Understanding payday loans in Houston

What are Payday loans and How Do They Work?

Payday loans in Houston, like in other states, are short-term, small-dollar loans designed to bridge the gap until your next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. Borrowers provide a post-dated check or authorize electronic access to their bank account for repayment. In our experience, the most common use for these loans is to cover unexpected expenses—a sudden car repair, a medical bill, or an overdue utility payment. However, it’s crucial to understand the high cost associated with this convenience.

A common mistake we see is borrowers underestimating the Annual Percentage Rate (APR) of payday loans. While the initial loan amount might seem manageable, the fees and interest can quickly escalate, leading to a debt cycle that’s difficult to escape. For example, a $300 loan with a $45 fee translates to a substantial APR, often exceeding 400%. Before applying for a payday loan, carefully compare offers from multiple lenders and thoroughly review the terms and conditions. Consider alternatives like credit counseling or borrowing from friends and family before resorting to payday loans, as they can have severe financial repercussions if not managed responsibly. Remember, responsible borrowing is key.

Payday Loan Regulations in Texas: What you need to Know

Texas payday loan regulations are complex and frequently misunderstood. A common mistake we see is borrowers failing to fully understand the fee structure, which often surpasses the interest rates seen in traditional loans. The Texas Department of Banking is the regulatory body, and they enforce laws designed to protect consumers. These laws limit the amount a lender can charge, but the cumulative effect of multiple loans can still lead to a significant debt burden. For example, a $300 loan with a $45 fee (a common rate) translates to a 15% fee on a two-week loan, significantly higher than annual interest rates on many credit cards. Always confirm the total cost of borrowing *before* signing any agreement.

In our experience, many borrowers are unaware of the rollover limitations. While some lenders might offer extensions, these usually come with additional fees, escalating the debt quickly. It’s crucial to have a solid repayment plan in place before taking out a payday loan. Consider exploring alternative solutions like credit counseling services or negotiating with creditors *before* resorting to high-cost payday advances. Failing to meet repayment deadlines can lead to further fees, collection attempts, and damage to your credit score. Remember, responsible borrowing means understanding the complete cost and potential consequences before signing on the dotted line.

No credit check Payday Loans: benefits and Risks

The allure of no credit check payday loans in Houston is understandable—quick access to cash without the scrutiny of a traditional credit check. However, this convenience comes with significant risks. In our experience, borrowers often overlook the potentially exorbitant interest rates associated with these loans. These rates can easily exceed 400% APR, making even a small loan incredibly difficult to repay. A common mistake we see is borrowers assuming that because a credit check isn’t performed, the terms will be lenient. This is often not the case.

While the lack of a credit check might seem beneficial for individuals with poor credit, it’s crucial to weigh the potential downsides. For example, lenders compensate for the increased risk by charging higher fees and interest. This can lead to a debt cycle where you’re constantly borrowing to repay previous loans, a situation many Houstonians find themselves trapped in. Consider exploring alternative financing options, such as credit counseling or negotiating with creditors, before resorting to a high-interest, no credit check payday loan. Remember, responsible borrowing involves understanding the total cost, not just the initial amount borrowed. Always carefully review the loan agreement before signing.

Finding Reputable Payday Lenders in Houston

Identifying Legitimate Lenders vs. Predatory Practices

Distinguishing between legitimate and predatory payday lenders in Houston requires vigilance. In our experience, a common red flag is lenders advertising exceptionally low interest rates or promising guaranteed approval with minimal documentation. These claims often mask exorbitant fees and hidden charges that quickly escalate the total cost of the loan. Legitimate lenders, on the other hand, are transparent about their fees and interest rates, clearly outlining all terms and conditions upfront. They also typically verify your income and employment to assess your ability to repay, a crucial step responsible lenders take to prevent borrowers from getting into further financial trouble.

