Understanding Payday Loans in Tyler, TX

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They are typically repaid in a single lump sum on the borrower’s next payday, usually within two to four weeks. This type of loan is often used for emergencies, such as car repairs or medical bills, but it’s crucial to understand the high costs involved. These loans are readily available in Tyler, Texas, but borrowers should always explore all options before considering one. Remember that responsible borrowing is key.

The interest rates on payday loans are significantly higher than those on traditional loans. This is because of the short repayment period and the higher risk for lenders. Before taking out a payday loan in Tyler, TX, thoroughly research all fees and interest rates. Carefully compare offers from multiple lenders to find the best terms possible. “Failing to fully understand the terms can lead to a debt cycle that’s difficult to escape.” Always consider alternatives like credit unions or small personal loans from friends or family before resorting to a payday loan.

How Payday Loans Work in Tyler

Payday loans in Tyler, Texas, are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. You typically borrow a relatively small amount, often up to $500, and repay the loan, plus fees, on your next payday. The application process is often quick and easy, sometimes completed entirely online. Many lenders in Tyler prioritize speed and convenience, aiming to get funds into your account as swiftly as possible. However, it’s crucial to understand the high interest rates associated with these loans.

Before applying for a payday loan in Tyler TX, carefully compare interest rates and fees across different lenders. Read the loan agreement thoroughly to understand all terms and conditions. Failing to repay the loan on time can lead to significant additional fees and damage your credit score. “Always prioritize responsible borrowing and only take out a payday loan if you’re certain you can repay it on time.” Consider exploring alternative financial solutions, such as negotiating with creditors or seeking assistance from local credit counseling agencies, before resorting to a payday loan. These alternatives may offer more sustainable, long-term solutions to your financial challenges.

Eligibility Requirements for Payday Loans in Tyler

Securing a payday loan in Tyler, TX requires meeting specific criteria. Lenders typically verify your age (generally 18 or older), residency in Texas, and a valid government-issued ID. Proof of income is crucial, often demonstrated through pay stubs or bank statements showing regular employment or other reliable income sources. Many lenders prefer a consistent income history, minimizing the risk of loan default. Finally, active checking or savings accounts are necessary for direct deposit of the loan proceeds and subsequent repayments. Failure to meet these minimum requirements will likely result in loan application rejection.

Beyond the basics, lenders may consider your credit history, although payday loans often cater to individuals with less-than-perfect credit. However, a history of responsible financial management, such as consistent repayment of previous debts, can significantly improve your chances of approval. Remember, each lender has its own specific requirements. Always check the individual lender’s stipulations before applying. “Comparing multiple lenders and carefully reviewing their terms and conditions is essential to securing the best possible payday loan in Tyler, Texas.” This diligent approach helps you avoid unexpected fees and potentially predatory lending practices.

Finding Reputable Lenders in Tyler

Identifying Licensed and Bonded Lenders

Securing a payday loan in Tyler, Texas requires diligence. Before borrowing, verify the lender’s licensing status with the Texas Department of Banking. This simple step protects you from unlicensed operators who may engage in predatory lending practices. Always check for a current license and avoid lenders who are evasive about their licensing information. “Choosing a licensed lender significantly reduces your risk of encountering illegal fees or deceptive terms.”

Licensed lenders often display their bonding information prominently. Bonding provides an additional layer of consumer protection. If a bonded lender engages in illegal activities, the bond ensures you have recourse to recover losses. Look for clear evidence of bonding, such as a certificate or readily available contact information for the bonding company. Remember to compare interest rates, fees, and repayment terms across multiple licensed and bonded lenders to find the best payday loan option for your circumstances. “Never rush the process; thorough research is key to a safe and responsible payday loan experience in Tyler, Texas.”

Comparing Interest Rates and Fees

Interest rates are the cornerstone of any payday loan. They vary significantly between lenders in Tyler, Texas. Don’t just focus on the advertised rate. Carefully examine the Annual Percentage Rate (APR). This reflects the total cost, including fees. A lower APR is always better. Shop around and compare offers from multiple lenders to find the most competitive rate. Remember, extremely low rates might hide extra fees, so always check the fine print.

Fees are just as important as the interest rate. Many lenders charge origination fees, application fees, or late payment penalties. These add up quickly, substantially increasing the overall cost of your loan. “Before signing anything, thoroughly review the loan agreement to fully understand all charges.” Consider the total repayment amount, not just the initial loan amount. This will give you a true picture of the loan’s affordability. Using a loan comparison website can simplify this process. It helps ensure you are getting the best payday loan deal in Tyler, Texas.

