Understanding Payday Loans Phoenix

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They are typically due on your next payday, hence the name. These loans are often characterized by high interest rates and fees. In Phoenix, as in other areas, accessing these loans requires careful consideration of the potential consequences. Many lenders operate both online and in physical locations, offering varying terms and conditions. It’s crucial to shop around and compare offers before committing. Understanding the total cost of borrowing—including all fees and interest—is paramount.

Borrowers often seek payday loans in Phoenix to address financial emergencies, such as car repairs or medical bills. However, “the high cost of these loans can quickly trap borrowers in a cycle of debt,” making it essential to explore alternative financing options first. Consider budgeting strategies, negotiating with creditors, or exploring options like credit counseling before resorting to a payday loan. Remember that responsible borrowing involves a thorough understanding of the terms and your ability to repay the loan in full on the due date. Failing to do so can lead to escalating fees and further financial hardship.

How Payday Loans Work in Arizona

In Arizona, payday loans are short-term, small-dollar loans. Borrowers typically write a post-dated check or authorize an electronic debit from their bank account for the loan amount plus fees. The loan term is usually until the borrower’s next payday. Arizona law caps the maximum loan amount at $500, and lenders cannot charge more than 15% interest on that amount. This means the total cost of borrowing is limited, offering some borrower protection. However, it is crucial to remember that even with these regulations, payday loans in Phoenix, and throughout Arizona, can still be expensive.

The application process is generally straightforward. Many lenders offer online applications for convenience. You’ll need to provide personal information, proof of income, and bank account details. Approval decisions often happen quickly. Before accepting a payday loan in Phoenix, carefully review the terms and conditions, including all fees and repayment schedules. “Failing to fully understand the repayment terms can lead to a cycle of debt that is difficult to escape.” Be sure to compare offers from multiple lenders to find the most favorable terms available to you. Remember to only borrow what you can confidently repay by your next payday.

Eligibility Requirements and Application Process

To qualify for a payday loan in Phoenix, you typically need a steady income source, a valid checking account, and a government-issued ID. Lenders will verify your employment and income to assess your ability to repay. Many lenders use online applications, making the process quick and convenient. Be prepared to provide personal information and banking details. Remember, providing false information is illegal and could severely impact your credit.

The application process itself is usually straightforward. Most lenders offer online payday loan applications, allowing for quick processing times. You’ll need to fill out an application form, providing details about your income, expenses, and banking information. Once submitted, the lender reviews your application. Approval decisions are often made within minutes, and funds may be deposited into your account the same day. “However, always compare offers from multiple lenders before accepting a loan to secure the best possible terms and interest rates.” Be sure to read the loan agreement carefully before signing.

Finding Reputable Lenders in Phoenix

Identifying Licensed and Trustworthy Lenders

Verifying a lender’s license is the first step in responsible payday loan borrowing in Phoenix. The Arizona Department of Financial Institutions (ADFI) maintains a registry of licensed lenders. Always check this registry before applying. Don’t rely solely on online reviews; many fraudulent operations manipulate these platforms. Cross-reference information from multiple sources to ensure accuracy. Look for transparency in fees and terms. Legitimate lenders openly disclose all charges.

Avoid lenders who pressure you into quick decisions or who are unwilling to answer your questions thoroughly. “A reputable lender will patiently explain the loan terms, including APR, fees, and repayment schedule.” Consider factors beyond licensing, such as a lender’s customer service reputation and online presence. Search for independent reviews from sources beyond the lender’s own website. Checking multiple sources ensures a more complete picture of the lender’s reliability and trustworthiness. Remember, taking the time to research and verify is crucial for protecting your financial well-being when seeking payday loans in Phoenix.

Checking Online Reviews and Testimonials

Before applying for a payday loan in Phoenix, thoroughly investigate potential lenders online. Don’t rely solely on a company’s website; look for independent reviews on sites like the Better Business Bureau (BBB) and Trustpilot. These platforms often host user experiences, highlighting both positive and negative aspects of a lender’s service. Pay close attention to recurring themes in reviews. For example, consistent complaints about high fees or aggressive collection practices should raise significant red flags.

Analyzing online testimonials provides invaluable insight. Search for reviews mentioning transparency, customer service responsiveness, and ease of the application process. “Look for lenders praised for clear communication and straightforward terms, avoiding those with vague or misleading information.” Remember that while positive reviews are encouraging, a few negative ones don’t automatically disqualify a lender. However, a preponderance of negative feedback, especially concerning ethical practices, should lead you to explore alternative options. Consider the overall pattern and the types of issues raised when assessing online feedback.

