Understanding payday loans in Fontana

What are Payday Loans and How Do They Work?

Payday loans in Fontana, CA, are short-term, small-dollar loans designed to bridge the gap until your next payday. Borrowers typically write a post-dated check or authorize an electronic debit from their bank account for the loan amount plus fees. These fees can be substantial, often resulting in a high annual percentage rate (APR), significantly higher than traditional loans. In our experience, many borrowers underestimate the total repayment cost, leading to a cycle of debt.

A common mistake we see is failing to fully understand the loan terms before signing the agreement. Always carefully review the contract, paying close attention to the APR, the total amount due, and the repayment schedule. For example, a $300 payday loan with a $45 fee due in two weeks translates to an extremely high APR, even though it might seem manageable at first glance. Consider exploring alternative options like credit counseling or small loans from credit unions before resorting to a payday loan. Remember, understanding the full implications, including potential consequences of default, is crucial before committing to a payday loan.

Payday Loan Laws and Regulations in California

California, like many states, has strict regulations governing payday loans to protect consumers from predatory lending practices. A key limitation is the loan amount cap, currently set at $300. Borrowers cannot obtain multiple loans simultaneously from the same lender, and lenders are prohibited from rolling over or renewing loans. In our experience, exceeding these limits often leads to financial distress. For instance, a borrower attempting to circumvent the rules by taking out multiple $300 loans from different lenders may find themselves overwhelmed by high fees and repayment obligations.

Furthermore, California law mandates a cooling-off period between loans, providing borrowers a chance to assess their financial situation before taking on additional debt. Lenders are also required to provide clear and concise disclosures outlining all fees and repayment terms. A common mistake we see is borrowers failing to thoroughly review these documents, leading to unexpected costs. The California Department of Financial Protection and Innovation (DFPI) actively monitors compliance, investigating complaints and imposing penalties on lenders violating these regulations. Understanding these laws is crucial for responsible borrowing and avoiding potential pitfalls associated with payday loans in Fontana, CA.

Advantages and Disadvantages of Payday Loans

Payday loans offer a quick solution to immediate financial needs. Their primary advantage is speed; funds are often deposited within 24 hours, providing immediate relief for unexpected expenses like car repairs or medical bills. This rapid access to cash can be crucial in preventing late fees or more significant financial repercussions. However, this speed comes at a cost. In our experience, borrowers often underestimate the high interest rates associated with these short-term loans. A common mistake we see is failing to fully understand the total repayment amount, leading to a cycle of debt.

The disadvantages are significant. The extremely high annual percentage rates (APRs) far surpass those of traditional loans. For example, a seemingly small loan of $300 could accrue fees exceeding $60, depending on the lender and state regulations. These substantial fees, combined with short repayment periods, often push borrowers into a cycle of repeatedly taking out new loans to pay off old ones. Consider alternatives like credit counseling or negotiating payment plans with creditors before resorting to payday loans. Careful budgeting and exploring other funding options can help you avoid the high costs and potential long-term financial damage associated with payday advances.

Finding Reputable Payday Lenders in Fontana

How to Spot a Legitimate Lender

Navigating the world of payday loans requires diligence, especially in a city like Fontana, CA, with a diverse lending landscape. In our experience, a common mistake borrowers make is failing to verify a lender’s licensing and legitimacy before applying. Always check the California Department of Financial Protection and Innovation (DFPI) website for a lender’s license. A legitimate lender will readily provide this information; if they hesitate or are evasive, proceed with extreme caution. Look for clear and transparent fee schedules; hidden charges are a major red flag. Avoid lenders who pressure you into a loan or make unrealistic promises of easy approval regardless of your credit history.

A further crucial step is to thoroughly read the loan agreement *before* signing. Understand the APR (Annual Percentage Rate), repayment terms, and any potential penalties for late payments. Compare offers from multiple lenders to find the best terms. For example, one lender might advertise a lower interest rate but have significantly higher origination fees, ultimately making it more expensive than a seemingly higher-interest loan with fewer fees. Legitimate lenders will be happy to answer your questions clearly and concisely. Remember, a reputable lender prioritizes responsible lending practices and transparency. Don’t hesitate to walk away if anything feels off – your financial well-being is paramount.

