Understanding Payday Loans Murfreesboro, TN

What are Payday Loans?

Payday loans Murfreesboro TN are short-term, small-dollar cash advances designed to help people cover unexpected expenses until their next payday. They’re typically due on your next payday, hence the name. These loans are usually for a relatively small amount, often ranging from $100 to $500, depending on state regulations and the lender’s policies. Borrowers often use them to cover emergencies like car repairs, medical bills, or unexpected home repairs—situations requiring immediate funds.

In Murfreesboro, TN, as in other states, payday loans are subject to specific regulations. It’s crucial to understand these regulations before considering a payday loan. High interest rates are a common characteristic of payday loans; failing to repay on time can lead to significant additional fees and potentially severe financial consequences. “Before applying for any payday loan in Murfreesboro, TN, carefully compare lenders, fees, and repayment terms to find the best option for your specific financial situation.” Always prioritize responsible borrowing and explore alternative solutions if possible.

Eligibility Requirements in Tennessee

To qualify for a payday loan in Murfreesboro, TN, you must meet specific criteria set by Tennessee state law and individual lenders. These typically include being at least 18 years old, possessing a valid Tennessee driver’s license or state-issued ID, and having a verifiable source of regular income. Proof of income might involve pay stubs or bank statements demonstrating consistent employment. Many lenders also require an active checking account for direct deposit of the loan and repayment. Remember, these are general requirements; individual lenders may have additional stipulations.

It’s crucial to carefully review each lender’s terms and conditions. Interest rates and fees vary significantly. Compare offers from multiple lenders before making a decision. “Failing to understand the full cost of a payday loan can lead to unexpected financial hardship.” Be aware of potential hidden fees and ensure you fully comprehend the repayment schedule to avoid defaulting on your loan. Responsible borrowing is key; always borrow only what you can realistically afford to repay promptly.

Interest Rates and Fees in Murfreesboro

Payday loans in Murfreesboro, Tennessee, are subject to state and federal regulations. These regulations govern the maximum interest rates lenders can charge. However, these rates can still be quite high compared to other forms of borrowing. Always confirm the Annual Percentage Rate (APR) before signing any agreement. This will give you the complete picture of the total cost of borrowing. Remember, the APR includes fees and interest.

Beyond the APR, be aware of additional fees. These might include origination fees, late payment penalties, or even rollover fees. Carefully review the loan agreement. Understand all charges before committing to a payday loan. “Failing to understand these fees can lead to unexpected debt and financial hardship,” so thorough research is crucial. Consider comparing offers from multiple lenders in Murfreesboro to find the best terms. Remember, cheaper isn’t always better. Prioritize reputable lenders with transparent fee structures.

Finding Reputable Lenders in Murfreesboro

Identifying Licensed and Bonded Lenders

Securing a payday loan requires careful consideration of the lender’s legitimacy. In Murfreesboro, TN, verifying a lender’s licensing is crucial. The Tennessee Department of Financial Institutions (TDFSI) maintains a database of licensed lenders. Check this database before engaging with any potential lender to ensure they are legally operating within the state. Avoid unlicensed lenders; they often operate outside of regulatory oversight, potentially leading to predatory practices and unfair terms. “Always prioritize licensed lenders to protect yourself from potential scams.”

Licensed doesn’t always equate to reputable. Many legitimate lenders are also bonded. Bonding provides an added layer of consumer protection. If a bonded lender engages in fraudulent or unethical activities, the bond acts as a financial guarantee for compensation. Look for this extra layer of security, as it signals a commitment to fair and transparent lending practices. While not all licensed lenders are bonded, “choosing a bonded lender significantly reduces your risk of financial harm.” Remember to thoroughly research any payday loan lender in Murfreesboro before signing any agreements.

Checking Online Reviews and Ratings

Before applying for a payday loan in Murfreesboro, TN, thoroughly research potential lenders online. Don’t rely solely on a company’s website. Instead, actively seek out independent reviews and ratings from sources like the Better Business Bureau (BBB) and Trustpilot. Look for patterns in customer feedback. Positive reviews often highlight quick processing times and helpful customer service. Negative reviews, however, might reveal hidden fees, aggressive collection practices, or difficulty contacting the lender. Paying close attention to these details will significantly impact your experience.

Consider the sheer volume of reviews. A lender with only a few reviews, whether positive or negative, may lack sufficient data for accurate assessment. Look for lenders with many reviews and a consistent rating. Websites like Google My Business also offer valuable insights, displaying both star ratings and user comments. “Remember, prioritizing lenders with overwhelmingly positive reviews and a proven track record of ethical practices can save you potential headaches and financial burdens down the line.” A high volume of positive reviews, coupled with a lack of serious negative feedback, strongly suggests a reputable Murfreesboro payday loan provider.

