Understanding Payday Loans in Long Beach

What are payday loans and how do they work?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They’re typically due on your next payday, hence the name. The application process is often quick and straightforward, often involving an online application or a visit to a local storefront lender. However, it’s crucial to understand the implications before borrowing. Interest rates on payday loans can be extremely high, significantly increasing the total repayment amount compared to the initial loan principal. These loans should be considered a last resort, for genuine emergencies only.

Many Long Beach residents use payday loans to bridge gaps between paychecks, but it’s vital to explore all other options first. Before applying for a payday loan in Long Beach, consider alternatives such as borrowing from family or friends, using a credit card (if you have a good credit history), or exploring local community resources that might offer financial assistance. “Failing to thoroughly research and compare lenders can lead to unfavorable terms and potentially harmful financial situations.” Always compare interest rates, fees, and repayment terms before committing to any loan. Carefully read all the fine print, understanding the full cost before signing.

Short-term vs. long-term implications of payday loans

Payday loans offer quick cash, but their short-term convenience can have significant long-term consequences. The high interest rates—often exceeding 400% APR—mean even a small loan can balloon into a substantial debt quickly. Missing payments results in further fees and can severely damage your credit score, impacting your ability to secure loans, rent an apartment, or even get a job in the future. Careful consideration is vital before taking out a payday loan in Long Beach.

Responsible borrowing requires understanding the total cost, including all fees and interest. Consider exploring alternative solutions, such as negotiating with creditors for extended payment plans or seeking financial counseling from reputable organizations like the National Foundation for Credit Counseling (NFCC). “Failing to fully grasp the financial implications of a payday loan can lead to a cycle of debt that is difficult to escape.” Remember, comparing offers from different lenders in Long Beach is crucial to finding the most affordable option, but always prioritize responsible financial management.

Key legal considerations in California and Long Beach

California, including Long Beach, has strict regulations governing payday loans. These laws aim to protect consumers from predatory lending practices. Key limitations include caps on the amount you can borrow and the fees lenders can charge. Interest rates are significantly regulated, preventing exorbitant costs. Failing to adhere to these regulations can result in severe penalties for lenders. Always verify a lender’s compliance before proceeding.

Understanding these regulations is crucial. The California Department of Financial Protection and Innovation (DFPI) oversees payday loan activity. Their website offers valuable resources and information on compliant lenders. “Borrowers should carefully review loan terms and conditions before signing any agreement,” ensuring full understanding of repayment schedules and potential fees. Ignoring the legal framework could lead to financial hardship and legal issues for both the borrower and the lender. Choosing a reputable payday loan provider in Long Beach is essential for a safe borrowing experience.

Finding Reputable Payday Loan Lenders in Long Beach

Identifying licensed and trustworthy lenders

Before borrowing from any payday loan lender in Long Beach, California, verify their licensing status. The California Department of Financial Protection and Innovation (DFPI) regulates payday lenders. Check the DFPI website to confirm a lender’s license and ensure they’re operating legally. Avoid lenders who are not listed. This simple step significantly reduces your risk of encountering fraudulent or predatory practices.

Look for lenders with transparent fee structures and clearly stated terms. Avoid companies hiding fees or using confusing language in their contracts. Read reviews from previous customers. Websites like the Better Business Bureau (BBB) offer valuable insights into a lender’s reputation and customer service. “Choosing a licensed and reputable lender is crucial for a safe and responsible payday loan experience in Long Beach.” Consider lenders who offer educational resources or financial literacy tools, showing a commitment beyond just profit. Remember, borrowing responsibly means understanding the terms completely before signing any agreement.

Comparing interest rates, fees, and repayment terms

Before committing to any payday loan in Long Beach, carefully compare offers from multiple lenders. Interest rates can vary significantly, impacting your total repayment cost. Don’t just focus on the advertised rate; examine all associated fees, such as origination fees or late payment penalties. These can dramatically increase the effective annual percentage rate (APR), making a seemingly low-interest loan far more expensive than it initially appears. Always request a clear breakdown of all charges before signing any agreement.

Pay close attention to repayment terms. Some lenders offer shorter repayment periods, potentially leading to higher payments but less overall interest. Others might provide longer repayment schedules, resulting in lower monthly payments but accumulating more interest over time. “Choosing the right repayment term depends on your individual financial situation and ability to manage monthly expenses.” Calculate the total cost of borrowing under different scenarios to make an informed decision. Remember to prioritize lenders that offer transparent and easy-to-understand repayment plans, minimizing the risk of unexpected charges or late fees.