Reviewing Lender’s Licenses and Accreditations

Before engaging with any payday lender in Fontana, CA, verifying their licensing and accreditation is paramount. In our experience, neglecting this crucial step can lead to significant financial repercussions, including predatory lending practices and exorbitant fees. The California Department of Financial Protection and Innovation (DFPI) is your primary resource for confirming a lender’s legitimacy. Their website provides a searchable database where you can verify licenses and check for any outstanding complaints or disciplinary actions. A common mistake we see is assuming a flashy website or aggressive advertising equates to trustworthiness; always independently verify their credentials.

Look for a clearly displayed license number and ensure it’s current. Don’t hesitate to contact the DFPI directly if you have any doubts about a lender’s information. Furthermore, while not all lenders hold additional accreditations, membership in organizations like the Community Financial Services Association of America (CFSA) can indicate a commitment to ethical lending practices. However, remember that accreditation alone doesn’t guarantee ethical behavior; it’s just one piece of the puzzle. Always compare multiple lenders, meticulously checking their licensing and any available accreditation information before making a decision. Thorough due diligence is your best protection against falling victim to predatory payday loan schemes.

Comparing Interest Rates and Fees

Interest rates and fees on payday loans in Fontana, CA, vary significantly. In our experience, rates can range from a seemingly low 15% to a much higher 400% APR or more, depending on the lender and the loan amount. A common mistake we see is borrowers focusing solely on the advertised rate without fully understanding the total cost, including all fees. Always obtain a complete breakdown of all charges before signing any agreement.

To effectively compare offers, calculate the Annual Percentage Rate (APR). This represents the total cost of borrowing, encompassing interest and fees, expressed as a yearly percentage. For example, a $300 loan with a $45 fee due in two weeks might seem reasonable, but that translates to a significantly high APR. Consider using online APR calculators to compare different loan offers side-by-side. Don’t hesitate to contact multiple lenders; obtaining multiple quotes empowers you to negotiate and find a potentially better deal. Remember, transparency is key—be wary of lenders who are vague or unwilling to fully disclose their fees.

Checking Customer Reviews and Ratings

Before committing to any payday lender in Fontana, CA, thoroughly investigating customer reviews and ratings is crucial. Don’t rely solely on a single platform; check multiple sources like Google Reviews, Yelp, the Better Business Bureau (BBB), and Trustpilot. In our experience, a lender with consistently high ratings across several platforms is a stronger indicator of reliability than one with only a few glowing reviews on their own website. A common mistake we see is focusing only on the star rating; delve into the written reviews themselves to understand the *nuances* of customer experiences.

Look for recurring themes in the reviews. For example, are there multiple complaints about hidden fees, aggressive collection practices, or difficulty contacting customer service? Pay close attention to negative reviews, as they often highlight potential red flags. For instance, a review mentioning unexpectedly high interest rates or a confusing loan agreement should raise immediate concerns. Conversely, positive reviews detailing transparent processes, helpful customer service, and easy repayment options are excellent signs. Remember, while a perfect score is unlikely, a consistent pattern of positive feedback across multiple reputable review sites significantly improves your chances of finding a trustworthy payday lender in Fontana.

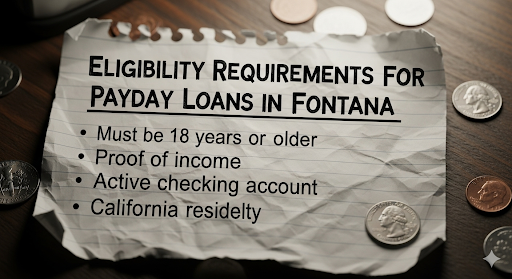

Eligibility Requirements for Payday Loans in Fontana

Income and Employment Verification

Lenders in Fontana, CA, rigorously verify income and employment to ensure you can repay the payday loan. This process often involves providing recent pay stubs, bank statements, or tax returns. In our experience, providing at least two months of consistent income documentation is crucial. A common mistake we see is applicants submitting only a single pay stub, leading to delays or loan denials. Be prepared to demonstrate a stable income stream sufficient to cover the loan’s repayment amount, plus your regular living expenses.