Reading Reviews and Checking for Transparency

Before choosing a payday loan lender in Tyler, Texas, thoroughly investigate their online reputation. Read reviews on sites like the Better Business Bureau (BBB) and Google Reviews. Look for patterns in feedback. Positive reviews mentioning excellent customer service and transparent fees are a good sign. Conversely, numerous complaints about hidden charges or aggressive collection practices should raise serious red flags. Don’t just focus on the star rating; dig into the details of individual reviews to get a comprehensive picture.

Transparency is crucial when considering short-term loans. A reputable lender will clearly outline all fees, interest rates, and repayment terms upfront. Avoid lenders who are vague about their lending practices. Check their website for a detailed FAQ section and easily accessible contact information. “Look for a clear explanation of their APR (Annual Percentage Rate) and all associated costs, ensuring there are no hidden fees.” If information is difficult to find or seems deliberately obscured, consider it a warning sign and explore other options. Your due diligence will protect you from predatory lending practices.

The Application Process: A Step-by-Step Guide

Gathering Necessary Documents

Securing a payday loan in Tyler, Texas, often requires providing specific documentation. Lenders need to verify your identity, income, and employment. This typically includes a government-issued photo ID, such as a driver’s license or state ID card. You’ll also need proof of income, which could be recent pay stubs, bank statements showing direct deposits, or proof of self-employment income. Failure to provide these crucial documents will likely delay or prevent loan approval. Remember, accurate and complete information is vital for a smooth application process.

Beyond the basics, some lenders in Tyler might request additional documents. This could include proof of residency, like a utility bill or lease agreement. They may also want to see your bank account details to ensure direct deposit is possible. Always confirm the exact requirements with the specific lender before submitting your application to avoid delays. “Having all necessary documents ready before you begin the application will significantly speed up the process and increase your chances of approval.” This proactive approach demonstrates responsibility and financial preparedness.

Completing the Online or In-Person Application

Applying for a payday loan in Tyler, Texas, is generally straightforward. Whether you choose an online or in-person application, you’ll need to provide accurate personal information. This typically includes your full name, address, Social Security number, driver’s license or state-issued ID, and employment details including income verification. Be prepared to answer questions about your banking information as well, as direct deposit is often required for receiving your funds. Remember, honesty is crucial throughout the process. Inaccurate information can lead to application denial.

Online applications often offer a quicker turnaround time. Many lenders in Tyler provide instant online applications, allowing you to complete the process from the comfort of your home. In-person applications, however, offer the opportunity to directly ask questions and clarify any doubts with a loan representative. “No matter which method you choose, carefully review all terms and conditions before signing any agreements.” Take your time; don’t feel pressured to rush into a decision. It’s always a good idea to compare offers from several lenders to find the best payday loan terms for your specific financial situation in Tyler, Texas. This might involve researching short-term loans in Tyler, same-day payday loans in Tyler, or cash advance loans in Tyler options to ensure you’re making an informed choice.

Understanding the Loan Agreement

Before signing, carefully read every detail. Understand the total amount you will repay, including all fees and interest. This is crucial for avoiding unexpected costs. Pay close attention to the repayment schedule, ensuring it aligns with your budget. Missing payments can lead to significant penalties and harm your credit score. Remember that Texas has regulations concerning payday loan interest rates and fees; familiarize yourself with these limits to protect yourself from predatory lending practices. Compare offers from multiple lenders to find the best terms.

Consider using a calculator to project your total repayment amount. This will give you a clear picture of the overall loan cost. Look for any clauses dealing with rollover or extensions. These can lead to a cycle of debt that is difficult to escape. “Don’t hesitate to ask questions if anything is unclear; reputable lenders will gladly explain the terms in detail.” Finally, keep a copy of the signed agreement for your records. This is essential proof of the agreement’s terms should any disputes arise.

Responsible Borrowing Practices

Creating a Realistic Repayment Plan

Before accepting a payday loan in Tyler, Texas, meticulously plan your repayment. Carefully review your monthly budget. Identify all income sources and necessary expenses. This will help you determine how much you can comfortably repay without jeopardizing other financial obligations. Remember, payday loans often have high fees. These fees can quickly escalate your debt if not managed carefully.

Prioritize essential expenses like rent, utilities, and food. Then, allocate funds for the loan repayment. Ensure the repayment amount fits within your budget. Consider setting aside a small emergency fund to cover unexpected expenses. This helps prevent further borrowing. “Failing to plan is planning to fail,” so create a realistic and achievable repayment schedule. Sticking to this schedule reduces the risk of late fees or defaulting on your loan. Contact a credit counselor if you struggle to create a budget or repayment plan. They can provide valuable guidance and support.

