Understanding Payday Loans Phoenix, AZ

What are Payday Loans?

payday loans phoenix az are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. Arizona, like many states, regulates these loans, setting limits on fees and interest rates to protect consumers. However, these regulations don’t eliminate the inherent risks. It’s crucial to understand the terms completely before borrowing. Consider the high cost of these loans, including interest and fees, which can quickly escalate into a debt cycle. Remember, payday loans Phoenix, AZ should be used as a last resort for genuine emergencies, not for everyday spending.

Before taking out a Phoenix payday loan, carefully compare offers from different lenders. Explore all available options first. This includes credit unions, friends and family, or even budgeting strategies. “Failing to understand the total cost and repayment terms can lead to serious financial hardship.” Borrow only what’s absolutely necessary and create a realistic repayment plan. Be aware of predatory lenders who might offer loans with excessively high fees or hidden charges. Research reputable lenders and check online reviews to protect yourself from scams and unfair practices. Using a payday loan responsibly requires careful planning and awareness of potential consequences.

How Payday Loans Work in Arizona

In Arizona, payday loans are short-term, small-dollar loans designed to bridge the gap until your next paycheck. You borrow a specific amount, typically due on your next payday. The lender will require access to your checking account for automatic repayment. Interest rates are high, reflecting the short repayment period and perceived higher risk. Always compare interest rates and fees before choosing a lender; this can significantly impact your overall cost. Be aware of potential hidden fees and read the loan agreement carefully.

Arizona law regulates payday loans, but it doesn’t prevent high costs. Lenders can charge a maximum fee of 15% of the amount borrowed. For a $300 loan, that’s a $45 fee. Before you borrow, carefully assess whether you can repay the loan on time. Failure to repay can lead to additional fees, impacting your credit score and potentially leading to a cycle of debt. “Borrowing a payday loan should always be a last resort, considered only after exhausting other options like budgeting or asking family/friends for assistance.” Seek advice from a financial counselor if you are struggling with debt.

Eligibility Requirements for Payday Loans in Phoenix

Securing a payday loan in Phoenix, AZ, requires meeting specific criteria. Lenders typically demand proof of regular income, usually demonstrated through pay stubs or bank statements. This income needs to meet a minimum threshold, often varying between lenders but generally requiring enough to comfortably repay the loan plus fees. You’ll also need a valid Arizona ID and an active checking account for direct deposit of the loan and automated payments. Failing to meet these basic requirements will likely result in your application being denied.

Beyond the basics, lenders often consider your credit history, though it’s not always the primary deciding factor for payday loans. However, a history of missed payments or significant debt could negatively impact your approval chances. Responsible borrowing is crucial, so carefully assess your ability to repay before applying. “Before committing to a payday loan, thoroughly compare interest rates and fees from different lenders to find the most favorable terms.” Remember, high-interest rates are a common feature of payday loans, so only borrow what you absolutely need and plan a repayment strategy to avoid a debt cycle.

Finding Reputable Lenders in Phoenix

Identifying Licensed and Reliable Lenders

Before borrowing from any payday loan provider in Phoenix, AZ, verify their licensing status with the Arizona Department of Financial Institutions (ADFI). This simple check helps protect you from unlicensed operators who may engage in predatory lending practices. Always look for clear and transparent information about fees, interest rates, and repayment terms on the lender’s website or in their physical location. Avoid lenders who pressure you into borrowing or who offer terms that seem too good to be true. “Unlicensed lenders often operate outside the law, offering misleading terms and charging exorbitant fees.”

Reputable lenders will readily provide details about their licensing and adhere to state regulations. Look for lenders with positive customer reviews and a strong online presence. Consider checking the Better Business Bureau (BBB) for complaints filed against potential lenders. Remember, securing a payday loan should be a carefully considered decision, and choosing a licensed and reliable lender is the first crucial step. “Choosing a lender with a history of fair practices and positive customer feedback significantly reduces your risk of encountering financial difficulties.” Take your time, research thoroughly, and prioritize your financial well-being.

Checking Online Reviews and Ratings

Before applying for a payday loan in Phoenix, thoroughly research potential lenders online. Websites like the Better Business Bureau (BBB) offer valuable insights into a lender’s reputation. Look for a consistent pattern of positive feedback regarding customer service, transparency in fees, and loan repayment processes. Consider the number of reviews, not just the average rating; a high average from only a few reviews is less reliable than a slightly lower average from hundreds. Pay close attention to negative reviews, looking for common complaints which might signal serious issues.

