Understanding Payday Loans Louisville KY

What are Payday Loans and How Do They Work?

Payday loans are short-term, small-dollar loans designed to help borrowers meet immediate financial needs until their next payday. They are typically due on your next payday, hence the name. These loans are often characterized by high interest rates and fees, making them a costly borrowing option. Borrowers should carefully consider the total repayment cost before applying. In Louisville, KY, as in other states, borrowers must meet specific eligibility requirements, such as proof of income and a valid bank account. Always read the loan agreement carefully to understand the terms and conditions.

It’s crucial to understand how these loans work to avoid unexpected surprises. The application process is usually quick and simple, often completed online or in person at a lending location. Upon approval, the funds are typically deposited directly into your bank account. Repayment is usually a single lump sum payment on your next payday. “Failing to repay on time can lead to additional fees and penalties, potentially creating a cycle of debt.” Therefore, ensure you can comfortably afford the repayment amount before borrowing. Consider exploring alternative financial solutions if a payday loan seems risky.

Payday Loan Regulations in Kentucky: What You Need to Know

Kentucky regulates payday loans, but the rules are complex. Borrowers should understand the interest rate caps and loan term limits before applying. These limits vary, so comparing lenders is crucial. Failure to repay on time can lead to significant fees and debt cycles. It’s essential to budget carefully and ensure you can afford repayments.

Always check the lender’s license and legitimacy. Kentucky’s Department of Financial Institutions provides a database of licensed lenders. Use this resource to verify any payday loan provider in Louisville. Avoid unlicensed lenders, as they often operate outside legal protections. “Understanding these regulations is vital to protecting yourself from predatory lending practices and unexpected financial burdens.” Researching thoroughly before signing any agreement is paramount for responsible borrowing.

Interest Rates and Fees: A Transparent Look at the Costs

Payday loans in Louisville, KY, are known for their high interest rates. These rates are often expressed as an Annual Percentage Rate (APR), but the actual cost can be significantly higher than what the APR suggests due to the short repayment period. Expect rates to vary between lenders, but you should always thoroughly research and compare options before committing to a loan. Always ask for a clear breakdown of all fees. Don’t hesitate to seek a second opinion if something seems unclear.

Understanding the total cost is critical. Besides interest, fees like origination fees, late payment penalties, and rollover fees can quickly add up. These added expenses can make the loan far more expensive than initially anticipated. “Failing to fully grasp these charges could lead to a debt cycle that’s difficult to escape,” so carefully review the loan agreement before signing. Remember that Kentucky has regulations on payday loans, but it’s still crucial to be a savvy borrower and choose a reputable lender to mitigate potential risks.

Finding Reputable Payday Lenders in Louisville

Identifying Licensed and Reliable Lenders

Before borrowing from any payday loan lender in Louisville, KY, thoroughly verify their licensing and legitimacy. The Kentucky Department of Financial Institutions (KFI) maintains a database of licensed lenders. Check this registry to ensure your chosen lender is operating legally and adhering to state regulations. This simple step can save you from potential scams and predatory lending practices. Avoid lenders who pressure you into quick decisions or offer terms that seem too good to be true.

Remember, reputable payday lenders will be transparent about fees and interest rates. They’ll provide clear and concise loan agreements, readily available for your review. Look for lenders with positive customer reviews and a long-standing presence in the Louisville community. “Always compare multiple lenders to find the best interest rates and terms before signing any loan agreement.” Consider using online comparison tools to assist in your search. By being diligent and informed, you can find a safe and reliable payday loan option when faced with unexpected expenses.

Checking Online Reviews and Customer Feedback

Before applying for a payday loan in Louisville, KY, thoroughly research potential lenders. Don’t rely solely on advertising. Check multiple online review platforms like Google Reviews, Yelp, and the Better Business Bureau (BBB). Look for consistent patterns in customer feedback. Positive reviews often mention reasonable fees, clear terms, and helpful customer service. Negative reviews might highlight hidden charges, aggressive collection practices, or difficulties in repaying the loan. Pay close attention to these details.

Consider the volume of reviews as well as their content. A lender with few reviews might lack sufficient track record. Conversely, a lender with many overwhelmingly negative reviews should be avoided. “Your goal is to find a reputable lender with a history of fair and transparent practices.” Remember, reading reviews helps you compare lenders and make an informed decision. This crucial step can save you from potential scams or exploitative loan terms common in the payday loan industry. Always prioritize lenders with positive and consistent feedback.

