Understanding Payday Loans Lake Charles

What are Payday Loans and How Do They Work?

Payday loans in Lake Charles, Louisiana, are short-term, small-dollar loans designed to help borrowers meet immediate financial needs until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. This type of loan is often used for unexpected expenses like car repairs or medical bills. Borrowers should carefully consider the high interest rates associated with payday loans before applying. These loans can be helpful in emergencies, but they are not a solution for long-term financial problems. Always explore other options first, such as borrowing from family or utilizing credit unions.

The application process for a payday loan in Lake Charles is generally quick and straightforward. Most lenders require proof of income and a valid ID. The loan amount is usually limited to a percentage of the borrower’s expected income. Once approved, the funds are typically deposited directly into the borrower’s bank account within 24 hours. However, the high cost of borrowing needs careful consideration. “Failing to repay on time can lead to additional fees and potentially damage your credit score.” Always understand the terms and conditions before signing any loan agreement. Consider exploring alternatives before applying for a payday loan.

Payday Loan Regulations in Louisiana: What You Need to Know

Louisiana regulates payday loans, aiming to protect consumers. The state limits the amount a lender can charge in fees. These fees are capped at a maximum percentage of the loan amount. This percentage varies depending on the loan size, but it’s crucial to understand these limits before borrowing. Always check the specific regulations to avoid unexpected costs. You can find this information on the Louisiana Office of Financial Institutions website.

Payday loans are short-term, high-cost loans. They are designed to bridge the gap until your next paycheck. However, the high interest rates can lead to a debt cycle. Before applying for a payday loan in Lake Charles, carefully consider the total cost. “It’s essential to only borrow what you can comfortably repay on your next payday to avoid further financial hardship.” Explore all other options first, such as borrowing from friends or family, or using a credit card if possible. Failing to repay on time can result in additional fees and damage your credit score.

Short-Term vs. Long-Term Financial Solutions: Weighing Your Options

Payday loans in Lake Charles, like elsewhere, are designed as short-term financial solutions. They provide quick access to cash, typically due on your next payday. This makes them suitable for covering unexpected expenses, such as a sudden car repair or medical bill. However, remember that the high interest rates make them unsuitable for long-term debt management. Using a payday loan to address chronic financial issues will likely worsen your situation.

Consider alternatives for long-term financial needs. Building an emergency fund, exploring options like a personal loan with a lower interest rate, or working with a credit counselor are far better strategies. “Prioritizing budgeting and responsible spending habits is crucial to preventing future reliance on high-cost short-term loans like payday loans in Lake Charles.” Before taking out a payday loan, carefully evaluate your financial situation and explore all available options to make an informed decision. Remember, responsible borrowing is key to maintaining good financial health.

Finding Reputable Lenders in Lake Charles

Identifying Licensed and Reliable Payday Loan Providers

Before you borrow, verify the lender’s license. The Louisiana Office of Financial Institutions (LOFI) maintains a registry of licensed payday lenders. Check this registry to confirm the lender’s legitimacy and avoid scams. Look for their physical address in Lake Charles. Avoid lenders who only operate online and lack a local presence. “This helps protect you from fraudulent operations.”

Reliable lenders are transparent about their fees and terms. They provide clear, concise loan agreements, easily understandable by the average person. Scrutinize the contract carefully. Look for hidden fees or excessively high interest rates. Compare offers from multiple licensed lenders to find the best terms. “Remember, responsible borrowing involves understanding the total cost of the loan, including all fees and interest.” Consider using online comparison tools to streamline this process. Choose a reputable lender that prioritizes consumer protection.

Avoiding Predatory Lending Practices: Red Flags to Watch For

In Lake Charles, as elsewhere, some lenders employ predatory practices. Be wary of extremely high interest rates, far exceeding Louisiana’s legal limits. Check the lender’s licensing and reputation with the Louisiana Office of Financial Institutions. Avoid lenders who pressure you into borrowing more than you need or who make unrealistic promises about repayment. “Hidden fees and unclear terms are major red flags indicating a potentially predatory payday loan.”

Look for transparency in fees and interest calculations. Legitimate lenders will clearly explain all costs upfront. They’ll provide a detailed loan agreement in simple language, easily understandable by the borrower. If a lender pressures you to sign quickly without fully explaining the terms, walk away. Consider using comparison websites to find multiple loan offers, enabling you to choose a fairer deal. Researching lenders and understanding your rights as a borrower in Lake Charles are crucial to avoiding predatory payday loans.

