Understanding Payday Loans Riverside, CA

What are Payday Loans and How Do They Work?

payday loans riverside ca, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. They’re typically repaid in a single lump sum, usually within two to four weeks. In Riverside, CA, as elsewhere, borrowers must provide proof of income and a valid bank account to qualify. The application process is often quick and easy, sometimes completed entirely online. Keep in mind, however, that these loans come with high interest rates and fees.

Understanding the repayment process is crucial. These loans are not intended for long-term debt solutions. Failure to repay on time can lead to additional fees and negatively impact your credit score. Before applying for a payday loan in Riverside, carefully consider the terms and conditions, including all associated costs. “Always explore alternative financing options, such as borrowing from family or friends, or using a credit card, before resorting to a payday loan if possible.” Remember to check the California Department of Financial Protection and Innovation (DFPI) website for licensed lenders in your area and to compare interest rates and fees to make informed decisions.

Payday Loan Regulations in California

California has strict regulations governing payday loans, aiming to protect consumers from predatory lending practices. These laws, including the California Finance Lenders Law, limit the amount a lender can charge in fees. The maximum finance charge is 15% of the principal amount for loans up to $300, decreasing on a sliding scale for larger loan amounts. This differs significantly from states with less stringent regulations, highlighting California’s commitment to responsible lending.

Crucially, California law places a cap on the total amount a borrower can owe. Lenders cannot issue multiple payday loans simultaneously to the same borrower. “Borrowers should carefully review the terms and conditions before signing any agreement to avoid unexpected fees or debt traps.” Moreover, the California Department of Financial Protection and Innovation (DFPI) actively monitors lenders and enforces these regulations. Understanding these limitations is vital for Riverside residents seeking payday loans, ensuring they borrow responsibly and avoid potential financial hardship.

Advantages and Disadvantages of Payday Loans

Payday loans offer quick access to cash, a significant advantage for individuals facing unexpected expenses or short-term financial emergencies. This speed and convenience can be a lifeline when dealing with immediate needs like car repairs or medical bills. Many Riverside, CA payday lenders offer online applications and same-day funding, further streamlining the process. However, it’s crucial to weigh these benefits against the inherent risks.

The most significant drawback is the extremely high cost. Payday loans typically involve very high interest rates and fees, leading to a quick accumulation of debt. Borrowers who are unable to repay the loan on their next payday often find themselves trapped in a cycle of debt, rolling over the loan and paying even more in fees. This can lead to serious financial consequences. “Always carefully consider the total cost of borrowing before taking out a payday loan in Riverside, CA, and explore alternative financing options if possible.” Remember, responsible borrowing practices are key.

Finding Reputable Payday Lenders in Riverside, CA

How to Identify Legitimate Lenders

Finding a trustworthy payday loan provider is crucial. Beware of lenders who pressure you into quick decisions or those with unclear fees and interest rates. Legitimate lenders in Riverside, CA, will readily provide detailed information about all charges upfront. They’ll also clearly explain the repayment terms and the total cost of borrowing. Always check the lender’s license with the California Department of Financial Protection and Innovation (DFPI). This simple step helps verify their legality and protects you from scams.

Scrutinize the lender’s website and online reviews. Look for transparency in their operations and positive customer feedback. Avoid lenders with hidden fees or excessively high interest rates. “Red flags include promises of guaranteed approval regardless of credit history, pressure tactics, and a lack of physical address or contact information.” Reputable lenders will be open and honest about their processes and willing to answer your questions thoroughly. Remember to compare offers from several lenders before making a decision. This helps you secure the best possible terms for your payday loan in Riverside, CA.

Checking Licenses and Reviews

Before you apply for a payday loan in Riverside, CA, always verify the lender’s license. The California Department of Financial Protection and Innovation (DFPI) maintains a database of licensed lenders. Check this database to ensure the lender is legally operating and authorized to offer payday loans in California. Avoid lenders not listed; unlicensed operations often engage in predatory practices.