Spotting red flags and avoiding predatory lenders

Beware of lenders who pressure you into borrowing more than you need. High-pressure sales tactics are a major red flag. Legitimate lenders will clearly explain the terms and conditions. They won’t rush you into a decision. Avoid lenders with extremely high interest rates or unclear fees. “Compare interest rates and fees across multiple lenders before committing to a loan.” Look for transparency in their processes.

Scrutinize online lenders carefully. Check for licensing and registration with the California Department of Financial Protection and Innovation (DFPI). The DFPI website is an excellent resource to verify lender legitimacy. Unlicensed lenders often operate outside the law, employing predatory practices. Be wary of lenders who promise guaranteed approval, regardless of your credit history. This is often a tactic used by those who engage in irresponsible lending practices. “Always review the loan agreement thoroughly before signing.” Understanding the terms and conditions is crucial to avoiding unforeseen problems.

Eligibility Requirements for Payday Loans in Long Beach

Income and employment verification procedures

Lenders in Long Beach typically require proof of regular income to approve a payday loan application. This ensures you have the means to repay the loan on your next payday. Common acceptable forms of income verification include recent pay stubs, bank statements showing regular deposits, or tax returns. Self-employment often requires additional documentation, such as business bank statements or tax filings. Always be prepared to provide accurate and complete information. Failure to do so may result in your application being denied.

The verification process itself varies among lenders. Some may simply review submitted documents. Others might perform a brief credit check or contact your employer for verification. “Understanding the specific requirements of each lender is crucial to a smooth application process.” Remember that lenders are legally obligated to protect your personal information. Always choose lenders who adhere to strict privacy regulations. If a lender seems overly vague about their procedures, consider this a red flag and look elsewhere for a more transparent and responsible loan provider. Comparing multiple lenders before applying can help you find the best terms and the most straightforward verification process.

Credit score and history considerations

Unlike traditional loans, many payday lenders in Long Beach don’t heavily scrutinize your credit score. They often focus more on your current income and employment stability. This makes them an option for those with bad credit or limited credit history. However, a poor credit history *might* lead to higher interest rates or stricter lending terms. Always compare offers to find the best deal.

Remember, even with a less-than-perfect credit score, responsible borrowing is key. Providing accurate information is vital to secure a loan and avoid potential issues. “Failing to do so can lead to penalties and further damage your credit standing,” so ensure you thoroughly understand the terms before signing any agreement. Consider exploring alternatives like credit unions or small-dollar loans from banks, which may offer better terms despite requiring a credit check. Thorough research is crucial before applying for any short-term loan, including payday loans in Long Beach.

Proof of residency and identification requirements

Securing a payday loan in Long Beach requires proving your identity and residency. Lenders typically need a government-issued photo ID, such as a driver’s license or passport. This verifies your identity and ensures you are who you claim to be. They will also cross-reference this with your address information. Failure to provide adequate identification will likely result in your application being rejected.

To prove residency, lenders often require recent documents showing your current address. This could include a utility bill, bank statement, or lease agreement. These documents must display your name and current Long Beach address. The documents should generally be no older than two months. “Be sure to have these documents readily available before applying to streamline the process and increase your chances of approval.” Remember, providing accurate information is crucial for a successful application. Incorrect or outdated information can delay your application or lead to rejection.

The Cost of Payday Loans: Interest Rates and Fees in Long Beach

Understanding Annual Percentage Rates (APRs)

Annual Percentage Rate (APR) is crucial for understanding the true cost of a payday loan in Long Beach. It’s not just the interest rate you see advertised. The APR includes all fees and charges, expressed as a yearly percentage. This gives you a complete picture of how much the loan will actually cost you. For example, a seemingly low interest rate might hide high origination fees, dramatically increasing your final APR.

Always compare the APRs from different lenders before deciding. “A lower APR means a cheaper loan,” so prioritize lenders with transparent and competitive rates. Check the lender’s website or contact them directly to get the complete APR information. Don’t rely solely on advertised interest rates; these often exclude additional charges which significantly impact the total cost. Remember, understanding the APR is vital for making a responsible decision regarding payday loans in Long Beach.

Breaking down various fees associated with payday loans

Payday loans in Long Beach, like elsewhere, often involve various fees beyond the initial interest rate. These can significantly increase the overall cost. For example, you might encounter originations fees, a one-time charge for processing your loan application. Late fees are another common expense, often substantial, and levied if you fail to repay on time. Some lenders also charge rollover fees if you extend the loan term, further compounding your debt. Always carefully review the loan agreement before signing to fully understand all associated charges.

