Understanding Payday Loans Akron Ohio

What are Payday Loans and How Do They Work?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. The loan amount is generally capped by Ohio state law, and borrowers provide a post-dated check or authorize electronic access to their bank account for repayment. Interest rates on payday loans are significantly higher than traditional loans, reflecting the inherent risk involved in this type of lending. Understanding these high costs is crucial before considering this option.

Borrowers in Akron, Ohio, should carefully research available lenders to compare fees and interest rates. Always read the loan agreement thoroughly before signing. Failure to repay on time can lead to significant additional fees and damage to your credit score. “Consider payday loans only as a last resort for emergency situations and explore alternative financial solutions whenever possible,” as they are often a costly way to borrow money. Remember to factor in all fees before agreeing to a payday loan to make an informed decision suitable to your financial situation.

Ohio Payday Loan Laws and Regulations

Ohio’s payday lending landscape is governed by specific state laws designed to protect consumers. These regulations aim to limit the potential for debt traps and high-interest rates. Crucially, the state caps the amount a payday lender can charge in fees. This helps to prevent borrowers from accumulating unsustainable debt. Lenders must also clearly disclose all fees and terms, providing transparency in the lending process. The Ohio Division of Financial Institutions oversees and enforces these regulations.

Understanding these limitations is vital before considering a payday loan in Akron. “Failing to fully understand the terms and conditions could lead to unforeseen financial difficulties.” Borrowers should carefully review all documents and compare offers from multiple lenders, if possible, before committing to a loan. Knowing your rights and obligations under Ohio law is essential for responsible borrowing. Always be aware of the potential risks associated with short-term, high-interest loans and explore alternative financial solutions when feasible. Remember, these loans are intended for short-term emergencies only and should not be used for long-term financial needs.

Short-Term Loan Alternatives in Akron

Before rushing into a payday loan in Akron, Ohio, explore alternatives. Consider credit unions. They often offer small-dollar loans with lower interest rates than payday lenders. The Akron area boasts several reputable credit unions, providing a safer borrowing option. Check their eligibility requirements and compare interest rates carefully. Many offer financial counseling, too, which can aid long-term financial health.

Another viable alternative is a personal loan from a bank or online lender. While these may take longer to process, they usually involve lower interest rates and longer repayment periods than payday loans. Carefully compare loan terms and fees from several institutions before committing. “Always prioritize responsible borrowing, understanding your repayment capacity before securing any loan.” Look into local community resources, such as non-profit organizations or financial literacy programs. These programs may provide free counseling and support. They can offer help in budgeting and creating a plan to manage your finances more effectively. Remember, responsibly managing your finances can prevent the need for high-interest short-term loans in the future.

Finding Reputable Payday Lenders in Akron

Checking for Licenses and Accreditation

Before you even consider applying for a payday loan in Akron, Ohio, verifying the lender’s licensing is crucial. The Ohio Department of Commerce’s Division of Financial Institutions regulates payday lenders. Their website is an excellent resource to confirm a lender’s active license. Always check the license number against the state’s database. Don’t hesitate to contact the Division directly if you have any doubts. Ignoring this step could lead to fraudulent activities or dealing with unlicensed operators who may charge exorbitant fees or engage in predatory lending practices.

Look beyond just licensing. While licensing ensures basic compliance, consider investigating a lender’s accreditation. Organizations like the Better Business Bureau (BBB) provide ratings based on customer reviews and business practices. Checking a lender’s BBB profile can offer valuable insights into their reputation. “A high BBB rating, combined with a valid Ohio state license, significantly increases your confidence in selecting a trustworthy payday lender in Akron.” Remember, protecting yourself from potential scams begins with thorough due diligence.

Comparing Interest Rates and Fees

Interest rates on payday loans in Akron, Ohio, vary significantly. Shop around and compare offers from multiple lenders before committing. Don’t focus solely on the advertised rate; thoroughly examine all associated fees. These can include origination fees, application fees, and late payment penalties, which substantially increase the overall cost. Remember, these fees compound quickly. A seemingly low interest rate can become extremely expensive with added charges.

