Understanding Payday Loans Tallahassee, FL

What are Payday Loans?

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They are typically due on your next payday, hence the name. Think of them as a quick financial bridge to tide you over a temporary shortfall. These loans are often used for emergencies like car repairs or unexpected medical bills, situations where immediate cash is crucial. However, it’s vital to understand the associated costs before borrowing.

Crucially, payday loans Tallahassee FL, like elsewhere, come with high interest rates and fees. “These costs can quickly escalate if the loan isn’t repaid on time,” making them a potentially expensive option. Before considering a payday loan, carefully evaluate your financial situation and explore alternative solutions, such as borrowing from friends or family, negotiating with creditors for payment extensions, or using a credit union for a small loan. Responsible borrowing is key; always understand the terms and conditions before signing any loan agreement. Consider the total cost, including fees and interest, to ensure it aligns with your repayment capacity.

How Payday Loans Work in Florida

In Florida, payday loans are short-term, small-dollar loans. You borrow a relatively small amount of money, typically due on your next payday. The lender will require access to your bank account to automatically withdraw the payment. Interest rates are high, reflecting the short repayment period and associated risk for the lender. Florida law limits the amount a lender can charge in fees, but it’s crucial to understand the total cost before borrowing. Always carefully read the loan agreement.

Before taking out a payday loan in Tallahassee, or anywhere in Florida, thoroughly research all fees and interest. Compare offers from multiple lenders to find the best terms. Consider alternatives, such as credit counseling or borrowing from friends or family, which may be less expensive. “Remember, payday loans should be used responsibly and only as a last resort for urgent, short-term financial needs.” Failure to repay on time can lead to additional fees and negatively impact your credit score. Understand the potential consequences before applying for a payday loan in Tallahassee, Florida.

Legal Aspects of Payday Lending in Tallahassee

Payday loans in Tallahassee, Florida, are governed by Florida state law, not federal law. This means the interest rates and fees are capped, but these caps can still be quite high compared to traditional loans. Understanding these limitations is crucial before considering a payday loan. Always check the Florida Office of Financial Regulation website for the most up-to-date information on legal limits and regulations.

Borrowers should be aware of potential predatory lending practices. Florida has laws designed to protect consumers from exorbitant fees and deceptive loan terms. However, carefully reviewing the loan agreement is essential before signing. Failure to understand the terms could lead to unforeseen financial difficulties. “If you are struggling to repay, seek help from a reputable credit counselor or non-profit organization immediately.” Resources are available to assist borrowers facing repayment challenges. Remember, a payday loan should be a last resort, used only when absolutely necessary and with a clear repayment plan in place.