Comparing Loan Terms and Conditions

Before committing to a payday loan in Murfreesboro, TN, meticulously compare the terms and conditions offered by different lenders. Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of borrowing. A lower APR is always preferable. Also, carefully review the loan fees, including origination fees and any potential penalties for late payments. These seemingly small charges can significantly impact the overall cost of your loan. Remember to factor these costs into your budget to ensure you can comfortably repay the loan.

Consider the loan repayment terms. Shorter repayment periods usually mean higher payments but lower overall interest. Longer terms might seem easier initially, but they usually mean paying more interest in the long run. “Choosing a repayment plan that fits your financial situation is critical to avoiding a cycle of debt.” Finally, thoroughly read the fine print. Understand the lender’s policies regarding rollovers, extensions, and collection practices. Compare these aspects across multiple lenders to find the most favorable terms for your specific circumstances. Reputable lenders will be transparent about their fees and conditions; if anything seems unclear or dubious, it’s best to seek another lender.

The Application Process: A Step-by-Step Guide

Gathering Required Documents

Securing a payday loan in Murfreesboro, TN, requires providing specific documentation. Lenders need to verify your identity, income, and employment. This typically involves presenting a government-issued photo ID, such as a driver’s license or passport. You’ll also need proof of income, which could be recent pay stubs, bank statements showing direct deposit, or tax returns. Failure to provide complete documentation will delay or prevent loan approval. “Always keep copies of all documents submitted for your records.”

Beyond income verification, lenders often request proof of your current address. This could be a utility bill, bank statement, or rental agreement. The specific documents may vary slightly between lenders. Therefore, it’s crucial to check the lender’s requirements *before* you begin the application process. Contacting the lender directly or reviewing their website for a comprehensive list of required documents is highly recommended. “This proactive step will significantly streamline your application and increase your chances of approval.”

Completing the Online or In-Person Application

Applying for a payday loan in Murfreesboro, TN, is generally straightforward. Whether you choose an online or in-person application, you’ll need to provide basic personal information. This includes your full name, address, contact details, Social Security number, and employment history. Many lenders utilize secure online portals for increased convenience and speed. Expect to provide proof of income, such as pay stubs or bank statements. This step verifies your ability to repay the loan. Remember to carefully review all terms and conditions before proceeding. Accuracy is critical; ensure all details are correct to avoid delays.

For in-person applications, visit a reputable lender’s physical location in Murfreesboro. Bring the necessary documentation mentioned above. A lender representative will assist you through the process. “Choosing a licensed and reputable lender is crucial to protect yourself from predatory lending practices.” In-person applications allow for immediate clarification of any questions. This can lead to a faster and smoother application process. While online applications might offer 24/7 access, in-person applications offer immediate feedback and potentially faster funding, depending on the lender’s policies.

Understanding Loan Disbursement Methods

After your payday loan application in Murfreesboro, TN is approved, understanding how you’ll receive your funds is crucial. Most lenders offer direct deposit into your bank account, which is often the fastest method. This typically involves providing your banking details during the application process. Expect the funds to appear within one to two business days, though processing times can vary slightly depending on the lender and your bank.

Alternatively, some lenders may offer cash pickup at a designated location, often a partner store or the lender’s office itself. This option requires an in-person visit. Before choosing this method, confirm the location’s hours and any identification requirements. “Always verify the legitimacy of the lender and the pickup location to avoid scams.” Remember, comparing different lenders and their disbursement methods is key to finding the best payday loan option for your specific needs in Murfreesboro, TN. Check reviews and compare fees before committing.

Responsible Borrowing Practices

Creating a Realistic Budget

Before applying for a payday loan in Murfreesboro, TN, honestly assess your income and expenses. Create a detailed budget, listing all your monthly income sources and meticulously tracking every expense, from rent and groceries to entertainment and transportation. This clear picture will reveal your actual spending habits. Many budgeting apps can help simplify this process. Consider using the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This framework offers a practical starting point for financial control.

Understanding your financial reality is crucial. A realistic budget prevents you from taking on more debt than you can manage. Payday loans, while convenient, come with high interest rates. Overspending and failing to account for loan repayments can lead to a dangerous cycle of debt. “By accurately budgeting, you can determine the maximum loan amount you can safely repay, minimizing the risk of financial hardship.” Consider seeking free financial counseling services available in Murfreesboro, TN, if you need assistance in creating a budget or managing your finances. These resources can provide invaluable support and guidance.

