Understanding Payday Loans Greenville SC

Defining Payday Loans and their Purpose

Payday loans in Greenville, SC, are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They’re typically due on your next payday, hence the name. These loans are often used for unexpected expenses like car repairs or medical bills, situations where immediate cash is needed. Borrowers should carefully consider the high cost of these loans, however, as interest rates and fees can significantly increase the total repayment amount. Understanding the terms and conditions is crucial before applying.

The purpose of a payday loan is to provide quick access to funds when facing a financial emergency. While convenient, they are not a solution for long-term financial problems. “Using payday loans to cover ongoing expenses can create a cycle of debt that’s difficult to break.” It’s vital to explore alternative solutions, such as budgeting, seeking financial counseling, or considering other less expensive borrowing options before resorting to a payday loan. Always compare lenders and their associated fees before making a decision. Remember, responsible borrowing practices are key to avoiding financial hardship.

How Payday Loans Work in South Carolina

In South Carolina, payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. Borrowers typically write a post-dated check to the lender for the loan amount plus fees. The lender holds the check until the agreed-upon repayment date. South Carolina law limits the amount you can borrow and the fees lenders can charge. Interest rates are often very high, so carefully consider the total cost before borrowing. “Understanding these costs is crucial to avoid getting trapped in a cycle of debt.”

South Carolina regulates payday lending to protect consumers. However, these loans remain expensive. Before seeking a Greenville payday loan, explore all available options. Consider alternatives like credit counseling services, negotiating with creditors, or borrowing from family and friends. Always compare offers from multiple lenders to find the best terms. “Remember that responsible borrowing is key to avoiding financial hardship.” The South Carolina Department of Consumer Affairs offers resources to help consumers understand their rights and responsibilities related to payday lending.

Interest Rates and Fees in Greenville

Payday loans in Greenville, SC, are notorious for their high interest rates. These rates are often expressed as an Annual Percentage Rate (APR), but the actual cost can be significantly higher due to various fees. Expect to pay significantly more than you initially borrow. Always thoroughly review the loan agreement before signing. South Carolina, like many states, regulates payday lending, but the regulations may not fully protect borrowers from exploitative practices. Understanding the total cost is crucial before committing.

Researching specific lenders in Greenville is important, as rates and fees can vary considerably. Some lenders may advertise lower APRs but include hefty origination fees or other hidden charges. “Compare multiple offers from different lenders before making a decision to avoid falling prey to predatory lending practices.” Check the lender’s reputation with the Better Business Bureau (BBB) and online review sites. Transparency is key. A reputable lender will clearly outline all fees and charges upfront. Don’t hesitate to ask questions if anything is unclear.

Finding Reputable Lenders in Greenville, SC

Identifying Licensed and Regulated Lenders

Before you borrow from any payday loan lender in Greenville, SC, always verify their licensing. The South Carolina Department of Consumer Affairs (SCDCA) regulates payday lenders. Check their website to confirm a lender’s license status and ensure they are operating legally. Avoid unlicensed lenders; they often operate without the consumer protections afforded by state regulations. “Using an unlicensed lender puts you at significantly higher risk of predatory practices and scams.”

Look beyond just licensing. A reputable lender will be transparent about fees and interest rates. They should clearly explain all terms and conditions in simple language. Scrutinize reviews and testimonials from past customers. Online resources like the Better Business Bureau (BBB) can offer valuable insights into a lender’s reputation. Don’t hesitate to contact the SCDCA with any questions or concerns about a specific lender. “Choosing a licensed and reputable lender is crucial to protecting yourself from potential financial harm.”

Comparing Interest Rates and Loan Terms

Before committing to a payday loan in Greenville, SC, meticulously compare interest rates from multiple lenders. Don’t just look at the advertised APR (Annual Percentage Rate); also examine any additional fees. These fees, such as origination or late payment charges, can significantly impact your total cost. Remember that even a small percentage difference in APR can translate into substantial savings or losses over the loan’s term. Always request a complete breakdown of all costs upfront.

