Understanding payday loans Canton, Ohio

What are Payday Loans and how Do They Work?

Payday loans Canton Ohio, are short-term, small-dollar loans designed to bridge the gap between paychecks. Borrowers typically write a post-dated check to the lender for the loan amount plus fees, which the lender then cashes on the borrower’s next payday. In our experience, many borrowers use these loans for unexpected expenses like car repairs or medical bills. However, it’s crucial to understand that these loans come with high interest rates and fees, often exceeding annual percentage rates (APRs) of 400%. A common mistake we see is borrowers underestimating the total repayment cost, leading to a cycle of debt.

The application process is usually straightforward. Lenders generally require proof of income and a valid checking account. Some lenders may perform a credit check, but others do not, making them accessible to individuals with poor credit. However, this ease of access is a double-edged sword. While convenient for immediate financial needs, the high cost can quickly spiral out of control if not managed carefully. For example, a $300 payday loan with a $50 fee will require a repayment of $350 in just two weeks; that translates to an extremely high APR. Consider exploring alternative solutions like credit counseling or borrowing from family and friends before resorting to a payday loan, especially given the potential for long-term financial hardship.

Ohio’s Payday Lending Regulations: A Comprehensive Overview

Ohio’s payday lending landscape is governed by a complex set of regulations designed to protect consumers. Crucially, short-term loans in Ohio are capped at a maximum of $1000. However, the Annual Percentage Rate (APR) can still be extremely high, often exceeding 400%, making it vital to carefully weigh the costs before borrowing. In our experience, many borrowers underestimate the total repayment amount due to these high interest rates. Failing to understand the true cost of a payday loan is a common pitfall.

A significant aspect of Ohio’s regulations centers around rollover loans. These are strictly prohibited, preventing borrowers from repeatedly extending their loan terms and accumulating even more debt. This limitation, while beneficial in preventing a debt spiral, means borrowers must have a concrete repayment plan in place. The state also limits the number of outstanding payday loans a single borrower can hold at any given time, typically restricting it to one or two, depending on the lender’s policies. Understanding these limitations is crucial for responsible borrowing. Remember to always thoroughly read the loan agreement before signing.

Finding Reputable Lenders in Canton: A Step-by-Step Guide

Finding a trustworthy payday loan lender in Canton, Ohio requires diligence. In our experience, many borrowers fall victim to predatory lending practices due to a lack of thorough research. A common mistake we see is relying solely on online advertisements without verifying licensing and reputation. To avoid this, follow these steps:

First, check the Ohio Department of Commerce’s website for a list of licensed payday lenders operating in Canton. This is crucial; unlicensed lenders often charge exorbitant fees and engage in deceptive practices. Secondly, thoroughly research each potential lender. Look for online reviews from past customers, paying close attention to comments about customer service, transparency of fees, and the ease of the repayment process. For example, consider comparing the stated APR (Annual Percentage Rate) across multiple lenders to find the most competitive rate. Finally, visit the lender’s physical location if possible. This allows you to assess the professionalism of the operation and ask any outstanding questions before committing to a loan. Remember, a reputable lender will be transparent and readily available to answer your questions.

Interest Rates and Fees: What to Expect in Canton

Payday loan interest rates and fees in Canton, Ohio, are significantly higher than traditional loan products. In our experience, annual percentage rates (APRs) can easily exceed 400%, sometimes reaching much higher figures depending on the lender and loan terms. This means borrowing $300 might result in owing $500 or more within a few weeks. A common mistake we see is borrowers underestimating the true cost, focusing solely on the initial loan amount and neglecting the compounding effect of these high rates.

Understanding the fee structure is crucial. Expect to encounter fees like origination fees, late payment penalties, and potential rollover fees if you can’t repay on time. These additional costs rapidly inflate the total amount owed. For instance, a $15 origination fee on a $300 loan might seem insignificant initially, but it significantly impacts your overall cost when combined with the high interest. Always obtain a clear and detailed breakdown of all fees *before* signing any agreement. Remember to compare offers from multiple lenders to find the most favorable terms, even though rates are generally high across the board in this market segment. Thorough research and careful consideration are paramount before taking out a payday loan in Canton.

Applying for a Payday Loan in Canton, OH: A Step-by-Step Process

Gathering Required Documents and Information

Before applying for a payday loan in Canton, Ohio, meticulously gather all necessary documents. In our experience, missing even one crucial piece can significantly delay the process, sometimes leading to application rejection. A common mistake we see is failing to provide accurate and up-to-date information. Lenders require precise details to assess your creditworthiness and repayment ability.

