Can You Refinance a Reverse Mortgage Loan?

A reverse mortgage allows homeowners, typically aged 62 or older, to convert part of their home equity into loan proceeds. This can provide financial relief, especially for retirees. However, as financial circumstances change, some may consider refinancing their reverse mortgage.

What Is Reverse Mortgage Refinancing?

Reverse mortgage refinancing involves replacing an existing reverse mortgage with a new one. The goal is often to secure better loan terms, access additional funds, or benefit from lower interest rates. It’s similar to refinancing a traditional mortgage, but with specific requirements and considerations unique to reverse mortgages.

The Basics of Reverse Mortgage Refinancing

Reverse mortgage refinancing is essentially a financial strategy to improve your loan terms. By refinancing, you can replace your current reverse mortgage with another one that potentially offers better conditions. This might involve lower interest rates or access to more funds, depending on your circumstances and the market conditions at the time of refinancing.

How Reverse Mortgage Refinancing Works

The refinancing process begins with assessing your current reverse mortgage and identifying areas where improvement is possible. This could be through better interest rates or accessing more of your home’s equity. Following this, you’d engage with a lender to initiate the refinancing process. They will evaluate your current situation and propose a new mortgage package that could meet your needs more effectively.

Key Considerations in Reverse Mortgage Refinancing

Before jumping into refinancing, it’s important to understand the unique aspects of reverse mortgages. Unlike traditional mortgages, reverse mortgages have no monthly payments. Instead, the loan is repaid when the homeowner sells the home or passes away. Thus, refinancing should align with your long-term financial goals and your personal circumstances.

Why Consider Refinancing Your Reverse Mortgage?

There are several reasons why homeowners might opt to refinance their reverse mortgage. Here are some common motivations:

Lower Interest Rates

One of the main motivations for refinancing is to take advantage of lower interest rates. If the rates have decreased since you originally took out your reverse mortgage, refinancing could significantly lower your interest costs. This reduction can lead to substantial savings over the life of the loan, allowing you to keep more of your equity intact.

Increased Home Equity

Property values fluctuate, and if your home’s value has increased, you may have more equity than when you first got your reverse mortgage. Refinancing could allow you to tap into this additional equity. This extra cash could be used for various purposes, such as home renovations, medical expenses, or simply to boost your retirement fund.

Change in Loan Terms

Sometimes, your financial goals or circumstances change. You might want to switch from an adjustable-rate to a fixed-rate mortgage to ensure stable payments. Alternatively, you may wish to adjust the loan’s term to better suit your financial planning. Refinancing gives you the flexibility to modify your loan terms in a way that aligns with your current needs.

Adding or Removing Borrowers

Life changes, such as marriage, divorce, or the death of a spouse, can affect your reverse mortgage. Refinancing allows you to add or remove borrowers from the mortgage, ensuring that the loan reflects your current living situation. This adjustment can be crucial for financial security and estate planning.

Avoiding Foreclosure

Refinancing might offer a lifeline if you’re facing foreclosure. By securing more favorable loan terms or extending the loan period, refinancing can provide the financial relief needed to avoid losing your home. It’s a crucial consideration for those who want to maintain their residence while managing financial difficulties.

