Understanding Payday Loans in Dothan

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They are typically due on your next pay date, hence the name. In Dothan, Alabama, as elsewhere, these loans are often characterized by high interest rates. Borrowers should carefully consider the total cost before taking out a payday loan, including all fees and interest charges. These loans are intended as a stop-gap measure and not a long-term solution to financial problems. Always explore alternative solutions first.

Before applying for a payday loan in Dothan, understand the implications. “Failing to repay on time can lead to significant financial difficulties, including additional fees and potential damage to your credit score.” Research the lenders carefully. Compare interest rates and fees. Check online reviews from previous borrowers. Alabama has specific regulations governing payday loans, so understanding these rules is crucial for responsible borrowing. Be sure to fully read and understand the loan agreement before signing.

How Payday Loans Work in Alabama

In Alabama, payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. You borrow a specific amount, typically due on your next payday. The lender will require access to your bank account for automatic repayment. Interest rates are usually high, reflecting the loan’s short repayment period and inherent risk for the lender. Before considering a payday loan in Dothan, carefully review the terms and conditions, including all fees and charges. Alabama regulates payday lending, so understanding these regulations is crucial for responsible borrowing.

Failure to repay on time can lead to rolled-over loans or increased fees, potentially creating a cycle of debt. “Always prioritize paying off your payday loan as soon as possible to avoid accumulating excessive fees and interest,” Consider exploring alternative financial solutions, such as credit counseling or borrowing from friends and family, before resorting to a payday loan. These alternatives might offer better terms and conditions. Remember to budget carefully and only borrow what you can comfortably repay. This will help prevent financial hardship. Exploring free credit counseling services in Dothan can be incredibly beneficial to those struggling with debt.

Regulations and Laws Governing Payday Loans in Dothan

Payday loans in Dothan, Alabama, are subject to state and federal regulations. These laws aim to protect borrowers from predatory lending practices. Alabama’s laws cap the amount a lender can charge in fees, though these fees can still be substantial. It’s crucial to understand these limits before considering a payday loan. You should always compare offers from multiple lenders to get the best possible terms. Failing to understand these regulations can lead to unexpected costs and financial hardship. Always read the fine print carefully.

The Alabama State Banking Department oversees payday lending regulations. Their website provides valuable resources and information on consumer rights. It’s highly recommended to familiarize yourself with these resources before taking out a loan. Understanding the interest rates and associated fees is critical. “Borrowers should be cautious of lenders offering unusually low rates or excessively easy approval processes, as these might mask hidden fees or predatory practices.” Be sure to ask clarifying questions and only borrow what you absolutely need.

Eligibility Criteria for Payday Loans in Dothan

Income and Employment Requirements

Securing a payday loan in Dothan, Alabama, often hinges on demonstrating a consistent income stream. Lenders typically require proof of regular employment or other reliable income sources, such as verifiable self-employment income or government benefits. This might involve providing pay stubs, bank statements showing regular deposits, or tax returns. The specific documentation required will vary depending on the lender. Always confirm requirements directly with the chosen lending institution.

The amount of income needed isn’t fixed across all payday loan providers in Dothan. However, most lenders will assess your income against the loan amount to ensure you can comfortably repay the loan on your next payday. “Insufficient income is a common reason for loan applications being denied,” so carefully review your financial situation before applying. Consider factors such as existing debt and monthly expenses to determine if a payday loan is a responsible financial choice. Remember to compare interest rates and fees between different lenders to find the best option for your circumstances.

Credit History and Score Impact

Payday loans in Dothan, Alabama, often don’t require a perfect credit history. Many lenders focus more on your current income and ability to repay the loan. This differs significantly from traditional loans, which heavily weigh credit scores. However, a poor credit history might lead to higher interest rates or stricter loan terms. Always compare offers from multiple lenders to find the best rates. “Checking your credit report before applying can help you understand your financial standing and potentially negotiate better terms.”

While payday loans themselves don’t typically report to credit bureaus, consistently missing payments *can* negatively impact your credit score. Late payments can show up on your report, hurting your creditworthiness for future loans and even impacting your ability to rent an apartment or obtain certain services. Therefore, borrowing responsibly is crucial. Careful budgeting and planning before taking out a payday loan is essential to avoid falling behind on payments. Consider the loan’s total cost, including fees and interest, before committing. Only borrow what you can comfortably repay on your next payday.

