Understanding Payday Loans Beaumont, TX

What are Payday Loans and How Do They Work?

payday loans beaumont tx, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. The loan amount is usually based on your income and ability to repay. Borrowers provide a post-dated check or authorize electronic access to their bank account for repayment. Interest rates on payday loans are significantly higher than traditional loans, reflecting the inherent risk and short repayment period. Consider this carefully before seeking a payday loan.

It’s crucial to understand that payday loans are intended for emergency situations only. They are not a solution for long-term financial problems. Misusing payday loans can lead to a cycle of debt due to the high interest rates and fees. Before applying for a Beaumont payday loan, carefully review the terms and conditions and compare offers from multiple lenders. “Always explore alternative financial solutions, such as negotiating with creditors or seeking assistance from non-profit credit counseling agencies, before resorting to a payday loan.” This ensures you make an informed decision suitable for your financial circumstances.

Payday Loan Regulations in Texas: What You Need to Know

Texas has specific regulations governing payday loans, designed to protect consumers. These laws limit the amount a lender can charge in fees and interest. The maximum loan amount is capped, preventing excessively large debts. Furthermore, the state regulates the loan term, typically preventing excessively long repayment periods. Understanding these limitations is crucial before applying for a Beaumont payday loan. Ignoring these regulations can lead to unforeseen financial difficulties.

Crucially, borrowers should carefully review all loan terms before signing any agreement. Shop around and compare offers from different lenders in Beaumont to find the best deal. Be aware of potential hidden fees or charges. “Failing to understand the terms can result in significant financial hardship.” Resources like the Texas Office of Consumer Credit Commissioner provide valuable information on consumer rights and protections related to short-term loans in Texas. Always prioritize responsible borrowing and only borrow what you can comfortably repay.

Interest Rates and Fees: A Clear Breakdown for Beaumont Residents

Payday loans in Beaumont, TX, are typically characterized by high interest rates. These rates are often expressed as an Annual Percentage Rate (APR), but the actual cost can vary significantly between lenders. Always carefully review the loan agreement before signing. Consider the total cost, including all fees, not just the initial loan amount. Some lenders advertise low fees, but the high APR can still result in a surprisingly expensive loan.

“Remember to compare offers from multiple lenders before committing to a payday loan in Beaumont,” as this is crucial to finding the best terms. Factors like loan amount and repayment period influence the total interest paid. Be aware of potential hidden fees. These can quickly escalate the overall cost. Thoroughly understand the terms and conditions to avoid unexpected charges. Check the lender’s reputation and licensing to ensure legitimacy and protect yourself from predatory lending practices.

Finding Reputable Payday Lenders in Beaumont, TX

Identifying Licensed and Trustworthy Lenders

Before considering any payday loan in Beaumont, TX, verify the lender’s license with the Texas Office of Consumer Credit Commissioner (OCCC). Their website provides a searchable database of licensed lenders. This simple step is crucial in protecting yourself from fraudulent operations. Avoid lenders who pressure you into quick decisions or lack transparent fee structures. Legitimate lenders will readily provide this information.

Always check online reviews and ratings from reputable sources like the Better Business Bureau (BBB). Look for consistent patterns in customer feedback. “A high volume of negative reviews, especially concerning hidden fees or aggressive collection practices, should raise significant red flags.” Pay close attention to details. Consider lenders with established histories and positive customer experiences. Remember, choosing a licensed and trustworthy payday lender is your first line of defense against predatory lending practices.

Tips for Avoiding Predatory Lending Practices

Beware of lenders advertising unrealistically low interest rates or fees. These can often mask exorbitant charges that accumulate quickly. Always carefully read the fine print before signing any agreement. Compare multiple offers to find the best terms. Don’t rush into a decision; take your time to understand the payday loan contract fully.