Comparing Interest Rates and Fees

Interest rates significantly impact the overall cost of a payday loan. Always compare the Annual Percentage Rate (APR), not just the stated interest rate. The APR includes all fees and charges, giving you a true picture of the loan’s cost. Don’t hesitate to contact multiple lenders and request detailed breakdowns of their fees. Hidden fees are common, so transparency is key. A reputable lender will openly provide this information.

Look beyond the advertised rate. Consider factors like origination fees, late payment penalties, and rollover charges. These added costs can quickly inflate the total amount you owe. “Carefully review all loan documents before signing, paying close attention to the fine print.” Websites like the Consumer Financial Protection Bureau (CFPB) offer valuable resources to understand payday loan regulations in Arizona and help you compare lenders effectively. Remember, the lowest APR isn’t always the best deal if hidden fees significantly increase the final cost.

Interest Rates, Fees, and APR in Phoenix

Understanding Interest Rates and APR

Understanding the cost of a payday loan in Phoenix is crucial before borrowing. Interest rates are expressed as a percentage of the principal borrowed. They represent the lender’s charge for the use of their money. However, this alone doesn’t fully reflect the true cost. Many payday lenders in Arizona also charge various fees, such as origination fees or late payment penalties.

This is where the Annual Percentage Rate (APR) becomes significantly more important. The APR calculates the total cost of the loan, including all fees and interest, as an annual percentage. It provides a more complete picture of the loan’s expense. “Always compare the APR from multiple lenders in Phoenix before committing to a payday loan to ensure you’re getting the best possible terms.” Failing to understand the APR can lead to unexpected and substantial debt. Remember, high APRs are a sign of a potentially expensive loan.

Typical Fees Associated with Payday Loans

Payday loans in Phoenix, like elsewhere, often come with several fees beyond the interest. These can significantly increase the total cost of borrowing. Common fees include origination fees, charged upfront for processing the loan, and sometimes NSF (Non-Sufficient Funds) fees if a payment bounces. Late payment fees are another significant concern, potentially adding substantially to your debt. Always carefully review the loan agreement to understand all applicable charges before signing. Transparency is key when dealing with payday loans. Avoid lenders who are vague about their fees.

Researching average fee structures across multiple lenders is crucial. While specific amounts vary, expect to encounter fees ranging from a few dollars to a substantial percentage of the loan amount itself. “The total cost, including all fees and interest, can easily exceed the initial loan amount if not carefully managed,” making responsible budgeting and repayment planning vital. Remember, comparing offers from different lenders helps you find the most affordable option. Always prioritize lenders with clear and upfront fee disclosures to avoid unexpected charges.

Calculating the Total Cost of a Payday Loan

Understanding the true cost of a payday loan in Phoenix goes beyond the advertised interest rate. Lenders often charge various fees, such as origination fees or late payment penalties. These add significantly to the total amount you repay. Always obtain a detailed breakdown of all charges before signing any agreement. Don’t hesitate to ask questions; a reputable lender will be transparent about their fees. Remember, a seemingly small loan can quickly become expensive if you fail to account for all associated costs.

To calculate the total cost, start by adding the loan amount to all fees. This includes any interest charges, application fees, and potential late fees. Then, divide this total cost by the loan amount to determine the Annual Percentage Rate (APR). “The APR provides a more accurate reflection of the loan’s overall expense than the stated interest rate alone.” Several online calculators are available to help simplify this process. Use these tools to compare different loan offers before making a decision. Ignoring this crucial step could lead to unexpected financial burdens.

Responsible Borrowing Practices

Creating a Realistic Budget

Before applying for a payday loan in Phoenix, or anywhere else, accurately tracking your income and expenses is crucial. Use budgeting apps, spreadsheets, or even a simple notebook to monitor your cash flow. Categorize your spending – housing, transportation, food, entertainment – to identify areas where you might cut back. This detailed understanding of your finances will reveal how much you can realistically afford to repay without further jeopardizing your financial situation. Remember, a responsible borrower always prioritizes repayment ability.

Understanding your spending habits is only half the battle. You must also project your future income. Account for any potential fluctuations, such as seasonal work or irregular bonuses. “Overestimating your income and underestimating your expenses is a common mistake that leads to repayment problems.” Building a buffer into your budget, even a small one, can provide a safety net in case of unforeseen circumstances. This foresight is key to preventing a cycle of debt and ensuring you can comfortably manage a payday loan in Phoenix, and pay it back on time.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Phoenix, explore alternatives. Many resources offer financial assistance without the high interest rates and potential debt traps associated with payday lending. Credit unions, for example, often provide small-dollar loans with more manageable repayment terms. They frequently have lower interest rates and more flexible repayment options than payday lenders. Consider exploring these avenues first.