Residency and Identification

Securing a payday loan in Dothan, Alabama, requires you to meet specific residency requirements. Lenders typically need proof you’ve lived in the state for a minimum period, often ranging from 30 days to six months. This is usually verified using a current utility bill, rental agreement, or bank statement showing your Dothan address. Failing to provide sufficient proof of residency will likely result in your application being denied. Remember, different lenders may have slightly varying requirements, so always check the specifics on the individual lender’s website before applying.

Valid identification is equally crucial for your payday loan application in Dothan. Most lenders will accept a driver’s license or state-issued ID card. A passport may also be acceptable. Ensure your identification is current and matches the information provided on your application. “Providing inaccurate or outdated identification is a serious issue and could lead to your application being rejected, or even legal consequences.” Always keep a copy of your identification for your records, and remember to check the lender’s specific requirements for accepted forms of ID before submitting your application.

Finding Reputable Lenders in Dothan

Identifying Licensed and Regulated Lenders

Securing a payday loan in Dothan, Alabama requires careful consideration of the lender’s legitimacy. Before applying, verify the lender’s licensing status with the Alabama State Banking Department. This crucial step helps you avoid predatory lenders and ensures compliance with state regulations. Always check for a valid license number and confirm its active status on the Department’s official website. Don’t hesitate to contact the Department directly if you have any doubts.

“Choosing a licensed and regulated lender significantly reduces your risk of encountering unfair practices or illegal fees.” Look for clear and transparent fee schedules, easy-to-understand loan terms, and readily available contact information. Avoid lenders who pressure you into a loan or who are unwilling to answer your questions directly and thoroughly. Remember, reputable lenders prioritize customer protection and comply with all applicable laws. A quick online search can often reveal customer reviews and complaints, which can provide valuable insights into a lender’s reputation.

Comparing Interest Rates and Fees

Interest rates significantly impact the overall cost of a payday loan in Dothan, Alabama. Always compare rates from multiple lenders before committing. Don’t just look at the stated APR; examine all fees, including origination fees, late payment penalties, and any potential rollover charges. These added costs can quickly inflate the total amount you repay. Remember, Alabama regulates payday lending, so be aware of the state’s legal limits on interest and fees to avoid predatory lenders. Check the Alabama State Banking Department’s website for current regulations.

“Shop around diligently and compare offers side-by-side using a spreadsheet or similar tool.” Consider the total repayment amount, not just the initial loan amount. Some lenders may advertise lower interest rates but hide higher fees. Transparency is key. Look for lenders that clearly disclose all costs upfront, avoiding hidden charges that can lead to unexpected debt. Payday loans should be a last resort, and understanding the total cost is crucial for responsible borrowing and avoiding financial hardship.

Avoiding Predatory Lending Practices

Payday loans can be helpful in emergencies, but high interest rates make them risky. In Dothan, Alabama, as elsewhere, it’s crucial to avoid predatory lenders. These lenders often employ deceptive tactics to trap borrowers in a cycle of debt. Look for transparent fee structures and avoid lenders who pressure you into borrowing more than you need or who make unrealistic promises. Always read the fine print carefully before signing any loan agreement.

Be wary of lenders who advertise excessively low interest rates, only to apply hidden fees that inflate the overall cost. Check the lender’s reputation with the Better Business Bureau (BBB) and online review sites. Consider comparing several payday loan offers before making a decision. Remember, a reputable lender will clearly explain all terms and conditions, answer your questions honestly, and provide you with a loan agreement easy to understand. “Choosing a responsible lender is paramount to protecting yourself from exploitative practices associated with high-cost, short-term credit.”

The Costs and Risks of Payday Loans

High-Interest Rates and Fees

Payday loans in Dothan, Alabama, are notorious for their extremely high interest rates. These rates can easily exceed 400% APR, far surpassing those of traditional loans. This means a seemingly small loan can quickly balloon into a significant debt burden if not repaid promptly. Remember, you’re paying a substantial amount for the convenience of short-term borrowing. Consider carefully if this cost is truly justified for your circumstances.

The fees associated with payday loans further exacerbate the financial strain. Late payment fees, insufficient funds fees, and other charges can quickly mount, pushing the total cost significantly higher. Many borrowers find themselves trapped in a cycle of debt, constantly rolling over their loans to cover the accumulating fees. “This cycle can severely damage your credit score and negatively impact your financial well-being for years to come.” Before considering a payday loan, thoroughly explore all available options and carefully weigh the potential costs against the benefits. Dothan residents should prioritize budgeting and financial planning to avoid relying on such expensive short-term credit solutions.

