Understanding payday loan kansas online

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They’re typically due on your next payday, hence the name. Borrowers often use them for unexpected expenses like car repairs or medical bills. Interest rates on payday loans are notoriously high, significantly impacting the total repayment amount. Understanding this high cost is crucial before considering this type of borrowing. Always compare options before making a decision.

In Kansas, specific regulations govern payday loans. These laws aim to protect consumers from predatory lending practices. However, it’s vital to thoroughly research the terms and conditions before signing any agreement. “Failing to understand the repayment schedule and associated fees can lead to a debt cycle that’s difficult to escape.” Kansas residents should carefully review all loan documents and explore alternative financial solutions, such as credit counseling or small loans from credit unions, before opting for a payday loan.

Kansas Payday Loan Laws and Regulations

Kansas has specific regulations governing payday loans, designed to protect consumers from predatory lending practices. These laws limit the amount a lender can charge in fees. The maximum loan amount is capped, preventing excessively large debts. The state also mandates a clear disclosure of all fees and terms before you sign a loan agreement. This ensures transparency and allows borrowers to make informed decisions. Ignoring these regulations can lead to serious penalties for lenders.

Crucially, Kansas law restricts the number of outstanding payday loans a borrower can have simultaneously. This prevents borrowers from accumulating overwhelming debt by taking out multiple loans at once. Rollover loans, extending the repayment period by paying only interest, are also heavily regulated or prohibited. “Understanding these limitations is critical to responsible borrowing and avoiding a cycle of debt.” Always check the Kansas Office of the State Bank Commissioner’s website for the most up-to-date information on payday loan laws and regulations before considering this type of financing. Staying informed is your best defense against unfair lending practices.

Typical Costs and Fees of Payday Loans in Kansas

Payday loans in Kansas, like those in many states, come with significant costs. These aren’t just the principal amount borrowed. Expect to pay high interest rates, often expressed as a finance charge per $100 borrowed. Kansas law caps the finance charge, but this still translates to a very high annual percentage rate (APR), often exceeding 300%. This means borrowing even a small amount can quickly become expensive. Always factor in these fees when considering a payday loan.

Beyond the interest, you’ll encounter additional fees. These can include origination fees, rollover fees (if you extend the loan), and late payment fees. These charges accumulate rapidly, potentially trapping borrowers in a cycle of debt. “Before taking out a payday loan, thoroughly research all associated costs to make an informed decision and understand the potential total cost of the loan.” Remember, these fees vary between lenders, so comparing offers is crucial before committing. Consider the total cost – not just the initial loan amount – to avoid unexpected financial burdens.

Applying for a Payday Loan Online in Kansas

Step-by-Step Online Application Process

Applying for a payday loan online in Kansas is generally straightforward. First, you’ll need to locate a reputable online lender licensed to operate in the state. Carefully compare interest rates and fees before proceeding. Many lenders have user-friendly websites with clear application forms. You’ll typically need to provide personal information, such as your name, address, Social Security number, and banking details. Be sure to double-check all information for accuracy before submitting. The lender will then review your application and, if approved, may deposit the funds directly into your bank account within 24-48 hours, although this timeframe can vary. Remember to always read the terms and conditions carefully before agreeing to any loan.

After submitting your application, you’ll receive a decision fairly quickly. Approval depends on factors like your credit score, income, and employment history. Lenders use automated systems to assess risk. If approved, you’ll electronically sign the loan agreement. Closely review the loan terms, including the repayment schedule and any associated fees. Understanding the repayment plan is crucial to avoid defaulting on your loan. “Failure to repay on time can lead to significant penalties and negatively impact your credit report.” Always budget carefully to ensure you can comfortably meet your repayment obligations. If you anticipate any difficulties, contact the lender immediately to discuss potential options.

