Understanding payday loans Dayton, ohio

What are Payday Loans and How Do They Work?

Payday loans Dayton Ohio, are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They typically involve borrowing a relatively small amount of money, often between $100 and $500, and repaying the principal plus a significant fee within a short timeframe, usually two to four weeks. In our experience, borrowers often use these loans for unexpected expenses like car repairs or medical bills. However, it’s crucial to understand that these loans come with very high interest rates—often exceeding 400% APR—making them a costly solution unless absolutely necessary.

A common mistake we see is borrowers underestimating the total repayment amount. For example, borrowing $300 with a $60 fee means a repayment of $360 in just two weeks. That equates to a dramatically high annual percentage rate (APR), significantly impacting your budget. Before considering a payday loan, carefully assess all available options, including exploring credit unions for smaller, more affordable loans, or negotiating payment extensions with creditors. Remember, responsible borrowing involves comparing fees and interest rates, and understanding the full implications of your financial commitment before signing any agreement. Always prioritize clear communication with the lender regarding repayment terms and potential consequences of default.

Ohio’s Payday Loan Regulations: Interest Rates & Limits

Ohio’s payday lending landscape is governed by a complex set of regulations designed to protect consumers. A key aspect is the interest rate cap, which is significantly higher than many other states. While this might seem advantageous at first glance, it’s crucial to understand the implications of these high rates on the total cost of borrowing. In our experience, many borrowers underestimate the cumulative effect of interest charges, leading to a debt cycle that’s difficult to escape. For example, a seemingly small $300 loan can balloon into a much larger debt if not repaid promptly. Remember that lenders are legally obligated to disclose all fees and interest rates upfront; carefully review these documents before signing any agreement.

Understanding the loan amount limits is equally vital. Ohio law typically restricts the maximum amount you can borrow through a payday loan, although this can vary slightly depending on the lender. It’s essential to carefully consider your budget and repayment capacity before applying for a payday loan of any size. A common mistake we see is borrowers taking out loans that exceed their ability to repay, leading to a cascade of additional fees and further debt. Before considering any payday loan, explore alternative financial solutions like credit counseling or negotiating payment plans with creditors. These alternatives may offer more sustainable solutions than the short-term relief offered by payday loans.

Are Payday Loans Right for your financial Situation?

Before considering a payday loan in Dayton, Ohio, honestly assess your financial situation. A common mistake we see is borrowers overlooking the high interest rates and short repayment periods. These loans are designed for short-term emergencies, not long-term financial solutions. If you’re facing ongoing financial hardship, a payday loan might only exacerbate the problem, leading to a cycle of debt. Consider your budget; can you realistically repay the loan in full on your next payday, including all fees?

In our experience, a responsible approach involves exploring all alternatives first. For example, could you temporarily reduce expenses, negotiate a payment plan with creditors, or seek help from a credit counseling agency? These options might offer more sustainable solutions than incurring the substantial costs associated with a payday loan. If, after careful consideration, a payday loan remains the only viable option, ensure you fully understand the terms and conditions, including all associated fees and penalties for late payments. Remember, borrowing responsibly involves prioritizing your long-term financial well-being.

Finding Reputable Payday Lenders in Dayton

Top-Rated Lenders in Dayton: A Comparison

Choosing a payday lender requires careful consideration. In our experience, comparing lenders solely on advertised interest rates is a common mistake. Factors like fees, repayment terms, and customer service are equally crucial. We recommend checking the Ohio Department of Commerce’s website for licensed lenders and reading online reviews from multiple sources, not just those hosted on the lender’s site. Look for consistent positive feedback regarding transparency and ease of the repayment process.

For example, some lenders in Dayton might offer slightly higher interest rates but provide more flexible repayment options, which can be beneficial in unexpected financial emergencies. Others may advertise lower rates but bury borrowers under hefty fees. Before committing, clarify all costs, including origination fees, late payment penalties, and any potential rollover charges. Consider factors like loan amounts offered, required documentation, and the lender’s reputation for responsible lending practices. Remember, a slightly higher interest rate coupled with excellent customer service and clear terms can often be a better choice than a seemingly lower rate with hidden fees and poor customer support. Always prioritize transparency and responsible lending practices above all else.

