Understanding payday loan in chicago il

What are Payday Loans and How Do They Work?

Payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They’re typically due on your next payday, hence the name. In Illinois, the maximum loan amount is $1,000, although lenders may offer less. You’ll typically need to provide proof of income and a checking account to apply. Interest rates on payday loans are significantly higher than other forms of credit. This is because of the high risk for the lender and the short repayment period.

To obtain a payday loan, you’ll usually apply online or in person at a licensed lender. The application process is often quick, and you may receive the funds the same day or within 24 hours. However, “the ease of access often masks the significant financial risks involved”. Before applying for a payday loan in Chicago, carefully compare interest rates and fees from multiple lenders. Understand the total cost of borrowing, including all fees and interest, before committing to a loan. Failing to repay on time can lead to substantial penalties and negatively impact your credit score. Explore alternatives before resorting to payday loans.

Illinois Payday Loan Laws and Regulations

Illinois has specific regulations governing payday loans, designed to protect consumers. These laws, found in the Illinois Uniform Consumer Credit Code, limit the amount a lender can charge in fees. The maximum fee is capped at a percentage of the loan amount, preventing excessively high interest rates that can trap borrowers in a cycle of debt. Lenders must also clearly disclose all fees and terms upfront. Failure to comply can result in significant penalties. “Understanding these regulations is crucial before considering a payday loan in Chicago.”

Before you borrow, carefully review the loan agreement. Pay close attention to the repayment schedule and the total cost. Illinois law also requires lenders to provide borrowers with information about alternative financial resources, like credit counseling services. Consider these alternatives before taking out a payday loan. “It’s vital to explore all options and compare interest rates and fees to make an informed decision that aligns with your financial capabilities.” Remember, responsible borrowing is key to avoiding financial hardship.

The Cost of Payday Loans: APR and Fees

Payday loans in Illinois, like those in Chicago, come with significant costs. These aren’t just small fees; they translate to extremely high Annual Percentage Rates (APRs). While the loan amount might seem manageable, the interest charges can quickly snowball. Expect APRs to easily exceed 400%, sometimes reaching much higher figures depending on the lender and loan terms. This makes them a very expensive borrowing option, potentially trapping borrowers in a cycle of debt.

Understanding the fee structure is crucial. Many lenders charge substantial fees, often a percentage of the loan amount, in addition to the high interest. These fees can be hidden or presented in confusing ways. “Always carefully review the loan agreement before signing to understand the total cost, including all fees and interest.” Failing to do so can lead to unexpected and overwhelming debt. Remember to compare offers from multiple lenders to find the best, albeit still expensive, terms available. Prioritize responsible borrowing practices to avoid the potential pitfalls of payday loans.

Finding Reputable Payday Lenders in Chicago

Identifying Licensed and Reliable Lenders

Before you consider any payday loan in Chicago, verify the lender’s licensing. The Illinois Department of Financial and Professional Regulation (IDFPR) maintains a database of licensed lenders. Always check this database to confirm the lender’s legitimacy. Don’t trust websites or advertisements alone; independent verification is crucial. Choosing an unlicensed lender exposes you to significant risks, including illegal interest rates and predatory practices. “Never proceed with a loan from a lender you cannot verify through official channels.”

Look beyond just licensing. Read online reviews and testimonials from previous borrowers. Reputable lenders often display their license information prominently on their website. They also clearly outline loan terms, fees, and repayment schedules. Be wary of lenders who pressure you into a loan or avoid answering your questions directly. Consider factors like customer service responsiveness and transparency when assessing a lender’s reliability. “A good payday loan provider in Chicago will prioritize clear communication and ethical lending practices.”

Checking for Transparency and Clear Terms

Transparency is paramount when choosing a payday loan provider. Avoid lenders who hide fees or use confusing jargon. Reputable companies openly display all charges, including APR (Annual Percentage Rate), origination fees, and any potential penalties for late payments. Look for easily accessible information on their website or in their physical branch. “A lack of clarity on fees is a major red flag, suggesting potentially predatory lending practices.”

Scrutinize the loan agreement meticulously before signing. Understand the repayment terms completely. Note the loan’s duration and the total amount due. Confirm the repayment schedule aligns with your budget and financial capabilities. Legitimate lenders will provide a straightforward, easy-to-understand contract. If anything seems unclear, don’t hesitate to ask questions. “Choosing a lender with transparent terms and conditions is crucial for responsible borrowing and avoiding unexpected financial burdens.” The Illinois Attorney General’s website offers valuable resources to help you understand your rights as a borrower.

