Understanding Payday Loans in Topeka, Kansas

What are Payday Loans?

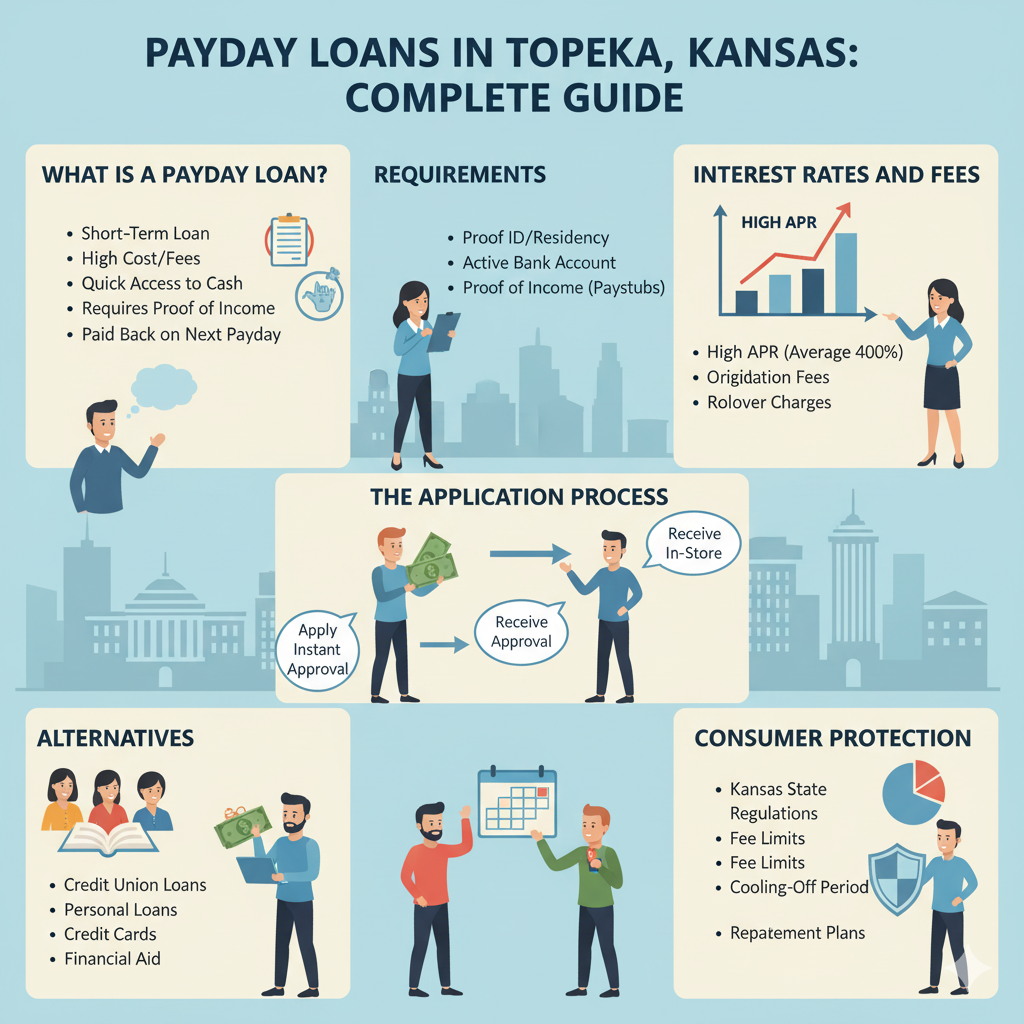

Payday loans Topeka, Kansas are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next paycheck. They are typically due on your next payday, hence the name. These loans are often used for emergencies like car repairs or unexpected medical bills. Interest rates on payday loans are significantly higher than traditional loans, reflecting the high risk for lenders. This high-interest aspect is crucial to understand before considering a payday loan in Topeka, Kansas, or anywhere else. Always explore alternative options first, such as borrowing from friends or family or utilizing a credit union.

Borrowing money through a payday loan in Topeka should be a last resort. The high cost of borrowing can lead to a debt cycle, making it difficult to repay the loan on time. Late fees and additional charges can quickly accumulate, further exacerbating the financial burden. “Before taking out a payday loan, carefully consider the total cost and whether you can comfortably afford repayment without jeopardizing your other financial obligations.” Kansas state regulations govern payday loans, limiting the amount you can borrow and the fees lenders can charge. Understanding these regulations is key to making informed decisions about payday loans in Topeka, Kansas.

