Understanding Payday Loans Midland TX

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. Borrowers provide a post-dated check or authorize electronic access to their bank account to ensure repayment. These loans are intended for emergency situations, not long-term financial solutions. Consider them a bridge, not a solution to ongoing financial challenges. Think of unexpected car repairs or a sudden medical bill—situations where a payday loan might offer temporary relief.

While seemingly convenient, payday loans in Midland, TX, and elsewhere, come with significant risks. High interest rates are a defining feature, leading to a substantial increase in the total amount repaid. Failure to repay on time can result in additional fees and potentially damage your credit score. Before considering a payday loan, carefully weigh the costs and potential consequences against alternative options, such as borrowing from friends or family, or exploring more affordable lending choices. “Always prioritize responsible borrowing practices and explore all available resources to manage your finances effectively.”

How Payday Loans Work in Midland, TX

Payday loans in Midland, TX, are short-term, small-dollar loans designed to bridge the gap until your next paycheck. You borrow a specific amount, typically due on your next payday. Interest rates are significantly higher than traditional loans, reflecting the risk associated with short repayment periods and the borrower’s credit history. The application process is often quick and easy, usually involving an online application or a visit to a local lender. Lenders will verify your employment and income before approving the loan. Remember to carefully read the loan agreement before signing, paying close attention to all fees and interest charges.

“Before taking out a payday loan, thoroughly explore all available options.” Consider alternatives like borrowing from friends or family, using a credit card (if you have a good credit history and can manage payments), or seeking assistance from local charities or non-profit organizations. These alternatives often offer more manageable terms and avoid the high costs associated with payday loans. Understanding the total cost of the loan is crucial before committing. Failing to repay on time can lead to hefty penalties and further financial complications. Always borrow responsibly, and only borrow what you can confidently repay.

Eligibility Criteria for Payday Loans in Midland, TX

Securing a payday loan in Midland, TX, requires meeting specific lender criteria. These typically include being at least 18 years old, possessing a valid Texas ID or driver’s license, and having a consistent source of income, such as a steady job or regular government benefits. Lenders will verify your employment history and income to assess your ability to repay the loan. Credit history often plays a less significant role compared to traditional loans, though a poor credit history might influence the interest rate offered. Always check the specific requirements of individual lenders in Midland, as they can vary.

Beyond basic identification and income verification, lenders will also scrutinize your banking information. You’ll need an active checking account in your name to receive the loan proceeds and for automatic repayment. Sufficient funds to cover the repayment amount on the due date is crucial. Failure to repay on time can result in substantial fees and impact your credit score, even though payday loans are typically not reported to major credit bureaus. “Understand the terms completely before signing any loan agreement, ensuring you can comfortably meet the repayment schedule to avoid financial hardship.” Consider comparing offers from multiple lenders to find the best terms for your circumstances.

Finding Reputable Lenders in Midland, TX

Identifying Licensed and Reliable Lenders

Before borrowing from any payday loan provider in Midland, TX, always verify their licensing. The Texas Office of Consumer Credit Commissioner (OCCC) maintains a registry of licensed lenders. Check this registry online to confirm a lender’s legitimacy and avoid fraudulent operations. Licensed lenders are subject to state regulations designed to protect consumers, ensuring fair practices and transparent terms. Don’t hesitate to contact the OCCC directly if you have any doubts about a lender’s credentials.

Look beyond just licensing. Research the lender’s reputation. Check online reviews on sites like the Better Business Bureau (BBB) and Google Reviews. Pay attention to customer feedback regarding their experiences with loan applications, repayment processes, and customer service. A consistently high rating and positive customer feedback are strong indicators of a reliable lender. “Prioritize lenders with transparent fee structures and easily accessible contact information; avoid those who are vague or unresponsive to your inquiries.” This due diligence will significantly reduce your risk of encountering predatory lending practices common in the payday loan industry.

Checking for Transparency and Fair Practices

Transparency is paramount when choosing a payday loan lender. Look for lenders who clearly display their fees, interest rates, and loan terms upfront on their website and in any loan agreements. Avoid lenders who are vague or obscure about their charges. A reputable lender will readily provide this information without pressure. “Hidden fees are a major red flag, often signaling predatory lending practices.” Legitimate lenders will answer your questions fully and frankly. Compare multiple offers to ensure you’re getting the best deal possible.

Scrutinize the lender’s reputation. Check online reviews from previous borrowers on sites like the Better Business Bureau (BBB) website. Look for consistent patterns of positive feedback or, conversely, numerous complaints regarding high fees, aggressive collection tactics, or deceptive practices. Consider only those lenders with a demonstrably clean record and high ratings. “Remember, your financial well-being is paramount, and choosing a trustworthy lender is crucial for navigating the payday loan process successfully in Midland, TX.” Prioritize lenders with a strong local presence and positive community engagement.