Look for lenders licensed by the state of Texas. The Texas Office of Consumer Credit Commissioner (OCCC) provides a database of licensed lenders. Verify a lender’s legitimacy before providing any personal information. Avoid lenders who pressure you into borrowing more than you need. “Remember, a responsible lender will prioritize your financial well-being and offer clear, transparent terms.” If a lender’s practices seem shady or unclear, walk away. Consider exploring alternative financial solutions, like credit counseling, before resorting to a Beaumont payday loan if possible.

Comparing Loan Offers: Interest Rates, Fees, and Repayment Terms

Before committing to a payday loan in Beaumont, TX, meticulously compare offers from multiple lenders. Don’t just focus on the advertised interest rate. Scrutinize all associated fees, including origination fees, late payment penalties, and any potential rollover charges. These additional costs can significantly inflate the total cost of borrowing. Remember that even a seemingly small fee can dramatically increase your total debt burden if you’re already facing financial hardship.

Pay close attention to the repayment terms. Understand the loan’s duration and the exact repayment schedule. Some lenders offer flexible repayment options, while others may impose strict deadlines. “Choose a lender whose repayment plan aligns with your anticipated income and expenses to avoid default and further financial problems.” Compare APR (Annual Percentage Rate) rather than just interest rates to gain a comprehensive picture of the loan’s true cost. This allows for accurate comparison across lenders with varying fee structures and will assist you in finding the best payday loan for your specific financial situation in Beaumont, TX.

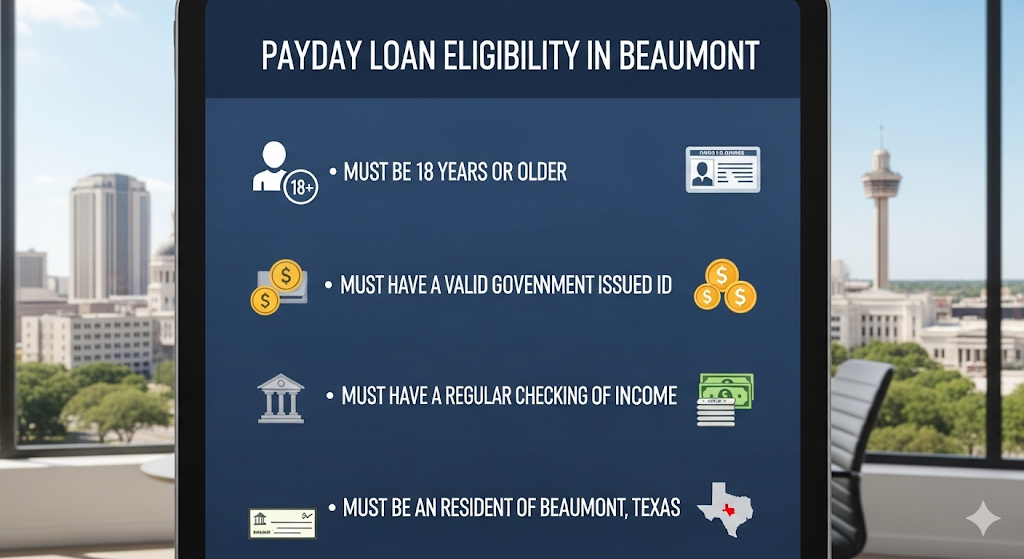

Eligibility Requirements for Payday Loans in Beaumont

Income and Employment Verification

Securing a payday loan in Beaumont, TX often hinges on demonstrating a stable income. Lenders need to verify you have the means to repay the loan. This usually involves providing proof of income, such as recent pay stubs, bank statements showing regular deposits, or tax returns. The specific documentation required may vary depending on the lender. Always clarify their requirements beforehand.

The frequency and consistency of your income are key factors. Lenders prefer applicants with a reliable employment history. They want to see evidence of consistent earnings that can cover loan repayments. Self-employment may require additional documentation to prove income stability. “Failing to meet these income requirements can result in your application being denied, so it is crucial to have all your documentation readily available.” Remember to be truthful and accurate in your application. Providing false information can have serious consequences.

