Understanding payday loans Houma, LA

What are payday loans and How Do They Work?

Payday loans Houma LA, are short-term, small-dollar loans designed to bridge the gap until your next paycheck. They’re typically repaid on your next payday, hence the name. Borrowers typically provide a post-dated check or authorize electronic access to their bank account for repayment. In our experience, the most crucial aspect to understand is the high cost. These loans carry significantly higher interest rates than traditional loans, often expressed as an Annual Percentage Rate (APR), which can reach several hundred percent. A common mistake we see is borrowers underestimating the total repayment amount due to the deceptive simplicity of the initial loan offer.

The application process is usually straightforward, often completed online or in-person at a lender’s location. You’ll need to provide proof of income, a valid ID, and bank account information. Lenders assess your ability to repay based on your income and existing financial obligations. Remember that while convenient, payday loans are intended for emergency use only. Consider alternatives like credit union small loans or seeking financial counseling before resorting to a payday loan, especially if you foresee difficulty repaying on time. Failure to repay can lead to additional fees and negatively impact your credit score, potentially making it harder to secure loans in the future.

Payday Loan Laws and Regulations in Louisiana

Louisiana’s regulatory landscape for payday loans is complex. The state permits payday lending, but under strict regulations designed to protect consumers. A key aspect is the loan amount limit, currently capped at $350. Lenders are prohibited from rolling over loans, meaning borrowers must repay the principal and fees by the due date. This is designed to prevent borrowers from falling into a cycle of debt, a common pitfall we see with unregulated payday loans in other states. Interest rates are capped, though the effective annual percentage rate (APR) can still be quite high, often exceeding 300%, highlighting the need for careful consideration before borrowing.

Borrowers should be acutely aware of all fees and charges associated with a payday loan in Louisiana. These can significantly impact the total cost. For instance, a seemingly small fee can inflate the overall cost when compounded over the loan’s term. In our experience, many borrowers underestimate these additional costs. Before signing any agreement, carefully review all terms and conditions, paying particular attention to the repayment schedule and potential penalties for late payment. Understanding these intricacies is crucial to making an informed decision and avoiding potential financial hardship. Always explore alternative financing options before resorting to a payday loan if possible. Seeking advice from a financial counselor can provide a valuable alternative perspective.

Who Qualifies for a Payday Loan in Houma?

Securing a payday loan in Houma, LA, hinges on meeting specific lender criteria. While requirements vary slightly between lenders, several common factors determine eligibility. In our experience, most lenders prioritize a consistent income source, typically demonstrated through pay stubs or bank statements showing regular deposits. This income needs to be sufficient to cover the loan repayment along with your existing financial obligations. A common mistake we see is applicants underestimating their existing debt burden, leading to loan applications being denied.

Beyond income verification, lenders also assess your credit history. While payday loans are often marketed to individuals with less-than-perfect credit, a demonstrably poor credit score can still hinder approval. Lenders will typically examine your credit report for signs of financial irresponsibility, such as late payments or bankruptcies. Furthermore, you’ll generally need a valid government-issued ID, proof of residency in Houma, and an active checking account for direct deposit of the loan and subsequent repayment. Remember, meeting the minimum requirements doesn’t guarantee approval; a strong application showing responsible financial management significantly increases your chances of securing a payday loan.

Finding Reputable Payday Lenders in Houma

How to Compare Payday Loan Lenders

Comparing payday loan lenders requires a keen eye for detail. Don’t just focus on the advertised interest rate; that’s only part of the picture. In our experience, many borrowers overlook crucial factors like fees. Some lenders bury hefty origination fees or other charges in the fine print, significantly increasing the actual cost of borrowing. Always calculate the Annual Percentage Rate (APR), which reflects the total cost, including fees, to get a true comparison. A common mistake we see is solely focusing on the lowest interest rate without considering the overall APR.

