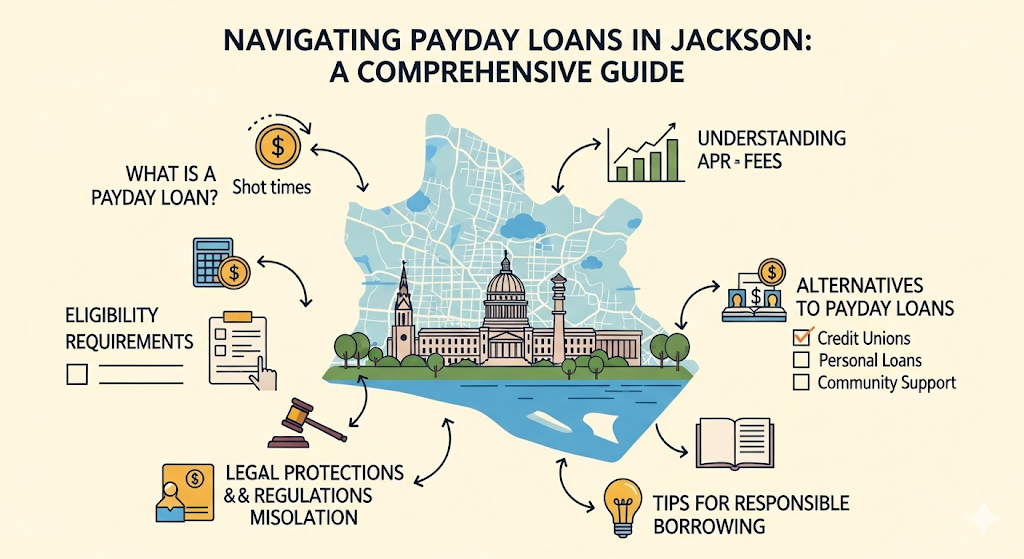

Understanding Payday Loans in Jackson

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers meet immediate financial needs until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. The amount borrowed is typically capped by state regulations, and in Mississippi (where Jackson is located), this amount varies depending on the lender. However, it’s crucial to understand that high interest rates are a defining characteristic of payday loans. These rates can make repaying the loan challenging if you don’t have a solid plan in place. Remember to thoroughly research any lender before applying.

Before considering a payday loan in Jackson, MS, carefully weigh the pros and cons. While they offer quick access to cash, the potential for incurring significant fees and rolling over the loan (which compounds the debt rapidly) makes them a risky choice. “Failing to repay a payday loan on time can lead to severe financial consequences, including damage to your credit score and debt collection actions.” Always explore alternative financial solutions, such as negotiating with creditors, seeking assistance from credit counseling agencies, or using budgeting tools, before resorting to a payday loan. Explore all options to avoid the high cost of this type of borrowing.

How Payday Loans Work in Mississippi

Mississippi law governs payday loans. Borrowers obtain a short-term loan, typically due on their next payday. The lender provides cash in exchange for a post-dated check or authorization for electronic funds withdrawal. Interest rates are capped by state law, but the effective annual percentage rate (APR) can still be extremely high. It’s crucial to understand these costs before borrowing. Always review the loan agreement carefully.

Payday loans in Mississippi are designed for emergency use. They are not a solution for long-term financial problems. Missed payments can lead to significant fees and impact your credit score. Consider exploring alternative financing options before resorting to payday loans. “Failing to fully understand the terms and conditions could lead to a cycle of debt.” Numerous resources are available in Jackson to help residents manage their finances effectively and responsibly. Seeking advice before applying is always a wise choice.

Legality and Regulations of Payday Loans in Jackson

Payday loans are legal in Jackson, Mississippi, but are subject to state regulations. These regulations aim to protect borrowers from predatory lending practices. Mississippi law caps the maximum fee a lender can charge, preventing excessively high interest rates. However, borrowers should carefully review all loan terms before signing any agreement. Understanding these regulations is crucial for making informed decisions.

“It’s vital to remember that even with regulations in place, payday loans can still be a risky financial product.” Always explore alternative financial solutions, such as credit counseling or borrowing from friends and family, before considering a payday loan. The Mississippi Office of the Attorney General offers resources and information on consumer rights regarding payday loans in Jackson and other parts of the state. Checking their website is a valuable first step before engaging with any lender. Remember to compare interest rates and fees from different lenders to find the best deal, and never borrow more than you can realistically repay.