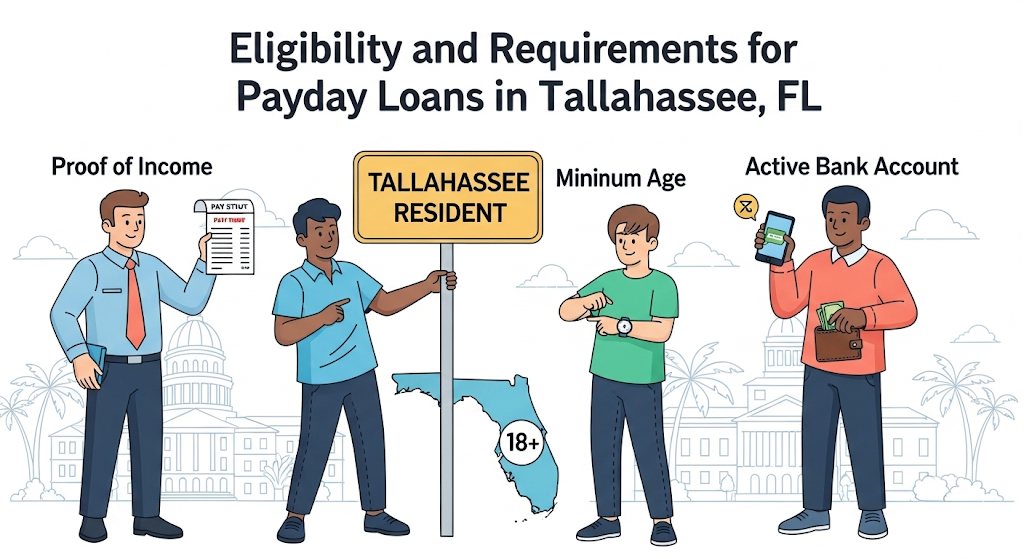

Eligibility and Requirements for Payday Loans in Tallahassee

Credit Score and History

Unlike traditional loans, payday loans in Tallahassee, Florida, often don’t require a stellar credit score. Many lenders prioritize your current income and employment stability over your credit history. This makes them accessible to individuals who may have struggled with credit in the past. However, a poor credit history might result in higher interest rates or stricter loan terms. Always compare offers from multiple lenders to secure the best possible deal.

While a perfect credit score isn’t a necessity, a completely nonexistent or severely damaged credit history could be a barrier. Lenders assess risk, and a lack of credit history can signal higher risk to them. Some lenders may utilize alternative credit scoring methods or focus heavily on verifying your income and employment. “It’s crucial to understand that even with a less-than-perfect credit score, obtaining a payday loan in Tallahassee remains a possibility, but the terms may be less favorable.” Always read the fine print carefully and ensure you understand the repayment terms before accepting any loan offer.

Income and Employment Verification

Lenders in Tallahassee, Florida, will want to verify your income to ensure you can repay the payday loan. They typically require proof of regular income, such as pay stubs or bank statements showing consistent deposits. Self-employment may require additional documentation, like tax returns or business bank statements. Insufficient income is a common reason for loan applications to be denied. The amount of income needed varies by lender and loan amount; however, lenders are legally obligated to assess your ability to repay before approving a loan.

Confirming employment involves providing information like your employer’s name, address, and contact number. Some lenders may contact your employer directly to verify your employment status and income. Be prepared to provide this information upfront to expedite the loan process. Remember, providing false information is illegal and can have severe consequences. Always be honest and transparent with your lender to build trust and increase your chances of approval for your payday loan in Tallahassee. “Providing accurate and complete information is crucial for a successful application.”

Residence and Identification

To qualify for a payday loan in Tallahassee, Florida, you must meet specific residency requirements. Lenders typically require proof of residency, such as a current utility bill, lease agreement, or bank statement showing your Tallahassee address. This verifies you live within the state’s jurisdiction and are therefore eligible to borrow. Failure to provide adequate proof of residency will likely result in your application being denied. Be prepared to provide documentation that clearly shows your name and current Tallahassee address.

Beyond residency, you need a valid form of government-issued photo identification. This is a standard requirement for all financial transactions. Acceptable forms include a Florida driver’s license, state-issued identification card, or passport. The identification must match the information you provide on your loan application. “Ensuring your identification details are accurate and consistent across all documents is crucial for a smooth and successful application process.” Incorrect or incomplete information can lead to delays or rejection. Always double-check your details before submitting your application for a Tallahassee payday loan.

Finding Reputable Lenders in Tallahassee, FL

Checking Lender Credentials and Licenses

Before you borrow money from any payday loan lender in Tallahassee, Florida, thoroughly check their credentials. Verify their licensing with the Florida Office of Financial Regulation (OFR). The OFR website provides a searchable database of licensed lenders. This simple step helps avoid scams and protects you from unlicensed operations. Always confirm the lender’s physical address in Tallahassee; a legitimate business will have a verifiable location.

Legitimate lenders are transparent about their fees and terms. Look for clear, concise information on their website and in any loan agreement. Avoid lenders who pressure you into a decision or who are vague about their processes. “Red flags include hidden fees, extremely high interest rates, or pressure to borrow more than you need.” Remember to compare interest rates and fees between multiple licensed lenders to find the best deal. Taking these steps can save you money and protect you from predatory lending practices common in the payday loan industry.