Comparing Interest Rates and Loan Terms

Before committing to a payday loan in Midland, TX, meticulously compare interest rates offered by different lenders. Interest rates vary significantly. A seemingly small difference in percentage can translate to a substantial amount over the loan’s lifespan. Always obtain the Annual Percentage Rate (APR) to understand the true cost. Avoid lenders who are vague or secretive about their fees.

Consider the loan terms alongside the interest rate. Some lenders offer shorter repayment periods, resulting in higher payments but potentially lower overall interest. Others may provide longer repayment schedules, easing individual payments but potentially increasing total interest paid. “Carefully weigh the benefits of lower monthly payments against the higher overall cost before making a decision.” Remember to factor in any potential penalties for late payments. Research Midland, TX lenders’ reputations thoroughly; check online reviews and the Better Business Bureau.

The Application Process: A Step-by-Step Guide

Online Application Procedures

Applying for a payday loan in Midland, TX, online is often faster and more convenient than in-person applications. Many lenders have user-friendly websites designed for straightforward navigation. Start by carefully reviewing the lender’s terms and conditions, including interest rates and fees. Pay close attention to the APR (Annual Percentage Rate) to fully understand the total cost of borrowing. You’ll typically need to provide personal information, employment details, and banking information. Ensure accuracy; any errors could delay processing. Most online applications are secure, using encryption to protect your data.

Once you’ve completed the online form, submit your application. You’ll usually receive a near-instantaneous pre-approval decision. Some lenders may require further documentation before final approval. “Be prepared to provide proof of income, like pay stubs or bank statements, to verify your ability to repay the loan.” After approval, the funds are often deposited directly into your bank account within one business day, significantly faster than traditional loan applications. Remember to compare offers from multiple lenders before making a final decision to secure the best terms for your specific financial needs.

Required Documents and Information

Securing a payday loan in Midland, TX, typically requires providing specific documentation. Lenders will need to verify your identity and employment. This usually involves presenting a government-issued photo ID, such as a driver’s license or passport. Proof of income, like recent pay stubs or bank statements showing consistent deposits, is also crucial. Be prepared to show your current address, often through a utility bill or bank statement. Finally, lenders will require your bank account information for direct deposit of the loan and for repayment. “Failure to provide complete and accurate documentation will likely delay or deny your application.”

Understanding these requirements is key to a smooth application process. Some lenders may request additional documents depending on your individual circumstances or the loan amount. For instance, they may ask for proof of residence if your address isn’t clearly linked to your other documents. It’s always best to gather all necessary paperwork *before* starting the application. Contacting the lender directly beforehand can clarify their specific requirements and prevent any unforeseen delays. “This proactive approach will significantly increase your chances of a successful and timely payday loan application in Midland, TX.”

Processing Times and Loan Disbursement

Processing times for payday loans in Midland, TX, vary depending on the lender and your individual circumstances. Most lenders aim for same-day approvals, but this isn’t always guaranteed. Factors like incomplete applications or required document verification can cause delays. Expect to receive a decision within a few hours to one business day, though some lenders may take longer. Always check the lender’s website or contact them directly for their typical processing time.

Once your application is approved, the disbursement of your funds usually follows quickly. Many lenders offer direct deposit to your checking account, often within the same business day of approval. However, some might issue the loan via debit card or check, which could slightly extend the timeframe. Confirm your chosen disbursement method with your lender to understand exactly when you can expect the money. “Remember to carefully review the loan agreement before accepting to understand all terms and conditions, especially concerning fees and repayment schedules.” Always compare different lenders to find the best deal in terms of fees and repayment flexibility.

Responsible Borrowing: Avoiding Potential Pitfalls

Understanding Interest Rates and Fees

Payday loans in Midland, TX, often come with high interest rates and substantial fees. These costs can quickly escalate the total amount you owe, making repayment difficult. Before you apply, thoroughly compare rates and fees from multiple lenders. Look beyond the advertised APR; inquire about all associated charges, including origination fees, late payment penalties, and any potential rollover fees. “Failing to understand these costs upfront can lead to unexpected debt.”

Understanding the true cost of borrowing is crucial. For example, a seemingly small loan might have a daily interest rate that compounds rapidly, significantly increasing your debt. Always calculate the total repayment amount, including all fees, before signing any agreement. Consider using online calculators or seeking advice from a financial counselor to understand the long-term financial implications. “Prioritize finding a lender transparent about their pricing structure and willing to clearly explain all associated costs.”