Debt Cycle and Financial Difficulty

Payday loans in Dothan, Alabama, like those offered nationwide, are notorious for trapping borrowers in a debt cycle. The high interest rates and short repayment periods make it incredibly difficult to pay back the loan on time. Missing even one payment can lead to additional fees and charges, quickly escalating the amount owed. This creates a vicious cycle where borrowers repeatedly take out new loans to cover old ones, resulting in accumulating debt and financial stress. Consider the average APR of 391% reported by the Consumer Financial Protection Bureau (CFPB) – a stark reality for many borrowers.

This cycle often leads to significant financial difficulty. Borrowers may find themselves struggling to meet basic living expenses, such as rent, utilities, or groceries. It can negatively impact credit scores, making it harder to obtain loans or credit cards in the future. Seeking help from credit counseling agencies or financial advisors is crucial for breaking this destructive pattern. “Failing to understand the true cost of a payday loan can have devastating long-term consequences on your financial well-being.” Remember, exploring alternative financial solutions, such as budgeting tools or small loans from credit unions, is often a far better option.

Alternatives to Payday Loans

Facing a financial shortfall in Dothan, Alabama? Payday loans might seem like a quick fix, but they often come with hefty costs. Before you apply, consider safer alternatives. Credit unions frequently offer small-dollar loans with lower interest rates and more flexible repayment terms than payday lenders. The National Credit Union Administration (NCUA) insures credit union accounts, offering a level of security missing from many payday loan providers. Explore this option first; it’s often a far more responsible choice.

Exploring other avenues is crucial. Consider budgeting apps to track spending and identify areas for savings. Negotiating with creditors for extended payment plans can buy you time and avoid additional fees. Local charities and non-profit organizations may provide emergency financial assistance programs in Dothan. Finally, “reaching out to friends or family for temporary support could provide a much-needed solution, free from the high-interest traps of payday loans.” Remember, thoroughly researching all available options before committing to any loan is essential for responsible financial management.

Responsible Borrowing Practices

Creating a Budget and Financial Plan

Before considering a payday loan in Dothan, Alabama, or anywhere else, create a detailed budget. Track your income and expenses for at least a month. This reveals spending patterns and areas for potential savings. Categorize your spending (housing, food, transportation, etc.) to pinpoint unnecessary expenses. Consider using budgeting apps or spreadsheets for ease of tracking. This crucial step offers a clear picture of your financial health. “Understanding your finances is the first step towards responsible money management.”

Next, develop a realistic financial plan. This plan should outline short-term and long-term financial goals. Prioritize debt reduction, including existing high-interest debts. Explore alternative solutions to a payday loan, such as negotiating with creditors or seeking credit counseling. A comprehensive plan reduces reliance on high-cost short-term loans like payday loans. Remember, a well-structured financial plan is key to long-term financial stability and avoids the debt cycle often associated with payday loans in Dothan, AL.

Exploring Alternative Financial Solutions

Before rushing into a payday loan in Dothan, Alabama, explore other options. Consider contacting a credit counselor. They offer free or low-cost guidance on budgeting and debt management. Many non-profit organizations provide such services. The National Foundation for Credit Counseling (NFCC) is a reputable example. They can help you create a personalized plan to tackle your financial challenges.

Think creatively about alternative solutions. Could you temporarily reduce expenses? Perhaps selling unused items could generate quick cash. Talking to your creditors about payment plans is another possibility. They might offer extended deadlines or reduced interest rates. “Remember, a payday loan in Dothan, Alabama should be a last resort, not your first choice.” Carefully weigh the potential costs and risks against the benefits of alternative solutions. Prioritizing responsible financial management prevents future reliance on high-interest loans.

Seeking Help for Debt Management

Financial difficulties can be overwhelming. If you’re struggling to manage your payday loan debt in Dothan, Alabama, remember you’re not alone. Many resources are available to help you regain control of your finances. Don’t hesitate to seek professional guidance. Credit counseling agencies, like the National Foundation for Credit Counseling (NFCC), offer debt management plans and financial education. These plans can help you create a budget, negotiate with creditors, and potentially lower your monthly payments. They can also provide valuable strategies for avoiding future debt cycles.

Consider exploring debt consolidation options. This strategy involves combining multiple debts into a single, more manageable payment. While this might not always reduce the total amount owed, it can simplify repayment and improve your financial organization. Remember to research reputable companies carefully before committing to any debt consolidation plan. Always verify their credentials and check online reviews. “Proactively addressing your financial challenges is key to long-term financial health.” Early intervention and professional help can prevent a small debt from snowballing into a larger, more unmanageable problem. Dothan residents facing financial hardship should not feel ashamed to seek support. The journey to financial stability is often best traveled with professional guidance.