Required Documents and Information

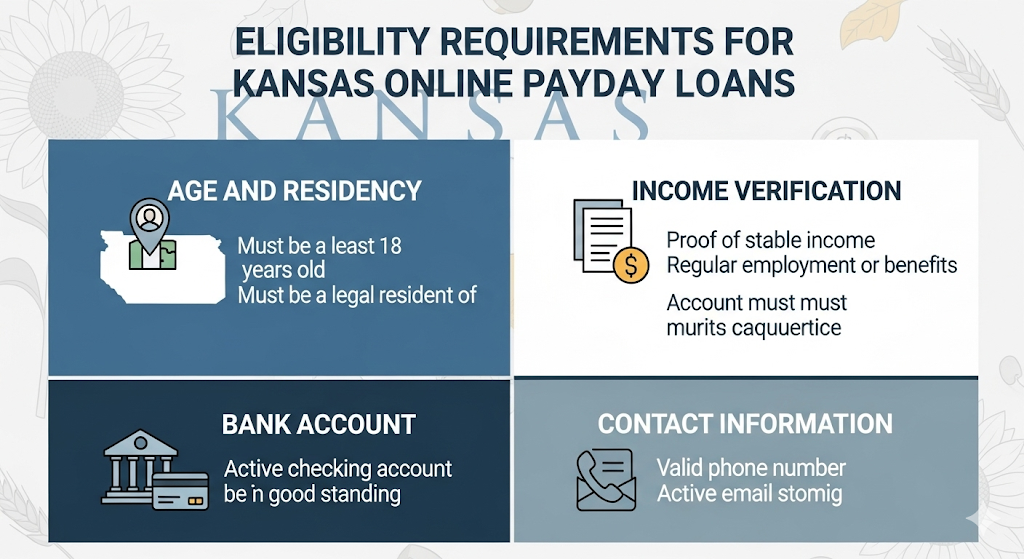

Securing a payday loan online in Kansas typically requires providing specific personal and financial information. Lenders will need your full name, current address, phone number, email address, and date of birth. You’ll also need to provide your Social Security number for verification purposes. Crucially, you’ll need to provide details about your employment, including your employer’s name, address, and how long you’ve been employed. This helps the lender assess your ability to repay the loan. Failure to provide complete and accurate information will likely delay or prevent loan approval.

Furthermore, expect to provide your bank account details. This is essential for direct deposit of the loan funds and automatic repayment. “Kansas payday lenders usually require a checking account in good standing; you’ll need to provide your account number and routing number.” Be wary of lenders who request access to your online banking account; this practice raises red flags. Always verify the lender’s legitimacy with the Kansas Office of the State Bank Commissioner before sharing any sensitive financial data. Remember to carefully review all loan terms and conditions before proceeding.

Factors Affecting Loan Approval

Several factors influence whether your payday loan application is approved in Kansas. Lenders typically check your credit history, though it’s not always the deciding factor. A strong credit score certainly helps, but many payday lenders focus more on your current income and employment stability. They’ll verify your employment details and income to ensure you can afford repayments. Providing accurate and complete information is crucial for a smooth and successful application. Inaccurate or incomplete information can lead to delays or rejection.

Beyond income verification, lenders also consider your existing debt. High levels of outstanding debt may signal a higher risk to the lender. Your banking history, including regular deposits and account activity, may be reviewed. “Consistent, reliable banking habits demonstrate financial responsibility and increase your chances of approval.” Finally, be aware that some lenders use automated systems to review applications, so even small errors can result in rejection. Carefully review all the details before submitting your application.

Eligibility Requirements for Kansas Online Payday Loans

Credit Score and History

Unlike many traditional loans, Kansas payday lenders often don’t perform extensive credit checks. They prioritize your current income and employment stability over your credit score. This means that even borrowers with a poor credit history or limited credit history may still qualify for a payday loan. However, a very low credit score might affect the interest rate offered or the loan amount approved. Some lenders may still use alternative credit scoring methods to assess risk.

Remember, while a bad credit score isn’t necessarily a deal-breaker for obtaining a payday loan in Kansas, it doesn’t eliminate all risk. High-interest rates are common with payday loans, regardless of your credit. “Carefully consider the total cost of borrowing before agreeing to a loan, as failing to repay on time can significantly worsen your financial situation.” Always explore alternative financing options, like credit counseling or small loans from credit unions, before resorting to a payday loan if possible. These alternatives usually have far more favorable terms.

Income and Employment Verification

Lenders in Kansas will verify your income to ensure you can repay the loan. They typically require proof of regular employment and consistent income. This might involve providing pay stubs, bank statements, or tax returns. The specific documents requested will vary by lender. Insufficient income is a major reason for loan applications being rejected. Therefore, be prepared to demonstrate a stable financial history.

Crucially, the lender needs to see that your income is sufficient to cover your existing expenses and the payday loan repayment. “They will assess your debt-to-income ratio to determine your affordability.” This ratio compares your monthly debt payments to your gross monthly income. A higher ratio indicates a greater financial burden, potentially leading to loan denial. Always be honest and transparent during the application process to increase your chances of approval. Knowing your debt-to-income ratio beforehand will help you understand your eligibility for a Kansas online payday loan.