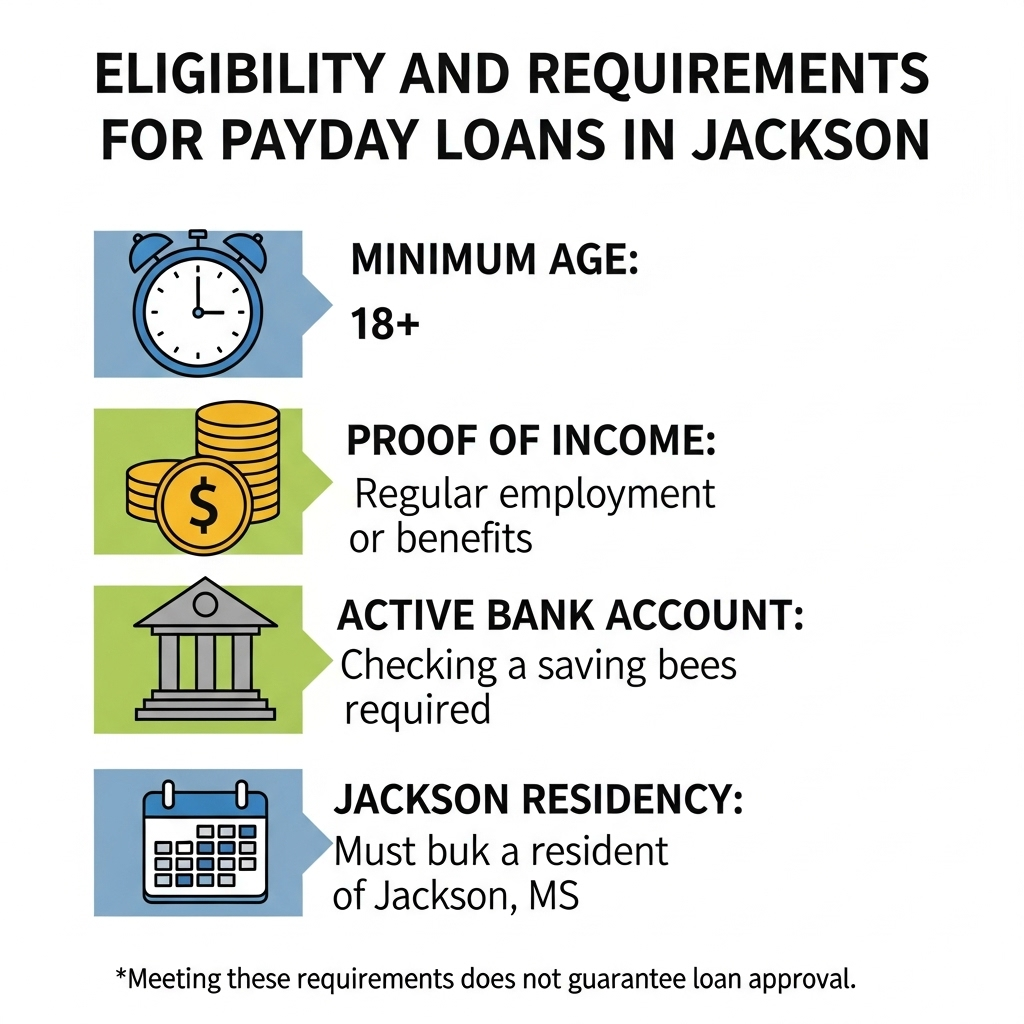

Eligibility and Requirements for Payday Loans in Jackson

Credit Score and History

Unlike traditional loans, many payday lenders in Jackson don’t perform extensive credit checks. They often prioritize your current income and employment stability over your credit score. A poor credit history might not automatically disqualify you. However, lenders will still review your credit report to assess your financial responsibility. A history of missed payments or bankruptcies could negatively impact your chances of approval, potentially leading to higher interest rates or smaller loan amounts. Remember to always check the lender’s specific requirements before applying.

