Understanding payday loans bossier city louisiana

What are Payday Loans and How Do They Work?

Payday loans in Bossier City, Louisiana, are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They typically range from $100 to $500 and are repaid on your next payday. In our experience, borrowers often use them for unexpected expenses like car repairs or medical bills. The application process is usually straightforward, often involving providing proof of income and a checking account. A common mistake we see is borrowers underestimating the total cost, including the high fees and interest rates. These fees can quickly escalate the amount owed, making repayment difficult for those who don’t budget carefully.

It’s crucial to understand how these loans work *before* you apply. The loan amount is deposited into your account, and repayment is typically done through an automatic debit on your next payday. However, rollover options sometimes exist, allowing you to extend the repayment period, but this usually comes with additional fees, further increasing the total cost. Consider alternatives like credit counseling or borrowing from friends and family before turning to a payday loan, as the high cost can quickly trap borrowers in a cycle of debt. Always carefully review the loan agreement and understand all associated charges before signing. Remember, borrowing responsibly is key to avoiding financial hardship.

Short-Term Loan Options vs. Payday Loans

While payday loans are a readily available short-term loan option in Bossier City, Louisiana, it’s crucial to understand they are not the only solution for immediate financial needs. In our experience, many borrowers overlook alternatives with potentially better terms. A common mistake we see is assuming a payday loan is the only route to quick cash.

Consider these alternatives: personal loans from credit unions or banks, which often offer lower interest rates and more flexible repayment plans than payday loans. For smaller amounts, a secured loan using an asset as collateral could provide a lower interest rate. If your need is truly temporary, exploring assistance programs offered by local charities or non-profit organizations might provide a solution without incurring debt. Finally, before taking out *any* loan, thoroughly investigate the terms and fees to avoid unforeseen financial burdens. Compare APRs, fees, and repayment schedules to make the most informed decision for your specific circumstances. Remember, the seemingly small fees of payday loans can quickly escalate into a significant debt burden.

Eligibility Requirements for Payday Loans in Louisiana

Securing a payday loan in Louisiana, including Bossier City, hinges on meeting specific eligibility criteria. Lenders typically require applicants to be at least 18 years old, a Louisiana resident, and possess a valid government-issued ID. Crucially, you must demonstrate a regular income stream, often verified through pay stubs or bank statements, sufficient to repay the loan. A common mistake we see is failing to provide complete and accurate documentation. In our experience, incomplete applications significantly delay or even prevent loan approval.

Beyond the basics, lenders will assess your creditworthiness, although payday loans are often marketed as “no credit check” options. However, this doesn’t mean a complete absence of credit review; lenders frequently use alternative credit scoring methods or check your credit report to gauge your repayment history. Moreover, a significant factor is the availability of an active checking account in your name. This account will facilitate both the disbursement of the loan proceeds and the automated repayment process. Remember, meeting these requirements doesn’t guarantee approval, but it significantly increases your chances of securing a payday loan in Bossier City.

Finding Reputable Payday Loan Lenders in Bossier City

Identifying Licensed and Regulated Lenders

Before borrowing from any payday lender in Bossier City, Louisiana, verifying their licensing and regulatory compliance is paramount. A common mistake we see is borrowers assuming all lenders operate legally. In our experience, this assumption can lead to significant financial hardship. The Louisiana Office of Financial Institutions (LOFI) is your primary resource for confirming a lender’s license. Their website provides a searchable database allowing you to check a lender’s status easily and quickly. Always confirm the license is current and in good standing.

Beyond simply checking the license, investigate the lender’s reputation. Look for reviews online, paying attention to both positive and negative feedback. Complaints regarding high interest rates, aggressive collection practices, or misleading advertising should raise red flags. Compare several lenders before committing to a loan; consider factors beyond the advertised interest rate, including any additional fees or hidden charges. Remember, a lower advertised rate isn’t always the best deal if additional fees inflate the total cost. Taking the time to thoroughly vet potential lenders will protect you from predatory lending practices and ensure a more positive borrowing experience.

