Understanding Payday Loans Roanoke, VA

What are Payday Loans?

payday loans roanoke va, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They are typically due on your next payday, hence the name. These loans are usually for smaller amounts, ranging from $100 to $500, and are often accessed through storefront lenders or online platforms in Roanoke, VA. Keep in mind, high interest rates are a defining characteristic. Borrowers should carefully consider the total cost before applying, as these can lead to a debt cycle if not managed responsibly.

Before taking out a payday loan in Roanoke, it’s crucial to understand the terms and conditions completely. These loans come with significant fees. Failing to repay on time can lead to additional charges and damage your credit score. Therefore, “thorough research and careful budgeting are absolutely essential before considering this type of financing.” Always explore alternative options, such as borrowing from friends or family, or using a credit card, if possible. Consider the long-term implications of using payday loans, and weigh the benefits against the potential drawbacks.

Eligibility Requirements in Roanoke

Securing a payday loan in Roanoke, VA, requires meeting specific criteria. Lenders typically demand proof of steady income, often verifying employment history and pay stubs. This ensures you possess the means to repay the loan on your next payday. Additionally, you’ll need a valid government-issued ID and an active bank account for direct deposit of the loan and subsequent repayment. Failing to meet these basic requirements will likely result in your application being denied.

Beyond the basics, lenders often assess your creditworthiness, though not always to the same stringent standards as traditional banks. A poor credit history might not automatically disqualify you, but it could impact the loan amount offered or the interest rate applied. Reviewing your credit report before applying is beneficial. “Remember, comparing offers from multiple lenders in Roanoke is crucial to securing the most favorable terms.” Each lender possesses unique eligibility requirements, so thorough research is paramount before committing to a payday loan.

Interest Rates and Fees in Virginia

Virginia law regulates payday loans, setting limits on interest rates and fees. Borrowers should carefully review these regulations before committing to a loan. High interest rates are common with payday loans, and the cost can quickly escalate if the loan isn’t repaid on time. Always compare offers from multiple lenders to find the most favorable terms.

The maximum allowable finance charge on a payday loan in Virginia is capped. However, this doesn’t always reflect the total cost. Late fees and other charges can significantly increase the final amount owed. “It’s crucial to understand the complete cost before agreeing to any payday loan in Roanoke, VA, to avoid unexpected financial hardship.” Explore all options carefully, including credit counseling and exploring alternative financial solutions, before considering a payday loan as a last resort. Remember, responsible borrowing practices are key to managing your finances effectively.

Finding Reputable Lenders in Roanoke

Identifying Licensed and Regulated Lenders

Before considering any payday loan in Roanoke, VA, verify the lender’s licensing. The Virginia State Corporation Commission (SCC) regulates lending. Check their website to confirm a lender’s legitimacy and ensure they are authorized to operate in Roanoke. Avoid unlicensed lenders; they often operate outside the law and may engage in predatory practices. Look for clear licensing information readily available on the lender’s website or in their physical location. Always confirm details independently.

A reputable lender will be transparent about fees and interest rates. They will also clearly explain the loan terms. Compare offers from multiple licensed lenders to find the best deal. “Choosing a licensed and regulated lender significantly reduces the risk of encountering scams or exploitative practices.” Pay close attention to the contract’s details. This will help to protect your financial well-being. Remember, understanding the terms protects you from unexpected costs.

Checking Online Reviews and Reputation

Before applying for a payday loan in Roanoke, VA, thoroughly investigate potential lenders online. Check multiple review platforms like Google Reviews, Yelp, and the Better Business Bureau (BBB). Look for consistent patterns in customer feedback. Positive reviews should detail positive experiences with loan processing, customer service, and repayment terms. Negative reviews, while important, should be assessed critically; a few isolated complaints don’t necessarily indicate a bad lender. However, numerous negative comments about high fees, aggressive collection tactics, or misleading practices are major red flags.

Pay close attention to the lender’s response to negative reviews. A responsible lender will address customer concerns promptly and professionally. This demonstrates their commitment to customer satisfaction and accountability. Remember, reputable lenders are transparent about their fees and terms. They’ll clearly outline all charges upfront, avoiding hidden fees or unexpected costs. “Using online reviews as part of your research process is crucial for identifying reliable and trustworthy payday loan providers in Roanoke.” Consider comparing several lenders’ reviews before making a decision. This approach helps you make an informed choice, protecting you from potentially exploitative lending practices.