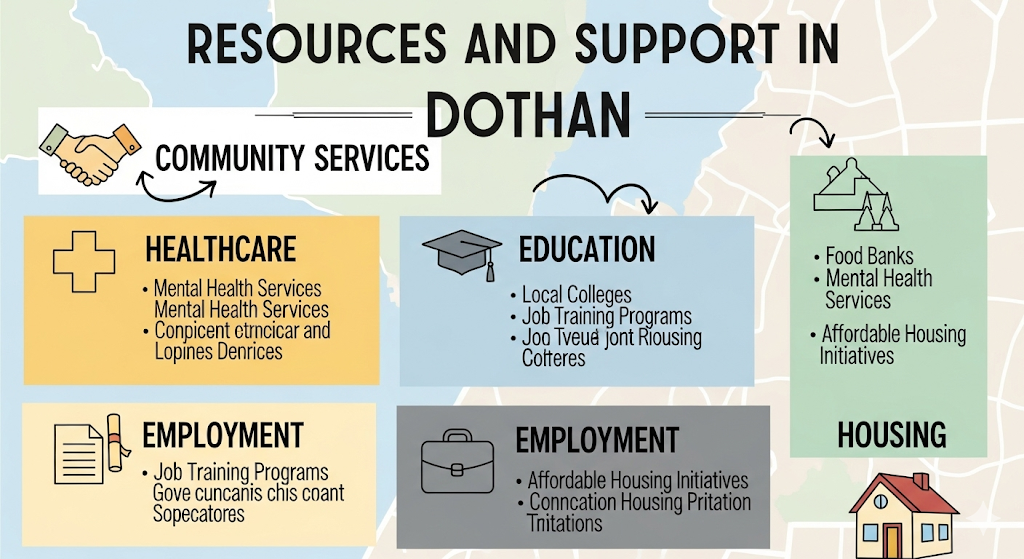

Resources and Support in Dothan

Local Credit Counseling Agencies

Facing financial hardship in Dothan, Alabama, and considering a payday loan? Before you borrow, explore free resources that can help you avoid debt traps. Local credit counseling agencies offer valuable support. They provide financial literacy education, helping you understand budgeting, debt management, and responsible borrowing practices. Many agencies offer free or low-cost services, including individual counseling sessions.

These agencies often work with individuals struggling with high-interest debt, such as payday loans. They can negotiate with creditors to reduce your debt burden. They can also help you create a realistic budget and develop a plan to repay your debts systematically. “Finding a reputable local agency is crucial, and you can often find them through online searches or by contacting the National Foundation for Credit Counseling (NFCC).” Remember, seeking help is a sign of strength, not weakness. Taking advantage of these free resources could save you significant money and stress in the long run.

Non-profit Organizations Offering Financial Assistance

Facing a financial crisis can be overwhelming, especially when considering payday loans in Dothan, Alabama. Before resorting to high-interest loans, explore the valuable resources available within your community. Several local non-profit organizations offer crucial financial assistance programs designed to help residents navigate difficult times. These programs often provide budgeting counseling, debt management strategies, and may even offer emergency financial aid. It’s always wise to explore these options first.

Contacting these organizations is a proactive step towards securing your financial well-being. They can provide a safety net, guiding you towards responsible financial management rather than the potential pitfalls of short-term, high-cost payday loans. “Remember to thoroughly research each organization to understand their eligibility requirements and the specific types of assistance they provide.” Always check for updated contact information and program availability. Exploring these free resources can significantly improve your chances of resolving your financial challenges without relying on predatory lending practices like payday loans in Dothan.

Government Programs for Financial Aid

Facing financial hardship in Dothan? Several government programs offer assistance. The Supplemental Nutrition Assistance Program (SNAP), administered by the Alabama Department of Human Resources, helps low-income families afford groceries. Eligibility is based on income and household size. You can apply online or at a local office. Consider the Temporary Assistance for Needy Families (TANF) program, providing temporary cash assistance and support services to help families achieve self-sufficiency. These resources can offer crucial help during emergencies.

Beyond SNAP and TANF, explore other potential avenues. The Low Income Home Energy Assistance Program (LIHEAP) assists eligible households with their energy bills, a significant expense, especially during extreme weather. The National Council on Aging website offers a helpful tool to locate local senior services, including financial assistance and counseling programs. “Remember to thoroughly research each program’s requirements and application process to determine your eligibility.” Always verify information directly with the relevant government agencies. Don’t hesitate to seek professional help navigating the application processes.