While a low credit score might not be a deal-breaker, it’s crucial to understand its influence. Lenders use your credit report as one factor among many to gauge your risk. A positive credit history showing responsible borrowing behavior can significantly improve your chances of securing a payday loan with favorable terms. Conversely, demonstrating consistent late or missed payments suggests a higher risk profile, impacting the lender’s willingness to offer you a loan, or making you only eligible for less desirable terms. “Always compare offers from multiple lenders to find the best rates and terms.” Consider improving your credit score before seeking a payday loan to secure more advantageous offers.

Income and Employment Verification

Lenders in Jackson, Mississippi, typically require proof of regular income to approve a payday loan application. This ensures you can repay the loan on your next payday. They’ll want to see evidence of consistent employment, such as pay stubs, bank statements showing direct deposits, or even tax returns in some cases. The specific documentation needed can vary between lenders, so it’s wise to contact the lender directly before applying to understand their exact requirements. Failing to provide sufficient proof of income is a common reason for loan application denials.

The amount of income needed will also vary depending on the lender and loan amount. Generally, lenders will assess your debt-to-income ratio (DTI) to gauge your ability to handle repayments. A high DTI, indicating a larger portion of your income goes towards existing debts, may hinder your chances of approval. Consider consolidating existing debts or reducing expenses before applying if you are concerned about your DTI. “Remember, responsible borrowing is key to avoiding a cycle of debt with payday loans.” Always compare offers from multiple lenders in Jackson to find the best terms and conditions to suit your financial situation.

Proof of Residency in Jackson

Proving you live in Jackson, Mississippi is crucial for securing a payday loan. Lenders need to verify your address to ensure they can reach you and to comply with state regulations. Acceptable proof usually includes a current utility bill (gas, electric, water), a bank statement, or a government-issued ID showing your Jackson address. Make sure the documents are recent, ideally within the last two months, to minimize delays in the application process. Outdated documents might lead to application rejection.

Many lenders utilize third-party verification services. These services cross-reference the information you provide against various databases. This ensures accuracy and helps prevent fraudulent applications. Failure to provide sufficient proof of residency will almost certainly result in loan denial. “Providing accurate and up-to-date documentation is paramount for a smooth and successful payday loan application in Jackson.” Remember to keep copies of all documents submitted for your records.

Interest Rates and Fees: Understanding the True Cost

Average Interest Rates for Payday Loans in Jackson

Finding precise average interest rates for payday loans in Jackson, Mississippi, requires careful research. State regulations and individual lender practices significantly impact the final cost. While a specific average is difficult to pinpoint without access to a constantly updated database of all lenders’ rates, expect rates to be exceptionally high. Mississippi does not currently cap payday loan interest rates, allowing for potentially exorbitant charges. This lack of regulation means you should always carefully compare offers before borrowing.

“Always check the Annual Percentage Rate (APR), not just the stated interest rate,” as the APR incorporates all fees and charges, providing a truer picture of the loan’s total cost. Remember to thoroughly review the loan agreement before signing. Consider using online comparison tools to explore options and discover the lowest rates available. However, be wary of misleading advertisements. Independent financial advice is always recommended before entering into any payday loan agreement in Jackson or elsewhere. Understanding the potential consequences of defaulting on a payday loan is crucial, particularly concerning the impact on your credit score.

Additional Fees and Charges

Beyond the headline APR, Jackson payday lenders often levy additional fees. These can significantly inflate the total cost of your loan. For example, you might encounter late payment fees, which can quickly add up if you’re even slightly delayed. Some lenders also charge NSF (non-sufficient funds) fees if your payment bounces. Always clarify all fees upfront before signing any agreement. Thoroughly review the loan contract for any hidden charges. Mississippi’s regulations on payday loans are complex, making it vital to understand every aspect of the loan terms.

Payday loans in Jackson, like those across the state, often involve origination fees. This is a fee charged simply for processing your loan application. These fees can range widely, so comparing offers from multiple lenders is crucial. Remember, the advertised interest rate is only part of the equation. “The accumulation of these seemingly small fees can dramatically increase the loan’s effective interest rate, making it far more expensive than initially perceived.” Always calculate the total repayment amount, including all fees, to fully grasp the true cost of borrowing. Don’t hesitate to seek independent financial advice before committing to a payday loan.