“Understanding these hidden costs is crucial to avoid a debt trap.” Payday loans should be used only as a last resort for genuine emergencies and with a clear plan for repayment. Failing to repay promptly can lead to a cycle of debt, as the accumulating fees quickly outweigh the initial loan amount. Comparing fees across different lenders in Long Beach is essential to find the most affordable option, but remember that even the lowest fees can still make payday loans incredibly expensive. Always prioritize exploring alternative financial solutions before considering a payday loan.

Comparing the total cost of borrowing from different lenders

Don’t just look at the advertised interest rate. Many payday lenders in Long Beach advertise low rates, but the true cost often involves significant fees. These fees can dramatically increase the Annual Percentage Rate (APR), making the loan far more expensive than it initially appears. Always calculate the total repayment amount, including all fees and interest, before committing to a loan. Compare this total cost across several lenders to find the best deal. Remember, even a small difference in fees can add up to a substantial amount over the loan term.

To effectively compare, request a Loan Estimate from each lender. This document details all costs involved. Pay close attention to the finance charge, which represents the total interest and fees. Use a loan calculator to simulate different loan amounts and repayment periods to better understand the impact of fees. “Choosing the lender with the lowest total repayment amount, not just the lowest interest rate, is crucial for responsible borrowing.” Consider the potential implications of late payment fees as well, as these can quickly escalate your debt. Thorough comparison protects you from predatory lending practices.

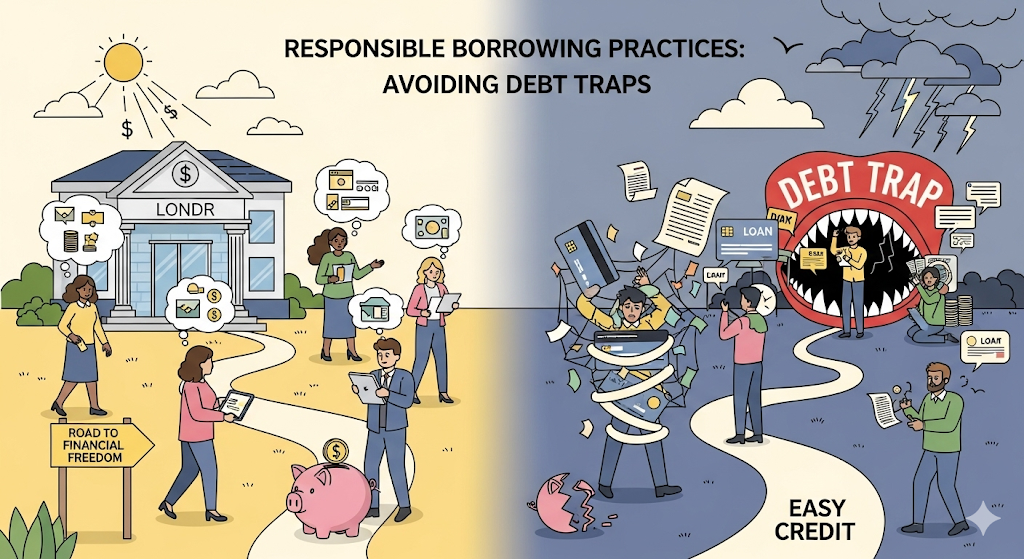

Responsible Borrowing Practices: Avoiding Debt Traps

Creating a realistic budget and repayment plan

Before applying for any payday loan in Long Beach, CA, meticulously track your income and expenses. Use budgeting apps or spreadsheets to get a clear picture of your monthly cash flow. Identify areas where you can cut back on spending to free up funds for repayment. This process is crucial for responsible borrowing. Ignoring this step often leads to further debt.

Once you understand your financial situation, create a detailed repayment plan. This plan should realistically allocate funds from your next paycheck specifically for loan repayment. Factor in all your other expenses to ensure you have enough money for essentials. “Failing to plan for repayment is a common reason borrowers end up in a cycle of debt, repeatedly taking out new loans to cover old ones.” Remember, payday loans are designed for short-term needs; prolonged reliance on them can have severe consequences. Consider exploring alternatives like credit counseling if you anticipate difficulties in repayment.