Consider the loan’s terms beyond the interest rate. Loan terms typically include the repayment period (often two to four weeks for payday loans), and the allowed repayment methods. Shorter repayment periods generally mean higher payments, while longer terms might have higher overall interest charges. Carefully assess your budget and repayment capacity to avoid default. “Choosing a lender with flexible repayment options can provide a safety net if unexpected expenses arise.” Finally, check for any prepayment penalties; some lenders charge extra fees for early repayment.

Checking Online Reviews and Testimonials

Before choosing a payday loan lender in Greenville, SC, thoroughly investigate their online presence. Check major review sites like Google Reviews, Yelp, and the Better Business Bureau (BBB). Look for patterns in customer feedback. Positive reviews highlighting fair interest rates, transparent terms, and helpful customer service are good signs. Conversely, numerous complaints about aggressive collection practices or hidden fees should raise red flags. Remember, a lender’s online reputation is a crucial indicator of their reliability and ethical practices.

Don’t just read the star ratings; delve into the actual comments. Pay close attention to specific details. Are customers satisfied with the loan application process? Were there any unexpected charges? Did the lender handle late payments reasonably? “Reading detailed reviews gives you a much clearer picture than simply looking at an average rating,” allowing you to make an informed decision. Consider the volume of reviews as well; a lender with few reviews may lack sufficient history to assess their trustworthiness fully. Always cross-reference reviews across multiple platforms for a more balanced perspective.

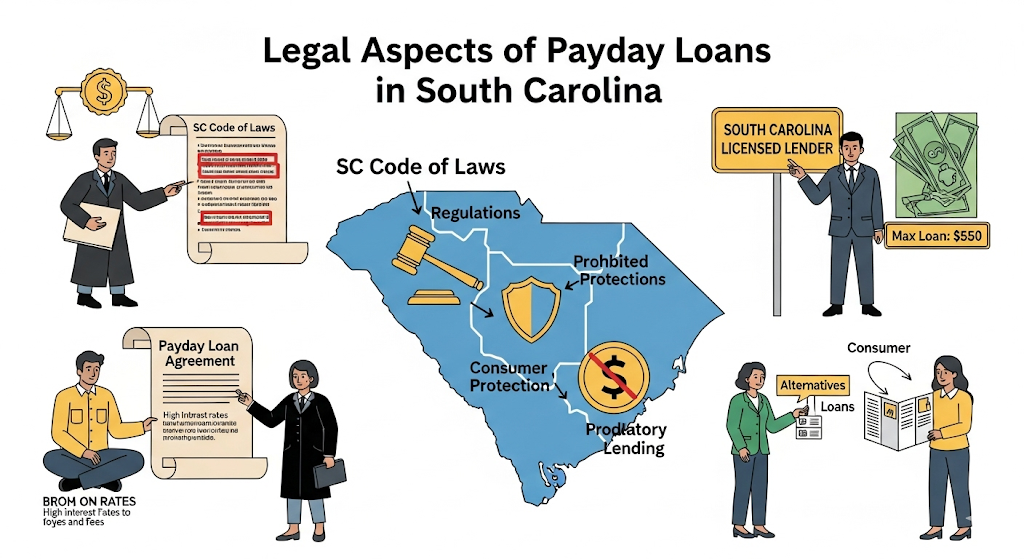

Legal Aspects of Payday Loans in South Carolina

South Carolina’s Payday Lending Laws

South Carolina’s regulatory framework for payday loans is complex. The state allows payday loans, but with significant restrictions. These loans are capped at $550, excluding fees. Interest rates are limited, although the effective annual percentage rate (APR) can still be quite high. Borrowers should carefully review all terms before signing any agreement. Understanding the fees and charges is critical to avoid unexpected costs. “Failing to do so can lead to a debt trap, making it difficult to repay the loan.”