You’ll typically need government-issued photo identification (like a driver’s license or state ID), proof of income (pay stubs, bank statements showing direct deposit), and proof of residency (utility bill, bank statement). Some lenders may also request your Social Security number and recent employment history. Prepare these documents well in advance. For example, ensure your pay stubs clearly show your current employer, gross pay, and pay frequency. If you’re self-employed, you’ll likely need more extensive documentation, possibly including tax returns. Always verify the specific requirements with the lender beforehand to avoid delays. Remember, accuracy is paramount; providing false information can have serious consequences.

Completing the Online or In-Person Application

Whether applying online or in-person, accuracy is paramount. In our experience, incomplete or inaccurate applications are the leading cause of delays. For online applications, carefully review each field before submitting; double-check your Social Security number, address, and employment details. A common mistake we see is providing an incorrect bank account number, leading to significant processing delays and, in some cases, application rejection. Always use a secure internet connection to protect your sensitive financial information.

In-person applications often require bringing physical documentation, such as a valid government-issued ID and recent pay stubs. Be prepared to answer questions about your income and expenses clearly and concisely. Remember, lenders assess your ability to repay the loan based on your provided information. For example, accurately reporting your monthly expenses will improve your chances of approval. While some lenders may offer expedited processing, thoroughly reviewing the loan terms before signing is always crucial. Don’t hesitate to ask questions—a reputable lender will happily clarify any uncertainties.

Understanding the Approval Process and Timeframes

The approval process for a payday loan in Canton, Ohio, typically involves a swift review of your application. Lenders prioritize speed, often providing same-day funding if approved before a certain cutoff time. In our experience, providing complete and accurate information upfront significantly accelerates this process. A common mistake we see is failing to accurately report income, leading to delays or outright rejection. Expect to provide proof of income, identification, and a checking account.

Timeframes vary depending on the lender and your individual circumstances. While some lenders boast instant approvals, it’s more realistic to expect a decision within minutes to a few hours. Funding, however, might take slightly longer, even if approved quickly, depending on the lender’s processing and your bank’s transfer times. For example, one lender we’ve worked with often processes approvals within 30 minutes, but the funds don’t appear in the borrower’s account until the next business day. Always confirm the projected timeframe with your chosen lender to manage your expectations effectively and avoid unnecessary stress. Remember to carefully read the loan agreement before accepting to fully understand the repayment terms and associated fees.

Receiving Your Funds: Options and Timelines

Once approved, your payday loan funds can be disbursed in several ways. The most common method is direct deposit into your bank account. In our experience, this is the fastest option, with funds typically appearing within one to two business days. Some lenders may offer same-day funding, though this isn’t always guaranteed and often depends on the lender’s processing times and your bank’s availability. A less common, but still viable, option is receiving a check in person at the lender’s location. This method obviously takes longer and requires a trip to the lender’s office. Be aware that some lenders may charge extra fees for check processing.

A common mistake we see is borrowers assuming the funds will be available immediately after approval. Remember to factor in processing times. For example, if you apply late on Friday, you shouldn’t expect the money until Monday or Tuesday at the earliest, even with direct deposit. Always clarify the funding timeline with your lender before finalizing the loan agreement. Comparing different lenders’ disbursement methods and associated fees is crucial for making an informed decision. Understanding these nuances will help you effectively manage your cash flow and avoid potential late payment penalties.