Local charities and non-profit organizations also offer valuable resources. Many provide financial assistance programs, budgeting counseling, and debt management services. These services can help you navigate financial hardship and develop a long-term plan for financial stability. “Researching and contacting these organizations is a crucial step toward responsible financial management, potentially avoiding the high costs and risks of payday loans altogether.” Remember, seeking help is a sign of strength, not weakness. Prioritize exploring these options before resorting to a high-cost short-term loan like a payday loan.

Developing a Plan for Repayment

Before you even consider a payday loan in Phoenix, create a detailed repayment plan. This isn’t just about knowing when your next paycheck arrives. It requires a realistic assessment of your income and expenses. List all your essential monthly costs: rent, utilities, groceries, transportation, and debt payments. Subtract these from your net income. This reveals how much you realistically have left for loan repayment. Without this clear picture, you risk defaulting. “Failing to plan is planning to fail,” a timeless adage perfectly illustrates the importance of this step.

Your repayment plan should also account for unexpected expenses. Life throws curveballs. A sudden car repair or medical bill can derail even the best-laid plans. Build a small buffer into your budget. Consider setting aside a small emergency fund. Even a few hundred dollars can prevent a payday loan from becoming a vicious cycle. Explore options like budgeting apps or seeking free financial counseling services offered through non-profits like the National Foundation for Credit Counseling. Careful planning minimizes the risk of high-interest charges and late fees associated with payday loans.

Avoiding Predatory Lending Practices

Recognizing Signs of Predatory Lenders

Predatory lenders often employ deceptive tactics to trap borrowers in cycles of debt. Watch out for excessively high interest rates, far exceeding the average rates found in Arizona or those reported by the Consumer Financial Protection Bureau (CFPB). Hidden fees are another red flag. These can significantly increase the total cost of your loan, making repayment incredibly difficult. Always scrutinize the loan agreement thoroughly before signing. Don’t hesitate to ask clarifying questions if anything seems unclear. “Understanding the terms is crucial to avoid being taken advantage of.”

Be wary of lenders who pressure you into decisions. Legitimate lenders will provide ample time to review the terms. They also won’t employ aggressive sales tactics. If a lender demands immediate action without sufficient explanation, proceed with extreme caution. This is a classic sign of a predatory practice. Finally, research the lender’s reputation thoroughly using online resources like the Better Business Bureau (BBB). Check for complaints filed by previous borrowers. “Your due diligence is your best protection against predatory payday loans in Phoenix.” Avoid lenders with consistently negative reviews or unresolved complaints.

Knowing Your Rights as a Borrower

In Arizona, and specifically Phoenix, you have significant protections against predatory payday loan practices. The Arizona Department of Financial Institutions regulates lenders. They ensure compliance with state laws designed to protect consumers. Familiarize yourself with these laws. Understanding your rights is the first step in avoiding exploitation. Resources like the Arizona Attorney General’s website offer valuable information on consumer protection and dispute resolution processes. Don’t hesitate to utilize these resources if you feel your rights have been violated.

Remember, you have the right to clear and concise information about loan terms. This includes APR (Annual Percentage Rate), fees, and repayment schedules. Lenders must disclose all charges upfront. “Never sign a contract you don’t fully understand.” Scrutinize the fine print carefully. If a lender pressures you into signing quickly or refuses to answer your questions thoroughly, that’s a major red flag. Seek a second opinion from a trusted financial advisor before committing to any loan. Protecting yourself involves being informed and assertive.

Reporting Predatory Lending Practices

If you suspect you’ve been a victim of predatory lending practices in Phoenix, reporting it is crucial. Contact the Arizona Attorney General’s Office. They investigate complaints about payday loans and other financial products. You can file a complaint online or by phone. Document everything—loan agreements, communication records, and evidence of excessive fees or harassment. This detailed record strengthens your case significantly.

Remember, you’re not alone. Many consumer protection agencies exist to help. The Consumer Financial Protection Bureau (CFPB) is a national resource. They handle complaints about high-interest loans nationwide, including those in Arizona. Payday loan lenders who engage in illegal practices can face serious consequences. “Reporting predatory lending is a vital step in protecting yourself and preventing others from falling victim to similar schemes.” Don’t hesitate to seek help; reporting such practices can lead to investigations and potential legal action against the lender.