Exploring alternative financial solutions

Before considering a payday loan in Long Beach, explore alternatives. These options often offer better long-term financial health. Many credit unions and community banks provide small-dollar loans with more manageable repayment terms than payday loans. These institutions frequently offer financial literacy programs, helping borrowers understand budgeting and responsible debt management. Researching these options can save you significant costs in the long run.

Consider also exploring non-loan solutions. Budgeting apps and free financial counseling services can help you manage your finances effectively. Negotiating with creditors for extended payment plans or exploring debt consolidation may provide relief. “Remember, exploring these options before resorting to a payday loan is crucial to avoiding a cycle of debt.” The Consumer Financial Protection Bureau (CFPB) offers many free resources to assist you in navigating financial challenges. Taking advantage of these readily available resources can significantly improve your financial well-being.

Seeking help from credit counseling services

Before taking out a payday loan in Long Beach, consider exploring free or low-cost credit counseling services. These services offer valuable guidance on managing your finances and exploring alternatives to high-interest payday loans. Many reputable non-profit organizations provide personalized budgeting advice, debt management plans, and assistance in negotiating with creditors. They can help you understand your financial situation and develop a plan to improve it. Finding a certified credit counselor ensures you receive trustworthy and ethical guidance.

The National Foundation for Credit Counseling (NFCC) is a good place to start your search for a reputable organization. They have a directory of member agencies across the country, including Long Beach. Remember, a qualified credit counselor will never pressure you into taking a loan. Instead, they’ll empower you to make informed decisions about your financial health. “Seeking help early is crucial for preventing a cycle of debt, especially when considering the high interest rates associated with payday loans.” Utilizing these free resources can dramatically improve your chances of successfully navigating your financial challenges and finding responsible solutions that avoid the debt trap.

Long Beach Community Resources and Financial Assistance

Local non-profit organizations providing financial aid

Long Beach boasts a network of dedicated non-profit organizations offering crucial financial assistance to residents facing hardship. These organizations often provide budget counseling, emergency financial aid, and assistance with essential bills like rent or utilities. They can help you navigate difficult financial situations and explore solutions beyond payday loans. For example, the Long Beach Community Action Partnership offers various programs aimed at poverty reduction, including direct financial aid and workforce development initiatives. Check their website or contact them directly to learn about eligibility requirements and application processes.

Many smaller, hyperlocal non-profits also exist within specific neighborhoods. These organizations often have a deeper understanding of community needs and can provide more personalized support. Searching online for “financial assistance Long Beach” along with your specific neighborhood will yield valuable results. Remember to thoroughly research any organization before sharing personal information. “Look for established groups with transparent operations and positive community reviews to ensure you’re working with a reputable and safe resource.” Don’t hesitate to contact multiple organizations to explore all available options.

Government assistance programs for low-income residents

Long Beach residents facing financial hardship can explore several government assistance programs. The California Department of Social Services administers crucial programs like CalFresh (food assistance) and CalWORKs (cash aid for families). These programs offer vital support to low-income families and individuals, helping them meet basic needs and avoid relying on high-cost short-term loans like payday loans. Eligibility requirements vary, depending on income, household size, and other factors. It’s crucial to check the specific guidelines for each program.

To access these resources, visit the official California Department of Social Services website or contact your local Long Beach social services office. They can provide detailed information on application processes, eligibility criteria, and available benefits. “Seeking assistance early can prevent a worsening financial situation and help you avoid predatory lending practices.” Remember, utilizing these programs doesn’t preclude seeking other financial support, such as budgeting assistance or credit counseling, to build long-term financial stability. Consider these programs as a first step before considering high-interest payday loans in Long Beach.

Community resources offering financial literacy education

Before considering a payday loan in Long Beach, explore free financial literacy education resources available within the community. Many local organizations offer workshops and classes designed to improve your understanding of budgeting, saving, and debt management. These programs can equip you with the skills to make informed financial decisions and potentially avoid needing high-interest loans like payday advances. The Long Beach Public Library, for example, frequently hosts financial literacy events, offering valuable resources and expert guidance. Check their website or contact them directly for details on upcoming programs.

Consider also exploring resources like the Consumer Credit Counseling Service (CCCS). They provide free or low-cost credit counseling and education. This can help you create a budget, manage debt effectively and develop healthy financial habits. “Learning to manage your finances proactively is the best way to avoid needing short-term, high-cost loans.” Remember to research and carefully evaluate any organization offering financial advice to ensure their legitimacy and credibility before sharing personal information. Proactive financial planning can significantly reduce your reliance on payday loans and other forms of high-interest credit.