Next, thoroughly investigate online reviews from previous borrowers. Websites like the Better Business Bureau (BBB) and Yelp offer valuable insights. Look for patterns in complaints. Recurring negative reviews about high fees, aggressive collection tactics, or misleading terms signal potential problems. “Choosing a lender with consistently positive reviews and a strong reputation is crucial for a safe and transparent borrowing experience.” Remember, your due diligence protects you from exploitative lending practices common in the Riverside, CA payday loan market.

Comparing Interest Rates and Fees

Interest rates and fees significantly vary among payday lenders in Riverside, CA. Don’t just look at the advertised APR; carefully examine all associated charges. These can include origination fees, late payment penalties, and potentially even NSF (Non-Sufficient Funds) fees. Compare the total cost of the loan, not just the interest rate alone. This will give you a clearer picture of which lender offers the most favorable terms. Remember to check the lender’s licensing and reputation before proceeding.

Always obtain and carefully review all loan documentation before signing. “Understanding the repayment schedule is crucial to avoid unexpected fees.” Calculate your total repayment amount to ensure you can comfortably afford it. Seek multiple quotes to compare offers. Online resources like the California Department of Financial Protection and Innovation website can provide helpful information on licensed lenders and responsible borrowing practices in Riverside. Consider the potential consequences of defaulting on a payday loan, which could include negative impacts on your credit score and further financial difficulties.

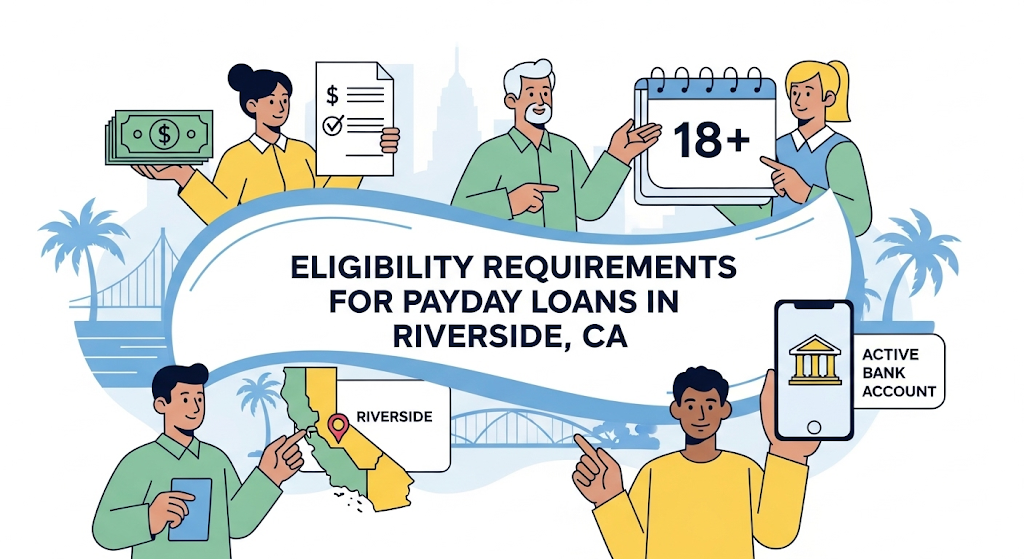

Eligibility Requirements for Payday Loans in Riverside

Credit Score and History

Unlike traditional loans, payday loans in Riverside, CA, often don’t require a perfect credit score. Many lenders prioritize your current income and employment stability over your credit history. They understand that borrowers sometimes face temporary financial setbacks. This means individuals with poor credit or even those with no credit history may still qualify. However, a strong credit score can improve your chances of securing a loan with favorable terms, such as a lower interest rate. Always check the specific requirements of each lender, as policies vary.

Remember, while a bad credit score won’t automatically disqualify you, it might impact the amount you can borrow or the interest rate offered. Lenders use credit reports to assess risk. A history of missed payments or bankruptcies can signal higher risk. Therefore, being upfront and honest about your financial situation with lenders is crucial. “Providing accurate information increases your chances of approval and helps you avoid potential problems down the line.” Consider comparing offers from multiple payday loan providers in Riverside to secure the best possible terms based on your individual credit profile.