Online vs. In-Person Lenders: Pros and Cons

Online payday lenders offer convenience, often allowing applications and approvals within minutes. This speed can be crucial in emergencies. However, in our experience, the lack of face-to-face interaction increases the risk of scams and hidden fees. It’s vital to thoroughly research any online lender before submitting personal information; check for licensing and customer reviews. A common mistake we see is borrowers overlooking the fine print of online loan agreements.

In contrast, in-person lenders in Dayton provide a tangible interaction. You can ask direct questions, clarify terms, and build a relationship. This transparency can lead to a better understanding of the loan’s implications. However, the convenience factor is lower, and availability may be limited by operating hours. Consider the pros and cons carefully; while in-person options offer greater accountability, online lenders cater to those seeking immediate accessibility. Remember, reputable lenders, whether online or in-person, will always be transparent about their fees and terms. Carefully comparing interest rates and fees between different lenders—both online and brick-and-mortar—is crucial before committing to a loan.

Spotting and Avoiding Payday Loan Scams in Dayton

In our experience, Dayton residents seeking quick cash are particularly vulnerable to payday loan scams. A common mistake we see is failing to verify the lender’s license with the Ohio Department of Commerce. Legitimate payday lenders are required to be licensed and adhere to strict regulations. Always check this crucial detail before providing any personal information or signing any agreements. Look for clear and transparent fee disclosures; hidden fees are a major red flag.

Beware of lenders promising unrealistically low interest rates or excessively easy approval processes. For example, a lender advertising a “0% interest” loan with hidden fees or exorbitant late charges is likely a scam. Another warning sign is pressure to apply quickly or a request for upfront fees. Reputable payday lenders never charge fees before approving your loan. Instead, they will fully explain all fees and terms upfront. Remember to carefully read all documents before signing and don’t hesitate to seek independent financial advice if unsure about any aspect of the loan agreement. Protecting yourself from predatory lending practices requires vigilance and informed decision-making.

The Payday Loan Application Process: Step-by-Step

Required Documents and Information

Securing a payday loan in Dayton, Ohio, requires providing specific documentation to verify your identity, income, and residency. In our experience, the most common requests include a valid government-issued photo ID, such as a driver’s license or state ID card. You’ll also need proof of current employment, which typically means providing recent pay stubs or bank statements showing consistent income for the past several months. A common mistake we see is failing to provide sufficient documentation proving consistent income; lenders require evidence of stable earnings to assess your repayment ability.

Beyond employment verification, lenders will also require proof of your current residential address. This usually takes the form of a utility bill, bank statement, or lease agreement, all reflecting your Dayton address within the last 30-60 days. Finally, expect to provide your bank account information, enabling direct deposit of the loan and automated withdrawals for repayment. Remember, accurate and complete information is crucial; providing inaccurate details can delay processing or even lead to loan denial. Always double-check your submitted documents before finalizing your application to streamline the approval process.

The Application Process: Online and In-Person

Applying for a payday loan in Dayton, Ohio, can be done either online or in person. Online applications often involve filling out a secure form on the lender’s website, providing personal details, employment information, and banking details. In our experience, this process is generally faster, offering instant approval in some cases. However, a common mistake we see is applicants failing to accurately provide all required information, leading to delays. Always double-check your entries before submitting.

In-person applications require a visit to a physical payday loan store. This allows for immediate interaction with a loan officer who can answer questions and guide you through the process. While this offers a personalized experience and potentially quicker processing for those comfortable with immediate face-to-face interaction, it does require travel time and may have longer wait times depending on the lender’s office traffic. Remember to bring all necessary documentation, such as a valid ID and proof of income, to expedite the in-person application. Choosing between online and in-person depends on your personal preference and comfort level with technology and face-to-face interactions.

