Understanding Payday Loans Boise

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They’re typically due on your next payday, hence the name. Borrowers often use them for unexpected expenses like car repairs or medical bills. Interest rates on payday loans are significantly higher than traditional loans. This is because of the inherent risk for lenders. The higher risk is due to the short repayment period and lack of collateral. Understanding this high cost is crucial before considering a payday loan in Boise, Idaho.

Before applying for a payday loan in Boise, carefully consider the total cost. This includes all fees and interest charges. These loans should be used responsibly and only as a last resort. Idaho, like many states, has regulations in place to protect borrowers. These regulations include limits on loan amounts and interest rates. Always check the Idaho Division of Finance’s website for the latest information on payday loan laws and regulations. “Failing to understand the terms and conditions could lead to a cycle of debt.” Always compare offers from multiple lenders to find the best terms available for your specific circumstances.

How Payday Loans Work in Idaho

In Idaho, payday loans are short-term, small-dollar loans. They’re designed to help borrowers cover unexpected expenses until their next paycheck. You typically borrow a relatively small amount, often a few hundred dollars. The loan is then due on your next payday, along with fees. Idaho law dictates specific regulations on these loans, including maximum loan amounts and interest rates. It’s crucial to understand these limits before taking out a payday loan in Boise.

The process usually involves applying online or in person at a licensed lender. You’ll need to provide personal information, proof of income, and your bank account details. Approval is often quick, but it depends on the lender and your financial situation. Once approved, the funds are usually deposited directly into your bank account, often within a business day. Remember to carefully review all loan terms and fees before signing any agreement. Failing to repay on time can result in significant additional fees and damage to your credit score. “Always borrow responsibly and only what you can comfortably repay.”

Eligibility Requirements for Boise Residents

Securing a payday loan in Boise, Idaho requires meeting specific criteria. Lenders typically verify your Boise residency through documents like a driver’s license or utility bill showing your address. You’ll also need to provide proof of income, demonstrating a regular stream of funds sufficient to repay the loan. This might involve pay stubs, bank statements, or other verifiable income documentation. Failure to meet these basic requirements will likely result in your application being denied.

Beyond proof of residency and income, lenders will assess your creditworthiness. While payday loans in Boise are often marketed to those with less-than-perfect credit, a poor credit history might lead to higher interest rates or stricter loan terms. It’s crucial to understand the total cost of borrowing before committing to a loan. “Carefully compare offers from multiple lenders to find the best terms and avoid predatory lending practices.” Be aware of fees and interest rates; these can significantly impact the overall cost, particularly if you have difficulty repaying on time. Remember to only borrow what you can afford to repay on your next payday.

Finding Reputable Lenders in Boise

Tips for Choosing a Safe Lender

Before choosing a payday loan lender in Boise, Idaho, thoroughly research their legitimacy. Check the Idaho Department of Finance’s website for licensed lenders. Avoid companies with hidden fees or unclear terms. Read online reviews carefully, paying close attention to complaints about high interest rates or aggressive collection practices. Always compare APRs (Annual Percentage Rates) across several lenders to find the best deal. Remember that a lower APR signifies a lower overall cost.

Scrutinize the lender’s website for transparency. A reputable lender will clearly display all fees, interest rates, and repayment terms. Be wary of lenders who pressure you into a loan or who request personal information before you’ve formally applied. “Consider using a credit union or community bank as an alternative; they may offer more affordable loan options.” Finally, never provide your banking details unless you are absolutely certain of the lender’s legitimacy and you have thoroughly reviewed the loan agreement. This diligence will help protect you from predatory lending practices.

Identifying Red Flags and Avoiding Scams

Beware of lenders demanding upfront fees. Legitimate payday loan providers in Boise, Idaho, never require payment before approving your loan. This is a major red flag indicating a scam. Always report such requests to the Idaho Department of Financial Institutions.

