Understanding Payday Loans Dothan, AL

What are Payday Loans and How Do They Work?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They typically involve borrowing a relatively small amount of money, often a few hundred dollars, and repaying the principal plus fees within a short period, usually two to four weeks. These loans are often marketed as a quick solution for financial emergencies, but it’s crucial to understand the potential high costs involved. Interest rates on payday loans can be exceptionally high, sometimes exceeding annual percentage rates (APRs) of 400%.

In Dothan, Alabama, as in other states, payday loan providers require borrowers to provide proof of income and a valid bank account. The loan amount is usually capped by state regulations, but borrowers should carefully review the terms and conditions before signing any agreement. Failing to repay the loan on time can lead to significant additional fees and potential damage to your credit score. “It’s vital to only borrow what you can comfortably repay within the repayment period to avoid falling into a cycle of debt.” Consider alternatives like credit counseling or borrowing from friends and family before resorting to a payday loan.

Short-Term Loan Eligibility Requirements in Alabama

Securing a payday loans dothan al , requires meeting specific eligibility criteria. Lenders typically demand proof of regular income, a valid Alabama driver’s license or state-issued ID, and an active checking account. Your income must meet a minimum threshold, often verified through pay stubs or bank statements. The lender will assess your creditworthiness, though payday loans generally don’t require pristine credit. However, a history of missed payments may hinder your application. Be aware that lenders often use alternative credit scoring methods.

It’s crucial to understand that Alabama payday loan regulations significantly impact eligibility. The state caps the amount you can borrow and sets limits on fees. “Failing to repay a loan on time can lead to significant financial consequences, including further fees and potential damage to your credit report.” Before applying for any short-term loan in Dothan, carefully review the terms and conditions. Compare offers from multiple lenders to find the most suitable option. Always prioritize responsible borrowing and ensure you can comfortably repay the loan within the stipulated timeframe to avoid a debt cycle.

The Cost of Payday Loans: APR, Fees, and Total Repayment

Payday loans in Dothan, Alabama, are notorious for their high costs. The Annual Percentage Rate (APR) on these short-term loans can easily exceed 400%, significantly higher than other forms of borrowing. This means the actual cost of the loan far surpasses the initial borrowed amount. Remember to factor in all associated fees, which can include origination fees, late payment penalties, and even rollover fees if you can’t repay on time. These fees quickly accumulate, making it crucial to understand the total repayment amount *before* signing any agreement.

“Always carefully review the loan agreement and calculate the total cost, including all fees and interest, to ensure you can afford repayment,” Before you borrow, compare offers from multiple lenders and shop around. This is vital because high-interest rates and steep fees can create a debt cycle that’s difficult to escape. Understand the implications of defaulting on a payday loan; it can severely damage your credit score and lead to further financial hardship. Responsible borrowing and thorough research are essential when considering a payday loan in Dothan.

Finding Reputable Payday Lenders in Dothan

Identifying Licensed and Regulated Lenders in Dothan, AL

Before considering any payday loan in Dothan, Alabama, verifying the lender’s licensing is crucial. The Alabama State Banking Department regulates payday lenders. You can check their website for a list of licensed lenders operating in Dothan. This simple step significantly reduces the risk of encountering fraudulent or predatory practices. Always confirm the lender’s physical address and contact information are legitimate and readily available.

Don’t hesitate to contact the Alabama State Banking Department directly if you have any doubts about a lender’s legitimacy. “Choosing a licensed and regulated lender protects you from exorbitant fees and unethical lending practices.” Look for transparency in fees and terms. Avoid lenders who pressure you into a loan or who are unwilling to answer your questions thoroughly. Remember, a reputable lender will prioritize clear communication and fair treatment. Checking the licensing status is the first step to securing a safe and responsible payday loan in Dothan, AL.

Comparing Interest Rates and Loan Terms

Before committing to a payday loan in Dothan, Alabama, meticulously compare interest rates offered by different lenders. Interest rates can vary significantly, impacting your total repayment cost. Always obtain the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including fees and interest. Don’t focus solely on the stated interest; a lower rate with hefty fees could be more expensive than a slightly higher rate with minimal additional charges.

Scrutinize loan terms carefully. Pay close attention to the repayment schedule, including the due date and the penalties for late payments. Understand the loan amount and total repayment amount to avoid unexpected surprises. “Failing to fully grasp these details can lead to unforeseen financial difficulties,” so take your time and ask clarifying questions. Consider the repayment options offered; some lenders may provide more flexible arrangements than others. This thorough comparison will help you choose the payday loan option best suited to your financial situation in Dothan.