Calculating the Total Cost of a Payday Loan

Understanding the true cost of a payday loan in Jackson, Mississippi, requires careful calculation beyond the initial loan amount. Payday lenders often advertise low upfront fees, but the Annual Percentage Rate (APR) is usually extremely high. This rate reflects the total cost of borrowing, including all fees and interest, over a year. Many borrowers fail to fully grasp this, leading to unexpected debt. To calculate the total cost, add the principal loan amount to all fees charged. Then, carefully consider the repayment schedule. Missing a payment can trigger substantial late fees, significantly increasing the total cost.

Remember, even a seemingly small loan can quickly become unaffordable if you don’t understand the full implications. Use online calculators, specifically those designed for Mississippi payday loans, to estimate the total repayment amount. “Compare multiple lenders and their fees before making a decision; the difference in total cost can be substantial.” Always check the lender’s licensing and ensure they comply with Mississippi’s regulations regarding payday loans. Failing to do your due diligence can leave you struggling with debt far exceeding your initial expectations.

Finding Reputable Lenders in Jackson

Identifying Licensed and Reliable Lenders

Before borrowing from any payday loan lender in Jackson, Mississippi, verify their licensing status with the Mississippi Department of Banking and Consumer Finance. This crucial step helps ensure you’re dealing with a legitimate business operating within the legal framework. Avoid lenders who pressure you into quick decisions or obscure fees. Legitimate lenders will transparently explain all terms and conditions.

Look for lenders with positive online reviews and a strong reputation. Check sites like the Better Business Bureau (BBB) for complaints and ratings. A consistently high rating suggests reliability and customer satisfaction. “Remember, a reputable lender will prioritize clear communication and responsible lending practices,” ensuring you understand the loan’s full implications before signing any agreement. Consider factors like interest rates, repayment terms, and any potential penalties for late payments when comparing different lenders. Don’t hesitate to seek advice from a financial counselor before making a decision.

Comparing Interest Rates and Loan Terms

Before committing to a payday loan in Jackson, meticulously compare interest rates offered by different lenders. Interest rates can vary significantly, impacting your total repayment amount. Don’t just focus on the advertised rate; carefully review all fees and charges. These added costs can dramatically increase the actual annual percentage rate (APR). Remember, lower APRs generally mean lower overall costs.

Consider the loan terms alongside interest rates. Shorter repayment periods might seem convenient, but they often lead to higher payments. Conversely, longer repayment terms may lower individual payments but increase the total interest paid over the loan’s life. “Carefully weigh the pros and cons of each option to choose a repayment plan that aligns with your budget and financial capabilities.” Check if the lender offers flexible repayment options or hardship programs, especially important if unexpected financial difficulties arise. This proactive approach will help you avoid the debt trap often associated with payday loans.

Avoiding Predatory Lending Practices

In Jackson, as elsewhere, predatory lenders target vulnerable borrowers. These lenders often charge exorbitant interest rates and fees, trapping borrowers in a cycle of debt. Look for lenders who clearly display their fees and interest rates upfront. Avoid lenders who pressure you into a loan or who make promises that sound too good to be true. Always read the fine print carefully before signing any agreement. Mississippi has laws to protect consumers from predatory lending practices; familiarize yourself with them.

Remember, reputable payday loan lenders in Jackson will operate transparently. They will clearly explain all loan terms and conditions. They will also provide you with a written agreement outlining the repayment schedule and total costs. Transparency is key. If a lender is evasive about fees or terms, or pressures you to borrow quickly, consider it a red flag. “Before committing to a payday loan, compare offers from multiple lenders to ensure you are getting the best possible terms.” This comparison shopping is crucial in protecting yourself from unscrupulous practices.

Responsible Borrowing and Repayment Strategies

Creating a Realistic Repayment Plan

Before taking out a payday loan in Jackson, Mississippi, meticulously plan your repayment. This involves honestly assessing your monthly income and expenses. List all your regular outgoings – rent, utilities, groceries, transportation – to determine how much disposable income you have. Budgeting tools and apps can be invaluable here. Remember, payday loans often have high interest rates and fees. Factor these costs into your repayment calculations to avoid unexpected debt. “Failing to account for these additional charges is a common reason for borrowers falling behind on their payments.”

