Understanding Payday Loans Meridian, MS

What are Payday Loans and How Do They Work?

Payday loans meridian ms are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They typically range from $100 to $500, although amounts may vary depending on the lender and state regulations. The application process is usually quick and easy, often completed online or in person. You’ll need to provide proof of income and identification. Repayment is typically due on your next payday. This fast turnaround time is the main appeal for many borrowers facing immediate financial needs.

It’s crucial to understand how these loans work before applying. You borrow a specific amount and agree to repay it, plus fees, on your next payday. These fees are often significant, expressed as an Annual Percentage Rate (APR), which can be quite high. Always carefully review the loan terms and fees before signing any agreement. Failure to repay on time can lead to additional fees and potential damage to your credit score. In Meridian, MS, as in other states, specific regulations govern payday lending, so understanding these rules is vital to responsible borrowing. “Failing to understand the full cost of a payday loan can lead to a cycle of debt.”

Understanding Interest Rates and Fees in Meridian, MS

Payday loans in Meridian, MS, are known for their high interest rates and fees. These charges can significantly increase the total cost of borrowing. While the initial loan amount may seem manageable, failing to repay on time can lead to a debt spiral. Always carefully review the loan agreement. Understand the Annual Percentage Rate (APR), which reflects the total cost of borrowing over a year, including all fees and interest. This crucial figure gives you a clear picture of the loan’s true cost.

Mississippi state law regulates payday loans. However, fees can still vary between lenders. Some lenders may charge a flat fee, while others use a percentage-based system. “Before agreeing to a loan, shop around and compare offers from multiple lenders to find the best terms.” This proactive approach will help you secure the most affordable payday loan available. Remember that responsible borrowing is key. Consider the total cost before committing to a loan, and only borrow what you can realistically repay by your next payday.

Legal Aspects of Payday Lending in Mississippi

Mississippi law governs payday lending. These laws dictate the maximum loan amount, interest rates, and repayment terms. Borrowers should carefully review these regulations before committing to a loan. The Mississippi Office of the Commissioner of Insurance oversees payday lenders and handles consumer complaints. Understanding these legal aspects protects you as a borrower.

Failure to repay a payday loan in Meridian, MS, can lead to serious consequences. Late fees and additional charges can quickly accumulate, significantly increasing the total debt. Furthermore, repeated borrowing can create a cycle of debt that is difficult to break. “It’s crucial to borrow responsibly and only take out a loan if you are confident in your ability to repay it on time.” Before seeking a payday loan, explore alternative financial solutions, such as credit counseling or assistance programs, to avoid potential legal ramifications. Always compare lenders and their terms to find the best option.

Finding Reputable Payday Lenders in Meridian, MS

How to Spot a Reputable Lender

Identifying trustworthy payday lenders in Meridian, MS requires careful scrutiny. Look for lenders licensed by the Mississippi Department of Banking and Consumer Finance. This ensures they operate legally and are subject to state regulations designed to protect consumers. Check online reviews from reputable sources like the Better Business Bureau (BBB). A history of positive customer feedback suggests responsible lending practices. Avoid lenders with vague or misleading information on their websites or in their advertising. “Transparency is key when dealing with any financial institution, especially those offering high-interest loans.”

Legitimate Meridian payday loan providers will clearly display their fees and interest rates upfront. Hidden charges are a major red flag. Be wary of lenders who pressure you into borrowing more than you need or who rush the application process. Reputable lenders prioritize customer understanding and will answer all your questions thoroughly. Always compare terms from multiple lenders before committing. “Thoroughly researching and comparing options is crucial to securing the best possible payday loan terms in Meridian, MS.” Remember, taking your time and being diligent can save you money and potential problems.

Online vs. In-Person Lenders: Weighing the Pros and Cons

Choosing between online and in-person payday loan lenders in Meridian, MS, requires careful consideration. Online lenders offer convenience and often a wider range of options, allowing you to compare interest rates and terms from multiple providers at your leisure. However, verifying their legitimacy is crucial; always check for licensing and customer reviews before applying. Beware of scams; a reputable online lender will have a clear website, contact information, and transparent fee schedules.