Eligibility Requirements for Payday Loans in Topeka

Securing a payday loan in Topeka, Kansas, hinges on meeting specific criteria. Lenders typically require borrowers to be at least 18 years old and a legal resident of Kansas. You’ll need a verifiable source of regular income, demonstrating your ability to repay the loan. This usually means providing pay stubs or bank statements. Crucially, you must possess a valid checking account for direct deposit of funds and repayment. Many lenders also conduct a credit check, though this isn’t always a strict requirement for all Topeka payday loan providers. Failure to meet these basic requirements will likely result in your application being denied.

Beyond the basics, lenders often consider the amount of your monthly income relative to your existing debt. High debt-to-income ratios can negatively affect your chances of approval. They also carefully assess your employment history for stability. A consistent job with a reliable employer significantly boosts your approval odds. “Remember, providing accurate and complete information is vital for a smooth application process.” Inaccurate or misleading information can lead to immediate rejection, even if you technically meet other eligibility requirements. Finally, be aware that interest rates and fees vary between lenders, so comparison shopping is recommended before committing to a loan.

How to Apply for a Payday Loan in Topeka

Applying for a payday loan in Topeka, Kansas is generally a straightforward process. Most lenders offer online applications, requiring basic personal information like your name, address, employment details, and bank account information. You’ll also need to provide proof of income, typically through pay stubs or bank statements. Be aware that lenders will verify this information. Expect a quick decision, often within minutes, depending on the lender and your credit history.

After submitting your application, you may need to visit a physical location to sign the loan agreement. However, many Topeka lenders offer completely online processes. Always read the loan agreement carefully before signing. Understand the interest rates, fees, and repayment terms. “Choosing a reputable lender is crucial to avoid predatory lending practices.” Compare offers from multiple lenders to find the best terms and interest rates available for your specific circumstances. Remember to only borrow what you can realistically repay. Responsible borrowing is key to avoiding a cycle of debt.

Finding Reputable Lenders in Topeka

Factors to Consider When Choosing a Lender

Choosing a payday loan lender requires careful consideration. Prioritize lenders licensed by the Kansas Office of the State Bank Commissioner. This ensures they operate legally and are subject to state regulations designed to protect borrowers. Check online reviews from past customers. Look for consistent positive feedback regarding transparency and customer service. Avoid lenders with excessively high interest rates or hidden fees. “Compare APRs (Annual Percentage Rates) across multiple lenders to find the best deal.” Remember, a low APR doesn’t automatically mean it’s the best option; consider all fees involved.

Transparency is key. Reputable lenders will clearly outline all terms and conditions. This includes interest rates, fees, repayment schedules, and any potential penalties for late payments. Look for lenders who offer a variety of repayment options to accommodate different financial situations. Don’t hesitate to ask questions. A trustworthy lender will gladly explain any aspect of the loan agreement. “Consider the lender’s accessibility – is their customer support readily available via phone, email, or in person?” A good lender provides convenient and accessible communication channels. Beware of lenders who pressure you into accepting a loan or who are unwilling to answer your questions.

Checking Lender Licenses and Reviews

Before applying for a payday loan in Topeka, Kansas, verify the lender’s license. The Kansas Office of the State Bank Commissioner regulates payday lenders. Check their website to confirm the lender is legally operating. This simple step protects you from fraudulent or unlicensed businesses. Always prioritize licensed lenders for your financial safety.

Read online reviews from previous borrowers. Websites like the Better Business Bureau (BBB) and Google Reviews offer valuable insights. Pay close attention to comments about interest rates, fees, and customer service. “Negative reviews highlighting aggressive collection practices or hidden fees should raise serious red flags.” Remember, a lender’s reputation is crucial. Thorough research can save you from a potentially harmful borrowing experience.

Avoiding Predatory Lending Practices

Payday loans can be a helpful short-term solution, but it’s crucial to protect yourself from exploitative lenders. Avoid lenders who pressure you into borrowing more than you need or offer loans with excessively high interest rates. Legitimate lenders in Topeka, Kansas, will clearly explain all fees and interest rates upfront. Always compare offers from multiple lenders before making a decision. Look for lenders licensed by the Kansas Department of Commerce. This helps ensure compliance with state regulations designed to protect consumers.