Residency Requirements

To qualify for a Kansas online payday loan, you must be a resident of the state. This isn’t just about having a Kansas address; lenders verify residency through various means, including driver’s licenses, utility bills, and bank statements. Providing inaccurate information could lead to loan denial or even legal repercussions. Always ensure your application reflects your current, verifiable Kansas address.

Confirming your residency is crucial. Lenders are bound by state regulations. These regulations often specify the minimum residency period required before loan approval. “This period varies between lenders but often requires several months of continuous residence in Kansas.” Failure to meet these requirements will immediately disqualify you from obtaining a payday loan, regardless of other factors like income or credit history. Double-check the specific requirements of the lender you choose before applying.

Risks and Responsibilities of Payday Loans

High Interest Rates and Fees

Payday loans in Kansas, like those in many states, come with extremely high interest rates. These rates can easily exceed 400% APR. This means borrowing a small amount can quickly lead to a significantly larger debt. Always carefully review the loan agreement to understand the total cost before signing. Failing to do so could lead to unexpected and crippling debt.

The fees associated with payday loans further exacerbate the problem. Late payment fees, rollover fees, and other charges quickly accumulate, making it difficult to repay the loan on time. These added costs can trap borrowers in a cycle of debt, requiring them to repeatedly take out new loans to cover old ones. “Kansas residents should be aware that the combination of high interest and substantial fees can make even a seemingly small payday loan incredibly expensive.” Remember to explore all alternatives before resorting to a payday loan.

Debt Cycle Risks

Payday loans in Kansas, like those in many states, carry a significant risk of trapping borrowers in a debt cycle. The high interest rates and short repayment periods make it difficult for many to repay the loan in full by the due date. This often leads to needing to take out another payday loan to cover the first, accruing even more interest and fees. This cycle can become incredibly difficult to escape, resulting in accumulating substantial debt and negatively impacting your credit score. The Kansas Office of the State Bank Commissioner provides resources for understanding these risks.

Repeated borrowing is a hallmark of the payday loan debt trap. Each subsequent loan increases the total owed, creating a snowball effect. “Many borrowers find themselves perpetually extending or refinancing their loans, leading to long-term financial hardship,” a fact supported by numerous financial literacy studies. This constant cycle of borrowing can severely impact your ability to meet other financial obligations, such as rent, utilities, and groceries. Consider carefully the potential consequences before seeking a payday loan in Kansas; explore alternative financial solutions whenever possible.

Understanding Your Rights as a Borrower

In Kansas, borrowers have crucial protections under the law. The Kansas Consumer Credit Code dictates several key rights. These include the right to receive a clear and concise loan agreement, detailing all fees and repayment terms. Before signing anything, carefully review the document. Understand the total cost of the loan, including all interest and fees. This helps avoid unexpected charges. Don’t hesitate to ask questions if anything is unclear. The lender is legally obligated to provide you with complete information.

Remember, you are not obligated to accept a payday loan if the terms are unfavorable. Shop around and compare offers from different lenders. Consider alternatives, like credit counseling or borrowing from friends and family. “Ignoring your rights can lead to serious financial repercussions, such as debt traps and potential legal issues.” Kansas’s Office of the State Bank Commissioner offers resources to help borrowers understand their rights and navigate disputes with lenders. Explore their website for additional information and assistance if needed. Protecting yourself is key when dealing with payday loans in Kansas.

Safe and Responsible Borrowing Practices

Comparing Lenders and Interest Rates

Before applying for a payday loan in Kansas, meticulously compare lenders. Don’t just focus on the advertised interest rate. Examine the Annual Percentage Rate (APR), which includes all fees and charges, providing a clearer picture of the actual cost. Websites like the Kansas Attorney General’s office offer resources to help you understand the regulations and identify reputable lenders. Avoid lenders with hidden fees or aggressive sales tactics. “Choosing a lender with transparent fees and a straightforward application process is crucial for responsible borrowing.”

Consider the loan’s terms carefully. Look beyond the interest rate. Check the repayment schedule and any potential penalties for late payments. Some lenders might offer flexible repayment options, which can be beneficial if unexpected expenses arise. Always read the fine print. Compare multiple lenders’ offers side-by-side before making a decision. Remember, the lowest APR isn’t always the best option. “Thorough comparison shopping empowers you to make an informed decision and secure the most suitable payday loan for your financial circumstances.”