A realistic repayment plan needs a clear timeline. Break down the total loan amount, including interest and fees, into manageable weekly or bi-weekly installments. Align these payments with your paycheck schedule. Explore options like setting up automatic payments to ensure timely repayment and avoid late fees. Consider creating a separate savings account specifically for loan repayment. This dedicated fund helps ensure you can meet your payment obligations without jeopardizing other essential expenses. “Prioritize your loan payments to prevent a debt spiral, especially with high-interest payday loans.”

Managing Your Finances After a Payday Loan

Successfully navigating a payday loan in Jackson, Mississippi, requires careful planning, not just before borrowing, but afterward as well. Once you’ve repaid your loan, the critical next step is to build a robust budget. This involves tracking all income and expenses to identify areas where you can save. Consider using budgeting apps or spreadsheets to gain a clear picture of your financial situation. Prioritize essential expenses like rent, utilities, and groceries. Then, systematically pay down any remaining debt. This structured approach will prevent you from needing another payday loan in the future.

Remember, the goal is financial stability. After repaying your payday loan, avoid using credit cards excessively, as high-interest rates can quickly lead to another debt cycle. Instead, focus on steadily increasing your savings. Even small, consistent contributions to a savings account build a safety net for unexpected expenses. “By establishing a strong financial foundation, you drastically reduce your reliance on high-cost short-term loans like payday loans.” This proactive approach helps prevent future borrowing needs, ensuring long-term financial health. Consider exploring free financial literacy resources available in Jackson to further enhance your financial management skills.

Seeking Help with Debt Management

Facing difficulty managing your payday loan debt in Jackson? Don’t hesitate to seek professional help. Credit counseling agencies, like those affiliated with the National Foundation for Credit Counseling (NFCC), offer debt management plans (DMPs). These plans negotiate lower interest rates and consolidate your debts into a single, manageable monthly payment. Remember, early intervention is key. Contacting a reputable agency sooner rather than later can significantly improve your outcome.

“Reaching out for help is a sign of strength, not weakness.” In Jackson, you can find numerous resources beyond credit counseling. The United Way of the Capital Area and local churches often provide free or low-cost financial literacy programs and debt advice. Explore options like debt consolidation loans from banks or credit unions; these may offer more favorable terms than payday loans. However, carefully evaluate all options and compare interest rates before committing. Always prioritize reputable organizations to avoid scams. Remember, responsible financial management is crucial for long-term financial well-being.

