Understanding Payday Loans Salt Lake City

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help people cover unexpected expenses until their next paycheck. They’re typically due on your next payday, hence the name. In Salt Lake City, as elsewhere, these loans are often characterized by high interest rates and fees. Borrowers should carefully consider the total cost before applying. Understanding the terms and conditions is crucial to avoid getting trapped in a cycle of debt.

These loans are generally unsecured, meaning they don’t require collateral. However, the lender will typically require access to your bank account to automatically debit the repayment. Always verify the lender’s licensing and legitimacy with the Utah Department of Financial Institutions to avoid scams. Remember that while payday loans can provide quick access to cash, they’re not a long-term financial solution. “Using them responsibly requires a clear repayment plan and a realistic assessment of your financial situation.” Consider exploring alternative financial options, like credit counseling or budgeting assistance, before resorting to payday loans.

How Payday Loans Work in Utah

In Utah, payday loans are short-term, small-dollar loans. They are designed to help borrowers cover unexpected expenses until their next paycheck. You typically borrow a small amount, often a few hundred dollars, and repay the loan plus fees on your next payday. Interest rates are high, reflecting the short repayment period and inherent risk for lenders. Utah law, however, does set limits on fees and total loan costs, offering some consumer protection. Remember to thoroughly review the loan agreement before signing.

Before considering a payday loan in Salt Lake City, carefully weigh the costs. Fees can quickly add up, making the total amount due significantly higher than the initial loan amount. Missed payments can result in further fees and negatively impact your credit score. Consider exploring alternative financial solutions, such as credit counseling or negotiating with creditors, before resorting to a payday loan. “Always prioritize responsible borrowing and fully understand the terms and conditions before committing to a payday loan.” Explore options like community resources or credit unions for more affordable financial assistance.

Regulations and Laws Governing Payday Loans in Salt Lake City

Utah, including Salt Lake City, regulates payday loans under the Utah Consumer Credit Code. These laws aim to protect borrowers from predatory lending practices. Key regulations include limits on loan amounts, interest rates, and the number of outstanding loans a borrower can have simultaneously. Failure to comply can result in significant penalties for lenders. The Utah Department of Financial Institutions oversees these regulations and enforces compliance.

Understanding these regulations is crucial for both borrowers and lenders. Borrowers should carefully review loan agreements to ensure they understand all terms and fees. Payday loan alternatives should also be explored, as these high-interest loans can create a cycle of debt if not managed carefully. “Always prioritize responsible borrowing and seek advice from a financial professional if you’re struggling with debt.” Knowing your rights and responsibilities under Utah law is paramount before entering into a payday loan agreement in Salt Lake City.

Finding Reputable Payday Lenders in Salt Lake City

Identifying Licensed and Reliable Lenders

Before considering any payday loan in Salt Lake City, Utah, verifying a lender’s license is crucial. The Utah Department of Financial Institutions (DFI) maintains a registry of licensed lenders. Always check this registry before applying. Don’t rely solely on online reviews; independently verify their licensing status. Failing to do so could expose you to predatory lenders and illegal practices. Look for clear and transparent fee structures, readily available contact information, and a physical address in Utah.

Reliable lenders prioritize responsible lending. They’ll offer you a loan agreement you can easily understand. They should clearly explain all terms and conditions. Avoid lenders who pressure you into a loan or who are unclear about fees and repayment schedules. Reputable lenders will assess your ability to repay the loan before approving it. They might consider your income and credit history. This helps protect you from getting into a cycle of debt. “Choosing a licensed and transparent lender is your best protection against high-cost loans and potential scams.”

Comparing Interest Rates and Fees

Interest rates on payday loans in Salt Lake City vary significantly. Always compare offers from multiple lenders before committing. Don’t just look at the advertised APR; carefully examine all fees. These can include origination fees, late payment penalties, and rollover charges. These added costs can dramatically increase the total cost of the loan. Remember, a lower APR doesn’t automatically mean a better deal.

“Scrutinize the loan contract thoroughly before signing,” as hidden fees can quickly negate any apparent savings from a seemingly low interest rate. The Utah Department of Financial Institutions website offers resources to help you understand payday loan regulations and compare lender practices. Consider using online comparison tools, but always verify the information independently with the lender. Choosing a lender solely based on low interest rates without considering total fees could lead to unexpected financial burdens. Take your time and make informed decisions to protect your financial wellbeing.

Checking Online Reviews and Testimonials

Before applying for a payday loan in Salt Lake City, thoroughly investigate potential lenders online. Don’t rely solely on a company’s website. Check independent review sites like the Better Business Bureau (BBB) and Google Reviews. Look for patterns in customer feedback. Positive reviews mentioning quick processing times and helpful customer service are good signs. Conversely, numerous complaints about high fees or aggressive collection practices should raise serious red flags.