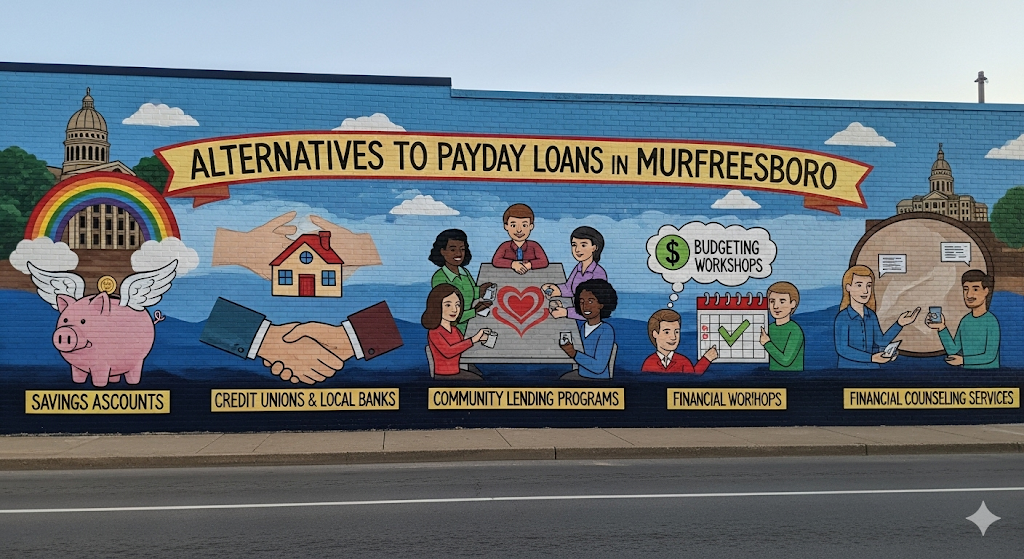

Exploring Alternatives to Payday Loans

Before rushing into a payday loan in Murfreesboro, TN, carefully consider alternatives. Many resources offer short-term financial assistance without the crippling interest rates often associated with payday loans. Local credit unions, for example, frequently provide smaller loans with more manageable repayment terms. They often prioritize member well-being and offer financial literacy resources, helping you avoid future debt cycles. Exploring these options first can save you significant money and stress in the long run.

Consider also tapping into your existing resources. Can you borrow from family or friends? Could you temporarily reduce spending or sell unused items to cover immediate needs? Many find success in negotiating payment plans with creditors, avoiding late fees and potentially preventing further debt accumulation. “Remember, responsible borrowing involves assessing all options before resorting to high-interest loans.” Utilizing free budgeting apps and seeking advice from non-profit credit counseling agencies in Murfreesboro can also provide valuable guidance and support to create a more sustainable financial plan.

Developing a Repayment Plan

Before taking out a payday loan in Murfreesboro, TN, meticulously plan your repayment. Carefully assess your monthly budget. Identify all sources of income and necessary expenses. Subtract your expenses from your income. This reveals how much you have available for loan repayment. Failing to accurately budget can lead to a debt cycle. Don’t underestimate the loan’s total cost, including fees and interest.

Create a realistic repayment schedule. Break down the total amount due into manageable weekly or bi-weekly payments. Align these payments with your payday schedule to avoid missed payments and extra charges. Consider setting up automatic payments from your bank account. This ensures on-time payments. “Always prioritize paying off the loan as quickly as possible to minimize interest costs.” If unexpected expenses arise, explore options like negotiating with the lender for an extended repayment plan before defaulting. Remember, responsible planning is key to successfully managing a payday loan in Murfreesboro.

Potential Risks and Consequences of Payday Loans

High Interest Rates and Debt Cycles

Payday loans in Murfreesboro, TN, like those offered across the nation, often come with extremely high interest rates. These rates can easily exceed 400% APR, far surpassing the rates of traditional loans. This means a small loan can quickly balloon into a significant debt. Even a seemingly manageable amount borrowed can become difficult to repay, especially if unexpected expenses arise.

The high interest charges quickly eat into your next paycheck, making it difficult to cover both the loan repayment and your regular living expenses. This can trap borrowers in a debt cycle, where they repeatedly take out new payday loans to cover old ones. “This cycle is incredibly difficult to escape and can severely impact your credit score and overall financial well-being.” Consider exploring alternative options, such as credit counseling or negotiating with creditors, before resorting to payday loans. Remember to thoroughly research all available resources and understand the potential consequences before committing to any loan agreement.