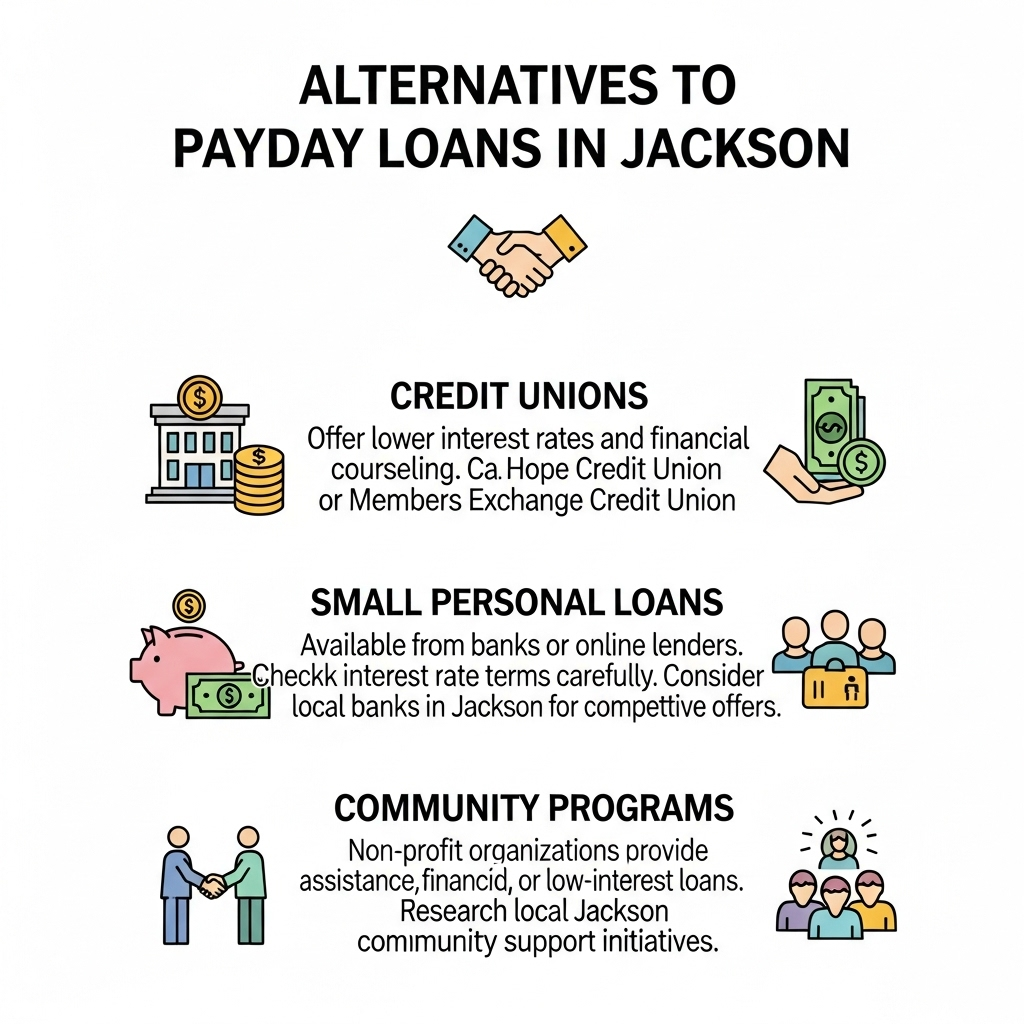

Alternatives to Payday Loans in Jackson

Personal Loans

Personal loans offer a significantly better alternative to payday loans in Jackson. Unlike payday loans’ high interest rates and short repayment periods, personal loans provide longer repayment terms and lower interest rates. This allows for more manageable monthly payments, reducing the risk of falling into a cycle of debt. Many credit unions and banks in Jackson offer personal loans with competitive rates, often based on your creditworthiness. Shop around and compare offers before committing.

Consider your credit score before applying. A higher credit score often translates to better loan terms. Improving your credit score beforehand can lead to more favorable interest rates and loan amounts. Remember to thoroughly read the loan agreement before signing. Understand the terms, fees, and repayment schedule to avoid unexpected costs. “Choosing a personal loan requires careful planning and research, but it offers a far more sustainable solution than a payday loan.” For reliable information on personal loan options in Jackson, explore resources from the Consumer Financial Protection Bureau (CFPB) and your local credit union.

Credit Unions

Credit unions offer a viable alternative to payday loans in Jackson, providing a more ethical and affordable borrowing experience. Unlike payday lenders, credit unions are not-for-profit financial cooperatives owned by their members. This structure means they prioritize member needs over profit maximization, often resulting in lower interest rates and more flexible repayment options. Many credit unions in Jackson offer small-dollar loans specifically designed to help members overcome short-term financial emergencies. These loans usually come with significantly lower APRs than payday loans, preventing borrowers from falling into a debt trap.

Before seeking a payday loan, explore what your local credit union offers. Research Jackson-based credit unions online to compare loan products and membership requirements. “Joining a credit union typically involves a small membership fee and may require a minimum deposit, but the long-term benefits significantly outweigh the initial costs.” They often provide financial literacy resources and counseling to help members improve their financial well-being, offering a far more supportive approach than the often predatory practices of payday loan companies. Consider this crucial step before resorting to high-interest, short-term loans.

Community Resources and Financial Counseling

Facing financial hardship? Before considering a payday loan in Jackson, explore the wealth of free resources available to you. Many local non-profit organizations offer financial counseling and budgeting assistance. These services can help you create a realistic budget, identify areas for savings, and develop a plan to manage your debt effectively. The United Way of Jackson, for example, often partners with local agencies to provide these crucial services. They can connect you with appropriate resources based on your individual needs.

Consider contacting a credit counseling agency. These agencies provide debt management plans and can negotiate with creditors on your behalf to reduce interest rates and monthly payments. They can also teach you valuable skills in financial literacy, empowering you to make informed decisions about your money in the long term. Remember, “seeking help is a sign of strength, not weakness,” and these community resources are designed to support you through difficult financial times. Don’t hesitate to utilize the support available before turning to high-interest payday loans.