Income and Employment Verification

Lenders in Riverside, CA, typically require proof of regular income to approve a payday loan application. This ensures you can repay the loan on your next payday. They need to see you have a consistent source of income, sufficient to cover the loan amount plus your living expenses. Acceptable proof might include pay stubs, bank statements showing regular deposits, or tax returns. The specific documentation required may vary by lender, so it’s always best to check directly with the institution.

To determine eligibility, lenders will assess your income relative to the loan amount and your debt. They want to see that your income significantly exceeds your expenses, including the payday loan repayment. “Insufficient income is a common reason for payday loan applications being denied.” Be prepared to provide detailed financial information. Remember, responsible lenders in Riverside will check your credit report, but a less-than-perfect credit score doesn’t always disqualify you from obtaining a payday loan. However, a strong income verification significantly increases your chances of approval.

Other Important Requirements

Beyond the basic requirements of age, income, and employment, several other factors significantly influence your eligibility for a payday loan in Riverside, CA. Lenders often verify your residential address, ensuring you’re a resident of California and potentially within their lending area. Providing proof of residency, such as a utility bill or rental agreement, is crucial. They also scrutinize your bank account information, needing a valid checking account for direct deposit and withdrawal of funds. Insufficient funds or a history of overdrafts can be immediate disqualification factors. In short, a clean financial history is essential.

Furthermore, lenders carefully review your credit history, although payday loans don’t always require perfect credit. However, a history of missed payments on other loans or high levels of outstanding debt may hinder your application. Your debt-to-income ratio is also a key consideration. Lenders want to see that you can comfortably manage your existing financial obligations alongside a new payday loan. “Failing to demonstrate responsible financial management will likely lead to rejection.” Remember to be completely truthful and accurate in your application; providing false information is illegal and could have serious consequences.

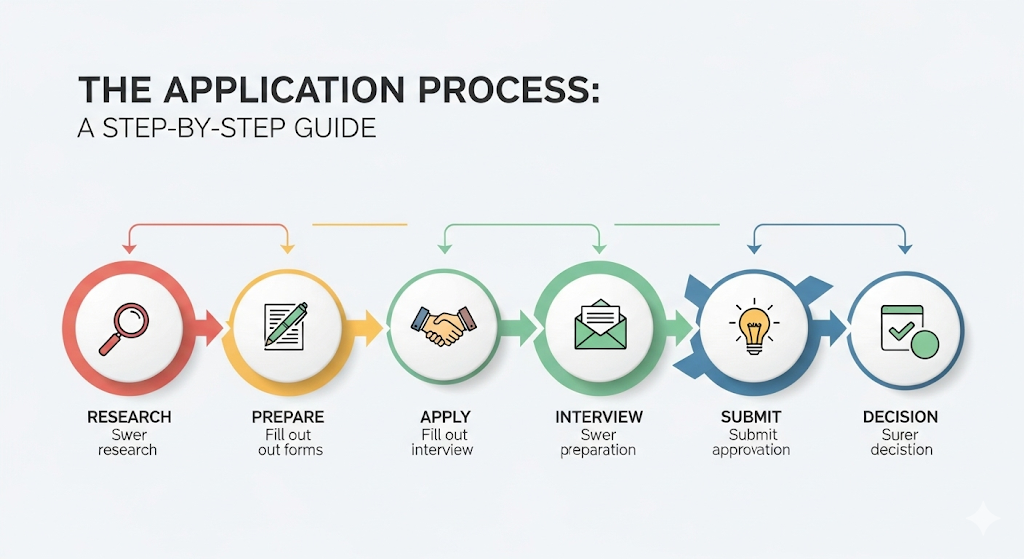

The Application Process: Steps to Getting a Payday Loan

Online Applications vs. In-Person Visits

Choosing between online and in-person payday loan applications in Riverside, CA depends on your preferences and circumstances. Online applications, offered by many lenders, provide convenience and speed. You can apply from anywhere with an internet connection, at any time. This eliminates travel time and potential wait times at a physical location. However, online applications might require more upfront information and digital literacy.