The specific requirements vary between lenders, but most will want to see proof of consistent employment for at least a few months. Some lenders may accept self-employment income, but they will require additional documentation, potentially including business tax returns or bank statements reflecting consistent business revenue. For example, a freelance writer might need to provide contracts and payment records. Remember, transparency is key; fully disclosing your income sources, even if unconventional, is preferable to omissions that could lead to a rejected application. Always contact the lender directly if you have questions about acceptable forms of income verification.

Bank Account and Identification Requirements

Securing a payday loan in Fontana, CA, hinges on meeting specific bank account and identification requirements. Lenders need verifiable proof you can receive and repay the loan funds. In our experience, this means a valid, active checking account in your name is almost always mandatory. Prepaid debit cards or savings accounts are generally insufficient. A common mistake we see is applicants providing accounts with insufficient funds or accounts showing recent overdraft activity, which can significantly impact approval odds.

Beyond the bank account, lenders require robust identification. This typically involves a government-issued photo ID, such as a driver’s license or state-issued ID card. A passport may also suffice. The identification must match the name on your bank account application. Some lenders might also request additional documentation, like a Social Security card or proof of residency (utility bill, rental agreement, etc.), to confirm your identity and address. Remember, discrepancies between provided information and lender records can lead to delays or loan rejection. Always ensure accuracy when supplying this crucial information.

Credit Score Impact (or lack thereof)

Unlike many traditional loans, payday loans in Fontana, CA, typically don’t require a credit check as a primary eligibility criterion. In our experience, lenders prioritize your ability to repay the loan based on your income and employment verification rather than your credit history. This means that individuals with poor or even nonexistent credit scores can still qualify for these short-term financial products. However, this doesn’t imply a complete disregard for credit. Some lenders might use your credit report to assess risk, influencing the interest rate or loan amount offered, though this isn’t always the case.

A common misconception is that payday loans don’t affect your credit score at all. While they generally aren’t reported to the major credit bureaus like other loans, repeated borrowing or defaulting on a payday loan *can* negatively impact your credit profile indirectly. For example, if a lender pursues collections and sends the debt to a collections agency, this negative activity will be reflected on your credit report, harming your credit score. Therefore, responsible borrowing and careful budgeting remain crucial, even when dealing with payday loans. Always prioritize repayment to prevent potential long-term credit consequences.

Alternative Lending Options if you don’t qualify

If you find yourself ineligible for a payday loan in Fontana, CA, don’t despair. Several alternative lending options exist, each with its own set of pros and cons. In our experience, many applicants overlook these alternatives, focusing solely on payday loans. A common mistake we see is failing to explore options with potentially lower interest rates and more manageable repayment terms.

Consider exploring personal loans from credit unions or banks. These often have higher approval rates than payday loans, albeit with more stringent eligibility criteria. For instance, a credit union may offer a personal loan with a lower APR (Annual Percentage Rate) than a payday lender, even if the loan application process is more involved. Alternatively, secured loans, using an asset like a car or savings account as collateral, can improve your chances of approval. Finally, explore community resources, such as local charities or non-profit credit counseling agencies. These organizations often provide financial assistance and guidance to individuals facing financial hardship. Remember to carefully compare interest rates, fees, and repayment terms before committing to any loan. Don’t hesitate to seek professional financial advice if needed to navigate this process effectively.

The Payday Loan Application Process: A Step-by-Step Guide

Gathering Required Documents

Before applying for a payday loan in Fontana, CA, meticulously gather all necessary documentation. In our experience, missing even one document can significantly delay the approval process, sometimes leading to denial. A common mistake we see is applicants assuming their driver’s license is sufficient; while it’s crucial for identification, lenders often require additional proof of residency and income.

To avoid delays, ensure you have the following: a valid government-issued photo ID (such as a driver’s license or state-issued ID card), proof of current address (utility bill, bank statement, or lease agreement), verifiable proof of income (pay stubs, bank statements showing direct deposit, or tax returns), and your personal banking information (checking account number and routing number). Providing clear, legible copies is crucial. Some lenders may also request additional information, such as employment verification or details about existing debts. It’s always best to err on the side of caution and have extra documentation readily available. Remember, transparency is key to a smooth application.