Crucially, South Carolina law limits the number of outstanding payday loans a borrower can have at one time. This is designed to prevent individuals from accumulating excessive debt. Loan rollovers are also restricted. These limitations aim to protect consumers from predatory lending practices. Before obtaining a payday loan in Greenville, SC, or anywhere else in the state, thorough research into the lender and a complete understanding of the state’s regulations are essential. “Always compare offers from multiple lenders to find the best terms and avoid hidden fees.” The South Carolina Department of Consumer Affairs website provides helpful resources on payday lending regulations and consumer protection.

Avoiding Predatory Lending Practices

South Carolina has specific regulations governing payday loans, designed to protect consumers from exploitative practices. Before borrowing, carefully compare interest rates and fees across different lenders in Greenville. Avoid lenders who pressure you into a loan or who have unclear terms and conditions. “Always read the fine print thoroughly before signing any agreement.” Look for reputable lenders with transparent fee structures, and be wary of lenders offering loans with excessively high interest rates or hidden charges.

Understanding your rights is crucial in avoiding predatory payday loan practices. The South Carolina Department of Consumer Affairs provides valuable resources and guidance on responsible borrowing. If you feel a lender is engaging in unfair or deceptive practices, contact the state’s Attorney General’s office or a consumer protection agency. Document all interactions with lenders, including loan agreements and payment confirmations. “By being informed and vigilant, you can significantly reduce your risk of falling victim to predatory lending.”

Understanding Your Rights as a Borrower

In South Carolina, borrowers have crucial protections against predatory lending practices associated with payday loans in Greenville, SC. The South Carolina Department of Consumer Affairs oversees payday lenders, ensuring compliance with state regulations. These regulations often cap interest rates and fees, preventing exorbitant charges. Before signing any payday loan agreement, carefully review all terms and conditions. Understand the annual percentage rate (APR) and all associated fees. Don’t hesitate to ask questions if anything is unclear. “A clear understanding of the loan terms is your first line of defense against unexpected costs.”

If you encounter difficulties repaying your payday loan, explore available options. Contact the lender immediately to discuss potential repayment plans or extensions. South Carolina offers resources to help consumers in financial distress. These resources may include credit counseling services or debt management programs. Consider exploring these options before resorting to additional loans, which can create a cycle of debt. Remember, defaulting on a payday loan can severely damage your credit score, potentially impacting future borrowing opportunities. Always prioritize seeking help when struggling to meet your financial obligations.

Responsible Borrowing and Financial Planning

Creating a Realistic Budget

Before considering a payday loan in Greenville, SC, meticulously track your income and expenses for at least a month. Use budgeting apps or spreadsheets to categorize spending (housing, food, transportation, etc.). This detailed picture reveals where your money goes. Identify areas where you can cut back. Even small savings add up. For example, reducing daily coffee shop visits or canceling unused subscriptions can free up significant funds over time.

Prioritize essential expenses like rent, utilities, and groceries. These are non-negotiable. Allocate funds for these needs first. Then, allocate funds for debt repayment, including any existing loans or credit card balances. Only after meeting these crucial obligations should you consider discretionary spending. “Failing to create a realistic budget significantly increases the risk of falling into a cycle of debt, particularly when relying on high-interest payday loans.” Remember, a solid budget is your strongest defense against financial hardship and the need for short-term loans.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Greenville, SC, explore financially sound alternatives. Credit unions often offer small-dollar loans with more manageable interest rates than payday lenders. The National Credit Union Administration (NCUA) insures these loans, offering a level of security payday loans lack. Check with your local credit union for eligibility requirements and available options. They may also provide financial counseling to help you better manage your budget.

Consider budgeting apps and free financial counseling services available in Greenville, SC. These resources can help you create a realistic budget, identify areas for savings, and develop a plan to pay off existing debts. The United Way of Greenville County, for example, offers financial stability programs. “Exploring these options before resorting to high-interest payday loans can save you significant money and prevent a cycle of debt.” Remember, responsible financial planning is key to long-term financial health.