Another significant warning sign is a lender promising guaranteed approval regardless of your credit history. Payday loans, while designed for short-term financial relief, still involve a credit check. Unrealistic promises should raise immediate suspicion. “If a deal sounds too good to be true, it probably is,” is a saying that applies strongly to the payday loan industry. Thoroughly research any lender before sharing personal information or financial details. Check online reviews and verify their licensing with the state. Consider using a reputable loan comparison website to find several pre-screened lenders to compare offers.

Checking Lender Licenses and Accreditation

Before you borrow from any payday loan provider in Boise, Idaho, verify their licensing. The Idaho Department of Finance regulates payday lenders. You can easily check a lender’s license status on their website. This simple step protects you from unlicensed, potentially fraudulent operations. Always confirm the license is current and valid. Don’t hesitate to contact the Department directly if you have any doubts.

Beyond licensing, consider whether the lender holds any relevant accreditations. While not mandatory for all payday lenders in Idaho, affiliations with reputable industry bodies can indicate a commitment to ethical practices and consumer protection. Look for memberships in organizations like the Community Financial Services Association of America (CFSA). Checking for accreditation offers an extra layer of assurance. “Choosing a lender with a proven track record and a commitment to responsible lending significantly reduces the risks associated with payday loans.” Remember, due diligence is key when dealing with any financial institution, especially when considering high-interest loans such as payday loans.

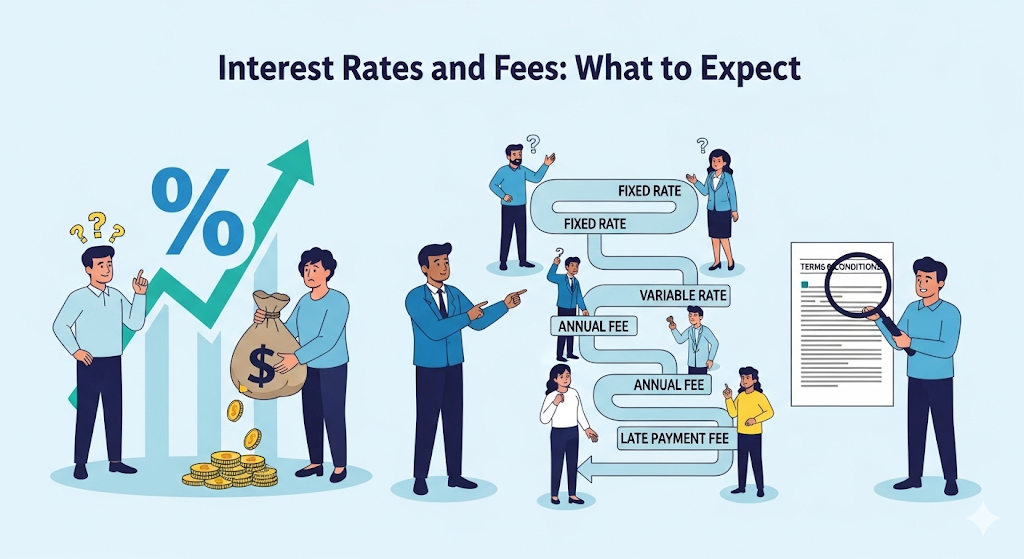

Interest Rates and Fees: What to Expect

Understanding APR (Annual Percentage Rate)

The Annual Percentage Rate (APR) is the most crucial figure to understand when considering a payday loan in Boise, Idaho. It represents the total cost of borrowing, expressed as a yearly percentage. This includes the interest rate plus any additional fees, like origination fees or late payment penalties. A higher APR means a more expensive loan. Always compare APRs from multiple lenders before making a decision. Don’t just focus on the interest rate alone; the APR gives you the complete picture of the loan’s true cost.

Remember, Idaho law regulates payday loan interest rates. However, these rates can still be quite high. “Be sure to carefully review the loan agreement to fully understand the APR and all associated fees before signing anything.” Failing to do so could lead to unexpected costs and potentially a debt cycle difficult to escape. Consider the total repayment amount, including interest and fees, to determine affordability. Use online calculators or consult a financial advisor if you need help interpreting APRs or evaluating loan options.