Online vs. In-Person Lenders: Which is Right for You?

Choosing between online and in-person payday loan lenders in Lake Charles depends on your priorities. Online lenders offer convenience. You can apply anytime, anywhere. Many operate nationally, potentially offering broader choices. However, online payday loans sometimes lack the personal touch. It’s crucial to thoroughly vet any online lender for legitimacy and licensing in Louisiana to avoid scams. Check reviews carefully before applying.

In-person lenders, often local credit unions or storefront payday loan providers, offer a face-to-face interaction. This can be beneficial for clarifying terms and asking questions. You can build a relationship with a local lender, potentially easing future borrowing. However, in-person lenders may have more limited hours and fewer loan options. “Always compare interest rates and fees across both online and in-person options to secure the best deal for your specific financial situation.” Remember to check the lender’s reputation and licensing with the Louisiana Office of Financial Institutions.

Eligibility Requirements and the Application Process

Credit Score and Requirements: What Lenders Look For

Unlike traditional loans, payday lenders in Lake Charles, Louisiana, often don’t place as much emphasis on a high credit score. They prioritize your ability to repay the loan within the short timeframe, typically two to four weeks. This means they’ll focus more on your current income and employment stability than your credit history. However, a poor credit history might lead to higher interest rates or loan denial. Some lenders may perform a soft credit check, impacting your credit score minimally, while others might conduct a hard inquiry, which shows up on your credit report. Always ask before applying to understand the lender’s credit check policy.

To qualify for a payday loan in Lake Charles, you’ll generally need to provide proof of regular income, such as pay stubs or bank statements, demonstrating your capacity to repay the loan on time. You’ll also need a valid government-issued ID and an active checking account for direct deposit of the loan proceeds and automatic repayment. “Failing to meet these basic requirements will likely result in an immediate application rejection,” so ensure all your documentation is up-to-date and accurate before submitting your application. Lenders often use automated systems for initial application assessments, so providing complete and correct information is crucial for a smooth and efficient process.

Income Verification and Proof of Residency

Securing a payday loan in Lake Charles, Louisiana, often hinges on demonstrating consistent income. Lenders typically require proof of regular employment, such as pay stubs for the past few months, or documentation of other reliable income sources like Social Security benefits or retirement income. Self-employment will require providing tax returns or bank statements clearly showing income. Failure to provide sufficient income verification will likely result in loan application denial. “Be prepared to show that your income is enough to comfortably repay the loan, including interest, within the stipulated timeframe.”

Verifying your residency is just as crucial. Lenders need confirmation that you live in Lake Charles and are a legal resident of Louisiana. Acceptable forms of proof include a current utility bill, a driver’s license with your Lake Charles address, or a rental or mortgage agreement. The address on your identification should match the address you provide on the application. Discrepancies in address information can lead to delays or rejection of your payday loan application. Keep all your documentation readily available to streamline the process.

Steps to Apply for a Payday Loan in Lake Charles

Applying for a payday loan in Lake Charles is generally straightforward. First, you’ll need to locate a reputable lender. Many operate online, offering convenience and a wider selection of loan options. However, be sure to verify their licensing with the Louisiana Office of Financial Institutions to avoid scams. You’ll then need to gather essential documents like proof of income (pay stubs or bank statements), a valid government-issued ID, and your bank account information for direct deposit. Remember, some lenders may have additional requirements, so always check their specific criteria before starting.

Once you’ve assembled the necessary documents, the application process itself is typically quick. Most lenders provide online applications that you can complete in minutes. You’ll need to provide accurate information. Incomplete or inaccurate applications will delay the process. After submitting your application, the lender will review it. They’ll check your creditworthiness and the information provided. Following approval (which can sometimes be instantaneous for online lenders), the funds are usually deposited directly into your bank account within one business day. “Be aware that interest rates and fees can vary significantly between lenders, so shop around and compare offers before committing to a loan.” Always borrow responsibly, and only take out what you can afford to repay promptly.