Look for lenders licensed by the state of Texas. Check the Texas Department of Banking’s website to verify licenses and ensure the lender is compliant with state regulations. A crucial difference between legitimate and predatory practices lies in the repayment terms. Predatory lenders often push for extremely short repayment periods, making it nearly impossible to repay on time and leading to a cycle of debt. Responsible lenders, conversely, provide flexible repayment options and work with borrowers facing difficulties. Avoid lenders who pressure you into accepting a loan or who seem unwilling to answer your questions thoroughly. Remember, a reputable lender prioritizes your financial well-being and will offer clear, understandable information about their services.

Online vs. In-Person Lenders: A Comparison

Choosing between online and in-person payday lenders in Houston requires careful consideration. In our experience, online lenders often offer broader access, potentially including better interest rates and more flexible repayment options. However, a common mistake we see is overlooking the potential risks. Scams are more prevalent online; therefore, thorough research and verification of lender legitimacy are paramount. Look for lenders registered with the Texas Office of Consumer Credit Commissioner and read online reviews carefully.

Conversely, in-person lenders provide a tangible sense of security. You can meet with the lender face-to-face, ask direct questions, and receive immediate feedback. However, the convenience factor is reduced, and options may be more limited compared to online marketplaces. For example, while you might find a local lender with competitive rates, they may not offer the same level of customization or technological advantages such as digital loan applications and online account management. Ultimately, the best choice depends on your personal comfort level, technical proficiency, and the urgency of your financial need. Weigh the pros and cons carefully before deciding which route suits you best.

Checking Lender Credentials and Licenses

Before engaging with any payday lender in Houston, verifying their legitimacy is paramount. A common mistake we see is borrowers overlooking this crucial step, leading to potential scams or predatory lending practices. In our experience, reputable lenders will readily display their licensing information prominently on their website and physical location. Look for a current Texas Office of Consumer Credit Commissioner (OCCC) license number. You can independently verify this number on the OCCC website to confirm the lender’s legal operation.

Don’t hesitate to ask for proof of licensing. Legitimate lenders will happily provide it. Furthermore, investigate online reviews and complaints. Sites like the Better Business Bureau (BBB) can offer valuable insights into a lender’s reputation and history of customer treatment. Pay close attention to complaints regarding fees, interest rates, and collection practices. Remember, a consistently high number of negative reviews should raise significant red flags. By taking these steps, you significantly reduce the risk of falling victim to unscrupulous payday loan providers in Houston.

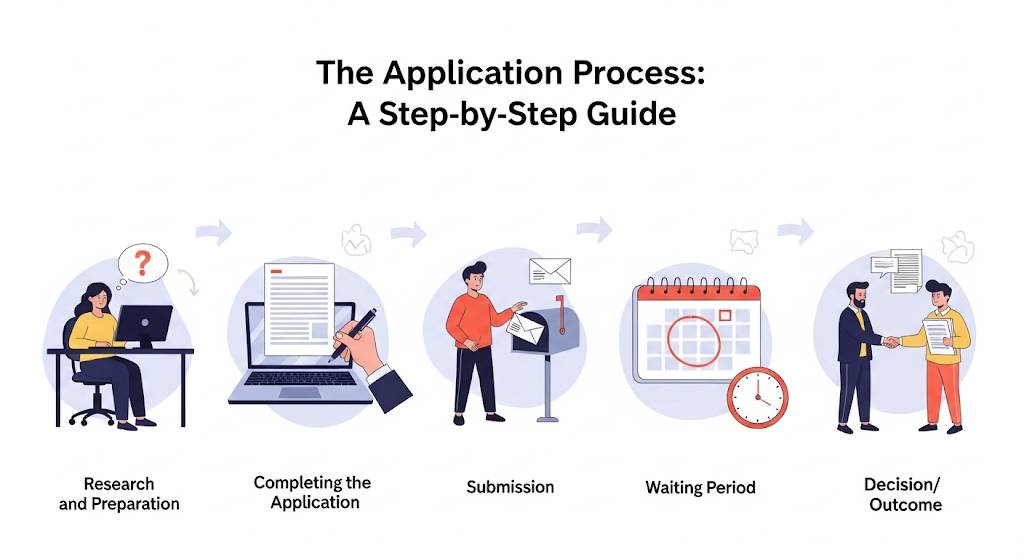

The Application Process: A Step-by-Step Guide

Required Documents and Information

Securing a payday loan in Houston, even without a stellar credit history, typically requires providing specific documentation. In our experience, lenders prioritize verifying your identity and income to assess your ability to repay. A common mistake we see is failing to bring all necessary paperwork, leading to delays or application rejection. Therefore, meticulous preparation is crucial.