Comparing Interest Rates and Fees

Interest rates and fees significantly impact the overall cost of a payday loan. Always compare offers from multiple lenders before making a decision. Don’t just focus on the advertised interest rate; examine all associated fees, including origination fees, late payment penalties, and any potential rollover charges. These additional costs can quickly inflate the total amount you repay. Remember, Florida regulates payday loans, so be aware of the state’s legal limits on fees and interest to avoid predatory lenders.

To effectively compare, create a simple table listing each lender’s interest rate, all applicable fees, and the total repayment amount. This allows for a clear side-by-side comparison. “Consider using online loan comparison tools to streamline this process.” These tools often provide a comprehensive overview of lenders and their associated costs. Beware of lenders who are vague about fees or pressure you into a quick decision. Transparency is crucial when choosing a reputable payday loan provider in Tallahassee. “Choosing a lender with clearly stated terms and conditions is vital to protect yourself from unexpected charges.”

Reading Reviews and Testimonials

Before applying for a payday loan in Tallahassee, Florida, thoroughly investigate potential lenders. Don’t rely solely on advertising. Take the time to read online reviews and testimonials from past borrowers. Look for consistent patterns in feedback. Positive comments about customer service, transparency, and reasonable fees are excellent indicators of a reputable lender. Sites like the Better Business Bureau (BBB) can provide valuable insights into a lender’s history and customer complaints.

Pay close attention to negative reviews. Do several negative reviews mention similar problems? This could signal serious issues with the lender’s practices. “Look for specific details about the lending process, fees, and repayment terms to gauge the lender’s honesty and fairness.” Consider the overall tone and sentiment expressed in the reviews. A preponderance of negative experiences should raise red flags. Remember, a few isolated negative reviews are normal. However, a consistent pattern of complaints is a significant warning sign you should heed before proceeding with a loan application.

Interest Rates and Fees: What to Expect

Understanding APR and Other Charges

Payday loans in Tallahassee, Florida, are subject to Florida state regulations, impacting their cost. The Annual Percentage Rate (APR) is a crucial figure reflecting the total cost of borrowing, including interest and fees, expressed as a yearly percentage. Don’t confuse the APR with the simple interest rate. The APR provides a more complete picture of your loan’s expense. Always compare APRs from different lenders before committing to a loan.

Remember, Florida payday loans often involve substantial fees. These may include origination fees, late payment penalties, and other charges. These fees significantly impact the overall cost. Understanding the complete fee structure is crucial before signing any agreement. “Failing to fully grasp these costs can lead to unexpected debt and financial hardship.” Research the specific fees each lender charges and consider whether the loan’s total cost aligns with your financial capacity. Consider the potential impact on your budget before proceeding.

Avoiding Predatory Lending Practices

In Tallahassee, as elsewhere, beware of extremely high interest rates. These are a hallmark of predatory payday loans. Florida law caps interest rates, but some lenders might try to circumvent these regulations through excessive fees. Always carefully review the loan agreement before signing. Look for hidden charges or unclear terms. Compare offers from multiple lenders. This helps you find the most favorable terms.

Don’t rush into a payday loan decision. Thoroughly investigate each lender’s reputation. Check online reviews and ratings from sources like the Better Business Bureau. “Consider alternatives like credit counseling or borrowing from friends and family before resorting to a high-cost payday loan.” If you feel pressured or uncertain about any aspect of the loan, walk away. Remember, there are resources available to help you manage your finances responsibly. Seeking assistance is a sign of strength, not weakness. Protecting yourself from predatory lending practices is crucial for your financial well-being.

Calculating the Total Cost of a Payday Loan

Understanding the true cost of a payday loan in Tallahassee, Florida, requires careful calculation beyond the initial loan amount. Lenders in Florida are legally permitted to charge a maximum fee of $10 per $100 borrowed. This fee, combined with the loan’s term (usually two weeks), significantly impacts the Annual Percentage Rate (APR). A seemingly small loan can quickly accumulate substantial interest. For example, a $300 payday loan with a $30 fee results in a repayment of $330 in just two weeks. This translates to a very high APR, often exceeding 400%. Always use a loan calculator to see the full cost before you borrow.