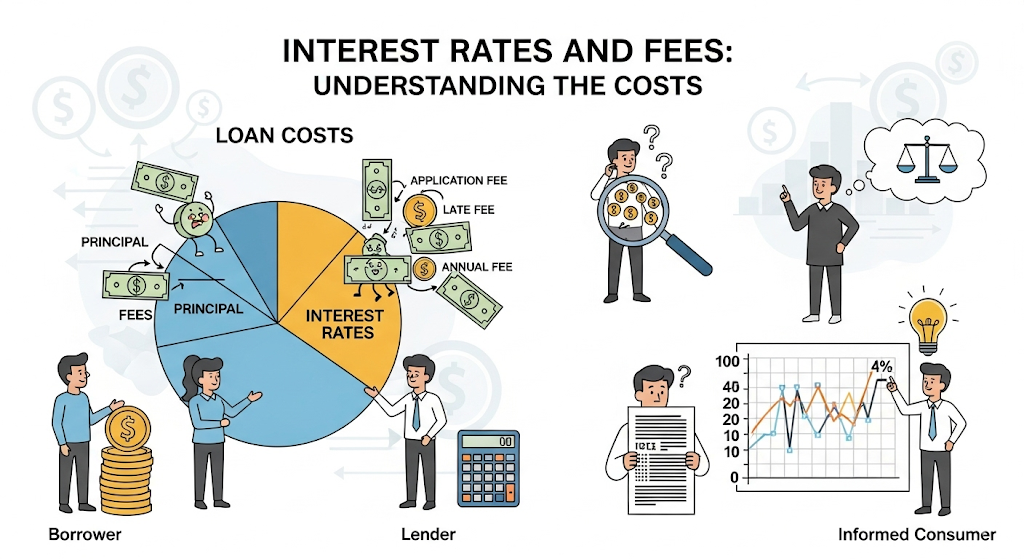

Interest Rates and Fees: Understanding the Costs

Average Interest Rates for Payday Loans in Lake Charles

Pinpointing the exact average interest rate for payday loans in Lake Charles, Louisiana, is difficult. State regulations don’t dictate a fixed rate, and individual lenders set their own terms. However, expect rates to be significantly higher than traditional loan options. You might see annual percentage rates (APRs) ranging from 300% to 700% or even more. This high cost reflects the short repayment period and the perceived higher risk for lenders. Always compare offers from multiple lenders to secure the best possible rate. Remember, these high APRs represent the true cost of borrowing, far exceeding what you initially see advertised.

“Understanding the substantial interest charges is crucial before considering a payday loan in Lake Charles.” Factors like credit history and the loan amount can influence the final interest rate. It’s vital to carefully read all loan documents and understand all fees before signing any agreement. Considering the potential for debt traps, explore alternative borrowing options whenever possible. Credit unions often offer smaller loans with far more manageable interest rates. Thorough research and responsible borrowing habits are key to avoiding financial difficulties associated with payday loans.

APR (Annual Percentage Rate) Explained

Understanding the true cost of a payday loan in Lake Charles, Louisiana, requires grasping the Annual Percentage Rate (APR). The APR isn’t simply the interest rate you see advertised. It’s a broader calculation encompassing all fees and charges associated with the loan, expressed as a yearly percentage. This includes origination fees, any early repayment penalties, and, of course, the interest itself. A higher APR means a more expensive loan. Always compare APRs from different lenders before committing to a payday loan in Lake Charles.

Think of it this way: a payday loan with a seemingly low interest rate might have a surprisingly high APR due to additional fees. “Always check the APR, not just the interest rate, to make an informed decision.” For example, a loan advertised at 10% interest might have a 300% APR when all fees are factored in. This significantly impacts the total repayment amount. Therefore, carefully review the loan agreement and understand how the APR is calculated before signing any paperwork for your payday loan in Lake Charles.

Hidden Fees and Charges to Avoid

Beware of seemingly insignificant charges that can quickly inflate the overall cost of your payday loan in Lake Charles, Louisiana. Many lenders tack on extra fees for things like application processing, origination, or even late payments. These fees, while individually small, can compound rapidly, especially if you are already struggling financially. Always thoroughly review the loan agreement before signing. Scrutinize every line item for unexpected additions to the principal.

Before committing to a payday loan, carefully inquire about all potential fees. Ask specifically about any late payment penalties, insufficient funds fees, or early repayment charges. Louisiana has specific regulations governing payday loans, but lenders still have some leeway in setting their fees. “Comparing loan offers from multiple lenders is crucial to finding the most transparent and reasonably priced option.” Don’t hesitate to ask for clarification on any fees you don’t understand. Choosing a reputable lender with a clear fee schedule is vital to avoiding hidden costs and unexpected financial burdens.