Pay close attention to the specifics of online testimonials. Do the reviews seem genuine? Are there specific details about the loan experience? Vague or overly positive reviews can be suspicious. A balanced range of reviews, including some negative ones, can actually build trust, showing a company’s willingness to address customer concerns. “Always prioritize lenders with a proven track record of fair and transparent practices, as reflected in their online reputation.” Remember, your due diligence is crucial to finding a reputable payday lender that meets your needs in Salt Lake City, Utah.

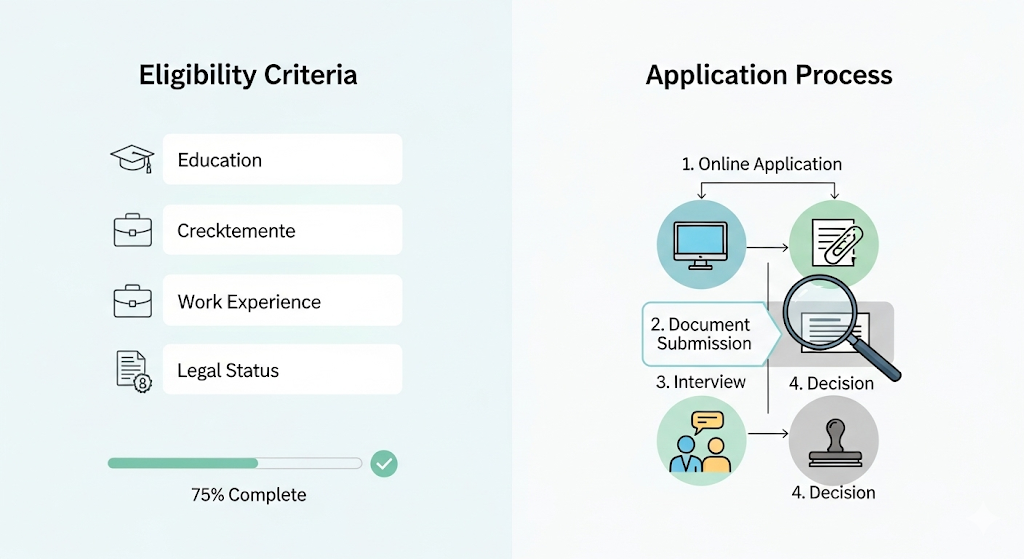

Eligibility Criteria and Application Process

Credit Score Requirements for Payday Loans

Securing a payday loan in Salt Lake City often hinges on your creditworthiness. While many lenders advertise payday loans for bad credit, they still assess your credit history. Don’t expect a lenient approach simply because you need emergency funds. Lenders often utilize a credit scoring system to gauge risk. A higher credit score generally translates to better loan terms and higher approval chances. However, some lenders specialize in payday loans for people with no credit or those with very low scores, although the interest rates may be higher. Always compare offers before committing.

“It’s crucial to remember that a poor credit score doesn’t automatically disqualify you.” Many lenders weigh other factors, including your income stability and employment history. Providing proof of regular income and a stable job significantly strengthens your application. This demonstrates your capacity to repay the loan promptly. Therefore, even with a less-than-perfect credit score, obtaining a payday loan in Salt Lake City, Utah remains possible. Thoroughly researching lenders and carefully comparing their requirements is vital for success. “Don’t hesitate to contact lenders directly with questions regarding their specific criteria.”

Required Documentation and Information

Securing a payday loan in Salt Lake City, Utah, typically requires providing specific documentation to verify your identity and financial situation. Lenders will almost always need a valid government-issued photo ID, such as a driver’s license or state ID card. Proof of income, such as recent pay stubs or bank statements showing regular deposits, is also essential. The exact requirements can vary between lenders, so it’s crucial to check directly with the payday loan provider you intend to use. Some lenders may also ask for your Social Security number. “Always carefully review the lender’s terms and conditions before providing any personal information.”

Beyond the basics, be prepared to provide additional information. This might include your current address and contact information. You’ll likely need to provide your bank account details for direct deposit of the loan and for repayment. Failure to provide complete and accurate information can delay or prevent loan approval. “Remember that responsible borrowing practices are crucial; only borrow what you can comfortably repay to avoid falling into a debt cycle.” Understanding the lender’s requirements beforehand helps ensure a smoother application process for your payday loan in Salt Lake City.