To accurately calculate your total cost, add the finance charges to the principal loan amount. This gives you the total repayment amount. Consider the implications of potential rollovers or extensions, which will further increase your overall debt. Florida law dictates that you must be given a clear disclosure outlining all fees and charges before you sign the loan agreement. “Failing to understand these calculations can lead to a debt cycle that is difficult to escape.” Remember, budgeting carefully and exploring alternative financial solutions before resorting to a payday loan can often prevent costly borrowing.

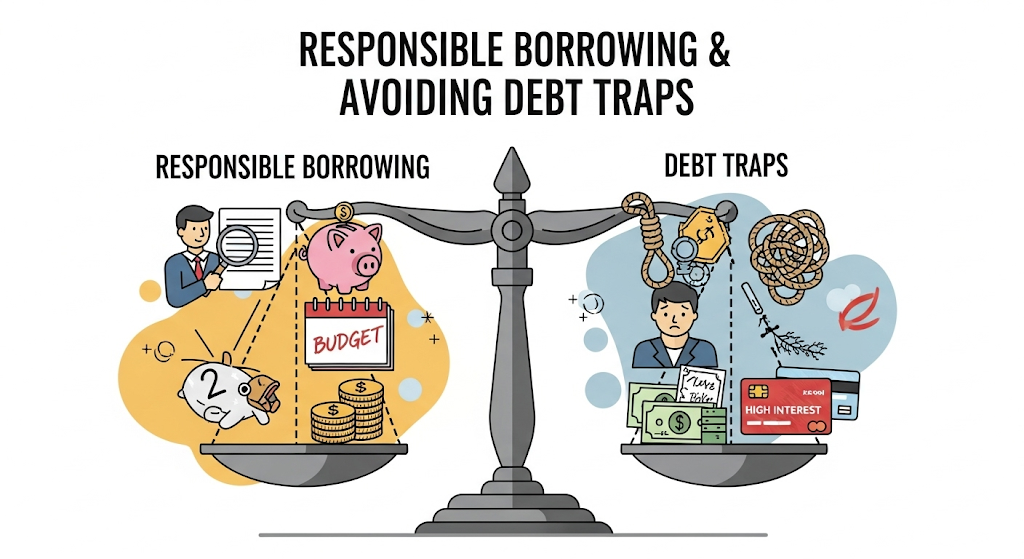

Responsible Borrowing and Avoiding Debt Traps

Creating a Realistic Budget

Before considering a payday loan in Tallahassee, Florida, thoroughly assess your current financial situation. Create a detailed budget that tracks all income and expenses. This should include essential needs like rent, utilities, and groceries, as well as non-essential spending like entertainment and dining out. Categorize everything to pinpoint areas where you might cut back. Many free budgeting apps and online resources are available to assist you.

Accurately reflecting your spending habits is crucial. Don’t underestimate costs. “Failing to account for unexpected expenses is a common pitfall that can easily lead to further debt.” Building a realistic budget allows you to see how much you can comfortably afford to repay, and importantly, whether a payday loan is truly necessary. Consider alternative options like negotiating with creditors or exploring low-interest personal loans before resorting to a high-cost short-term loan. Remember, responsible financial planning is key to avoiding the debt trap associated with payday lending.

Exploring Alternatives to Payday Loans

Before rushing into a payday loan in Tallahassee, Florida, consider alternative solutions. Many local resources offer financial assistance to help you manage unexpected expenses. The United Way 211 helpline, for example, can connect you with local charities and non-profit organizations providing emergency financial aid and budget counseling. These services often provide more sustainable solutions than the short-term relief of a payday loan. Exploring these options first can prevent you from falling into a cycle of debt.