In contrast, visiting a payday loan store in person allows for immediate interaction with a loan officer. This can be beneficial if you have questions or need help navigating the application process. Face-to-face interaction can also be helpful for those less comfortable with online transactions or who prefer a more personal approach. “Remember to compare interest rates and fees from multiple lenders, whether you apply online or in person, to secure the best possible deal on your payday loan.” Always verify the lender’s license with the California Department of Financial Institutions before proceeding.

Required Documents

Securing a payday loan in Riverside, CA, typically requires providing specific documentation to verify your identity and financial stability. Lenders need to confirm you are who you say you are and can repay the loan. Commonly requested documents include a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income, such as recent pay stubs or bank statements showing consistent deposits, is also crucial. The lender will assess your income to determine your ability to repay the loan on time. Failure to provide sufficient proof may lead to your application being denied.

Beyond the basics, some lenders in Riverside may request additional documents. These could include proof of residence, like a utility bill or lease agreement, showing your address in Riverside, CA. They may also ask for your bank account information for direct deposit of the loan and automatic repayment. Always confirm the exact requirements with the specific lender before submitting your application. “Remember, providing accurate and complete documentation streamlines the process and increases your chances of approval.” Be prepared to answer questions about your employment history and current financial situation. This transparency builds trust and helps ensure a smooth transaction.

Processing Time and Loan Disbursement

Once you’ve submitted your completed application, the processing time for your payday loan in Riverside, CA, will vary depending on the lender. Many lenders offer same-day approvals, meaning you could have the funds in your account by the end of the business day. However, others may take a little longer, perhaps up to 24-48 hours. Factors like the completeness of your application and the lender’s internal processes play a significant role. Always confirm the expected processing timeline with the lender before submitting your application.

Loan disbursement usually follows approval. Most lenders transfer funds electronically directly to your designated bank account. This is the quickest method, providing almost immediate access to your funds. Check your bank account regularly to confirm receipt. Some lenders might offer alternative disbursement methods like check pickup, but this is less common due to the speed and convenience of electronic transfers. “Remember to carefully review the loan agreement before accepting the funds to ensure you understand the terms and conditions.” Be aware of any potential fees or charges associated with the disbursement method.

Responsible Borrowing and Avoiding Predatory Practices

Understanding Interest Rates and Fees

Payday loans in Riverside, CA, often come with high interest rates and substantial fees. These charges can quickly escalate the total cost of the loan far beyond the initial borrowed amount. Always carefully review the loan agreement, paying close attention to the Annual Percentage Rate (APR). This number represents the total cost of borrowing, including all fees and interest, expressed as a yearly percentage. Don’t hesitate to ask questions if anything is unclear. Understanding these costs is crucial to making an informed decision.

Comparing APRs across different lenders is essential. Shop around before committing to any loan. Some lenders may advertise low initial fees but bury high interest charges in the fine print. Beware of lenders who pressure you into a decision or make promises that seem too good to be true. “Remember, responsible borrowing involves comparing offers and choosing a lender with transparent and competitive terms.” Utilizing online comparison tools can help streamline this process, saving you time and potentially money. Prioritize lenders with a proven track record of ethical practices and customer satisfaction.

Creating a Repayment Plan

Before you take out a payday loan in Riverside, CA, meticulously plan your repayment. Understand the loan’s terms, including the APR and all fees. Carefully assess your monthly income and expenses. Identify areas where you can cut back to free up funds for repayment. “Failing to create a realistic budget significantly increases your risk of defaulting on the loan.” Consider using budgeting apps or spreadsheets to track your spending and create a clear picture of your financial situation.

A strong repayment plan involves prioritizing the loan payment. Treat it like a crucial bill, similar to rent or utilities. Automate payments if possible to avoid missed payments and late fees. Explore alternative repayment options with your lender if you foresee difficulty making a payment on time. Contacting them early is key. “Proactive communication can help you avoid the stress and penalties associated with late or missed payments.” Remember, responsible borrowing minimizes the risks associated with payday loans.