In contrast, in-person lenders in Meridian, MS, provide a face-to-face interaction, which can be beneficial for those who prefer personal assistance or need clarification on the loan terms. This approach allows for immediate feedback and a quicker application process, potentially securing funds faster. However, the limited number of local lenders might restrict your choices, and you may find fewer competitive interest rates compared to the online market. “Always compare offers from multiple sources, both online and in-person, to ensure you’re getting the best deal.” Remember to thoroughly read all contracts before signing.

Checking Lender Credentials and Licenses

Before you apply for a payday loan in Meridian, MS, always verify the lender’s legitimacy. The Mississippi Office of the State Bank regulates payday lenders. Check their website to confirm the lender holds the necessary license. This simple step protects you from fraudulent operations. Avoid lenders who lack transparency about fees or licensing.

Look for clear contact information, a physical address in Meridian, and a professional website. Legitimate lenders openly display their licensing details. “Scammers often hide this crucial information, so be wary of any lender that is evasive or unwilling to provide proof of licensing.” Thorough research safeguards you from predatory lending practices and ensures you’re working with a reputable financial institution. Remember, due diligence is key when seeking a quick cash loan or short-term loan in Meridian, MS.

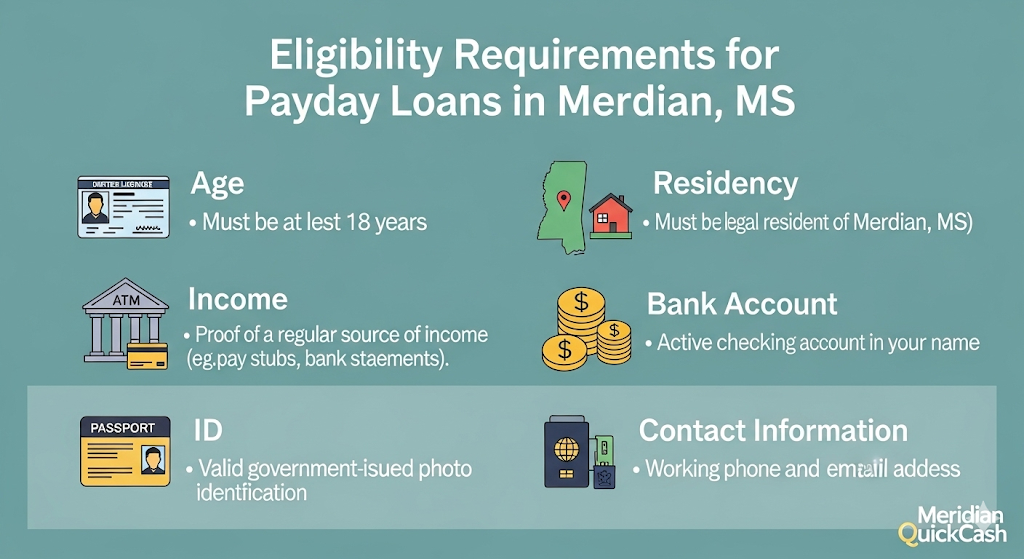

Eligibility Requirements for Payday Loans in Meridian, MS

Key Factors Affecting Loan Approval

Several key factors influence whether your payday loan application in Meridian, MS, will be approved. Lenders typically scrutinize your credit history, although many payday loans cater to borrowers with less-than-perfect credit. Your income is crucial; lenders need assurance you can repay the loan. They’ll verify your employment status and income level through pay stubs or bank statements. A consistent employment history demonstrates financial stability, increasing your chances of approval. Finally, your debt-to-income ratio (DTI) matters significantly. A high DTI suggests you might struggle to manage additional debt, potentially impacting your approval.

Beyond these basics, the specific requirements vary by lender. Some lenders might place greater emphasis on the length of your residency in Meridian, MS, or require a valid checking account. “Carefully review each lender’s terms and conditions before applying to ensure you meet all their criteria.” Remember, providing accurate and complete information is vital for a smooth application process. False information can lead to immediate rejection or even legal consequences. Shop around and compare offers from multiple payday lenders in Meridian, MS, to find the best terms for your individual circumstances.

Required Documentation for Application

Securing a payday loan in Meridian, MS requires providing specific documentation to verify your identity and financial standing. Lenders typically need a government-issued photo ID, such as a driver’s license or state ID card. Proof of income, like recent pay stubs or bank statements showing consistent deposits, is also essential. Failure to provide these documents will likely result in application denial. Many lenders utilize online systems, streamlining the process, but always confirm the specific requirements with the lender beforehand.