Consider the Annual Percentage Rate (APR) instead of just the interest rate. The APR provides a more accurate representation of the total cost of the loan, incorporating all fees and interest. Ohio’s regulations on payday lending can influence rates, so understanding these regulations is crucial. Always check the lender’s licensing and reputation with the Ohio Department of Commerce to ensure compliance and trustworthiness. “Failing to compare thoroughly could lead to choosing a lender with excessively high fees, resulting in a much more expensive loan than necessary.”

Reading Online Reviews and Testimonials

Before applying for a payday loan in Akron, Ohio, thoroughly research potential lenders online. Don’t just look at a lender’s website; delve into independent review sites like Google Reviews, Yelp, and the Better Business Bureau (BBB). Look for patterns in customer feedback. Many positive reviews suggest a reliable lender. Conversely, numerous negative reviews citing high fees, aggressive collection practices, or difficulty contacting the lender should raise serious red flags. Pay close attention to the specifics of each review; a few isolated negative experiences may be anomalies. However, consistent negative themes indicate potential problems.

Focus on reviews that detail the entire loan process, from application to repayment. Detailed reviews are more informative than simple star ratings. Look for comments addressing transparency in fees, clarity in terms and conditions, and the lender’s responsiveness to customer inquiries. “Checking multiple review platforms provides a more comprehensive picture than relying on a single source.” Remember, online reviews are subjective, but they offer valuable insight into a lender’s reputation and how they treat their customers. Use this information to make an informed decision about which Akron payday loan provider is right for you.

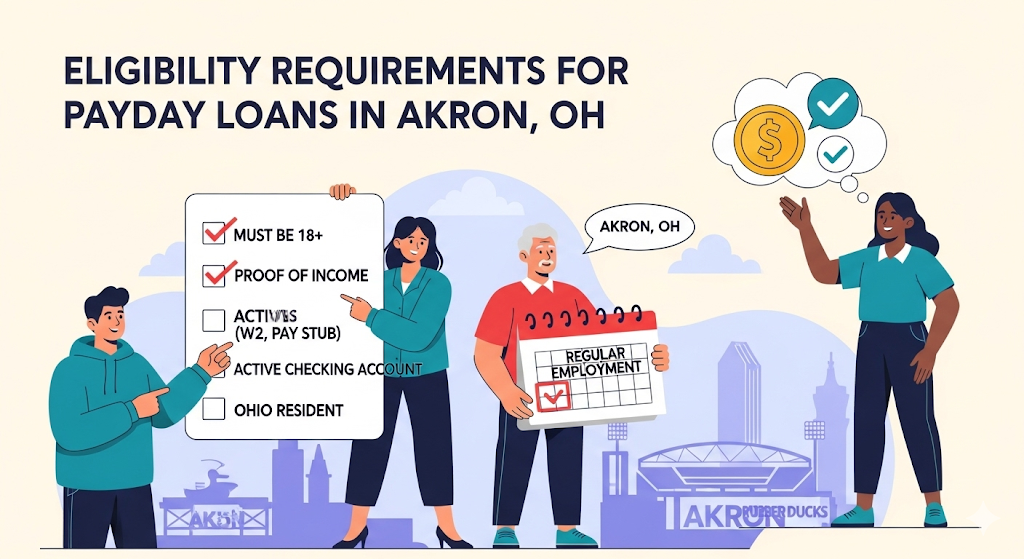

Eligibility Requirements for Payday Loans in Akron

Credit Score and History

Unlike traditional loans, payday loans in Akron, Ohio, often don’t heavily rely on a strong credit score. Many lenders prioritize your current income and employment stability over your credit history. This makes them a potential option for individuals with poor credit or limited credit history seeking short-term financial assistance. However, a completely nonexistent credit history may still present challenges in securing approval. Some lenders may perform a soft credit check, impacting your score minimally, while others may forgo a credit check altogether.

It’s crucial to understand that while a low credit score may not automatically disqualify you, a history of missed payments or bankruptcies could still influence a lender’s decision. Lenders assess your repayment ability. They want assurance you can repay the loan on your next payday. Therefore, providing accurate and verifiable income information is vital. “Failing to disclose accurate financial information can lead to loan denial or even legal consequences.” Always compare offers from multiple lenders to find the most favorable terms, especially if your credit report has some blemishes.