Budgeting and Financial Planning

Before considering a payday loan in Kansas, meticulous budgeting is crucial. Create a detailed monthly budget, tracking all income and expenses. Identify areas where you can cut back spending to free up cash flow. Consider using budgeting apps or spreadsheets to manage your finances effectively. This step helps determine if a payday loan is truly necessary or if alternative solutions exist. Remember, responsible financial planning prevents reliance on high-interest loans.

“A payday loan should be a last resort, not a regular solution for managing expenses.” Explore alternatives like negotiating payment plans with creditors or seeking free financial counseling services offered by organizations such as the Kansas Consumer Credit Counseling Service. These resources can provide valuable guidance and support in navigating challenging financial situations and developing long-term financial stability. Careful financial planning minimizes the need for payday loans, ultimately protecting your financial well-being.

Seeking Alternative Financial Solutions

Before considering a payday loan in Kansas, explore alternative options. Many resources offer financial assistance without the high interest rates and potential debt cycle associated with short-term loans. Credit counseling agencies, like those affiliated with the National Foundation for Credit Counseling (NFCC), provide free or low-cost budgeting guidance and debt management plans. These services can help you create a realistic budget and explore ways to manage existing debts. They can also negotiate with creditors on your behalf, potentially reducing your monthly payments.

Consider tapping into your existing resources first. Explore options like selling unused possessions, borrowing from family or friends (with a formal agreement), or utilizing a 0% APR introductory credit card for a short-term need (if creditworthy). Remember to carefully review the terms and conditions of any credit card offer. Many banks and credit unions also offer small, short-term loans with significantly lower interest rates than payday lenders. “Always prioritize exploring these options before resorting to a high-cost payday loan.” This proactive approach can help you avoid the pitfalls often associated with payday loans in Kansas and similar states.

Finding Reputable Online Lenders in Kansas

Tips for Identifying Legitimate Lenders

Scrutinize online lenders carefully before applying for a payday loan in Kansas. Look for lenders licensed by the Kansas Office of the State Bank Commissioner. This verification step is crucial for protecting yourself from predatory lenders. Check for transparent fee structures clearly displayed on their website. Avoid lenders who hide fees or use confusing jargon. A reputable lender will openly explain all costs involved.

Always read reviews from other borrowers. Sites like the Better Business Bureau (BBB) offer valuable insights into a lender’s reputation. Pay attention to complaints about high interest rates, aggressive collection practices, or hidden fees. “Choosing a lender with a positive track record significantly reduces your risk of encountering problems.” Finally, be wary of lenders promising guaranteed approval. Legitimate lenders will assess your application and determine your eligibility based on your creditworthiness. Remember, a responsible lender prioritizes your financial well-being.

Avoiding Scams and Predatory Lending

Kansas residents seeking payday loans online must be vigilant against predatory lenders. These unscrupulous businesses often charge exorbitant interest rates and hidden fees, trapping borrowers in a cycle of debt. Look for lenders licensed by the Kansas Office of the State Bank Commissioner. Checking this licensing is a crucial first step in protecting yourself. Avoid lenders who pressure you into quick decisions or demand access to your bank account without clear explanation.

Legitimate lenders will transparently display all fees and interest rates upfront. They’ll also provide clear terms and conditions in easily understandable language. Be wary of lenders promising guaranteed approval or offering loans with suspiciously low interest rates. “If a deal seems too good to be true, it probably is.” Remember, you have rights as a borrower under Kansas law. Before signing any agreement, carefully review all documents. Consider seeking independent financial advice if you’re unsure about the terms. By being informed and cautious, you can significantly reduce your risk of becoming a victim of a payday loan scam.

Resources and Support for Financial Assistance

Before considering a payday loan in Kansas, explore free resources offering financial guidance. The Kansas Statewide Financial Literacy Program, for example, provides workshops and online materials to help you budget effectively and manage debt. They can offer valuable strategies to avoid high-interest loans altogether. Contacting a credit counselor is another crucial step. These professionals can help you create a personalized debt management plan and explore alternatives like debt consolidation or negotiation with creditors. Remember, seeking help early can prevent a spiraling debt cycle.

Utilizing these resources is vital. “They can equip you with the skills and knowledge to make informed financial decisions,” reducing your reliance on short-term, high-cost loans like payday loans. The Consumer Financial Protection Bureau (CFPB) website also provides extensive information on consumer rights and avoiding predatory lending practices. Understanding your options and rights is crucial before engaging with any lender, online or otherwise, ensuring you make the best choice for your financial well-being. Remember to always research lenders thoroughly before committing to any loan.