This means they prioritize members’ financial well-being. Many credit unions provide small-dollar loans with more manageable repayment terms. These loans can help you avoid the debt trap associated with high-interest payday loans. Check with your local credit unions to see what options are available. Consider your credit history and eligibility requirements.

Exploring low-interest personal loans from banks or online lenders is another viable alternative. These loans usually have a longer repayment period. This makes monthly payments more affordable. However, thoroughly compare interest rates, fees, and terms before committing. “Always read the fine print and understand the total cost of borrowing before signing any loan agreement.” Websites like the National Endowment for Financial Education (NEFE) offer resources to help you compare loan options and make informed decisions. Remember to check your credit report for any errors before applying for a loan.

Considering Financial Counseling and Budgeting Assistance

Facing financial hardship in Los Angeles can feel overwhelming, but seeking professional guidance is a crucial first step. Nonprofit credit counseling agencies, like those affiliated with the National Foundation for Credit Counseling (NFCC), offer free or low-cost financial counseling services. These agencies can help you create a realistic budget, identify areas for savings, and negotiate with creditors to potentially lower payments or avoid late fees. They provide valuable tools and strategies for long-term financial health, unlike the short-term, high-interest trap of payday loans.

Remember, financial counseling isn’t just about managing debt. It’s about developing healthy financial habits for the future. These agencies often offer workshops and educational resources on topics like debt management, saving and investing, and building credit. “By addressing the root causes of your financial difficulties, instead of merely applying a quick fix, you’ll achieve sustainable financial stability and avoid the cycle of relying on high-cost loans like payday loans.” Consider this a proactive step toward a more secure financial future. Many local resources are available; a simple online search for “Los Angeles financial counseling” will reveal numerous options.

Utilizing Community Resources and Support Programs

Los Angeles offers a safety net of community resources specifically designed to help residents facing financial hardship. Many non-profit organizations provide emergency financial assistance programs, offering short-term loans or grants to cover immediate expenses. These programs often have less stringent requirements than payday lenders, focusing on need rather than credit scores. Examples include local churches, community centers, and charities like the Salvation Army, which offer assistance with rent, utilities, and food. You can find a comprehensive list of local organizations through a quick online search or by contacting the Los Angeles County Department of Public Social Services.

Before considering a payday loan, explore the extensive network of support available in LA. Many programs provide budgeting counseling and financial literacy workshops, equipping you with the tools to manage your finances effectively and avoid future debt cycles. Job training programs and career services can help you increase your income, providing a long-term solution to financial instability. “Taking advantage of these free resources is often a far better and more sustainable solution than relying on high-interest payday loans.” Remember to thoroughly research eligibility requirements and application processes for each program to maximize your chances of receiving aid.

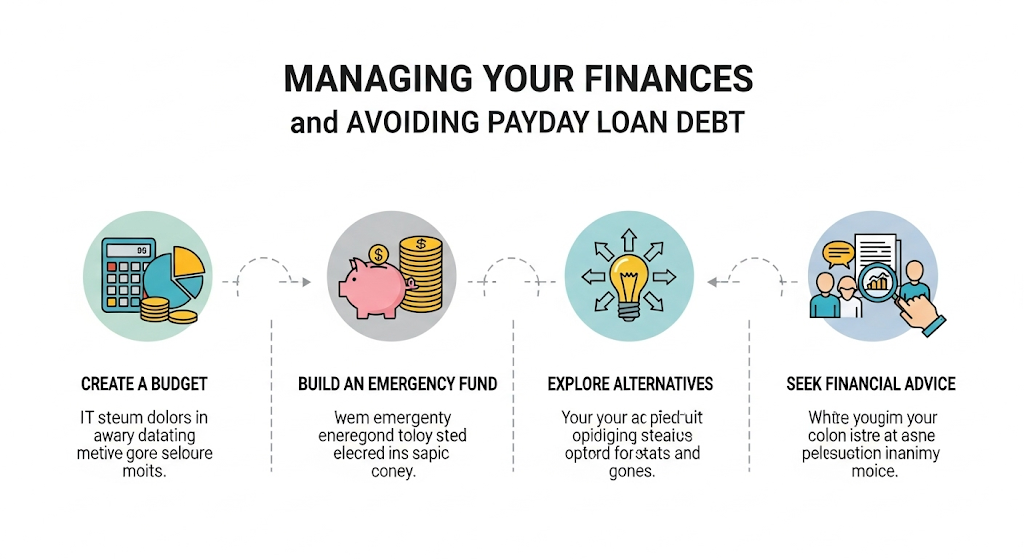

Managing Your Finances and Avoiding Payday Loan Debt

Creating a Realistic Budget and Sticking to It

A realistic budget is your first line of defense against needing a payday loan in Los Angeles. Track your income and expenses meticulously. Many free budgeting apps and spreadsheets can help. Categorize spending to pinpoint areas for potential savings. Consider using the 50/30/20 rule: allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Even small adjustments can make a big difference over time. For example, reducing daily coffee purchases or canceling unused subscriptions can free up significant funds.