Income Verification and Employment

Lenders in Akron, Ohio, typically require proof of regular income to approve a payday loan application. This is to ensure you have the means to repay the loan on your next payday. Acceptable forms of income verification can include pay stubs, bank statements showing regular deposits, or employment letters. The specific requirements may vary depending on the lender, so it’s vital to check with each institution individually. Be prepared to provide documentation showing consistent income for at least the last few months. Some lenders might also request details about your job, such as your employer’s name and contact information, and the length of your employment.

“Failure to provide sufficient proof of income will likely result in your payday loan application being rejected,” so it’s crucial to gather all necessary documentation beforehand. Lenders assess your ability to repay based on your income and expenses. They need to be confident you can comfortably afford the loan’s repayment without causing further financial strain. Regular employment is usually a key factor in their decision-making process, even if self-employment is sometimes considered with the submission of appropriate tax documents. Understanding these requirements helps applicants prepare thoroughly and increase their chances of approval for a payday loan in Akron.

Residency Requirements

Securing a payday loan in Akron, Ohio, often hinges on meeting specific residency requirements. Lenders typically require proof of residency within the state of Ohio, often demonstrated through a current utility bill, rental agreement, or driver’s license showing an Akron address. This verification confirms your connection to the community and helps lenders assess the risk involved in extending a short-term loan. Failing to provide adequate proof can lead to immediate loan application rejection.

Beyond simply residing in Ohio, some lenders may have more specific Akron-centric requirements. For example, they might need verification that you’ve lived at your current address for a minimum period, such as 30 or 90 days. This helps establish stability and reduces the chances of borrowers moving before loan repayment. “Always check the individual lender’s requirements, as they can vary significantly,” and comparing several lenders’ specific conditions before applying is highly recommended. Don’t hesitate to contact the lender directly with any questions about their residency stipulations.

The Costs and Risks of Payday Loans

High-Interest Rates and APR

Payday loans in Akron, Ohio, are notorious for their extremely high interest rates. These rates are often expressed as an Annual Percentage Rate (APR), which can easily exceed 400%. This means you’ll pay far more in interest than you originally borrowed. Consider a $500 loan with a 400% APR; the interest alone could quickly eclipse the principal amount. Always carefully review the loan agreement to understand the total cost. “Failing to understand these high costs can lead to a debt trap.”

The consequence of these high APRs is a rapid accumulation of debt. Many borrowers find themselves in a cycle of repeatedly taking out new loans to pay off old ones. This cycle is very difficult to escape. Ohio state law limits payday loan amounts, but this doesn’t mitigate the risk of high interest. “Before considering a payday loan, explore all other financing options, such as credit unions, family, or friends, to avoid the potentially devastating financial consequences of these high-interest loans.” Understand that even small loans can become major financial burdens.

Potential for Debt Traps

Payday loans in Akron, Ohio, like elsewhere, are notorious for their potential to ensnare borrowers in a cycle of debt. The high interest rates, often exceeding 400% APR, make it incredibly difficult to repay the loan on time. Missing even one payment triggers additional fees, quickly escalating the amount owed. This can lead to a situation where borrowers find themselves repeatedly taking out new loans to cover the existing debt, creating a dangerous and costly spiral. “This is a classic debt trap, and it’s a serious financial concern for many Akron residents.”

Understanding this risk is crucial before considering a payday loan. Many borrowers underestimate the difficulty of repaying these high-interest loans, particularly during unforeseen financial emergencies. The short repayment period, often just two weeks, puts immense pressure on borrowers to find the full amount, including hefty fees. Consider alternatives, such as credit counseling or negotiating with creditors, before resorting to such a high-risk financial product. Failing to plan for repayment realistically is a major factor contributing to payday loan debt traps. Always explore lower-cost options first.

Consequences of Default

Defaulting on a payday loan in Akron, Ohio, carries severe consequences. Your credit score will suffer significantly, making it harder to obtain credit cards, mortgages, or even rent an apartment in the future. Collection agencies may aggressively pursue you for repayment, potentially impacting your employment through phone calls and wage garnishment. These agencies often employ aggressive tactics, causing considerable stress and anxiety. Further, the high interest rates and fees can snowball rapidly, making the original debt much larger than initially anticipated.