Understanding Your Loan Agreement

Before signing anything, meticulously review your payday loan agreement. In our experience, many borrowers skim this crucial document, leading to unforeseen consequences. Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including fees. This figure often far exceeds what initially appears on the surface, so compare APRs from multiple lenders to secure the most favorable terms. A common mistake we see is overlooking the finance charges, which can significantly inflate your repayment amount.

Understand the exact repayment schedule and the penalties for late payments. For example, some Dayton lenders charge exorbitant late fees, while others might report delinquencies to credit bureaus, negatively impacting your credit score. Always clarify the lender’s policy on rollover loans; these can create a cycle of debt if not managed carefully. Finally, ensure the agreement clearly states all fees—including origination fees, processing fees, and any other charges—avoiding hidden costs that could derail your budget. If anything is unclear, ask the lender for clarification before proceeding. Don’t hesitate to seek independent financial advice if needed; understanding your loan agreement is the first step towards responsible borrowing.

Managing Your Payday Loan Debt

Creating a Budget and Repayment Plan

Creating a realistic budget is paramount to successfully repaying your payday loan. A common mistake we see is underestimating necessary expenses. In our experience, many borrowers forget to include smaller, recurring costs like subscriptions or gas. To avoid this, meticulously track your spending for a month, categorizing each expense. This will provide a clear picture of your income and outgoings, allowing you to identify areas where you can cut back. Utilize budgeting apps or spreadsheets for efficient tracking.

Next, develop a detailed repayment plan. This should clearly outline how much you can afford to pay each week or month towards the loan, factoring in your budget adjustments. Don’t just focus on the minimum payment; aim for a higher amount to pay off the debt faster and minimize interest charges. For example, if your budget allows an extra $50 per week, incorporate this into your plan. Consider setting up automatic payments to ensure you consistently meet your repayment schedule. Remember, consistently sticking to your budget and repayment plan is key to successfully managing your payday loan debt in Dayton, Ohio and avoiding further financial strain.

What to Do if You Can’t Repay Your Loan

Facing difficulty repaying your payday loan in Dayton, Ohio is a serious situation, but proactive steps can mitigate the damage. A common mistake we see is ignoring the problem, hoping it will magically disappear. This only worsens the situation, leading to escalating fees and potential damage to your credit score. Instead, immediately contact your lender. Explain your circumstances honestly and explore potential solutions like extending the repayment period or creating a payment plan. Many lenders are willing to work with borrowers facing genuine hardship. Be prepared to provide documentation supporting your financial difficulty.

Remember, seeking external help is crucial. Consider contacting a non-profit credit counseling agency. These organizations offer free or low-cost debt management services, providing guidance and negotiating with lenders on your behalf. In our experience, they can be invaluable in navigating complex financial situations. For example, a client facing overwhelming debt successfully reduced their monthly payments by 40% through a carefully structured payment plan negotiated by a credit counselor. Don’t hesitate to utilize the resources available; facing financial hardship doesn’t mean you have to face it alone. Ignoring the issue often leads to far worse outcomes than seeking help early.

Exploring Alternative Financial Solutions

Before resorting to a payday loan, explore alternatives that offer better long-term financial health. In our experience, many clients initially overlook these options, focusing solely on immediate cash needs. Consider credit counseling services, which can help you create a budget and negotiate with creditors for lower payments or debt consolidation. These agencies often offer free initial consultations and can provide valuable guidance navigating complex financial situations. For instance, one client successfully reduced their monthly debt payments by 40% through a debt management plan facilitated by a credit counselor.

Another viable option is tapping into your existing resources. Could you temporarily reduce expenses, sell unused items, or ask for an advance from your employer? A common mistake we see is overlooking readily available resources like family or friends who may be able to offer short-term financial assistance. While payday loans offer quick access to funds, they often come with high fees and interest rates that can exacerbate existing financial problems. Prioritizing alternative solutions – even those requiring more effort – can lead to more sustainable financial management and avoid a cycle of recurring debt. Remember to explore all available avenues before considering a payday loan as a last resort.