Completing the Online Application

Most Fontana, CA payday loan providers offer online applications, streamlining the borrowing process. In our experience, completing the application accurately and efficiently is crucial for a swift approval. Begin by carefully reviewing the lender’s requirements; these often include proof of income (pay stubs or bank statements), a valid government-issued ID, and an active checking account. A common mistake we see is neglecting to accurately input personal information, leading to delays or application rejection. Ensure all details are correct before submitting.

After gathering the necessary documents, navigate to the lender’s secure website. The online application typically asks for personal details such as your full name, address, date of birth, and Social Security number. You will then be prompted to provide information about your employment and income, as well as the loan amount you’re requesting. Remember to read all terms and conditions thoroughly before proceeding. For example, some lenders may have specific requirements regarding employment length or minimum income thresholds. Carefully review the Annual Percentage Rate (APR) and all associated fees to fully understand the total cost of the loan. Finally, electronically sign and submit the completed application. Most lenders provide instant or near-instant feedback on the status of your application.

Understanding the Loan Agreement

Before signing *any* payday loan agreement in Fontana, CA, meticulously review every clause. A common mistake we see is borrowers glossing over the fine print, leading to unexpected fees or repayment difficulties. In our experience, understanding the Annual Percentage Rate (APR) is crucial. This isn’t simply the interest rate; it encompasses all loan costs, providing a true picture of the loan’s overall expense. Compare APRs across different lenders to find the most favorable terms. Also, carefully note the loan term, the exact repayment schedule, and any prepayment penalties. These details directly impact your overall cost and repayment flexibility.

Pay close attention to the late payment policy. many payday loans in Fontana carry steep penalties for even slightly delayed payments. The agreement should clearly outline these penalties, which can significantly increase your debt burden. For example, a seemingly small late fee might compound quickly, especially if you’re facing unforeseen financial setbacks. Finally, ensure you completely understand the collection practices detailed in the agreement. Reputable lenders will clearly state their procedures for handling missed payments, while less reputable ones may have vague or aggressive policies. Don’t hesitate to ask questions and seek clarification from the lender before committing to the loan. Thorough understanding protects you from potential financial distress.

Funds Disbursement and Repayment

Once approved, funds disbursement for your payday loan in Fontana, CA, typically occurs quickly. In our experience, most lenders offer same-day funding, often via direct deposit into your bank account. However, some may opt for alternative methods like a check or load funds onto a prepaid card. Always clarify the disbursement method with the lender before applying to avoid delays or unexpected fees. A common mistake we see is assuming all lenders use the same process.

Repayment is equally crucial. Your loan agreement will clearly outline the repayment date, typically within two to four weeks. Failing to repay on time incurs significant late fees, potentially escalating the debt rapidly. To avoid this, consider setting up automatic payments or reminders. Explore options like budgeting apps to effectively manage your finances and ensure timely repayment. Remember, responsible borrowing includes planning for repayment from the outset; consider the impact on your upcoming budget before accepting a payday loan.

Managing Your Payday Loan Responsibly

Creating a Repayment Plan

Before you even consider borrowing, create a detailed repayment plan. This isn’t just about knowing when your payday is; it’s about realistically assessing your income and expenses. In our experience, many borrowers underestimate the impact of unexpected costs. A common mistake we see is failing to account for regular bills like utilities or groceries when budgeting for loan repayment.

To build a robust plan, meticulously track your income and expenses for at least a month. Categorize your spending to identify areas where you can cut back. Then, allocate a specific portion of your income solely for loan repayment. Consider using budgeting apps or spreadsheets to monitor your progress. For example, if your payday loan is $500 with a two-week repayment term, you’ll need to set aside at least $250 each week to avoid default. Remember, prioritizing the loan repayment within your budget is crucial for responsible financial management. If you anticipate any difficulties, contact the lender immediately to explore options like an extended payment plan; proactive communication can prevent late fees and further financial strain.

Budgeting Tips for Avoiding Future Loans

Creating a realistic budget is crucial to breaking the cycle of payday loans. In our experience, many individuals underestimate their monthly expenses, leading to unexpected shortfalls. Start by meticulously tracking every dollar spent for a month. Categorize your spending (housing, transportation, food, entertainment, etc.) to identify areas for potential savings. Consider using budgeting apps or spreadsheets to simplify this process. A common mistake we see is failing to account for irregular expenses like car repairs or medical bills; build a contingency fund to absorb these shocks.