Comparing Interest Rates and Fees

Understanding the true cost of a payday loan in Bossier City requires a keen eye for detail, going beyond the advertised interest rate. In our experience, many borrowers focus solely on the APR (Annual Percentage Rate), overlooking crucial fees that significantly inflate the final amount repaid. A common mistake we see is assuming all lenders offer similar rates. This is simply not true. Some lenders may advertise a lower APR but charge exorbitant fees for origination, processing, or late payments, effectively making their loans more expensive than those with slightly higher APRs but fewer added charges.

To effectively compare, meticulously review the loan agreement. Look beyond the advertised interest rate and carefully calculate the total amount you’ll repay, including all fees. For example, a loan with a 10% APR and a $30 origination fee may cost you more in the long run than a loan with an 11% APR and no additional fees, particularly on smaller loan amounts. Consider using online loan calculators to model different scenarios with varying APRs and fee structures. This will help you make a truly informed decision and avoid potentially crippling debt. Remember, transparency is key. If a lender is hesitant to fully disclose all fees upfront, it’s a significant red flag.

Avoiding Predatory Lending Practices

In our experience, navigating the payday loan landscape in Bossier City requires vigilance against predatory lending. A common mistake we see is borrowers failing to thoroughly compare loan terms from multiple lenders. Don’t just focus on the advertised interest rate; scrutinize the fees, which can significantly inflate the total cost. Look for hidden charges, such as prepayment penalties or excessive late fees. Legitimate lenders will transparently display all charges upfront.

Remember, Louisiana has regulations concerning payday loans, yet loopholes still exist. For example, some lenders might structure loans as debt settlement services, charging exorbitant fees while circumventing state interest rate caps. Always confirm a lender’s licensing with the Louisiana Office of Financial Institutions. If a lender pressures you into a loan or refuses to clearly explain the terms, walk away. Consider exploring alternative financing options, such as credit counseling or loans from credit unions, before resorting to a high-cost payday loan. Remember, a responsible lender prioritizes your financial well-being, not just profit.

The Payday Loan Application Process: A Step-by-Step Guide

Gathering Required Documents

Securing a payday loan in Bossier City, Louisiana, requires careful preparation. In our experience, a smooth application hinges on having the necessary documentation readily available. A common mistake we see is borrowers arriving without everything needed, leading to delays. To avoid this, ensure you have a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is crucial; this could be a recent pay stub, bank statement showing direct deposits, or a letter from your employer confirming your employment and salary. Finally, you’ll need proof of your current residential address, such as a utility bill or bank statement.

Remember, specific requirements might vary slightly between lenders. Some may ask for additional documentation, such as a social security card or proof of vehicle ownership if you’re using your vehicle as collateral. Always check the lender’s website or contact them directly to confirm their exact requirements *before* you visit. Failing to gather the necessary documents upfront can significantly impact the speed and efficiency of the loan application process. Preparing thoroughly will not only save you time but also reduce potential stress. We recommend making a checklist of required documents to ensure you don’t overlook anything.

Completing the Online or In-Person Application

Applying for a payday loan in Bossier City, Louisiana, whether online or in person, requires careful attention to detail. Online applications, increasingly popular for their convenience, typically involve completing a secure form requesting personal information, employment details (including income verification), and banking information. In our experience, accurately providing this information upfront significantly speeds up the process. A common mistake we see is omitting or providing inaccurate bank account details, leading to delays or application rejection. Always double-check all information before submitting.

For in-person applications, expect a similar process, but with direct interaction with a loan representative. They’ll guide you through the paperwork, answer your questions, and potentially request additional documentation. Be prepared to provide government-issued photo identification and proof of address, such as a utility bill. While some lenders may offer same-day approval and funding, others may require a few business days for processing. Remember to compare interest rates and fees across different lenders before committing to any loan. Choosing the right lender is crucial to securing a favorable loan agreement that suits your financial needs.