Seeking Financial Counseling and Resources

Facing financial hardship can be overwhelming, but help is available in Greenville, SC. Before considering a payday loan, explore free financial counseling services. Many reputable non-profit organizations offer budgeting assistance, debt management strategies, and guidance on navigating challenging financial situations. These services can provide a personalized plan to address your immediate needs and prevent future reliance on high-interest loans like short-term loans or payday advances.

Consider contacting the Consumer Credit Counseling Service (CCCS) or a similar local agency. They offer credit counseling and can help you create a budget, explore debt consolidation, and develop long-term financial stability. “Remember, seeking professional guidance is a sign of strength, not weakness, and can save you from the potential pitfalls of predatory lending practices.” Prioritizing responsible financial management through these resources is crucial before turning to short-term loans as a last resort. Explore all available options to avoid the high costs often associated with payday loans in Greenville, SC.

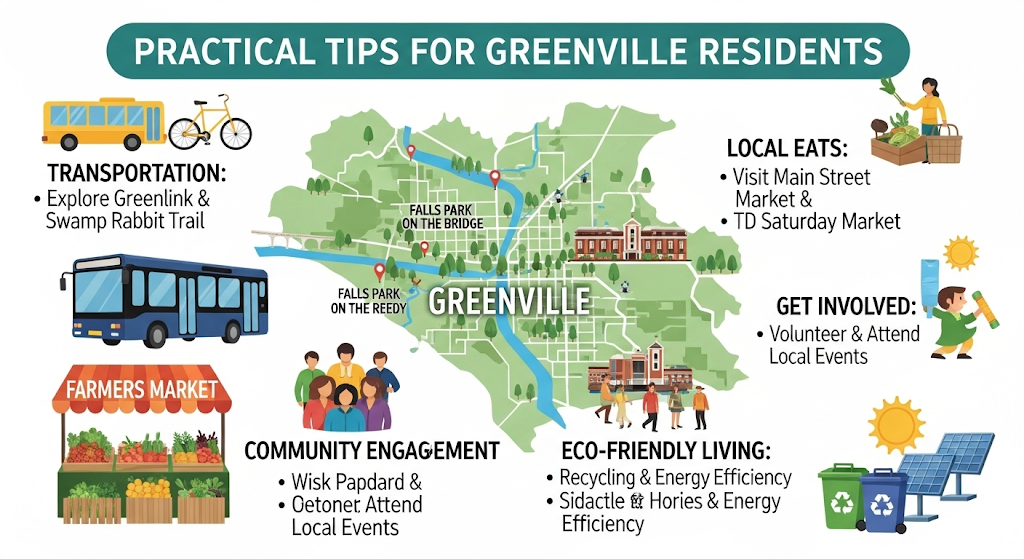

Practical Tips for Greenville Residents

Budgeting and Expense Tracking

Before considering a payday loan in Greenville, SC, meticulously track your income and expenses. Use budgeting apps, spreadsheets, or even a simple notebook to monitor your spending habits. Identify areas where you can cut back. This detailed record provides a clear picture of your financial situation. This crucial step helps determine if a short-term loan is truly necessary, or if alternative solutions, like negotiating with creditors or exploring free financial counseling services offered by organizations like the United Way, might be more suitable.

Careful expense tracking helps you create a realistic budget. This budget should prioritize essential expenses like rent, utilities, and groceries. By understanding your spending patterns, you can identify unnecessary expenses and adjust your budget accordingly. “This proactive approach minimizes the risk of falling into a cycle of debt, a common pitfall associated with frequent payday loan reliance.” Remember, responsible financial management is key to avoiding the high-interest rates and fees associated with these loans. Consider exploring community resources and credit counseling before resorting to a payday loan as a last resort.

Local Resources for Financial Assistance

Facing financial hardship in Greenville, SC? Don’t despair. Several local organizations offer vital financial assistance programs to help residents avoid predatory payday loans. The United Way of Greenville County, for example, maintains a comprehensive online resource directory connecting individuals with numerous local charities offering emergency financial aid. These charities often provide budget counseling, assistance with utility bills, or even short-term financial grants. Remember to thoroughly research each organization’s eligibility requirements.