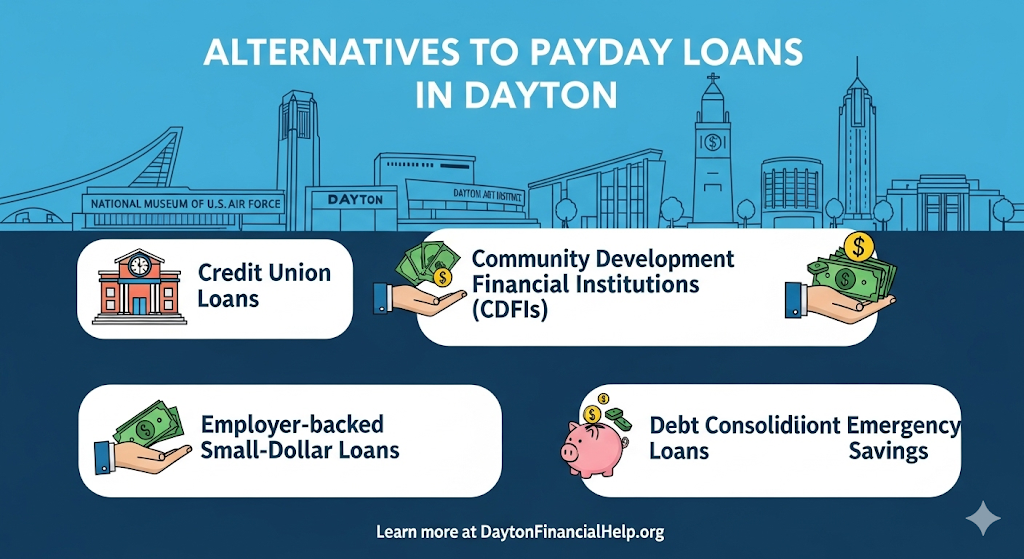

Alternatives to Payday Loans in Dayton

Personal Loans

Personal loans offer a viable alternative to payday loans, providing a structured repayment plan and often lower interest rates. In our experience, many Dayton residents find personal loans a more manageable solution for unexpected expenses. Unlike payday loans, which often trap borrowers in a cycle of debt, personal loans allow for predictable monthly payments, making budgeting significantly easier. A common mistake we see is borrowers failing to compare interest rates and terms across different lenders. Always shop around!

Before applying, carefully assess your credit score and debt-to-income ratio. Lenders consider these factors heavily. For example, a borrower with excellent credit might qualify for a personal loan with an APR of 8%, significantly less than the triple-digit interest rates common with payday loans. Conversely, someone with poor credit might face a higher interest rate, potentially making the loan less affordable. Consider exploring options like credit unions, which often offer more favorable terms to their members than traditional banks. Remember to read the fine print, understanding all fees and repayment terms before signing any loan agreement. It’s also helpful to create a detailed budget to ensure you can comfortably afford the monthly payments.

Credit Unions

Credit unions offer a compelling alternative to payday loans, providing a more responsible and often less expensive way to borrow money. In our experience, many Dayton residents are unaware of the diverse financial services available through their local credit union. Unlike payday lenders, credit unions are not-for-profit organizations focused on member well-being, offering lower interest rates and more flexible repayment options. A common mistake we see is assuming credit unions only serve those with perfect credit—this is untrue. Many offer small-dollar loans designed specifically for members needing short-term financial assistance.

To access these resources, start by researching credit unions in the Dayton area. Consider factors like membership requirements (often tied to employment or geographic location) and loan products offered. Many credit unions offer small-dollar loans, personal loans, or even secured loans using assets like a car as collateral. It’s crucial to compare interest rates, fees, and repayment terms across several institutions before deciding. Remember to carefully review the loan agreement to understand the full cost of borrowing before committing. Don’t hesitate to ask questions; credit union staff are generally highly trained and can guide you toward the best financial solution for your needs.