Beyond the basics, prepare to show proof of your current address. This might involve a utility bill, bank statement, or lease agreement. Some lenders may also request your Social Security number for verification purposes. “Remember, providing accurate and complete documentation is crucial for a smooth and quick application process.” Don’t hesitate to contact the lending institution directly if you have questions about the necessary paperwork. This ensures compliance and avoids delays in receiving your Meridian payday loan.

Credit Score Impact

Payday loans in Meridian, MS, are often marketed as a quick solution for short-term financial needs. However, it’s crucial to understand that these loans don’t typically perform a hard credit check in the same way a mortgage or car loan would. This means your credit score won’t be directly impacted in the same manner. Lenders primarily assess your ability to repay the loan based on your income and employment history.

That said, repeated use of payday loans can indirectly affect your credit score. Multiple loan applications within a short period can trigger “hard inquiries,” which can slightly lower your score. Furthermore, failing to repay a payday loan on time can lead to negative marks on your credit report, significantly harming your creditworthiness. “Late payments remain on your credit report for several years, making it harder to secure favorable loan terms in the future, even for things unrelated to payday loans.” Therefore, responsible borrowing practices are essential when considering a payday loan in Meridian, MS. Always prioritize repayment to minimize any potential negative consequences.

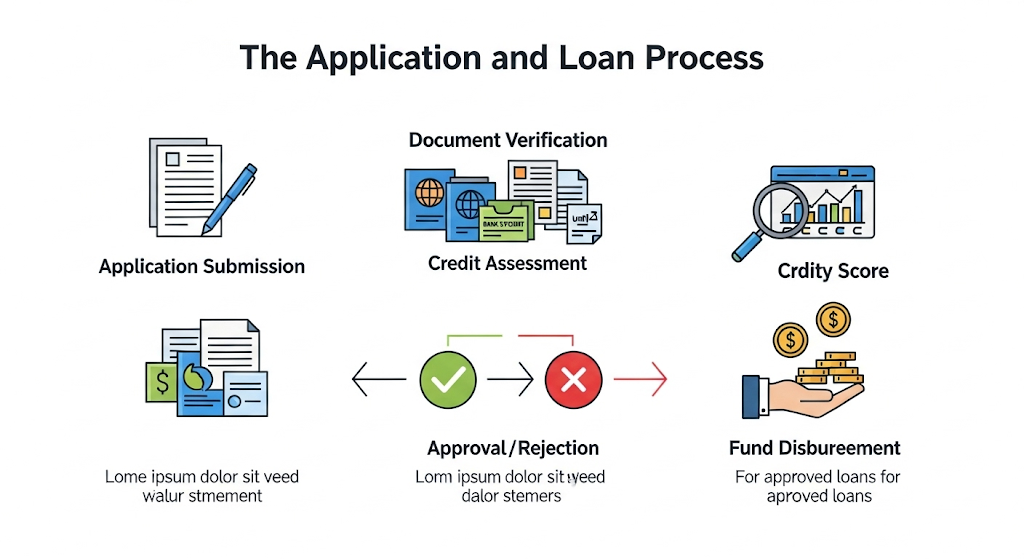

The Application and Loan Process

Step-by-Step Guide to Applying for a Payday Loan

Applying for a payday loan in Meridian, MS is generally a straightforward process. First, you’ll need to locate a reputable lender. Many operate online, offering convenience and a broad comparison of rates and terms. Be sure to check reviews and verify their licensing with the Mississippi Department of Banking and Consumer Finance. Next, gather the necessary documents, including proof of income, a valid ID, and your bank account information. “Lenders often require recent pay stubs or bank statements to confirm your ability to repay.” The application itself usually involves completing a short online form or providing the information in person.

Once you submit your application, the lender will review it. This usually takes a short time, often within minutes for online applications. If approved, you’ll receive your funds, often deposited directly into your bank account. Remember to carefully read the loan agreement before accepting, paying close attention to the interest rates and repayment terms. Failing to understand these terms can lead to unforeseen financial difficulties. “Always borrow responsibly, only taking out what you can comfortably repay on your next payday.” Understand the fees and penalties associated with late payments before committing to a loan.