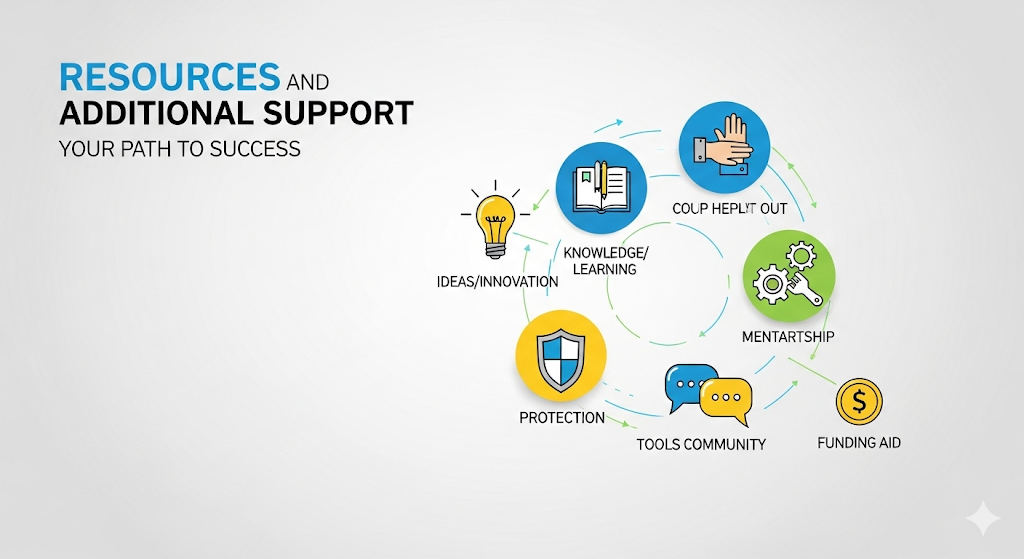

Resources and Additional Support

Arizona State Government Resources

Arizona offers various programs to help residents facing financial hardship. The Arizona Department of Economic Security (DES) is a crucial resource. They administer several programs, including emergency assistance for essential needs like food and housing. Checking their website for eligibility requirements and application processes is vital before seeking a payday loan in Phoenix. Understanding these alternatives can help you make informed decisions. Consider exploring these options before resorting to high-interest loans.

The Arizona Attorney General’s office also provides valuable resources for consumers. Their website offers information on avoiding predatory lending practices, including those associated with short-term loans. They provide guides on understanding loan terms and your consumer rights. “Understanding your rights is crucial when considering any loan, especially payday loans.” Contacting the Attorney General’s office can help resolve disputes with lenders or report suspected fraudulent activity. This proactive approach can protect you from exploitative practices common in the payday loan industry in Phoenix.

Non-profit Financial Counseling Services

Facing financial hardship can be overwhelming, but help is available. Several non-profit organizations in Phoenix offer free financial counseling services. These services provide personalized guidance to help you create a budget, manage debt, and explore options beyond payday loans. They can help you understand your financial situation and develop a long-term plan for stability. Many offer workshops and educational materials on topics like credit repair and responsible money management.

Consider contacting organizations like the United Way of Phoenix & Maricopa County or Catholic Charities Community Services. These established non-profits have extensive experience working with individuals facing financial challenges. They can connect you with resources tailored to your specific needs, including debt management programs and assistance with accessing public benefits. Remember, seeking help is a sign of strength, and these organizations provide a safe and supportive environment to explore your options. “Don’t hesitate to reach out; professional guidance can make a significant difference in navigating your financial situation responsibly.”

Credit Unions and Community Banks

Credit unions and community banks often offer more affordable alternatives to payday loans in Phoenix. They are not-for-profit organizations, prioritizing member needs over profit maximization. This often translates to lower interest rates and more flexible repayment terms than those typically found with payday lenders. Consider exploring your local options for personal loans or lines of credit. These alternatives can help you avoid the high-cost cycle of debt associated with payday loans.

Many credit unions offer financial literacy programs and budgeting resources. These programs can help you better manage your finances and prevent the need for high-interest borrowing in the future. Before applying for any loan, investigate the terms carefully. Compare APRs (Annual Percentage Rates), fees, and repayment schedules to find the best fit for your budget. “Remember, responsible borrowing involves careful planning and understanding the total cost of credit.” Checking your credit report for accuracy is also a crucial step before seeking any type of loan. This proactive approach can improve your chances of securing favorable terms.