Creating a Repayment Plan

Before you accept a payday loan in Midland, TX, meticulously plan your repayment. This isn’t just about knowing the due date; it’s about ensuring you have the funds available *before* the loan comes due. Unexpected expenses often derail even the best intentions. Consider using budgeting apps to track your income and expenses. This will give you a clear picture of your financial situation and help you identify areas where you can cut back. Remember, late fees on payday loans can quickly escalate the debt.

A realistic repayment plan involves identifying a reliable source of income to cover the loan. This might mean prioritizing your spending or seeking additional income streams. For example, you could sell unused items or pick up extra shifts at work. “Failing to plan is planning to fail,” so carefully consider your options and don’t underestimate the loan’s total cost, including interest and fees. Avoid borrowing more than you can comfortably repay on time. Your local credit union or a non-profit financial counseling agency in Midland might offer free budgeting assistance and resources to help you create a manageable repayment strategy.

Managing Your Finances to Avoid Loan Dependency

Payday loans in Midland, TX, offer quick cash, but relying on them repeatedly can create a dangerous cycle of debt. Avoid this by diligently tracking your income and expenses. Budgeting apps or simple spreadsheets can help monitor spending and identify areas for savings. Prioritize essential bills. Then, allocate funds to gradually pay down existing debts. This proactive approach reduces the need for future payday loans.

Building a financial safety net is crucial. Aim for an emergency fund covering at least three months’ worth of living expenses. This cushion prevents unexpected costs from pushing you into seeking high-interest payday loans. Consider exploring alternative financial solutions, such as credit counseling or negotiating payment plans with creditors. “Remember, responsible financial planning is the best way to prevent becoming reliant on short-term loans like payday loans in Midland, TX.” Seek professional advice if you’re struggling to manage your finances independently. Many free or low-cost resources are available to help you gain control of your financial situation.

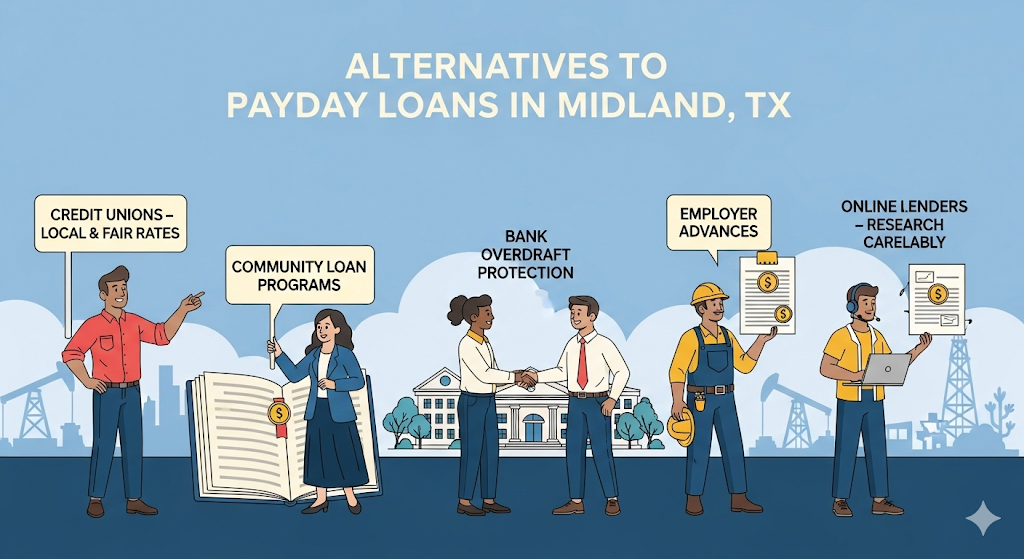

Alternatives to Payday Loans in Midland, TX

Exploring Small Loans from Credit Unions

Credit unions often offer small loans with more favorable terms than payday lenders. They are not-for-profit organizations, meaning their primary goal is to serve their members, not maximize profits. This often translates to lower interest rates and more flexible repayment options compared to payday loans. Many credit unions in Midland, TX, such as those affiliated with larger national organizations, provide a range of financial services including small personal loans specifically designed for short-term needs. It’s worth exploring their options before resorting to high-interest payday loans.

Before applying, carefully review the credit union’s loan requirements and interest rates. Compare these to payday loan offers to make an informed decision. “Checking your credit score beforehand can also improve your chances of approval and secure a better interest rate.” Remember, credit unions often prioritize building long-term relationships with their members, offering valuable financial guidance and resources beyond just loan products. This makes them a far more responsible and sustainable option for managing short-term financial challenges than payday loans.