Comparing Loan Terms and Conditions

Before committing to a payday loan in Roanoke, VA, meticulously compare the terms and conditions offered by different lenders. Interest rates vary significantly. Some lenders may charge exorbitant fees. Always check the Annual Percentage Rate (APR), which reflects the total cost of borrowing. Don’t overlook additional charges, such as origination fees or late payment penalties. These can substantially increase your overall debt.

Pay close attention to the repayment schedule. Understand the loan’s duration and the expected payment amounts. Choose a repayment plan that comfortably fits your budget. “Failing to understand these crucial details can lead to a debt cycle that’s difficult to escape.” Reputable lenders provide clear and concise documentation. This should include all fees, interest rates, and repayment terms. Review everything carefully before signing. Consider comparing several loan offers side-by-side to make the most informed decision for your financial situation.

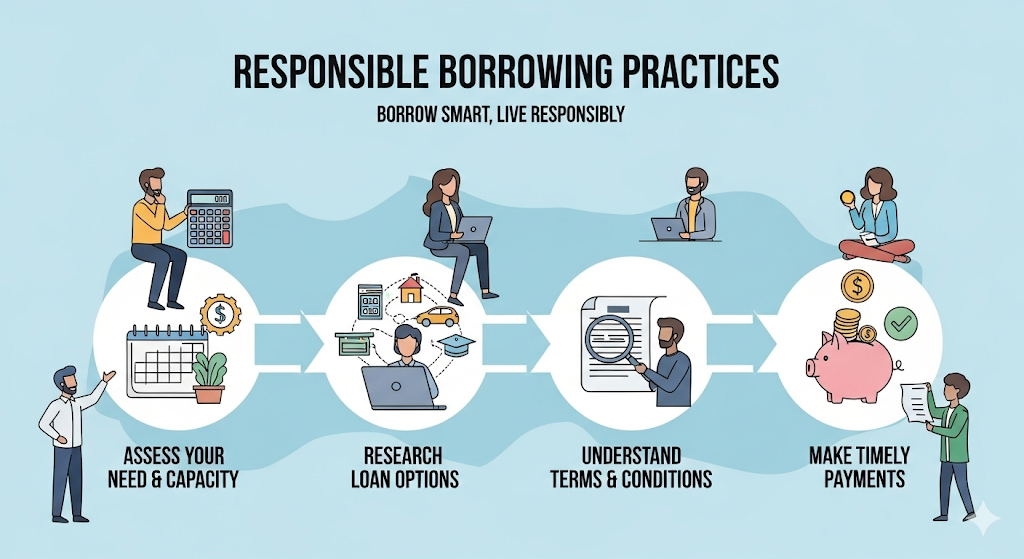

Responsible Borrowing Practices

Creating a Realistic Budget

Before applying for a payday loan in Roanoke, VA, it’s crucial to understand your current financial situation. Create a detailed budget that lists all your monthly income and expenses. This includes necessities like rent, utilities, groceries, and transportation, as well as non-essential spending. Honest self-assessment is key. Ignoring smaller expenses can lead to inaccurate budgeting, potentially causing further financial strain. Track your spending for a month to get a clear picture.

Once you have a realistic budget, identify areas where you can cut back. Even small savings can significantly impact your ability to repay a payday loan. Consider using budgeting apps or spreadsheets to help you track and manage your finances. “Prioritizing essential expenses and reducing non-essential spending will significantly improve your financial health and reduce your reliance on short-term loans like payday loans.” Remember, responsible financial planning is the cornerstone of avoiding a debt cycle. Using budgeting tools, like those offered by the Consumer Financial Protection Bureau (CFPB), can provide valuable support.

Understanding the Loan Repayment Process

Before accepting a payday loan in Roanoke, VA, fully understand the repayment terms. Payday loans are typically due on your next payday. This often means a repayment period of just two weeks. Confirm the exact due date with your lender. Late fees can be substantial, potentially exceeding the original loan amount. Carefully review your loan agreement for all details regarding repayment. Missing a payment can severely damage your credit score.

Planning for repayment is crucial. Budget carefully to ensure you can afford the repayment amount when it’s due. Consider setting aside a portion of each paycheck specifically for loan repayment. This proactive approach minimizes the risk of defaulting on the loan. “Failing to plan is planning to fail,” and this is especially true with short-term, high-interest loans like payday loans. Explore alternative borrowing options if you anticipate difficulty repaying the loan on time. Remember, responsible borrowing is key to avoiding financial hardship.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Roanoke, VA, explore alternatives. Many resources offer financial assistance without the high interest rates and potential for a debt cycle. Credit unions often provide small-dollar loans with more manageable terms. Check with local credit unions like the Virginia Credit Union or similar institutions for options. They frequently offer financial literacy programs as well, helping you budget better and avoid future borrowing needs.