Comparing Interest Rates and Loan Fees

Interest rates and fees significantly impact the overall cost of a payday loan. Always compare offers from multiple lenders before committing to a loan. Don’t just focus on the advertised interest rate; carefully examine all associated fees, such as origination fees or late payment penalties. These fees can dramatically increase the actual cost of borrowing, sometimes exceeding the initial loan amount. The Illinois Department of Financial and Professional Regulation (IDFPR) website is a valuable resource for checking lender licensing and understanding state regulations.

Consider using online comparison tools to streamline the research process. These tools can save you valuable time and effort in comparing various payday loan offers in Chicago. “Remember, a lower advertised rate doesn’t always mean a better deal; scrutinize the total cost of borrowing before signing any agreement.” Be wary of lenders offering exceptionally low rates or minimal fees, as these may indicate less reputable operations. Transparency is key—a reputable lender will clearly outline all fees and charges upfront. Avoid lenders who are evasive or pressure you into a quick decision.

Eligibility Criteria for Payday Loans in Chicago

Credit Score Requirements and Impact

Many Chicago residents mistakenly believe a perfect credit score is needed for a payday loan. This isn’t true. Payday lenders in Illinois, unlike traditional banks, often prioritize your current income and employment stability over your credit history. They understand that individuals facing short-term financial emergencies may have less-than-perfect credit. Therefore, a low credit score might not automatically disqualify you.

However, a poor credit history *can* impact the terms of your loan. Lenders may offer a smaller loan amount or charge higher interest rates to compensate for perceived risk. Some lenders might even deny your application altogether. “Building and maintaining a good credit score is always beneficial, even when seeking short-term financial solutions like payday loans.” Checking your credit report before applying can help you understand your standing and potentially negotiate better loan terms if you have some blemishes on your report. Remember to always compare offers from multiple lenders to secure the best possible deal.

Income and Employment Verification

Lenders in Chicago typically require proof of regular income to approve payday loan applications. This is to ensure you can repay the loan. They want to see you have a stable financial situation. Acceptable proof might include recent pay stubs, bank statements showing direct deposits, or tax returns. The specific requirements vary between lenders. Always check with the individual lender for their precise needs.

The amount of income needed also varies. It’s usually based on the loan amount. Generally, you’ll need sufficient income to cover your living expenses and the loan repayment. Failing to provide sufficient proof of income will likely result in your application being rejected. “It’s crucial to be honest and transparent about your financial situation when applying for a payday loan.” Remember, responsible borrowing involves understanding your repayment ability before applying for any short-term loan.

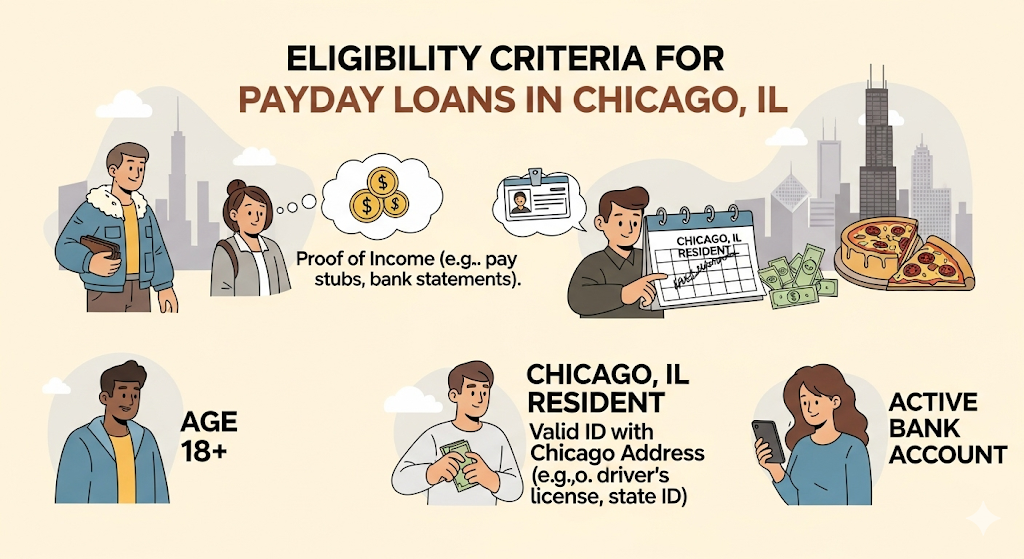

Required Documentation and Application Process

Securing a payday loan in Chicago typically requires providing specific documentation. Lenders will usually ask for proof of income, such as pay stubs or bank statements, demonstrating your ability to repay the loan. You’ll also need a valid government-issued photo ID and proof of your current Chicago address, like a utility bill. Failing to provide complete documentation will likely delay or prevent loan approval. Remember, always verify the lender’s legitimacy and review all terms carefully before signing any agreement.