Credit Score Requirements

Unlike traditional bank loans, payday loans in Beaumont, TX often have more lenient credit score requirements. Many lenders prioritize your current income and employment stability over your credit history. This means that even if you have a low credit score or past financial difficulties, you might still qualify for a payday loan. However, it’s important to understand that lenders will still review your credit report. A very poor credit history might impact the interest rate offered or even disqualify you entirely.

“While a perfect credit score isn’t necessary, demonstrating responsible financial behavior in other areas can significantly improve your chances of approval.” Some lenders may use alternative credit scoring methods or consider factors like your employment history and bank account activity. Always check the specific requirements of each lender, as they may vary. Researching and comparing several lenders before applying can help you find the best terms and potentially secure a more favorable interest rate, even with less-than-perfect credit. Remember to fully understand the loan terms and repayment schedule before borrowing.

Required Documentation: A Step-by-Step Guide

Securing a payday loan in Beaumont, TX, often requires providing specific documentation. This verifies your identity, income, and residency. Typically, lenders will request a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is crucial, usually in the form of recent pay stubs or bank statements showing regular deposits. These documents demonstrate your ability to repay the loan. Finally, proof of your current Beaumont address is necessary; this could be a utility bill, bank statement, or rental agreement. Gathering these documents beforehand streamlines the application process.

Remember, requirements may vary slightly between lenders. It’s always best to check directly with the chosen payday loan provider for their precise needs. Some lenders may also request additional documents, depending on your individual circumstances. “Failing to provide complete and accurate documentation will likely delay or deny your application.” Be prepared to answer questions about your employment history and financial situation. This transparency helps lenders assess your creditworthiness and ensure responsible lending practices. Contacting the lender directly beforehand to clarify requirements is highly recommended.

The Payday Loan Application Process: A Simple Guide

Online vs. In-Person Applications: Which is Right for You?

Choosing between an online or in-person payday loan application in Beaumont, TX depends on your personal preferences and circumstances. Online applications offer unparalleled convenience. You can apply from anywhere with an internet connection, at any time of day or night. This is particularly beneficial for those with busy schedules or limited mobility. Many lenders provide instant decision payday loans, speeding up the process significantly. However, you’ll need a reliable internet connection and a comfortable level of tech proficiency.

Conversely, in-person applications at a physical location provide a more personal touch. You can directly interact with a loan officer, clarifying any questions or concerns face-to-face. This can be reassuring for those who prefer a more traditional approach or need help navigating the application process. Consider the level of customer service and potential fees each option offers. “Ultimately, the best method depends on your comfort level with technology and your need for immediate assistance.” Remember to carefully compare lenders before making a decision, checking reviews and interest rates to find the best short-term loan for your needs.

What Documents Will You Need?

Securing a payday loan in Beaumont, TX usually requires providing some basic documentation. Lenders need to verify your identity and employment to assess your ability to repay. This typically includes a government-issued photo ID, such as a driver’s license or state ID card. You’ll also need proof of income, which could be your recent pay stubs or bank statements showing consistent deposits. Some lenders may also request proof of your current address, like a utility bill or bank statement. Always check the specific requirements with the lender beforehand.

“Remember, providing accurate and complete information is crucial for a smooth application process,” as inaccuracies can lead to delays or rejection. Failing to provide necessary documents will almost certainly delay your application. Be prepared to present these documents in person or electronically, depending on the lender’s preferred method. Keep in mind that requirements may vary between lenders, so it’s best to contact several before making a decision. “Choosing a reputable lender in Beaumont is key to a positive experience.”

Step-by-Step Instructions for a Smooth Application

First, gather the necessary documents. You’ll typically need a valid photo ID, proof of income (like pay stubs or bank statements), and your current bank account information. Ensure all information is accurate and readily available to avoid delays. Many lenders in Beaumont, TX, offer online applications, streamlining the process significantly. Be sure to read the terms and conditions carefully before submitting your application. “Understanding the terms, including interest rates and repayment schedules, is crucial to making an informed decision.”