Comparing Interest Rates and Loan Terms

Before you apply for a payday loan in Louisville, KY, meticulously compare interest rates offered by different lenders. Interest rates significantly impact your total repayment cost. A seemingly small difference in percentage can add up to a substantial amount over the loan’s term. Always check the Annual Percentage Rate (APR), not just the stated interest rate, for a complete picture of the borrowing cost. Remember that high interest rates are a common feature of payday loans, reflecting the inherent risk for lenders.

Carefully review the loan terms alongside the interest rates. This includes the repayment schedule, any fees (late payment fees, origination fees, etc.), and the loan amount. Look for transparent terms and conditions – avoid lenders who are vague or difficult to understand. “Understanding these details beforehand is crucial to making an informed decision and preventing unexpected financial burdens.” Consider the total cost of borrowing, including all fees, to accurately compare offers. Choosing a loan with a shorter repayment period, even if it has a slightly higher interest rate, can often result in less overall interest paid.

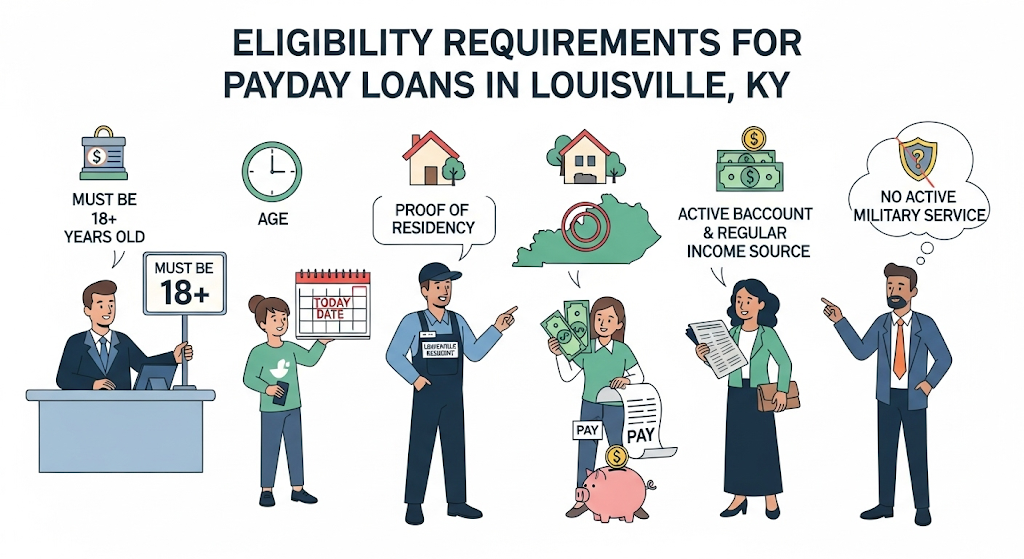

Eligibility Requirements for Payday Loans in Louisville

Income and Employment Verification

Securing a payday loan in Louisville, KY, often hinges on demonstrating consistent income. Lenders typically require proof of regular employment or a reliable source of income. This could include pay stubs from your employer, bank statements showing regular deposits, or other documentation showing a consistent flow of funds. The specific requirements vary between lenders, so it’s crucial to check individual lender policies. Don’t assume one set of documents will work everywhere.

Your income must generally meet a minimum threshold, often reflecting the loan amount. This ensures you can realistically repay the loan on your next payday. Expect lenders to verify your employment status. They might contact your employer directly to confirm your employment and salary. Failing to provide accurate information during the application process can lead to loan denial or even legal consequences. “Always be truthful and transparent when applying for a payday loan to avoid potential problems.” Remember, responsible borrowing involves understanding and meeting the lender’s requirements.

Credit Score Considerations

Unlike traditional loans, payday loans in Louisville, KY, often don’t heavily rely on a high credit score for approval. Many lenders prioritize your current income and employment stability over your credit history. This makes them accessible to individuals who might struggle to obtain financing through banks or credit unions. However, a poor credit history *could* influence the interest rates offered. Expect higher interest charges if your credit report shows missed payments or defaults.