To effectively compare, gather information from multiple lenders. Create a simple spreadsheet to list key details such as the APR, loan amount, repayment terms, and any associated fees. Check online reviews on sites like the Better Business Bureau (BBB) to gauge customer satisfaction and identify potential red flags. Look for lenders licensed by the Louisiana Office of Financial Institutions. Don’t hesitate to contact several lenders directly to ask questions about their policies and procedures. For example, inquire about their process for handling late payments and potential consequences. Thorough comparison shopping can save you considerable money and frustration in the long run.

Identifying Legitimate vs. Predatory Lenders

Distinguishing between legitimate and predatory payday lenders in Houma requires careful scrutiny. In our experience, a common red flag is excessively high interest rates far exceeding the Louisiana state-mandated limits. Always confirm the Annual Percentage Rate (APR) and compare it to the legal maximum before proceeding. Predatory lenders often obfuscate fees, making the true cost of borrowing unclear. Look for lenders who transparently list all charges upfront, avoiding hidden fees or surprise costs. A legitimate lender will readily provide this information; if they’re hesitant, proceed with caution.

Another crucial aspect is the lender’s licensing and registration. Legitimate payday loan providers in Louisiana are required to possess the necessary licenses and adhere to state regulations. You can verify a lender’s license through the Louisiana Office of Financial Institutions. A lack of transparency regarding licensing or a refusal to provide this information is a major warning sign. Remember, comparing multiple lenders is key to finding competitive rates and terms. Don’t rush the process; take your time to research and compare options before committing to a loan. Ignoring these steps can lead to financial hardship.

Checking Lender Reviews and Testimonials

Before applying for a payday loan in Houma, LA, thoroughly investigate potential lenders. Don’t rely solely on advertising; actively seek out and analyze customer reviews and testimonials. In our experience, neglecting this crucial step often leads to borrowers encountering hidden fees or predatory lending practices. Look for reviews across multiple platforms – Google reviews, the Better Business Bureau website, and independent financial review sites. Pay close attention to the frequency and consistency of positive and negative feedback. A few isolated negative reviews are understandable, but a pattern of complaints should raise serious red flags.

A common mistake we see is focusing only on the star rating. Instead, delve into the specifics of each review. Look for mentions of transparency in fees, the lender’s responsiveness to customer inquiries, and the overall ease of the borrowing process. For instance, a lender consistently praised for its clear communication and efficient repayment options is likely a more reputable choice than one with numerous complaints about unclear terms or aggressive collection tactics. Remember, reading a diverse range of reviews – both positive and negative – provides a more balanced perspective and helps you make an informed decision about which payday lender in Houma best suits your needs.

The Payday Loan Application Process: A Step-by-Step Guide

What Documents Will you need?

Securing a payday loan in Houma, LA, requires providing specific documentation to verify your identity and financial standing. Lenders will typically request a government-issued photo ID, such as a driver’s license or state ID card. In our experience, failing to provide a valid, unexpired ID is the most common reason for application delays. You’ll also need proof of income, which can be a recent pay stub, bank statement showing direct deposit, or tax return documentation. The lender will need to verify that you have a consistent income stream sufficient to repay the loan.

Beyond the basics, be prepared to provide additional documentation depending on the lender and loan amount. Some lenders might ask for proof of address, such as a utility bill or bank statement showing your current address. They may also request your Social Security number to verify your identity and creditworthiness. A common mistake we see is borrowers assuming only a pay stub suffices for income verification; always double-check the lender’s specific requirements beforehand. Finally, be aware that some lenders may utilize alternative verification methods, such as accessing your bank account information directly, to streamline the process. Always review the lender’s privacy policy carefully before providing this level of access.

Online vs. In-Person Applications

Choosing between an online and in-person payday loan application in Houma, LA, depends heavily on your personal preferences and circumstances. In our experience, online applications offer unmatched convenience. Many lenders boast streamlined digital platforms, allowing you to complete the entire process from your phone or computer, 24/7. This eliminates travel time and the need to adjust your schedule around a lender’s business hours. However, a common mistake we see is applicants overlooking the importance of thoroughly reading the terms and conditions before electronically signing the agreement.