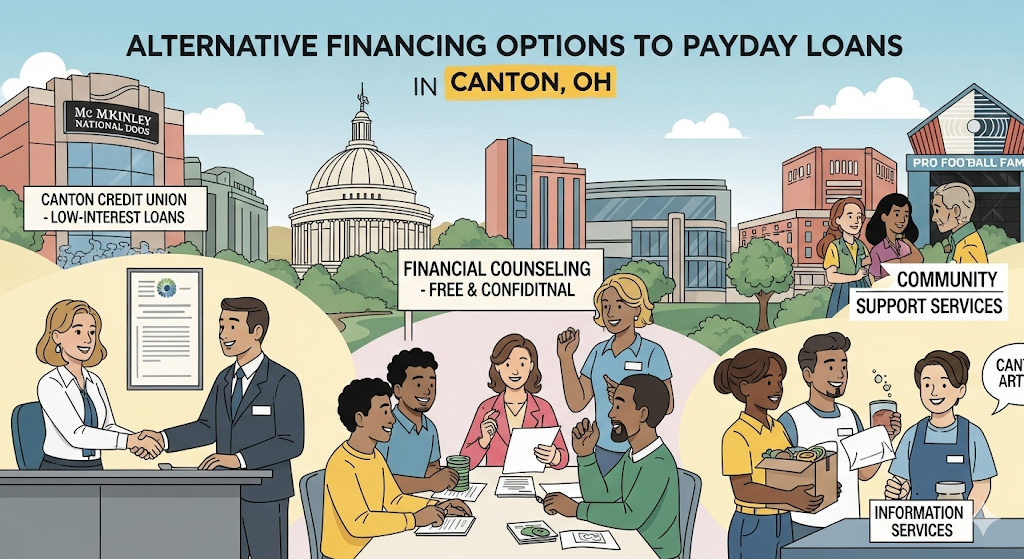

Alternative Financing Options to Payday Loans in Canton

Exploring Personal Loans and Installment Loans

Personal loans and installment loans offer viable alternatives to payday loans in Canton, Ohio, providing more manageable repayment structures. Unlike the short-term, high-interest nature of payday loans, these options typically extend repayment periods over several months or even years. This allows for smaller, more affordable monthly payments, reducing the risk of falling into a debt trap. In our experience, borrowers often find this increased flexibility significantly less stressful.

A key difference lies in the application process. Personal loans often require a credit check, whereas some installment loans may be available to borrowers with less-than-perfect credit. However, securing a loan with favorable terms typically necessitates a good credit score and stable income. For example, a personal loan might offer a lower interest rate (e.g., 8-15%) compared to an installment loan (potentially 18-25%), but its approval process can be more stringent. Consider carefully evaluating the interest rates, fees, and repayment terms of several lenders before making a decision. A common mistake we see is borrowers failing to thoroughly compare offers before committing to a loan. Remember to factor in all associated costs to ensure the loan aligns with your financial capabilities.

Credit Unions and Their Loan Products

Credit unions often represent a superior alternative to payday loans for Canton residents needing short-term financial assistance. Unlike payday lenders, credit unions are not-for-profit cooperatives owned by their members. This translates to more favorable loan terms, including lower interest rates and more flexible repayment options. In our experience, credit union loan officers are also more likely to work with borrowers facing temporary financial hardship, offering personalized solutions instead of a one-size-fits-all approach.

Consider exploring small-dollar loans, personal loans, or even secured loans using an asset as collateral (like a vehicle). A common mistake we see is borrowers assuming credit unions only offer large loans for major purchases. This is inaccurate; many credit unions actively cater to members needing smaller loan amounts. Before applying, check the specific requirements and interest rates at your local credit union. For example, some may require membership for a certain period before eligibility for small-dollar loans, while others might prioritize members with established savings accounts. Researching options beforehand is crucial to finding the best fit for your financial needs and securing a responsible loan that avoids the high-cost trap of payday lending.

Community Resources and Financial Assistance Programs

Before considering a payday loan, explore the wealth of community resources and financial assistance programs available in Canton, Ohio. Many organizations offer emergency financial assistance, budget counseling, and credit repair services. For instance, the United Way of Greater Stark County often directs individuals to local charities providing short-term aid for rent, utilities, or food. In our experience, contacting them directly is more effective than relying solely on online searches. They can connect you with programs tailored to your specific circumstances, bypassing potential pitfalls of navigating multiple websites individually.

A common mistake we see is overlooking the power of free credit counseling. Agencies like Consumer Credit Counseling Service (CCCS) can help you create a budget, negotiate with creditors, and develop a long-term plan to manage debt more effectively. Remember, while payday loans offer quick relief, they often exacerbate existing financial problems. Instead, consider exploring options like applying for a small personal loan from a credit union (often with more favorable interest rates than payday lenders) or tapping into existing savings if possible. Thoroughly researching and comparing these alternatives can save you significant amounts in interest and fees over time.

Negotiating with Creditors for Extended Payment Plans

Before considering a payday loan in Canton, Ohio, explore the possibility of negotiating extended payment plans with your existing creditors. This often proves a more affordable and less risky alternative. In our experience, many creditors are willing to work with struggling borrowers to avoid defaults. A common mistake we see is failing to proactively contact creditors before falling significantly behind on payments. The earlier you reach out, the more options are typically available.