Beyond financial repercussions, a default can also lead to legal action. Lenders can file lawsuits, resulting in court judgments against you. These judgments can be levied against your bank accounts and wages, causing substantial financial hardship. Ohio law dictates specific procedures for debt collection, but understanding these nuances may require seeking legal counsel. It’s crucial to understand the terms and conditions of any payday loan agreement thoroughly before signing. “Failing to repay a payday loan can have lasting and devastating effects on your personal finances and creditworthiness.” Remember, exploring alternatives like credit counseling or negotiating with the lender is vital before defaulting.

Responsible Borrowing Practices

Creating a Realistic Budget

Before considering a payday loan in Akron, Ohio, meticulously track your income and expenses for at least a month. Use budgeting apps or spreadsheets to categorize spending. This detailed analysis reveals your actual spending habits, highlighting areas where you might cut back. Identify non-essential expenses – entertainment, dining out, subscriptions – to free up cash flow. This proactive approach prevents further debt accumulation.

Once you have a clear picture of your finances, create a realistic budget. Prioritize essential expenses like rent, utilities, and groceries. Allocate funds for unexpected costs, building a small emergency fund. Remember, “a payday loan should be a last resort, not a solution for ongoing financial difficulties.” Only borrow what’s absolutely necessary, and factor in the loan’s total cost, including fees and interest, when planning repayments. Failing to account for these costs can lead to a cycle of debt.

Exploring Alternative Financial Solutions

Before considering a payday loan in Akron, Ohio, explore alternative options. Many resources offer financial assistance without the high interest rates associated with payday loans. Local charities and non-profit organizations, such as the United Way of Summit County, often provide emergency financial aid and budget counseling. These services can help you manage your finances effectively and avoid the debt trap often associated with short-term, high-interest loans. They may offer debt management programs or connect you with other helpful resources within the community.

Consider tapping into your existing resources. Can friends or family provide short-term assistance? Could you sell unused possessions to generate quick cash? Exploring these options first can prevent you from needing a payday loan altogether. Budgeting apps and tools can also help you track spending and identify areas where you can cut back. Remember, “seeking help early is crucial in managing financial difficulties and avoiding the potentially harmful cycle of payday loan debt.” The Ohio Attorney General’s office also provides helpful information on consumer rights and financial literacy, offering further guidance on navigating difficult financial situations responsibly.

Seeking Financial Counseling if Needed

Facing financial hardship can be overwhelming, especially when considering a payday loan in Akron, Ohio. Before taking out a high-interest loan, explore all available options. One crucial step is seeking professional financial counseling. Many non-profit organizations and credit counseling agencies offer free or low-cost services to help you create a budget, manage debt, and develop long-term financial stability. These services can provide valuable guidance on alternative solutions to payday loans, potentially saving you from a cycle of debt.

The United Way of Summit County, for example, connects residents with various financial assistance programs. They can help you understand your financial situation and explore options like debt management plans or negotiating with creditors. Remember, financial counseling is not a sign of failure; it’s a proactive step towards building a healthier financial future. “Seeking help early can prevent serious long-term financial problems, including bankruptcy.” Don’t hesitate to reach out for support; it’s a vital tool in navigating challenging financial circumstances and making informed decisions about your short-term borrowing needs in Akron.