Scrutinize the loan agreement thoroughly. Understand all terms and conditions before signing. Be wary of lenders who make promises that sound too good to be true. “High APRs and hidden fees are common tactics of predatory lenders.” Check online reviews and ratings from reputable sources before engaging with any lender. Resources like the Better Business Bureau (BBB) can provide valuable insights into a lender’s reputation and history. Remember, a responsible lender will prioritize your financial well-being, not just profit. Choosing wisely can save you from a debt spiral.

Interest Rates and Fees: What to Expect

Understanding APR and Interest Calculations

Payday loans in Topeka, Kansas, are characterized by high Annual Percentage Rates (APR). The APR reflects the total cost of borrowing, including interest and fees, expressed as a yearly percentage. Unlike traditional loans with fixed interest rates, payday loans often use a flat fee calculation. This means the total interest is determined upfront based on the loan amount, not the remaining balance. For example, a $300 loan with a $45 fee has a significant APR, even if the loan is for a short period. Always carefully review the loan agreement to understand the exact calculations used.

Understanding these calculations is crucial before borrowing. Many lenders in Topeka will provide a loan disclosure outlining all charges. Compare APRs across different lenders to find the most competitive option. Remember, high APRs can lead to a debt cycle if you’re unable to repay the loan on time. “Failing to repay on time usually incurs additional fees and extends the loan term, dramatically increasing the overall cost.” Use online payday loan calculators to estimate the total cost before committing. Consider exploring alternative financing options if the APR is excessively high.

Comparing Loan Offers from Different Lenders

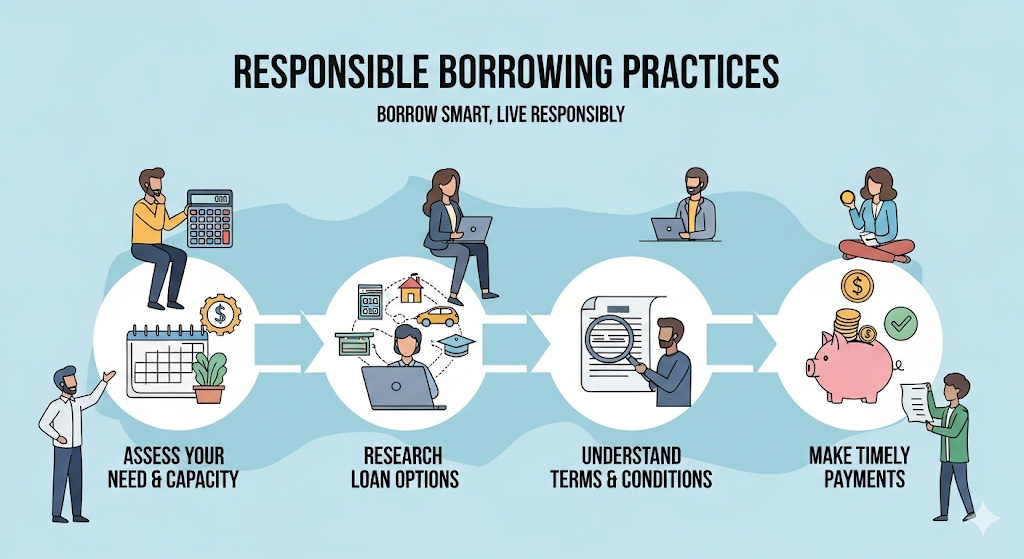

Before committing to a payday loan in Topeka, Kansas, meticulously compare offers from several lenders. Don’t just focus on the advertised interest rate. Consider all fees, including origination fees, late payment penalties, and any potential rollover charges. These added costs significantly impact the loan’s total cost. Remember, seemingly small differences in fees can quickly add up, potentially making one loan far more expensive than another.

Use online comparison tools or consult with a financial advisor to aid in your research. Pay close attention to the lender’s reputation. Check online reviews and look for any red flags, such as numerous complaints about deceptive practices or high rates of customer dissatisfaction. “Choosing a reputable lender is crucial to avoid predatory lending practices and ensure a smoother borrowing experience.” Ultimately, the lender with the lowest overall cost – factoring in all fees and interest – should be your preferred choice. Consider the loan’s repayment terms as well; a shorter repayment period may mean higher payments, but it will also reduce the total interest paid.