The application process itself is often straightforward. Many lenders offer online applications for convenience, allowing you to submit your documents electronically. Others may require an in-person visit to a physical location. Expect a quick decision; payday loans are designed for fast access to funds. However, be aware that some lenders may conduct a credit check, though this isn’t always a requirement. “Carefully compare offers from multiple lenders to find the best terms and interest rates before committing to a loan.” This ensures you get the most suitable payday loan for your circumstances in Chicago.

The Application Process: A Step-by-Step Guide

Online Application vs. In-Person Application

Choosing between an online or in-person payday loan application in Chicago depends on your preferences and circumstances. Online applications, offered by many lenders, are incredibly convenient. You can apply from anywhere with an internet connection, at any time of day or night. This offers flexibility, especially if your schedule is busy. However, you’ll need a reliable internet connection and a computer or smartphone. You’ll also need to be comfortable sharing sensitive information online. Always verify the lender’s security measures before submitting your application.

In contrast, an in-person application at a physical storefront provides immediate interaction with a loan officer. This can be beneficial if you have questions or require assistance with the application process. You can get personalized help and immediate feedback. However, this method requires travel to the lender’s location during their business hours. “Remember to compare interest rates and fees across both online and in-person lenders before making a decision,” as rates can vary. Carefully review all terms and conditions before signing any agreement, whether online or in person.

Required Documents: What You‘ll Need

Securing a payday loan in Chicago often requires providing specific documentation to verify your identity and financial situation. Lenders typically need a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is crucial; this could be your recent pay stubs, bank statements showing consistent deposits, or a letter from your employer confirming your employment and salary. Some lenders may also request proof of your current residential address, such as a utility bill or lease agreement. Failing to provide these documents will likely delay or prevent your application from being processed.

Remember, the exact requirements can vary between lenders. It’s always best to check the specific requirements of the payday loan provider you choose *before* you apply. Carefully review their website or contact them directly. “Providing accurate and complete information is essential for a smooth and successful application process.” Inaccurate information can lead to delays and even rejection. Don’t hesitate to ask questions; understanding the requirements beforehand will save you time and potential frustration. This diligent preparation will help ensure a smoother experience when seeking fast cash options through a payday loan in Chicago.

Processing Time and Funding Options

Processing times for payday loans in Chicago vary depending on the lender and your individual circumstances. Many lenders advertise same-day funding, but this isn’t always guaranteed. Expect the process to take anywhere from a few hours to a couple of business days. Factors influencing processing time include the completeness of your application, verification of your information, and the lender’s internal procedures. Always confirm the estimated processing time with the lender *before* you apply.

Funding typically occurs through direct deposit into your bank account. Some lenders may offer alternative options, such as a check or a prepaid debit card. However, direct deposit is the most common method. Confirm your banking details carefully to ensure funds are deposited correctly. “If you encounter delays, contact the lender immediately to inquire about the status of your loan and troubleshoot any potential issues.” Remember to read the fine print and understand all fees associated with the chosen funding method. Choosing a reputable lender can help streamline this process and ensure a smoother experience.

Responsible Borrowing and Avoiding Payday Loan Traps

Budgeting and Financial Planning Tips

Before considering a payday loan in Chicago, prioritize creating a realistic budget. Track your income and expenses meticulously. Identify areas where you can cut back on spending. Even small adjustments can make a significant difference. Consider using budgeting apps or spreadsheets to simplify the process. The Consumer Financial Protection Bureau (CFPB) offers many free resources to help you get started.

Financial planning is crucial for long-term financial stability. Explore options like creating an emergency fund. Aim for at least three to six months’ worth of living expenses. This safety net can prevent future reliance on high-cost loans like payday loans. “Building a strong financial foundation is the best way to avoid the debt cycle associated with short-term borrowing.” Seek free financial counseling services available through local non-profit organizations or credit unions. These services provide valuable guidance and support.