“Don’t just focus on star ratings; read the actual reviews.” This allows you to discern whether negative experiences stem from isolated incidents or reflect systemic problems within the lending company. Sites like Google Reviews and Yelp can also provide additional perspectives. Remember, checking online reviews and ratings is crucial for avoiding predatory lenders and ensuring a smoother experience with your payday loan application in Phoenix, Arizona. Use multiple sources to cross-reference information and form a well-rounded opinion before making any financial decisions.

Comparing Interest Rates and Fees

Interest rates and fees dramatically impact the overall cost of a payday loan. Don’t just focus on the advertised rate. Scrutinize the Annual Percentage Rate (APR), which includes all fees and interest, providing a true picture of the loan’s cost. Compare APRs across multiple lenders. Look for lenders transparent about their fees, clearly outlining all charges in their loan agreement. Avoid lenders with hidden fees or those that use confusing jargon.

Remember, lower APRs are always better. Payday loans are inherently expensive, but some lenders are more reasonable than others. Check online reviews to see if other borrowers have reported unexpectedly high fees. “Always carefully read the loan agreement before signing, paying close attention to the details of the fees and repayment schedule.” Consider using a loan comparison tool to easily compare offers from various lenders in Phoenix, AZ. This will help you make an informed decision and avoid falling prey to predatory lending practices.

The Cost of Payday Loans: Fees and Interest Rates

Understanding APR and Fees

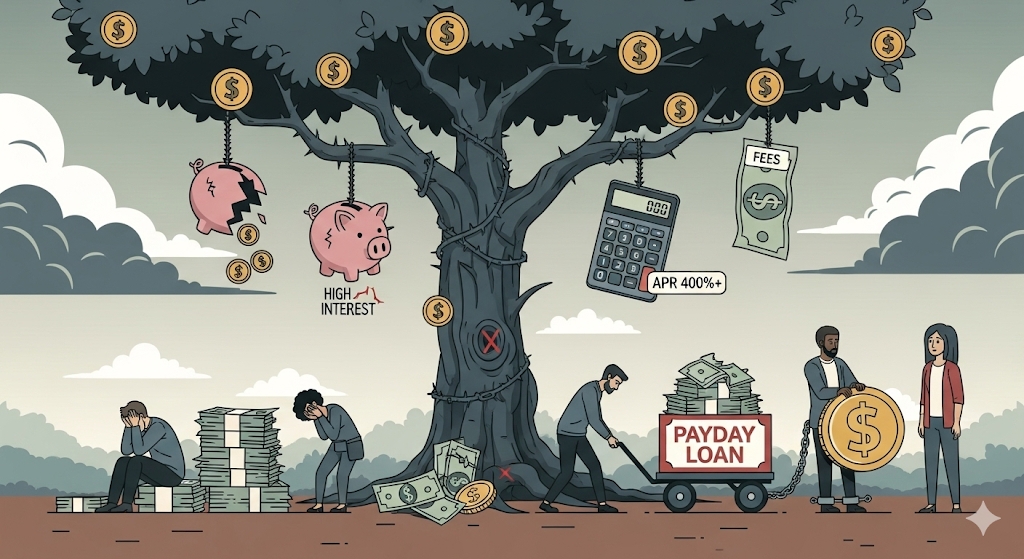

Understanding the true cost of a payday loan in Phoenix requires careful examination of both the Annual Percentage Rate (APR) and associated fees. The APR reflects the total cost of borrowing, including interest and fees, expressed as a yearly percentage. It’s crucial to understand that Arizona, like many states, has regulations on payday loan interest rates; however, these rates can still be very high. For example, a payday loan with a $15 fee per $100 borrowed might seem small, but this translates to a significantly higher APR than traditional loans. Always ask for the APR before agreeing to a loan.

“Don’t let low initial fees mislead you; the cumulative effect of these charges, combined with high interest, can quickly escalate the debt.” Payday loan providers often advertise low upfront fees, but this can be deceptive. Consider all charges carefully, including origination fees, late payment penalties, and rollover fees. These additional costs can dramatically increase the overall expense of the loan, trapping borrowers in a cycle of debt. Thoroughly review the loan agreement before signing. Comparing APRs from multiple lenders is also vital before committing to any payday loan in Phoenix.

Calculating the Total Cost of a Payday Loan

Understanding the true cost of a payday loan in Phoenix, Arizona, requires careful calculation beyond the initial loan amount. Arizona law limits payday loan fees to 15% of the amount borrowed, but this seemingly small percentage can quickly accumulate into a substantial sum, especially when considering the short repayment period. Remember, you’ll be paying these fees on top of the principal, significantly increasing your total repayment. Always calculate the total amount due before signing any agreement. This includes the principal, the flat fee, and any potential added charges.