Considering Personal Loans from Banks

Banks offer personal loans as a viable alternative to payday loans in Midland, TX. These loans typically come with lower interest rates than payday loans, making them a more affordable option in the long run. However, securing a personal loan requires a stronger credit history than payday loans. Banks assess your creditworthiness carefully. They consider your income, debt, and credit score. Expect a more rigorous application process.

Before applying, carefully compare interest rates and repayment terms from multiple banks in Midland. Consider factors like loan amounts and fees. “Shop around to find the best deal, as rates can vary significantly between institutions.” Local credit unions often offer competitive personal loan options, and their member-focused approach may provide more flexible terms. Remember to thoroughly read the loan agreement before signing. This ensures you understand all the terms and conditions.

Utilizing Community Resources and Financial Counseling

Midland, TX, offers several valuable community resources to help residents avoid the high-cost trap of payday loans. Local charities and non-profit organizations often provide emergency financial assistance programs. These might include short-term grants or help with utility bills, alleviating immediate financial pressures. The United Way of Midland is a great starting point for finding such programs; their website and local office can connect you with relevant services. Remember to research eligibility requirements and application procedures thoroughly.

Seeking financial counseling is another crucial step. Certified credit counselors can help you create a personalized budget, identify areas for savings, and develop a plan to manage your debt effectively. These services can offer valuable long-term solutions, far surpassing the temporary relief a payday loan provides. Credit counseling agencies often provide free or low-cost initial consultations. “By addressing the root causes of your financial struggles, you can build a more stable and secure future, avoiding the debt cycle associated with payday loans.” Consider this a crucial investment in your long-term financial health.

Legal Protections and Consumer Rights

Texas Payday Loan Regulations

Texas has specific regulations governing payday loans, designed to protect consumers. These laws limit the amount a lender can charge in fees and interest. The maximum loan amount is capped, preventing borrowers from accumulating overwhelming debt. It’s crucial to understand these limits before considering a payday loan in Midland, TX. The Texas Office of Consumer Credit Commissioner (OCCC) oversees these regulations and offers resources for borrowers. You can find helpful information on their website regarding your rights and responsibilities.

Understanding these regulations is key to responsible borrowing. Always carefully review the loan agreement before signing. Compare offers from multiple lenders to find the best terms. “Remember, failing to repay a payday loan can lead to serious financial consequences, including damage to your credit score.” Knowing your rights and responsibilities under Texas law will empower you to make informed decisions and avoid potential pitfalls associated with payday loans. Don’t hesitate to seek independent financial advice if you’re unsure about managing your finances or the terms of a payday loan.

Protecting Yourself from Predatory Lending

In Midland, Texas, as elsewhere, borrowers need to be vigilant against predatory payday lending practices. These practices often involve excessively high interest rates and fees, trapping borrowers in a cycle of debt. Be wary of lenders who pressure you into a loan or fail to clearly explain the terms and conditions. Always read the fine print carefully before signing any agreement. Compare offers from multiple lenders to find the best terms. The Texas Office of Consumer Credit Commissioner (OCCC) is a valuable resource for information and assistance.

To protect yourself, thoroughly research any lender before applying for a payday loan in Midland, TX. Check online reviews and verify the lender’s licensing with the OCCC. Consider the total cost of the loan, including all fees and interest, before borrowing. “Never borrow more than you can comfortably repay on your next payday.” If you’re struggling to manage your finances, explore alternative options such as credit counseling or negotiating with creditors before resorting to high-cost payday loans. Remember, responsible borrowing is key to avoiding financial hardship.

Knowing Your Rights as a Borrower in Midland, TX

In Midland, Texas, borrowers have crucial legal protections when considering payday loans. Texas law dictates strict regulations on loan amounts, interest rates, and fees. Understanding these limitations is vital to avoid predatory lending practices. For example, the Texas Finance Code clearly outlines the maximum allowable fees and the total amount a borrower can owe. Familiarize yourself with these specifics before signing any agreement. Always read the fine print carefully. Don’t hesitate to ask questions if anything is unclear.

The Office of the Comptroller of Public Accounts in Texas is a valuable resource. Their website offers information about consumer rights related to payday lending. They can help you understand your options if you face difficulty repaying your loan. Knowing your rights empowers you to make informed decisions. “Always seek clarification if a lender’s terms seem unfair or confusing,” as this proactive approach can prevent future financial hardship. Remember, responsible borrowing involves awareness of your rights and responsibilities.