Required Information and Documentation

Securing a payday loan in Meridian, MS requires providing specific information to lenders. Expect to share personal details such as your full name, address, phone number, and date of birth. You’ll also need to provide your Social Security number and details about your employment, including your employer’s name, address, and how long you’ve been employed. Accurate information is crucial for a smooth application process. Providing false information can lead to application denial or even legal consequences. Remember to double-check all entries for accuracy.

Lenders will also require proof of income and a bank account. This typically involves providing pay stubs or bank statements showing regular income deposits. The lender needs verification that you can repay the loan. “Providing this documentation ensures compliance with lending regulations and helps the lender assess your ability to repay the loan on time.” Be prepared to present these documents electronically or in person, depending on the lender’s requirements. Understanding these needs upfront streamlines the process and increases your chances of approval for your Meridian, MS payday loan.

What to Expect After Applying

After submitting your payday loan application in Meridian, MS, you’ll typically receive a response within minutes. Many lenders offer instant approval decisions through their online platforms. However, some may require a few hours for processing, especially if additional verification is needed. You’ll be notified via email or phone regarding the lender’s decision.

If approved, you’ll then need to review and e-sign the loan agreement. Read carefully before signing! Understand the terms, fees, and repayment schedule. Once signed, the funds are usually deposited directly into your bank account within one business day, sometimes even faster. “Remember to always check the lender’s reputation and read reviews before applying for any payday loan to ensure a safe and transparent borrowing experience.” If denied, you might receive an explanation of the reasons. Explore options for improving your application or consider alternative financial solutions.

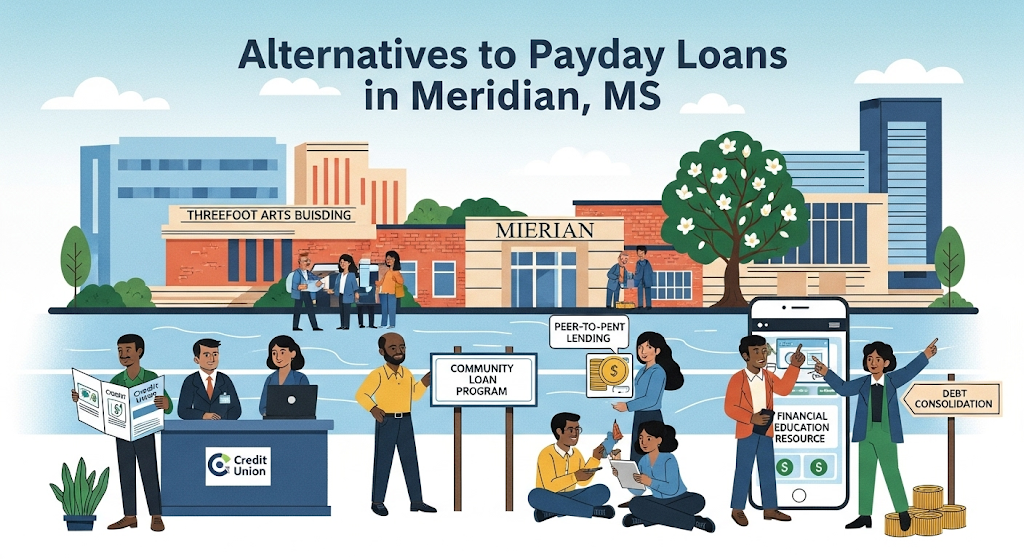

Alternatives to Payday Loans in Meridian, MS

Exploring Lower-Cost Borrowing Options

Before rushing into a payday loan in Meridian, MS, consider less expensive alternatives. Credit unions often offer small-dollar loans with more favorable terms than payday lenders. These loans typically have lower interest rates and more manageable repayment schedules. Check with local credit unions like the Mississippi Credit Union League for options. They frequently provide financial counseling services, too, aiding in responsible budgeting.

Exploring other avenues is also wise. Community assistance programs can sometimes provide emergency financial aid. Look into local charities and non-profit organizations in Meridian. They may offer grants or interest-free loans. Negotiating with creditors can also buy you time. Contact your creditors directly to explain your situation and explore possible payment arrangements. “Remember, thoroughly researching all options before borrowing is crucial to avoid high-cost debt traps.”