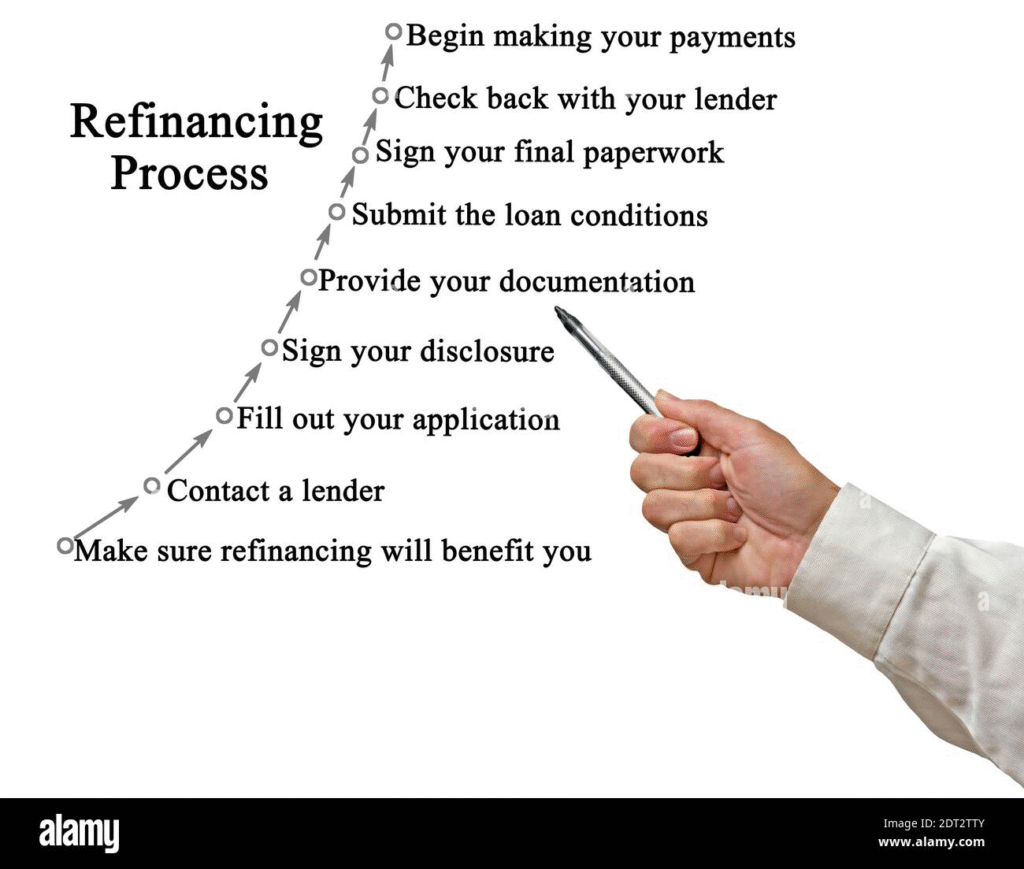

The Refinancing Process

Refinancing a reverse mortgage is a straightforward process but requires careful consideration. Here’s a step-by-step guide to help you understand what’s involved:

Step 1: Evaluate Your Situation

Before proceeding, assess your financial situation and determine if refinancing aligns with your goals. Consider factors like current interest rates, home value, and personal financial needs.

Assess Your Current Financial Health

Start by taking a close look at your financial situation. Evaluate your income sources, monthly expenses, and any outstanding debts. Understanding your financial health will help you determine whether refinancing is a beneficial move. Consider how refinancing might impact your cash flow and long-term financial goals.

Examine Current Interest Rates

Interest rates play a significant role in deciding to refinance. Research current market rates and compare them to the rate on your existing reverse mortgage. If the current rates are significantly lower, refinancing could offer substantial savings. However, remember to weigh this against potential costs associated with refinancing.

Consider Your Home’s Current Value

Property values fluctuate, so it’s essential to get an accurate appraisal of your home’s current market value. Increased home equity could mean more funds available to you through refinancing. A higher property value can also improve your loan terms, making refinancing a more attractive option.

Step 2: Consult with a Financial Advisor

Given the complexity of reverse mortgages, consulting with a financial advisor can provide valuable insights. They can help you understand the implications of refinancing and assist in making an informed decision.

The Role of a Financial Advisor

A financial advisor can offer guidance tailored to your unique situation. They help you understand how refinancing fits into your broader financial plan. Advisors can also clarify any complex terms or conditions associated with reverse mortgages, ensuring you make informed decisions.

Benefits of Professional Guidance

By consulting with a financial advisor, you gain access to expert knowledge and experience. They can provide a detailed analysis of how refinancing might affect your financial future. This includes potential savings, changes in loan terms, and impacts on your estate planning or inheritance goals.

Finding the Right Advisor

Choosing a qualified financial advisor is crucial. Look for professionals with experience in reverse mortgages and refinancing. Check their credentials and seek recommendations or reviews from previous clients. A good advisor will take the time to understand your financial goals and work collaboratively to achieve them.