Next, complete the online application form truthfully and completely. Provide all requested information precisely. Incorrect or missing data will slow down the approval process. Once submitted, you’ll likely receive an immediate response regarding your application. If approved, you may receive your funds directly deposited into your bank account within a business day. Remember that responsible borrowing is key. “Borrow only what you can comfortably repay to avoid potential financial hardship.” Explore all available options before opting for a payday loan. Consider alternatives like negotiating with creditors or seeking financial counseling if possible.

Responsible Borrowing and Repayment Strategies

Creating a Realistic Repayment Plan

Before you accept a payday loan in Beaumont, TX, meticulously plan your repayment. Carefully examine your monthly budget. Identify non-essential expenses you can cut. This might include entertainment, dining out, or subscriptions. Allocate the saved funds directly toward your loan repayment. Remember, even small reductions in spending can significantly impact your ability to repay the loan on time. Consider using budgeting apps or spreadsheets to track your income and expenses. This will give you a clear picture of your financial situation.

A realistic repayment plan considers the loan’s terms and your financial capacity. Failing to repay on time incurs significant fees. These fees can quickly spiral out of control. Therefore, “prioritize your loan repayment above all other non-essential spending.” If you anticipate difficulty meeting your payment obligations, contact your lender immediately. Explore options like extending the repayment period, though this may involve additional charges. Proactive communication is crucial. It prevents further financial complications.

Budgeting Tips to Avoid Further Debt

Creating a realistic budget is crucial to avoiding further debt after taking out a payday loan in Beaumont, TX. Start by tracking your income and expenses for a month. This will give you a clear picture of where your money goes. Identify areas where you can cut back on spending. Even small changes can make a big difference. For example, reducing daily coffee shop visits or canceling unused subscriptions can free up significant funds. Consider using budgeting apps or spreadsheets to simplify the process. Remember, transparency is key to successful budgeting.

Once you have a firm grasp on your spending habits, prioritize essential expenses like rent, utilities, and groceries. Then, allocate funds for loan repayment. Prioritize your payday loan repayment to prevent accumulating additional fees and interest. Consider setting up automatic payments to ensure timely repayment. If you anticipate trouble meeting your payment deadline, contact your lender immediately. Exploring options like debt consolidation or seeking advice from a credit counselor can prevent a downward spiral into more debt. “Proactive financial management is essential after securing a payday loan, ensuring a smooth repayment process and preventing future financial stress.”

Understanding Your Rights as a Borrower in Texas

In Texas, borrowers have crucial protections under the law. These laws regulate payday loan terms, interest rates, and collection practices. Familiarize yourself with the Texas Finance Code, specifically Title 1, Chapter 392, which governs payday lending. Understanding this code is vital for responsible borrowing. You have the right to a clear and concise loan agreement, detailing all fees and repayment schedules. This ensures transparency and prevents unexpected charges. Don’t hesitate to ask questions before signing any agreement.

Before taking out a payday loan in Beaumont, TX, carefully review all terms and conditions. Scrutinize the APR (Annual Percentage Rate) to fully understand the true cost of borrowing. If you feel a lender is acting unethically or violating Texas lending laws, contact the Texas Office of Consumer Credit Commissioner (OCCC). They can provide guidance and address any complaints. “Remember, responsible borrowing is about making informed decisions and understanding your legal rights; don’t be afraid to seek help if needed.” Ignoring your rights could lead to financial hardship. Always choose reputable lenders in Beaumont to minimize risks.