Steps Involved in Applying for a Payday Loan

Applying for a payday loan in Salt Lake City is generally a straightforward process, but understanding the steps involved is crucial. First, you’ll need to locate a reputable lender. Many payday loan companies operate in Salt Lake City, both online and with physical locations. Thoroughly research potential lenders, comparing interest rates and fees to ensure you’re getting a fair deal. Check online reviews and consider using comparison websites to aid your research. Remember, Utah state law governs payday lending, so it’s important to choose a lender who fully complies.

Next, gather the necessary documentation. This typically includes a valid government-issued photo ID, proof of income (pay stubs or bank statements), and your current banking information. Some lenders might require additional paperwork, so it’s best to contact the lender directly to confirm their specific requirements. Once you have all the documents, complete the online or in-person application. Be sure to double-check all the information for accuracy to avoid delays. “Submitting an incomplete or inaccurate application can significantly delay the loan process and may even lead to rejection.” After submitting your application, you should receive a prompt response from the lender regarding approval and disbursement of funds.

Responsible Borrowing and Financial Management

Budgeting and Financial Planning Tips

Before considering a payday loan in Salt Lake City, Utah, carefully assess your financial situation. Create a detailed budget, tracking all income and expenses. Identify areas where you can reduce spending. This will give you a clearer picture of your financial health and help determine if a payday loan is truly necessary. Consider using budgeting apps or spreadsheets for easier tracking. Remember, responsible financial planning is key to avoiding a cycle of debt.

Prioritize building an emergency fund. Aim for at least three to six months’ worth of living expenses. This safety net will help you handle unexpected costs without resorting to high-interest payday loans. Consider exploring alternative financing options, such as negotiating payment plans with creditors or seeking assistance from local credit counseling agencies like the Utah Non-profit Housing Corporation. “A well-planned budget and emergency fund are your best defenses against the high cost and potential risks of payday loans.” Remember, these loans are designed for short-term use only and should not become a long-term solution for financial struggles.

Understanding the Risks of Payday Loans

Payday loans in Salt Lake City, like elsewhere, carry significant risks. The high interest rates, often exceeding 400% APR, can quickly spiral into unmanageable debt. Missing even one payment can lead to escalating fees and further financial hardship. Debt cycles are common, trapping borrowers in a continuous loop of borrowing to repay previous loans. This is particularly true for individuals already struggling with low income or unexpected expenses. Consider the potential long-term consequences before pursuing this option.

Before taking out a payday loan, carefully weigh the pros and cons. Explore all alternative financing options first. Credit unions often offer lower-interest small-dollar loans or financial counseling services. Budgeting tools and free financial literacy resources are also widely available. “Remember, a payday loan should be a last resort, not a first choice, for managing your finances.” Failing to fully understand the terms and conditions can have severe repercussions, impacting your credit score and overall financial health for years to come. Thorough research and responsible decision-making are crucial.

Alternatives to Payday Loans

Before considering a payday loan in Salt Lake City, explore alternatives. Many resources offer financial assistance without the high interest rates and potential debt cycle associated with payday loans. Credit unions, for example, often provide small-dollar loans with more manageable terms. They may also offer financial literacy programs to help you better manage your finances. Local charities and non-profit organizations can also provide emergency financial assistance. Check online resources like the United Way’s 211 helpline for local options.

Consider budgeting tools and apps. These can help you track spending and identify areas where you can cut back. Exploring debt consolidation or a balance transfer on credit cards might lower your overall interest payments, providing a more affordable path to debt management. Remember, careful planning is key. “Seeking professional financial advice from a credit counselor can provide a personalized roadmap to financial stability.” This is crucial for navigating financial challenges and avoiding the high costs of payday loans. Explore all options before resorting to short-term, high-interest loans.

Avoiding Payday Loan Scams and Predatory Lending

Recognizing Red Flags and Warning Signs

Be wary of lenders who pressure you into a loan immediately. Legitimate payday loan providers in Salt Lake City will explain the terms clearly and answer your questions thoroughly. High-pressure tactics are a major red flag. Avoid any lender who refuses to provide details in writing. Always review the contract carefully *before* signing. Check the interest rate and all fees. A significantly high Annual Percentage Rate (APR) exceeding Utah’s legal limits should raise serious concerns. Remember, reputable lenders are transparent about their fees.

Look for inconsistencies in the lender’s information. Mismatched addresses or contact details are strong indicators of a scam. Unsolicited offers via email or text are often a warning sign. Legitimate payday loan businesses in Salt Lake City rarely use such methods. If a lender requires upfront fees or payment before receiving funds, it’s almost certainly a fraud. “Always verify the lender’s license with the Utah Department of Financial Institutions.” Don’t hesitate to contact the Utah Attorney General’s office if you suspect fraudulent activity. Protecting yourself from predatory payday lending practices requires vigilance and careful due diligence.