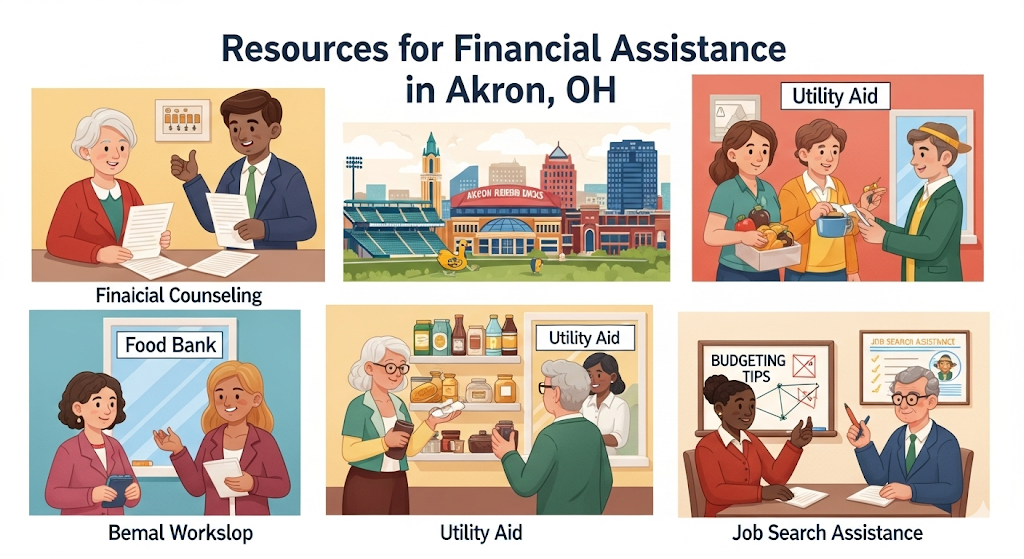

Resources for Financial Assistance in Akron

Local Non-profit Organizations

Akron boasts a network of dedicated non-profit organizations offering crucial financial assistance. These groups often provide budget counseling, credit repair guidance, and assistance with utility bills or rent payments, helping residents avoid the payday loan cycle. Many offer workshops and classes on financial literacy, empowering individuals to manage their money effectively and make informed decisions about their finances. Contacting these organizations early can prevent a financial crisis and reduce the need for high-interest payday loans.

For example, the United Way of Summit County acts as a central hub, connecting individuals with numerous local charities providing diverse financial support services. Other vital organizations include local food banks, which address food insecurity, a significant factor contributing to financial stress and reliance on short-term loans. “Remember to thoroughly research and verify the services offered by any non-profit before seeking assistance,” as eligibility requirements and program availability may vary. Exploring these resources is a crucial first step before considering a payday loan in Akron.

Government Assistance Programs

Akron residents facing financial hardship can explore several government aid programs. The Ohio Department of Job and Family Services (ODJFS) offers a range of assistance, including SNAP (Supplemental Nutrition Assistance Program) for food, and Medicaid for healthcare. These programs can alleviate some financial pressure, freeing up funds that might otherwise be used for essential needs. Eligibility requirements vary depending on income and household size. It’s crucial to check the ODJFS website for the most up-to-date details and application processes.

Beyond the state level, federal programs also offer support. The Temporary Assistance for Needy Families (TANF) program provides cash assistance to eligible families. Additionally, the Low Income Home Energy Assistance Program (LIHEAP) can help with heating and cooling costs, a significant expense, especially during extreme weather. Remember to thoroughly investigate program requirements before applying, as qualifications are income-based and subject to change. “Accessing these resources can significantly reduce the reliance on high-interest payday loans.” Contact your local social services agency or visit the relevant government websites for detailed information.

Credit Counseling Services

Finding yourself in a tough financial spot can be stressful. Fortunately, Akron offers several credit counseling services to help residents navigate debt and avoid predatory payday loans. These non-profit organizations provide free or low-cost financial guidance, including budgeting assistance, debt management plans, and educational workshops. They can help you understand your financial situation and develop a sustainable plan to improve it. Many are accredited by the National Foundation for Credit Counseling (NFCC), ensuring a high standard of service and ethical practices. Look for agencies with experience working with individuals facing short-term financial crises, especially those needing alternatives to high-interest short-term loans.

Reputable credit counseling agencies can offer valuable support in avoiding the debt cycle often associated with payday loans in Akron, Ohio. They’ll work with you to create a personalized plan, negotiating with creditors on your behalf if necessary. Remember to thoroughly research any agency before engaging their services, checking for accreditation and client reviews. “Choosing a reputable credit counselor is crucial for a successful financial recovery and a path towards financial stability.” Their expert advice can help you make informed decisions about your finances and avoid the potentially damaging consequences of relying on high-interest payday loan options.