Conversely, applying in person provides a more immediate interaction with a loan officer. This can be beneficial for borrowers who prefer a face-to-face consultation to clarify any doubts or discuss their specific financial situation. For example, if you have a complex financial history or require personalized guidance, an in-person application can offer more clarity and support. While some may find the in-person process less efficient, it allows for immediate feedback and potential troubleshooting of any application issues. Remember to always compare interest rates and fees from multiple lenders, regardless of your application method, to ensure you are securing the best possible terms for your payday loan in Houma.

Understanding the Loan Terms and Fees

Before accepting a payday loan in Houma, LA, meticulously review all loan terms and fees. A common oversight is failing to fully understand the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including interest and fees. In our experience, many borrowers underestimate the true cost, leading to unexpected debt burdens. For example, a seemingly small loan of $300 might carry a hefty APR of 400% or more, resulting in significantly higher repayment amounts. Always obtain a detailed breakdown of all charges, including origination fees, late payment penalties, and any potential rollover fees.

Scrutinize the repayment terms carefully. Payday loans typically have short repayment periods, often just two to four weeks. Missing a payment can trigger substantial penalties, further escalating your debt. Some lenders may offer extended repayment plans, but these often come with additional fees. Consider the implications of the repayment schedule on your budget. Can you comfortably afford the repayment amount given your other financial commitments? If unsure, seek free financial counseling to explore alternative options before committing to a payday loan. Remember, comparing offers from multiple lenders is crucial to securing the most favorable terms and fees.

Managing Your Payday Loan Responsibly

Creating a Budget to Repay Your Loan

Creating a realistic budget is crucial for successfully repaying your payday loan in Houma, LA. In our experience, many borrowers underestimate the total repayment amount, leading to missed payments and added fees. A common mistake we see is failing to account for all essential expenses, such as rent, utilities, groceries, and transportation. Before even considering the loan, meticulously track your spending for at least a month to understand your baseline expenses. Categorize your spending to identify areas where you can cut back.

To create a repayment plan, first list all your income sources, including your regular paycheck and any additional income. Then, subtract your essential expenses. The remaining amount should cover your payday loan repayment. If the remaining funds are insufficient, consider exploring options like reducing non-essential spending (e.g., dining out, entertainment) or seeking assistance from a credit counselor. Remember, prioritizing loan repayment prevents the accumulation of late fees, which can quickly spiral your debt out of control. For example, a $300 loan with a 15% fee for late payment could rapidly increase to a significant amount. A detailed, realistic budget is your best defense against financial hardship.

Avoiding the Debt Trap: Tips for responsible Borrowing

Before taking out a payday loan in Houma, LA, carefully assess your budget and ensure you can comfortably repay the loan on your next payday. A common mistake we see is borrowers underestimating the total cost, including fees and interest. In our experience, accurately projecting your income and expenses for the repayment period is crucial. Failing to do so can lead to a cycle of repeated borrowing, ultimately trapping you in a debt spiral. Consider alternatives like negotiating with creditors or seeking financial counseling before resorting to a payday loan.

To avoid the debt trap, prioritize paying off the loan immediately upon receiving your next paycheck. Create a dedicated repayment plan, budgeting specifically for this obligation. Consider setting up automatic payments to avoid late fees. Building a financial safety net through savings, even a small emergency fund, is critical. This minimizes reliance on high-interest short-term borrowing for unexpected expenses. Remember, while payday loans offer quick access to cash, responsible management is paramount to avoiding long-term financial hardship. Always borrow only what you absolutely need and explore all alternative options first.

What to Do If You Can’t Repay Your Loan

Facing difficulty repaying your payday loan in Houma, LA, is a serious situation, but proactive steps can mitigate the consequences. A common mistake we see is ignoring the lender; this only exacerbates the problem. Instead, immediately contact your lender. Explain your circumstances honestly and transparently. Explore options like extending the repayment period or negotiating a payment plan. In our experience, lenders are often willing to work with borrowers who demonstrate genuine effort to resolve the debt. Remember to document all communication, including dates, times, and agreements reached.