Community Resources

Before considering a payday loan, explore the wealth of community resources available in Dayton. Many local organizations offer financial assistance programs that can provide short-term relief without the high interest rates and potential debt traps associated with payday lending. For instance, the Dayton Foodbank not only addresses food insecurity but often connects individuals with resources for rent and utility assistance, indirectly alleviating the need for a payday loan. In our experience, many people overlook these vital connections, focusing solely on immediate cash needs. A common mistake is failing to research all available options before resorting to high-cost borrowing.

We strongly advise contacting local churches and charities. Many faith-based organizations and non-profits in Dayton run confidential financial assistance programs. These programs often have eligibility requirements, so it’s crucial to gather the necessary documentation before applying. Additionally, explore the services offered by United Way of Greater Dayton. They act as a central hub, often connecting individuals with a wide range of social service agencies, including those providing budget counseling and debt management services. Remember to thoroughly research each program’s specifics to determine the best fit for your unique circumstances. Actively pursuing these community resources can be far more beneficial in the long run than relying on the quick, but often costly, solution of a payday loan.

Frequently Asked Questions (FAQs) about Payday Loans in Dayton, OH

How much can I borrow?

The amount you can borrow with a payday loan in Dayton, Ohio, is capped by state law. Currently, Ohio limits payday loans to a maximum of $1,000, though lenders may offer smaller loan amounts. In our experience, many lenders in the Dayton area will start with a loan offer closer to the $400-$600 range for first-time borrowers, assessing creditworthiness and repayment ability before approving larger amounts. This is a crucial detail often overlooked.

Remember, the amount you *can* borrow doesn’t necessarily mean the amount you *should* borrow. A common mistake we see is borrowers requesting the maximum amount without carefully considering their ability to repay within the short timeframe, usually two to four weeks. Before applying, create a realistic budget to determine how much you can comfortably repay without impacting essential expenses. Consider exploring alternative solutions like credit counseling or negotiating payment plans with creditors if you’re facing significant financial hardship. A responsible approach is key to avoiding a debt cycle. Always borrow only what is absolutely necessary.

What are the fees and charges?

Payday loans in Dayton, Ohio, come with various fees and charges that can significantly impact the total cost. The most common is the finance charge, a percentage of the loan amount, which varies by lender but often falls between 15% and 20%. This translates to a high annual percentage rate (APR), often exceeding 400%. In our experience, borrowers often underestimate the cumulative cost. For example, a $300 loan with a 15% finance charge would incur a $45 fee, payable upon repayment. Always clarify the total repayment amount upfront.

Beyond the finance charge, you should also be aware of potential late fees, which can range from $15 to $30 or more, depending on the lender and the length of the delay. Some lenders may also levy rollover fees if you’re unable to repay on time and need to extend the loan. These fees can quickly compound, making an already expensive loan even more burdensome. A common mistake we see is borrowers failing to fully understand these additional charges, leading to unforeseen debt. Carefully review the loan agreement before signing to ensure you understand all associated costs, including any potential penalties for non-payment. Remember, comparing offers from multiple lenders is crucial to finding the most favorable terms.

What happens if I default on my loan?

Defaulting on a payday loan in Dayton, Ohio, carries significant consequences. In our experience, the most immediate impact is the accrual of late fees, which can quickly escalate the total debt owed. These fees vary by lender, but they often represent a substantial percentage of the original loan amount. For example, a $300 loan might accrue $30-$50 in late fees within a week. This can create a debt snowball effect, making repayment increasingly difficult.

Beyond late fees, lenders may pursue various collection methods. This can include repeated phone calls, emails, and even letters from debt collection agencies. More severely, your credit report will be negatively impacted, potentially lowering your credit score and making it harder to secure loans, rent an apartment, or even get a job in the future. A common mistake we see is borrowers believing the consequences are limited to their finances; however, the impact on your credit and reputation can be far-reaching and long-lasting. It’s crucial to contact your lender immediately if you anticipate difficulty repaying your loan to explore potential options like repayment plans or extensions. Ignoring the problem only exacerbates the situation.