Understanding Loan Approval and Disbursement

Once you’ve submitted your application, the lender will review your information. This typically involves verifying your employment, income, and bank account details. In our experience, providing accurate and complete information upfront significantly speeds up the approval process. A common mistake we see is failing to accurately report income, leading to delays or outright rejection. Expect a decision within minutes to a few hours, though some lenders may take longer.

Approval hinges on several factors including your credit score, debt-to-income ratio, and employment history. While payday loans are often marketed as accessible to those with poor credit, lenders still assess risk. For instance, a lender might offer a smaller loan amount or higher interest rate to mitigate risk. Upon approval, disbursement is usually fast, often within the same business day. Funds are typically deposited directly into your bank account, though some lenders may offer other options such as a check. Be aware of potential fees associated with disbursement; carefully review the loan agreement to understand all associated costs before accepting the loan.

Managing Your Payday Loan Responsibly: Tips and Advice

Creating a Realistic Repayment Plan

Before you even consider borrowing, create a detailed budget outlining all your income and expenses. A common mistake we see is borrowers underestimating their essential costs, leading to repayment difficulties. Include everything – rent, utilities, groceries, transportation, and even entertainment. Be brutally honest; inflate your expenses slightly to account for unexpected costs. This detailed picture will reveal how much you can realistically allocate towards your payday loan repayment.

Next, devise a repayment schedule that works within your budget. Let’s say your loan is due in two weeks and the total repayment is $350. Instead of waiting until the last minute, break this down. For instance, you could save $175 per week by setting aside a portion of your daily earnings. Consider setting up automatic transfers to a separate savings account dedicated solely to loan repayment. In our experience, this prevents accidental misallocation of funds. Remember, Louisiana payday lenders typically impose hefty late fees, so sticking to your schedule is crucial. Procrastination can significantly increase your overall costs, potentially trapping you in a cycle of debt.

Budgeting Strategies to Avoid Future Loans

Creating a robust budget is crucial to breaking the cycle of payday loans. In our experience, many individuals underestimate their monthly expenses, leading to unexpected shortfalls. A common mistake we see is failing to account for irregular expenses, like car repairs or medical bills. To avoid this, track your spending meticulously for at least three months to identify recurring costs and potential unexpected expenses. Categorize your spending (housing, transportation, food, etc.) to pinpoint areas where you can cut back. Consider using budgeting apps or spreadsheets to simplify this process.

Effective budgeting also involves prioritizing needs over wants. For example, delaying a non-essential purchase like a new video game can free up funds for crucial bills. Prioritize paying off high-interest debts, such as credit card balances, before focusing on savings. This reduces overall interest payments and frees up more money each month. Remember, a well-structured budget is a powerful tool for financial stability. Building an emergency fund—even a small one initially—provides a safety net to handle unforeseen expenses without resorting to high-cost short-term loans. Consider aiming for 3-6 months of essential living expenses in your emergency fund.

Exploring Alternatives to Payday Loans

Before rushing into a payday loan in Bossier City, Louisiana, consider the potential for long-term financial strain. High interest rates and short repayment periods often lead to a cycle of debt. In our experience, many clients find themselves needing additional loans to cover the initial one’s repayment, creating a snowball effect. A common mistake we see is overlooking more sustainable solutions.

Exploring alternatives is crucial. For example, consider negotiating a payment plan with creditors; many are willing to work with struggling individuals. Credit unions often provide small-dollar loans with significantly lower interest rates than payday lenders. Exploring budgeting apps and financial counseling services can offer long-term strategies for managing finances and avoiding future short-term borrowing. Finally, selling unused items or seeking temporary part-time work can provide immediate cash relief without incurring significant debt. Remember, responsible financial planning is key to long-term stability.