Understanding the Risks of Payday Loans

Payday loans in Chicago, like elsewhere, carry significant risks. The high interest rates are the most immediate concern. These rates can easily exceed 400% APR, making it incredibly difficult to repay the loan on time. Missing even one payment can lead to a snowball effect of added fees and charges, quickly pushing you further into debt. This can create a vicious cycle, trapping borrowers in a never-ending cycle of borrowing. “Understanding these exorbitant costs is crucial before considering a payday loan.”

Beyond the high interest, payday loans often target vulnerable populations. Many borrowers already face financial hardship, making them susceptible to the quick-cash appeal. This can lead to irresponsible borrowing decisions, exacerbating existing financial problems. The short repayment period, typically two weeks, adds to the pressure. Many borrowers struggle to repay on time, leading to further fees and prolonged debt. “Consider alternative financing options, such as credit counseling or community assistance programs, before turning to a payday loan.” These resources can offer more sustainable and responsible solutions to short-term financial needs.

Alternatives to Payday Loans in Chicago

Before considering a payday loan in Chicago, explore alternatives. Many resources offer financial assistance without the high interest rates and potential debt cycle. Local credit unions often provide smaller loans with more manageable repayment terms. They frequently focus on community support and offer financial literacy programs, helping you manage your finances better long-term. The National Federation of Credit Unions website is an excellent resource to locate one near you.

Consider budgeting apps and debt counseling services. These tools can help you track expenses, identify areas for savings, and create a realistic repayment plan for existing debts. Non-profit organizations in Chicago also offer assistance, including emergency financial aid and guidance on managing debt. “Carefully researching and comparing options is crucial to avoiding the high costs and potential pitfalls of payday loans.” Remember, responsible financial planning is key to long-term financial health, and there are many paths to achieving it.

Frequently Asked Questions (FAQs) about Payday Loans in Chicago

What happens if I can’t repay my payday loan?

Falling behind on a payday loan in Chicago can have serious consequences. Late fees quickly accumulate, significantly increasing the total amount owed. Your lender may attempt to collect the debt through repeated phone calls, emails, and potentially, legal action. Credit reporting agencies will likely be notified of your delinquency, negatively impacting your credit score. This can make it harder to secure loans, rent an apartment, or even get a job in the future. Consider exploring options like debt counseling or negotiating a payment plan with your lender *before* you default.

It’s crucial to understand the risks involved before taking out a payday loan. Defaulting can lead to a cycle of debt, making it increasingly difficult to manage your finances. Illinois has specific regulations regarding payday loans, but these regulations don’t eliminate the potential for financial hardship if repayment becomes problematic. “If you anticipate trouble repaying, contact your lender immediately to explore solutions—proactive communication is key to avoiding the most severe consequences.” Remember, responsible borrowing is essential; always borrow only what you can comfortably repay on time. Seek help from financial literacy resources if you need assistance managing your budget.

Can I get a payday loan with bad credit?

Many payday lenders in Chicago understand that people experience financial setbacks. They often focus less on a perfect credit history and more on your current income and ability to repay. Several lenders advertise their services to those with bad credit, highlighting their willingness to consider applicants outside the traditional lending framework. However, this doesn’t mean approval is guaranteed. Interest rates might be higher to compensate for the increased risk. Always compare offers carefully.

Expect a thorough application process, including income verification and employment history checks. Lenders will want to see proof you can comfortably repay the loan within the short timeframe. Don’t assume your bad credit is an automatic disqualification. It’s crucial to be upfront about your financial situation. Shop around and compare lenders before committing to any loan. “Failing to provide accurate information could lead to rejection or further financial complications.” Prioritize responsible borrowing practices to manage your debt effectively and improve your credit score over time.

Are there any penalties for late payments?

Yes, late payments on payday loans in Chicago carry significant penalties. These penalties vary by lender, but you can expect substantial extra fees. These fees often compound quickly, making it increasingly difficult to repay the loan. Always check your loan agreement carefully for the specific late payment policies of your chosen lender. Failure to adhere to the payment schedule could lead to your loan being sent to collections, negatively impacting your credit score. Illinois law dictates some restrictions, but lender practices can differ. Be sure to understand the full implications before taking out a payday loan.

“Understanding these penalties is crucial for responsible borrowing.” Missing a payment date can drastically increase the total cost of your payday loan, potentially creating a cycle of debt. Contact your lender immediately if you anticipate trouble making a payment. They may offer options to avoid late fees or help you restructure your payment plan. However, remember that such options are not always guaranteed. Proactive communication is key to navigating these situations and minimizing potential financial hardship. Always prioritize exploring alternatives before facing the consequences of late payments.