You’ll almost certainly need a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is essential; this might include recent pay stubs showing consistent employment over several months, bank statements demonstrating regular deposits, or even tax returns (if self-employed). Lenders also often request your current address verification, which could be a utility bill, bank statement, or lease agreement. Finally, be prepared to provide your bank account details for direct deposit of the loan and for automated payments. Remember, discrepancies between provided information and lender records can cause delays. For instance, if your pay stubs don’t match the income reported on your application, your loan request might be denied. Thoroughly review all documents before submission.

Step-by-Step Application Instructions

First, locate a reputable payday lender in Houston. In our experience, checking online reviews and verifying licensing with the Texas Office of Consumer Credit Commissioner is crucial. A common mistake we see is skipping this step, leading to potentially predatory lending practices. Once you’ve chosen a lender, gather the necessary documents: a valid Texas driver’s license or state-issued ID, proof of income (pay stubs or bank statements), and your current banking information. Be prepared to provide accurate information; discrepancies can delay or even deny your application.

Next, complete the online or in-person application. Most lenders have user-friendly online portals. However, be aware that some may require a visit to their physical location. Carefully review each field before submission. For example, accurately recording your employment details and bank account information is critical for a smooth process. After submitting, you’ll likely receive a near-instantaneous decision. If approved, the funds are typically deposited into your account within 24 hours – though this timeframe varies based on lender processing times and your bank. Remember to thoroughly read the loan agreement before signing to understand the terms, fees, and repayment schedule.

Understanding Fees and Interest Rates

Payday loans in Houston, like elsewhere, come with significant fees and high interest rates. Understanding these charges is crucial before borrowing. A common mistake we see is borrowers focusing solely on the advertised loan amount, neglecting the added costs which can quickly inflate the total repayment. In our experience, these fees can range from a flat fee of $15-$30 per $100 borrowed, to APRs exceeding 400%, depending on the lender and loan terms. This means that a seemingly small loan could quickly become unmanageable if not carefully considered.

For instance, a $300 payday loan with a $30 fee and a two-week repayment period translates to a massive annual percentage rate (APR). Always request a clear breakdown of all charges – including origination fees, late fees, and any rollover charges – before signing any agreement. Remember, comparing offers based solely on the interest rate alone is insufficient; consider the total cost of borrowing. Shop around for the best terms, and if possible, explore alternative financial solutions before resorting to payday loans due to their potentially devastating impact on your finances.

Comparing Interest Rates and Loan Terms

Factors Influencing Payday Loan Costs

Several key factors significantly impact the overall cost of a payday loan in Houston, often exceeding what initially appears on the surface. In our experience, borrowers frequently underestimate these hidden costs. A common mistake is focusing solely on the advertised Annual Percentage Rate (APR) without considering the added fees. These fees, which can include origination fees, late payment penalties, and even rollover charges, dramatically inflate the final amount due. For example, a seemingly small $15 origination fee on a $300 loan can represent a substantial percentage increase in the effective interest rate.

Beyond the upfront fees, the loan’s term length plays a crucial role. Shorter repayment periods typically mean higher daily or weekly interest charges, quickly accumulating debt. Conversely, while longer terms might seem beneficial, they often involve greater overall interest payments. Consider this: a loan rolled over multiple times can drastically increase the total cost compared to paying it off within the initial repayment schedule. Always carefully review the loan agreement, paying close attention to all fees and interest calculations before signing, and compare offers from multiple lenders to find the most favorable terms. Remember, understanding these cost drivers is essential for making informed borrowing decisions and avoiding a cycle of debt.