Step 3: Shop for Lenders

Contact multiple lenders to compare terms, interest rates, and fees. This step is crucial to ensure you find a deal that suits your financial needs.

Importance of Shopping Around

Shopping around for lenders is essential to find the best refinancing deal. Different lenders may offer varying terms, interest rates, and fees. By comparing multiple offers, you can identify the most favorable conditions that align with your financial goals.

Evaluating Lender Offers

When evaluating lender offers, consider not only the interest rates but also the associated fees and terms. Pay attention to any hidden costs or charges that might affect the overall value of the offer. A thorough comparison will help you choose a lender that provides the best balance of affordability and benefits.

Negotiating with Lenders

Don’t hesitate to negotiate with lenders to secure better terms. If you have a good credit history and sufficient home equity, you may have leverage to negotiate lower rates or fees. Being proactive and assertive in your negotiations can lead to more favorable refinancing terms.

Step 4: Submit Your Application

Once you’ve chosen a lender, you’ll need to complete an application. Be prepared to provide necessary documentation, such as income statements, property appraisals, and existing loan details.

Completing the Application Process

Filling out the application is a critical step in the refinancing process. Ensure that all information provided is accurate and up-to-date. This includes personal details, financial information, and specifics about your existing reverse mortgage. Accuracy and completeness are key to avoiding delays or complications.

Required Documentation

Be prepared to submit various documents to support your application. This typically includes income statements, tax returns, property appraisals, and details of your existing loan. Having these documents ready in advance can expedite the application process and improve your chances of approval.

Understanding the Application Timeline

The application process can take some time, depending on the lender and the complexity of your financial situation. Be patient and proactive in following up with the lender for any additional information or clarification they might need. Understanding the timeline will help you manage expectations and plan accordingly.

Step 5: Undergo Appraisal and Underwriting

An appraisal of your home will be conducted to determine its current market value. The lender will then review your application, a process known as underwriting, to assess your eligibility.

The Appraisal Process

The appraisal is a crucial step in determining your home’s current market value. A licensed appraiser will assess your property based on various factors, including size, location, and condition. The appraisal value will influence the loan amount and terms you’re eligible for during refinancing.

What is Underwriting?

Underwriting is the lender’s evaluation of your application to assess risk and eligibility. During this process, the lender reviews your financial documents, credit history, and the appraisal report. This comprehensive assessment determines whether you qualify for the refinancing terms offered.

Preparing for Appraisal and Underwriting

To prepare for appraisal and underwriting, ensure your home is in good condition and all financial documents are organized. Address any potential issues that could negatively impact your appraisal value. Being well-prepared can lead to a smoother underwriting process and increase your chances of approval.

Step 6: Close on the Loan

If approved, you’ll proceed to closing. This involves signing the new loan agreement and settling any closing costs or fees. Once closed, the new reverse mortgage replaces the old one.

Understanding the Closing Process

Closing is the final step in the refinancing process. During this stage, you’ll review and sign the new loan agreement. It’s important to read all documents carefully and ask questions about any terms or conditions you’re unsure of. Understanding the agreement ensures there are no surprises later.

Managing Closing Costs

Refinancing involves closing costs, which can include fees for appraisal, underwriting, and document preparation. Be prepared to cover these expenses at closing. Ensure that you have a clear understanding of what these costs entail and how they impact your overall refinancing benefits.

Finalizing the Refinancing

Once closing is complete, your new reverse mortgage takes effect, replacing the old one. Ensure that you understand the new loan terms and are clear about any changes in your financial obligations. This final step marks the beginning of a new phase in managing your home equity and financial planning.

Benefits of Refinancing a Reverse Mortgage

Refinancing a reverse mortgage can offer several advantages, depending on your situation:

Improved Loan Terms

Securing better terms can lead to significant savings over the life of the loan.

Lower Interest Rates

Refinancing can offer the opportunity to lock in lower interest rates. A reduced rate can lead to decreased interest costs over time, preserving more of your home equity. This can be particularly beneficial if market rates have fallen since you first obtained your reverse mortgage.