Sticking to your budget requires discipline and consistent monitoring. Regularly review your spending habits. Identify any discrepancies between your planned and actual spending. Adjust your budget as needed. Don’t be afraid to seek professional financial advice if you’re struggling. “Developing good financial habits is key to long-term financial health and prevents the need for high-interest, short-term loans like payday loans.” Resources like the Consumer Financial Protection Bureau (CFPB) offer free guidance and tools to aid in budgeting and financial planning. Remember, consistency is crucial.

Strategies for Building Good Credit and Financial Health

Building strong financial habits is key to escaping the payday loan cycle. Focus on creating a realistic budget, tracking your income and expenses meticulously. Many free budgeting apps and online resources can help. Prioritize paying down existing debts, starting with the highest interest rates. This reduces your overall debt burden and improves your creditworthiness. Remember, consistent, small steps make a big difference.

Improving your credit score takes time, but it’s achievable. Pay all your bills on time. This is the single most important factor affecting your credit. Consider paying more than the minimum amount due each month. Aim to keep your credit utilization ratio (the amount you owe compared to your available credit) low – under 30% is ideal. Check your credit report annually for errors and monitor your score’s progress. “Building a positive credit history is the best way to avoid relying on high-interest loans like payday loans in the future.”

Seeking Help When Overwhelmed by Debt

Feeling overwhelmed by debt is common, especially after relying on Los Angeles payday loans. Don’t hesitate to seek help. Many resources are available to guide you toward debt management and financial recovery. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, connecting you with certified professionals. They can help you create a budget, explore debt consolidation options, and negotiate with creditors. Remember, seeking help is a sign of strength, not weakness.

“Taking proactive steps is crucial to escape the cycle of payday loan debt in Los Angeles.” Consider contacting non-profit credit counseling agencies like the NFCC. They offer free or low-cost services including debt management plans (DMPs) and budget counseling. These plans can help you consolidate high-interest debts, like payday loans, into a single, more manageable monthly payment. Exploring these options can provide a path towards financial stability and prevent further reliance on short-term, high-interest loans. Remember, you’re not alone, and professional guidance can make a significant difference.

Legal Aspects and Consumer Protection

California Laws Governing Payday Loans

California has strict regulations regarding payday loans, designed to protect consumers from predatory lending practices. These laws limit the amount a lender can charge in fees. The maximum fee is 15% of the principal amount for a loan of $300 or less. For larger loans, the fee is capped at $45. These caps aim to prevent exorbitant interest rates that trap borrowers in cycles of debt. The California Department of Financial Protection and Innovation (DFPI) oversees and enforces these regulations. Borrowers should familiarize themselves with these limits before considering a payday loan.

Crucially, California law also dictates the loan term. Payday loans cannot exceed 31 days. Rollover loans, extending the repayment period, are strictly prohibited. This prevents borrowers from accumulating significant debt through repeated extensions. Failing to repay a payday loan on time can lead to significant consequences, including damage to credit scores and potential legal action. Before taking out a payday loan, carefully review all terms and conditions. Understanding California’s laws is essential for responsible borrowing and avoiding potential pitfalls. “Always prioritize exploring alternative financial solutions before resorting to a payday loan.”

Your Rights as a Borrower in Los Angeles

In Los Angeles, as in all of California, significant protections exist for payday loan borrowers. The California Department of Financial Protection and Innovation (DFPI) regulates these loans, setting strict limits on fees and interest rates. Lenders cannot charge exorbitant amounts. They are also legally obligated to provide you with clear and concise information regarding loan terms, fees, and repayment schedules. Understanding these regulations is crucial for protecting yourself from predatory lending practices. Remember to carefully read all loan documents before signing.

“Failing to understand your rights can lead to serious financial consequences.” Don’t hesitate to ask questions if anything is unclear. The DFPI’s website offers valuable resources and guidance for consumers. You can report any violations of California’s payday lending laws directly to the DFPI. Knowing your rights empowers you to navigate the Los Angeles payday loan landscape responsibly and avoid exploitative practices. Seeking assistance from a consumer rights organization can also be beneficial if you encounter problems with a payday lender.

Reporting Predatory Lending Practices to the Authorities

Facing unfair or illegal practices from a payday lender in Los Angeles is unfortunately a possibility. If you suspect predatory lending, documenting everything is crucial. Keep copies of all loan agreements, payment receipts, and communication with the lender. This detailed record will be invaluable when filing a complaint. Contacting the California Department of Financial Protection and Innovation (DFPI) is your first step. They are responsible for regulating financial institutions, including payday lenders, and investigating complaints of illegal activity. Their website offers resources and complaint forms to simplify the process.

The Consumer Financial Protection Bureau (CFPB) is another vital resource. This federal agency has nationwide jurisdiction and can assist with complaints involving payday loans that cross state lines, or involve violations of federal consumer protection laws. Filing a complaint with both the DFPI and the CFPB increases your chances of a successful resolution. Remember, reporting predatory lending practices is essential not just for individual protection, but also for helping prevent others from falling victim to the same exploitative tactics. “By reporting these issues, you contribute to a fairer financial landscape for all consumers in Los Angeles.” Don’t hesitate; utilize these resources to protect your rights.