Consider seeking help from a reputable credit counseling agency. These agencies offer free or low-cost guidance on managing debt, including payday loans. They can help you create a budget, prioritize your debts, and negotiate with creditors. Furthermore, exploring debt consolidation may be a viable option, combining multiple debts into one manageable payment. However, be wary of predatory lenders offering seemingly easy solutions. Always thoroughly research any financial institution before engaging their services. Ignoring the issue only leads to escalating fees and potential legal repercussions. Taking swift action is key to resolving your financial difficulties.

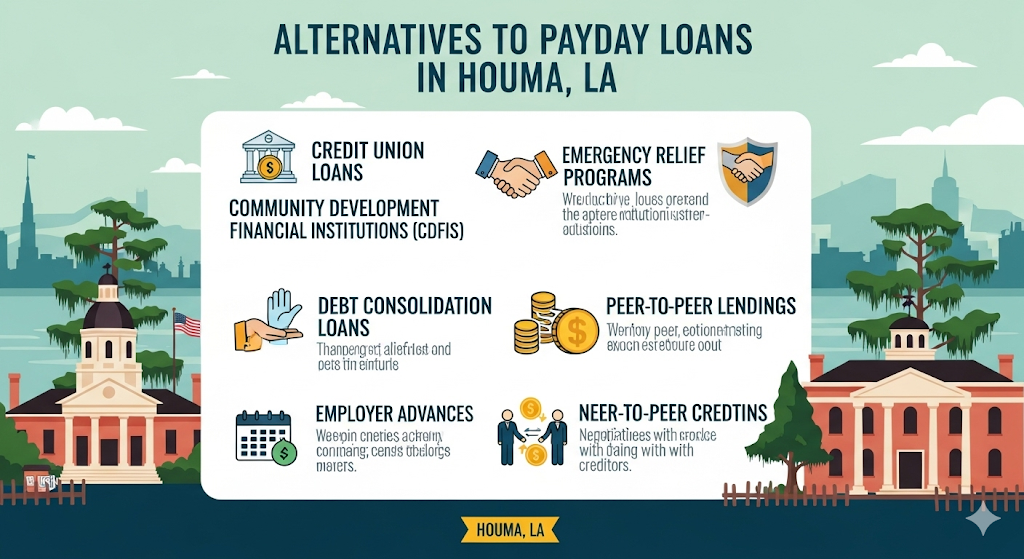

Alternatives to Payday Loans in Houma, LA

Exploring Personal loans and Installment Loans

Personal loans and installment loans offer viable alternatives to payday loans, providing more manageable repayment structures and potentially lower overall costs. A key difference lies in their repayment terms: personal loans typically span several months to several years, while installment loans often have shorter terms, but still longer than the typical two-week payday loan. In our experience, borrowers often find the extended repayment period of these loans less stressful than the rapid repayment demanded by payday lenders. This allows for better budgeting and reduces the risk of default.

Consider the example of Maria, who needed $1,000 for unexpected car repairs. A payday loan would have burdened her with high interest and a short repayment period. Instead, she secured a personal loan with a lower APR and a 24-month repayment plan, significantly easing her financial pressure. When comparing options, scrutinize the Annual Percentage Rate (APR) carefully—it reflects the total cost of borrowing. Always explore multiple lenders to compare rates and terms. Remember, responsible borrowing involves understanding the loan’s total cost and ensuring you can comfortably meet the monthly payments. Failing to do so can lead to further financial difficulties.

Credit Unions and Community Banks as Alternatives

Credit unions and community banks often provide more affordable and flexible lending options than payday loans. Unlike payday lenders, these institutions prioritize building long-term relationships with their members and customers. In our experience, credit unions frequently offer small-dollar loans with significantly lower interest rates and more manageable repayment terms. For example, a credit union might offer a loan with an APR of 18%, compared to the triple-digit APRs common with payday loans. This difference can dramatically impact your overall cost.

A common mistake we see is overlooking the potential for secured loans at these institutions. If you have savings or own an asset like a car, using it as collateral can dramatically improve your chances of approval and secure a lower interest rate. Community banks also frequently participate in government-backed loan programs designed to help individuals in need, such as those offered by the Small Business Administration (SBA). These programs often have more lenient credit requirements than traditional banks or payday lenders. Before resorting to a high-cost payday loan, explore the lending options available at your local credit union or community bank – it could save you considerable financial hardship in the long run.