Budgeting Effectively to Manage Debt

Before taking out a payday loan in Tyler, Texas, or anywhere else, create a detailed budget. List all your monthly income and expenses. Identify areas where you can cut back. Even small savings can make a difference. Prioritize essential expenses like housing, utilities, and food. Consider using budgeting apps or spreadsheets to track your spending and progress. This allows for a clear picture of your financial situation. This step is crucial to determining if a payday loan is truly necessary and affordable.

Careful planning is essential for managing debt from any source, including payday loans. Prioritize debt repayment. Create a repayment plan that fits your budget. This might involve making extra payments when possible. Consider consulting with a credit counselor for personalized advice. They can offer strategies to manage debt effectively and avoid further financial difficulties. “Failing to plan is planning to fail,” so remember to be proactive and realistic about your repayment capacity before applying for a payday loan. This will help avoid a cycle of debt.

Seeking Help from Credit Counseling Services

Facing financial hardship can be overwhelming, but help is available. Nonprofit credit counseling agencies offer free or low-cost services to residents of Tyler, Texas, and nationwide. These services can provide valuable guidance on managing debt, budgeting effectively, and exploring alternatives to high-interest payday loans. They can help you create a realistic budget and develop a plan to tackle your financial challenges. Remember, seeking help is a sign of strength, not weakness.

Reputable credit counseling agencies, such as those accredited by the National Foundation for Credit Counseling (NFCC), offer personalized financial guidance. They can help negotiate with creditors, potentially reducing your debt burden. They provide education on responsible financial management, empowering you to make informed decisions and avoid the debt cycle. “Before taking out a payday loan in Tyler, Texas, or anywhere, consider contacting a credit counseling agency; it could save you significant money and stress in the long run.” They can assess your situation and offer tailored solutions, potentially leading to a healthier financial future.

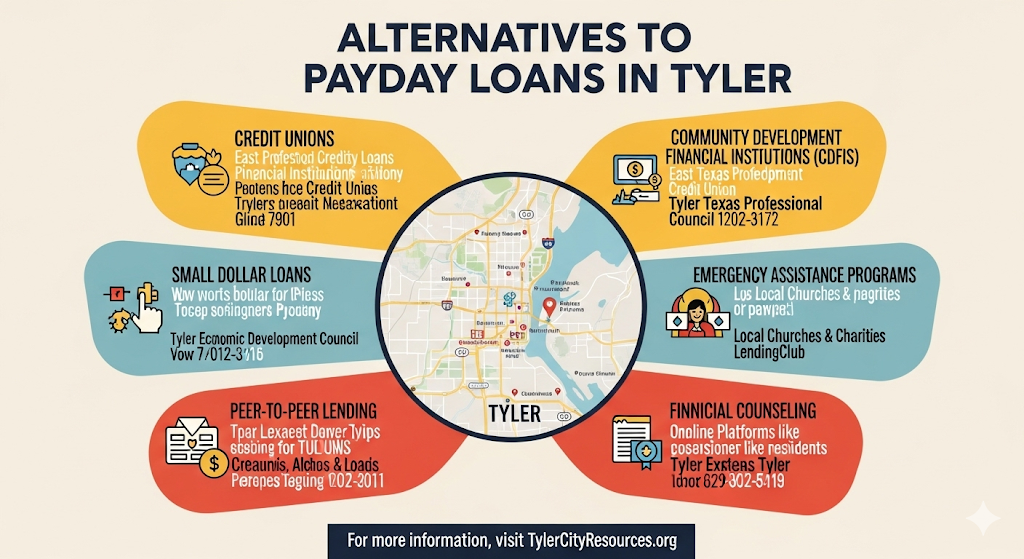

Alternatives to Payday Loans in Tyler

Exploring Personal Loans

Personal loans offer a viable alternative to payday loans in Tyler, Texas, providing a structured repayment plan over a longer period. Unlike the short-term, high-interest nature of payday loans, personal loans typically offer lower interest rates and more manageable monthly payments. This makes budgeting easier and reduces the risk of falling into a debt cycle. Credit unions and online lenders often provide competitive rates and flexible terms, sometimes catering to borrowers with less-than-perfect credit scores. Be sure to compare interest rates, fees, and repayment terms carefully before committing.

Shop around and compare offers from multiple lenders to find the best personal loan for your needs in Tyler. Consider factors like the loan amount, interest rate, repayment period, and any associated fees. “Checking your credit report before applying can help you understand your creditworthiness and potentially negotiate better terms.” Remember, responsible borrowing involves understanding the loan agreement completely. Failing to do so could lead to unforeseen financial difficulties. A personal loan, when used responsibly, can be a valuable tool for managing unexpected expenses or making significant purchases.