Reading the Fine Print: Avoiding Predatory Lending Practices

Before signing any payday loan agreement in Dothan, Alabama, meticulously review all terms and conditions. Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of borrowing. High APRs often signal predatory lending. Also, carefully examine the fees; excessive charges are a red flag. Compare offers from multiple lenders to find the most favorable terms. Don’t hesitate to ask questions if anything is unclear. Understanding these details empowers you to make informed decisions.

Scrutinize the repayment terms. Understand the loan’s duration and the total amount due. Predatory lenders might structure loans with short repayment periods, leading to a debt trap. If you anticipate difficulty repaying on time, explore alternative financial solutions like credit counseling or negotiating a payment plan with creditors. “Remember, a responsible lender will work with you, not against you.” Always choose a lender licensed and compliant with Alabama’s regulations to ensure protection against illegal practices. Consider checking the Alabama Department of Banking’s website for reputable lenders and warnings against those with a history of predatory lending.

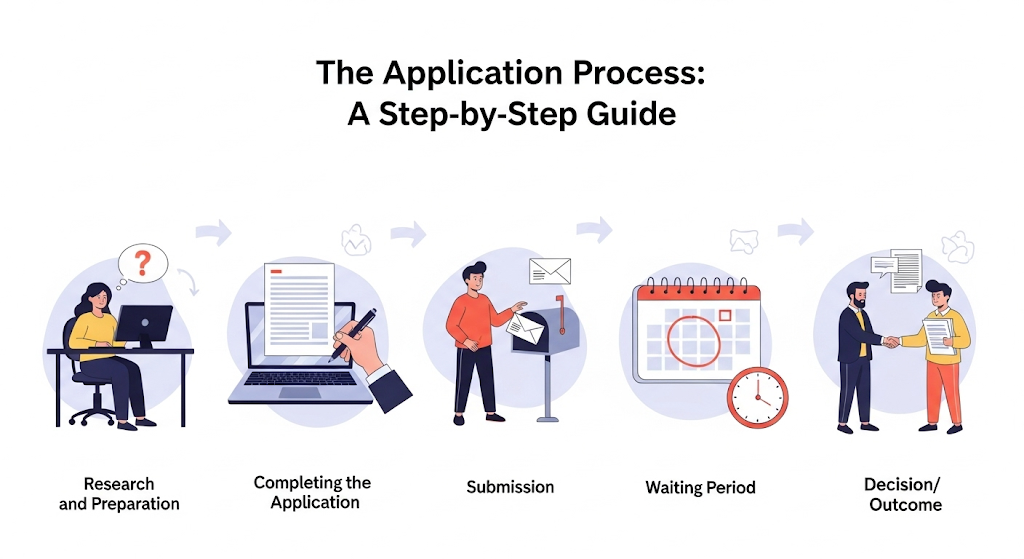

The Application Process: A Step-by-Step Guide

Gathering Necessary Documents for Your Application

Before applying for a payday loan in Dothan, Alabama, gather all necessary documents. This will streamline the application process and increase your chances of approval. You’ll typically need a valid government-issued photo ID, proof of income (like pay stubs or bank statements showing consistent deposits), and your current bank account details. Some lenders may also request proof of address, such as a utility bill. Failure to provide complete documentation can delay or prevent approval.

“It’s crucial to ensure all documents are accurate and up-to-date,” as inaccuracies can lead to rejection. Double-check all information before submitting your application. Consider making copies of everything for your records. Remember, different lenders in Dothan may have slightly different requirements. Always check the specific needs of the payday loan provider before you begin the application. Contacting the lender directly is the best way to clarify any uncertainties about required documents for a payday loan in Dothan. This proactive approach avoids delays and ensures a smoother application process.

Completing the Online or In-Person Application

Applying for a payday loan in Dothan, Alabama, whether online or in person, generally requires similar information. Expect to provide your government-issued ID, proof of income (like pay stubs or bank statements), and your active bank account details. Many lenders in Dothan use secure online portals. These platforms streamline the process. You’ll need to carefully review the loan terms and fees before submission. Incorrect information delays approval. Double-check everything!

In-person applications at a local lender will follow a similar process. Expect to complete a paper application. This process requires bringing the same documentation. Lenders usually review applications immediately. However, always inquire about their processing times. “Be prepared to answer questions about your financial situation to ensure you can repay the loan responsibly.” Choosing a reputable lender is crucial, especially in Dothan where many options exist. Carefully compare interest rates and fees. Remember, responsible borrowing is key when using payday loans.

Understanding Loan Approval and Disbursement Times

Loan approval times for payday loans in Dothan, Alabama, vary considerably depending on the lender and your individual circumstances. Many lenders offer same-day approval, particularly if you apply online and provide all necessary documentation promptly. However, it’s crucial to understand that this isn’t guaranteed. Expect a response within 24 to 48 hours in most cases. Always check the lender’s stated processing time on their website.