Budgeting and Financial Planning Resources

Mastering your finances is crucial to avoiding the high-cost cycle of payday loans. In our experience, many Houma residents struggle with budgeting, leading them to seek short-term loans. A common mistake we see is underestimating monthly expenses. Start by meticulously tracking every dollar spent for a month using budgeting apps like Mint or Personal Capital, or even a simple spreadsheet. Categorize your spending to identify areas where you can cut back. For example, reducing dining out or entertainment expenses can free up significant funds.

Beyond tracking, consider creating a realistic budget. This involves forecasting your income and expenses for the coming months, aiming for a surplus rather than a deficit. Many free resources are available online, including the Consumer Financial Protection Bureau (CFPB) website, which offers guides and worksheets. Local organizations like credit unions frequently provide free financial literacy workshops and one-on-one counseling. These services can help you develop a personalized financial plan, address specific debt concerns, and explore options like debt consolidation or credit counseling. Remember, taking control of your finances is the most effective long-term solution to avoiding the need for high-interest payday loans.

Frequently Asked Questions (FAQs) about Payday Loans in Houma

What happens if I default on my payday loan?

Defaulting on a payday loan in Houma, LA, carries significant consequences. In our experience, the most immediate impact is the accrual of late fees, which can quickly escalate the total debt owed. These fees, often exceeding the initial loan amount, are frequently compounded daily, making repayment increasingly difficult. Furthermore, your credit score will suffer a severe blow, impacting your ability to secure future loans, credit cards, or even rent an apartment. This negative mark can remain on your credit report for several years.

Beyond the financial repercussions, lenders may pursue various collection methods. These can range from repeated phone calls and letters to legal action, including wage garnishment or lawsuits. A common mistake we see is borrowers believing they can simply ignore the debt. This only exacerbates the problem. Consider exploring options like debt consolidation or negotiating a payment plan with the lender *before* defaulting. Remember, proactive communication is key. Contacting the lender immediately upon facing financial hardship is often the best strategy to mitigate the negative effects of a potential default on your payday loan.

Can I get a payday loan with bad credit?

Yes, you can typically obtain a payday loan in Houma, LA, even with bad credit. Unlike traditional bank loans, payday lenders often prioritize your current income and employment stability over your credit score. They understand that many people seeking short-term loans face unforeseen circumstances that have impacted their credit history. In our experience, a consistent income stream and a verifiable employment history are key factors considered more heavily than a low credit score.

However, this doesn’t mean approval is guaranteed. Lenders will still assess your application thoroughly. A common mistake we see is applicants assuming their bad credit is inconsequential. While it may not be the sole deciding factor, a very low credit score might result in higher interest rates or stricter loan terms. It’s crucial to shop around and compare offers from multiple payday lenders in Houma to find the most favorable terms. Remember to always read the fine print carefully before signing any loan agreement, paying close attention to the Annual Percentage Rate (APR) and any potential fees. Understanding these details will help you make an informed decision and avoid unexpected costs.

What is the maximum loan amount I can borrow?

The maximum loan amount for a payday loan in Houma, Louisiana, isn’t a fixed number. It varies considerably depending on several factors, including the individual lender’s policies and your personal financial situation. In our experience, most lenders in the area will cap payday loans at a sum between $300 and $500. However, it’s crucial to confirm the maximum loan amount directly with the specific lender you are considering. A common mistake we see is borrowers assuming all payday lenders adhere to the same limits.

To determine your *eligible* loan amount, lenders will typically review your income, employment history, and credit report (though this is less frequently a factor with payday loans). For example, someone with a steady, demonstrably high income might qualify for a loan closer to the upper limit, while someone with a less stable income might be offered a significantly smaller loan amount. Remember, lenders assess your ability to repay—a smaller loan with manageable repayment terms is usually better than a larger loan that leads to a debt spiral. Always carefully review the loan agreement before signing to ensure you fully understand the terms and the total cost, including interest and fees.