Negotiating with Creditors

Facing financial hardship? Before considering a payday loan in Meridian, MS, explore negotiating with your creditors. Many are willing to work with you. Contact them directly to explain your situation. Propose a payment plan or a temporary reduction in payments. Be honest and prepared to provide documentation of your financial difficulties. Remember to get any agreement in writing.

Following up with a formal letter outlining the agreed-upon terms strengthens your position. Consider seeking guidance from a credit counselor. They can help negotiate with creditors on your behalf. “A credit counselor can often secure better terms than you could achieve alone, potentially saving you money and avoiding the high fees associated with payday loans.” Remember, proactive communication is key to avoiding the high-cost cycle of payday loans and building a healthier financial future.

Building a Financial Safety Net

Building a strong financial foundation is crucial to avoid relying on high-interest payday loans. This involves creating an emergency fund, a crucial safety net for unexpected expenses like car repairs or medical bills. Aim to save 3-6 months’ worth of living expenses. Even small, consistent contributions add up over time. Consider automating your savings through direct deposit to make saving effortless. Many banks offer high-yield savings accounts to maximize your returns. These provide better returns than payday loans, which carry significant risks.

A well-structured budget is also vital. Tracking your income and expenses helps identify areas where you can cut back and redirect funds toward savings. Consider using budgeting apps or spreadsheets to monitor your finances. “Creating a budget isn’t about restricting yourself; it’s about making informed financial decisions and gaining control of your money.” By consistently saving and budgeting, you significantly reduce your dependence on quick but costly payday loans in Meridian, MS, building long-term financial security and independence.

Managing Your Payday Loan Responsibly

Creating a Budget to Repay Your Loan

Before taking out a payday loan in Meridian, MS, meticulously plan your repayment strategy. This involves creating a realistic budget. List all your monthly income sources, then meticulously list every expense. Identify areas where you can cut back. Even small savings add up. For example, reducing daily coffee shop trips or canceling unused subscriptions can free up significant funds. Prioritize essential expenses like housing, utilities, and food. Then, allocate a specific amount each month towards your payday loan repayment. This disciplined approach ensures you meet your payment deadlines and avoid accumulating additional fees.

Accurate budgeting is critical for responsible payday loan management. Use budgeting apps or spreadsheets to track your spending. These tools provide a clear overview of your financial situation. “Failing to plan is planning to fail,” so take the time to create a detailed budget *before* you apply for a short-term loan. Consider exploring free financial resources available in Meridian, MS, such as credit counseling services. They can offer personalized guidance to help you manage your finances more effectively and avoid future reliance on high-interest loans. Remember, proactive budgeting is your best defense against debt traps.

Avoiding Debt Traps

Payday loans in Meridian, MS, offer quick access to cash, but they can easily lead to a cycle of debt if not managed carefully. Avoid rolling over your loan. This practice extends the repayment period and significantly increases the total cost due to accumulating interest charges. Remember, each rollover pushes the due date further, making it harder to repay on time. The high-interest rates associated with payday loans quickly amplify the original loan amount.

To break free from this trap, create a realistic budget before applying for a payday loan. Identify essential expenses and areas where you can cut back to free up funds for repayment. Explore alternative solutions like negotiating with creditors for extended payment plans or seeking financial counseling from reputable organizations. Consider borrowing only what you absolutely need, and explore smaller loan amounts if feasible. “Failing to plan is planning to fail,” so prioritize responsible financial planning to avoid falling into long-term debt from a seemingly short-term solution.

Seeking Financial Counseling if Needed

Facing financial hardship can be overwhelming. If you’re struggling to manage your payday loan in Meridian, MS, or any debt, don’t hesitate to seek professional help. Numerous free or low-cost resources are available to guide you. These services can provide valuable support in creating a budget, exploring debt management options, and developing a long-term financial plan. They can also help you navigate the complexities of payday loans in Mississippi and avoid potential pitfalls.

Consider contacting a reputable non-profit credit counseling agency. These agencies often offer financial counseling services to individuals facing debt challenges. They can provide personalized advice tailored to your specific situation. “Reaching out for help is a sign of strength, not weakness, and it can significantly improve your chances of successfully managing your finances and avoiding future debt cycles.” The Consumer Financial Protection Bureau (CFPB) website offers a directory of certified credit counselors to help you find a trusted professional near you in Meridian. Remember, responsible financial management is key to long-term financial well-being.