Safeguarding Your Personal Information

Protecting your personal data is crucial when dealing with payday loans in Salt Lake City, or anywhere else. Never share sensitive information like your social security number, bank account details, or driver’s license number unless you are absolutely certain of the lender’s legitimacy. Verify the lender’s license with the Utah Department of Financial Institutions before submitting any application. Legitimate lenders will never pressure you to provide information quickly or demand unusual fees upfront.

Beware of lenders who ask for access to your entire banking history or who use aggressive or high-pressure tactics. Remember, reputable payday loan providers in Salt Lake City will clearly display their licensing and contact information on their website and physical locations. “If a lender seems too good to be true, it probably is,” particularly regarding interest rates and fees. Always read the fine print carefully and understand all terms before signing any agreements. Consider seeking free financial counseling from a reputable organization to navigate challenging financial situations and avoid the high cost of payday loans altogether.

Reporting Suspicious Lending Practices

If you suspect predatory lending practices, reporting is crucial. The Utah Department of Financial Institutions (DFI) is your primary resource. Their website provides detailed information on how to file a complaint, including online submission forms. They investigate complaints about unfair or deceptive lending practices. This includes excessively high interest rates and hidden fees, common hallmarks of payday loan scams in Salt Lake City. Remember to gather all relevant documentation: loan agreements, payment records, and communication with the lender.

Providing detailed information helps the DFI build a strong case. You can also report suspicious activities to the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency dedicated to consumer protection in financial matters. They accept complaints online or by phone. Filing a complaint is a powerful step in protecting yourself and others from exploitative payday loan practices. “By reporting these scams, you contribute to a safer financial environment for everyone in Salt Lake City.” Don’t hesitate; your report could prevent others from falling victim to predatory lenders.

Frequently Asked Questions (FAQs)

What happens if I can’t repay my payday loan?

Falling behind on a payday loan in Salt Lake City can have serious consequences. Your lender will likely attempt to collect the debt through repeated phone calls and letters. They may also report your delinquency to credit bureaus, negatively impacting your credit score. This can make it harder to secure loans, rent an apartment, or even get a job in the future. Understanding the terms of your payday loan agreement is crucial to avoid these situations.

Consider exploring options like negotiating a payment plan with your lender *before* you miss a payment. Utah state law, however, does not explicitly mandate specific payment plan accommodations. “Reaching out to a reputable credit counseling agency can provide valuable guidance and explore potential solutions.” Remember, ignoring the problem only worsens the situation. Proceeding with caution and proactive communication is vital when facing difficulties repaying a payday loan. Always seek professional advice if you anticipate challenges meeting your repayment obligations.

Can I get a payday loan with bad credit?

Many payday lenders in Salt Lake City understand that financial emergencies can happen to anyone, regardless of credit history. They often focus less on traditional credit scores and more on your current income and ability to repay the loan. This means that even if you have a bad credit score, you might still qualify for a payday loan. However, you should expect higher interest rates compared to borrowers with excellent credit. Always compare offers from multiple lenders to secure the best terms.

Before applying for a payday loan with bad credit in Salt Lake City, carefully review the terms and conditions. Pay close attention to the APR (Annual Percentage Rate), fees, and repayment schedule. “Failing to understand these details can lead to unexpected costs and potential debt traps.” Consider exploring alternative financial solutions, such as credit counseling or borrowing from friends and family, if you’re struggling with debt. Remember, responsible borrowing is key to managing your finances effectively, even with a less-than-perfect credit history.

What are the legal implications of defaulting on a payday loan in Utah?

Defaulting on a payday loan in Utah can have serious consequences. Your credit score will suffer, impacting your ability to secure loans, rent an apartment, or even get a job in the future. Collection agencies may aggressively pursue repayment, potentially leading to wage garnishment or bank levy. Utah law allows for these actions. Furthermore, you may face legal action, including lawsuits. These lawsuits can result in additional fees and court costs. This could significantly worsen your financial situation.

Remember, it’s crucial to understand the terms of your payday loan agreement before signing. Carefully review the repayment schedule and potential penalties for late or missed payments. If you anticipate trouble making payments, contact your lender immediately to explore options like payment plans or extensions. Ignoring the problem will only make it worse. “Proactive communication is key to avoiding the severe legal ramifications of payday loan default.” Consider seeking help from a credit counselor or financial advisor if you’re struggling to manage your debt. They can offer guidance and support.