“Payday loans are designed for short-term use, but often lead to long-term financial problems.” Instead of a high-interest payday loan, consider seeking help from credit unions. Credit unions frequently offer small-dollar loans with more manageable interest rates than payday lenders. They also often provide financial literacy resources to help you better manage your money. Exploring these alternatives allows you to address the root cause of your financial need, rather than just temporarily covering the expense, thus avoiding the high cost and potential debt trap associated with payday loans in Tallahassee, Florida.

Seeking Financial Counseling

Facing financial hardship can be overwhelming, making it crucial to seek professional guidance before considering a payday loan in Tallahassee, Florida. The Consumer Credit Counseling Service (CCCS) and other non-profit credit counseling agencies offer free or low-cost financial counseling services. These services can help you create a budget, identify areas for savings, and explore alternative solutions to payday loans, such as debt management plans or negotiating with creditors. They can also provide valuable education on responsible money management.

Remember, payday loans are designed for short-term use, and repeated reliance can quickly lead to a cycle of debt. A certified credit counselor can help you understand your finances thoroughly. They provide personalized strategies for long-term financial stability. “Taking proactive steps to address your financial situation through professional guidance is often the most effective way to avoid the high costs and potential pitfalls associated with payday loans.” Contacting a reputable agency like the CCCS is a vital first step towards securing your financial future and avoiding the dangers of payday loan debt traps.

Frequently Asked Questions (FAQs) About Payday Loans in Tallahassee

What happens if I can’t repay my loan?

Falling behind on your payday loan in Tallahassee can have serious consequences. Your lender will likely attempt to contact you repeatedly. They may charge late fees, which can quickly add up and significantly increase your debt. Non-payment can severely damage your credit score, impacting your ability to secure loans, rent an apartment, or even get a job in the future. Consider exploring options like debt counseling or negotiating a payment plan with your lender *before* you default. Remember, ignoring the problem will only make it worse.

It’s crucial to understand the legal ramifications of defaulting on a payday loan. In Florida, collection agencies may pursue legal action to recover the debt. This could include wage garnishment or the freezing of bank accounts. While payday loans offer short-term financial relief, they carry significant risk. “Failing to repay on time can lead to a cycle of debt that is very difficult to escape.” Explore all available resources, including credit counseling services, before taking out a payday loan to ensure responsible borrowing. Always carefully review the loan agreement and understand all the terms and conditions before signing.

Can I roll over my payday loan?

No, payday loan rollovers are illegal in Florida. This includes Tallahassee. Attempting to extend your loan by taking out another payday loan to cover the first one is considered a violation of state law. Florida’s laws aim to protect borrowers from falling into a cycle of debt. These laws specifically prohibit the practice of repeatedly refinancing payday loans.

This restriction exists to prevent borrowers from accumulating excessive fees and interest. The high-interest rates associated with short-term payday loans make rollovers extremely costly. “Repeated rollovers quickly lead to an unaffordable debt burden for many individuals,” making responsible borrowing practices crucial. Instead of seeking a rollover, explore alternative solutions like budgeting, negotiating with creditors, or seeking help from credit counseling agencies. Consider these responsible alternatives before considering any loan product, including payday loans in Tallahassee.

What are the consequences of defaulting on a payday loan?

Defaulting on a payday loan in Tallahassee, Florida, has serious repercussions. Your lender will likely pursue collection efforts, which can include repeated phone calls, letters, and potentially legal action. These actions can severely damage your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Furthermore, Florida law allows for the collection of fees and additional charges, significantly increasing your debt. Be aware that these fees can quickly spiral out of control.

The consequences extend beyond financial penalties. Repeated defaults can lead to wage garnishment, where a portion of your paycheck is automatically seized to repay the debt. In some cases, your bank accounts could also be levied. Failing to repay a payday loan can negatively impact your overall financial health, leading to a cycle of debt that’s difficult to break. “Before taking out a payday loan, carefully consider your ability to repay on time to avoid these potentially devastating consequences.” Explore alternative financial solutions if you anticipate difficulty making payments. Remember, resources exist to help you manage your finances responsibly.