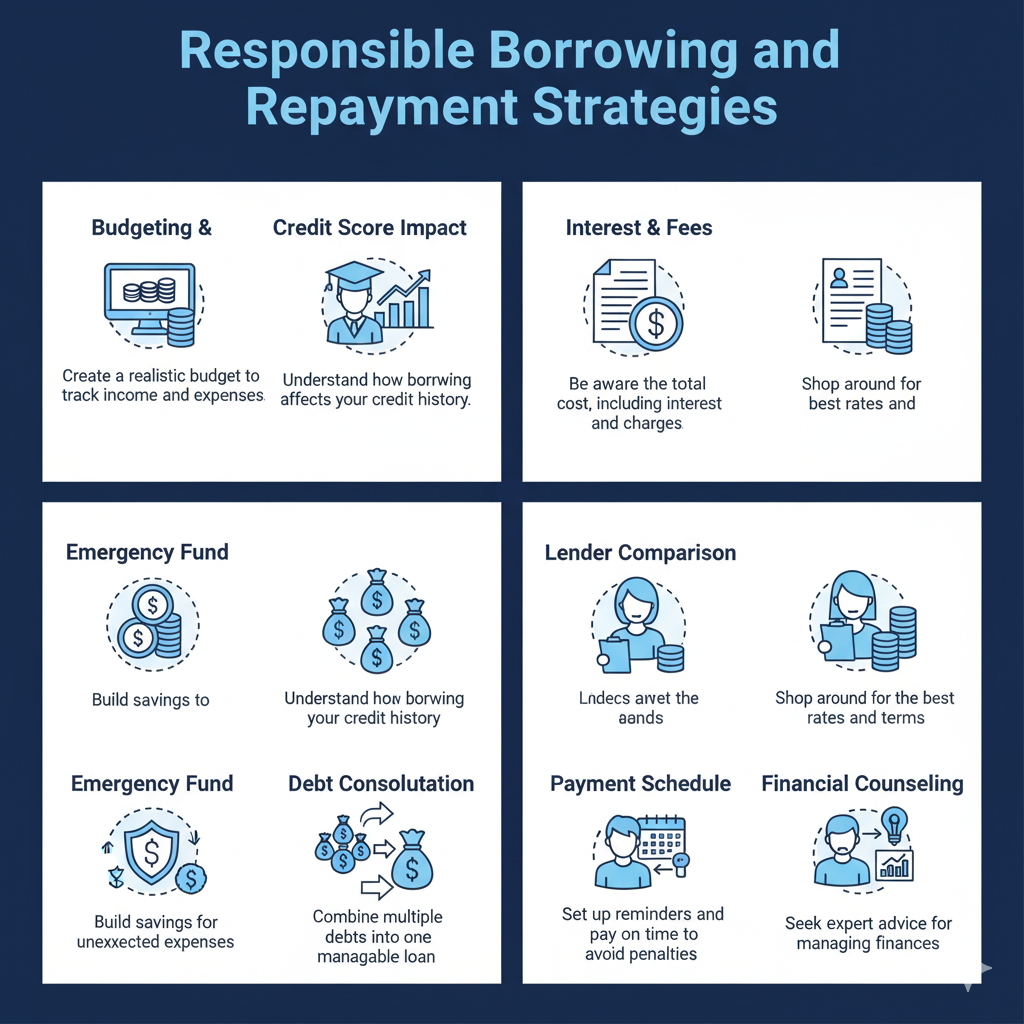

Responsible Borrowing and Repayment Strategies

Creating a Repayment Plan to Avoid Default

Before you apply for a payday loan in Lake Charles, Louisiana, create a detailed repayment plan. This crucial step prevents default and its damaging consequences. Consider your income, essential expenses, and the loan’s terms. Allocate a specific amount each payday for loan repayment. Budget meticulously. Track your spending. Adjust your plan as needed. Unexpected expenses happen. Building in flexibility is essential.

“Failing to plan is planning to fail.” This proverb rings true for payday loans. A realistic budget, combined with a dedicated repayment schedule, significantly reduces the risk of default. Explore options like setting up automatic payments from your bank account. This ensures timely repayment and avoids late fees. Contact your lender immediately if you anticipate trouble making a payment. Many lenders offer hardship programs or extensions for responsible borrowers facing temporary financial difficulties. Remember, proactive communication is key to avoiding default and preserving your credit.

Budgeting Tips for Managing Your Finances

Before taking out a payday loan in Lake Charles, Louisiana, or anywhere else, meticulous budgeting is crucial. Create a detailed budget that tracks all your income and expenses. Categorize spending into needs (housing, food, transportation) and wants (entertainment, dining out). Identify areas where you can cut back. Even small reductions can make a significant difference in your ability to repay your loan on time and avoid additional fees. Prioritize essential expenses and consider delaying non-essential purchases until after the loan is repaid.