Transparency and Hidden Fees

Payday loans in Topeka, Kansas, are governed by state and federal regulations. However, transparency isn’t always guaranteed. Before agreeing to a loan, carefully review all documentation. Understand every fee. Don’t hesitate to ask questions if anything is unclear. “Ignoring small print can lead to unexpected costs and a debt spiral.” Many lenders clearly state their fees upfront. Others, however, may bury them in complex terms and conditions.

Be wary of lenders who pressure you into a quick decision. Legitimate lenders will gladly explain their fees. They will provide a clear breakdown of the total cost. Watch out for hidden charges. These can significantly increase the final repayment amount. Research reputable lenders. Compare their fee structures before making a commitment. “Choosing a transparent lender is crucial for responsible borrowing.” Remember, unexpected fees can quickly make your payday loan unaffordable.

Responsible Borrowing Practices

Creating a Realistic Budget

Before applying for a payday loan in Topeka, Kansas, honestly assess your finances. Create a detailed budget that outlines all your monthly income and expenses. Categorize spending into needs (rent, utilities, groceries) and wants (entertainment, dining out). Identify areas where you can cut back to free up funds. Tracking your spending for a month beforehand provides valuable insight. This helps you understand your spending habits and identify potential savings.

Consider using budgeting apps or spreadsheets to track your progress. Many free tools are available online to assist. A clear picture of your finances will help you determine if a payday loan is truly necessary and whether you can comfortably afford the repayment terms. “Failing to budget accurately can lead to a cycle of debt, making it harder to manage future finances.” Remember, responsible financial planning is crucial before seeking any type of short-term loan, including payday loans in Topeka.

Exploring Alternatives to Payday Loans

Before considering a payday loan in Topeka, Kansas, explore other options. Many resources offer financial assistance without the high interest rates and potential debt traps associated with payday lending. Local credit unions often provide small-dollar loans with more manageable terms. They may also offer financial literacy counseling to help you better manage your finances. Check with organizations like the United Way or local charities; they might offer emergency assistance programs.

Consider exploring budgeting apps or seeking advice from a non-profit credit counselor. These tools and services can help you identify areas to cut expenses and create a realistic budget. “Understanding your spending habits is crucial before taking on any debt, especially high-interest debt like payday loans.” Remember, responsible financial planning is key to long-term financial health. Exploring these alternatives can prevent you from falling into a cycle of debt and allow you to address your financial needs in a sustainable way.

Managing Your Debt Effectively

Taking out a payday loan in Topeka, Kansas, requires careful planning and responsible management. Avoid the debt trap by creating a realistic budget before applying. Track your income and expenses meticulously. This helps determine how much you can comfortably repay without jeopardizing your financial stability. Prioritize essential expenses like rent and groceries. Only then allocate funds towards loan repayment and other non-essential items. “Ignoring your budget can lead to a cycle of debt, necessitating more loans and escalating interest charges.” Remember, responsible borrowing is key to avoiding long-term financial difficulties.

Consider exploring alternative solutions *before* resorting to a payday loan. Could you temporarily reduce spending or negotiate with creditors for extended payment plans? Seek free credit counseling from reputable organizations like the National Foundation for Credit Counseling. They offer resources and strategies for managing debt effectively. Explore all available options to ensure you’re making the most informed decision. “Understanding your options and planning carefully can significantly reduce the stress and risks associated with payday loans.” Prioritize building good financial habits for your long-term well-being.

Legal Protections and Consumer Rights

Kansas State Regulations on Payday Lending

Kansas has specific regulations governing payday loans to protect consumers. The state limits the amount a lender can charge in fees. These fees are capped as a percentage of the loan amount, preventing excessively high costs. This is crucial, as it helps prevent borrowers from falling into a cycle of debt. The Kansas Office of the State Bank Commissioner oversees payday lending and enforces these regulations. You can find their contact information online for any questions or concerns.

Crucially, Kansas law dictates the maximum loan term. This prevents lenders from extending loans indefinitely. Loan terms are usually limited to a short period, often 30 days. “This time limit helps ensure borrowers can repay their debt within a reasonable timeframe, minimizing the risk of prolonged financial hardship.” Before entering into any payday loan agreement in Topeka, carefully review all terms and conditions. Understanding these regulations is essential for responsible borrowing and avoiding potential legal issues.

Understanding Your Rights as a Borrower

In Topeka, Kansas, as in all states, you have significant protections when taking out a payday loan. The Kansas Office of the State Bank Commissioner oversees payday lenders, ensuring compliance with state laws. These laws limit the amount lenders can charge in fees and interest. Understanding these limits is crucial to avoiding predatory lending practices. Always carefully review the loan agreement before signing. Look for details on the Annual Percentage Rate (APR) and all associated fees. Don’t hesitate to ask questions if anything is unclear.