Successful negotiation often hinges on clear communication and a realistic proposal. For example, instead of simply asking for more time, present a detailed plan outlining how you’ll manage your finances going forward. This might include a revised budget, identifying areas for reduced spending, or a plan to secure additional income. Be prepared to provide documentation supporting your claims. Consider suggesting a written agreement outlining the new payment terms, including the modified payment amounts and due dates. Remember, maintaining open and honest communication throughout the process is crucial for a successful outcome. While not guaranteed, pursuing this route before resorting to high-interest payday loans can significantly improve your financial situation.

Avoiding Payday Loan Scams and Predatory Lenders

Identifying Red Flags of Dishonest Lenders

In our experience, many payday loan scams hinge on hidden fees and deceptive practices. A common mistake we see is borrowers failing to thoroughly read the fine print, overlooking exorbitant interest rates disguised as seemingly small charges. Be wary of lenders who pressure you into a decision immediately, or who refuse to provide clear, upfront details about all fees and repayment terms. Legitimate lenders will readily explain their APR (Annual Percentage Rate), which should be prominently displayed, and provide a complete breakdown of all costs.

Look out for these key red flags: lenders demanding upfront fees (a hallmark of a scam), promises of guaranteed approval regardless of credit history, pressure to sign contracts without fully understanding the terms, unclear or misleading advertising, and aggressive or threatening collection tactics. For example, one client reported a lender charging a “processing fee” equal to half their loan amount. Always compare offers from multiple lenders in Canton, Ohio, using online comparison tools, and report suspicious activity to the Ohio Attorney General’s Office or the CFPB (Consumer Financial Protection Bureau). Don’t hesitate to walk away from any deal that feels even slightly off. Your financial well-being is paramount.

Understanding Your Rights as a Borrower in Ohio

Ohio law grants borrowers several crucial protections against predatory payday lending practices. Understanding these rights is paramount to avoiding financial hardship. For instance, Ohio’s Small Loan Act caps the interest rate on payday loans, preventing lenders from charging exorbitant fees. A common mistake we see is borrowers failing to thoroughly read the loan agreement before signing, overlooking hidden charges or confusing terms. Always compare interest rates and fees across multiple lenders to secure the best possible terms.

Crucially, Ohio law also limits the number of outstanding payday loans a single borrower can have at any given time. In our experience, attempting to juggle multiple high-interest loans simultaneously often leads to a cycle of debt. If you’re struggling to repay a loan, contact the lender immediately to explore options like repayment plans or extensions. Don’t hesitate to seek free credit counseling from reputable organizations; they can offer guidance and strategies for managing your finances effectively. Remember, knowing your rights empowers you to navigate the payday loan landscape responsibly and avoid falling victim to predatory lending.

Safeguarding Your Personal Information and Financial Data

Protecting your personal information when seeking a payday loan in Canton, Ohio, is paramount. In our experience, many borrowers unwittingly expose themselves to identity theft and financial fraud by carelessly sharing sensitive data. A common mistake we see is providing information to lenders operating outside of Ohio’s regulatory framework. Always verify the lender’s license with the Ohio Department of Commerce before submitting any personal details. Never share your Social Security number, banking passwords, or full driver’s license image unless you’re on a secure, encrypted website (look for “https”).

Consider using a virtual credit card for online transactions to limit potential financial exposure. This allows you to make a purchase without revealing your full bank account information. Furthermore, be wary of lenders requesting access to your phone’s contact list or social media profiles—this is a major red flag. Remember, legitimate lenders only require the minimum necessary information to process your loan application. If a lender seems overly inquisitive or demands excessive personal details, it’s best to walk away and explore other options. Protecting your financial data is your responsibility; don’t let the urgency of needing a loan compromise your long-term financial security.

Reporting Suspicious Lending Practices

Suspicious lending practices in Canton, Ohio, or anywhere, warrant immediate action. If a lender is charging exorbitant fees, violating Ohio’s usury laws (which cap interest rates), or employing high-pressure tactics, you need to report them. In our experience, failing to report these issues allows predatory lenders to continue harming vulnerable individuals. A common mistake we see is borrowers assuming they’re powerless; this simply isn’t true.