Comparison of Interest Rates from Various Lenders

Interest rates on payday loans in Houston vary significantly, often exceeding 400% APR. In our experience, a crucial first step is obtaining quotes from multiple lenders before making a decision. Don’t solely focus on the advertised rate; carefully examine the total cost, including any fees and additional charges. A common mistake we see is overlooking these hidden costs, leading to a much higher effective interest rate than initially anticipated. For example, one lender might advertise a lower APR but include numerous processing fees, ultimately making it more expensive than a lender with a slightly higher advertised rate and fewer fees.

To effectively compare, create a simple table outlining the Annual Percentage Rate (APR), all applicable fees (originations, late payment, etc.), and the total repayment amount for each loan offer. Consider lenders offering both online and in-person services in Houston, as rates may differ based on the application method. Remember, while convenience is a factor, prioritizing the lowest total cost should be your primary focus. Failing to do so could result in a debt cycle that’s difficult to escape. Always confirm the lender’s licensing and compliance with Texas state regulations before proceeding with any loan.

Tips for Negotiating Better Loan Terms

Negotiating a payday loan in Houston, even with a no-credit-check option, requires a strategic approach. In our experience, many borrowers fail to explore all available options. A common mistake is assuming the initial terms are set in stone. Instead, be prepared to discuss your financial situation clearly and confidently. Highlight any positive aspects, such as consistent employment or a history of on-time bill payments, even if it’s not reflected in your credit score. Explore potential compromises, perhaps offering a larger down payment to secure a lower interest rate or shorter loan term.

Remember, lenders are businesses; they want to minimize their risk. By demonstrating your commitment to repayment, you increase your leverage. For instance, presenting a detailed budget showing how you’ll manage repayments can significantly influence the negotiation. Consider asking about potential discounts for prompt payment or loyalty programs. Finally, don’t hesitate to shop around. Comparing offers from multiple lenders, even those specializing in no-credit-check payday loans, is crucial for securing the best possible terms. This proactive approach can save you hundreds, if not thousands, of dollars in interest charges over the life of the loan.

Managing Your Payday Loan Effectively

Creating a Repayment Plan to Avoid Default

Creating a robust repayment plan is crucial to avoid the pitfalls of payday loan default in Houston. In our experience, many borrowers underestimate the total cost, including fees and interest, leading to unexpected financial strain. A common mistake we see is failing to account for unforeseen expenses that can disrupt the repayment schedule. Before signing any agreement, meticulously review the terms and conditions, calculating the total amount due and the daily/weekly interest charges. Then, create a detailed budget, factoring in your essential expenses and the payday loan payment.

To proactively manage your repayment, consider several strategies. Prioritize the loan payment in your budget – treating it like a crucial utility bill. Explore options like setting up automatic payments to avoid missed installments. If you anticipate difficulty, contact your lender *immediately* to discuss potential payment extensions or alternative repayment arrangements. For example, a client recently avoided default by proactively negotiating a longer repayment period, reducing their weekly payment burden and preventing a damaging impact on their credit score. Remember, open communication with your lender is key to navigating repayment challenges successfully.

Budgeting Tips for Responsible Borrowing

Before taking out a payday loan in Houston, meticulous budgeting is crucial. A common mistake we see is borrowers underestimating the total repayment amount, including fees. In our experience, accurately calculating your monthly disposable income is paramount. This means tracking all income sources and subtracting essential expenses like rent, utilities, groceries, and transportation. Only then can you determine the affordable loan amount without jeopardizing your financial stability. Remember, even small payday loans can snowball into larger debt if not managed carefully.

To avoid this, create a detailed budgeting plan that specifically accounts for the loan repayment. For example, if your repayment is due on your next payday, allocate that entire amount before any discretionary spending. Consider using budgeting apps or spreadsheets to visualize your cash flow and track your progress. We recommend setting up an automatic transfer to a dedicated savings account to ensure timely repayment. Remember, responsible borrowing involves proactive planning and strict adherence to your budget. Failing to do so can significantly impact your credit score and overall financial health, making future borrowing more difficult.