Impact on Credit Score

Payday loans can significantly impact your credit score, often negatively. While payday lenders typically don’t report directly to the three major credit bureaus (Equifax, Experian, and TransUnion), missed or late payments can lead to debt collection efforts. These collection actions are almost always reported to credit bureaus, severely damaging your creditworthiness. A lower credit score makes it harder to obtain future loans, credit cards, and even rent an apartment, impacting your financial health long-term. The effects can linger for years.

Repeated borrowing from payday lenders, a sign of potential financial difficulty, may also be flagged by credit scoring models. Even if individual loans aren’t directly reported, the consistent need for short-term, high-interest loans can indicate poor financial management. This perception can translate to a lower credit score. “Failing to repay a payday loan in Murfreesboro, TN, can have severe and lasting consequences on your credit profile.” Consider carefully the long-term impact on your credit score before taking out a payday loan, particularly if you have a history of inconsistent repayments. Explore alternative financing options if possible.

Legal Protections for Borrowers in Tennessee

Tennessee law offers some protection to payday loan borrowers. The state regulates the maximum amount lenders can charge in fees. This helps prevent excessively high interest rates that can trap borrowers in a cycle of debt. However, these protections are limited. Thorough research before borrowing remains crucial. Understanding the terms and conditions fully is vital. You must carefully evaluate your ability to repay before taking out a payday loan in Murfreesboro, TN.

For example, the Tennessee Department of Financial Institutions oversees payday lenders. They ensure compliance with state regulations. However, it’s your responsibility to understand your rights and responsibilities. Seek independent financial advice if needed. “Failing to fully understand the loan agreement can lead to severe financial hardship, even with existing legal protections.” Don’t hesitate to contact consumer protection agencies if you encounter unfair lending practices. Always prioritize responsible borrowing practices to avoid the pitfalls of high-interest payday loans.

Alternatives to Payday Loans in Murfreesboro

Small Loans from Credit Unions

Credit unions often offer small loans with more favorable terms than payday lenders. They are not-for-profit organizations, meaning their primary goal is serving their members, not maximizing profits. This often translates to lower interest rates and more flexible repayment options. Many credit unions in Murfreesboro, TN, provide small-dollar loans specifically designed to help members manage unexpected expenses. Before applying for a payday loan, explore what your local credit union might offer. Research local credit unions online to compare their loan products.

Check your eligibility requirements. Credit unions typically require membership, often tied to employment or residency. They also assess creditworthiness, though their standards might be less stringent than traditional banks. “Securing a loan from a credit union can be a significantly better alternative to a high-interest payday loan, offering a more manageable repayment plan and potentially saving you considerable money in the long run.” Consider this a responsible path towards managing your finances. Contact several credit unions in Murfreesboro to compare rates and terms before making a decision.

Personal Loans from Banks

Banks in Murfreesboro, TN, offer personal loans as a viable alternative to payday loans. These loans typically have lower interest rates than payday loans, making them a more affordable option in the long run. You’ll need good credit to qualify, however. Consider checking your credit report beforehand to understand your standing and improve your chances of approval. Many banks offer online applications and pre-qualification tools, which allow you to quickly see if you meet their requirements without impacting your credit score.

Before applying for a personal loan from a bank in Murfreesboro, carefully compare interest rates, fees, and repayment terms from several institutions. This will help you secure the best deal. Remember that personal loans usually involve larger loan amounts and longer repayment periods than payday loans. This makes them suitable for larger expenses or debt consolidation. “Choosing a personal loan carefully can offer a more sustainable solution to your financial needs compared to the high-cost cycle of payday loans.” Factors such as your credit score, income, and debt-to-income ratio play a crucial role in determining your eligibility and the terms offered.

Community Resources and Financial Counseling

Facing a financial shortfall can be stressful, but before considering a payday loan in Murfreesboro, TN, explore the wealth of free resources available. Many local non-profit organizations offer financial counseling and budgeting assistance. These services can help you create a personalized plan to manage your debt and avoid the high costs associated with payday loans. They often provide education on responsible financial management, including credit building and debt reduction strategies.

The United Way of Rutherford County, for instance, connects residents with various social services, including financial aid programs. Similarly, local credit unions frequently provide free financial literacy workshops and individual consultations. “Seeking help from these organizations can significantly improve your financial well-being and empower you to make informed decisions about your money.” Remember, proactive planning and professional guidance are far more beneficial in the long run than the quick fix offered by a payday loan. Don’t hesitate to utilize these valuable community resources; they are there to support you.