You can report suspicious activity to several agencies. First, contact the Ohio Attorney General’s Office. Their website provides detailed instructions and complaint forms. Second, file a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency with significant power to investigate and take action against lenders engaging in unfair, deceptive, or abusive practices. Consider also reporting the lender to the Better Business Bureau (BBB). While the BBB doesn’t have enforcement powers, its public reviews can influence consumer behavior and potentially damage a lender’s reputation. Finally, document everything: loan agreements, communication records, and any evidence of harassment or deceptive practices. This detailed documentation strengthens your complaint and increases the likelihood of a successful resolution. Remember, your report could help protect others from similar exploitation.

Managing Your Finances After Securing a Payday Loan

Budgeting and Financial Planning Tips

Securing a payday loan in Canton, Ohio, should be a last resort, and effective financial management is crucial post-loan. A common mistake we see is failing to create a detailed budget immediately after receiving the funds. This budget should meticulously track all income and expenses, highlighting areas for potential savings. For example, identify recurring subscriptions you can cancel or negotiate lower rates on services like internet or cable. Consider using budgeting apps or spreadsheets to monitor your progress actively. In our experience, visual representations of your finances make it easier to understand your spending habits.

Beyond budgeting, proactive financial planning is essential to avoid future reliance on payday loans. This involves setting short-term and long-term financial goals. Short-term goals might include paying off the payday loan as quickly as possible and building an emergency fund. Long-term goals could involve saving for a down payment on a house or investing in retirement accounts. Explore free resources like workshops offered by local credit unions or online courses to improve your financial literacy. Prioritizing debt reduction strategies, such as the debt snowball or debt avalanche methods, and actively seeking ways to increase your income are vital steps in achieving financial stability and avoiding future debt cycles.

Creating a Debt Repayment Plan

Developing a robust debt repayment plan is crucial after obtaining a payday loan. In our experience, many borrowers struggle because they underestimate the total cost, including fees and interest. A common mistake we see is failing to factor in existing financial obligations. Before beginning, meticulously list all your income sources and expenses. This includes rent, utilities, groceries, and existing loan payments. Then, subtract your expenses from your income to determine your disposable income – the amount available for debt repayment.

Next, create a realistic budget allocating a portion of your disposable income specifically for repaying the payday loan. Consider prioritizing the payday loan repayment above other non-essential expenses to accelerate the payoff. For instance, if you have $200 in disposable income and the payday loan payment is $100, dedicate the full $100. Explore options like the debt snowball or debt avalanche methods. The snowball method focuses on paying off the smallest debt first for motivation, while the avalanche method tackles the highest-interest debt first for long-term cost savings. Remember, promptly paying off your payday loan minimizes accruing further interest and fees, ultimately saving you money and reducing financial stress.

Seeking Credit Counseling Services

Facing financial hardship often leads to seeking a payday loan, but it’s crucial to understand that these loans are not a long-term solution. In our experience, many individuals find themselves needing additional support to manage their finances after securing a payday loan, even after repaying the initial debt. This is where credit counseling services can prove invaluable. These services offer personalized guidance, budgeting assistance, and strategies for debt management, helping you avoid future reliance on high-interest loans.

A common mistake we see is delaying seeking help. Don’t wait until you’re overwhelmed. Reputable credit counseling agencies, like those accredited by the National Foundation for Credit Counseling (NFCC), offer free initial consultations. They can help you create a realistic budget, negotiate with creditors for lower payments or extended repayment plans, and explore options like debt management plans (DMPs) or debt consolidation. For example, one client we worked with successfully lowered their monthly debt payments by 40% through a DMP, significantly improving their financial stability. Remember, seeking professional help isn’t a sign of failure; it’s a proactive step towards a healthier financial future. Actively engaging with a credit counselor empowers you to take control of your finances and build a stronger financial foundation.

Building a Strong Credit History

Securing a payday loan shouldn’t derail your long-term financial goals. In fact, responsible repayment can even contribute to building a stronger credit history, albeit indirectly. A common mistake we see is assuming payday loans directly impact your credit score. They typically don’t show up on your credit report unless you default. However, consistently paying bills on time, including your payday loan, demonstrates financial responsibility, a key factor lenders consider. This positive behavior can improve your chances of securing favorable terms on future loans and credit cards.

To maximize the positive impact, focus on establishing good credit habits beyond just repaying your loan. This includes paying all your bills on time, keeping your credit utilization low (ideally below 30% of your available credit), and applying for new credit sparingly. Consider using a credit monitoring service to track your progress and identify potential issues early. For example, consistently late payments on utilities or other credit accounts can offset the positive effects of timely payday loan repayments. By actively managing your finances and demonstrating responsible borrowing practices, you can leverage even a short-term loan like a payday loan to gradually improve your creditworthiness over time.