Once you have a clear picture of your spending habits, prioritize essential expenses. Then, explore ways to cut back on non-essential spending. For example, consider cheaper entertainment options, reducing dining out, or negotiating lower bills for utilities or subscriptions. Prioritizing debt repayment, especially high-interest debts like payday loans, should be a key part of your budget. Consider using the debt snowball or avalanche method to strategically tackle your debts. Remember, small, consistent changes can lead to significant long-term savings, making you less reliant on short-term, high-cost loans.

Seeking Financial Counseling and Assistance

Facing financial hardship can be overwhelming, but seeking professional guidance is a crucial step towards responsible debt management. In our experience, many individuals struggling with payday loans in Fontana, CA, benefit immensely from financial counseling. These services offer personalized budgeting advice, debt management strategies, and connections to local resources. A common mistake we see is delaying help until the situation becomes critical; proactive intervention often yields better results.

Consider contacting non-profit credit counseling agencies like the National Foundation for Credit Counseling (NFCC) or reputable local organizations. They provide free or low-cost services, including debt consolidation, budgeting workshops, and assistance with negotiating with creditors. For example, one client we worked with successfully reduced their monthly payments by 40% through a debt management plan facilitated by a credit counselor. Remember, exploring these options doesn’t mean failure; it signifies a commitment to regaining control of your finances. Don’t hesitate to reach out – taking this step can significantly improve your financial outlook.

Alternatives to Payday Loans for Long-Term Financial Solutions

Payday loans, while offering quick access to cash, often exacerbate long-term financial problems due to their high interest rates and short repayment periods. In our experience, relying solely on payday loans for recurring financial needs is a recipe for a debt cycle. Instead of resorting to these short-term solutions, consider building a stronger financial foundation. This involves proactively managing your budget, identifying areas for savings, and exploring more sustainable borrowing options.

For example, a client facing unexpected car repairs might initially consider a payday loan. However, a more responsible approach would involve exploring credit unions which often offer small personal loans with significantly lower interest rates and more flexible repayment terms. Alternatively, community resources like local non-profits might provide financial assistance programs or budgeting workshops. A common mistake we see is neglecting the free resources available; these often offer valuable guidance and support in navigating challenging financial situations. Before taking out any loan, meticulously compare interest rates, fees, and repayment plans. This diligent approach allows you to make an informed decision that aligns with your long-term financial well-being.