Beyond the United Way, explore resources like the Greenville Housing Authority, which offers programs to assist low-income families with housing and financial stability. Local churches and faith-based organizations frequently provide similar support, often offering confidential counseling and guidance. “Always verify the legitimacy of any organization before sharing sensitive financial information.” Remember, researching and utilizing these free resources is crucial before considering a high-interest payday loan in Greenville, SC. These local resources can provide the support needed to navigate difficult financial times effectively and responsibly.

Long-Term Financial Planning Strategies

Escaping the cycle of payday loans in Greenville, SC requires proactive financial planning. Budgeting is key. Track your income and expenses meticulously. Identify areas where you can cut back. Even small savings add up over time. Consider using budgeting apps or working with a financial counselor for personalized guidance. Many free resources are available locally through credit unions or non-profit organizations. “Building a solid budget is the foundation for long-term financial stability, preventing future reliance on high-interest loans.”

Once you have a budget, focus on building an emergency fund. Aim for three to six months’ worth of living expenses. This safety net protects you from unexpected costs, eliminating the need for a payday loan. Slowly increase your savings each month. Explore options like high-yield savings accounts to maximize your returns. Consider automating your savings to make it effortless. “A robust emergency fund is your best defense against financial emergencies and the temptation of predatory lending practices like payday loans.”

Frequently Asked Questions about Payday Loans in Greenville

What is the maximum loan amount?

South Carolina law dictates the maximum amount you can borrow with a payday loan. This limit isn’t set at a statewide flat rate, but rather is tied to your ability to repay. Lenders in Greenville, SC, must assess your income and expenses to determine a responsible loan amount. They cannot exceed a limit that would be considered predatory or unaffordable. Always check the lender’s specific terms and conditions.

While you might see advertisements promising large sums, be wary of lenders who don’t follow South Carolina’s regulations. “The actual maximum you can borrow will vary greatly depending on individual circumstances and the lender’s policies, but exceeding legal lending limits is a serious offense.” Remember, the goal is responsible borrowing, and a reputable lender will work within the confines of the law to offer you a manageable loan amount. If you’re unsure, contacting the South Carolina Department of Consumer Affairs is recommended for further clarity on regulations concerning payday loans in Greenville, SC.

How long is the repayment period?

Payday loans in Greenville, SC, typically have a short repayment period. Most lenders offer loans due on your next payday, usually within two to four weeks. This short timeframe is designed to cover unexpected expenses until your next paycheck arrives. However, some lenders may offer slightly longer terms, but always confirm the exact repayment schedule *before* signing any agreement. Be aware that extending the loan may lead to additional fees.

It’s crucial to understand the implications of this short repayment window. “Failing to repay on time can result in significant penalties and increased debt,” impacting your credit score and financial stability. Before applying for a payday loan, carefully assess your budget and ensure you can comfortably repay the loan in full by the due date. Consider exploring alternative financial solutions, like credit counseling or small loans from credit unions, if a payday loan seems too risky given your current financial situation. Always prioritize responsible borrowing practices.

What if I cannot repay the loan?

Failing to repay a payday loan in Greenville, SC, has serious consequences. Your lender will likely attempt to collect the debt through repeated phone calls and letters. They may also report your delinquency to credit bureaus, harming your credit score and making it harder to obtain loans or credit cards in the future. South Carolina law allows for specific collection practices, so understanding your rights is crucial. Consider seeking advice from a consumer credit counselor if you are facing repayment difficulties.

More severe actions can include wage garnishment or lawsuits. Lenders can pursue legal action to recover the debt plus fees and interest. “This can lead to significant financial hardship, potentially impacting your bank accounts and other assets.” Before reaching this point, explore all available options, including negotiating a payment plan with your lender. Remember that ignoring the problem will only worsen the situation. Proactive communication with your lender is often the best approach to managing a challenging financial situation. Ignoring communication will only exacerbate the problem.