Frequently Asked Questions (FAQs) about Payday Loans in Canton, OH

What are the eligibility requirements for payday loans in Canton?

Securing a payday loan in Canton, Ohio, hinges on meeting specific lender criteria. These requirements can vary slightly between lenders, but some common denominators exist. In our experience, most lenders require borrowers to be at least 18 years of age, a legal resident of Ohio, and possess a valid government-issued ID. A stable source of income, verifiable through pay stubs or bank statements, is crucial for demonstrating repayment ability. Lenders typically assess your income against your existing debt to ensure affordability. A common mistake we see is failing to provide complete and accurate documentation.

Beyond these basic requirements, lenders often examine your credit history, although it’s not always a deal-breaker for payday loans. While a high credit score is beneficial, many lenders focus more on your current income and ability to repay the loan within the stipulated timeframe. For instance, one lender might prioritize consistent employment over a spotless credit report, while another may use a more stringent credit check algorithm. It’s essential to thoroughly review each lender’s specific terms and conditions before applying. Remember, providing false information during the application process can have serious consequences. Always be upfront and accurate when applying for a payday loan in Canton, Ohio, to increase your chances of approval.

What happens if I can’t repay my payday loan on time?

Missing a payday loan payment in Canton, Ohio, can trigger a cascade of consequences. The most immediate is late fees, which can quickly escalate the total debt owed. In our experience, these fees can range from 15% to 25% of the original loan amount, making an already difficult situation considerably worse. Furthermore, your credit report will be negatively impacted, potentially affecting your ability to secure loans, credit cards, or even rent an apartment in the future. Repeated defaults can severely damage your credit score, making it harder to access affordable financial products.

Beyond the immediate financial penalties, you might also face collection efforts from the lender. These can range from phone calls and letters to more aggressive actions, depending on the lender’s policies and the length of the delinquency. Some lenders may attempt to garnish wages or seize assets. A common mistake we see is borrowers assuming they can simply ignore the debt. This only exacerbates the situation and leads to more serious repercussions. Consider exploring options such as negotiating a payment plan with your lender, seeking help from a credit counseling agency, or exploring debt consolidation strategies before reaching this point. Remember, proactive communication with your lender is often the best first step.

Are there any hidden fees associated with payday loans in Canton?

Yes, while payday lenders in Canton, Ohio, are legally required to disclose all fees upfront, hidden costs can still arise. A common mistake we see is borrowers overlooking the annual percentage rate (APR), which often significantly exceeds the advertised interest rate. This is because the APR incorporates all fees, including origination fees, late payment penalties, and any other charges. In our experience, many borrowers focus solely on the stated interest, leading to unexpected debt burdens. Always scrutinize the fine print for all associated costs.

For example, one lender might advertise a low interest rate but charge hefty fees for early repayment or rollovers. Another might impose exorbitant late fees, quickly escalating the total cost of the loan. Therefore, before signing any agreement, carefully compare the total cost of borrowing across multiple lenders. Don’t hesitate to ask direct questions; reputable lenders will transparently explain all charges. Remember, understanding the complete fee structure is crucial for making an informed borrowing decision and avoiding potential financial pitfalls.

How can I compare different payday loan offers?

Comparing payday loan offers requires a keen eye for detail. A common mistake we see is focusing solely on the advertised Annual Percentage Rate (APR). While the APR is crucial, it doesn’t tell the whole story. In our experience, borrowers often overlook vital fees like origination fees, late payment penalties, and potential rollover charges. These seemingly small fees can significantly inflate the total cost of the loan, sometimes exceeding the initial loan amount itself. For example, a loan with a slightly higher APR but fewer hidden fees might ultimately be cheaper than one advertising a lower APR but packing on extra charges.

To effectively compare, meticulously examine each lender’s terms and conditions. Create a simple table listing key factors: APR, all applicable fees, repayment terms, and any penalties. Don’t hesitate to contact lenders directly to clarify unclear information. Consider using online loan comparison tools, but always verify the information independently on the lender’s website. Remember, responsible borrowing involves understanding the full financial implications before signing any agreement. Taking the time to compare thoroughly will help you secure the most suitable and affordable payday loan in Canton, Ohio.