While a perfect credit score isn’t a requirement, a demonstrably responsible financial history can still work in your favor. Lenders often use credit checks to assess risk. A strong credit report might result in better terms, such as a slightly lower annual percentage rate (APR) on your payday loan. “Always compare offers from multiple lenders to secure the best possible terms, even with less-than-perfect credit.” Remember, payday loans are short-term solutions, and responsible borrowing practices are crucial to avoid a cycle of debt.

Required Documentation

Securing a payday loan in Louisville, KY, often requires providing specific documentation to verify your identity and financial stability. Lenders typically request a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is also crucial, usually in the form of recent pay stubs or bank statements showing regular deposits. This demonstrates your ability to repay the loan. Failure to provide these documents will likely result in loan application denial.

Beyond the basics, some lenders might request additional documentation. This could include proof of address, such as a utility bill or bank statement showing your current residence. They may also ask for your social security number for verification purposes. “Always carefully review the lender’s specific requirements before submitting your application, as these can vary slightly between institutions.” This will ensure a smoother and faster application process. Remember to keep copies of all documents you submit for your records.

The Application Process: Step-by-Step Guide

Online Application vs. In-Person Application

Choosing between an online and in-person payday loan application in Louisville, KY depends on your preferences and circumstances. Online applications, offered by many lenders, are incredibly convenient. You can apply from anywhere with an internet connection, at any time of day or night. This offers speed and discretion. However, you’ll need a reliable internet connection and a comfortable level of online banking familiarity. Some lenders may require digital verification of your identity and income.

In contrast, an in-person application at a physical payday loan store provides immediate feedback and a chance for face-to-face interaction with a loan officer. This can be beneficial if you need help understanding the terms or have questions about the application process. “However, this method requires travel to the lender’s location, potentially during their business hours, and might be less private.” Remember to compare interest rates and fees between online and in-person lenders in Louisville before making your decision. Payday loans should be used responsibly, and understanding the application process is key to making an informed choice.

Required Documents and Information

Securing a payday loan in Louisville, KY, typically requires providing specific documentation. Lenders need to verify your identity and income to assess your ability to repay. Expect to provide a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income is also crucial, which might include recent pay stubs, bank statements showing direct deposit, or other documentation demonstrating regular income. Some lenders may also request proof of address, like a utility bill or bank statement. It’s essential to have all these documents readily available to streamline the process.

Failing to provide the necessary documentation will likely delay or prevent loan approval. “Remember, accuracy is paramount; providing false information is illegal and can have serious consequences.” Different lenders may have slightly varying requirements, so it’s always best to check with the specific payday loan provider in Louisville, KY, beforehand. This preemptive step avoids unnecessary delays. Finally, ensure all documents are current and clearly legible. This straightforward approach ensures a smoother, faster application process for your payday loan in Louisville.

Processing Time and Disbursement Methods

Processing times for payday loans in Louisville, KY, vary depending on the lender and your individual circumstances. Some lenders boast same-day approvals and funding, while others may take a business day or two. Check the lender’s website or contact them directly to inquire about their typical processing time. Be aware that providing complete and accurate information will significantly speed up the process. Incomplete applications often lead to delays.

Disbursement methods also differ. Many lenders offer direct deposit into your bank account, the quickest option. This is often the preferred method for both speed and convenience. Other lenders might provide a check, either mailed or picked up in person. “Always confirm the disbursement method before submitting your application to avoid unexpected delays or complications.” Remember to carefully review all terms and conditions before accepting any loan offer to fully understand the repayment schedule and any associated fees. Choosing the right lender and method is key to a smooth and efficient payday loan experience in Louisville.

Responsible Borrowing and Avoiding Debt Traps

Budgeting Tips to Manage Your Finances

Creating a budget is crucial before considering a payday loan in Louisville, KY. Start by listing all your monthly income and expenses. Categorize your spending—housing, transportation, food, etc.—to identify areas for potential savings. Even small adjustments can make a significant difference. For example, reducing your daily coffee shop visits or canceling unused subscriptions can free up funds. Consider using budgeting apps or spreadsheets to track your spending effectively. These tools provide a clear picture of your financial health, helping you make informed decisions.

Effective financial planning is essential to avoid the cycle of debt. Prioritize paying down high-interest debts first. Explore options like creating an emergency fund to cover unexpected costs, preventing future reliance on payday loans. “Building a solid financial foundation through careful budgeting and responsible spending is the best way to avoid the high costs and potential pitfalls of short-term loans.” Regularly review your budget and adjust as needed. Remember, responsible financial management is key to long-term financial stability, minimizing the need for high-interest loans.