To illustrate, a $300 payday loan with a 15% fee would incur a $45 fee. Your total repayment obligation is $345, which you would need to pay back within the usually short timeframe – often just two weeks. Failing to repay on time incurs even more fees, potentially leading to a cycle of debt. “Use an online calculator or contact a financial advisor to ensure you fully grasp the financial implications before committing to a payday loan.” Consider all costs before borrowing; it’s crucial for responsible financial management. Don’t be misled by low initial borrowing amounts – the true cost can be much higher.

Comparing Costs Across Different Lenders

Don’t assume all payday loans in Phoenix are created equal. Interest rates and fees vary significantly between lenders. Some lenders advertise low APRs, but hidden fees can quickly inflate the total cost. Always carefully review the loan agreement before signing. Compare the Annual Percentage Rate (APR), not just the stated interest rate. The APR reflects all charges, providing a truer picture of the loan’s expense.

To effectively compare costs, gather quotes from multiple lenders. Use online comparison tools or visit lenders directly. Note the total amount you’ll repay, including all fees and interest. Consider the loan term, as shorter loans may have higher APRs but lower overall costs. “Choosing the cheapest option isn’t always the best strategy; ensure the terms align with your repayment capabilities.” Remember, failing to repay a payday loan on time can lead to severe financial consequences, including escalating fees and damage to your credit score.

Responsible Borrowing Practices

Creating a Budget and Financial Plan

Before considering a payday loan in Phoenix, AZ, carefully create a detailed budget. Track your income and expenses for at least a month. This will clearly show where your money goes. Identify areas where you can cut back. Even small savings add up. Prioritize essential expenses like rent, utilities, and food. Consider using budgeting apps or spreadsheets for easier tracking. “Failing to plan is planning to fail,” so a robust budget is your first line of defense against debt.

Next, develop a comprehensive financial plan. This goes beyond a simple budget. It outlines your short-term and long-term financial goals. Think about paying off existing debts, building an emergency fund, or saving for a down payment on a house. A financial plan helps you see the bigger picture. It can help you determine if a payday loan is truly necessary or if alternative solutions exist. Remember, payday loans should be a last resort, not a long-term solution for financial difficulties. Consider seeking free financial counseling from organizations like the Consumer Credit Counseling Service (CCCS) before taking out high-interest loans.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Phoenix, explore alternative financial solutions. These options often offer more manageable repayment terms and avoid the high interest rates associated with payday lending. Consider seeking assistance from reputable non-profit credit counseling agencies like the National Foundation for Credit Counseling (NFCC). They can provide guidance on budgeting and debt management strategies, potentially preventing the need for a payday loan altogether. Many also offer free financial literacy workshops.

Exploring other avenues is crucial. Consider borrowing from family or friends, if possible. This can offer a more supportive and flexible arrangement. Another viable option might be using a secured credit card or a small personal loan from a bank or credit union. These typically have lower interest rates than payday loans. “Remember to carefully compare interest rates, fees, and repayment terms before committing to any loan.” Always prioritize borrowing responsibly and only when absolutely necessary. Carefully assess your budget and repayment capacity before taking on any debt.

Managing Debt and Avoiding the Debt Cycle

Falling into a cycle of payday loan debt is easy in Phoenix, AZ, but breaking free requires proactive management. Careful budgeting is key. Track your income and expenses meticulously. Identify areas where you can cut back to free up cash flow. Consider creating a realistic budget that prioritizes essential expenses like rent and utilities before discretionary spending. Remember, “even small savings add up over time, helping you pay down debt faster.”

Once you understand your spending habits, create a debt repayment plan. Prioritize paying off the highest-interest debts first. Explore options like debt consolidation or credit counseling agencies. These agencies offer guidance and potentially lower interest rates. In Arizona, organizations like the Consumer Credit Counseling Service provide free or low-cost services. Remember, seeking help is a sign of strength, not weakness. “Proactive debt management minimizes the chances of getting trapped in a cycle of repeated borrowing.”

Avoiding Payday Loan Scams and Predatory Lending

Recognizing Red Flags and Warning Signs

Be wary of lenders demanding upfront fees. Legitimate payday lenders in Phoenix, AZ, never require payment before disbursing the loan. This is a major red flag indicating a scam. Always check the lender’s license with the Arizona Department of Financial Institutions. Avoid lenders who pressure you into accepting a loan immediately, without giving you time to review the terms. “High-pressure sales tactics are a common characteristic of predatory lenders.”

Look out for excessively high interest rates or fees. Payday loans are inherently expensive, but rates far exceeding the legal limits in Arizona are a serious warning sign. Compare offers from multiple lenders to gauge reasonable costs. If a lender’s terms seem too good to be true, they likely are. Be cautious of lenders who obscure fees or make the loan terms difficult to understand. “Transparency is key when choosing a responsible lender for your financial needs.” Always read the fine print carefully before signing any agreement.