Considering Small Credit Unions

Credit unions often provide a friendlier alternative to payday loans in Tyler, Texas. They’re not-for-profit organizations, meaning their focus is on member benefit, not maximizing profits. This often translates to more affordable small loans with lower interest rates and more flexible repayment plans than you’d find with a payday lender. Many credit unions offer small-dollar loans specifically designed for unexpected expenses, bridging the gap until your next paycheck. Before applying, check your eligibility requirements.

Explore local credit unions in Tyler. Research their loan options online. Compare their interest rates and fees with payday loan options. “Choosing a credit union can significantly reduce the financial burden associated with short-term borrowing.” Consider factors like loan amounts, terms, and application processes. Remember to carefully read the fine print before committing to any loan, regardless of the lender. Taking the time to compare options ensures you find the best fit for your financial situation and avoid the high-cost trap of payday loans.

Utilizing Community Resources

Tyler, Texas, boasts a network of helpful community resources designed to assist residents facing financial hardship. These organizations often offer free or low-cost financial assistance programs, including budget counseling, emergency financial aid, and assistance with utility bills or rent. Many are faith-based or non-profit organizations dedicated to supporting the local community. You can find comprehensive lists of these services through the United Way of Smith County or by searching online for “financial assistance Tyler, TX.” Don’t hesitate to reach out; they are there to help.

Before considering a payday loan in Tyler, explore the options available through local charities and government programs. The Texas Department of Housing and Community Affairs (TDHCA) website offers a wealth of information on rental assistance and homeownership programs. Additionally, many local churches and community centers provide direct assistance to those in need. “Exploring these resources first can often provide more sustainable solutions than the high-interest rates associated with payday loans.” Remember, seeking help is a sign of strength, and these community resources are designed to support you through challenging times.

Legal Aspects and Consumer Protection

Texas Payday Loan Laws and Regulations

Texas has specific regulations governing payday loans, designed to protect consumers. The Texas Office of Consumer Credit Commissioner (OCCC) oversees these laws. Lenders must adhere to strict limitations on loan amounts, fees, and repayment terms. For example, loan amounts are capped, and lenders cannot charge excessive fees that create a debt trap for borrowers. Failure to comply can result in significant penalties. “Understanding these regulations is crucial for both borrowers and lenders to avoid legal issues.”

Borrowers in Tyler, Texas, should be aware of the annual percentage rate (APR) on any payday loan they consider. The APR reflects the total cost of borrowing, including fees. It’s vital to compare APRs from different lenders before committing to a loan. Always review the loan agreement carefully before signing. “If you have questions or encounter problems with a payday lender, contact the OCCC immediately for assistance.” The OCCC provides resources and complaint mechanisms to address consumer concerns regarding payday loans. They are a key source for ensuring compliance with Texas state law.

Avoiding Predatory Lending Practices

In Tyler, Texas, as elsewhere, payday loans can sometimes involve predatory lending. Predatory lenders often target vulnerable individuals with high-interest rates and hidden fees. They may pressure borrowers into agreements they don’t fully understand. Be wary of lenders who aggressively push loans. Always read the fine print carefully before signing any contract. Understand all fees and the total cost of the loan. Don’t hesitate to ask questions if anything is unclear. Compare offers from multiple lenders to find the best terms. The Texas Office of Consumer Credit Commissioner (OCCC) is a valuable resource for information and assistance with complaints. Their website provides details on consumer rights and protections.

“To avoid becoming a victim of predatory payday loan practices, thoroughly research lenders before borrowing,” is crucial. Check online reviews and ratings from reputable sources like the Better Business Bureau. Confirm the lender is licensed and complies with all Texas state regulations. Never borrow more than you can realistically repay on your next payday. Consider alternative financing options, like credit counseling or borrowing from family or friends. Remember, a payday loan should be a last resort, not a long-term solution for financial difficulties. Responsible borrowing practices are key to avoiding a cycle of debt.

Knowing Your Rights as a Borrower

In Tyler, Texas, as in all of Texas, payday loans are governed by state law. Understanding these laws protects you. The Texas Department of Banking oversees payday lenders, ensuring compliance. They can help resolve disputes. Familiarize yourself with the Texas Finance Code, Title 1, Chapter 392, which details payday lending regulations. Knowing this information is key to responsible borrowing. “Ignoring these laws could lead to serious financial repercussions.”

Before signing any payday loan agreement, carefully read the entire contract. Pay close attention to the Annual Percentage Rate (APR), fees, and repayment terms. Don’t hesitate to ask questions. If anything is unclear, seek clarification from the lender or a financial advisor. Don’t sign anything you don’t understand. Remember, you have the right to a clear and concise explanation of all loan terms. The Texas Attorney General’s office also provides resources for consumers facing issues with lenders. “Utilizing these resources empowers you to make informed decisions and avoid predatory lending practices.”