Seeking Help with Debt Management

Facing financial hardship can be overwhelming, but help is available. If you’re struggling to repay a payday loan in Riverside, CA, or managing other debts, several resources can provide crucial support. Don’t hesitate to seek professional guidance; ignoring the problem will only worsen your situation. Consider contacting a reputable credit counseling agency. These agencies offer debt management plans that can help you consolidate your debts and create a manageable repayment schedule. They can also provide valuable financial literacy education, equipping you with the tools to make better financial decisions in the future.

The National Foundation for Credit Counseling (NFCC) is a great place to start your search for a certified credit counselor. They can connect you with local agencies in Riverside that offer free or low-cost services. Remember, early intervention is key. “Reaching out for help is a sign of strength, not weakness, and can prevent a debt crisis from spiraling out of control.” Exploring options like debt consolidation or negotiating with your creditors directly may also be beneficial. Always be wary of companies promising quick fixes, and thoroughly research any agency before sharing your financial information. Prioritizing responsible financial practices is crucial for long-term financial health.

Alternatives to Payday Loans in Riverside, CA

Small Personal Loans

Small personal loans offer a potentially better alternative to payday loans in Riverside, CA. These loans, typically offered by credit unions or online lenders, provide a fixed amount of money at a set interest rate over a defined repayment period. Unlike payday loans’ short repayment terms and high fees, personal loans offer more manageable monthly payments and often lower overall costs. Consider your credit score; a better score will often result in more favorable loan terms. Many institutions offer educational resources to help you improve your credit.

Before applying for a personal loan, shop around and compare interest rates from different lenders. Check for hidden fees and understand the loan’s total cost. “Carefully review the loan agreement before signing to ensure you understand all the terms and conditions.” Credit unions, in particular, are known for providing competitive rates and more personalized service than some online lenders. They sometimes offer financial literacy programs that can be immensely helpful in managing finances and avoiding future need for high-interest loans. Remember to budget carefully to ensure you can comfortably afford the monthly payments.

Credit Unions

Credit unions offer a viable alternative to payday loans in Riverside, CA, providing a more affordable and responsible borrowing experience. Unlike payday lenders, credit unions are not-for-profit financial cooperatives owned by their members. This structure means they prioritize member needs over profit maximization, often resulting in lower interest rates and fees on loans. Many credit unions offer small-dollar loans designed specifically to help members manage unexpected expenses, bridging the gap until their next paycheck. They also frequently provide financial literacy resources and budgeting counseling, empowering members to improve their long-term financial health.

Before applying for a payday loan, explore the loan options available at local Riverside credit unions. They may require a membership fee, but this is often a small price to pay compared to the exorbitant fees associated with payday loans. “Credit unions often perform a more thorough credit check, but this is a safeguard against overextending credit and prevents borrowers from getting trapped in a cycle of debt.” Check with credit unions like the California Credit Union or your local branch for more information on eligibility requirements, interest rates and loan terms. Remember to compare options carefully to find the best fit for your financial situation.

Community Resources

Riverside, CA, boasts a network of community resources designed to assist residents facing financial hardship. These organizations often offer free financial counseling, helping you create a budget, explore debt management options, and navigate challenging financial situations. Many provide referrals to other services like food banks, housing assistance programs, and job training, addressing the root causes of financial instability rather than just providing short-term loans. Contacting 211, the United Way’s helpline, is a great starting point to discover relevant local services.

Several local churches and non-profit organizations also operate aid programs. These often include emergency financial assistance, which can be crucial in bridging the gap until your next paycheck. Remember to thoroughly research any organization before engaging with them. Check their legitimacy and understand their application processes. “Seeking help from reputable community resources is often a far better alternative to the high-interest rates and potential debt traps associated with payday loans.” By exploring these options, you can secure more sustainable and responsible solutions for your financial needs.