Common Fees Associated with Payday Loans

Payday loans in Boise, Idaho, often involve several fees beyond the principal interest rate. These added costs can significantly increase the overall loan expense. For example, you might encounter origination fees, charged upfront to process your application. Late payment fees are another common occurrence, often steep penalties for even a slightly delayed payment. Finally, many lenders impose rollover fees if you’re unable to repay the loan on the due date and need to extend the loan term. These fees can quickly accumulate, making it crucial to understand the full cost before borrowing.

Remember, these fees vary between lenders. Shop around and compare offers carefully. Don’t hesitate to ask potential lenders for a complete breakdown of all charges. “Failing to do so could lead to unexpected and potentially crippling debt.” Check the Idaho Division of Finance’s website for additional information and resources on payday lending regulations in the state. Understanding these fees is vital to making an informed decision and avoiding financial hardship. Always prioritize responsible borrowing practices.

Comparing Costs Across Different Lenders

Finding the best payday loan in Boise, Idaho, requires careful comparison. Don’t just focus on the advertised interest rate. Many lenders charge various fees, such as origination fees or late payment penalties. These can significantly increase your total cost. Always obtain a clear breakdown of all charges before signing any agreement. “Checking multiple lenders is crucial to finding the lowest overall cost.” Consider using online comparison tools to streamline this process.

Remember, interest rates on Boise payday loans can vary widely. Factors like your credit score and the loan amount will influence the rate offered. Some lenders may advertise lower interest rates but have higher fees. Others might offer more flexible repayment options, which can indirectly affect the final cost. Carefully review the terms and conditions of each offer. “Comparing apples to apples is essential; focus on the total repayment amount, not just the stated interest rate.” This ensures you’re making an informed decision based on the true cost of borrowing.

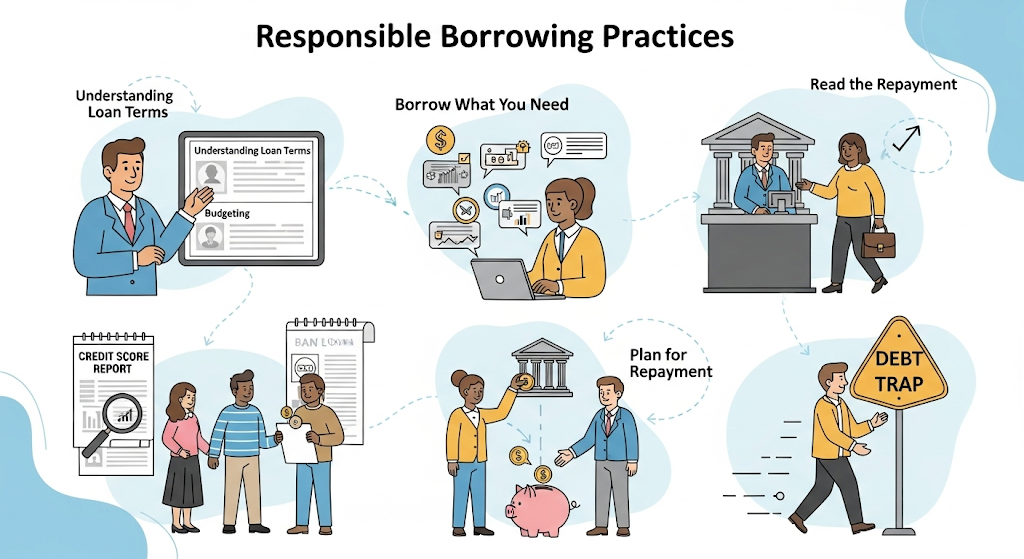

Responsible Borrowing Practices

Creating a Realistic Budget

Before considering a payday loan in Boise, Idaho, honestly assess your current financial situation. Track your income and expenses for at least a month. Use budgeting apps or spreadsheets to categorize spending. Identify areas where you can realistically cut back. This detailed analysis will reveal your true financial picture. This process helps you understand your spending habits and identify potential savings.