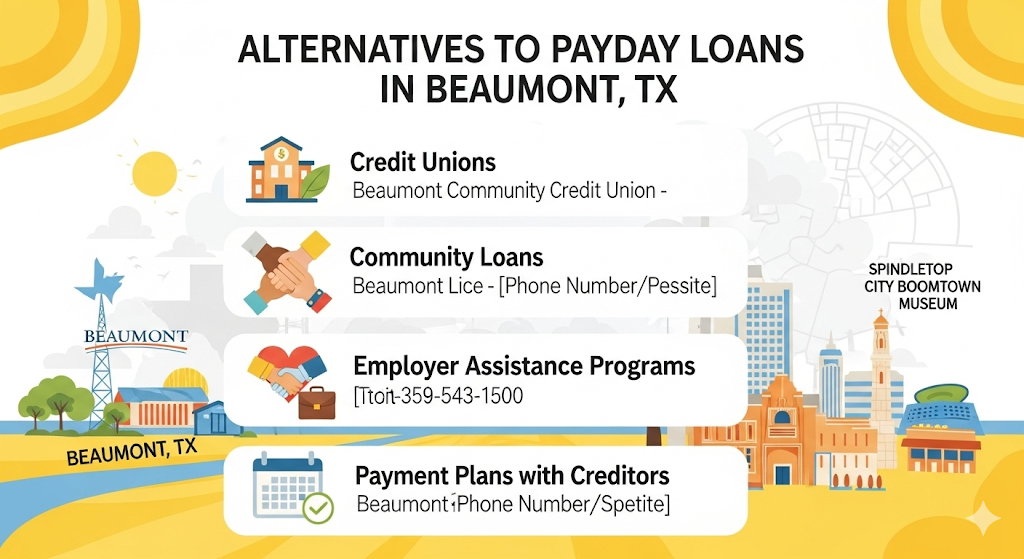

Alternatives to Payday Loans in Beaumont, TX

Exploring Options Like Small Personal Loans

Small personal loans offer a potentially better alternative to payday loans in Beaumont, TX. They typically come with lower interest rates and longer repayment terms, making them more manageable than the often-crushing short-term repayment schedules of payday loans. Credit unions and online lenders frequently offer these small personal loans, sometimes with more flexible approval criteria than traditional banks. Before applying, carefully compare interest rates, fees, and repayment options from multiple lenders to find the best fit for your financial situation.

Researching reputable lenders is crucial. Consider checking with the Better Business Bureau or reading online reviews before committing to any loan. Remember to factor in all associated costs, including origination fees and potential penalties for late payments. “Choosing a personal loan with a manageable monthly payment will help you avoid the debt trap many payday borrowers fall into.” While approval isn’t guaranteed, the potential benefits—lower interest, longer repayment periods, and increased financial stability—make exploring small personal loans in Beaumont a worthwhile endeavor when compared to the high-cost, short-term solution of a payday loan.

Seeking Assistance from Local Charities and Nonprofits

Many local charities and nonprofits in Beaumont, TX, offer financial assistance programs. These organizations often provide emergency financial aid, rent assistance, or help with utility bills. Before seeking a payday loan, explore resources like the Salvation Army, Catholic Charities, and local food banks. These groups frequently have dedicated caseworkers who can assess your situation and connect you with appropriate services. Remember to check their eligibility requirements.

To find these valuable resources, a simple online search for “Beaumont, TX charity assistance” or “nonprofit financial aid Beaumont” will yield many results. You can also contact the United Way of Southeast Texas, a well-established organization that maintains a comprehensive database of local charities and their services. “Don’t hesitate to reach out; these organizations are often better equipped to offer sustainable solutions compared to the short-term relief of a payday loan.” Taking advantage of these free resources could save you from the high interest rates and potential debt cycle associated with payday lending.

Budgeting Resources and Financial Counseling

Facing a financial emergency often necessitates quick solutions. However, before rushing into a payday loan in Beaumont, TX, explore readily available budgeting resources and professional guidance. Many non-profit organizations and government agencies offer free or low-cost financial counseling services. These services can help you create a realistic budget, identify areas for savings, and develop a plan to manage your debt effectively. The Consumer Credit Counseling Service (CCCS), for example, provides accredited counselors who can guide you through debt management strategies.

Utilizing these services can empower you to take control of your finances. “They offer personalized plans, tailored to your specific circumstances and financial goals,” enabling you to address the root causes of your financial hardship rather than simply masking them with short-term loans. Remember, financial literacy is key to long-term financial well-being. Seeking professional help is a proactive step towards securing a more stable financial future and avoiding the high-interest rates often associated with payday loans in Beaumont, TX.