Alternatives to Payday Loans in Houston

Before committing to a payday loan, Houstonians should explore viable alternatives. A common mistake we see is overlooking readily available resources. For example, many residents are unaware of the assistance programs offered by local charities and non-profit organizations. These programs often provide emergency financial aid or budget counseling to help manage unexpected expenses. In our experience, seeking help from a reputable credit counseling agency can significantly improve your financial situation in the long run.

Consider exploring secured loans from credit unions or banks. While these require collateral, they typically offer lower interest rates and longer repayment terms than payday loans, making them significantly more manageable. Another option is to discuss payment plans with creditors. Many utility companies and other service providers are willing to work with customers facing temporary financial hardship. Remember to thoroughly investigate all available options before turning to high-interest payday loans. Exploring these alternatives can not only save you substantial money but also prevent you from spiraling into a cycle of debt.

Avoiding Payday Loan Scams and Protecting Yourself

Red Flags to Watch Out For

In our experience, navigating the payday loan landscape in Houston requires vigilance. A common mistake we see is overlooking crucial details in the fine print, leading to unexpected fees and high interest rates. Be wary of lenders who promise loans with unbelievably low interest rates or minimal paperwork—these are often hallmarks of predatory practices. For example, a lender advertising a 0% APR loan without a proper credit check should raise significant concerns; it’s almost certainly a scam designed to extract upfront fees and personal information.

Look out for these specific red flags: unclear or hidden fees, aggressive sales tactics, pressure to borrow more than you need, and lenders who request access to your bank account without clear explanation. We’ve seen instances where borrowers, struggling to repay, find their accounts drained of funds due to automatic withdrawals they were unaware of. Remember to always compare interest rates and fees from multiple lenders before committing. Don’t hesitate to walk away if anything feels off. Thoroughly investigate any lender before providing personal information—check online reviews and verify their licensing with the Texas Office of Consumer Credit Commissioner. Protecting yourself requires due diligence; don’t let the pressure of needing quick cash compromise your financial well-being.

How to Report Suspicious Lending Practices

In our experience, identifying and reporting suspicious payday lending practices in Houston requires a proactive approach. A common mistake is assuming only outright fraud warrants reporting. Instead, be vigilant about predatory interest rates significantly exceeding legal limits (Texas has a 10% cap on payday loans, with some exceptions), hidden fees disguised as processing or administration charges, and persistent harassment tactics via phone calls or text messages. If you encounter any of these red flags, don’t hesitate to act.

To file a formal complaint, you should first gather all relevant documentation: loan agreements, communication records, and payment receipts. Then, report the lender to the Texas Office of Consumer Credit Commissioner (OCCC). Their website provides clear instructions and online complaint forms. Simultaneously, consider filing a report with the Consumer Financial Protection Bureau (CFPB), a federal agency with broader jurisdiction over consumer financial issues. Finally, depending on the nature of the suspected violation (e.g., criminal activity), contacting the Houston Police Department or the Harris County District Attorney’s Office may also be appropriate. Remember, reporting suspected predatory lending protects not only yourself but also other potential victims. Don’t suffer in silence—take action.

Resources for Financial Help and Counseling

Facing a financial emergency can feel overwhelming, especially when considering high-interest payday loans. Before resorting to such loans, explore readily available resources offering free financial counseling and guidance. In our experience, many people are unaware of the extensive support networks available. These services often provide budgeting assistance, debt management strategies, and negotiation with creditors, potentially saving you significant money compared to payday loan interest. A common mistake we see is assuming these services are only for those deeply in debt; in reality, they are invaluable for preventative measures and proactive financial planning.

Consider contacting reputable non-profit organizations like the National Foundation for Credit Counseling (NFCC) or Consumer Credit Counseling Service (CCCS). These organizations connect individuals with certified credit counselors who provide personalized plans. For instance, a client struggling with multiple high-interest debts might receive a debt management plan that consolidates payments at a lower interest rate, ultimately leading to faster debt elimination. Alternatively, individuals facing temporary hardship could benefit from budgeting workshops and education to improve their financial literacy. Remember, seeking help is a sign of strength, not weakness, and proactive financial planning significantly reduces the likelihood of needing a payday loan in the future.