Once approved, the disbursement of your funds depends on your chosen payment method. Direct deposit is generally the quickest option, often transferring funds to your bank account within the same business day. However, some lenders might offer check pick-up or alternative methods, which could extend the disbursement time. “Always confirm the disbursement method and expected timeframe with your chosen lender before finalizing the application to avoid unexpected delays.” Be aware that some lenders may have stricter verification processes, leading to slightly longer processing times. This is particularly true if you’re applying for a larger loan amount or have a less-than-perfect credit history.

Responsible Borrowing and Financial Management

Creating a Realistic Budget and Repayment Plan

Before applying for a payday loan in Dothan, Alabama, meticulously track your income and expenses for at least a month. This allows you to create a realistic budget, identifying areas where you can potentially cut back. Consider using budgeting apps or spreadsheets to simplify the process. Understanding your spending habits is crucial for responsible financial management and avoiding further debt cycles. Remember, accurate budgeting is the first step towards successfully repaying any loan, including a payday loan.

Once you have a clear picture of your finances, develop a detailed repayment plan for the potential payday loan. This plan should specify the exact amount you’ll repay each pay period, ensuring you can comfortably meet your loan obligations without jeopardizing essential expenses like rent or groceries. “Failing to plan is planning to fail,” so thoroughly consider your income streams and allocate enough funds for the loan repayment *before* applying. Contact a reputable credit counselor in Dothan if you need assistance creating a budget and repayment plan; many offer free or low-cost services.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Dothan, Alabama, explore safer alternatives. Credit unions often offer small-dollar loans with more manageable repayment terms than payday loans. These loans typically have lower interest rates and avoid the debt trap many payday borrowers fall into. The National Credit Union Administration (NCUA) is a great resource for finding a local credit union. Check their website for a branch locator.

Consider budgeting apps and financial counseling services. These tools can help you manage your finances and identify areas where you can cut back. Local non-profit organizations frequently offer free financial literacy programs and debt management advice. “These resources provide crucial support to prevent unnecessary borrowing and promote long-term financial health.” Remember, responsible financial planning is key to avoiding the high-cost cycle of payday loans. Seeking professional advice is a proactive step towards achieving your financial goals.

Seeking Financial Counseling and Debt Management Resources

Facing financial hardship can be overwhelming, but help is available in Dothan, Alabama. Don’t hesitate to seek professional guidance. Credit counseling agencies offer free or low-cost financial advice and can help you create a budget, manage debt, and explore options beyond payday loans. They can also negotiate with creditors on your behalf, potentially reducing your payments. The National Foundation for Credit Counseling (NFCC) is a reputable organization that can connect you with certified counselors in your area.

Remember, proactive steps are crucial. Exploring debt management plans (DMPs) can provide a structured approach to tackling your debt. These plans consolidate multiple debts into a single, manageable monthly payment. Before committing to any debt management plan, carefully review the terms and fees. “Contacting a non-profit credit counseling agency is often the wisest first step when struggling with debt, as they offer unbiased advice and can help explore all available options.” This will allow you to make informed decisions that best suit your individual financial situation and prevent reliance on high-interest payday loans in the future.

Legal Protections and Consumer Rights in Alabama

Alabama’s Laws Governing Payday Loans

Alabama regulates payday loans, but the regulations are not as stringent as in some other states. The state allows payday loans, also known as small-dollar loans, but caps the amount a lender can charge in fees. This fee cap, however, can still result in high annual percentage rates (APRs), making these loans expensive. Borrowers should carefully review all loan terms and fees before agreeing to a loan. Understanding the total cost is crucial to avoid unforeseen financial difficulties. Failing to repay a payday loan can have serious repercussions, including damage to your credit score and potential legal action.

The Alabama Legislature has attempted to balance the need for access to credit with the protection of consumers from predatory lending practices. However, “the effectiveness of these regulations is a subject of ongoing debate among consumer advocates and the payday lending industry.” It’s vital for Dothan residents considering a payday loan to thoroughly research all available options and compare offers. Consider exploring alternatives like credit counseling or borrowing from friends and family before resorting to high-cost payday loans. Remember that responsible borrowing is key to avoiding a cycle of debt.

Understanding Your Rights as a Borrower

In Alabama, you have significant legal protections when dealing with payday loans in Dothan, or anywhere else in the state. The Alabama Legislature has capped the amount a lender can charge in fees. This helps prevent predatory lending practices that trap borrowers in cycles of debt. It’s crucial to understand the maximum allowable fees before signing any loan agreement. Carefully review the contract to ensure compliance with state regulations. Contact the Alabama Attorney General’s office if you suspect any violations.