A realistic budget is crucial. It helps you determine if a payday loan is truly necessary. Consider alternatives like negotiating with creditors or exploring debt consolidation options. “If, after careful budgeting, you still need a short-term loan, you’ll have a clearer picture of how much you can realistically afford to borrow and repay.” Prioritize essential expenses like rent, utilities, and groceries. Avoid unnecessary spending. Remember, responsible borrowing starts with a well-planned budget. This minimizes the risk of falling further into debt.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Boise, Idaho, explore other options. Many resources offer financial assistance without the high interest rates and potential debt traps associated with payday loans. Consider contacting local credit unions; they often provide small-dollar loans with more manageable terms. The Idaho Department of Finance also offers resources and guidance on finding responsible lenders. Exploring these alternatives could save you significant money in the long run.

Community action agencies and nonprofit organizations frequently offer financial literacy programs and emergency assistance. These programs might include budgeting workshops, debt counseling, or even direct financial aid for essential expenses. Remember, seeking professional financial advice is crucial before taking on any debt. “Carefully weigh the pros and cons of each option to make an informed decision that aligns with your financial situation and long-term goals.” Utilizing these resources can help you navigate your financial challenges responsibly and avoid the potential pitfalls of payday loans.

Managing Debt and Avoiding a Cycle of Borrowing

Falling into a cycle of payday loans is easy. Many borrowers find themselves repeatedly taking out new loans to pay off old ones. This is a dangerous path leading to high interest charges and potential financial hardship. To avoid this trap, create a realistic budget that tracks your income and expenses. Identify areas where you can cut back spending to free up cash flow. Consider exploring free credit counseling services offered by organizations like the National Foundation for Credit Counseling. These services can help you manage debt and develop a personalized debt repayment plan.

Prioritize paying off your high-interest debt first. This often includes payday loans. Explore options like debt consolidation or balance transfer credit cards to lower your overall interest rate. Remember, “seeking professional financial advice is crucial if you’re struggling to manage your debt.” Don’t be afraid to ask for help. Reaching out to a financial advisor or credit counselor can provide valuable guidance and support to navigate your financial situation and make informed decisions about your debt. Careful planning and proactive management are key to breaking free from the cycle of payday loan borrowing in Boise, Idaho.

Legal Aspects of Payday Loans in Idaho

Idaho State Regulations on Payday Lending

Idaho has specific laws governing payday loans. These regulations aim to protect borrowers from predatory lending practices. The Idaho Department of Finance oversees the industry, ensuring lenders comply with state statutes. Loan amounts are capped, and interest rates are strictly controlled. Violation of these rules can result in significant penalties for lenders. Understanding these limits is crucial for both borrowers and lenders to avoid legal trouble.

Crucially, Idaho law limits the total amount of fees a lender can charge on a payday loan. This includes interest and any other associated charges. The maximum loan term is also defined by state law. It is important to note that these regulations are subject to change, so always check with the Idaho Department of Finance for the most up-to-date information before entering into any payday loan agreement. “Failing to understand these regulations can lead to unexpected and potentially devastating financial consequences.” Borrowers should always carefully review loan agreements and seek independent advice if needed.

Consumer Protection Laws

Idaho has specific laws designed to protect consumers from predatory lending practices associated with payday loans. These laws, found within Idaho Code Title 26, Chapter 33, place limits on the fees and interest rates lenders can charge. Borrowers should carefully review the loan agreement to understand the total cost before signing. Ignoring these details can lead to unexpected and potentially unaffordable repayment burdens. The Idaho Department of Finance is a valuable resource for understanding these protections.