“Before signing any payday loan agreement, thoroughly understand the repayment terms and the potential consequences of default.” Missing payments can lead to additional fees and negatively impact your credit score. Kansas law provides avenues for dispute resolution if you believe a lender has violated your rights. You can contact the Kansas Attorney General’s office or the Office of the State Bank Commissioner to file a complaint. Remember, responsible borrowing involves careful budgeting and a clear understanding of your financial capabilities. Avoid taking out loans you cannot reasonably repay, as this can lead to a cycle of debt.

Where to Report Potential Issues or Violations

Facing issues with a payday loan in Topeka? Knowing where to turn for help is crucial. The Kansas Attorney General’s Office is your primary resource for reporting potential violations of state lending laws. Their website offers detailed information on consumer rights and provides avenues for filing complaints. You can also contact them by phone or mail. Don’t hesitate to document all interactions with your lender, including loan agreements and communication records. This will be vital if you need to file a formal complaint.

For federal-level concerns, or if your issue involves a payday lender operating outside of Kansas state jurisdiction, the Consumer Financial Protection Bureau (CFPB) is another valuable resource. The CFPB handles complaints against payday lenders nationwide and actively works to protect consumers from predatory lending practices. They offer online complaint filing, along with educational materials to help you understand your rights. “Remember, reporting potential issues is a vital step in protecting yourself and other consumers from unfair or illegal payday loan practices in Topeka, Kansas.” Thoroughly documenting all interactions with your lender will greatly aid in your complaint.

Frequently Asked Questions (FAQs)

What if I can’t repay my loan?

Falling behind on a payday loan in Topeka, Kansas, can have serious consequences. It’s crucial to contact your lender immediately if you anticipate trouble making a payment. Many lenders offer options like payment extensions or repayment plans to help borrowers avoid default. Exploring these options early is key to preventing further financial hardship. Ignoring the problem only exacerbates the situation, leading to additional fees and potentially impacting your credit score. Remember, proactive communication is vital.

Don’t hesitate to seek help from credit counseling agencies or nonprofit organizations in Topeka. These resources can provide guidance on managing your debt and exploring alternative solutions. They might offer debt management plans or connect you with resources for financial literacy. “Failing to communicate with your lender is often the biggest mistake borrowers make.” Remember, you’re not alone, and there are avenues to explore before facing severe repercussions from unpaid payday loans. Always explore every possible option before letting a payday loan go into default.

Are there any credit requirements for payday loans?

Payday loans in Topeka, Kansas, typically don’t require a stellar credit history. Many lenders focus more on your current income and ability to repay the loan. They’ll often check your credit report, but a low credit score won’t automatically disqualify you. However, a very poor credit history might result in higher interest rates or stricter loan terms. It’s crucial to compare offers from multiple lenders to find the best terms for your situation. Remember, responsible borrowing is key, regardless of your credit score.

While a perfect credit score isn’t a necessity, lenders still assess your creditworthiness. They want assurance you can repay the loan on time. Factors like your employment history and income stability often play a larger role than your credit score. “Some lenders might offer payday loans to individuals with no credit history at all, focusing instead on verifying your income and employment.” Always read the fine print carefully and understand the loan’s terms, including fees and repayment schedules, before signing any agreement. Consider exploring alternatives if payday loans seem too risky or expensive.

What happens if I default on a payday loan?

Defaulting on a payday loan in Topeka, Kansas, has serious consequences. Your lender will likely attempt to collect the debt through various means. This could include repeated phone calls, letters, and even legal action. Late fees and additional charges will quickly accrue, significantly increasing the amount you owe. Your credit score will also suffer, making it harder to obtain credit in the future, such as mortgages, car loans, or even other loans. These negative marks can remain on your credit report for several years.

Furthermore, Kansas law allows lenders to pursue legal action to recover the debt. This could result in a judgment against you, allowing the lender to seize your assets or garnish your wages. It’s crucial to understand that ignoring the debt will not make it disappear. “The best course of action is to contact your lender immediately if you anticipate difficulty repaying your loan. They may offer options such as payment plans or extensions to help you avoid default.” Remember, proactive communication is key to mitigating the potential negative impacts of defaulting on a payday loan.