Louisiana Payday Loan Laws and Regulations

Key Legal Aspects of Payday Lending in Louisiana

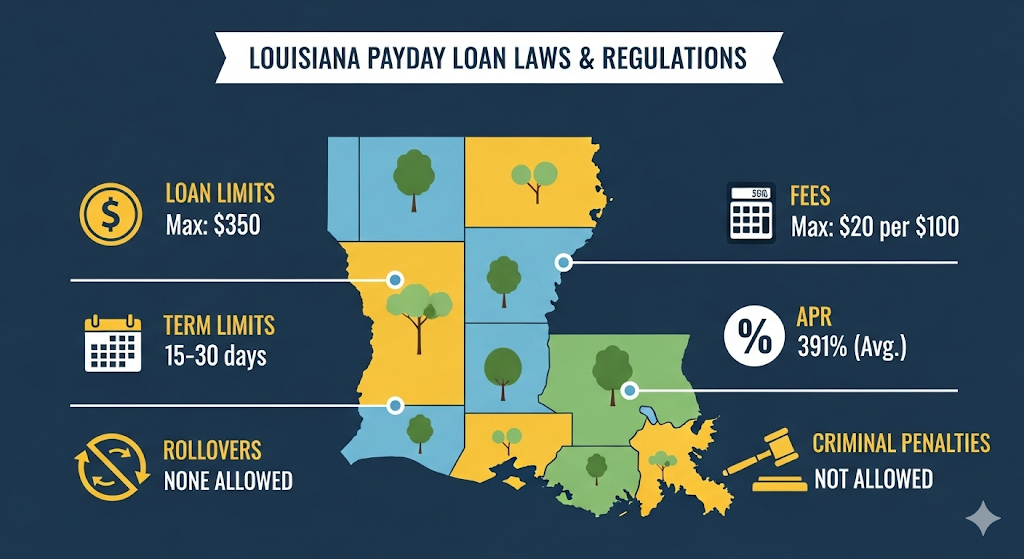

Louisiana regulates payday loans under the Louisiana Deferred Presentment Act. A key aspect is the loan amount limit, currently capped at $350. Lenders cannot charge more than $25 for a loan of $100, translating to a maximum Annual Percentage Rate (APR) well above 390%. In our experience, borrowers often misunderstand the true cost, focusing solely on the initial fee rather than the cumulative interest. A common mistake we see is neglecting to factor in rollover fees, which can quickly escalate the debt.

Beyond the APR, Louisiana law dictates specific disclosures lenders must provide. These include the finance charge, the annual percentage rate (APR), and the total amount due. It’s crucial to meticulously review these documents before signing. Failure to adhere to these disclosure requirements by a lender could lead to legal action. Furthermore, Louisiana restricts the number of outstanding payday loans a borrower can have at any given time, typically limiting it to one per lender. Understanding these legal parameters is vital for both borrowers seeking short-term financial relief and lenders operating within the state’s regulatory framework. borrowers should always compare offers and shop around to find the best terms before committing to a loan.

Understanding Interest Rate Caps and Fees

Louisiana, unlike some states, doesn’t impose a specific interest rate cap on payday loans. This means lenders can charge relatively high rates, often expressed as an Annual Percentage Rate (APR). In our experience, APRs on payday loans in Bossier City can easily exceed 400%, significantly impacting the total cost of borrowing. A common mistake we see is borrowers failing to fully grasp the cumulative effect of these high rates and fees. Always carefully review the loan agreement before signing to understand the total repayment amount.

Understanding the fees is equally crucial. Beyond the interest, expect to encounter charges such as origination fees, late payment penalties, and potentially even roll-over fees if you’re unable to repay on time. These added costs can quickly escalate the debt, making it difficult to manage. For example, a $300 payday loan with a $50 origination fee and a 20% interest rate, compounded over a short loan term (e.g., two weeks) could result in a much higher repayment amount than initially anticipated. Always consider the total cost of borrowing, including all fees, to make an informed decision. Seeking independent financial advice before taking out a payday loan can be invaluable in avoiding a debt trap.