Remember, you have the right to receive a clear and concise explanation of all loan terms and conditions. This includes the Annual Percentage Rate (APR), all fees, and the total repayment amount. Don’t hesitate to ask questions if anything is unclear. “If you feel pressured or don’t understand the terms, walk away; it’s your right to seek a loan that you fully comprehend.” Understanding your rights empowers you to make informed decisions and avoid potentially harmful high-interest payday loans in Dothan, AL. The Alabama Department of Banking oversees these regulations, providing additional resources for borrowers.

Reporting Unfair or Illegal Lending Practices

In Alabama, you have significant legal recourse if a payday lender engages in unfair or illegal practices. If you believe you’ve been subjected to predatory lending, such as excessively high interest rates exceeding Alabama’s legal limits, harassment, or deceptive advertising, you should immediately document everything. This includes loan agreements, communication records (emails, texts, voicemails), and any evidence of fees exceeding those disclosed upfront.

Reporting these issues is crucial. First, contact the Alabama Attorney General’s Office. Their Consumer Protection Division investigates complaints against payday lenders and other financial institutions. You can also file a complaint with the Consumer Financial Protection Bureau (CFPB), a federal agency with jurisdiction over payday lenders nationwide. “Failing to report these issues could leave you vulnerable to further exploitation, and reporting empowers regulators to take action against unethical lenders.” Remember to gather all supporting documentation before filing a formal complaint to strengthen your case. Consider seeking advice from a legal aid organization or consumer advocate if you need assistance navigating the reporting process.

Dothan-Specific Resources and Financial Assistance Programs

Local Non-profit Organizations Offering Financial Aid

Dothan, Alabama, boasts several dedicated non-profit organizations committed to assisting residents facing financial hardship. These organizations often provide financial aid beyond simple payday loan alternatives. They might offer budget counseling, credit repair assistance, or even emergency funds for essential expenses like rent or utilities. Before considering a payday loan, explore the resources available through these local charities. Contacting them directly is crucial, as programs and availability can change.

To find suitable financial assistance programs in Dothan, start by searching online for local charities and non-profits. Websites like the United Way of Southeast Alabama often list affiliated organizations offering direct aid. The Wiregrass United Way, for example, serves a wide area including Dothan and may connect you with emergency financial assistance. Remember that eligibility criteria vary. “Thorough research and direct communication with these organizations are key to accessing available help, and greatly reduces the need for high-interest payday loans.” Don’t hesitate to reach out; many non-profits are equipped to guide you towards the best support for your specific situation.

Government Assistance Programs Available in Dothan

Dothan residents facing financial hardship can explore several government assistance programs. The Department of Human Resources (DHR) offers crucial support, including Temporary Assistance for Needy Families (TANF), which provides cash assistance and supportive services to eligible families. They also administer the Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, helping families afford groceries. The Medicaid program provides healthcare coverage for low-income individuals and families, alleviating the stress of unexpected medical bills. It’s essential to check eligibility requirements and application processes on the DHR website or by contacting their local office.

Eligibility for these programs varies. Factors such as income, household size, and residency are considered. “Successfully navigating the application process often requires patience and persistence, and seeking help from local non-profit organizations can be invaluable.” These organizations frequently offer assistance with applications and understanding program guidelines. Remember, accessing available government aid is a crucial step in managing financial challenges and avoiding reliance on high-interest payday loans. For detailed information on specific programs and their application processes, it’s recommended to visit the official Alabama Department of Human Resources website.

Community Resources for Debt Management and Financial Literacy

Dothan residents facing financial hardship can access valuable resources for debt management and improved financial literacy. The Wiregrass Area United Way is a significant organization offering various programs, including financial counseling and workshops designed to teach budgeting skills and responsible money management. They often partner with local agencies to provide comprehensive assistance, guiding individuals toward long-term financial stability and helping them avoid predatory lending practices like excessive reliance on payday loans. Contacting them is a crucial first step for those seeking to regain control of their finances.

Beyond the United Way, exploring local credit counseling agencies is highly recommended. These agencies typically offer free or low-cost services, such as debt consolidation advice and budgeting consultations. They can provide personalized strategies to manage existing debt, negotiate with creditors, and develop a realistic plan to avoid future financial difficulties. “Remember, seeking professional help is a sign of strength, not weakness, especially when dealing with the complex world of debt management.” Many agencies also offer financial literacy classes, equipping individuals with the tools and knowledge necessary to make informed financial decisions. A quick online search for “credit counseling Dothan Alabama” will reveal local options.