Protecting Your Personal Information

Payday loans in Phoenix, like elsewhere, often require extensive personal information. Protect yourself from scams by only using reputable lenders. These lenders are licensed by the Arizona Department of Financial Institutions. Verify their license online before sharing any sensitive data. Never provide your Social Security number, bank account details, or other identifying information until you’ve confirmed legitimacy. Be wary of unsolicited offers appearing via email or text message. Legitimate lenders will not contact you proactively.

Criminals use stolen information for identity theft. They create fraudulent accounts and debts. Always review the lender’s privacy policy. Understand how they handle your information. Look for clear statements regarding data security and protection from unauthorized access. “Sharing your personal information with an unlicensed or unregulated lender puts you at significant risk.” Report any suspicious activity to the Arizona Attorney General’s Office immediately. Protecting your data is crucial when dealing with payday loans, or any financial transaction.

Reporting Fraudulent Lending Practices

In Phoenix, as elsewhere, encountering predatory payday loan practices is a serious concern. If you believe you’ve been a victim of a scam or unfair lending, reporting it is crucial. The Arizona Attorney General’s Office is your first point of contact. Their website provides detailed information on filing complaints and outlining illegal lending activities. They actively investigate complaints and take action against offenders. Remember to gather all relevant documentation, including loan agreements, communication records, and payment confirmations. This will strengthen your case significantly.

Don’t hesitate to report suspicious activity. Even seemingly minor issues can be signs of a larger problem. The Consumer Financial Protection Bureau (CFPB) is another excellent resource. They handle complaints nationwide and can assist with investigations. “Failing to report fraudulent activities allows these predatory lenders to continue harming vulnerable individuals.” Contacting both the Arizona Attorney General and the CFPB provides a broader reach and increases the chances of a successful outcome. Reporting scams helps protect yourself and prevents others from falling victim to similar schemes.

Resources and Support for Financial Wellness in Phoenix

Local Credit Counseling Agencies

Finding yourself in a tight spot and considering a payday loan in Phoenix? Before you take that step, explore free resources that offer better long-term solutions. Local credit counseling agencies provide invaluable support for navigating financial challenges. These non-profit organizations offer free or low-cost financial guidance, including budgeting workshops, debt management plans, and assistance with negotiating with creditors. They can help you understand your options and create a plan to improve your financial health, avoiding the high fees and debt cycles often associated with payday loans.

Many reputable agencies operate throughout the Phoenix metropolitan area. The National Foundation for Credit Counseling (NFCC) is a great place to start your search for a certified agency in your area. They can connect you with local professionals who can provide personalized support. Remember, “seeking help is a sign of strength, not weakness,” and these agencies are equipped to offer confidential and judgment-free assistance. Utilizing their services can be a crucial step in achieving lasting financial wellness and escaping the trap of high-interest debt. Don’t hesitate to reach out – your financial future is worth it.

Non-profit Financial Assistance Programs

Phoenix offers several non-profit organizations dedicated to helping residents achieve financial stability. These groups often provide free financial counseling, budgeting workshops, and assistance with navigating debt. They can be invaluable resources when facing a payday loan crisis, offering alternatives and strategies to avoid future reliance on high-interest loans. For example, the United Way of Greater Phoenix offers various programs connecting individuals with resources tailored to their specific needs. Contacting them is a crucial first step to exploring these options.

“Many non-profits also assist with identifying and applying for government assistance programs, such as SNAP benefits or housing subsidies, that can alleviate financial burdens.” These programs, while not directly addressing payday loan debt, can significantly improve overall financial well-being, thus reducing the need for such loans in the future. Remember to research organizations carefully and verify their legitimacy before sharing sensitive financial information. Look for organizations with established reputations and positive community reviews to ensure you receive reliable and trustworthy support in managing your finances effectively.

Government Assistance Programs

Phoenix residents facing financial hardship can access vital government assistance. The Arizona Department of Economic Security (DES) administers several crucial programs. These include TANF (Temporary Assistance for Needy Families), which provides cash assistance and support services to eligible families. Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, helps low-income individuals and families purchase groceries. The Low Income Home Energy Assistance Program (LIHEAP) offers help with energy bills during winter months. It’s crucial to check eligibility requirements, as they vary by program.

Applying for these benefits requires careful attention to detail. Complete applications accurately and thoroughly to avoid delays. The DES website offers online applications and detailed information on eligibility criteria. You can also find local assistance offices throughout Phoenix for in-person support. Remember, seeking help is a sign of strength, not weakness. “Taking advantage of these resources can significantly alleviate financial stress and prevent reliance on high-interest payday loans.” Contacting a local non-profit may also provide additional guidance navigating the application process.