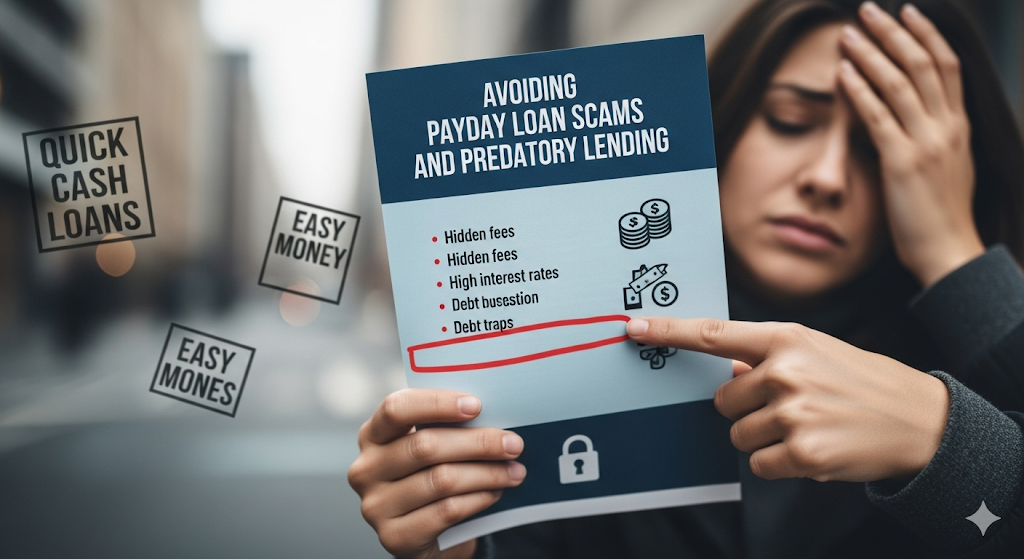

Avoiding Payday Loan Scams and Predatory Practices

Recognizing Red Flags of Fraudulent Lenders

Several red flags signal a potentially fraudulent payday loan lender in Fontana, CA. In our experience, excessively high interest rates are a primary indicator. Legitimate lenders in California are subject to strict regulations, and rates far exceeding the legal limits should raise immediate suspicion. For example, a lender quoting an APR of 500% or higher is almost certainly operating outside the law. Always independently verify interest rates using the California Department of Financial Protection and Innovation (DFPI) resources.

Another common mistake we see is borrowers falling prey to lenders demanding upfront fees. A reputable lender never requires payment before disbursing the loan. Be wary of any lender requesting fees for application processing, credit checks, or other services prior to loan approval. Furthermore, scrutinize loan contracts carefully. Look for hidden fees, ambiguous terms, or clauses that could lead to unexpected charges. If anything seems unclear or potentially unfair, seek independent legal advice before signing. Remember, protecting yourself from predatory lending practices starts with thorough due diligence.

Protecting Your Personal Information

In our experience, protecting your personal information when dealing with payday lenders in Fontana, CA, is paramount. A common mistake we see is borrowers readily providing sensitive data without verifying the lender’s legitimacy. Before sharing any details, always confirm the lender is licensed with the California Department of Financial Protection and Innovation (DFPI) and check for online reviews to gauge their reputation. Never transmit sensitive documents via unsecure channels like email; opt for secure platforms or in-person interactions when possible.

Remember, legitimate lenders will never ask for your bank login credentials or social security number upfront. Be wary of any requests for excessive personal information beyond what’s strictly necessary for the loan application. For example, a request for your mother’s maiden name alongside your banking details should raise immediate red flags. If a lender pressures you to divulge information you’re uncomfortable sharing, it’s a strong indicator of a potential scam. Consider utilizing credit unions or banks as alternative financing options, prioritizing institutions with established security protocols and a proven track record of protecting customer data.

Understanding Your Rights as a Borrower

In California, borrowers have significant protections against predatory payday lending practices. Understanding these rights is crucial to avoiding exploitation. For instance, California law caps the total fees a payday lender can charge at 15% of the principal, regardless of loan size. Exceeding this limit is illegal. A common mistake we see is borrowers failing to carefully review the loan agreement before signing, overlooking hidden fees or excessively high interest rates. Always request a clear breakdown of all charges.

Remember, you have the right to a clear and concise loan contract detailing all terms and conditions, including repayment schedule, fees, and APR. If a lender pressures you into signing without providing this information or attempts to obscure important details, walk away. Further, you’re entitled to receive a detailed explanation of the loan’s terms from the lender before signing, ensuring you fully understand your obligations. If you believe a lender has violated California’s payday lending laws, you can file a complaint with the California Department of Financial Protection and Innovation (DFPI). Don’t hesitate to seek legal advice if you’re facing difficulties with a payday loan; many consumer rights organizations offer free or low-cost assistance.

Where to Report Suspicious Activities

If you suspect you’ve encountered a payday loan scam in Fontana, CA, reporting it promptly is crucial. In our experience, swift action can help prevent others from falling victim and potentially recover lost funds. First, contact the California Department of Financial Protection and Innovation (DFPI). They are the primary regulatory body for financial institutions in California and are equipped to investigate complaints about predatory lending practices and illegal activities involving payday loans. Their website offers detailed instructions on filing a complaint, and you should include all relevant documentation, such as loan agreements and communication records.

Beyond the DFPI, consider filing a report with the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency with jurisdiction over payday lenders nationwide. They handle complaints related to unfair, deceptive, or abusive acts or practices. A common mistake we see is failing to report to both state and federal agencies. Doing so increases the chances of a thorough investigation. Finally, if you’ve suffered significant financial harm, consult with a consumer protection attorney. They can advise you on your legal options and potentially assist in recovering your losses through legal channels. Remember, documenting everything meticulously is paramount in these situations.