Understanding the Risks of Payday Loan Debt

Payday loans, while offering quick access to cash, carry significant risks. The high interest rates are the most immediate concern. These rates can easily exceed 400% APR, making even small loans extremely expensive to repay. Missing a payment triggers additional fees, quickly escalating your debt. This can create a debt trap, where you’re constantly borrowing to cover previous loans, leading to a cycle of borrowing and repayment.

Consider the potential impact on your credit score. Late or missed payments are reported to credit bureaus, negatively affecting your creditworthiness. This makes it harder to secure loans, mortgages, or even rent an apartment in the future. Responsible borrowing means carefully weighing the short-term benefit against the long-term financial consequences. “Before taking out a payday loan in Louisville, KY, fully understand the potential costs and explore all other available options first.” This includes budgeting adjustments, seeking assistance from credit counseling agencies, or reaching out to friends or family for help.

Alternatives to Payday Loans

Before considering a payday loan in Louisville, KY, explore alternatives. Many offer better long-term financial health. Credit unions often provide small-dollar loans with lower interest rates than payday lenders. Check with your local credit union for their eligibility requirements and loan options. They frequently offer financial education resources, too, helping you manage your money better.

Consider also tapping into your existing resources. Friends or family might offer short-term help. Selling unused items online or at a consignment shop generates quick cash. Negotiating a payment plan with creditors can buy you time. Remember, “carefully weighing your options before taking on debt is crucial to avoid a cycle of borrowing.” Explore all avenues before resorting to high-interest payday loans. Local charities and non-profit organizations may also provide emergency financial assistance programs in Louisville, KY. These resources offer support without the high cost of payday loans.

Seeking Additional Financial Help in Louisville

Local Charities and Non-profit Organizations

Louisville boasts a network of charitable organizations dedicated to assisting residents facing financial hardship. These groups often provide more sustainable solutions than payday loans, offering emergency financial assistance for essential needs like rent, utilities, or groceries. They may also connect you with budget counseling services to help you manage your finances long-term. Remember to thoroughly research any organization before applying, checking their requirements and reputation.

Before considering a payday loan in Louisville, KY, explore the resources available through local charities. Groups like the Salvation Army and the local branches of Catholic Charities often offer immediate aid. “Exploring these options first can save you from the high interest rates and potential debt cycle associated with payday loans.” Check online for a comprehensive directory of non-profits in your area, or contact your local United Way for referrals. They can help you find the specific assistance you need, potentially avoiding the need for a short-term, high-cost loan.

Government Assistance Programs

Louisville residents facing financial hardship can explore various government assistance programs. The Kentucky Cabinet for Health and Family Services offers several crucial programs, including Medicaid for healthcare and SNAP (Supplemental Nutrition Assistance Program) for food assistance. These programs can significantly reduce household expenses, freeing up funds for immediate needs. Eligibility requirements vary depending on income and household size; it’s essential to check the specific requirements on the Kentucky government website.

To access these vital resources, you’ll need to apply online or in person. Many local community organizations provide support with the application process. The United Way of Greater Louisville is a valuable resource, offering assistance navigating the complexities of government aid and connecting individuals with relevant services. “Remember to thoroughly research all available programs to determine which best suits your individual circumstances.” This can significantly alleviate short-term financial stress and provide a path towards long-term financial stability, reducing the reliance on high-interest payday loans in Louisville, KY.

Credit Counseling Services

Before considering a payday loan in Louisville, KY, explore free or low-cost credit counseling services. These services offer valuable tools and guidance to manage your finances effectively. They can help you create a realistic budget, identify areas for savings, and negotiate with creditors for more manageable payment plans. Many reputable organizations offer these services, both in-person and online. The National Foundation for Credit Counseling (NFCC) is a good starting point to find a certified agency near you.

Consider the long-term benefits. Credit counseling provides education and support beyond immediate debt relief. It empowers you to make informed decisions about your finances and avoid future reliance on high-interest short-term loans like payday loans. “By addressing the root causes of your financial challenges, credit counseling can help you build a stronger financial foundation.” Remember to carefully vet any counseling service before sharing personal financial information, verifying their legitimacy and experience through independent sources.