Apps and online tools can help you track spending and create a budget. Many free resources are available. Consider using the 50/30/20 budgeting rule. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This framework can improve your financial health. “Remember, responsible financial planning is key to avoiding the debt cycle often associated with payday loans.” Building a solid budget before considering a payday loan will significantly increase your chances of successful repayment and minimize the risk of financial hardship.

Alternative Financial Resources: Exploring Other Options

Before considering a payday loan in Lake Charles, Louisiana, explore alternative financial solutions. Credit unions often offer smaller, short-term loans with more manageable interest rates than payday lenders. The National Credit Union Administration (NCUA) insures these loans, offering a level of security. Local charities and non-profit organizations may also provide emergency financial assistance programs, including grants or low-interest loans. These resources frequently have less stringent requirements than payday loans. Research available options carefully; comparing interest rates and repayment terms is crucial.

“Always prioritize exploring these alternatives before turning to high-cost payday loans.” Contact your local United Way or search online for community assistance programs in Lake Charles. Remember, understanding your financial situation thoroughly is key to making informed decisions. Budgeting apps and free financial counseling services can also help you manage your money effectively and avoid future reliance on payday loans. Responsible financial planning reduces the need for short-term, high-interest borrowing. Prioritize building a financial safety net to mitigate unforeseen expenses.

Seeking Help: Resources for Financial Assistance

Local Non-Profit Organizations Offering Financial Counseling

Before considering a payday loan in Lake Charles, explore free resources offering financial counseling. Many local non-profit organizations provide valuable support to residents facing financial hardship. These organizations often offer budgeting workshops, credit counseling, and assistance with debt management strategies. They can help you create a realistic budget and develop a plan to address your financial challenges, potentially avoiding the high fees and interest rates associated with payday loans.

For example, the United Way of Southwest Louisiana often partners with local agencies to offer comprehensive financial literacy programs. They can connect you with certified credit counselors who can provide personalized guidance. Similarly, local churches and community centers frequently host financial assistance workshops. Remember to thoroughly research any organization before sharing personal information. “Seeking help from a reputable non-profit can be a crucial first step toward achieving long-term financial stability, often a much better alternative to a short-term payday loan.” Always confirm their legitimacy and the services they offer before engaging.

Government Assistance Programs in Lake Charles

Before considering a payday loan in Lake Charles, explore government aid options. The Louisiana Department of Social Services offers several crucial programs. These include TANF (Temporary Assistance for Needy Families), providing cash assistance to eligible families. Additionally, the Supplemental Nutrition Assistance Program (SNAP) helps with food costs. Eligibility criteria vary. You should check the official state website for precise details and application procedures. Contacting your local Department of Social Services office directly is also highly recommended.

For housing assistance, explore the Louisiana Housing Corporation’s programs. These programs offer rental assistance and support for homeowners facing foreclosure. The United Way of Southwest Louisiana also provides a comprehensive list of local resources, including referrals to various community action agencies that might offer assistance with utility bills, rent, or other essential needs. Remember to thoroughly research each program’s requirements. “Acting quickly and providing complete documentation is key to a successful application.” Don’t hesitate to seek help navigating these processes; many organizations offer free assistance.

Credit Counseling and Debt Management Services

Facing financial hardship can be overwhelming, but help is available. Credit counseling agencies offer valuable resources to manage debt effectively. These non-profit organizations provide debt management plans (DMPs), budgeting advice, and financial education. They can negotiate with your creditors to lower interest rates and consolidate payments, making it easier to repay your debts. Many reputable agencies are available in Lake Charles, Louisiana, offering free or low-cost services. Consider contacting several agencies to compare their services and choose the best fit for your situation. Remember to verify their accreditation with organizations like the National Foundation for Credit Counseling (NFCC).

Finding the right credit counselor is crucial. Look for agencies with experience working with individuals struggling with payday loan debt. A good counselor will help you understand your financial situation, create a realistic budget, and develop a long-term plan to become debt-free. “They will not only address your immediate need but also help you avoid similar situations in the future, thereby promoting sustainable financial well-being.” Consider the agency’s reputation, client testimonials, and their commitment to client confidentiality. Remember, choosing the right support can make all the difference in successfully managing your finances and avoiding the pitfalls of high-interest debt.