Consider tapping into your existing resources first. Could you borrow from family or friends? Negotiating a payment plan with creditors can buy you time. Many creditors are willing to work with you, especially if you’re upfront about your financial struggles. “Explore all available options before resorting to a high-cost payday loan; it’s crucial to understand the long-term implications of such debt.” Finally, non-profit credit counseling agencies provide free or low-cost guidance on budgeting and debt management. These services can help you create a personalized plan to navigate financial challenges effectively.

Alternatives to Payday Loans in Roanoke, VA

Community Resources and Financial Assistance

Roanoke, VA offers several community resources to help residents facing financial hardship. These organizations often provide free financial counseling and can help you create a budget and explore options beyond payday loans. The United Way of Roanoke Valley, for example, maintains a comprehensive online database of local social service agencies. This database helps connect individuals with services like emergency financial assistance programs, rent and utility assistance, and food banks. Many local churches and non-profit organizations also offer similar support. “Exploring these options first can often prevent the need for a high-interest payday loan.”

Remember, seeking help is a sign of strength, not weakness. Don’t hesitate to contact these resources. They can provide valuable guidance and support as you navigate challenging financial situations. Before applying for a payday loan, consider contacting organizations like the Salvation Army or local credit unions. They often provide small loans with far more manageable interest rates. Many also offer financial literacy workshops to equip individuals with the tools and knowledge to better manage their finances in the long term. “Utilizing these free community resources is a crucial first step in achieving lasting financial stability.”

Credit Unions and Small Loan Options

Credit unions often offer small loans with more favorable terms than payday loans. They are member-owned, not-for-profit financial institutions, prioritizing member needs over profit. This often translates to lower interest rates and more flexible repayment options. Many credit unions in Roanoke, VA, such as the Virginia Credit Union, offer various loan products designed for smaller amounts, bridging short-term financial gaps. Check with your local credit union to learn about eligibility requirements and available loan programs.

Exploring options at your local credit union is a smart first step when facing unexpected expenses. “Before considering a payday loan, always investigate the availability of smaller, more affordable loans from credit unions or other financial institutions.” These alternatives often have significantly lower interest rates, protecting you from the debt trap frequently associated with high-cost payday lending. Remember to compare interest rates, fees, and repayment terms carefully before committing to any loan. Consider the total cost of borrowing to make the most informed decision.

Long-Term Financial Planning Strategies

Escaping the cycle of payday loans in Roanoke, VA, requires a proactive approach to your finances. This means shifting your focus from short-term fixes to long-term financial stability. Start by creating a realistic budget, tracking your income and expenses meticulously. Identify areas where you can cut back on spending, even small amounts can add up over time. Consider using budgeting apps or spreadsheets to simplify the process. Prioritize essential expenses like housing, food, and transportation before addressing discretionary spending. “Building a strong financial foundation is key to avoiding the need for high-interest loans like payday loans.”

Once you have a handle on your current spending, explore strategies for increasing your income. This could involve seeking a higher-paying job, taking on a part-time role, or developing new skills to improve your job prospects. Explore options for debt consolidation, potentially lowering your monthly payments and simplifying your finances. Consider contacting a reputable credit counseling agency for guidance on managing debt and creating a long-term repayment plan. Remember, consistent effort and mindful financial habits are crucial for building a strong financial future and avoiding the trap of recurring payday loan debt. “By taking control of your finances through diligent planning, you can achieve lasting financial security and independence.”

Legal Protections for Borrowers in Virginia

Virginia’s Usury Laws

Virginia has usury laws designed to protect borrowers from excessively high interest rates on loans, including payday loans in Roanoke. These laws set a maximum interest rate that lenders can legally charge. Exceeding this limit is illegal and can result in serious consequences for the lender. The specific rate allowed can vary slightly depending on the loan amount and type, so it’s crucial to understand the applicable regulations before agreeing to any loan terms. “Always carefully review the loan agreement to ensure compliance with Virginia’s usury laws.”

Understanding Virginia’s usury laws is vital for consumers in Roanoke seeking payday loans. The state’s regulations are in place to prevent predatory lending practices. While payday loans can offer short-term financial relief, the high interest rates often associated with them can quickly become unaffordable. Familiarize yourself with the legal limits on interest charges to make informed decisions and avoid potentially exploitative lending arrangements. “If you’re unsure about the legality of a loan’s interest rate, seek independent legal advice before signing any paperwork.” Resources like the Virginia State Corporation Commission website can provide further information.