The state also mandates certain disclosures from lenders. This includes clear information about the loan terms, fees, and repayment schedule. Lenders must present this information in a straightforward manner, easily understandable to the average consumer. Transparency is key to responsible borrowing. “Failure to provide these mandated disclosures is a violation of Idaho law, offering borrowers legal recourse if exploited.” Remember to always compare offers from different lenders before choosing a payday loan in Boise. Researching and understanding your rights is crucial to avoiding financial hardship.

Your Rights as a Borrower in Idaho

In Idaho, borrowers have crucial protections when taking out payday loans in Boise. The Idaho Division of Finance regulates these loans, setting limits on fees and interest rates. These regulations aim to prevent predatory lending practices and protect consumers from excessive debt. Before signing any loan agreement, carefully review all terms and conditions. Understand the total cost of the loan, including all fees and interest charges. If anything is unclear, seek clarification from the lender *before* proceeding.

Crucially, Idaho law mandates lenders provide you with clear disclosures. This includes information on the annual percentage rate (APR) and all applicable fees. “Understanding these figures is critical to making an informed decision.” If a lender fails to comply with these disclosure requirements, it could invalidate the loan agreement. Furthermore, you have the right to file a complaint with the Idaho Division of Finance if you believe a lender has violated Idaho’s payday lending laws. Don’t hesitate to exercise your rights as a consumer. Remember to always borrow responsibly, only taking out loans you can comfortably repay on time.

Resources and Support

Credit Counseling Services in Boise

Facing financial hardship and considering a payday loan in Boise, Idaho? Exploring credit counseling might be a beneficial first step. Several reputable non-profit organizations offer free or low-cost credit counseling services in the Boise area. These services can help you create a budget, identify areas for savings, and develop a plan to manage debt, potentially eliminating the need for a high-interest payday loan. They provide education on responsible financial management and can negotiate with creditors on your behalf.

Remember, credit counseling is not a quick fix, but a process requiring commitment and active participation. Organizations like the National Foundation for Credit Counseling (NFCC) have a network of certified counselors across the country, including Boise. You can find local NFCC member agencies through their website. “Before taking out a payday loan, it is highly recommended to exhaust all available free resources and explore the benefits of professional credit counseling to understand your financial options fully.” Contacting a counselor allows for a personalized assessment of your situation and exploration of alternatives to short-term, high-cost loans.

Debt Management Programs

Facing overwhelming debt can feel isolating, but help is available in Boise. Several debt management programs offer solutions for residents struggling with payday loan repayments or other financial burdens. These programs often provide credit counseling, budgeting assistance, and negotiation services with creditors. They can help you create a manageable debt repayment plan, potentially lowering interest rates and consolidating your debts. Consider exploring options like non-profit credit counseling agencies, which are often better choices than for-profit services.

Remember to thoroughly research any program before enrolling. Look for agencies accredited by the National Foundation for Credit Counseling (NFCC). Checking online reviews and testimonials can also offer valuable insights. “Choosing the right debt management program can significantly impact your ability to overcome financial hardship and avoid further debt accumulation.” Utilizing these resources can provide a crucial path toward financial stability. Do not hesitate to seek professional help; a counselor can offer personalized guidance based on your individual financial situation and help navigate the complexities of managing payday loan debt in Boise, Idaho.

Financial Literacy Resources

Finding reliable financial education is crucial before considering a payday loan in Boise, Idaho. Several excellent resources offer free or low-cost financial literacy programs. The Idaho State Department of Insurance website provides information on consumer protection and responsible borrowing practices. They offer pamphlets and online resources to help you understand your options and avoid predatory lending. Consider exploring their website for valuable budgeting tips and debt management strategies.

The Federal Trade Commission (FTC) also offers a wealth of information on payday loan alternatives and managing your finances. Their website provides detailed explanations of different loan types, their associated costs, and how to compare offers effectively. “Understanding your credit score and building good credit is key to avoiding high-interest loans like payday loans in the long run.” The FTC provides tools and resources to help you monitor your credit and improve your financial health. Remember, taking the time to educate yourself is the best way to make informed decisions about your finances.