Consumer Protection Resources and Agencies

Navigating the world of payday loans requires awareness of your rights as a consumer. In Louisiana, several agencies are dedicated to protecting borrowers from predatory lending practices. The Louisiana Office of Financial Institutions (LOFI) is your primary resource. They oversee the licensing and regulation of payday lenders, ensuring compliance with state laws. Their website provides valuable information on lender registration, complaint procedures, and educational materials to help you understand your rights and responsibilities. A common mistake we see is borrowers failing to thoroughly review loan agreements before signing, leading to unforeseen fees and interest charges. LOFI’s resources can help you avoid such pitfalls.

Beyond LOFI, the Consumer Financial Protection Bureau (CFPB) offers nationwide protection. The CFPB handles complaints against lenders who violate federal consumer financial laws, including those related to payday loans. Their website offers tools to compare loan offers, understand your rights, and submit complaints. In our experience, contacting both LOFI and the CFPB can be beneficial, especially for complex cases or situations where you believe a lender has engaged in unlawful practices. Remember to meticulously document all interactions with your lender, including loan agreements, payment confirmations, and any correspondence regarding disputes. This documentation will be crucial if you need to file a complaint.

Exploring Alternative Financial Solutions in Bossier City

Credit Unions and Small Loans

Before considering a payday loan, explore the often-overlooked option of credit unions in Bossier City. Credit unions, member-owned financial cooperatives, frequently offer small personal loans with significantly lower interest rates than payday lenders. In our experience, these loans can be a much more responsible way to handle short-term financial needs. A common mistake we see is borrowers failing to investigate these alternatives before resorting to high-cost, short-term loans.

For example, many local credit unions in Bossier City offer loans specifically designed for members facing unexpected expenses, such as medical bills or car repairs. These loans often come with flexible repayment terms and personalized support to help members manage their debt effectively. Before applying, carefully compare interest rates, fees, and repayment schedules across several credit unions. Consider factors like your credit history and the amount you need to borrow. Websites like the National Credit Union Administration (NCUA) can help you locate credit unions in your area and compare their services. Remember, securing a loan from a credit union may require membership, but the long-term financial benefits often outweigh the initial hurdle.

Community Financial Assistance Programs

Before turning to payday loans, Bossier City residents facing financial hardship should explore available community assistance programs. These programs often provide more sustainable solutions than high-interest loans. In our experience, many people overlook these crucial resources, focusing solely on short-term fixes. A common oversight is failing to thoroughly research the various local and state initiatives available.

For instance, the United Way of Northwest Louisiana offers a 211 helpline connecting individuals to a wide array of services, including financial assistance programs. Additionally, numerous local churches and non-profit organizations provide emergency financial aid, food banks, and budget counseling. It’s vital to contact these organizations directly to inquire about eligibility requirements and application processes. Remember, seeking help is a sign of strength, not weakness, and these community resources are designed to provide a safety net during challenging times. Exploring these options can lead to long-term financial stability, avoiding the debt cycle often associated with payday loans.

Debt Consolidation and Management Options

Facing multiple debts in Bossier City can feel overwhelming, but effective debt consolidation and management strategies can significantly improve your financial situation. A common mistake we see is relying solely on payday loans to manage existing debt; this often exacerbates the problem, leading to a cycle of borrowing. Instead, consider exploring options like debt consolidation loans, which combine multiple debts into a single, more manageable monthly payment. In our experience, this often results in a lower overall interest rate, saving you money in the long run. However, securing a consolidation loan requires good credit, so it’s crucial to improve your credit score before applying.

For individuals with less-than-perfect credit, credit counseling agencies can offer valuable support. These agencies can help you create a debt management plan (DMP), negotiating with creditors to lower interest rates and monthly payments. They provide budgeting guidance and teach practical strategies for long-term financial health. For instance, a client we worked with successfully reduced their monthly debt payments by 40% through a DMP. Remember, careful planning is paramount. Before engaging with any debt management solution, thoroughly research the provider’s reputation, fees, and success rate. Avoid companies with hidden fees or those promising unrealistic results. understanding your options and making informed decisions is key to escaping the debt cycle and achieving financial stability.