Better Loan Conditions

Improved loan conditions can provide more favorable repayment terms, which might include changes to the loan structure. This could involve switching from an adjustable-rate to a fixed-rate mortgage, providing stability and predictability in your financial planning.

Enhanced Financial Flexibility

Better loan terms can also enhance your financial flexibility. With improved conditions, you might have more freedom to allocate funds towards other financial goals or necessities. This flexibility can be invaluable in managing your retirement finances effectively.

Access to More Funds

Increased home equity can provide access to additional funds, which can be used for various needs like home improvements or medical expenses.

Utilizing Additional Equity

Refinancing can unlock additional equity that has built up over time due to rising property values. This equity can be converted into accessible funds, providing a financial cushion for various expenses or investments. Accessing more funds can significantly improve your financial security.

Funding Home Improvements

Additional funds from refinancing can be used to finance home improvements or renovations. Investing in your home can enhance its value and improve your living conditions. This can be particularly advantageous for aging homeowners looking to make their homes more comfortable and accessible.

Covering Medical and Living Expenses

Refinancing can provide the necessary funds to cover unexpected medical expenses or increase your monthly income. Having access to extra cash can alleviate financial stress and ensure that you maintain a comfortable standard of living during retirement.

Stabilized Payments

Switching to a fixed-rate loan can provide predictable monthly payments, offering peace of mind.

Predictability in Financial Planning

A fixed-rate loan offers the stability of consistent monthly payments. This predictability can simplify budgeting and financial planning, eliminating concerns about fluctuating interest rates. Knowing your exact payment obligations allows for better financial management.

Protection Against Interest Rate Increases

Refinancing to a fixed-rate mortgage protects you from future interest rate increases. This stability ensures that your financial obligations remain consistent, regardless of market fluctuations. Protection against rising rates can be particularly beneficial in volatile economic conditions.

Long-term Financial Security

Stabilized payments contribute to long-term financial security by allowing you to plan with confidence. A predictable payment schedule ensures that you can allocate funds effectively without unexpected financial burdens. This security is crucial for maintaining a comfortable lifestyle during retirement.

Extended Loan Period

Refinancing might extend the loan term, providing more flexibility in managing your finances.

Longer Loan Duration

Extending the loan term through refinancing can reduce monthly payment obligations. A longer loan duration can ease financial pressure by spreading payments over a more extended period. This option can be beneficial if your financial situation requires more manageable monthly expenses.

Enhanced Financial Control

An extended loan term offers more control over your financial commitments. With lower payments, you can allocate funds towards other essential expenses or investments. Enhanced control over your finances contributes to a more balanced and sustainable financial strategy.

Aligning with Long-term Goals

Refinancing to extend the loan period can align with your long-term financial goals. Whether you’re planning for significant future expenses or aiming to preserve equity, a longer loan term provides the flexibility needed to achieve these objectives.

Potential Drawbacks

While there are benefits, refinancing a reverse mortgage also comes with potential drawbacks:

Closing Costs

Refinancing involves closing costs, which can add up. It’s essential to weigh these costs against the potential benefits.

Understanding Closing Costs

Closing costs are fees associated with the refinancing process, including appraisal, underwriting, and administrative charges. These costs can be substantial, impacting the overall financial benefit of refinancing. Understanding the breakdown of these costs helps in evaluating whether refinancing is a worthwhile decision.

Comparing Costs and Benefits

It’s crucial to compare the closing costs with the potential savings or benefits of refinancing. While refinancing might offer improved terms, the costs can offset these advantages if not carefully considered. A thorough cost-benefit analysis is necessary to ensure that refinancing aligns with your financial goals.

Budgeting for Closing Expenses

Planning for closing expenses is essential to avoid financial strain. Ensure that you have the necessary funds available to cover these costs without compromising your financial stability. Proper budgeting ensures that the refinancing process is smooth and financially viable.

Interest Accumulation

A longer loan term might mean more interest accumulates over time, increasing the total cost.

Impact of Extended Terms on Interest

While extending the loan term can reduce monthly payments, it often results in higher total interest costs. More extended periods mean more interest payments, which can accumulate significantly over time. Understanding this impact is vital when considering the overall cost of refinancing.