Consumer Protection Agencies in Roanoke

Roanoke residents have several avenues for recourse if they encounter issues with payday loans. The Virginia State Corporation Commission (SCC) regulates lenders and investigates complaints. Their website provides valuable information on payday loan regulations and a process for filing complaints. You can also contact the SCC’s consumer services division directly for assistance with resolving disputes. Remember to gather all relevant documentation, such as loan agreements and communication records, before contacting any agency.

Beyond the SCC, the Consumer Financial Protection Bureau (CFPB) offers a national platform for lodging complaints against lenders. The CFPB is a federal agency with broad oversight of financial products and services, including payday loans. They can investigate unfair, deceptive, or abusive practices. “Filing a complaint with the CFPB can be a powerful tool, especially if you suspect illegal activity on the part of a lender.” While not specific to Roanoke, their jurisdiction is nationwide, providing an additional layer of consumer protection for those seeking help with predatory lending practices.

Debt Consolidation and Management Options

In Virginia, struggling with multiple payday loans can feel overwhelming. Fortunately, debt consolidation offers a potential solution. This involves combining several smaller loans into one larger loan, often with a lower interest rate and a simplified repayment schedule. This can make managing your finances easier and potentially reduce your overall interest paid. However, carefully compare offers from different lenders before committing. Consider factors such as interest rates, fees, and the loan term to find the best option for your circumstances.

Exploring debt management options alongside consolidation is crucial. Credit counseling agencies, like those affiliated with the National Foundation for Credit Counseling (NFCC), offer free or low-cost services. They can help you create a budget, negotiate with creditors, and develop a debt repayment plan. “Remember, seeking professional guidance can significantly improve your chances of successfully navigating your debt and avoiding further financial hardship.” The Virginia State Corporation Commission also provides resources for consumers facing financial difficulties. Don’t hesitate to utilize these resources; they are designed to help you manage your payday loans responsibly.

Frequently Asked Questions (FAQs)

What if I can’t repay my payday loan?

Falling behind on a payday loan in Roanoke, VA, can be stressful. Your first step should be contacting your lender immediately. Explain your situation honestly. Many lenders are willing to work with borrowers facing temporary hardship. They may offer payment extensions or alternative repayment plans to avoid default. Don’t ignore communication from the lender; this will only worsen the situation. Proactive communication is key.

Ignoring the problem won’t make it disappear. Late payments accrue significant fees and interest charges, quickly increasing your debt. In some cases, the lender might send your debt to a collections agency. This negatively impacts your credit score, making it harder to obtain loans or credit in the future. “Consider seeking help from a credit counseling agency if you’re struggling to manage your finances.” They can provide guidance and strategies to address your debt effectively. Remember, exploring your options early is crucial to minimize the long-term consequences of missed payday loan payments.

Are there any hidden fees associated with payday loans?

Yes, unfortunately, hidden fees are a common problem with payday loans. While the advertised interest rate might seem manageable, borrowers often face unexpected charges. These can include origination fees, which are charged for processing your application. Late payment fees are also frequent, and these can quickly escalate the total cost of your loan. Some lenders may also charge non-sufficient funds (NSF) fees if your payment bounces. It’s crucial to carefully read the loan agreement before signing to understand all associated costs.

Before committing to a payday loan in Roanoke, VA, meticulously review all the terms and conditions. “Don’t hesitate to ask the lender to clarify any unclear fees or charges.” Compare offers from multiple lenders to find the most transparent and affordable option. Websites like the Virginia State Corporation Commission can offer additional information on regulations concerning payday lending in the state. Being aware of potential hidden fees can help you make an informed decision and avoid unexpected financial burdens. Remember, transparency is key. A reputable lender will openly disclose all fees upfront.

How can I improve my credit score after using a payday loan?

Improving your credit score after a payday loan requires proactive steps and consistent effort. Paying back your payday loan on time is the single most important action. This demonstrates responsible borrowing and prevents further damage to your credit report. On-time payments are crucial for building a positive payment history, a major factor in your credit score. Consider setting up automatic payments to avoid missed deadlines.

Beyond repayment, explore strategies to build credit positively. You might consider obtaining a secured credit card or becoming an authorized user on a family member’s card with good standing. These actions help establish a longer credit history and demonstrate responsible credit management. “Remember, rebuilding your credit takes time and patience; consistent responsible financial behavior is key.” Monitor your credit report regularly using free services like AnnualCreditReport.com to track your progress and identify any errors. This proactive approach will help you improve your creditworthiness.