Balancing Monthly Payments and Total Cost

Finding the right balance between lower monthly payments and the total cost of interest is crucial. While reducing immediate financial obligations is appealing, it’s important to consider how increased interest affects your long-term financial health. This balance is key to ensuring that refinancing supports your financial objectives.

Strategies to Minimize Interest Costs

Consider strategies to minimize interest costs, such as opting for a shorter-term loan if financially feasible. Even slight adjustments in loan duration can significantly reduce overall interest payments. Exploring these strategies with a financial advisor can help optimize your refinancing decision.

Impact on Inheritance

Refinancing can affect the equity left in your home, potentially impacting what you leave to heirs.

Evaluating Inheritance Implications

Refinancing can reduce the equity available in your home, affecting the inheritance you plan to leave. It’s essential to weigh this impact against the benefits of refinancing. Understanding how refinancing affects your estate planning is crucial for making informed decisions.

Discussing with Family

Open discussions with family members about the impact of refinancing on inheritance can prevent misunderstandings or conflicts. Transparency about your financial decisions ensures that your loved ones understand the reasons behind refinancing and its implications for their future.

Balancing Current Needs and Future Goals

Balancing your current financial needs with future inheritance goals is essential. While refinancing might provide immediate benefits, consider how it aligns with your long-term objectives for your estate. This balance ensures that your financial decisions support both present and future priorities.

Credit and Financial Requirements

Lenders may have strict credit and financial requirements, which can limit eligibility for some borrowers.

Understanding Eligibility Criteria

Lenders have specific criteria for refinancing, including credit scores, income levels, and financial stability. Understanding these requirements helps you determine your eligibility and prepare accordingly. Being aware of potential limitations ensures that you approach the refinancing process realistically.

Improving Creditworthiness

Improving your credit score and financial profile can enhance your eligibility for refinancing. Timely payments, reducing debt, and ensuring accurate financial documentation can improve your creditworthiness. Taking proactive steps to strengthen your financial position increases your chances of securing favorable refinancing terms.

Exploring Alternative Options

If refinancing isn’t feasible due to strict requirements, explore alternative financial strategies. This could involve adjusting your current mortgage terms or considering other financial products. Exploring various options ensures that you find the best solution for your financial situation.

Is Refinancing Right for You?

Deciding whether to refinance a reverse mortgage depends on your unique circumstances. Here are some questions to consider:

Evaluating Interest Rate Benefits

Do current interest rates offer a significant advantage over your existing rate? Assessing this factor helps determine if refinancing can provide meaningful savings. Compare the potential savings with the costs to ensure that lower rates justify refinancing.

Assessing Home Equity

Has your home’s value increased, providing more equity to access? Understanding your home’s current market value helps evaluate the benefits of accessing additional equity. This assessment informs your decision on whether refinancing can enhance your financial resources.

Considering Loan Term Changes

Are you seeking to change your loan terms for more financial stability? Determine if modifications to your loan structure align with your financial goals. This consideration is crucial in deciding if refinancing offers the stability or flexibility you need.

Weighing Closing Costs

Can you afford the closing costs associated with refinancing? Evaluate your financial readiness to cover these expenses without compromising your budget. A clear understanding of these costs ensures that refinancing is a financially viable option.

Aligning with Long-term Goals

How might refinancing impact your long-term financial goals? Consider how refinancing aligns with your broader financial objectives, such as retirement planning or inheritance goals. Ensuring that refinancing supports these goals is essential for making informed decisions.

Conclusion

Refinancing a reverse mortgage can be a strategic move to enhance your financial planning and leverage home equity loans effectively. However, it’s crucial to evaluate the pros and cons carefully. By understanding the process, consulting with professionals, and exploring your options, you can make an informed decision that aligns with your financial objectives.

Remember, the choice to refinance should be made with thorough consideration of your current financial situation and future goals. It’s always wise to seek professional advice to ensure your decision is in your best interest. Consulting with experts and carefully weighing all factors ensures that refinancing supports your financial well-being and long-term security.